Notwithstanding India's lengthy battle after achieving independence, improvements to the country's previous employment standards point to a brighter tomorrow for the country's employment situation.

Although minimum wage changes began in other nations starting in the early 1890s, the Act did not reach India until 1943. On March 15, 1948, the Indian Parliament passed the guidelines that were implemented across the country.

Minimum wage is the amount every worker or labor must receive to fulfill basic physical needs and comfort. The minimum wages vary from state to state, across India and we shall be learning about Punjab minimum wages. Let's see what we can find out:

- Minimum Wage and its Importance?

- What are Punjab Minimum Wages Rules, 1960?

- Chapter 1: Title and Interpretation

- Chapter 2: Membership, Meetings, and Staff of the Committee

- Chapter 3: Summoning of Witness and Production of Documents

- Chapter 4: Computations and Payment of Wages, Hours, and Holidays

- Chapter 5: Claims under the Act

- Chapter 6: Scale Of Cost In Proceedings Under The Act

- Forms

- What are Minimum Wages in Punjab in 2022?

- How can Deskera Help You?

- Key Takeaways

Minimum Wage and its Importance?

Minimum wages refer to the minimum salary the employers pay to their employees or workers for the work done in a specific time period. We define minimum wages as the smallest amount of money that companies pay their employees for tasks completed within a certain time limit. It's also the sum that can't be reduced by negotiation or contract.

A government entity establishes minimum wages to ensure that employees are paid fairly for their labor. It aims to decrease or reduce any instances of workers receiving excessively low and unfair wages.

The following are the key objectives of the Minimum Wages Act:

- Workers in organized industries should be paid a minimum wage.

- To concentrate on ending labor exploitation.

- To give the government the authority to take necessary actions on a regular basis.

- To ensure that all workers have a decent standard of living.

What are Punjab Minimum Wages Rules, 1960?

The Punjab Minimum Wages Rules, 1960 apply to the entire state of Punjab and were drafted by section 11 of the State Reorganization Act of 1956. In this rule book, the act refers to the Minimum Wages Act of 1948.

It comprises six chapters and twelve forms. We shall be wading through all the chapters in the document and visit all the important highlights of the minimum wage rules in the state of Punjab.

Chapter 1: Title and Interpretation

This is a preliminary chapter that gives a glimpse of the details of the terms used in the document. The rules were formed by section 11 based on the State Reorganization Act, 1956, and are applicable to the state of Punjab.

The term Act implies or refers to the Minimum Wages Act of 1948.

Chapter 2: Membership, Meetings, and Staff of the Committee

This chapter sums up the term of the office members of the committee and members of the board. It also offers details about the traveling allowance and the eligibility criteria of the members of the committee.

Along with this, the chapter offers insights into the process of the resignation of the Chairman or any members of the committee or the board. Once a member has resigned, the document also explains the procedure for restoration of their membership.

Conducting the meetings, and other duties of the Chairman are prescribed in this part of the document

Chapter 3: Summoning of Witness and Production of Documents

In the course of any investigation, a committee or the Board may summon any person to appear as a witness.

Summoning a witness: A witness may be summoned to appear before it on a specific date and provide any books, papers, or other documents and items in his possession or under his control that are related to the investigation in any way.

All documents and items generated before a committee or the Board in response to a summons issued under sub-rule (1) may be thoroughly checked by the Chairman and independent members, as well as by other parties permitted by the Chairman with the consent of the other party. However, the information obtained from them shall not be made public.

Expenses of witnesses: Any individual summoned and appearing as a witness before the Committee or the Board is entitled to an allowance. These allowances are for costs paid in accordance with the rate in effect for payment of allowances to witnesses who appear in civil courts in the State at the time.

Chapter 4: Computations and Payment of Wages, Hours, and Holidays

This is a chapter dedicated to the calculation and payment of the wages of the workers. It also gives out insights into the hours of work and the holidays they are entitled to. Let’s take a look:

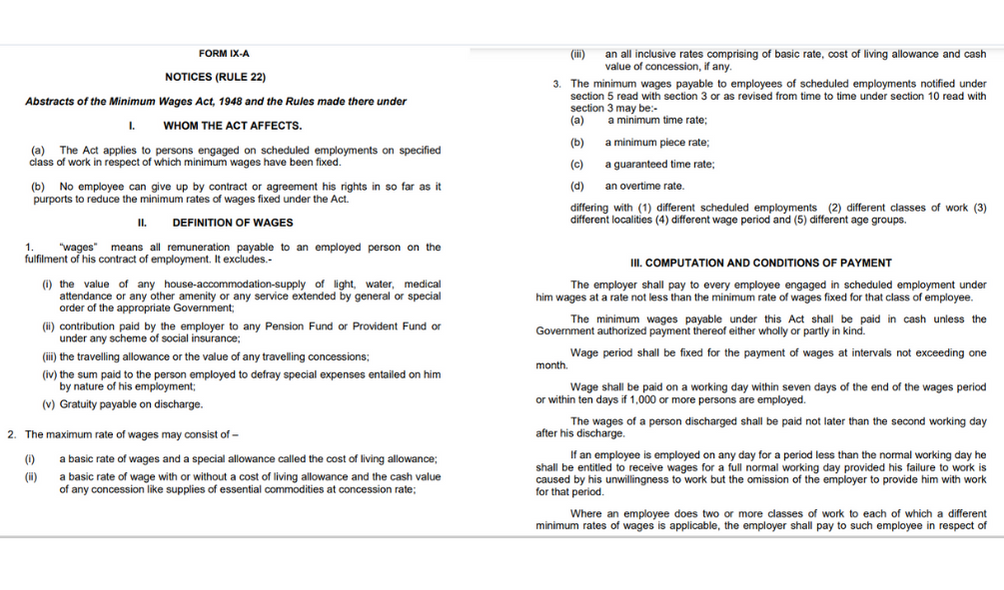

Mode of calculation of the cash value of workers’ wages

The cash value of wages provided in-kind and essential items supplied at concession rates shall be computed using the retail price at the nearest retail market. This calculation must be done in accordance with any instructions published by the government in this regard.

Time and conditions of wage payment and the deductions permissible from wages

The wage period is one month for any scheduled employment and the wages shall be paid as follows:

a)before the end of the seventh day, in the case of a firm employing less than one thousand people; and

b) before the tenth day, in the case of other establishments, after the final day of the wages period for which the wages are payable.

The wages earned by any individual whose employment is ended by the employer must be paid before the second working day ends after the day on which his employment is ended:

Provided, however, that upon receipt of a representation with regards to any scheduled employment or class or classes of employees in such employment, the Government may, after inviting public comment, notify any other wage periods or payment time limits. These will be applicable to all, or any class or classes of employees in such employment.

An employed person's pay must be paid to him without deductions unless otherwise approved by these regulations.

- Explanation I: To fulfill the objectives of these rules, every payment made by the employee to the employer or his agent is considered a deduction from wages.

- Explanation II: Any salary loss resulting from the application of any of the following penalties on an employee for good and sufficient cause:

(i) denial of increment or promotion (including denial of increment at an efficiency bar);

(ii) relegation to a lower position or time scale, or to a lower level in a time scale; or

(iii) suspension;

All the three subpoints above must not be regarded to be a deduction from pay in any situation when the employer's regulations for imposing any such penalty are in compliance with any conditions if any, that the State Government may specify in this regard by the announcement in the Official Gazette.

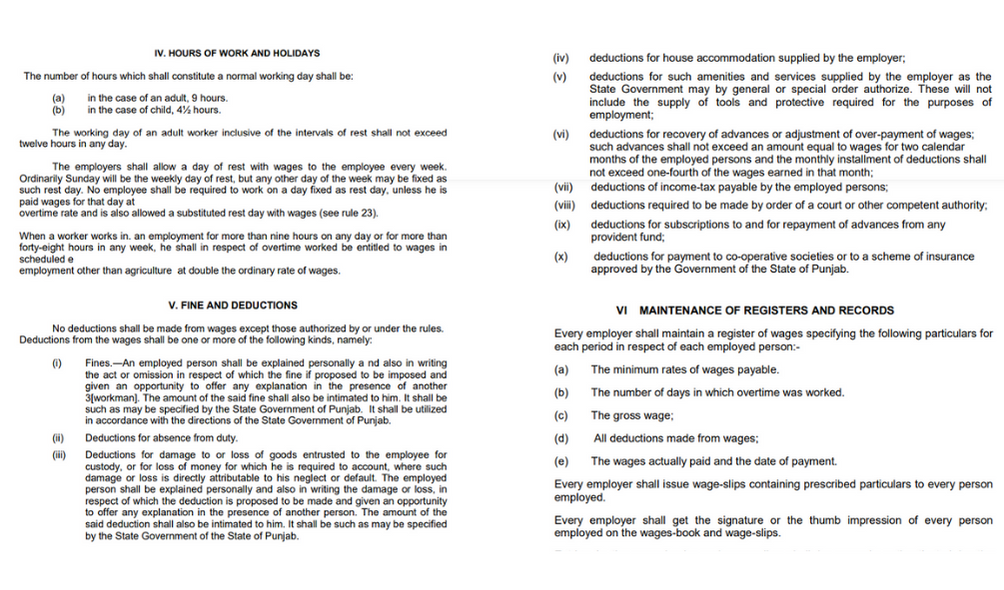

Fines and Penalties

Fines imposed on any of the following grounds may be deducted from the salary of a person employed in scheduled employment:

- Fines imposed on any of the following grounds:

(a) Absence from work without good reason (a fine may be levied solely as an alternative to the deduction permitted under clause (ii) of such rule (2) of Rule 21.

(b) Workplace negligence or omission.

(c) Smoking within the boundaries of the workplace, unless in designated smoking areas.

(d) Attempting to enter or leave the premises by any means other than the gate designated for that purpose.

(e) Absence from work without a good reason

(f) Overstepping rules or guidelines for maintenance of cleanliness within the premises

(g) Damaging work processes or employer’s property

(h) Messing with safety instruments installed on the work premises

(i) Distributing handbills, posters, and pamphlets without the permission of the employer

(j) Any kind of misconduct

- Deductions made due to absence from work

- Deductions for loss or destruction of goods assigned to the employed person for custody, or for loss of money for which he is responsible if the damage or loss is directly attributable to his carelessness or failure

- Deductions for housing provided by the employer, a State Government, or any authority created by a State Government for the purpose of providing housing

- Deductions for employer-provided facilities and services that the government may permit by general or particular order

- Deduction for repayment of advances or correction of wage overpayments. Provided, however, that such advances do not exceed an amount equal to the employed people's salary for two calendar months, and that the monthly deduction installment does not exceed one-fourth of the wage obtained in the month

- Income-tax deductions are applicable to the employed person

- Deductions imposed by a court or other competent authority's order

- Deductions for contributions to and repayments of advances from any provident fund to which the Provident Fund Act, 1952, applied, or any recognized provident fund as defined in section 58-A of the Indian Income-tax Act, 1922, or any approved Provident Fund by the Government for the duration of such approval.

- Deductions for payments to a co-operative group or a government-approved insurance scheme

- A deduction for the purchase of securities of the Government of India or any State Government, or for deposit in any Post Office Savings Bank in furtherance of any such Government's savings scheme, made with the written authorization of the employee.

- Deductions for the rent of livestock shelters and storage provided by the employers

deductions with written permission from the employee or the President or Secretary of the registered union of which the employee is a member

- Deductions for the repayment of any loan made from any fund established for the welfare of workers in accordance with rules approved by the State Government, as well as the interest payable;

- deduction for payment of Fidelity Guarantee Bond insurance premium

- Any person who wishes to impose penalties on an employed person or make a deduction for damage or loss caused by him must explain the act of omission or damage or loss for which the fine or deduction is proposed to be imposed or made to him personally and in writing, and provide him with an opportunity to offer any explanation in the vicinity of another individual. He will also be informed of the amount of the fine or deduction.

- Notwithstanding anything in these rules, the total amount of deduction from an employee's pay that is made based on sub-rule (2) in any pay period shall not exceed.

- if such deductions are made entirely or partially for payments to co-operative societies under clause (x) of sub-rule (2), 75% of such earnings and fifty percent of such wages in all other cases

- Nothing in these regulations shall be understood as preventing the employer from recovering from the employed people's salary or otherwise any money due them under any legislation in force at the time other than the Indian Railways Act of 1890.

- (iii) (a) Except as stated in clause I of sub-rule, no fine shall be imposed on any hired person (2)

(b) A notice detailing such acts and omissions shall be displayed in Punjabi with a Hindi translation near the main entrance of the premises.

- The total amount of fine that may be imposed on any employed person in any one wage period shall not exceed three paise in a rupee of the earnings payable to him during such wage period.

(d) No fine shall be imposed on anyone under the age of fifteen who is employed.

(e) No fine imposed on an employed person may be collected by installments on or after the sixty-day period following the date of issuance.

(f) A fine is considered to have been imposed on the day of the act or omission for which it was imposed.

(g) Any person other than the employer, as defined in subsection (e) of section 2 of the Act, may not impose a fine.

(h) All fines collected may be credited to a shared fund for the entire employees.

Provided, however, that the fund is used solely for the benefit of the employees of the establishment from whom the fine was collected.

- (iv) (a) Deductions under clause (ii) of sub-rule (2) may be made only if an employed person is absent from the place or places where he is required to work under the terms of his employment, such absence being for the entire or any part of the period during which he is so obliged to work.

- (b) In no case shall the number of such deductions bears a greater proportion to the wages payable to employed persons in respect of the wage period for which the deductions are made than the period for which he is absent bears to the total period within such 10 wage period during which he was required to work by the terms of his employment:

- If ten or more employed persons act in concert and leave without due notice and reasonable cause, such deduction from any person may include an amount not exceeding his wages for eight days.

- c) The pay of an employed person under the age of fifteen years or a woman must not be deducted for breach of contract.

- (d) No deduction from wages shall be made for violation of the contract of the employee unless there is a written provision that is part of the terms of the contract.

- (ii) The notice period cannot exceed one month or the wage period, whichever is shorter.

- (iii) the notice period does not exceed the notice period required by the employer for termination of employment;

- (iv) this rule has been posted in Punjabi and Hindi at or near the establishment's main entrance for at least one month prior to the start of the absence for which the deduction is made; and

- (v) a notice identifying the persons from whom the deduction is intended, the number of days for which the wages are to be deducted, and the conditions (if any) on which the deductions will be repaid has been posted at or near the establishment's main door;

Provided, however, that where a deduction is requested from all people engaged in any department or division, specifying the departments or sections impacted shall suffice in lieu of supplying the names of the persons in such department or division of the facility.

- In case of breach of contract, the deductions shall not be greater than the wages of the employees for the period during which the notice of termination of service falls short of the period required by the employment contract.

- In case of breach of contract, deductions shall not be made from any individual who has complied with the conditions indicated in the notification shown under sub-clause (d) (v).

- Deductions under clause (iii) of sub-rule (2) are limited to the amount of harm or loss caused to the employer by the employed person's negligence or default.

- (vi) A deduction under clauses (iv) and (v) of sub-rule (2) shall not be made from the wages of employed persons unless he has accepted the house accommodation amenity and this deduction should not be more than the amount equal to the values of the house accommodation amenity or service supplied.

- (vii) The deduction under sub-rule (2) clause (vi) is subject to the following conditions:

- (a) An advance of money given before the employment began shall be recovered from the first payment of wages for the entire wage period, but no such advance shall be recovered for travel expenses;

- (b) an advance of wages not yet earned shall not exceed an amount equivalent to the wages earned by the employed person during the preceding two calendar months, or if he has not been employed during the preceding two calendar months, without the prior permission of an Inspector;

- (c) the advance may be recovered in installments by deductions from wages. No installment shall exceed one-third or where the wages for any wage period are not more than twenty rupees, one-fourth of the wages for the wage periods in respect of which deduction is made.

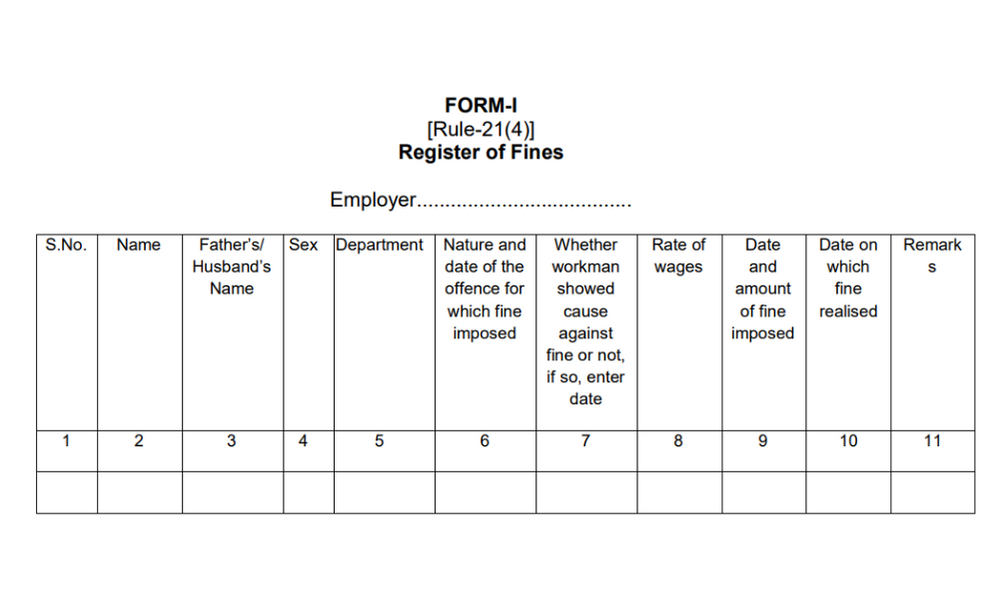

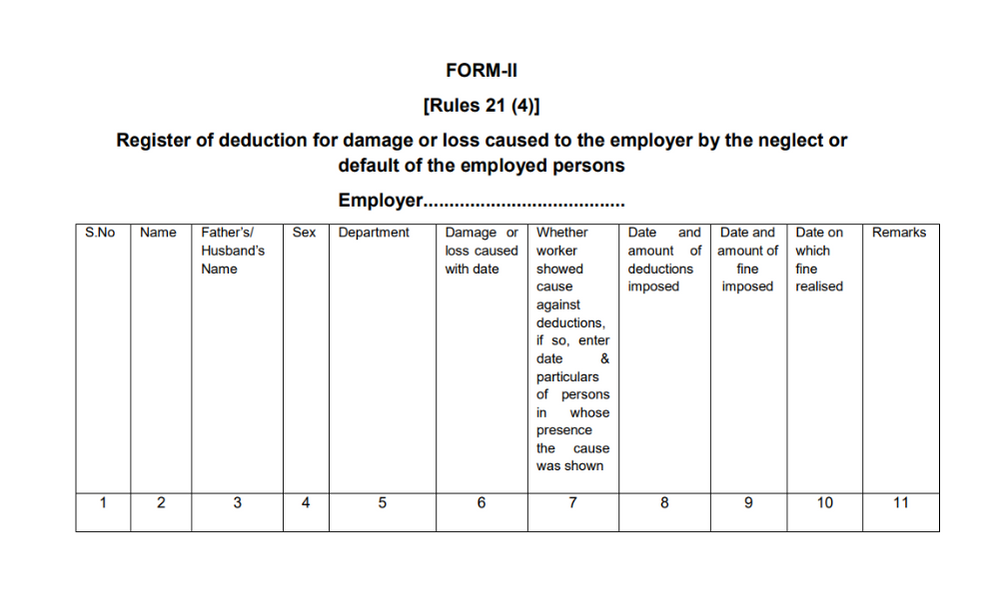

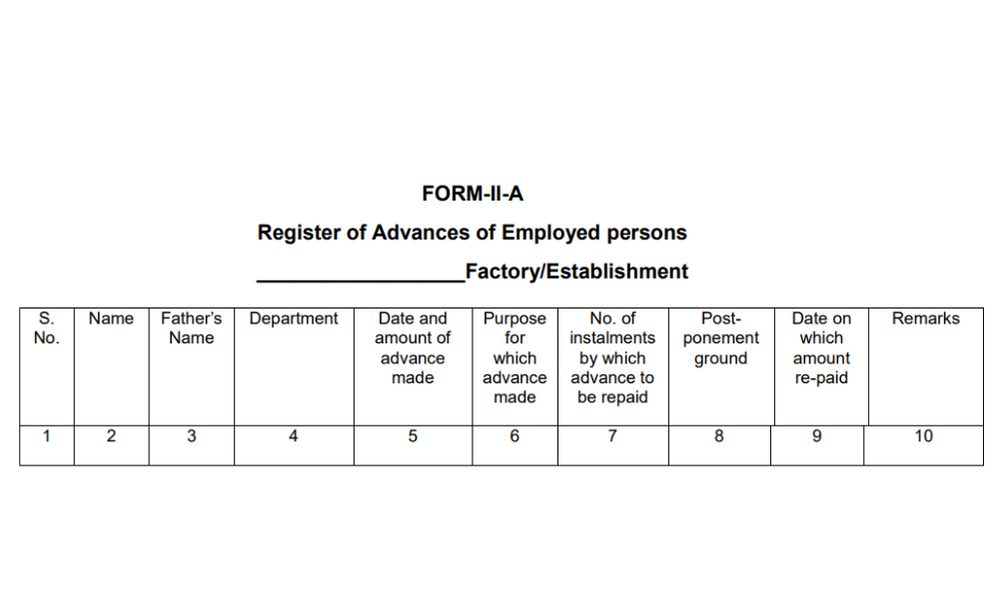

- (viii) All such fines imposed and deductions made and advances given shall be recorded in the registers maintained in forms I, II, and II-A, respectively. These registers shall be kept at the work spot and maintained up to date. Where no fine has been imposed or no deduction has been made from an employed person in any wage period, a ‘nil entry shall be made in the relevant register at the end of 12 the wage period, indicating also and in precise terms the wage period to which the ‘nil’ entry relates.

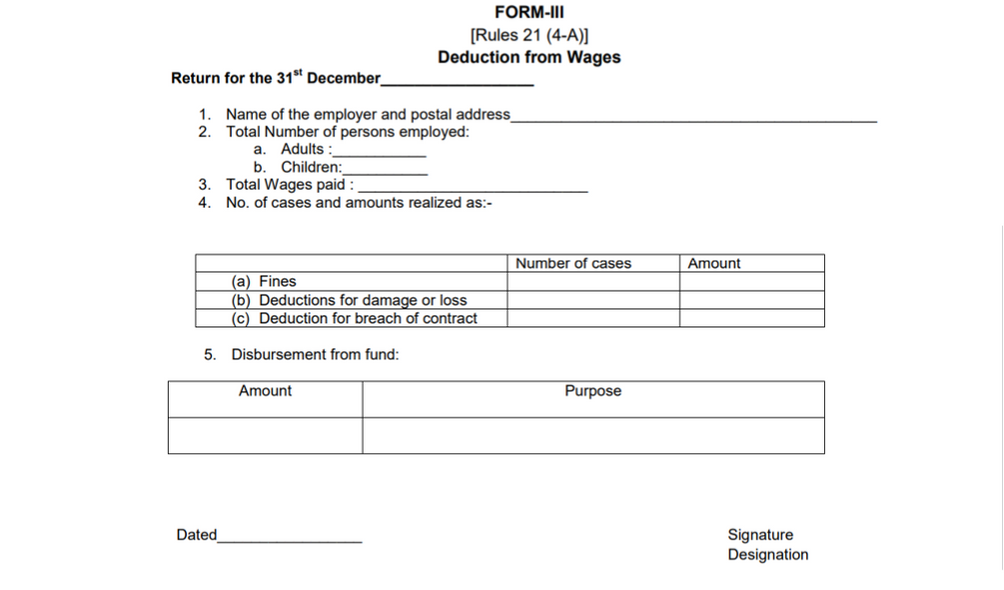

- (4-A) Every employer must file the annual return in Form III detailing the deductions from wages to the Inspector by the 1st of February following the conclusion of the fiscal year in question.

- (5) The fine imposed under sub-rule (3) may only be used for purposes that benefit employees and have been approved by the State Government.

- (6) The requirements of this rule shall not be construed to exclude an employee from receiving more favorable terms.

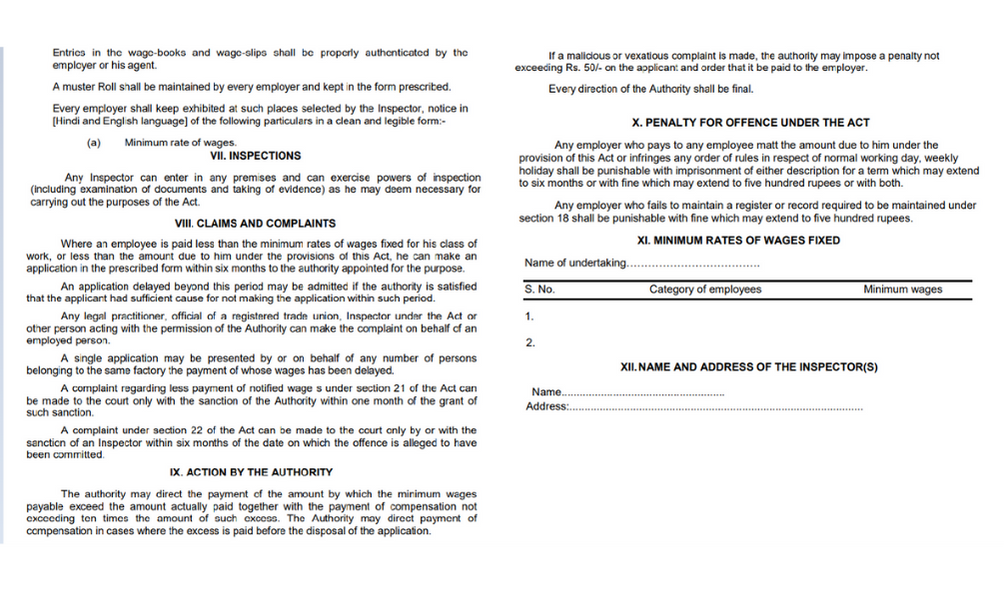

Notices regarding the minimum wage fixed under the Act

Notices in Form IX-A containing the minimum wages of rates imposed, as well as summaries of the Act, the rules adopted, and the name and address of the Inspector, shall be displayed in Punjabi at the main entrance of the establishment and its office and shall be kept clean and readable. All Sub-Divisional and District Offices must post such notices on their bulletin boards.

Weekly Day of Rest

(1) In accordance with the provision of this rule, an employee in scheduled employment for which minimum rates of wages have been established under the Act is entitled to a weekly day of rest which is ordinarily Sunday, but the employer may designate any other day of the week as the day of rest for any employee:

If the employee has worked in the scheduled position for at least six days under the same employer, the following applies:

– Furthermore, the employee shall be informed of the day designated as a rest day, as well as any subsequent changes in the rest day, prior to the change taking effect, by posting a notice to that effect in the place of employment at the location designated by the Inspector.

– Furthermore, nothing in this rule shall be construed as affecting the provisions of the Factories Act, 1948, or any other Act in force at the time.

(2) Any such employee shall not be compelled or permitted to work on the day of rest unless they have a substituted rest day for the entire day on one of the three days immediately after or before the rest day:

Provided, however, that no substitution is made that will result in the employee working for more than ten days in a row without a full day of rest.

(3) If an employee works on a rest day and is given a substituted rest day on any of the five days before or after the rest day, the rest day is included in the week for the purposes of computing weekly hours of labor.

(4) An employee is entitled to rest day pay calculated at the rate in effect the day before, and if he works on the rest day and is given a substituted rest day, he is entitled to overtime wages for the rest day on which he worked, as well as wages for the substituted rest day.

Wages will not be paid for the rest day if the employee's minimum daily rate of wages as notified under the Act has been calculated by dividing the minimum monthly rate of wages by twenty-six or if the actual daily rate of wages of the employee has been evaluated by dividing the monthly rate of wages by twenty-six. These daily rate of wages is not lower than the notified minimum daily rate of wages of the employee.

In the case of a piece-rate employee, the wages for the rest day, the day of rest, and the substituted day of rest shall be such as the Punjab Government may prescribe by notification in the Official Gazette, particularly with regard to the minimum rate of wages resolved based on the Act.

(5) This point has been omitted in the document.

(6) A week is defined as a period of seven days that begins at midnight on Saturday night and ends at midnight on Sunday night.

Number of hours of work that shall constitute a normal working day

(1) A normal day is defined as:

(a) no more than 9 hours in the case of an adult;

(b) no more than 4 and half hours in the case of a child; provided,

However, no person shall work for more than 48 hours in a week, according to the restrictions of these rules.

(2) An adult worker's working day must be structured in such a way that it does not exceed 10 or 12 hours on any given day, including any rest intervals. In scheduled employment, the time of labor on any given day shall be established such that no continuous period of work goes beyond five hours, and no worker shall be forced or permitted to work for further than five hours unless he has/had a half-hour rest gap after the aforementioned four hours:

Provided, however, that where the spread over based on any other legislation is less than twelve hours, the regulations concerning lesser spread over shall apply.

(2-A) Working hours must not be more than 10 hours each day or 60 hours per week, provided that the total overtime is not more than 50 hours in three months.

(3) The number of hours of work for an adolescent shall be the same as for an adult or a kid if he is certified by a competent medical practitioner authorized by the State Government to work as an adult or a child. No adolescent or child shall be obliged or permitted to work for more than 40 hours in any one week on any plantation defined in section 2 (f) of the Plantation Labor Act, 1951, and no child under the age of 12 shall be allowed or required to work on any such plantation.

(4) The regulations of sub-rules (1) to (3) are subject to any adjustments that the State Government may notify from time to time.

(5) Nothing in this rule affects the provisions of the Factories Act of 1948.

Night Shifts

When a worker in a regular job performs a shift that lasts past midnight:

(a) For the purposes of Rule 23, a full-day holiday in his instance means a period of 24 consecutive hours beginning at the end of his shift

(b) In such a scenario, the following day shall be understood to be the period of 24 hours beginning when such shift finishes, and the hours after midnight during which such employee was employed shall be counted towards the preceding day.

Extra Wages for overtime

(1) Where an employee's employment is controlled by a section of the Factories Act or any other enactment that mandates overtime pay, he is entitled to overtime pay at the rates mandated.

(2) When a worker works in an employment for more than the number of hours that constitute a normal working day, or for more than 48 hours per week in instances not covered by sub-rule (1), he is entitled to double the ordinary rate of pay for overtime work:

Provided, however, that the Government, may notify a change of payment of amount for overtime in respect of any scheduled employment in such employment after inviting public comments.

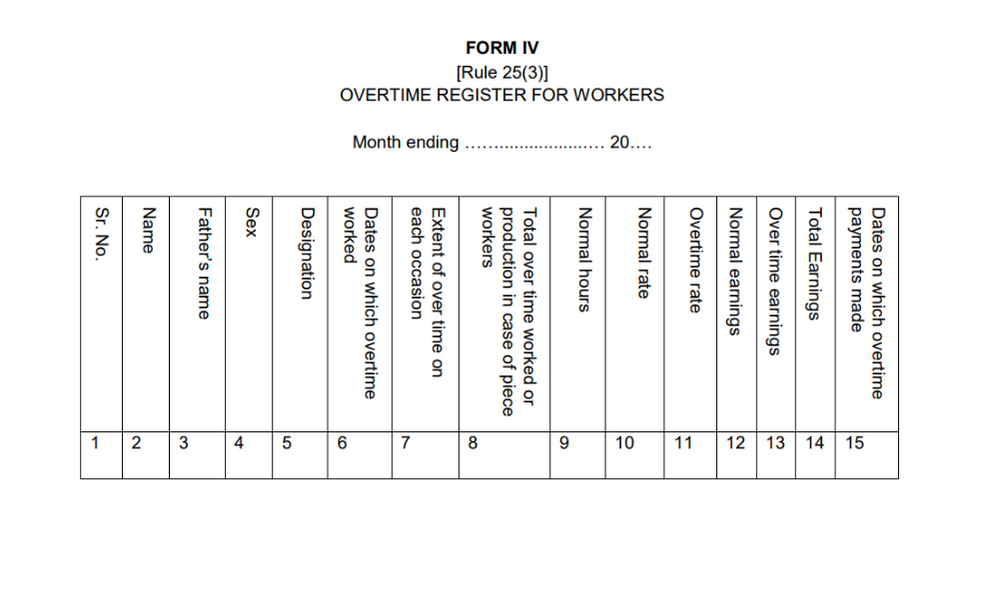

(3) Every employer must keep a record of overtime hours worked on Form IV, with entries made in the columns indicated as and when overtime is worked in any establishment. The registration must be stored on the job site and kept up to date. When no overtime is performed during a wage period, a 'nil' entry is made in the register, stating the wage period to which the 'nil' entry pertains in precise terms.

(4) No rule should be misconstrued to prejudice the Factories Act of 1948.

Part-time Employees

Where an employee works part-time for one or more employers and his minimum wages are set by the day, he is allowed to claim earnings for the number of hours he works on a pro rata basis from each employer for whom he works in a given day for less than the usual working day.

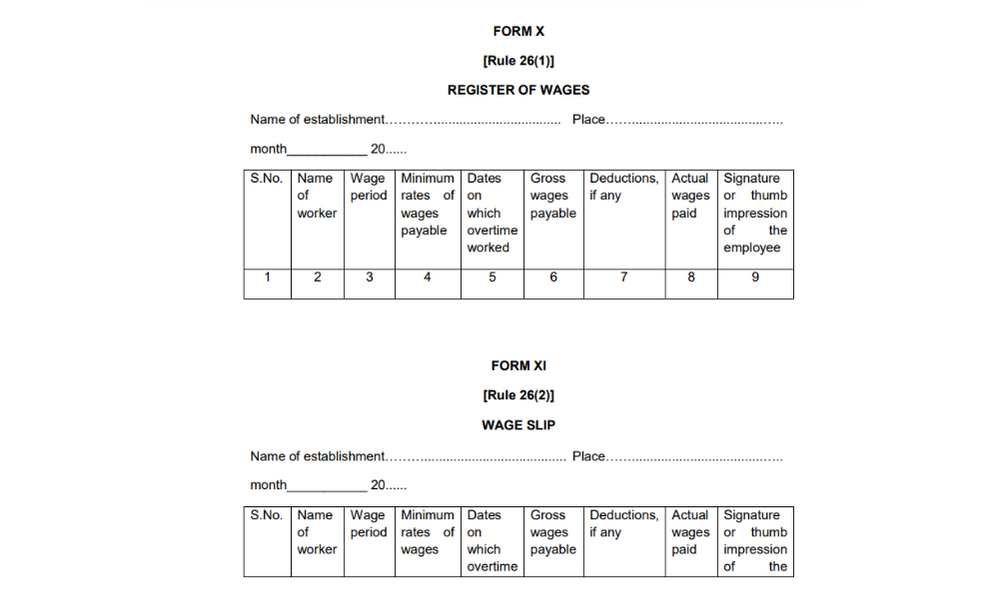

Form of Registers and Records

(1) Every employer must keep a wage register at the worksite in the form prescribed by the State Government, and it must include the following information:

(a) the minimum wages payable to every employee;

(b) the number of days each employee worked over-time for every wage period;

(c) the gross wages of each employee for every wage period;

(d) all deductions made from wages, with a sign in each case of the kinds of deductions mentioned in sub-rule (2) of rule 21;

(e) the wages actually paid to every employee for every wage period and the payment date.

(2) Wages slips containing the aforementioned particulars, as well as any other particulars declared by the State Government, must be issued by every employer to every individual employed by him at least one day prior to wage payment.

(3) Every employee's signature or thumb impression must be recorded in the wage book and wage slip by the employer.

(4) The employer or any person authorized by him in this capacity must authenticate entries in wage books and wage slips.

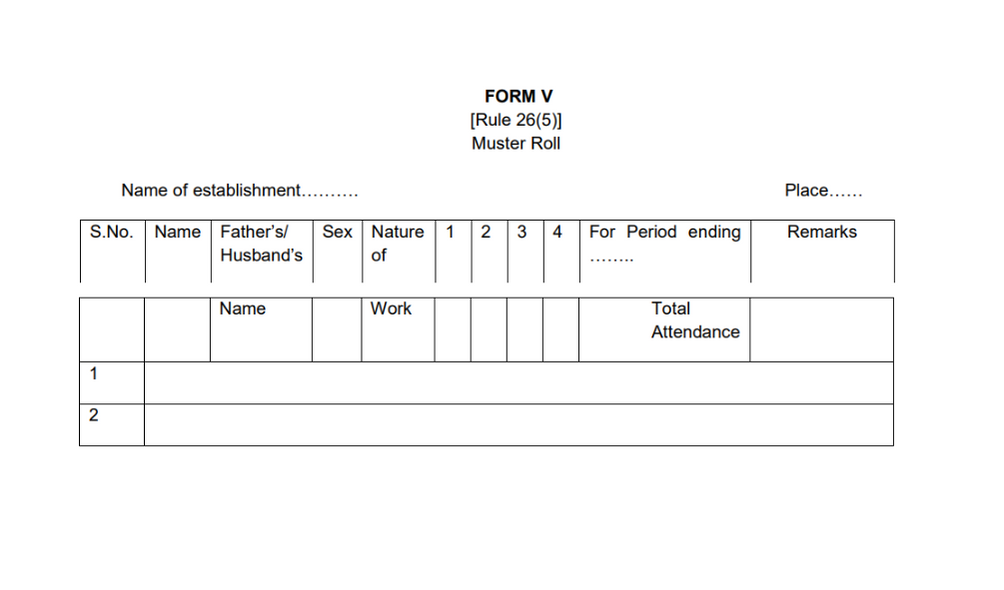

(5) Every employer is required to keep a muster roll in form V at the worksite.

(6) Notwithstanding anything in this rule, where an employer seeks to use a consolidated form to avoid redundant work in order to comply with the provisions of any other Act, an other appropriate form in lieu of any of the forms prescribed under this rule may be used with the prior approval of the Punjab Labor Commissioner.

Provided, however, that the Government may exempt any scheduled employment from the observance of any of the requirements under this rule, conditionally or otherwise, by notification in the Official Gazette. It may also vary those obligations in relation of the employees in such employment.

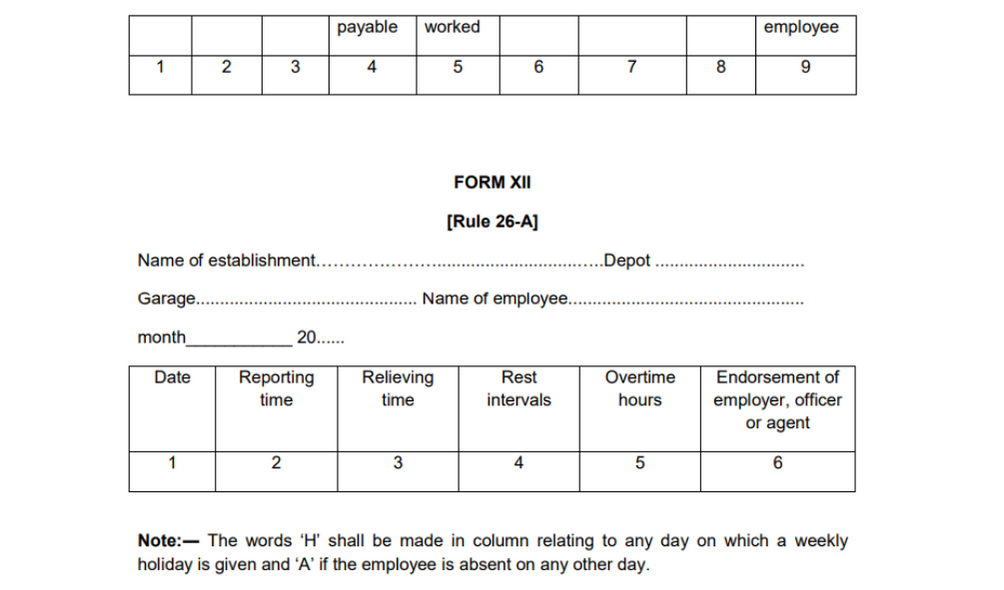

Employers should provide cards to employees engaged in public motor transport

- The employers must provide the driver, conductor, or any worker of public motor transport with a card in Form XII, every month. This could be in Hindi, Punjabi, or any other language easily understood by the employee.

- This card must be with the employee throughout the month, after which it shall be returned to the employer. The employer must preserve it for three years.

- The employer makes entries in the card in the presence of the employee.

- If the employee loses the card, the employer must provide a new card for ten paise.

Preservation of registers

The register and the muster roll must be preserved for three years, under rule 21(4), 25 (3) and 26(1) and under rule 26(5) respectively.

Production of registers and other records

The employer must produce the preserved documents as and when demanded by an inspector.

Provided, however, that the establishment has closed down and the inspector demands to see the documents.

Chapter 5: Claims under the Act

This chapter highlights the claims under the act. Let’s check the details:

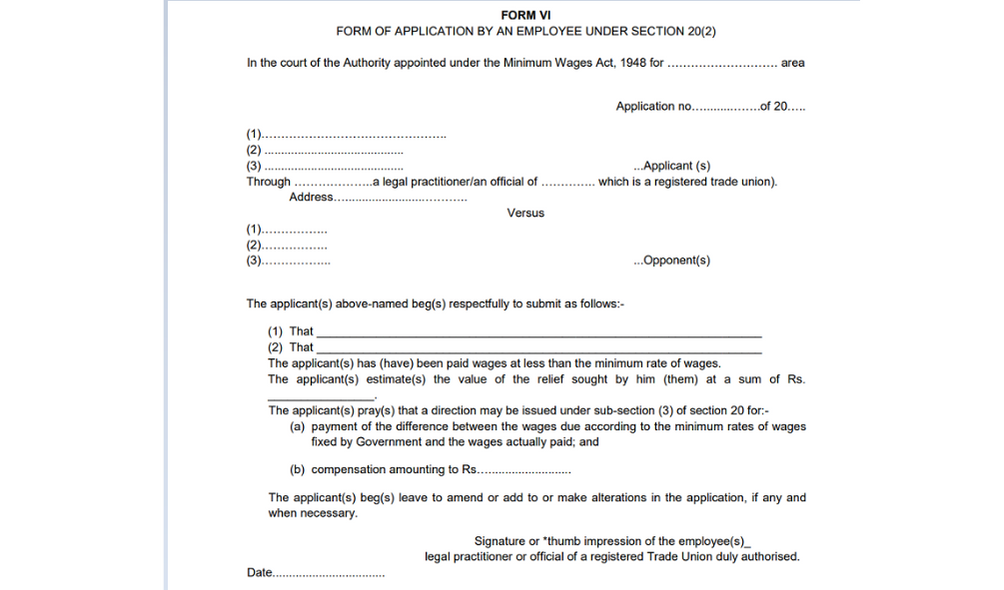

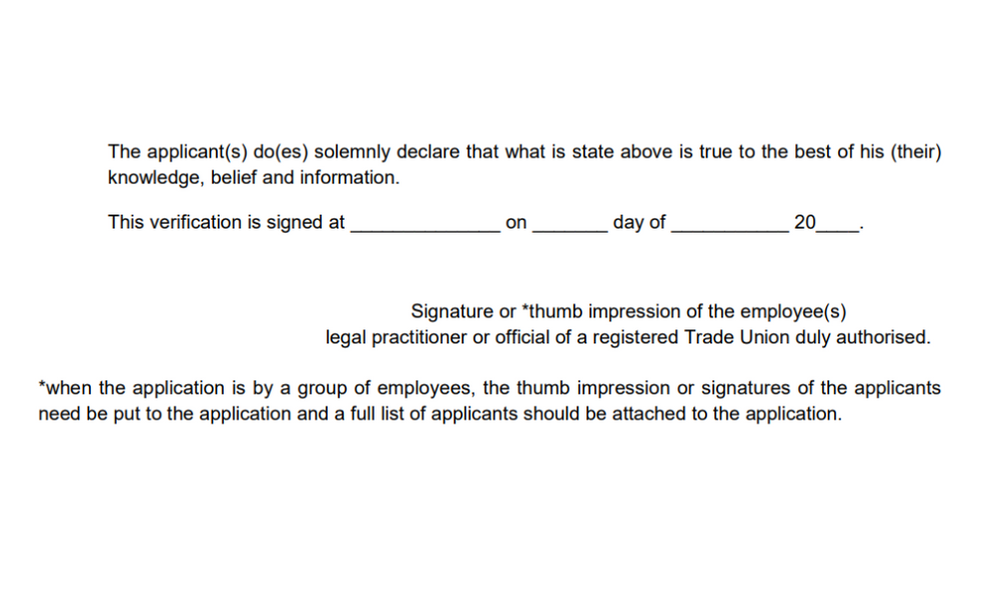

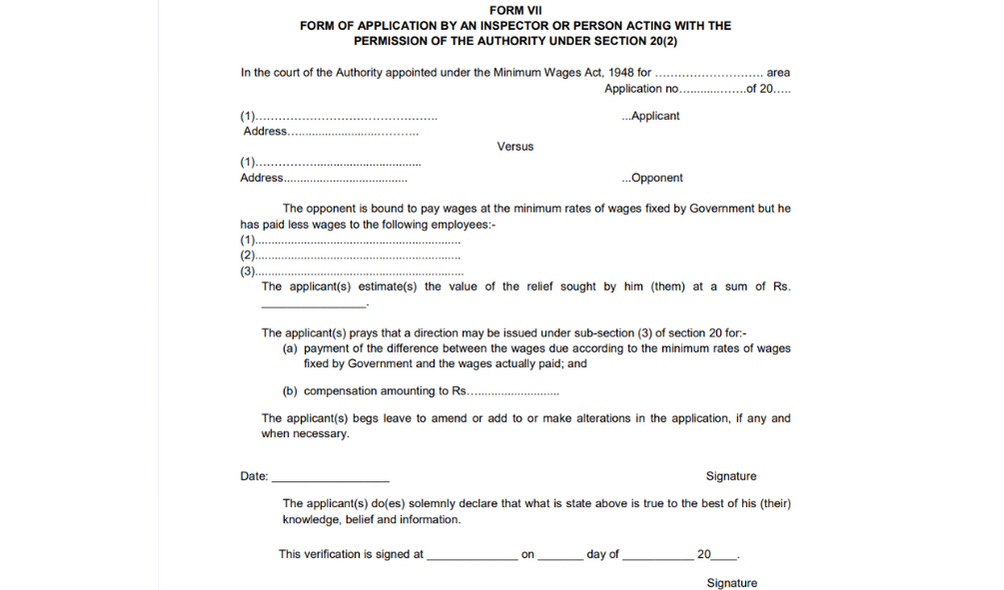

Applications

An application filed by or on behalf of an employed person or group of employed persons under subsection (2) of section 20 or subsection (1) of section 21 must be made in duplicate on form VI and VII, as the case may be.

Authorization

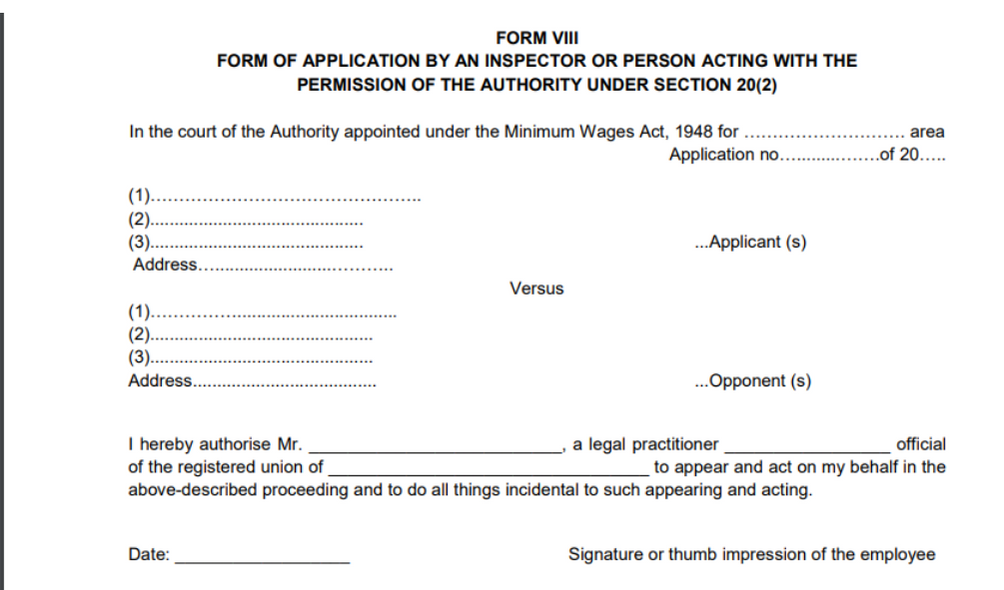

Based on sub-section (2) of section 20 or sub-section (1) of section 21, authority to act on behalf of an employed person or individuals must be given in form VIII by an instrument, which must be presented to the Authority hearing the application and become part of the record.

Appearance of parties

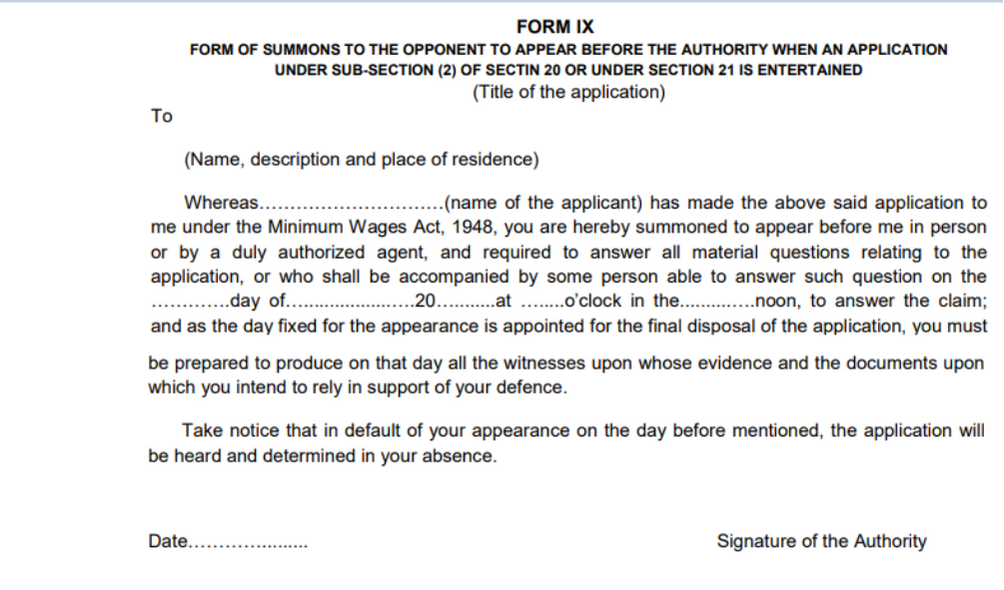

- If an application under section 20 or 21 sub-section (2) is granted, the authority must provide on the employer a notice in form IX to appear before him on a particular date with all supporting paperwork and witnesses, if any, and shall notify the applicant of the date so indicated by registered post.

- If the employer or his representative does not show up on the scheduled date, the authority can hear and decide the application ex parte.

- The Authority may discard the application if the applicant or his agent fails to appear on the appointed date.

- An order made under sub-rule (2) or (3) may be set aside if the defaulting party shows adequate cause within one month of the date of the order, and the application must be following service of notice on the opposing party of the reconsideration date in the manner indicated in sub-rule (1).

Chapter 6: Scale Of Cost In Proceedings Under The Act

This chapter explains about the various costs involved in the proceedings.

Costs

The costs of the proceedings shall include expenses for the following:

- court fees

- Expenses incurred on witness subsistence money

- Pleader's fees of ten rupees; provided, however, that the Authority may decrease the fees to an amount not less than five rupees in any action or increase it to a total not exceeding twenty-five rupees for reasons to be stated in writing.

- Where there is more than one petitioner, the authority may award the prevailing party or parties such expenses as it deems appropriate.

Court Fees

The court fee for procedures brought under section 20 will be as follows:

- For each application to summon a witness

- One Rupee for each application made by or on behalf of an individual; provided, however, that the Authority may relieve an applicant from payment of such costs entirely or partially if it believes the applicant is a pauper:

Furthermore, no fee must be charged

(a) to people employed in agriculture; or

(b) to an Inspector in respect of an application:

Provided, however, that the government may modify the scale of court fees for any class or groups of employees in any scheduled job by notification.

Forms

The various forms applicable to the Punjab Minimum Wages Rules, 1960 are as follows:

What are the Minimum Wages in Punjab in 2022?

The minimum wages in Punjab applicable for the year 2022 have been updated in November 2021 as per vide notification No. ST/17065 Minimum Wages.

Table No. I

Note : Minimum wages rate Vide Notification No. ST/17065.

Table No. II

Minimum wages of Staff Categories are as mentioned in the Table.

Table No. III

Minimum rates of Wages in Agriculture (Unskilled workers) attached labor (Consolidated per annum with meals or food grains equivalent). Based on the notification dated 15th Nov 2012.

Table No. IV

Other Agriculture Labour Daily Basis

Table No. IV

Brick Kiln (Piece Rate) Per 1000 Bricks/Tiles

How can Deskera Help You?

Payroll management and employee management are integral to any organization. If you are looking for a comprehensive and automated tool to manage payroll, employees, expenses, and contractor management, Deskera People could be the apt solution.

Key Takeaways

Minimum wages refer to the minimum salary the employers pay to their employees or workers for the work done in a specific time period. The minimum wages rules were introduced to ensure that all the workers empoyed in the varous scheduled employment categories reeive a fair and decent amount as daily wages.

Punjab Minimum Wages Rules, 1960 extends to the entire state of Punjab. The minimum wages in Punjab applicable for the year 2022 have been updated in November 2021 as per vide notification No. ST/17065 Minimum Wages.

Related Articles