Kerala Professional Tax (PT) is a tax paid by people who receive a salary and work for governmental or non-governmental organizations, are employed in the legal or accounting fields, or are otherwise involved in business.

In accordance with the Kerala Municipal Act of 1994, the Kerala State Government is given the responsibility to manage professional tax in Kerala. The Kerala government's set of income slabs serves as the basis for the professional tax rates. The responsible municipal body assesses the profession tax every six months. Under the Income Tax, the amount paid in professional tax is deductible.

The entire professional tax paid during the course of the year may be deducted in accordance with the Income Tax Act. In today’s guide, we’ll study about the Kerala Professional Tax and its related crucial information. Read the entire article to make sure you don't miss any crucial details.

Let’s take a look at the table of content before we dive in:

- Professional Tax in Kerala

- Kerala Municipality Act of 1994

- Kerala Professional Tax Slab

- Kerala Professional Tax Registration Requirements

- Kerala Professional Tax: Liability of Members of Firm

- Professional Tax Assessment in Kerala

- Calculation of Salary for Professional Tax

- Documents Required for Professional Tax Registration

- Registration Procedure for Kerala Professional Tax

- Kerala Professional Tax Must be Paid by a Self-Drawing Official

- Non-Payment of Professional Tax Penalty

- Who is in Charge of Obtaining and Paying Professional Tax in Kerala?

- How Do You Pay Professional Taxes Online In Kerala?

- When Is Kerala's Professional Tax Payment Due Date?

- Paying Professional Tax in Kerala: Exemption List

- What information should individuals who are in the employment include on their application for professional tax?

- How Deskera Can Assist You?

Let's get started!

Professional Tax in Kerala

Kerala Professional Tax (PT) is a tax paid to the state government by salaried workers, independent contractors, and professionals who work for both public and private organizations or in any other capacity. In accordance with the Kerala Municipal Act of 1994, the Kerala State Government is given the responsibility to manage professional tax in Kerala.

The Kerala government's set of income slabs serves as the basis for the professional tax rates. The responsible municipal body assesses the profession tax every six months. Under the Income Tax, the amount paid in professional tax is deductible.

Professional tax is imposed on members of the working class, including salaried people who work for the government, nonprofit organizations, or in any profession. Chartered accountants, attorneys, and those running businesses are also included in this.

Kerala Municipality Act of 1994

The Kerala Government established the Kerala Municipality Act of 1994, which allows the power to set professional taxes. The Kerala Municipality Amendment Act, 2015 mandates that Kerala professional tax be paid by everyone who receives a salary of more than Rs. 12,000 per half-year.

Additionally, under Section 16 of the Income Tax Act of 1961, a salaried person's profession tax payment may be deducted from income.

Kerala Professional Tax Slab

To learn more about Kerala's professional tax slabs, refer to the table below.

*Note: Late payments of professional taxes will result in a 1% monthly penalty. In addition, the profession tax imposes a Rs. 5000 fines for non-payment.

Kerala Professional Tax Registration Requirements

The following organizations would be subject to Kerala professional tax:

- Professional tax is due by every company that has been active in the municipality for at least 60 days.

- Any company that operates outside of the municipal boundaries but has its main office there for 60 days in order to supervise its activities is required to pay Professional tax.

- Every person who engages in business, practices their profession, art, or calling, occupies a public or private office, or engages in any other activity inside the municipal area is also required to pay professional tax. This condition is in effect for a minimum of 60 days.

- Professional tax is available to anyone who has lived in the municipal area for at least sixty days while working outside the boundaries of the municipality.

- Anyone who operates a business outside the municipality but maintains a primary office or other place from which they have control of the business for not less than 60 days.

- Anyone who has lived in the municipal area for a total of at least sixty days and receives any income from investments is liable to a half-yearly assessed tax.

Kerala Professional Tax: Liability of Members of Firm

The professional tax due by a firm or association may be assessed against the agent of the firm or association.

Liability of Servants of Agents to Professional tax

A corporation or person will be deemed to be conducting business in a municipal area if they employ an agent or servant to carry out their operations there, and the servant or agent will be liable for paying professional tax related to the company or person's operations.

Neither the former entity nor the agent's principal will be liable for a separate professional tax obligation on the same income when one entity works as the other's agent.

Professional Tax Assessment in Kerala

Kerala would conduct a professional tax assessment every six months. A notice directing all heads of office or employers to assess each employee in their organization who is subject to professional tax and to require self-drawing officers to pay the professional tax owed in accordance with the schedule to the notice must be sent out by the concerned corporation or municipality secretary every six months, between May and November.

A list of all the officers' names and a statement of their pay or income should be included in the material.

Calculation of Salary for Professional Tax

Professional tax is a tax levied by the state governments in India on salaried individuals and professionals. The amount of professional tax depends on the state in which you are employed and the salary you earn.

To calculate the professional tax on your salary, you need to first determine the amount of your salary that is taxable. This amount is typically the total gross salary minus any deductions for taxes, deductions for retirement contributions, and any other deductions that are allowed.

Once you have determined your taxable salary, you can then use the professional tax rate for the state in which you are employed. This rate is typically published by the state government, and it will vary from state to state.

Salary for professional tax purposes is calculated taking into account Basic, Special Allowance, Dearness Allowance, Bonus, and Extra Income (arrears, leave surrender, etc. if any).

Documents Required for Professional Tax Registration

The following documents must be submitted in order to register for Kerala Professional Tax.

- Articles of Association

- PAN Card

- Employee list with salary details

- Lease Agreement

- Memorandum of Association

- Employer Address Proof and ID Proof and photos

- List of Board of Directors

Registration Procedure for Kerala Professional Tax

A thorough explanation of Kerala's professional tax registration procedure is provided below:

The employer's head office is required to assess each employee who is liable to tax before the end of August and February of each year, collect the money from him, and then submit the money to the municipality together with a list of all the employees who have been assessed.

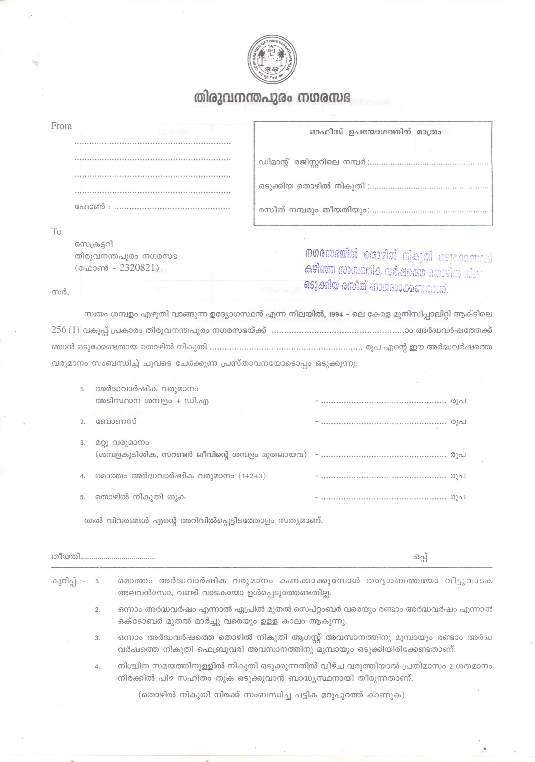

Application Submission

Step 1: The head of the office must submit the data in the necessary application form to the secretary of the relevant municipality along with the aforementioned papers within the time range provided in the notice.

The following details must be on the application form:

- The name of the employee

- Designation of Employee Half-Yearly Income

- Amount of tax recovered.

The relevant Municipality Corporation has an application for the Kerala Professional Tax. This document has an attachment that is a professional tax application form for the Thiruvananthapuram Municipal Corporation.

Step 2: The secretary will enter the names of the offices or institutions in a register kept for professional tax purposes after receiving the information given to him.

The Issue of Receipts for Remittances

Step 3: After receiving the money, the Secretary will issue a formal receipt in the name of the office's head.

Step 4: Each office head must give each taxpayer a document proving they have recovered and paid their half-worth years of taxes to the municipality.

Kerala Professional Tax Must be Paid by a Self-Drawing Official

Before the end of each fiscal year, the self-drawing officer is required to remit or make arrangements for the payment of the profession tax owed to him in respect of each half-year in accordance with the applicable tax schedule, along with a declaration outlining the specifics of half-yearly income. After receiving payment, the Secretary is required to issue an official receipt.

Non-Payment of Professional Tax Penalty

Late payments of professional taxes will result in a 1% monthly penalty. A fine of Rs. 5000 will also be assessed by the professional tax for late payments.

Who is in Charge of Obtaining and Paying Professional Tax in Kerala?

The Professional tax in Kerala is paid by the relevant municipal corporations.

The aforementioned logic suggests that Kerala's professional tax is a must for all incomes. Based on the different types of job, people can be divided into two groups. Here are a few examples:

1. Salaried Individuals

According to the Kerala Municipality Amendment Act, 2015, salaried individuals in Kerala who make a half-yearly salary of at least 12,000 rupees are obligated to pay Professional tax.

The employer deducts the salary of salaried workers and deposits the remaining funds with the state government.

2. Self-Employed Individuals

According to the Kerala Municipality Amendment Act of 2015, self-employed individuals in Kerala who make at least 12,000 rupees every six months are required to pay Professional tax.

Individuals who work for themselves have the choice of making payments directly or through the regional organizations assigned to handle them.

How Do You Pay Professional Taxes Online In Kerala?

In Kerala, both individuals and organizations can submit their professional tax payments online. There are now five organizations in Kerala that provide the service. They are Thiruvananthapuram, Thrissur, Kollam, Kozhikode, and Kannur.

Those who are willing to pay Professional Tax in Kerala can register their profile after providing their contact details and professional information. Based on a person's income slab, the system will determine how much professional tax must be paid following a successful registration and give them the option to do so.

When Is Kerala's Professional Tax Payment Due Date?

Earning people have till the end of August to finish paying their professional taxes for the first half of the year (April through September).

However, earning persons must finish paying their professional taxes for the second quarter of the year (October through March) by the end of February.

Individuals are required to pay 1% interest as a penalty charge each month in situations like late professional tax payment. However, earning people in Kerala are required to pay a fine of 5,000 for failing to pay Professional Tax.

Paying Professional Tax in Kerala: Exemption List

Following, we've discussed the list of individuals who are exempted from paying professional tax. Let’s learn:

- Members of the forces as per the Army Act, 1950, the Navy Act, 1957, and the Air Force Act, 1950

- Persons whose age is above 65 years

- Badli workers belonging to the textile industry

- Individuals who are suffering from a permanent physical disability, including blindness

- Parents of children who have a mental disability or permanent disability

- Women involved as an agent under the Director of Small Savings or the Mahila Pradhan Kshetriya Bachat Yojana

- Members of reservists or auxiliary forces serving in the state

- Parents or guardians of individuals suffering from a mental disability.

What Information Should Individuals Who are in the Employment include on their Application for Professional Tax?

Earners are required to provide information on the professional tax registration application form, including their half-yearly income, the name and title of their employee, and the amount of tax deducted from their salaries.

How Deskera Can Assist You?

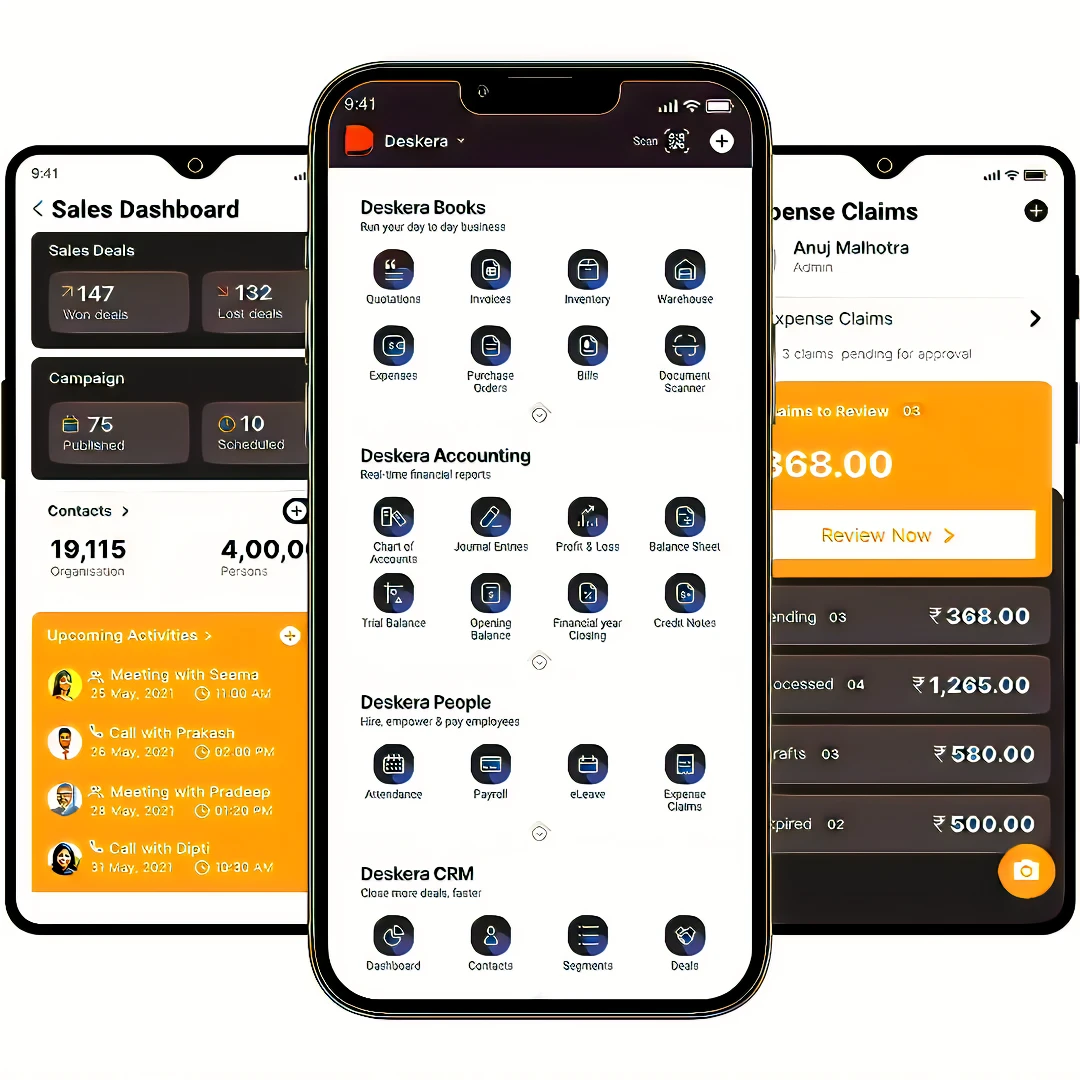

Deskera's integrated financial planning tools allow investors to better plan their investments and track their progress. It can help investors make decisions faster and more accurately.

Deskera Books enables you to manage your accounts and finances more effectively. Maintain sound accounting practices by automating accounting operations such as billing, invoicing, and payment processing.

Deskera CRM is a strong solution that manages your sales and assists you in closing agreements quickly. It not only allows you to do critical duties such as lead generation via email, but it also provides you with a comprehensive view of your sales funnel.

Deskera People is a simple tool for taking control of your human resource management functions. The technology not only speeds up payroll processing but also allows you to manage all other activities such as overtime, benefits, bonuses, training programs, and much more. This is your chance to grow your business, increase earnings, and improve the efficiency of the entire production process.

Final Takeaways

We've arrived at the last section of this guide. Let's have a look at some of the most important points to remember:

- Kerala Professional Tax (PT) is a tax paid to the state government by salaried workers, independent contractors, and professionals who work for both public and private organizations or in any other capacity. In accordance with the Kerala Municipal Act of 1994, the Kerala State Government is given the responsibility to manage professional tax in Kerala.

- The Kerala Government established the Kerala Municipality Act of 1994, which allows the power to set professional taxes. The Kerala Municipality Amendment Act, 2015 mandates that Kerala professional tax be paid by everyone who receives a salary of more than Rs. 12,000 per half-year.

- A corporation or person will be deemed to be conducting business in a municipal area if they employ an agent or servant to carry out their operations there, and the servant or agent will be liable for paying professional tax related to the company or person's operations.

- To calculate the professional tax on your salary, you need to first determine the amount of your salary that is taxable. This amount is typically the total gross salary minus any deductions for taxes, deductions for retirement contributions, and any other deductions that are allowed.

- According to the Kerala Municipality Amendment Act of 2015, self-employed individuals in Kerala who make at least 12,000 rupees every six months are required to pay Professional tax. Individuals who work for themselves have the choice of making payments directly or through the regional organizations assigned to handle them.

- In Kerala, both individuals and organizations can submit their professional tax payments online. There are now five organizations in Kerala that provide the service. They are Thiruvananthapuram, Thrissur, Kollam, Kozhikode, and Kannur.

- Earners are required to provide information on the professional tax registration application form, including their half-yearly income, the name and title of their employee, and the amount of tax deducted from their salaries.

Related Articles