A limited liability company (LLC) is an authorized type of business organization in the United States that combines the simplicity, flexibility, and tax benefits of a partnership with the accountability protection of a corporation. Owners are referred to as Members in LLCs.

Let's look at a detailed explanation of how to obtain an LLC and other aspects of an LLC covered in the article.

What is an LLC?

A limited liability company (LLC) in the United States is a business structure that shields its owners from personal accountability for its debts or liabilities. Limited liability companies (LLCs) are hybrid businesses that combine the advantages of a corporation with those of a partnership or a single proprietorship.

A limited liability company (LLC) is capable of owning and operating a company. LLCs are popular because they provide the same limited liability protection as corporations while being easier to set up and manage.

LLCs offer many options for ownership, management, and taxation. There are no restrictions on the number of owners (here known as members) that an LLC can have. Many LLCs have just one member, but they can have five, 10, or even hundreds.

Limited liability companies (LLCs) are a good option for business owners who want the liability protection of a corporation but don't want to pay double taxes (LLC). An LLC offers all of the benefits of a corporation while also allowing you to pass along any business profits and losses on your tax return.

An LLC is a hybrid business form in which the LLC's owners are referred to as "members", and all of them benefit from the benefits that an LLC provides. A single business owner, numerous partners, or other firms can all be LLC members.

State statutes allow limited liability firms to exist, and the rules governing them differ from one state to another. Members refer to the people who own an LLC.

Individuals, businesses, foreigners, foreign entities, and even other LLCs can all be members in many states that don't have ownership restrictions. Banks and insurance businesses, for example, are prohibited from forming LLCs.

A limited liability company (LLC) is a legal partnership that must file articles of incorporation with the state. An LLC is more accessible to form than a corporation, and it offers investors more flexibility and security.

LLCs have the option of opting out of paying federal taxes. Instead, the owners' tax returns are used to disclose their profits and losses. Another categorization, such as a corporation, may be chosen by the LLC.

When do you need an LLC?

If you prefer the simplicity of establishing a sole proprietorship or partnership but require liability protection, a limited liability corporation may be the right choice for you. An LLC will secure your assets while also establishing your business as you want.

Regrettably, not all firms are eligible to incorporate a limited liability company (LLC). Forming an LLC is not permitted for banks, trusts, or insurance companies. Furthermore, several states prohibit the formation of an LLC by professional service-oriented businesses such as a doctor's office or a legal firm.

Although LLC regulations differ in each state, there are some constants. The first step for owners or members is to develop a name.

After that, the articles of incorporation can be documented and filed with the state. These articles define each LLC member's rights, powers, responsibilities, liabilities, and other obligations. The individual names and addresses of its participants, the name of the LLC's registered agent, and the company's statement of purpose are also contained on the forms.

The articles of incorporation, as well as a fee paid directly to the state, are filed. The firm must deposit extra paperwork and fees submitted to the federal government to receive an Employment identification number(EIN),

Advantages of LLC

Limited liability

An LLC's resemblance to a corporation is one of its characteristics. A limited liability company (LLC) protects its owners from debt and liability in the event of a business failure. Take, for example, John's merchandise store "Suit up," which loses customers to one of the more upscale stores around the corner. The company isn't doing well, and it hasn't paid rent in ten months or paid invoices for four shipments of merchandise. As a result, "Suit up" owes a significant amount of money to its creditors, who have filed a lawsuit against it.

In this situation, the creditors have complete authority over the money owing to the corporation, but they have no authority over John's personal property (Gold or deposits or lands). Only the company's assets, not the owners', can be used to satisfy the debt in an LLC. This is a significant advantage that a single partnership cannot offer because the owners and the firm are treated as one entity, putting personal assets at risk.

Protects personal asset

An LLC limits the responsibility of its owner or owners. An LLC ensures that any member of the LLC is not personally accountable for some debt incurred by the LLC or for most litigation linked to your LLC business.

Creditors or persons who bring lawsuits against your company can't gather against your assets, such as your personal bank accounts, car, or home, because you're not personally accountable. They can only collect from your LLC's assets, such as its bank account.

Flexibility

A limited liability company (LLC) can pick from various tax treatment options. They can pick between sole proprietorships, partnerships, S companies, and C corporations as their tax structure. This allows the company to be recognized as a flow-through entity instead of a corporation.

A flow-through entity's income is recognized as its owners' income. Owners of an LLC can avoid paying double taxation due to this.

Income is taxed twice when the corporation earns it and when it is delivered to shareholders as dividends. Income earned by members of an LLC is taxed at the individual level rather than the company level.

If the business chooses to be taxed as a partnership, income might be distributed among members in ways other than ownership proportion. In the operating agreement, members agree to this.

The company's operating agreement functions similarly to a corporation's bylaws. It is in charge of its finances, structure, and operations. An LLC's management structure is more flexible than that of a corporation, which must designate executives and a board of directors. This is also determined and specified in the operating agreement. Creating an operating agreement from scratch can be a complex process. Use an LLC operating agreement template to ensure every member is accounted for and your business stays legally compliant as it grows and changes.

Taxation

Pass-through taxation is typically available to LLC owners. The company's profit or loss suffered are passed through to the owner's self tax return. Profits from such businesses are taxed at the owner's rate.

SMLLCs (single-member limited liability companies) are taxed similarly to sole proprietorships. The LLC's income, losses, and deductions are reported on IRS Schedule C, which is filed alongside the owner's tax return.

When there are two or more members in an LLC, it is typically taxed as a partnership. Profits and losses are recorded on the owners' tax returns and taxed at their individual rates.

Remember that the IRS automatically classifies certain LLCs as corporations for tax purposes, so make sure you know if yours does. By completing Form 8832, LLCs that are not automatically designated as corporations can choose their preferred business entity. If the LLC wishes to modify its classification status, it must use the same form.

Since LLCs are typically pass-through organizations, owners may be eligible for the Tax Cuts and Jobs Act's new special pass-through tax deduction. The deduction began in 2018 and will last until 2025. This is a tax break worth up to 20% of the pass-through business's net income.

Simplicity

Starting a limited liability company (LLC) is the simplest business structure, with fewer complications, paperwork, and expenses. This business structure offers much operational flexibility and fewer record-keeping and compliance concerns.

LLCs also give you a lot of management flexibility because you don't have to worry about establishing a board of directors, holding yearly meetings, or keeping meticulous records. These functions help save time and effort by removing unnecessary inconveniences.

An LLC is the most straightforward business structure to set up and run. Unlike a corporation, there are no executives or directors, no board or shareholder meetings, and additional administrative obligations.

Credibility

If it comes down to leading or managing a firm, forming a limited liability company (LLC) can help you establish credibility. It gives customers confidence that you are a legitimate company. You'll also be able to utilize an official company name.

Disadvantages of LLC

Fees and Taxes

Although limited liability firm owners avoid double taxation, they must pay self-employment taxes. Because the owner is both an employee and an employer, these taxes are paid twice.

Some states also charge an annual fee for the restricted liability benefits that LLCs provide their members. A franchise tax is a term used to describe this fee.

To prevent this, the entity might choose to be taxed as a corporation if it is more advantageous, based on the company turnover and tax burden. Before making this decision, seek advice from an accountant.

Regulations

As previously stated, an LLC is governed by state law, which can significantly impact how the firm operates in many situations. Some states, for example, may dissolve a limited liability company when one of its members dies. The company passes on the deceased member's membership equity to their executor and operates in other states.

These examples show the state's default resolutions. In the circumstances like the one described above, LLC members can select how they want the company to proceed and document it in the operating agreement.

As you can see, the agreement is essential documentation that members should not overlook while forming the business. It's also crucial to think about how the business will operate in international marketplaces. Because the distinction between the two is not recognised in Canada, an American LLC will most likely be classified as a corporation.

Investment Disadvantages

LLCs aren't the best choice for entrepreneurs looking for outside funding. This is especially important if you want to raise money from venture capitalists, who usually only fund corporations.

Corporations are ideal for outside funding because firms may issue stock in exchange for investors' money. Outside investors can participate in LLCs and earn LLC ownership interests, although it is more complicated than investing in a corporation.

Limited Life

The duration of an LLC's members determines how long it can exist. In comparison, there are differences between states. When a member of an LLC leaves, the business is dissolved or ceases to exist in most of them, requiring the remaining members to finish any outstanding business or legal duties to shut the business.

The remaining members can form a new LLC or split apart. An LLC's weakness can be overcome by inserting proper clauses in the operating agreement.

How do I form an L.L.C. in California?

Here’s breakdown of the process:

Choosing a name for the L.L.C.

You'll need to come up with a unique name for your L.L.C. It can't be the same as or too similar to an existing name in the California Secretary of State's database, and it can't be deceptive to the public.

The California Secretary of State's business has a database that can check the availability of names. The Name Reservation Request form can reserve an available name for up to 60 days. The paperwork must be mailed or delivered in-person to the California Secretary of State's office.

ACCORDING TO CALIFORNIA LAW, an L.L.C.'s name must end in a Limited Liability Company, or the acronyms L.L.C. or L.L.C. Limited and Company can be shortened as Ltd. and Co., respectively. The words bank, incorporated, inc., corporation, corp., or any other phrases implying that the L.L.C. is in the insurance industry are prohibited from being used in its name.

The Secretary of State gives additional, critical information about company name availability online and in a downloadable pamphlet.

Some more considerations :

- Availability of URL: Even if you don't believe you'll need one, chances are you will. At the very least, by purchasing your domain name now, you reserve the possibility of owning one later. It is wise to confirm the availability of the URL before deciding on your L.L.C. name. If you're unsure about how to select a domain name, utilizing a domain name generator can be helpful.

- Reservation of name: You can reserve your L.L.C. name for a nominal price if you aren't ready to register it yet but are worried it will be snatched by someone else. Names can be reserved for up to 60 days in California by paying a fee and submitting the appropriate form to the state authorities.

File Articles of the organization with the Secretary of State

A California L.L.C. is formed by submitting Form LLC-1, Articles of Organization, to the California Secretary of State's office. The name of the L.L.C., its purpose, information on how it will be handled, its address, and the details of its registered agent must all be included in the articles.

Form LLC-1 can be completed online, mailed, or delivered to the Secretary of State's office. A filing fee of $70 is required. For a charge, you can request expedited filing for hand-delivered submissions at the Sacramento Secretary of State's office.

Choose Your Registered Agent

A service agent for the process is required for every California L.L.C. (called a registered agent in other states). If the L.L.C. is issued, this person or Company agrees to accept legal documents on its behalf. For service of process, an L.L.C. cannot act as its agent. Before the limited liability company's designation, the agent should agree to accept service of process on its behalf.

Individual agents must be California residents with a street address (not a P.O. box) recorded in the L.L.C.'s articles of organization. The agent does not need to be a member, manager, or officer of the L.L.C.

The California Secretary of State keeps a list of private service businesses (registered commercial agents) who will operate as process servers for a fee.

Prepare and File Articles of the Organization

The Articles of Organization is an authorized document that forms your limited liability company (L.L.C.) by giving its fundamental facts. Form LLC-1 is used in California to submit Articles of Organization.

To properly register your California L.L.C., prepare Articles of Organization and file them with the Secretary of State. Though it may appear to be an enormous task, it merely entails completing and submitting a short internet form. It's also possible to mail it.

The article requires necessary details, such as the name and address of the L.L.C., its purpose, details of the registered agent, the structure of management, and the signature of the person forming the article.

The secretary of state will review your Articles of Incorporation after filing them. The L.L.C. becomes a legitimate business entity once the articles are authorized. You can submit your application via regular mail, online, or in-person in California.

Filing a statement of information

Every California and international L.L.C. must file a Statement of Information, Form LLC-12, with the California Secretary of State. After that, a Statement of Information must be filed (biennial). The filing period consists of the calendar month in which the original articles of incorporation were filed, as well as the five preceding calendar months. The statement can be filed online, printed, mailed, or delivered to the California Secretary of State. The cost of filing is $20.

It must include the following :

- The name of the L.L.C. and California Secretary of State file number.

- The street address of the L.L.C. principal executive office.

- The name and number of the L.L.C.'s agent for the process service.

- The mailing address of the L.L.C. (if different from the street address)

- The name and complete address of any manager/managers and C.E.O.

- The email address of the L.L.C.

- The general type of business that the L.L.C. will carry out.

Pay the Annual Franchise Tax

1) If they are organized, registered, or conduct business in California; and

2) they have opted out to be taxed as a corporation—that is, they are taxed as a partnership or sole proprietorship—all L.L.C.s and foreign L.L.C.s are required to pay California taxes to the California Franchise Tax Board (F.T.B.) (disregarded entities). The corporate tax rules apply to L.L.C.s taxed as companies in California.

An L.L.C. must pay an $800 franchise tax to conduct business in California. This cost is required to be paid every year, regardless of whether the business generates any revenue.

A separate annual charge is necessary if your L.L.C.'s gross revenue exceeds $250,000 per year.

L.L.C.s incorporated in California in 2021, 2022, or 2023 are eligible for a tax exemption. An L.L.C. that registers or organizes to do business in California for the first taxable year is exempt from the state's $800 minimum annual franchise tax. The L.L.C. must pay the $800 fee during the second taxable year.

What will be the Expense?

To give you a closer look at the expense breakdown of forming an L.L.C., here are the details :

Reservation fee

Before registering your L.L.C., you can file a $10 name reservation request to hold the name for 60 days. Although a reservation fee isn't required to register or form an L.L.C., it may be a good idea to pay it to ensure you receive the name you desire.

Statement of information cost

All California L.L.C.s must file a statement of information within 90 days of forming. This can be done on the internet, in person, or by mail. The price is $20. A penalty will be imposed if you do not comply.

Every two years, a statement of information must be filed, with a $20 cost.

Articles of organization

Most states demand that you draught and file articles of organization incorporate an L.L.C. The articles of organization are a legal document that forms your limited liability company (L.L.C.) by giving forth essential information about it. The Secretary of State in California will charge you $70 to register your Articles of Organization.

An L.L.C. must pay an $800 franchise tax to conduct business in California. This cost is required to be paid every year, regardless of whether the business generates any revenue.

A separate annual charge is necessary if your L.L.C.'s gross revenue exceeds $250,000 per year.

L.L.C.s incorporated in California in 2021, 2022, or 2023 are eligible for a tax exemption. An L.L.C. that registers or organizes to do business in California for the first taxable year is exempt from the state's $800 minimum annual franchise tax. The L.L.C. must pay the $800 fee during the second taxable year.

Cost to register a foreign

You must pay to register as a foreign L.L.C. if you have an L.L.C. registered in another state and wish to develop your business in California. The registration fee is $70.

Amendment to Article of Org.

It costs a total of $30 to fill up.

Obtaining certified copies

Official copies of documentation related to business filings are sometimes required. The first page costs $1 in California, and each subsequent page costs $.50. A $5 certified fee is charged, as well as a $10 handling fee if you request these documents in person.

How Can Deskera Assist You?

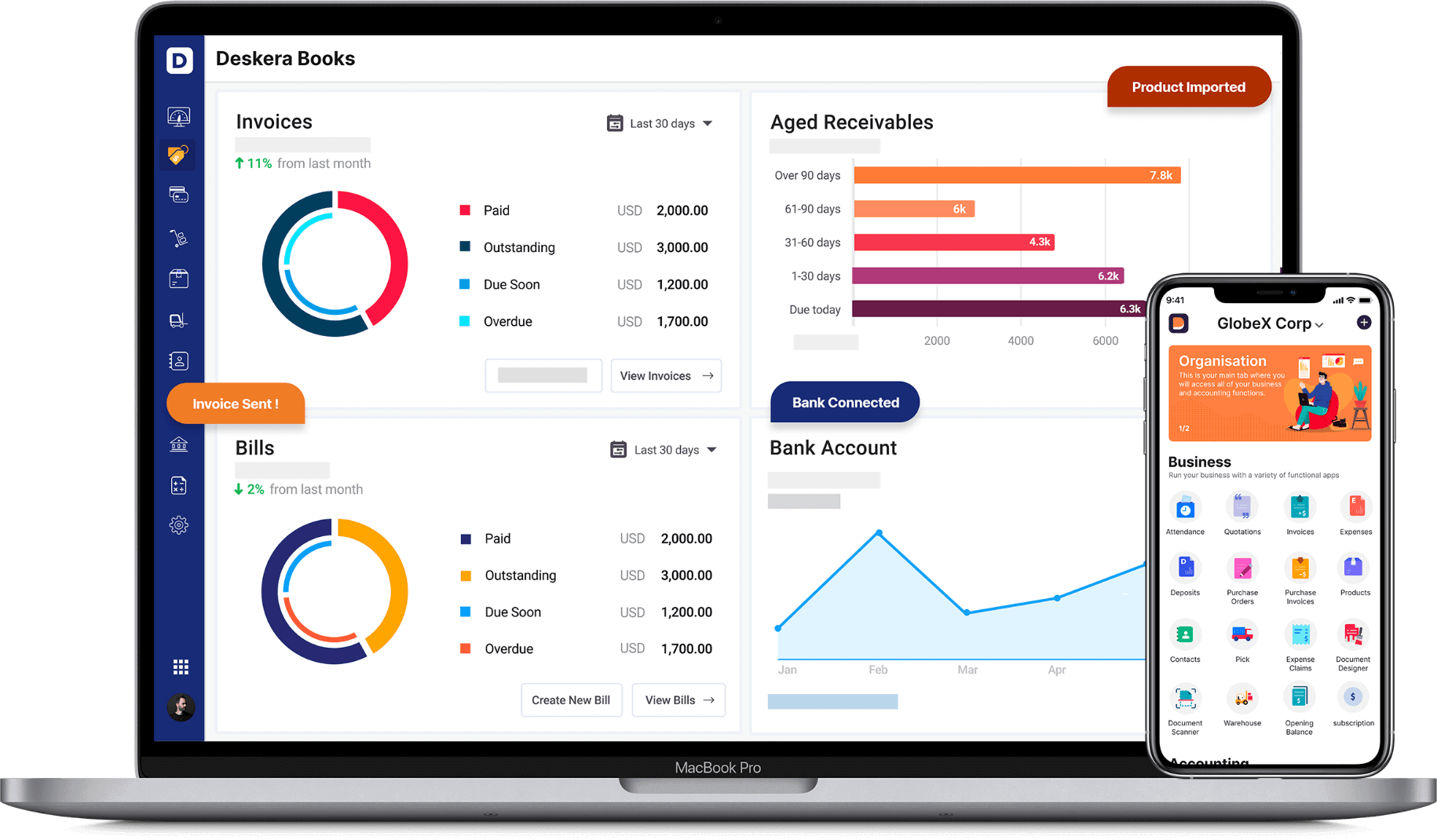

Deskera Books can help you automate your accounting and mitigate your business risks. Creating invoices becomes easier with Deskera, which automates a lot of other procedures, reducing your team's administrative workload.

Key Takeaways

- A limited liability corporation (LLC) is a business structure that shields its owners from personal accountability for its debts and liabilities.

- The procedure and rules to regulate the LLCs vary from state to state.

- As they are inexpensive, easy to organise and manage, forming a limited liability corporation (LLC) is the optimal business structure for most small enterprises. An LLC is the best option for business owners who want to protect their assets.

- A limited liability company (LLC) can own and operate a company. LLCs are popular because they provide limited liability protection as corporations while being easier to set up and manage. Any profit or loss incurred by the business is the responsibility of all LLC members

Related Articles