A robust product pricing strategy is crucial for businesses to thrive in today's competitive market landscape. Effective pricing not only ensures profitability but also influences customer perception and market positioning. Central to this strategy is accurate finished goods costing, which forms the foundation for determining optimal pricing.

Accurate costing provides a comprehensive understanding of the true expenses incurred in manufacturing a product, encompassing direct materials, labor, overhead, and indirect costs. However, many businesses struggle with the challenge of obtaining precise costing data, leading to flawed pricing decisions and negative financial implications.

This article explores the significance of accurate finished goods costing in improving product pricing strategies. It delves into the factors that influence costing, highlights the strategies for achieving accuracy, and emphasizes the importance of leveraging accurate costing to set competitive prices while maintaining profitability.

By prioritizing accurate finished goods costing, businesses can unlock greater precision in pricing strategies and drive overall success.

- Importance Of A Sound Product Pricing Strategy In The Competitive Business Landscape

- Role Of Accurate Finished Goods Costing In Determining Optimal Pricing

- Understanding the Significance of Accurate Finished Goods Costing

- Factors Influencing Finished Goods Costing

- Strategies for Achieving Accurate Finished Goods Costing

- Leveraging Accurate Finished Goods Costing for Pricing Strategy

- Overcoming Challenges and Implementing Continuous Improvement

- Why should Businesses Prioritize the Implementation of Effective Costing Practices to Optimize their Pricing Strategies and Profitability

- Conclusion

- How can Deskera Help You?

- Key Takeaways

- Related Articles

Importance of a Sound Product Pricing Strategy in the Competitive Business Landscape

In today's fiercely competitive business landscape, a sound product pricing strategy is essential for companies aiming to thrive and succeed. Pricing directly influences a company's profitability, market positioning, and customer perception, making it a critical element of strategic decision-making.

An effective pricing strategy enables businesses to maximize revenue, optimize resource allocation, and create sustainable competitive advantages.

Maximizing Profitability: A well-crafted pricing strategy allows businesses to strike the right balance between generating revenue and managing costs. By accurately assessing costs, , and competitive dynamics, companies can set prices that maximize profitability and ensure long-term financial viability.

Differentiating from Competitors: Price plays a significant role in positioning a product or service in the market. A thoughtfully designed pricing strategy can help businesses differentiate themselves from competitors, attract target customers, and build a distinct brand image based on perceived value.

Responding to Market Dynamics: The business landscape is dynamic, with market conditions, customer preferences, and competitive pressures constantly evolving. An adaptable pricing strategy equips companies to respond to these changes effectively, enabling them to adjust prices in real-time, capitalize on market opportunities, and mitigate risks.

Influencing Customer Perception: Price has a psychological impact on customer perception. A well-calibrated pricing strategy can shape how customers perceive a product's quality, value, and exclusivity. By aligning pricing with customer expectations, businesses can enhance brand reputation and foster customer loyalty.

Promoting Market Penetration or Expansion: Pricing strategies can be leveraged to penetrate new markets or expand customer reach. By strategically adjusting prices, businesses can attract price-sensitive segments, penetrate untapped markets, and gain a competitive edge over established players.

Optimizing Product-Market Fit: Pricing is closely intertwined with product-market fit. A well-aligned pricing strategy ensures that the price reflects the product's value proposition and resonates with the target audience. This synergy enhances market acceptance, demand, and ultimately, sales.

Role Of Accurate Finished Goods Costing In Determining Optimal Pricing

Accurate finished goods costing plays a pivotal role in determining optimal pricing for products. It provides businesses with a comprehensive understanding of the true expenses associated with manufacturing a product, enabling them to set prices that align with costs and maximize profitability.

In the competitive business landscape, where pricing decisions significantly impact a company's financial performance and market positioning, accurate costing is critical.

This section explores the role of accurate finished goods costing in determining optimal pricing strategies and its implications for business success.

Cost-based Pricing: Accurate finished goods costing forms the foundation for cost-based pricing strategies. By calculating the direct materials, labor, overhead, and indirect costs associated with manufacturing a product, businesses can establish a pricing structure that covers expenses while ensuring a reasonable profit margin.

Profit Margin Calculation: Accurate costing enables businesses to calculate profit margins accurately. By subtracting the total costs from the selling price, companies can determine the profit earned per unit or the overall profit margin for a product. This information guides pricing decisions to achieve desired profit targets.

Competitor Analysis: Accurate costing allows businesses to conduct a comprehensive competitor analysis. By understanding their own production costs and comparing them with competitors' prices, companies can identify opportunities to position their products competitively. This analysis helps in setting prices that balance competitiveness and profitability.

Value-based Pricing: Accurate costing facilitates value-based pricing, which focuses on the perceived value of a product to customers. By accurately determining costs, businesses can align pricing with the value that customers derive from the product, leading to optimal pricing decisions and enhanced customer satisfaction.

Pricing Adjustments: Accurate finished goods costing provides the necessary information to make pricing adjustments based on market conditions, such as changes in input costs or shifts in demand. By understanding the cost implications, businesses can adapt their pricing strategies in response to market dynamics, ensuring profitability and competitiveness.

Pricing Strategy Evaluation: Accurate costing allows businesses to evaluate the effectiveness of their pricing strategies. By comparing the actual costs incurred with the projected costs, companies can assess the accuracy of their pricing models and make adjustments to improve future pricing decisions.

Understanding the Significance of Accurate Finished Goods Costing

Accurate finished goods costing holds immense significance for businesses as it forms the bedrock for effective pricing strategies. By providing a comprehensive assessment of the true expenses associated with manufacturing a product, accurate costing empowers companies to make informed decisions regarding pricing, profitability, and market competitiveness.

In this section, we delve into the crucial role of accurate finished goods costing and shed light on its significance in driving sound pricing strategies. We explore the consequences of inaccurate costing, examine the impact on pricing decisions and overall business outcomes, and present real-world examples illustrating the importance of precise costing in achieving sustainable success.

By understanding the significance of accurate finished goods costing, businesses can grasp the critical link between costing accuracy and their ability to set optimal prices, ultimately positioning themselves for profitability and growth in today's competitive landscape.

Concept of finished goods costing and its relevance in pricing decisions

The concept of finished goods costing refers to the calculation and analysis of all the direct and indirect costs associated with manufacturing a product until it is ready for sale. It encompasses various cost components such as direct materials, labor, overhead, and indirect expenses.

Accurate finished goods costing is essential as it provides businesses with a clear understanding of the total expenses incurred in producing a product, allowing them to make informed pricing decisions.

Relevance in Pricing Decisions

Let’s look at its relevance in pricing decisions.

Setting Competitive Prices: Accurate finished goods costing helps businesses determine the minimum price that covers their costs and ensures profitability. By understanding the cost structure, companies can set prices that are competitive within the market while still meeting their financial goals.

Profit Margin Calculation: Costing data enables businesses to calculate profit margins accurately. By subtracting the total costs from the selling price, companies can determine the profit earned per unit or the overall profit margin. This information guides pricing decisions to achieve desired profit targets.

Cost-Based Pricing: Finished goods costing forms the foundation for cost-based pricing strategies. Businesses calculate the total costs associated with producing a product and add a desired profit margin to determine the selling price. This approach ensures that costs are adequately covered while generating profits.

Value-Based Pricing: Accurate costing provides insights into the cost structure, allowing businesses to align pricing with the perceived value of the product to customers. It ensures that prices reflect the value customers derive from the product, enabling businesses to capture the maximum value and enhance customer satisfaction.

Pricing Adjustments: Finished goods costing data helps businesses make pricing adjustments based on changes in market conditions, such as fluctuations in input costs or shifts in demand. By understanding the cost implications, companies can adapt their pricing strategies accordingly, maintaining profitability in dynamic market environments.

Evaluating Pricing Strategies: Accurate costing data facilitates the evaluation of pricing strategies. Businesses can compare projected costs with actual costs incurred and assess the effectiveness of their pricing models. This analysis enables them to refine and optimize pricing strategies for better profitability and performance.

How inaccurate costing can lead to flawed pricing strategies and negative business outcomes

Inaccurate costing can have detrimental effects on pricing strategies and lead to negative business outcomes. Here are some ways in which inaccurate costing can result in flawed pricing decisions and adverse consequences:

Underpricing or Overpricing: Inaccurate costing may result in underestimating or overestimating the actual costs of producing a product. Underpricing can lead to selling products below cost, eroding profitability and hindering business sustainability. On the other hand, overpricing can lead to decreased customer demand, lost sales opportunities, and damaged customer relationships.

Profit Margin Compression: Flawed costing calculations can result in inaccurate profit margin estimations. If costs are underestimated, the profit margins may be lower than anticipated, impacting the company's ability to generate sufficient profits to cover expenses, reinvest, and grow the business.

Competitor Disadvantage: Inaccurate costing can affect a company's ability to compete effectively in the market. If costs are overestimated, the pricing may be higher than competitors, making the company less attractive to price-sensitive customers. Conversely, underestimating costs may lead to lower prices, but without sufficient profit margins to support sustainable operations.

Inefficient Resource Allocation: Inaccurate costing can misrepresent the actual costs associated with various components of production, such as materials, labor, or overhead. This can lead to misallocated resources, as decisions may be based on inaccurate cost data. Inefficient resource allocation can result in higher costs, production delays, and decreased operational efficiency.

Reduced Profitability: Flawed costing affects the bottom line, potentially reducing profitability. Inaccurate cost calculations may lead to selling products at prices that do not generate adequate profits to cover expenses, resulting in financial losses. Over time, sustained losses can erode the financial health and viability of the business.

Damage to Brand Reputation: Inconsistent pricing resulting from inaccurate costing can negatively impact a company's brand reputation. Customers may perceive frequent price changes or disparities between perceived value and pricing, leading to a lack of trust and diminished brand loyalty.

Inability to Respond to Market Changes: Inaccurate costing can hinder a company's ability to respond effectively to changes in market conditions, such as fluctuating input costs or shifts in demand. Without accurate cost information, businesses may struggle to make timely pricing adjustments, missing out on opportunities or exposing themselves to unnecessary risks.

To mitigate these risks, it is crucial for businesses to prioritize accurate costing methodologies and regularly review and refine their costing processes. Accurate costing data serves as the foundation for sound pricing strategies and ensures better decision-making, leading to improved profitability and positive business outcomes.

Factors Influencing Finished Goods Costing

Several factors contribute to the determination of finished goods costing, encompassing direct materials, labor, overhead, and indirect costs. Understanding these factors is crucial for businesses to accurately estimate and analyze the total expenses associated with manufacturing a product.

In this section, we delve into the key factors that influence finished goods costing, shedding light on their significance and complexities. By exploring these factors, businesses can gain valuable insights into the challenges and considerations involved in estimating costs accurately, ultimately leading to improved costing practices and informed pricing decisions.

Key factors that contribute to finished goods costing, such as direct materials, labor, overhead, and indirect costs

Key factors contribute to finished goods costing, encompassing direct materials, labor, overhead, and indirect costs. Each factor plays a significant role in determining the overall expenses associated with manufacturing a product. Understanding these factors is essential for accurate costing calculations. Let's explore each factor in more detail:

Direct Materials: Direct materials refer to the tangible components and resources that directly contribute to the production of a product. This includes raw materials, components, and any other materials specifically used in the manufacturing process. The cost of direct materials has a direct impact on the total cost of producing a finished good.

Labor: Labor costs encompass the wages, salaries, and benefits paid to employees involved in the production process. This includes both direct labor, which involves individuals directly involved in manufacturing the product, and indirect labor, which includes support staff such as supervisors or maintenance personnel. Accurately accounting for labor costs is crucial for determining the overall cost of production.

Overhead: Overhead costs include all the indirect expenses incurred during the manufacturing process that are not directly tied to specific materials or labor. Examples of overhead costs include rent, utilities, depreciation of equipment, insurance, and maintenance. These costs are essential for the functioning of the production facility but cannot be directly attributed to a single product.

Indirect Costs: Indirect costs are additional expenses that are not directly tied to the production process but still impact the overall cost of goods. This category may include costs such as administrative expenses, marketing costs, research and development expenses, and other general operating costs that are necessary for the business to function.

Indirect costs are allocated to products using cost allocation methods to determine their contribution to the cost of the finished goods.

Accurately estimating and tracking each of these factors is crucial for determining the true cost of manufacturing a product. Overlooking or underestimating any of these factors can lead to inaccurate costing, which can have detrimental effects on pricing decisions, profitability, and overall business performance.

Challenges and complexities associated with estimating each factor accurately

Estimating each factor accurately in finished goods costing poses several challenges and complexities for businesses. These challenges can impact the overall accuracy of cost calculations and require careful consideration.

Here are some key challenges associated with estimating each factor:

Fluctuating Material Costs: The cost of direct materials can vary due to factors such as market volatility, availability, supplier relationships, and changes in global trade dynamics. Estimating and tracking these costs accurately requires staying updated on market trends and maintaining effective supplier management.

Labor:

Variability in Labor Rates: Labor costs can vary based on factors such as skill levels, experience, and labor market conditions. Accurately estimating labor costs involves accounting for different wage rates and considering factors like overtime, shift differentials, and employee benefits.

Overhead:

Allocation Methods: Allocating overhead costs to specific products or processes can be challenging. Determining the most appropriate allocation method that reflects the true usage of overhead resources requires careful analysis and consideration of various cost drivers.

Indirect Costs:

Allocation and Apportionment: Allocating indirect costs to specific products or services can be complex. Different cost allocation methods, such as activity-based costing or traditional costing, may be employed based on the nature of the business. Ensuring fair and accurate allocation of indirect costs requires a deep understanding of cost drivers and appropriate cost allocation techniques.

Cost Tracking and Data Accuracy:

Data Collection and Accuracy: Gathering accurate and reliable data for each cost component is essential for precise costing. Businesses may face challenges in obtaining complete and up-to-date information, especially when dealing with multiple suppliers, complex labor structures, or indirect costs spread across various departments.

Complexity of Manufacturing Processes:

Diverse Product Mix: Businesses that produce a wide range of products may encounter complexities in cost estimation due to variations in materials, labor requirements, and production processes across different product lines.

Evolving Business Operations:

Changes in Processes or Technology: Business operations are subject to changes, such as process improvements or technological advancements, which can impact cost structures. Ensuring that cost estimates reflect these changes accurately requires constant monitoring and adjustment.

Addressing these challenges requires effective cost management systems, robust data collection processes, regular review of cost estimates, and collaboration between finance, operations, and production teams. By overcoming these complexities, businesses can enhance the accuracy of finished goods costing, leading to more informed pricing decisions and improved overall financial performance.

Consequences of overlooking or underestimating these factors in costing calculations

Overlooking or underestimating the factors involved in costing calculations can have significant consequences for businesses. These inaccuracies can lead to flawed costing calculations and result in negative outcomes across various aspects of the business.

Here are some potential consequences of overlooking or underestimating these factors:

Pricing Inefficiencies:

Underpricing: Underestimating costs can lead to setting prices that do not cover the expenses incurred in producing the product. This can result in selling products at a loss or with minimal profit margins, impacting the overall profitability of the business.

Overpricing: Overestimating costs may result in setting higher prices than necessary, potentially leading to lost sales opportunities and reduced competitiveness in the market.

Profitability Challenges:

Reduced Profit Margins: Inaccurate costing can result in lower-than-expected profit margins. If costs are underestimated, the actual profitability of products may be lower than anticipated, affecting the overall financial health and sustainability of the business.

Financial Losses: Significant cost underestimation can lead to financial losses, particularly if expenses consistently exceed revenues. This can impact the company's ability to invest, grow, and meet its financial obligations.

Competitive Disadvantage:

Pricing Misalignment: Inaccurate pricing due to flawed costing calculations can result in pricing that is misaligned with competitors. This can make the business less competitive, potentially leading to a loss of market share and reduced customer demand.

Resource Allocation Challenges:

Inefficient Resource Utilization: Inaccurate costing can impact resource allocation decisions, leading to inefficient utilization of materials, labor, and overhead. Overlooking or underestimating these factors can result in the misallocation of resources, increased costs, and reduced operational efficiency.

Damaged Customer Relationships:

Pricing Inconsistencies: Inaccurate costing can lead to pricing inconsistencies, such as frequent price changes or pricing that does not align with the perceived value of the product. This can erode customer trust, damage relationships, and negatively impact customer loyalty and retention.

Missed Business Opportunities:

Inability to Identify Profitable Products: Flawed costing calculations may result in an inability to identify the most profitable products or product lines. This can lead to missed opportunities for growth and profitability as resources may be allocated to less profitable areas of the business.

To mitigate these consequences, businesses should prioritize accurate costing methodologies, regularly review and refine cost estimates, and establish robust systems for data collection and analysis. By ensuring accurate costing calculations, businesses can make more informed pricing decisions, enhance profitability, and maintain a competitive edge in the market.

Strategies for Achieving Accurate Finished Goods Costing

Accurate finished goods costing is a critical aspect of pricing decisions and overall financial performance for businesses. However, achieving accuracy in costing can be challenging due to the complexities involved in estimating various cost factors.

In this section, we explore strategies and best practices that businesses can implement to improve the accuracy of their finished goods costing. By focusing on data accuracy, comprehensive cost tracking systems, and cross-functional collaboration, businesses can enhance their costing methodologies and make informed pricing decisions.

These strategies empower organizations to optimize their cost calculations, mitigate risks associated with inaccurate costing, and drive profitability. Let's delve into the strategies that enable businesses to achieve accurate finished goods costing and set a strong foundation for sound pricing strategies.

Approaches and best practices for improving finished goods costing

Improving finished goods costing requires the implementation of effective approaches and best practices. By adopting these strategies, businesses can enhance the accuracy and reliability of their costing methodologies.

Here are some key approaches and best practices for improving finished goods costing:

Accurate Data Collection and Analysis:

- Implement Robust Data Management: Establish comprehensive systems and processes for collecting, recording, and organizing cost data. Ensure the accuracy and reliability of data sources, and regularly update and validate the data to reflect current costs accurately.

- Utilize Technology Solutions: Leverage technology tools such as cost tracking software, enterprise resource planning (ERP) systems, and data analytics platforms to streamline data collection, automate calculations, and improve accuracy.

Cost Segregation and Classification:

- Break Down Costs into Granular Components: Analyze costs at a detailed level by segregating them into specific categories, such as direct materials, direct labor, overhead, and indirect costs. This granularity provides a more accurate understanding of the cost structure.

- Develop Cost Allocation Methods: Determine appropriate cost allocation methods to distribute indirect costs accurately across products or processes. Consider factors such as cost drivers, activity-based costing, or standard costing techniques.

Regular Cost Reviews and Updates:

- Conduct Periodic Cost Reviews: Regularly review and evaluate the accuracy and relevance of cost estimates. Identify areas where costs may have changed or require adjustment, such as changes in material prices, labor rates, or overhead expenses.

- Update Costing Models: Adjust costing models and formulas based on updated data, market changes, or improvements in cost estimation techniques. Incorporate feedback and lessons learned from previous costing exercises to refine future estimates.

Cross-Functional Collaboration:

- Involve Key Stakeholders: Foster collaboration between finance, operations, and production teams to ensure a comprehensive understanding of cost components. Engage relevant departments in the costing process to gather insights, validate assumptions, and enhance accuracy.

- Share Information and Knowledge: Facilitate knowledge sharing and communication between departments to improve data accuracy, alignment of cost assumptions, and better understanding of cost implications.

Continuous Improvement:

- Establish a Culture of Continuous Improvement: Encourage a mindset of ongoing improvement in cost estimation practices. Regularly evaluate the effectiveness of costing methodologies and identify opportunities for refinement and optimization.

- Learn from Historical Data: Analyze historical cost data to identify patterns, trends, and areas for improvement. Incorporate these learnings into future costing exercises to enhance accuracy and reduce potential errors.

By adopting these approaches and best practices, businesses can strengthen their finished goods costing capabilities. Accurate costing provides a solid foundation for pricing decisions, ensures profitability, and supports overall financial success.

Importance of data accuracy, record-keeping, and comprehensive cost tracking systems

Data accuracy, record-keeping, and comprehensive cost tracking systems play a vital role in achieving accurate finished goods costing. These elements are crucial for businesses aiming to make informed pricing decisions and improve their financial performance. Here is the importance of each:

Data Accuracy:

- Reliable Decision-Making: Accurate costing relies on reliable data. Ensuring data accuracy helps businesses make well-informed pricing decisions, allocate resources efficiently, and identify cost-saving opportunities.

- Avoiding Cost Overruns: Inaccurate or incomplete data can lead to underestimating costs, resulting in cost overruns during production. Accurate data reduces the risk of unexpected expenses and supports better cost control.

Record-Keeping:

- Historical Analysis: Detailed and well-maintained records provide a historical perspective on costs. This allows businesses to analyze trends, identify cost fluctuations, and make more accurate predictions for future costing exercises.

- Audit Compliance: Proper record-keeping is essential for audit purposes. Accurate records substantiate the cost figures, ensuring transparency, compliance with regulations, and facilitating smooth audits.

Comprehensive Cost Tracking Systems:

- Enhanced Cost Visibility: Robust cost tracking systems provide a clear and comprehensive view of all cost components, such as direct materials, labor, overhead, and indirect costs. This visibility enables businesses to track and analyze costs accurately throughout the production process.

- Timely Updates: Automated cost tracking systems allow for real-time updates of cost data. This enables businesses to respond quickly to changes in material prices, labor rates, or overhead expenses, ensuring accurate and up-to-date cost calculations.

- Improved Cost Allocation: Comprehensive cost tracking systems facilitate accurate allocation of costs to specific products or processes, providing a more precise understanding of the cost structure and enabling better pricing decisions.

By prioritizing data accuracy, record-keeping, and implementing comprehensive cost tracking systems, businesses can improve their costing methodologies and enhance the accuracy of finished goods costing. This, in turn, supports better pricing decisions, optimized resource allocation, and improved overall financial performance. It enables businesses to maintain profitability, make informed strategic decisions, and stay competitive in the dynamic business landscape.

Role of cross-functional collaboration between finance, operations, and production teams in obtaining reliable costing data

Cross-functional collaboration between finance, operations, and production teams plays a crucial role in obtaining reliable costing data. This collaboration fosters a comprehensive understanding of cost components and ensures accurate costing calculations. Here's the role of cross-functional collaboration in obtaining reliable costing data:

Insights from Multiple Perspectives:

- Finance Expertise: The finance team brings financial acumen and expertise in cost analysis, budgeting, and financial reporting. They provide insights into cost accounting principles, ensure compliance with accounting standards, and offer financial guidance throughout the costing process.

- Operations Knowledge: The operations team possesses in-depth knowledge of the production process, including equipment usage, labor requirements, and production efficiencies. They contribute valuable insights into how costs are incurred at different stages of production.

- Production Input: The production team provides details about materials usage, labor hours, machine setup times, and other production-related information. Their inputs are crucial for accurate cost estimation.

Validation of Cost Assumptions:

- Collaborative Review: Cross-functional collaboration allows for a review and validation of cost assumptions. Different perspectives ensure that cost factors, such as material prices, labor rates, and overhead expenses, are accurately captured and validated against actual data.

- Identification of Cost Drivers: Through collaboration, teams can identify the key cost drivers within the production process. This enables a more focused approach to cost tracking and allocation, leading to better accuracy in costing calculations.

Data Accuracy and Consistency:

- Shared Data Sources: Collaborative efforts ensure the use of shared data sources that are consistent and reliable. By establishing centralized databases or systems for cost data, teams can access accurate and up-to-date information, reducing the risk of data inconsistencies or discrepancies.

- Data Validation and Verification: Collaboration helps in validating and verifying cost data across departments. This ensures that data accuracy is maintained and any discrepancies or errors are identified and rectified promptly.

Continuous Improvement:

- Feedback and Learning: Cross-functional collaboration allows for the exchange of feedback, lessons learned, and best practices in costing. This promotes continuous improvement in costing methodologies, data collection processes, and overall accuracy in cost estimation.

- Alignment with Strategic Objectives: Collaborative efforts align costing practices with the strategic objectives of the organization. By sharing insights and aligning goals, teams can ensure that costing decisions support the broader business strategy.

Overall, cross-functional collaboration between finance, operations, and production teams enhances the reliability and accuracy of costing data. It enables a holistic approach to cost estimation, leverages expertise from different disciplines, ensures data consistency, and promotes continuous improvement.

By working together, these teams can obtain reliable costing data that forms the foundation for informed pricing decisions, improved financial performance, and overall business success.

Leveraging Accurate Finished Goods Costing for Pricing Strategy

Accurate finished goods costing serves as a powerful tool for businesses to develop effective pricing strategies that strike the right balance between profitability and market competitiveness. By leveraging precise costing data, companies can set optimal prices that align with costs, customer value, and market dynamics. In this section, we explore the significance of accurate finished goods costing in pricing strategy and its implications for business success.

We delve into how costing data enables businesses to determine appropriate pricing margins, establish value-based pricing, and make informed pricing decisions that drive profitability. Real-world examples and best practices illustrate the transformative impact of leveraging accurate costing for pricing strategy. Let's explore how businesses can leverage accurate finished goods costing to optimize their pricing strategies and gain a competitive edge in the market.

How accurate costing enables businesses to set competitive prices while maintaining profitability

Accurate costing empowers businesses to set competitive prices while maintaining profitability by providing a comprehensive understanding of the true expenses incurred in producing a product. Here's how accurate costing enables businesses to achieve this balance:

- Cost-Based Pricing: Accurate costing serves as the foundation for cost-based pricing strategies. By accurately estimating direct materials, labor, overhead, and indirect costs, businesses can calculate the total cost per unit and determine the minimum price necessary to cover expenses. This ensures that prices are set at a level that maintains profitability while remaining competitive within the market.

- Pricing Margin Calculation: Accurate costing data allows businesses to calculate appropriate pricing margins. By subtracting the total costs from the desired profit margin, companies can determine the selling price that ensures profitability. This ensures that prices are set at a level that covers costs while generating the desired level of profit.

- Competitor Analysis: Accurate costing enables businesses to conduct comprehensive competitor analysis. By understanding their own production costs and comparing them with competitors' prices, companies can position their products competitively in the market. This analysis helps in setting prices that balance competitiveness and profitability, allowing businesses to capture market share while maintaining their financial goals.

- Value-Based Pricing: Accurate costing supports value-based pricing, which focuses on pricing products based on the perceived value to customers. By understanding the cost structure, businesses can align prices with the value that customers derive from the product. This ensures that customers perceive the price as reasonable and justifiable based on the benefits they receive, enhancing the perceived value and maintaining profitability.

- Pricing Adjustments: Accurate costing data enables businesses to make pricing adjustments in response to market conditions. Fluctuations in input costs, changes in market demand, or competitive pressures may necessitate price changes. With accurate costing information, businesses can make timely and informed pricing adjustments while considering the impact on profitability.

- Profit Optimization: Accurate costing allows businesses to optimize profitability by identifying areas for cost reduction or efficiency improvements. By understanding the cost breakdown, businesses can identify cost drivers, eliminate waste, streamline processes, and optimize resource allocation. This can result in improved profitability without compromising the competitiveness of pricing.

By leveraging accurate costing, businesses can set competitive prices that align with costs, maintain profitability, and enhance their position in the market. Accurate costing data provides the necessary insights to make informed pricing decisions that strike the right balance between profitability and competitiveness, ensuring long-term success in the marketplace.

Use of costing data in determining appropriate pricing margins and markups.

Costing data plays a crucial role in determining appropriate pricing margins and markups for businesses. By analyzing and leveraging accurate costing data, companies can set prices that cover their expenses, generate desired profit margins, and remain competitive in the market.

Here's how costing data is used to determine pricing margins and markups:

- Cost-Plus Pricing Approach: Costing data is fundamental to the cost-plus pricing approach, where a company adds a desired profit margin to the total cost per unit to determine the selling price. Costing data provides insights into direct materials, labor, overhead, and indirect costs, allowing businesses to calculate the total cost accurately. By applying a predetermined profit margin percentage or amount, businesses can establish appropriate pricing margins that cover costs and generate desired profits.

- Gross Margin Calculation: Costing data enables the calculation of gross margin, which is the difference between the selling price and the direct cost of producing a product. By subtracting the direct cost per unit from the selling price, businesses can determine the gross margin. Costing data provides the necessary input to accurately assess the direct cost and calculate the appropriate gross margin, reflecting the desired level of profitability.

- Target Profit Margins: Costing data helps businesses determine target profit margins. By analyzing costs and considering factors such as market conditions, competition, and company goals, businesses can establish the desired profit margin for their products. Costing data assists in understanding the cost structure, allowing businesses to set pricing margins that align with their financial objectives.

- Value-Based Pricing: Costing data supports value-based pricing strategies, where pricing is based on the perceived value of the product to customers. By understanding the cost structure, businesses can determine appropriate pricing markups that reflect the value proposition of the product. Costing data helps businesses establish the right balance between costs, value, and desired profitability, enabling them to set markups that capture the perceived value and justify the price to customers.

- Market Analysis and Competitor Pricing: Costing data plays a critical role in analyzing market conditions and competitor pricing. By comparing the cost structure with competitor pricing, businesses can assess the pricing landscape and determine competitive pricing margins or markups. Costing data helps businesses identify opportunities to position their products competitively while maintaining profitability.

By utilizing costing data, businesses can make informed decisions about pricing margins and markups. This data ensures that prices cover costs, generate desired profit margins, align with market conditions, and reflect the perceived value of the product. The use of accurate costing data helps businesses establish pricing strategies that are both financially sound and competitive in the marketplace.

Concept of value-based pricing and its alignment with accurate finished goods costing

Value-based pricing is a pricing strategy that focuses on setting prices based on the perceived value of a product to the customer. It takes into consideration the benefits, uniqueness, and competitive advantages offered by the product, rather than solely relying on the costs incurred in producing it. Accurate finished goods costing plays a critical role in aligning with and supporting value-based pricing. Here's how accurate costing and value-based pricing are interconnected:

- Understanding Customer Value: Accurate costing provides businesses with a clear understanding of the costs associated with producing a product. This knowledge enables businesses to assess the resources invested in creating value for the customer. By accurately estimating costs, businesses can align their pricing strategies with the value that customers perceive in the product.

- Pricing based on Perceived Value: Value-based pricing takes into account the customer's perception of the product's value, which may be influenced by factors such as quality, functionality, brand reputation, or unique features. Accurate costing data helps businesses ensure that the prices they set are justified by the perceived value customers derive from the product.

- Establishing Pricing Margins: Accurate costing allows businesses to calculate the minimum pricing margin required to cover costs and generate desired profits. With value-based pricing, businesses can set pricing margins that reflect the additional value they provide to customers, allowing for a reasonable return on investment while justifying the premium pricing.

- Differentiation and Competitive Advantage: Accurate costing helps businesses identify the costs associated with features or attributes that differentiate their product in the market. By understanding the cost implications of these differentiators, businesses can price their products accordingly, leveraging their competitive advantage and capturing the value they offer to customers.

- Pricing Flexibility: Accurate costing data enables businesses to be more flexible in their pricing strategies. It provides insights into cost structures, allowing businesses to adjust prices based on changes in costs, market conditions, or customer preferences. This flexibility ensures that pricing decisions are aligned with both the costs incurred and the value delivered to customers.

- Profit Optimization: Accurate costing allows businesses to optimize profitability within a value-based pricing approach. By understanding the costs associated with different components of the product, businesses can identify opportunities to reduce costs without compromising the perceived value. This optimization helps in maximizing profits while delivering value to customers.

By leveraging accurate finished goods costing, businesses can effectively implement value-based pricing strategies.

Accurate costing data provides the necessary insights to align pricing with the perceived value of the product, differentiate from competitors, establish appropriate pricing margins, and optimize profitability. This alignment enables businesses to capture the value they provide to customers while ensuring financial sustainability and market competitiveness.

Overcoming Challenges and Implementing Continuous Improvement

Implementing accurate finished goods costing is not without its challenges, as businesses must navigate complexities in data collection, analysis, and cost estimation. However, by recognizing these challenges and actively seeking continuous improvement, businesses can enhance their costing practices and achieve greater accuracy.

In this section, we explore the common challenges faced in finished goods costing and strategies to overcome them. We delve into the importance of data accuracy, technology adoption, process optimization, and cross-functional collaboration in driving continuous improvement.

Through a commitment to overcoming challenges and implementing continuous improvement initiatives, businesses can refine their costing methodologies, make more informed pricing decisions, and ensure long-term success in the marketplace.

Let's explore the strategies and best practices for overcoming challenges and implementing continuous improvement in finished goods costing.

Potential challenges and obstacles in implementing accurate finished goods costing

Implementing accurate finished goods costing can be accompanied by various challenges and obstacles. These challenges can impact the reliability and accuracy of costing data and hinder the effectiveness of pricing strategies. Here are some potential challenges and obstacles in implementing accurate finished goods costing:

Data Availability and Accuracy:

- Incomplete or Inaccurate Data: Obtaining complete and accurate data on direct materials, labor, overhead, and indirect costs can be challenging. Inaccurate or incomplete data can lead to flawed cost estimates and compromise the accuracy of finished goods costing.

Cost Allocation:

- Indirect Cost Allocation: Allocating indirect costs to specific products or processes can be complex. Determining the appropriate allocation methods and accurately attributing costs to specific units of production require careful analysis and consideration.

Changing Cost Factors:

- Fluctuating Input Costs: Input costs, such as raw materials and energy prices, can vary over time. Keeping track of these fluctuations and updating cost estimates accordingly can be challenging but necessary for accurate costing.

- Evolving Labor Rates: Labor rates may change due to factors such as minimum wage adjustments, collective bargaining agreements, or changes in market conditions. Staying updated on labor rate changes is crucial for accurate labor cost estimation.

Complexity of Production Processes:

- Diverse Product Mix: Businesses that produce a wide range of products may face challenges in accurately estimating costs due to variations in materials, labor requirements, and production processes across different product lines.

Cost Tracking Systems and Tools:

- Limited Technology Infrastructure: Outdated or inadequate technology infrastructure can hinder the efficient tracking and analysis of cost data. The absence of automated cost tracking systems may lead to manual errors, data inconsistencies, and inefficiencies in the costing process.

Cross-Functional Collaboration:

- Lack of Communication and Collaboration: Limited collaboration and communication between finance, operations, and production teams can impede the accuracy of cost estimates. Failure to gather insights and validate assumptions across departments may result in incomplete or inaccurate costing data.

Continuous Improvement:

- Resistance to Change: Implementing continuous improvement initiatives and refining costing methodologies require a culture that embraces change. Resistance to change within the organization may hinder efforts to enhance accuracy and optimize costing practices.

Addressing these challenges requires proactive measures such as improving data collection processes, implementing robust cost tracking systems, utilizing technology solutions, fostering cross-functional collaboration, and promoting a culture of continuous improvement.

By overcoming these obstacles, businesses can enhance the accuracy of finished goods costing, make more informed pricing decisions, and optimize their financial performance.

Strategies for overcoming these challenges, such as regular cost reviews and refinement of costing methodologies

Overcoming the challenges associated with accurate finished goods costing requires the implementation of effective strategies. Here are some strategies that businesses can employ to overcome these challenges and improve their costing methodologies:

Regular Cost Reviews:

- Conduct periodic cost reviews to assess the accuracy and relevance of cost estimates. Regularly review and analyze cost data, compare it with actual expenses, and identify areas where costs may have changed or require adjustment.

- Establish a process for ongoing cost monitoring and updates to ensure that cost estimates remain aligned with current market conditions and internal cost structures.

Refinement of Costing Methodologies:

- Continuously refine costing methodologies based on feedback, lessons learned, and changes in the business environment. Regularly evaluate the effectiveness of cost estimation techniques and explore new approaches that align with the specific needs and complexities of the business.

- Incorporate advancements in technology, data analytics, and costing practices to improve accuracy, efficiency, and reliability of cost estimates.

Data Accuracy and Validation:

- Emphasize the importance of data accuracy and implement measures to ensure data integrity. Establish robust data collection processes, validate and verify data inputs, and regularly audit data sources to maintain high-quality data.

- Implement data validation checks, such as cross-referencing data from multiple sources or conducting internal audits, to identify and rectify data inconsistencies or errors.

Technology Adoption:

- Invest in technology solutions for cost tracking, data management, and analysis. Implement cost tracking software, enterprise resource planning (ERP) systems, or data analytics tools to streamline data collection, automate calculations, and improve accuracy and efficiency in costing processes.

- Leverage technology to enhance data accuracy, automate data integration, and facilitate real-time updates and analysis of cost data.

Cross-Functional Collaboration:

- Foster collaboration and communication between finance, operations, and production teams. Encourage the sharing of insights, knowledge, and best practices to ensure a comprehensive understanding of cost components and promote accuracy in cost estimation.

- Establish regular cross-functional meetings or workshops to align cost assumptions, validate data inputs, and collectively address challenges in costing processes.

Continuous Improvement Culture:

- Foster a culture of continuous improvement by promoting a mindset that encourages innovation and refinement in costing methodologies. Create a safe environment for employees to share ideas, provide feedback, and contribute to the enhancement of costing practices.

- Encourage employees to actively participate in identifying opportunities for improvement, sharing best practices, and implementing changes that optimize cost estimation and pricing strategies.

By implementing these strategies, businesses can overcome challenges in accurate finished goods costing, improve costing methodologies, and enhance the accuracy and reliability of cost estimates. This, in turn, enables more informed pricing decisions, improved financial performance, and a competitive edge in the market.

Why Should Businesses Prioritize the Implementation of Effective Costing Practices to Optimize their Pricing Strategies and Profitability

Accurate costing is essential for making informed pricing decisions, ensuring that prices are set at levels that cover costs, generate desired profits, and remain competitive in the market. Here are key reasons why businesses should prioritize effective costing practices:

- Maximizing Profitability: Accurate costing enables businesses to set optimal prices that align with costs and desired profit margins. By understanding the true expenses associated with producing a product, businesses can avoid underpricing or overpricing, optimizing their profitability and financial performance.

- Competitive Advantage: Effective costing practices allow businesses to identify their competitive advantages and leverage them in their pricing strategies. By understanding cost structures and analyzing market dynamics, businesses can set prices that differentiate them from competitors, capturing market share and maintaining a competitive edge.

- Value-Based Pricing: Accurate costing provides the foundation for implementing value-based pricing strategies. By understanding the value customers perceive in their products, businesses can align prices with the perceived value, maximizing customer satisfaction and willingness to pay.

- Cost Control and Efficiency: Effective costing practices help businesses gain control over their costs and identify areas for cost reduction or efficiency improvements. By analyzing cost components, businesses can streamline operations, eliminate waste, and optimize resource allocation, leading to improved cost management and increased profitability.

- Informed Decision-Making: Accurate costing data empowers businesses to make informed strategic decisions. It provides insights into the financial implications of product development, pricing changes, or market expansions, enabling data-driven decision-making and mitigating risks associated with inaccurate cost assumptions.

- Business Sustainability: Implementing effective costing practices is essential for the long-term sustainability of a business. By ensuring that prices cover costs and generate profits, businesses can maintain financial stability, invest in growth opportunities, and weather market fluctuations.

To prioritize effective costing practices, businesses should focus on data accuracy, implement robust cost tracking systems, foster cross-functional collaboration, continuously refine costing methodologies, and embrace a culture of continuous improvement. By optimizing their costing practices, businesses can enhance their pricing strategies, improve profitability, and achieve sustainable success in the marketplace.

Conclusion

In conclusion, accurate finished goods costing is a critical component of effective pricing strategies and overall business success. By understanding the true costs associated with producing a product, businesses can set prices that cover expenses, generate desired profit margins, and remain competitive in the market. Accurate costing enables businesses to make informed pricing decisions, align prices with customer value, and optimize profitability.

However, implementing accurate costing practices is not without its challenges. Businesses must navigate complexities in data collection, cost estimation, and cost allocation. To overcome these challenges, businesses should prioritize data accuracy, regularly review and refine cost estimates, embrace technology solutions, foster cross-functional collaboration, and cultivate a culture of continuous improvement.

By prioritizing accurate finished goods costing, businesses can optimize their pricing strategies, differentiate themselves in the market, and achieve sustainable profitability. Accurate costing data serves as a reliable foundation for pricing decisions, enabling businesses to set competitive prices while maintaining financial stability.

Ultimately, businesses that prioritize effective costing practices gain a competitive advantage, maximize profitability, and position themselves for long-term success in the dynamic and evolving business landscape. By investing in accurate costing, businesses can unlock new opportunities, enhance their financial performance, and drive growth in their respective industries.

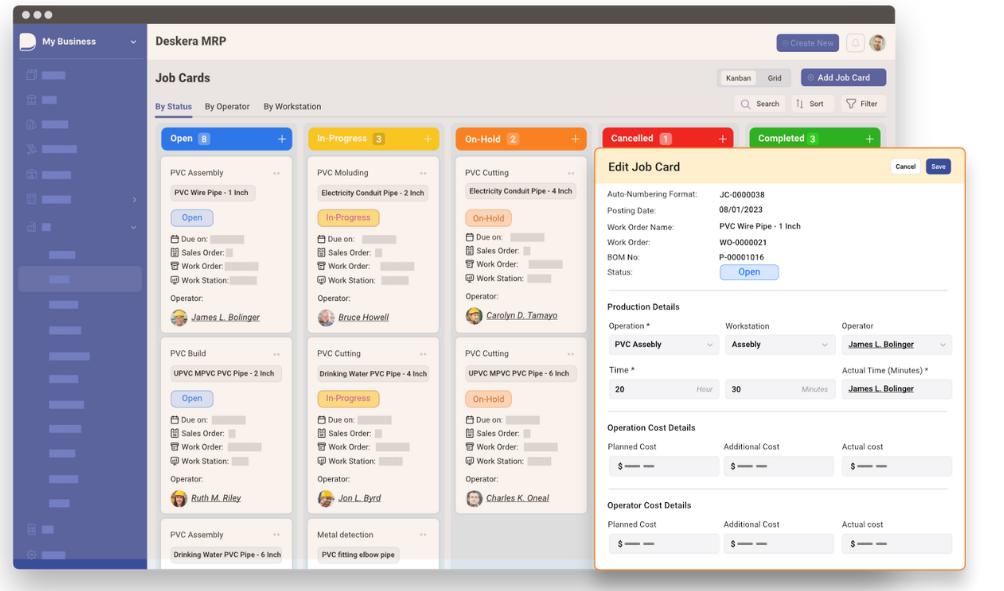

How can Deskera Help You?

Deskera ERP and MRP systems help you to keep your business units organized. The system's primary functions are as follows:

- Keep track of your raw materials and final items inventories

- Control production schedules and routings

- Keep a bill of materials

- Produce thorough reports

- Make your own dashboards

Deskera's integrated financial planning tools enable investors to better plan and track their investments. It can assist investors in making faster and more accurate decisions.

Deskera Books allows you to better manage your accounts and finances. Maintain good accounting practices by automating tasks like billing, invoicing, and payment processing.

Deskera CRM is a powerful solution that manages your sales and helps you close deals quickly. It not only enables you to perform critical tasks like lead generation via email, but it also gives you a comprehensive view of your sales funnel.

Deskera People is a straightforward tool for centralizing your human resource management functions.

Key Takeaways

- Accurate finished goods costing is crucial for businesses to set prices that cover costs, generate desired profits, and remain competitive in the market.

- Effective costing practices enable businesses to make informed pricing decisions based on reliable data and insights.

- Accurate costing provides a comprehensive understanding of direct materials, labor, overhead, and indirect costs, allowing businesses to calculate total costs accurately.

- Accurate costing supports cost-based pricing approaches, such as cost-plus pricing, where prices are determined by adding a desired profit margin to the total cost per unit.

- Costing data plays a vital role in determining appropriate pricing margins and markups, ensuring profitability while aligning with market conditions and customer value.

- Value-based pricing, which focuses on the perceived value of a product to customers, relies on accurate costing to align prices with the value delivered.

- Overcoming challenges in accurate costing requires strategies such as regular cost reviews, refinement of costing methodologies, and ensuring data accuracy and validation.

- Technology adoption, such as cost tracking software and data analytics tools, enhances accuracy, efficiency, and reliability in costing processes.

- Cross-functional collaboration between finance, operations, and production teams ensures a comprehensive understanding of cost components and validation of cost assumptions.

- Continuous improvement in costing practices is essential for businesses to optimize their pricing strategies, control costs, and enhance profitability, ensuring long-term success in the marketplace.

Related Articles