Did you know that PPO plans have a higher enrollment rate than HMO policies? In 2020, 47 percent of insured workers participating in an employer-sponsored health insurance plan chose a PPO and only 13 percent chose HMO.

It's typical to have to choose between an HMO and PPO to get the best healthcare. At some point in our lives, we will all have to deal with an illness or ailment. You must be able to make an informed decision about which plan is best for you.

It's difficult to overestimate the significance of having health insurance. The rising cost of healthcare might put an individual or family in a dire financial predicament in the event of a major illness or accident.

To help them deal with the dilemma, a person can pick between two types of health insurance providers: a Health Maintenance Organization or Preferred Provider Organization ( HMO and PPO respectively).

According to the US government's health care exchange marketplace, people who are deemed able to buy health insurance but do not acquire it may be compelled to pay an Individual Shared Responsibility Payment.

The cost is also called a penalty, fine, or individual requirement, according to the exchange's website. Responsibilities shared Payment is no longer necessary.

Several states have individual health insurance mandates, which require consumers to have eligible health coverage or pay a levy with their state taxes.

If you don't have health insurance or an exemption in a state where it's needed, you'll almost likely be charged a fee when filing your state taxes.

Table of contents

- What is an HMO?

- What is a PPO?

- Types of Managed Health Care Plans

- Health Insurance and Provider Networks

- HMO vs. PPO

- What happens if you need to go to the hospital?

- Is the plan you're considering including visits with your favourite doctor if you already have one?

- How Do Managed Health Care Plans Work?

- What are the Additional Options?

- Cost Comparison of POS, EPO, HMO and PPO Health Care Plans

What is an HMO?

A Health Maintenance Organization (HMO) is a collection of healthcare providers who have agreed to provide services at reduced prices negotiated by an insurance company.

Members select a single physician from a list of approved healthcare providers.

An HMO's varied services/benefits may vary depending on the organisation and the health plan. Health screenings, cancer screenings, prescribed medications, laboratory testing, X-rays, and other scans may be covered. HMOs frequently include prenatal and well-baby care.

A Health Maintenance Organization (HMO) plan is one of the most cost-effective types of health insurance. It has predetermined premiums, deductibles, and copays for doctor visits. HMOs, compel you to use their network of doctors.

When you sign up for the plan, you'll choose a primary care physician (PCP), and you'll see him or her for regular exams. A recommendation from your primary care physician is required before you may see a dermatologist.

What is a PPO?

A Preferred Provider Organization, or PPO, is a healthcare provider network that provides a wide range of healthcare and healthcare provider options to its members.

Patients with PPOs are not obligated to seek care from providers in their network. It is not required to designate a PCP (primary care physician). Patients can make their appointments with doctors without the need for a referral.

PPO plans often give higher benefits and lower pricing for network provider services, which are encouraged to be used. Members can, however, seek care from providers outside the network, albeit at a higher cost.

A Preferred Provider Organization (PPO) has higher premiums than an HMO or POS. This plan, on the other hand, allows you to see specialists and out-of-network doctors without a referral.

If you expect to need more health care in the coming year and can afford higher premiums, a PPO is a great option.

Types of Managed Health Care Plans

Managed health care plans are health insurance plans that incorporate contracts with health care providers and medical facilities of HMO and PPO.

You can pay for services at a lesser rate using these contracts of HMO and PPO. A network is made up of doctors and medical facilities, and whether you stay in-network or seek treatment outside of it impacts how much your plan covers of HMO and PPO.

Managed health care plans have become increasingly popular as a strategy to keep healthcare costs under control. The type of managed plan you have will impact how you obtain medical care.

HMO and PPO

When it comes to health insurance, distinguishing between an HMO and PPO might be challenging. You've probably heard of HMO and PPO, and potentially other acronyms.

But what are HMO and PPO, exactly? What's the difference between HMO and PPO? And, more importantly, how do you determine which one is best for you between HMO and PPO?

To begin, HMO stands for Health Maintenance Organization, and it is a type of insurance that restricts people to a particular network of doctors.

Preferred Provider Organization (PPO) allows patients to see any doctor they desire, whether in or out of their network. Insurers use managed care, which includes HMO and PPO, to assist down costs.

When it comes to health insurance, it may appear simple, but there's always more to the story. Let's take a look at the differences between HMO and PPO to see which is best for you and your family.

Managed-care programmes are designed to reduce the cost of medical care without losing the quality of HMO and PPO. As a result of the rising demand for managed care plans( HMO and PPO), which provide coverage regardless of the provider or hospital utilised, HMO and PPO plans have gained in popularity.

Aside from acronyms, there are important distinctions between HMO and PPO. The main differences between the HMO and PPO plans are the cost, the size of the plan network, your ability to see experts, and coverage for out-of-network therapies.

Consider all of your healthcare expenses when choosing between HMO and PPO, not just the monthly premium you'll pay to an insurance provider.

Although the monthly premium is substantial, other charges, which are typically packaged together as out-of-pocket fees, can have a major impact on your total healthcare spending and can be more than the monthly premium of HMO and PPO.

Consider the deductible, copayments, and coinsurance, as well as whether your plan includes an out-of-pocket maximum of HMO and PPO.

The deductible is the amount you must pay out of pocket for covered services before your insurance company would cover anything other than free preventative services such as an annual physical of HMO and PPO.

Copayments and coinsurance are payments you make for medical services after you've reached your deductible.

The out-of-pocket maximum is the maximum amount you'll have to spend for covered services in a given year. If your plan includes one, the insurance company will pay for all covered operations in full after you achieve it.

Health Insurance and Provider Networks

In exchange for a fee from an insurance company, a network is a group of healthcare providers that have agreed to give subsidised services.

These networks usually include general practitioners and specialists, such as dermatologists and chiropractors. Labs, X-ray facilities, and medical equipment vendors could all be included.

What Is the Difference Between HMO and PPO?

The key differences between an HMO and PPO plan are as follows:

Patients enrolled in an HMO must first see their primary care physician (PCP). Your primary care physician will refer you to an in-network specialist if they are unable to treat your condition.

If you have a PPO plan, you can see a specialist without a referral. There are several exceptions, such as trips to a gynaecologist or obstetrician inside the network for routine treatment.

To be covered under an HMO plan, you must stay inside your provider network. Patients with a PPO plan have access to a network of doctors, but they are not restricted to seeing only those providers. You have the option of seeing any healthcare provider you like for HMO and PPO.

So, what's the catch? You can expect the most extensive insurance coverage for the services you receive by your plan if you stay in your HMO's network between HMO and PPO.

Your coverage disappears when you leave your network. With a PPO, you can see doctors who aren't in your network and still be covered, but not to the same extent as if you stayed in your network.

So, a PPO is a way to go because it allows you to choose your doctor, right? Certainly not; there are plenty of other aspects to consider while deciding between the two.

Cost Analysis of HMO and PPO

The cost of health insurance is a fundamental differentiator between an HMO and PPO.

A higher monthly premium offsets the cost of having some coverage outside of your network with a PPO. Patients often pay lower premiums since an HMO does not provide coverage outside of its network.

For example, in 2021, the average monthly premium for an HMO will be $427 ($5,124 annually), whereas the average monthly premium for a PPO will be $517 ($5,628 annually).

The out-of-pocket expenditures of an HMO are often lower than those of a PPO. HMOs that are in-network typically do not have annual deductibles and instead charge a copay at the time of service.

PPOs are a little trickier to comprehend between HMO and PPO. Examples include deductibles, coinsurance, and copays. It is totally up to you to devise a strategy. If your plan is only based on copays, it will operate similarly to an HMO.

You pay a predetermined charge at the time of service of HMO and PPO. You will be responsible for a portion of the cost of services until your deductible is met if you have a deductible with coinsurance.

Even if your deductible has been met, you may still be required to pay a copayment at the time of service of HMO and PPO.

What Kinds of Services Are Included?

The services that are covered vary depending on the plan. If a plan is marketed through the Affordable Care Act (ACA) marketplace, it must provide preventative care, emergency care, and maternity coverage. These services are referred to as the ten major benefits.

Creating a Claim

Another difference between an HMO and PPO is the amount of legwork necessary on both sides. An HMO does not need patients to file a claim because the insurance company pays the healthcare provider directly.

A PPO patient, on the other hand, may be obliged to pay out-of-network doctors before filing a claim with their insurance company for reimbursement.

Refilling Prescriptions

Pharmacies are constrained to a network of providers in the same way that HMO members are. Patients must fill their prescriptions at in-network pharmacies to be covered by HMO and PPO.

PPO members, on the other hand, can fill their prescriptions almost anywhere. However, using an out-of-network pharmacy could lead to increased prescription drug prices.

HMO and PPO for Dental

Dental HMO and PPO plans, also known as DHMO and DPPO, function similarly to traditional HMO and PPO. A dental health maintenance organisation (DHMO) necessitates the use of a primary care dentist and often offers lower out-of-pocket payments and no out-of-network coverage.

How to Choose a Health Maintenance Organization (HMO) or a Preferred Provider Organization (PPO). When deciding between the HMO and PPO, think about what's most important to you and which will be more suitable.

Consider the healthcare options available in your area as well. Maybe you live in a rural area with a small number of HMO-affiliated doctors.

It's possible that your favourite doctor isn't part of an HMO network. What if you travel frequently and require medical attention while away from home? Due to its flexibility, a PPO may be preferable in some instances.

Some people, on the other hand, prefer to have a primary care physician (PCP) coordinate all of their healthcare, maintain a more detailed record of their medical history, and provide the more personal experience of seeing the same doctor every time.

Large families may benefit from a PCP who can also serve as a family doctor. In these cases, an HMO may be the better option.

HMO vs. PPO

HMO and PPO have been around since the early twentieth century, but it wasn't until 1973 that President Richard Nixon signed the Health Maintenance Organization Act, which encouraged and even required certain firms to offer HMOs as a healthcare plan option to their employees.

HMOs offer patients to get vaccines, physicals, and mammograms as part of their preventative care.

Network model

This is the most common or default type of HMO, in which members are limited to a network of doctors.

Staff model

This sort of HMO hires its doctors, who only see subscribers who are part of the shared HMO. Staff models aren't as popular as they used to be.

Group model

A group model is similar to a mix of network and staff structures. While the physicians in a group model are not directly employed by the HMO, they are exclusively contracted with the HMO and paid in bulk.

The physicians then divide the HMO's bulk payment amongst themselves. Doctors in a group model, like those in the staff model, treat just the members of their HMO.

Open-panel model

An open-panel HMO functions similarly to a group HMO, except that the doctors in an open-panel HMO will also treat individuals who are not insured by the HMO.

The open-panel approach is distinguished by the fact that the primary care physician (PCP) can refer patients to doctors outside of the HMO network while still receiving partial coverage.

PPOs can be traced back to the Health Maintenance Organization Act. When HMOs were first introduced, insurance companies saw an opportunity to give customers more flexibility while also gaining more control over medical expenditures.

As a result, PPOs were created. PPOs have been increasingly popular among major firms with numerous offices across the country, as a comprehensive PPO plan allows for greater geographic flexibility among the many employees of HMO and PPO.

Provider Networks

A network is a group of healthcare providers who have agreed to work with insurance companies to provide discounted services to members of a certain HMO and PPO plan.

General practitioners, as well as specialists such as dermatologists and chiropractors, are generally present. To be insured by an HMO, you must first see your PCP, regardless of the problem.

They will refer you to another member of the network if they are unable to treat you. If you stay within your HMO's network, you'll get the most insurance coverage if you choose between HMO and PPO.

Your coverage vanishes as you leave the network. With a PPO, you can see doctors who aren't in the network and still be covered, but not to the same extent as if you stayed in the network.

Cost Analysis

The freedom of choice and flexibility that a PPO provides comes at the cost of higher plan premiums. Patients pay reduced premiums since an HMO does not provide coverage outside of its network.

Claims Forms

In an HMO, patients do not need to file a claim because the insurance company pays the medical providers directly.

Patients with PPO plans, on the other hand, maybe obliged to pay out-of-network doctors first before filing a claim with the insurance company.

Services Covered

The services provided under the HMO and PPO differ based on the company and the plan is chosen, but they are generally similar.

The number of pharmacies where one can fill their prescriptions and be covered by the plan is limited, just as coverage under an HMO is limited to a network.

Patients with PPOs can fill their prescriptions almost anywhere, but if they travel to an out-of-network pharmacy, they will be charged more.

Exceptions

Patients with an HMO plan do not need a referral in an emergency or for in-network visits to a gynaecologist or obstetrician.

Primary Care Physician

A primary care physician (PCP) is usually associated with a medical group or a hospital. HMOs keep expenses down by limiting referrals to primary care physicians.

Because your PCP's referral ensures the insurance company that specialises care is medically essential, the assumption is that if one provider organises care, it would be more efficient.

Deductible and Copay

Even though most HMOs do not have a deductible or have a modest deductible, copayment fees for non-preventive visits are common.

A PPO, on the other hand, allows members to see any health care provider in the insurance company's network without obtaining a reference, even specialists.

A PPO is frequently preferable to an HMO if your situation needs frequent visits to specialists because no PCP is necessary for referrals. There are also fewer restrictions on seeing non-network providers of HMO and PPO.

Copayments for non-preventive medical care are likely to be included in a PPO plan, similar to HMO policies. A PPO plan, on the other hand, will most probably have a higher annual deductible and premiums.

What happens if you need to go to the hospital?

Other than maternity stays, non-emergency hospital stays must be approved or pre-certified in advance.

This information will be used by Cigna to determine whether the services are covered under your plan. Pre-certification is not necessary for maternity stays of 48 hours for vaginal deliveries and 96 hours for caesarean sections.

Who is in charge of obtaining pre-certification?

Your physician will assist you in determining which operations require hospitalisation and which can be completed as an outpatient procedure.

If your doctor is part of the Cigna network, he or she will help you get pre-approved. You are responsible for making arrangements if you see a doctor who is not in your network. Which procedures require pre-certification will be mentioned in your plan papers.

Do you prefer to travel regularly or stay near to home?

A PPO may be the best option for you if you travel frequently and are more likely to seek medical attention while away from home, especially if you have a chronic disease or engage in high-risk activities such as certain sports.

If you need a lot of specialised treatment, such as for a rare or chronic illness, an HMO plan may be preferable because it allows you to choose experts and see them right away.

If you normally seek treatment in your hometown or from your family physician, an HMO is more likely to offer you the right coverage.

Is the plan you're considering including visits with your favourite doctor if you already have one?

Even though CareFirst's HMO plans have a bigger network than many other HMOs, the PPO plans still have a greater network of healthcare providers. Check whether your present doctor is in-network under an HMO and PPO, or both if you wish to keep him or her.

Choosing the right health insurance plan can provide you peace of mind, knowing that your medical requirements will be met.

How Do Managed Health Care Plans Work?

Managed health care plans are more cost-effective than traditional fee-for-service (FFS) or indemnity health insurance plans because they share the medical cost financial risks among members, their insurance plans, and members of the managed care network.

Employers who sponsor a managed health insurance plan will pay a portion of the annual payment.

Being a part of a network allows plan members to get discounted treatments from network health service providers, which lowers the plan's costs.

Pros and Cons Explained

If you have a managed health care plan, you will have guaranteed access to a network of health care providers. Furthermore, if you visit an in-network doctor or specialist, you will pay less than if you see an out-of-network doctor or specialist.

There is a billing system in place when you visit in-network doctors to make the paperwork and claims process run more smoothly. This may also help to expedite the process.

Physicians and providers gain from managed health care plans because they are more likely to see patients who are part of the network. As a result, they have a steady stream of customers and employees.

What are the Additional Options?

EPO, POS, FFS, HDHP

Health insurance isn't limited to HMO and PPO. A few other insurance programmes operate similarly.

An EPO, or Exclusive Provider Organization, is similar to an HMO in that it does not require all medical care to be coordinated via a primary care physician and does not require specialist referrals.

Like an HMO, coverage is limited to doctors in a network. In comparison to HMOs, EPOs have higher rates.

Another alternative is a POS (Point of Service) health insurance plan. A POS shares certain similarities with both an HMO and a PPO. A POS, like an HMO, requires you to visit a primary care physician regularly.

With a recommendation from your primary care physician, a POS, like a PPO, allows for coverage outside of the network.

A fee-for-service (FFS) plan, often known as an indemnity plan, provides the most flexibility and freedom but is also the most expensive option.

Patients with FFS have the freedom to choose their doctors and specialists, but they must pay considerable out-of-pocket expenses and preventive therapies are not usually reimbursed.

You may be asked to pay for all services upfront and then submit a reimbursement claim to your insurance carrier.

As the name implies, a High-Deductible Health Plan (HDHP) has a high deductible. You'll pay a lower monthly premium in exchange. In employer-sponsored plans, an HDHP and an HSA, or Health Savings Account, are typically combined.

An HSA is a form of health savings account that uses non-taxed contributions to pay for out-of-pocket health expenses including copays and coinsurance.

Cost Comparison of POS, EPO, HMO and PPO Health Care Plans

Employees with some sort of employer-sponsored health insurance plan paid an average yearly premium of $5,588 for family coverage in 2020, according to the Kaiser Family Foundation's (KFF) 2020 Employer Health Benefits Survey.

Employees paid an average of $1,243 per year for single coverage (across all plans). The Kaiser Family Foundation also discovered that 47% of employees were enrolled in a PPO plan, 13% in an HMO, and 8% in a POS plan.

Even though the Kaiser Family Foundation previously considered the EPO and HMO plan to be the same HMO plan, EPO expenses were not specifically mentioned in the poll.

EPOs can be cost-effective as long as you stay in-network. You may be responsible for the entire cost if you receive care outside of the EPO network or member hospitals.

According to the Kaiser Family Foundation, PPO plans, despite being the most popular in 2020, may be more expensive than other plan types because you'll pay more out-of-pocket costs, such as a higher monthly premium.

POS plans are more expensive than HMOs and EPOs, even though they offer the most flexibility. These plans may give the most flexibility due to the lack of pre-negotiated network member agreements, but they are also likely to be the most expensive of HMO and PPO.

You can’t choose between HMO and PPO easily. HMO and PPO have a lot of benefits but which will be more beneficial for you between HMO and PPO will be different for everyone.

The question of whether you should go for an HMO, or PPO is better has no clear answer. It is primarily determined by the preferences of the clients of HMO and PPO. HMOs are more cost-effective in the end, while PPOs provide greater flexibility and freedom of choice.

According to data, PPO plans enrol more individuals than HMO plans. In 2014, 58 per cent of employees preferred a PPO to an HMO as their employer-provided health insurance plan, while just 13% preferred an HMO.

Despite their popularity, consumer satisfaction with HMO plans is greater, according to a survey conducted by the National Committee for Quality Assurance (NCQA) for HMO and PPO.

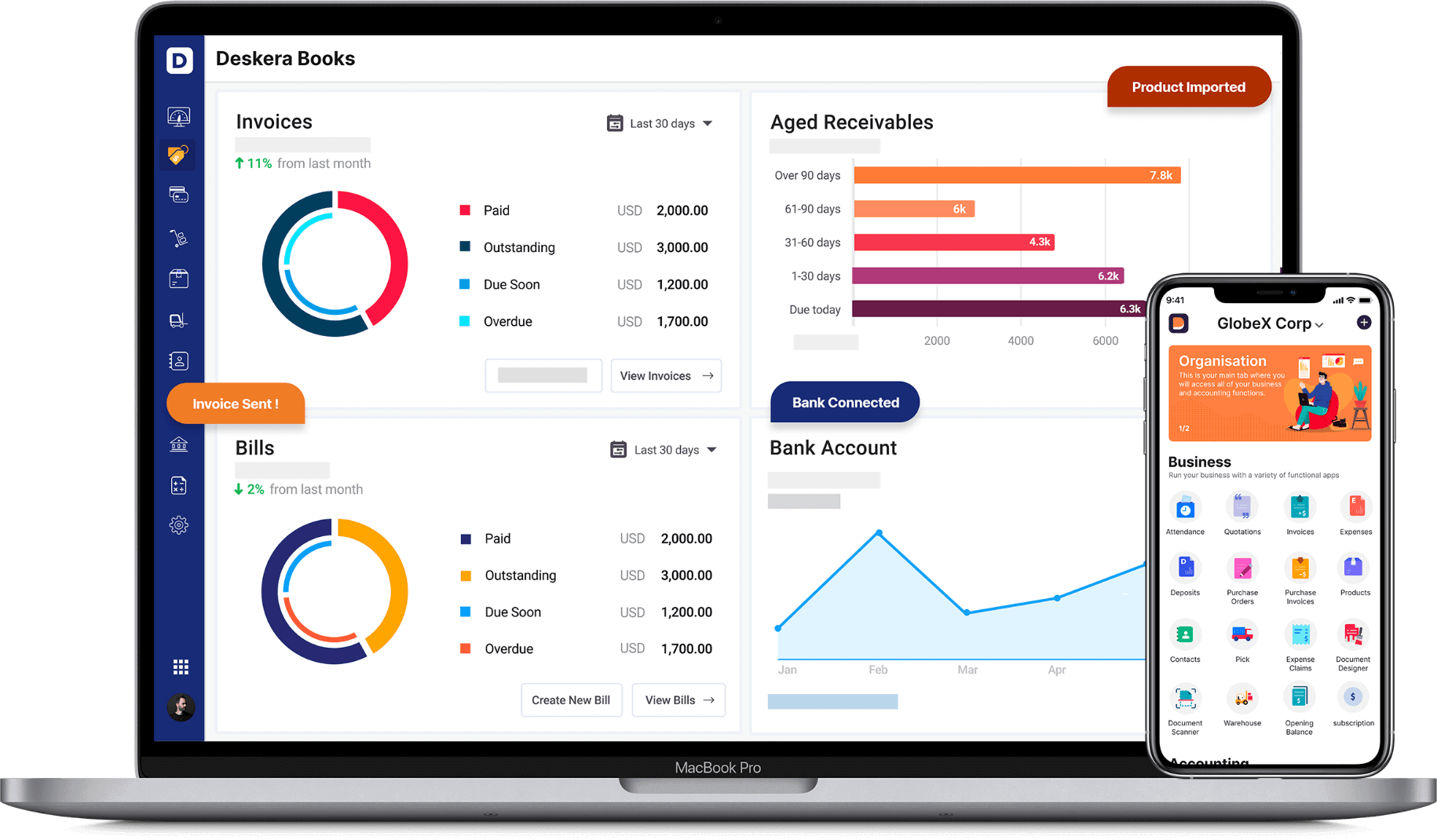

To manage your costs and expenses you can use many available online accounting software.

How Can Deskera Assist You?

Deskera Books can help you automate your accounting and mitigate your business risks. Creating invoices becomes easier with Deskera, which automates a lot of other procedures, reducing your team's administrative workload.

Key Takeaways

- It's typical to have to choose between an HMO and PPO to get the best healthcare. At some point in our lives, we will all have to deal with an illness or ailment. You must be able to make an informed decision about which plan is best for you.

- When it comes to health insurance, distinguishing between an HMO and PPO might be challenging. You've probably heard of HMO and PPO, and potentially other acronyms.

- A Preferred Provider Organization, or PPO, is a healthcare provider network that provides a wide range of healthcare and healthcare provider options to its members.

- Managed health care plans are health insurance plans that incorporate contracts with health care providers and medical facilities of HMO and PPO.

- Your coverage disappears when you leave your network. With a PPO, you can see doctors who aren't in your network and still be covered, but not to the same extent as if you stayed in your network.

- Pharmacies are constrained to a network of providers in the same way that HMO members are. Patients must fill their prescriptions at in-network pharmacies to be covered by HMO and PPO.

- Consider all of your healthcare expenses when choosing between HMO and PPO, not just the monthly premium you'll pay to an insurance provider.

- A PPO may be the best option for you if you travel frequently and are more likely to seek medical attention while away from home, especially if you have a chronic disease or engage in high-risk activities such as certain sports.

- According to data, PPO plans enrol more individuals than HMO plans. In 2014, 58 percent of employees preferred a PPO to an HMO as their employer-provided health insurance plan, while just 13% preferred an HMO

Related Articles