Most of the labour in India is informal. Informal labourers struggle for their livelihood daily, often having to skirt several labour laws to survive. However, the continuous efforts of policymakers and employers to improve the workers' condition have improved the labour legislation in the country, leading to the establishment of a few Acta.

One such landmark Act is the Contract Labour (Regulation & Abolition) Act, 1970, which marked a revolutionary step by abolishing the contract labour system and regulating the hiring of labourers by contractors.

The Central Register Fines Form xxi comes under the purview of the Contract Labour (Regulation and Abolition) Act, 1970.

Contract Labour (Regulation & Abolition) Act, 1970 - An Overview

The Contract Labour (Regulation & Abolition) Act, 1970 is an Act of the Parliament of India enacted in 1970 to regulate the contract labour system in India.

It prohibits the employment of contract labour in certain establishments and regulates work conditions for those employed under contracts. The Act was passed after extensive debates and consultations with various stakeholders.

The Contract Labour (Regulation and Abolition) Act, 1970 (the CLRA) prohibits the employment of workers on a contract basis in certain essential services with the enforcement of the Central Register Fines Form xxi.

Parliament enacted the CLRA to regulate the employment of workers on a contract basis by providing for the regulation and abolition of that practice in certain essential services. The preamble of the CLRA for records like the Central Register Fines Form xxi states that "it is expedient to regulate and abolish the system of contract labour in certain essential services."

The Act has three parts: Part I deals with the regulation of employment through contractors; Part II deals with the abolition of contract labour; Part III enacts provisions for miscellaneous matters such as the establishment of Appellate Tribunal, monitoring committees, etc. In addition, it includes forms like the Central Register Fines Form xxi.

Essential Features of the Contract Labour (Regulation & Abolition) Act, 1970

The Contract Labour (Regulation & Abolition) Act, 1970 is Indian legislation that aims to protect a worker from exploitation by his employer. It seeks to ensure a fair contract between the parties and penalties for infringement of its provisions. The Act came into force in 1971 with forms like Central Register Fines Form xxi. The main objective of this Act is to ensure that the contractor does not exploit the labour during the execution of work.

The following are some crucial features of this Act:

1. Definition of employer and contractor

Any person who employs any other person to do any work or execute any work or any service has been defined as an employer here. A person who hires himself out or offers his services to carry out any work or service is called a contractor.

2. Prohibition against the employment of children below 14 years

Under this Act, it has been provided that no children shall be employed under the age of 14 years except under certain circumstances where they may be permitted to work up to the age of 18 years.

3. Security of employment

No person shall employ a contractor unless he secures a written guarantee from the contractor that he will not discharge or dismiss any employee employed by him except for reasons connected with health, conduct, or efficiency.

What are the objectives of the Contract Labour (Regulation & Abolition) Act, 1970?

The Contract Labour (Regulation & Abolition) Act, 1970, states that a contractor cannot employ contract labour for any work within the premises of the principal employer for a stipulated time.

Till the enactment of this Act, contractors were free to employ contract labour for their benefit by seeking out loopholes in other legislations. With existing forms like Central Register Fines Form xxi, the rights of the contract labour are safeguarded under the provisions of the Act.

The main objectives of the Act are:

Abolition of the contract labour system

Contractors are not allowed to employ contract labour on any work undertaken about the principal employer's business. The contractor is only entitled to contract labour if such an activity is incidental to his main business.

Testing contractors employing contract labour

The contractor must obtain permission from the appropriate government authority before using contract labour.

- The Act provides for the regulation of supply, engagement, and employment of contract labour in connection with a Government contract to ensure fair wages, reasonable hours of work, and other conditions of service as covered in the Central Register Fines Form xxi.

- The Act also prohibits the employment of contract labour in any establishment where regular workers are available for doing the work. However, one or more persons may be employed daily in any occupation if the total number used does not exceed 10% of the total number of workers employed in that occupation in that establishment.

- Ensure that no contractor is engaged for work unless he has an office or place of business in the locality where the work is to be executed. Such office or location of the company shall be fitted with all necessary furniture and equipment.

- The law created several exemptions for specific industries such as construction, mining, and oil exploration from the definition of "contractor" and therefore, from the provisions of the abolition of contract labour. This has led to the continuation of large numbers of workers who are treated as contractors rather than employees.

How does the Contract Labour (Regulation & Abolition) Act, 1970, help prevent contract labour?

The Contract Labour (Regulation & Abolition) Act, 1970 states that any agreement creating an obligation to perform labour or service for another person in consideration of wages lower than the minimum wage is illegal. The provisions of the Act is clear in forms like Central Register Fines Form xxi.

The Ministry of Labour and Employment enforces the Act, and its enforcement ensures that contract labour does not fall victim to exploitation by unscrupulous contractors.

This Act protects the interest of workers working on a contractual basis.

- It regulates employment at a lower wage than what is prescribed by the government.

- The state government may fix the minimum wage of any state, and such minimum wage will prevail over any contract provision specifying a lower wage.

- Any provision of contract or agreement or any regulation in forms like Central Register Fines Form xxi made thereunder which has the effect of fixing wages at a lower rate than that prescribed under this Act shall be void.

- The central government may make rules to carry out the provisions of this Act through forms like Central Register Fines Form xxi.

It was primarily enacted with an eye to the welfare of industrial workers who were engaged in industries where there was a lack of protection.

How does the Contract Labour (Regulation & Abolition) Act, 1970, Protect Workers' Rights?

The Contract Labour (Regulation & Abolition) Act, 1970, was passed on February 10, 1971, to ensure that workers' rights were protected. The aim of the Act within forms like Central Register Fines Form xxi is to ensure fair terms of employment to workers engaged on a contract basis at workplaces.

Several provisions in this Act deal with the following:

a) The number of workers and the nature of work to be done shall be specified in the contract

b) The basic minimum wage rate and other terms and conditions of service shall be specified in the contract

c) Any deductions from wages for any purpose shall be specified in the contract and through forms like Central Register Fines Form xxi

d) The contractor shall have no right to transfer a worker from one establishment to another or to discharge him during the currency of a contract except for reasons connected with his health or conduct

e) In case of dispute between the contractor and his workers or anyone claiming through them, it shall be mandatory for the contractor to refer such dispute to an arbitrator whose decision on any question of fact shall be final and binding on both parties.

f) All disputes relating to interpretation or implementation of an agreement between the contractor and his worker or anyone claiming under him, including questions regarding wages, shall, unless they are settled amicably.

What is the Central Register Fines Form XXI?

A contractor shall maintain the Central Register Fines Form xxi as per the below format. The above record is to be maintained by the contractor in triplicate. The original copy is to be left with the principal employer.

The Central Register Fines Form xxi is given to the principal employer, and another copy is to be retained by the contractor. The format of the Central Register Fines Form xxi may be amended as per the directives issued by the Labour Commissioner from time to time.

The contractor shall ensure that wages, deductions, and other particulars are recorded in each Central Register Fines Form xxi at the end of each month. Wages are paid within seven days after the end of the wage period as per the records available in the Central Register Fines Form xxi.

The said register shall be maintained in respect of every contract where such employer has entered into any agreement with a principal employer or sub-contractor to provide labour and services.

The first part of the Central Register Fines Form xxi shall be for registration of establishments/contractors, second for registration of principal employers, and third for registration of employees working under such contractors/leading employers.

The first part of the Central Register Fines Form xxi shall contain information on the contractor/principal employer such as name, registration number, address, contact person, phone number, etc.

The second part of the Central Register Fines Form xxi shall contain information on the establishments such as establishment number, contract number, name of the establishment, etc.

The third part of the Central Register Fines Form xxi shall contain information on the employees such as employee number with photograph (if any), employee name, etc.

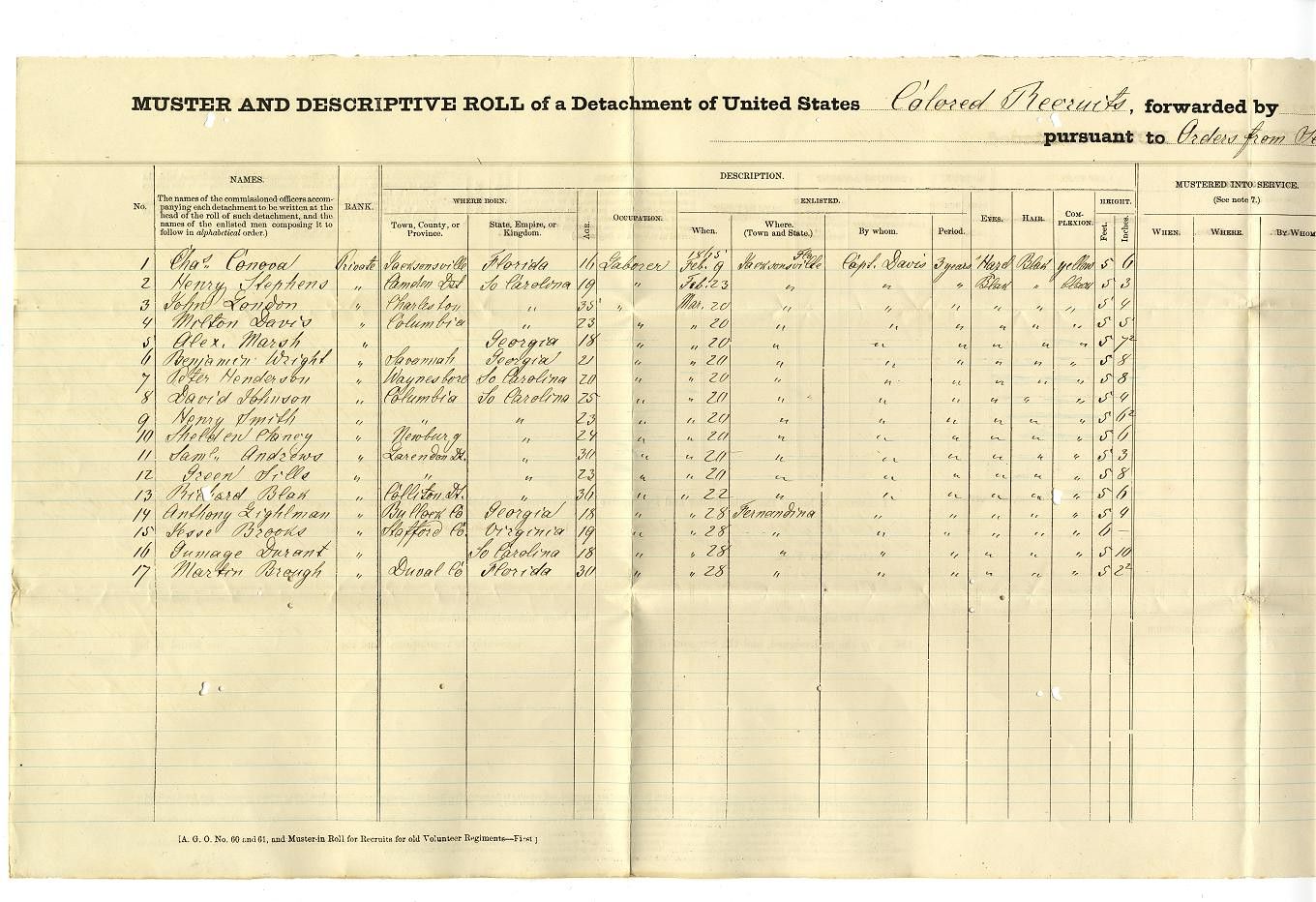

Central Register Fines Form xxi

1[See rule 78 (1) a) (ii)]

Register of Fines

Name and address of the contractor

Nature and location of work

Name and address of establishment in/under which contract is carried on

Name and address of principal employer

|

Sr. No. |

Name of workman |

Father's? Husband's name |

Designation Nature of employment |

Act/Omission for which fine imposed |

Date of offense |

Whether workman showed cause against fine |

Name of person in |

|

1 |

2 |

3 |

4 |

5 |

6 |

7 |

8 |

|

|

|

Wage periods and wages payable |

Amount of fine Imposed |

The date on which fine realized |

Remarks |

|

9 |

10 |

11 |

12 |

|

|

Wrapping Up

The Contract Labour (Regulation & Abolition) Act, 1970 (the CLRA) was enacted to provide for the regulation of employment of contract labour in certain establishments and provide relief to workers employed in contravention of the provisions of any law ordinance or regulations as covered in the Central Register Fines Form xxi.

The Central Register Fines Form xxi informs you that the office intends to enforce the provisions of law governing the maintenance of registers and records.

It acts as a deterrent against employers who are not paying their dues to workers and their families, enabling them to be brought to book. This will help prevent further violations by such employers, thereby improving compliance in the country.

How Can Deskera Payroll Help?

Payroll management and employee management are integral to any organization. If you are looking for a holistic and automated tool to manage payroll, employees, expenses, contractor management, Deskera People could be the apt solution.

Process your payroll now with Deskera People

Key Takeaways

- The Contract Labour Act, 1970 is an act of the Parliament of India. It regulates the employment of contract labour in any establishment through forms like the Central Register Fines Form xxi. It was enacted to prohibit contract labour in certain employments and provide social security to such labourers.

- The Act provides for the regulation and abolition of the contract labour system and matters connected therewith.

- The Central Register Fines Form xxi informs you that the office intends to enforce the provisions of law governing the maintenance of registers and records.

- The significant features of the Act are:

(i) A worker's employment as contract labour shall be deemed to mean that another person employs him for a specific period upon payment of wages for particular work to be done under his supervision and control.

(ii) The Central Government may declare employment specified in such notification as employment on a contract basis by notification in the Official Gazette.

(iii) No employer shall engage any contractor either directly or indirectly to supply workers to him to circumvent the provisions of this Act through forms like the Central Register Fines Form xxi or any other law for the time being in force relating to minimum wages, overtime work, hours of work, weekly holidays, leave with wages, or other conditions of service of workers.

(iv) The State Government may also declare by general or special order any industry which employs contract labour as an exempted industry subject to such conditions as they may specify in the order.

Related Articles