The IRS Form 1065, United States Return of Partnership Income, is used to report each partner's share of the business's profit or loss. On Form 1065, no tax is calculated or paid. This information is simply reported to the IRS. The tax burden is passed on to the members, who then pay income taxes on their personal returns.

Table of contents

- What is Form 1065 K-1?

- What Is the Beneficiary's Share of Income, Deductions, and Credits on form 1065 K-1?

- Corporate Taxes: Filing and Payment

- What Is Business Income?

- The IRS Form 1065 K-1 Purpose

- What are Form Reports?

- How much money do you need to file taxes?

- What happens if you don't file your taxes on time?

- When Filing Form 1065 K-1, Take Special Care

- What Is a Trust Fund?

- Do Trust Beneficiaries Have to Pay Taxes?

- Beneficiaries and Trusts: An Overview

- Interest vs. Principal Distributions

- Is a Trustee able to remove a Beneficiary from the Trust?

- Who needs to fill out Form 1065 K-1?

- Are you wondering whether or not your business is a partnership?

- How to Complete and Submit Form 1065 K-1?

- The Importance of Partnership Agreements in form 1065 K-1 Filings

- How can you submit Form 1065 K-1?

- Key Takeaways

What is Form 1065 K-1?

IRS Form 1065 K-1, U.S. Return of Partnership Income, has a schedule k-1. Form 1065 K-1 is given to business partners in order for them to declare their portion of the partnership's income, losses, deductions, and credits to the IRS.

Schedule K-1 is part of Form 1065, the Partnership Tax Return, and it reports your partnership's entire net income.

Profits and losses pass through to the partners or LLC members, who report and pay taxes on their portion of the firm revenue on their personal tax returns. So, while a partnership or LLC is required to file a single IRS Form 1065 K-1, the business does not pay income tax.

In a nutshell, Form 1065 K-1, also known as the US Return of Partnership Income, is a specialty tax document that is only issued by the IRS. This form 1065 K-1 is used to disclose an existing general partnership's net gains and losses, as well as deductions and tax credits.

To put it another way, it's one of the most crucial net income forms that a company partnership must complete at the end of the fiscal year to comply with tax requirements is form 1065 K-1.

What Is the Beneficiary's Share of Income, Deductions, and Credits on form 1065 K-1?

Form 1065 K-1 is an annual tax form provided by the Internal Revenue Service (IRS) for an investment in partnership interests. The aim of form 1065 K-1 is to show how much each partner contributed to the partnership's profits, losses, deductions, and credits.

Form 1065 K-1 has the same tax reporting purpose as one of the several Forms 1099, which reports dividends or interest from securities, as well as income from the sale of stocks.

Shareholders of S corporations, or companies with fewer than 100 stockholders that are taxed as partnerships, use the form 1065 K-1. Form 1065 K-1 are also filed by trusts and estates that have dispersed income to beneficiaries.

Individual partners (including limited partners) are responsible for income tax on their share of the partnership income, whether or not it is distributed. A form 1065 K-1 is typically provided to taxpayers who have made investments in limited partnerships (LPs) and certain exchange traded funds (ETFs), such as commodity ETFs.

Corporate Taxes: Filing and Payment

If you're completing an income tax return for your corporation or S corporation, you must utilise approved software or a tax expert who is an authorised e-file provider. Limited liability businesses (LLCs) that decide to be taxed as corporations or S corporations are included in this category.

Other Business Taxes to Pay

The best and easiest way to pay your taxes is to do so online. IRS epay options include direct debit from a bank account, credit card, or debit card for LLC owners, sole proprietors, or partners in partnerships.

Making an Extension Request

You can apply for an extension online or by mail to the IRS. Depending on the type of business, there are two application forms: Form 7004 for corporations and partnerships, and Form 4868 for other types of businesses and personal returns.

You can also request an extension on your personal tax return via IRS E-File, which will give you until October 17, 2022 to file. To obtain an extension, you must calculate your tax liability and pay any outstanding balance.

What Is Business Income?

Business income is a sort of earned income that falls within the category of ordinary income for tax purposes. It includes any revenue generated as a result of a company's operations. In its most basic form, it is a company's net profit or loss, which is determined as revenue from all sources less operating costs.

Firm expenses and losses can balance out business profits, which can be positive or negative depending on the year. Most businesses have a profit motive behind their earnings. However, the taxation of business income varies depending on whether the business is a sole proprietorship, a partnership, or a corporation.

Insurance Coverage for Business Income

A business income coverage form is a type of property insurance policy that covers a company's loss of income as a result of a delay or temporary cessation of normal activities caused by physical property damage.

Let's imagine a hurricane damages a doctor's office in Florida. The doctor is unable to see patients in that office until the structure has been determined to be safe. During the time when the doctor's business is disrupted, the business income coverage would kick in.

What are business income examples?

As the name implies, business income is revenue created by a company. Any payment received in exchange for a product or service provided by a business is considered business revenue, according to the Internal Revenue Service (IRS). A sale made in a store or online, or rent received by a real estate company, are examples.

The IRS Form 1065 K-1 Purpose

Partners pay taxes on their gains, not the partnership. Partnerships are pass-through entities that report their earnings, deductions, credits, and other items to their partners, who then input their portion of the information on their individual tax returns.

This information is listed on Form 1065 K-1, U.S. Return of Partnership Income, by the partnership and any entity treated as a partnership for federal income tax purposes.

What are Form Reports?

Page One

The top of the form displays basic information about the collaboration. The partnership then specifies if the return is exceptional, the accounting method, and the number of Schedule K-1s attached.

The income section of the partnership's financial statement lists various income items from the partnership's trade or business, such as gross receipts from sales and net gain or loss on the sale of business assets.

Some things on shareholders' (partners') own returns require special treatment; these are referred to as separately stated items and do not appear on page one of Form 1040. You won't see these rents listed in the income section of the Form 1065 K-1 return because of particular restrictions for rental real estate revenue and deductions.

While some of a partnership's trade or business deductions are disclosed on page one of Form 1065 K-1, others (such as charitable contributions and the Sec. 179 deduction) are reported elsewhere so that partners can apply their own limitations to these write-offs. Salaries and compensation to employees are among the deductions on page one of Form 1065 K-1.

Ordinary business income profit or loss is the difference between the partnership's total income and total deductions. This net sum is distributed to partners, along with other items.

Two and three pages

Schedule B, Other Information, consists of a series of yes-or-no questions about the partnership. Check the box for question one if you're a limited liability company (LLC) with two or more participants or a limited liability partnership (LLP). Schedule B also contains information about the Tax Matters Partner, who has been appointed by the partnership to sign the return and communicate with the IRS about it.

Page Four

The partners' distributive share of things is listed on Schedule K. Allocations to individual partners of each of these things are decided based on this schedule.

Fifth page

The net income (loss) analysis in Schedule K is a breakdown of the income or loss by partnership type (corporate, individual (active), person (passive), and so on). It further divides profits and losses between general and limited partners.

The partnership's books are used to populate the entries for assets and liabilities. The difference between assets and liabilities, like with any balance sheet, effectively reflects the capital accounts of the partners.

The revenue or loss on the books is reconciled with the income or loss on the return on Schedule M-1. This reconciliation is important since tax regulations do not always match the economic realities of partnership activity.

While a partnership may deduct the full cost of meals and entertainment on its books, only half of these costs are deductible for tax purposes; the reconciliation is done on Schedule M-1.

The capital accounts of the partners are examined in Schedule M-2. This ownership interest fluctuates each year to reflect partner contributions, partnership profit or loss, partnership payouts to partners, and other activities.

As previously stated, this form distributes partnership and separately declared items to shareholders so that they can report them on their individual tax returns. Partners who are persons filing Form 1040 should report the items on page two of this schedule.

For example, on Schedule E of an individual's Form 1040, a partner's share of profit or loss (the ordinary income or loss from page one of Form 1065 K-1) is recorded. 8 Schedule D of Form 1040 is used to disclose a partner's portion of net long-term capital gains.

The due date for filing Form 1065 K-1 is the 15th day of the third month following the end of the entity's tax year. For a calendar year entity, the deadline is March 15 for form 1065 K-1. A partnership can get an automatic six-month filing extension till September 15 right now for form 1065 K-1. Partnerships that do not file their returns on time face a penalty of $195 per partner per month they wait.

The IRS needs Form 1065 K-1 to see how your company's financial situation is progressing until the end of the tax year. The IRS can use this form 1065 K-1, along with other tax forms, to get a full picture of your business's financial activity and determine if it owes you money or if you owe the IRS additional taxes.

If your general partner or limited partnership operates legally in the United States, you must file a Form 1065 K-1. You must also pay income tax on your earnings, regardless of where the money was earned or disbursed. All business partnerships or limited partners in the United States must file a completed Form 1065 K-1.

How much money do you need to file taxes?

The IRS uses a number of criteria to determine who is required to file a tax return. Your filing status (married, single, etc. ), the amount of federal income tax withheld from your earnings, and your gross income for the year all factor into the calculation. Even if your income is low enough to avoid filing, you may wish to file to claim the EITC or other tax credits, or to receive a refund for the year.

On the IRS website, you can utilise the interactive tax assistant, which guides you through a series of questions to determine whether you need to file a tax return.

What happens if you don't file your taxes on time?

If you file late, don't submit a correct return, or don't pay on time, the IRS will levy you penalties. If you do not pay the penalty in full, the agency may charge you interest. The best strategy to stop the penalty metre from running is to file as soon as possible and pay as much as possible.

If you can establish that you behaved in good faith or had good reason for not paying, the IRS may decrease your penalties. For further information, see the IRS's entry on penalty relief.

In some situations, the US tax system permits pass-through taxation, which moves tax liability from an entity (such as a partnership) to the individuals who own a stake in it. As a result, the Schedule K-1 exists, which compels the partnership to keep track of each partner's basis (or degree of financial participation) in the business.

A partnership will create a K-1 to determine each partner's share of the partnership's profits depending on the amount of capital they have invested. Capital contributions and their portion of revenue enhance a partner's basis, while their share of losses and any withdrawals lower it.

The IRS receives the financial information from each partner's Schedule K-1 together with Form 1065 K-1. K-1s are also filed by S corporations, along with Form 1120S.

When Filing Form 1065 K-1, Take Special Care

The Schedule K-1 is required for a partner to accurately establish how much income to report for the year, even though it is not filed with an individual partner's tax return.

The K-1, unfortunately, has a reputation for being late. It must be received by March 15 (or the 15th day of the third month following the end of the entity's tax year). In fact, it's frequently one of the last tax paperwork a taxpayer receives.

The intricacy of determining partners' shares and the requirement to compute each partner's form 1065 K-1 individually are the most typical causes. (It used to be worse: K-1s didn't have to be received until April 15 before the IRS revised its requirements in 2017.)

To add salt to injury, the Schedule K-1 can be fairly complicated and necessitate many entries on the taxpayer's federal return, including Schedule A, Schedule B, Schedule D, and, in some situations, Form 678.

This is because a partner's Schedule K-1 might include rental income from a partnership's real estate holdings, as well as income from bond interest and stock dividends.

Death and taxes are two things you can't avoid in life. While there are strategies to reduce your tax liability, you won't be able to avoid the tax collector.

From earned income to capital gains from the sale of stocks and property, almost everything we touch is taxed; even assets received from an estate are taxed. Trust funds, which have a relationship with both death and taxes, are similar.

What Is a Trust Fund?

Estate planning methods such as trust funds are utilised to accumulate money for future generations. A trust fund is a legal entity that owns property or other assets in the name of a person, persons, or group, such as money, stocks, personal possessions, or any combination of these.

The trust is managed by a trustee, who is an impartial third party with no ties to the grantor or beneficiary. Revocable and irrevocable trusts are the two basic types of trusts. The grantor's assets are held under a revocable trust, often known as a living trust.

These assets can be distributed to any beneficiary named by the grantor. While the grantor is still living, changes to the trust can be made. An irrevocable trust, on the other hand, is difficult to amend yet avoids probate complications.

Taxing Trust Funds

The Internal Revenue Service allows trusts to deduct income given to beneficiaries. In this situation, rather than the trust, the recipient pays income tax on the taxable amount.

Beneficiaries receive distributions from current-year income first, followed by principal. Because taxes have been paid, distributions from the principal are tax-free. The trust or the beneficiary may be liable for capital gains on this sum. Amounts distributed to and for beneficiaries are taxable to them up to the trust's deduction.

The income tax is paid by the trust and not passed on to the beneficiary if the income or deduction is part of a change in the principal or part of the estate's distributable income.

Non-Grantor Trusts vs. Grantor Trusts

Grantor trusts and non-grantor trusts are the two types of trusts, with different sub-categories within each.

Trusts with grantors

A grantor trust is one in which the grantor owns the trust's assets and is responsible for reporting and paying the trust's income taxes. Grantor trusts are all revocable, however not all grantor trusts are revocable.

The trust fund is established by a grantor, who is usually the owner of the assets provided. Grantors control the trust's terms and conditions, as well as the beneficiaries, investments, and trustees. Because grantors have complete control over the trust, they can cancel it or convert it to an irrevocable trust.

Instead of the trust's tax return, income is recorded on the grantor's personal tax return. Grantor trusts are preferred by many wealthy people because their personal income tax rates are often lower than trust tax rates.

Trusts without a grantor

Non-grantor trusts, on the other hand, are ones in which the grantor is not accountable for the trust's income or taxes. The trust is responsible for reporting and paying income taxes as a distinct tax entity.

Beneficiaries are required to declare and pay taxes on income received. The trust receives a tax deduction for the amount distributed in exchange.

Simple or complicated non-grantor trusts exist. In a basic trust, all earned income must be given to a beneficiary or beneficiaries on a yearly basis. However, no disbursements from the principal are permitted, and charitable donations are not permitted.

When it comes to distributing revenue from a complex or discretionary trust, the trustee has more leeway. Direct contributions to charity and distributions from the primary are both permitted.

Reporting Income

The income, credits, and deductions received by a beneficiary from a trust or estate are recorded on Schedule K-1, an IRS tax form. The trust must file a Schedule K-1 for each beneficiary paid, and the beneficiary is taxed on trust disbursements. The income will be reported on the tax return of the beneficiary.

The trust must also file a Form 1041 to report the total amount of revenue earned since the grantor passed away. On the form, the total amount paid to beneficiaries for the reportable tax year is also listed.

All Schedule K-1s and Form 1041 must be included in the trust's tax return. To claim the IRS Income Distribution Deduction, the trust must complete and submit Schedule B of Form 1041 with the return.

The deduction is equal to the lesser of the DNI or the amounts disbursed to the beneficiaries or required to be distributed. 3 Income distributed outside of complex or discretionary trusts is not deductible.

Do Trust Beneficiaries Have to Pay Taxes?

Rather than the trust paying the tax, the beneficiaries of a trust often pay it on the trust's revenue distributions. However, trust principle distributions are exempt from taxation for such recipients.

When a trust makes a distribution, it deducts the money from its own taxes and sends the receiver a K-1 tax form. The K-1 illustrates how much of the beneficiary's distribution is interest income versus principal, and thus how much is taxable income.

Beneficiaries and Trusts: An Overview

In estate planning, trusts are widely used to provide legal and asset protection. Trusts can guarantee that assets are distributed to beneficiaries in accordance with the grantor's wishes.

Trusts can also help with estate and inheritance taxes, as well as avoiding probate, which is the legal procedure of transferring assets when the owner passes away.

Despite the fact that trusts come in a variety of shapes and sizes, they usually fall into one of two categories. A revocable trust can be changed or closed at any time during the grantor's lifetime.

In contrast, once established, an irrevocable trust, including those that become irrevocable upon the grantor's death, cannot be changed or closed. The grantor has essentially transferred entire ownership or title to the trust's assets by creating an irrevocable trust.

Interest vs. Principal Distributions

Trust beneficiaries who receive distributions from the trust's main amount are not required to pay taxes on the payout. The Internal Revenue Service (IRS) believes that this money was taxed before it was placed in the trust. The interest earned on funds deposited into the trust is taxable as income to either the beneficiary or the trust.

After the fiscal year ends, the trust must pay taxes on any interest income it holds but does not distribute. The interest income distributed by the trust is taxable to the beneficiary.

The recipient's award is computed using current-year income first, followed by cumulative principal. This is typically the initial donation plus any additional donations, and it is revenue over the amount distributed.

On this sum, the trust or the beneficiary may be liable for capital gains. The full amount transferred to and for the benefit of the beneficiary is taxable to him or her to the extent of the trust's distribution deduction.

If the income or deduction is part of a change in the principal or part of the estate's distributable income, the trust pays the tax rather than the beneficiary.

Is a Trustee able to remove a Beneficiary from the Trust?

A beneficiary can be removed from a revocable trust if the grantor has specifically retained authority to modify the trust. The trustee can make modifications to the trust at any time if the trust is a revocable living trust and the trustee is also the grantor.

One example of such adjustments is adding or removing beneficiaries. A trustee can only remove a beneficiary if the trust's grantor (or creator) has given them a power of appointment, which is a clause in the trust agreement that expressly allows them to do so.

Unless the trust provisions clearly allow it, neither the grantor nor the trustee can remove a beneficiary if the trust is irrevocable. A revocable trust becomes an irrevocable trust when the grantor passes away.

Who needs to fill out Form 1065 K-1?

All partnerships in the United States must submit one IRS Form 1065 K-1. The IRS defines a partnership as any association between two or more people who join together to carry on a trade or business, form 1065 K-1. A corporation is not the same as a partnership. Unlike a corporation, a partnership is not a separate legal entity from its owners.

Are you wondering whether or not your business is a partnership?

The majority of partnerships are described in a formal written agreement known as a partnership agreement, which is then registered in the state where they operate. Depending on your partnership agreement, you may be a general partnership, a limited partnership, or a limited liability partnership.

If your LLC has two or more members and you haven't chosen to be taxed as a corporation this year, you must file taxes as a partnership and file Form 1065 K-1.

Form 1065 K-1 is required for foreign partnerships making more than $20,000 in annual income in the United States, or more than 1% of their total income in the United States. A partnership that does not have any revenue or costs for the year is not required to file a return, form 1065 K-1.

How to Complete and Submit Form 1065 K-1?

All of your partnership's significant year-end financial documents, including a profit and loss statement showing net income and revenues, a breakdown of all the partnership's deductible expenses, and a balance sheet for the beginning and end of the year, are required to submit Form 1065 K-1.

If your company sells tangible things, you'll need to supply data to calculate the cost of each item sold.

You'll also need to enter your Employer Identification Number (commonly known as your Tax ID), your Business Code Number, the number of partners in your company, the company's founding dates, and whether your company utilises the cash or accrual method of accounting.

If you paid anyone outside the partnership more than $600 for contract work and submitted a Form 1099, you must also include this information on your form 1065 K-1.

Using an online filing provider that supports Form 1065 K-1 is the simplest way to file a 1065. H&R Block, TurboTax, and TaxAct, among the most popular online tax preparation services, all enable submitting Form 1065 K-1.

The most significant piece of information you'll need for the tax year is information on partner distributions and contributions, which includes the total amount of all partner capital accounts at the beginning and end of the year, as well as rises and declines, including dividends.

To complete and file Form 1065 K-1, you'll need various year-end financial statements, including a profit and loss or income statement that shows your partnership's net income or loss. This should detail the partnership/unique LLC's sources of revenue as well as any deductible expenses for the year.

If you choose to file by mail, make sure you submit it to the appropriate IRS centre for your state.

You won't be able to figure out how much tax your partnerships owe if you use Form 1065 K-1. Instead, Schedule K-1 is used to assign income, losses, dividends, and capital gains to partners.

Each partner must submit a separate Schedule K-1, and the information stated on it is assigned to each partner's personal tax return.

The Income and Expenses portion of Form 1065 K-1 will provide you with the majority of the information you'll need to complete Schedule K-1.

Form 1065 K-1 includes real estate revenue, bond interest, royalties and dividends, capital gains, overseas transactions, and any other guaranteed payments you may have received as part of your partnership engagement.

L Schedule

Schedule L is a balance sheet that lists all of your partnership's assets, liabilities, and capital. It's used to keep the IRS informed about your partnership's financial situation.

Schedules L, M-1, and M-2 must be completed if your partnership does not meet all four conditions in part 6 of Schedule B—for example, if your partnership's total annual receipts are more than $250,000 or its assets are more than $1 million. Page 5 of your form 1065 K-1 has all three of these schedules.

Any changes in the balance sheet over the reporting period should be consistent with the information you give on Schedules M-1 and M-2 for income and capital accounts.

M-1 Schedule

It's common for a difference between what a partnership records as net income on its books and what the IRS recognises as actual taxable profits since the IRS tallies things up differently than the usual partnership.

Schedule M-1 helps you resolve these discrepancies by asking about any income, costs, or depreciation you didn't report in your tax return.

A partnership that does not meet all four conditions in part 6 of Schedule B must submit Schedule M-1, even if there are no disparities between book and reported revenue.

M-2 Schedule

Schedule M-2 is used to notify the IRS of any changes to your or your partner's capital accounts, such as cash, property, or other capital contributions.

Schedules L and M-1 contain things that must match those on M-2, so make sure to complete those first before moving on to M-2.

The Importance of Partnership Agreements in form 1065 K-1 Filings

Partners will frequently engage with a lawyer to establish their partnership agreement when starting a business. Partnership agreements offer information on how decisions will be made inside the firm and how earnings will be distributed among partners, in addition to specifying the entity type of the business.

When it comes to taxes, it's all about how profits and losses are allocated, but there are a variety of options. The most popular way to distribute ownership is based on how much each partner put into the business at the start.

For instance, if two partners in a small business each invest $100,000, they may agree to split earnings (and maybe losses) 50/50.

If one partner contributes $100,000 and the other only contributes $25,000, they may opt for a 75/25 split. There are a variety of elements that can influence how earnings are shared, including how much money is invested up front, so partners should pay particular attention while creating the partnership agreement to ensure they're comfortable with their distribution.

That's because, when the fiscal year ends and it's time to file the partnership tax return, they'll only have to pay taxes on the profits assigned to them on their individual forms.

Deadline for Form 1065 K-1

Every year, the deadline for submitting Form 1065 K-1 is March 15. If you submit an extension, your deadline will be six months later, on September 15. The deadlines will be postponed to the next business day if any of these days fall on a legal holiday or weekend.

Because partnerships are pass-through businesses, participants must pay their individual tax responsibilities before the April 15 federal tax deadline.

How can you submit Form 1065 K-1?

You must have your year-end financial statements, such as your profit and loss statement and balance sheet, in order to file Form 1065 K-1. You'll also need to have your EIN, business code (NAICS code), and partnership start date on hand.

You'll need to know your accounting system, gross revenues and refunds, and any other data that will assist you in calculating the cost of goods sold (i.e. inventory).

You'll notice a section titled 'Schedule B' on Form 1065 K-1 that asks for some additional information about your company. Depending on your answers on Schedule B, the partnership return will include additional tax forms. Schedule L, Schedule M-1, and Schedule M-2 are among them.

For partnerships with 100 or fewer partners, mailing your Form 1065 K-1 to an IRS location is still an option. The specific location and address are determined by a number of factors, including your total asset worth at the end of the tax year and the state in which your firm is based. On its website, the IRS provides a comprehensive list of the necessary locations.

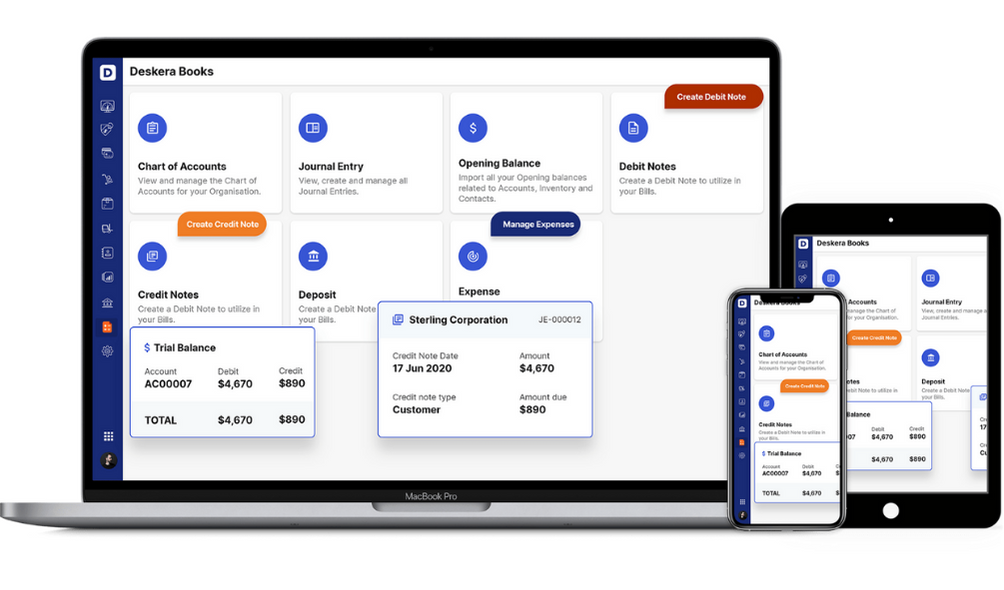

To manage your costs and expenses you can use many available online accounting software.

How can Deskera Help You?

Deskera Books is an online accounting, invoicing, and inventory management software that is designed to make your life easy. A one-stop solution, it caters to all your business needs, from creating invoices and tracking expenses to viewing all your financial documents whenever you need them.

Key Takeaways

- Form 1065 K-1, also known as the US Return of Partnership Income, is a specialty tax document that is only issued by the IRS. This form 1065 K-1 is used to disclose an existing general partnership's net gains and losses, as well as deductions and tax credits

- Shareholders of S corporations, or companies with fewer than 100 stockholders that are taxed as partnerships, use the form 1065 K-1. Form 1065 K-1 are also filed by trusts and estates that have dispersed income to beneficiaries.

- The best and easiest way to pay your taxes is to do so online. IRS epay options include direct debit from a bank account, credit card, or debit card for LLC owners, sole proprietors, or partners in partnerships.

- In some situations, the US tax system permits pass-through taxation, which moves tax liability from an entity (such as a partnership) to the individuals who own a stake in it. As a result, the Schedule K-1 exists, which compels the partnership to keep track of each partner's basis (or degree of financial participation) in the business.

- Business income is a sort of earned income that falls within the category of ordinary income for tax purposes. It includes any revenue generated as a result of a company's operations. In its most basic form, it is a company's net profit or loss, which is determined as revenue from all sources less operating costs.

- The income, credits, and deductions received by a beneficiary from a trust or estate are recorded on Schedule K-1, an IRS tax form. The trust must file a Schedule K-1 for each beneficiary paid, and the beneficiary is taxed on trust disbursements. The income will be reported on the tax return of the beneficiary.

- Partners will frequently engage with a lawyer to establish their partnership agreement when starting a business. Partnership agreements offer information on how decisions will be made inside the firm and how earnings will be distributed among partners, in addition to specifying the entity type of the business.

- You'll notice a section titled 'Schedule B' on Form 1065 K-1 that asks for some additional information about your company. Depending on your answers on Schedule B, the partnership return will include additional tax forms. Schedule L, Schedule M-1, and Schedule M-2 are among them.

Related Articles