How complicated is it to decide which structure your entity belongs to? Picking the right legal structure for your business begins with analyzing your organization's objectives and considering local, state, and federal laws. By characterizing your objectives, you can pick the legal structure that best accommodates your organization's culture.

As your business develops, you can change your legal structure to meet your business' new necessities. This blog will help you understand how to Pick the Right Business Entity. Following are the concepts covered:

- Partnership

- Limited liability company

- Sole proprietorship

- Corporation

- Cooperative

- Factors to consider before picking a business structure

- Key takeaways

The most well-known kinds of business entities incorporate sole proprietorship, partnerships, limited liability companies, corporations, and cooperatives. Here's more about each type of legal structure.

Partnership

A partnership involves two or more people who agree to partake in the benefits or losses of a business. An essential benefit is that the organization doesn't bear the taxation burden of profits or the benefit of losses-profits or losses are "passed through" to partners to report on their individual income tax returns. An essential hindrance is a liability-each partner is actually at risk for the monetary commitments of the business.

This entity is owned by at least two people. There are two sorts: a general partnership, where everything is shared equally; and a limited partnership, where just a single partner has control of its activity while the other individual or people add to and gets part of the profits. Partnerships carry a double status as a sole proprietorship or limited liability partnership (LLP), contingent upon the entity's funding and liability structure.

This entity is great for any individual who needs to start a new business with a relative, companion, or colleague, such as running an eatery or organization together. A partnership permits the partners to share profits and losses and settle on choices together within the business structure. Remember that you will be expected to take responsibility for the choices made, as well as those actions made by your partner.

The expense of a general partnership fluctuates, yet it is more costly than a sole proprietorship since you need a lawyer to audit your partnership agreement. The experience and area of the lawyer can influence the cost range. A general partnership should be a mutual benefit for the two sides for it to find success.

An illustration of this sort of business is Google. In 1995, co-founders Larry Page and Sergey Brin made a small search engine and transformed it into the main web search tool universally.

The co-founders initially met at Stanford University while pursuing their doctorates and later left to foster a beta rendition of their web search tool. Soon after, they brought $1 million up in funding from investors, and Google started getting a large number of visitors daily. Having combined ownership of 16% of Google furnishes them with a total net worth of nearly $46 billion.

Advantages of a business partnership:

- Special taxation. General partnerships should record government tax Form 1065 and state returns, at the same time, typically, they don't cover income tax. The two partners report their shared income or loss on their individual income tax returns.

Every owner brings a specific degree of experience and working capital to the business, which can influence each partner's share of the business and their contribution. Suppose you brought the most seed capital for the business; it very well may be concluded that you hold a higher share percentage, making you the majority owner.

- Simple to form. Like a sole proprietorship, there is little desk work to record. Assuming your state expects you to work under a fictitious name "doing business as" or DBA, you'll have to document a Certificate of Conducting Business as Partners and draft an Articles of the Partnership agreement, the two of which have additional fees. A license to operate is typically needed as well.

- Development potential. You're bound to get a business credit when there's more than one owner. Investors can consider two credit lines instead of one, which can be valuable on the off chance that you have a less-than-stellar credit score.

Examples of partnerships

Next to a sole proprietorship, organizations are one of the most widely recognized types of business structures. Examples of effective partnerships include: Warner Brothers

- Hewlett Packard

- Apple

- Microsoft

- Ben & Jerry’s

Protect yourself and your business with a partnership agreement

- Would the partners be able to have other external partnership interests? Specifically, can interest be in similar or competitive businesses?

- What are the responsibilities and duties of each partner? Be specific about each partner's role in the everyday tasks of the organization.

- What is each partner's investment? Is one investing money and the other energy? Do any of the partners claim consideration as part of the start-up investment?

- How might clashes be settled? Most frequently, an arbitrator is utilized.

- Assuming a partner becomes disabled, how long will the individual get a share of the profits? Assuming a partner dies, what happens to that share? A decent method for managing this issue: is life insurance for all partners.

- How might you confine partnership-interest transfers? Can a partner transfer be able to move their possession to anybody, or would you be able to restrict that transfer? This implies the remaining partners won't end up in an organization with somebody they object to. This is every now and again used to safeguard the business if one of the partners gets divorced and his advantage turns into a part of the divorce settlement.

- How will you respond to withdrawal by the partner? Typically, you'll set up a buyout agreement, yet it's smart to settle based on the conditions before the situation emerges. You'll likewise need to incorporate a non-compete covenant.

- Would a partner be able to promise their advantage as collateral for a credit?

- Are additional contributions compulsory? On the off chance that the business needs capital, later on, are partners expected to make capital contributions?

Limited liability company

A limited liability company (LLC) is a hybrid structure that permits proprietors, partners, or investors to restrict their own liabilities while partaking in the tax and flexibility benefits of a partnership. Under an LLC, individuals are protected from individual risk for the debts of the business in the event that it can't be demonstrated that they acted in an unlawful, dishonest, or reckless way in completing the activities of the business.

A hybrid type of partnership, the limited liability company (LLC), is acquiring popularity since it permits proprietors to enjoy the advantages of both the enterprise and organization types of business. The benefits of this business design are that profits and losses can be gone through to proprietors without tax collection from the actual business while proprietors are safeguarded from individual liability.

Limited liability companies were made to give entrepreneurs the risk security that companies enjoy while permitting earnings and losses to go through to the proprietors as pay on their personal tax returns. LLCs can have at least one individual or more members, and earnings and losses don't need to be divided equally among members.

The expense of forming an LLC contains the state filing charge and can go from $40 to $500, contingent upon the state you documented in. For instance, assuming that you document an LLC in the territory of New York, there's a $200 filing charge and a $9 biennial expense. Further, you should file a biennial statement with the NY Department of State. Albeit small businesses can be LLCs, a few huge organizations pick this legal structure.

Examples of LLCs

The LLC is typical among accounting, tax, and law firms, however different types of organizations additionally file as LLCs. Notable examples include:

- IBM

- Pepsi-Cola

- Blackberry

- Sony

- eBay

- Nike

- Hertz Rent-a-Car

Advantages of LLC

- Flexible distribution. Profits and losses don't need to be distributed with respect to the cash every individual puts in. A customary C corporation can't allocate profits and losses. Furthermore, in a sub-chapter S corporation taxed as a partnership, profits and losses are with respect to shares held.

- Limited liability. Your main risk is capital paid into the business. Business debts and different liabilities can't be extracted from your personal assets. If you actually guarantee a debt, you've forfeited your limited liability.

- Flexible administration. A member, investor equivalent can be an individual, corporation, or partnership. Individuals get a level of ownership. Smaller LLCs are generally member-managed; however, this is not always the case.

- Tax simplicity. Profits and losses are accounted for and taxed on proprietors' individual returns. There's no separate business tax return, except if you have more than one member and decide to be taxed as a partnership, in which case you record Form 1065. What's more, there's no corporate "twofold tax collection," in which both the business and the investors are taxed.

Disadvantages of LLCs

Here are some of the drawbacks

- Paperwork. LLCs file articles of organization with the State Corporation Commission or Secretary of State and should draft a working arrangement posting members' rights and responsibilities.

Some administrative work that should be documented, similar to an application for an employer ID number IRS Form SS-4 and choice of tax status IRS Form 8832, is a single shot; others yearly report, quarterly withholding and tax deposit coupons, and business bank account are continuous. While it's anything but an incomprehensible burden, there's more administrative work than if you're a sole proprietor.

- No stock. LLCs are extreme assuming you have several financial backers or raise public money since you don't bring shares or stock certificates to the table. Assuming that you give a percentage of ownership to outside financial backers, you should conclude whether they'll be managing individuals.

Inquire as to whether you want greater flexibility concerning corporate stock ownership, funding choices, and so on Provided that this is true, the LLC is presumably not a smart thought -attempt a C corporation

- Fewer incentives. LLCs aren't great if you have any desire to give fringe benefits to yourself or your workers. Dissimilar to a C corporation, you can't deduct the cost of benefits with an LLC. Also, since there's no stock, you can't involve stock options as incentives for your workers.

- Two's a crowd. LLCs in many states require just a single member that is you. However, assuming you live in the District of Columbia, you should have two members, and that could be a deal buster.

- Taxes. LLC members cover self-employment taxes, the Medicare/Social Security charge paid by entrepreneurs; it's determined on 15.3 percent of profits.

Compare this with an S corporation: Self-employment tax is expected on compensation only, not your whole profits. You're trapped in the self-employment tax net if:

1) You can sign agreements for the LLC.

2) You participate in the business for over 500 hours during the LLC tax year

3) You work in a professional services LLC health, law, engineering

At last, the LLC choice is one you won't have any desire to make alone. Get guidance from an expert about the best corporate structure to take. It can have an immense effect later on. In business, as throughout everyday life, one size seldom fits all.

Sole proprietorship

A sole proprietorship is the most well-known type of business structure. It's not difficult to form and offers total managerial control to the proprietor. Notwithstanding, the proprietor is likewise liable for all financial obligations of the business. This is the easiest type of business entity. With a sole proprietorship, one individual is answerable for each of the organization's profits and debts.

If you have any desire to work for yourself and maintain a business from home without an actual retail facade, a sole proprietorship permits you to be in complete control. This entity doesn't offer the separation or protection of individual and professional assets, which could demonstrate to turn into an issue later on as your business develops and more angles expect you to take responsibility.

Proprietorship costs differ, contingent upon which market your business is essential for. By and large, your initial costs will comprise state and government fees, taxes, banking fees, office space, equipment needs, and any expert services your business chooses to contract. A few instances of these organizations are tutors, babysitters, freelance writers, bookkeepers, and cleaning service providers.

Here is a portion of the benefits of this business structure:

- Simple exit. Forming the proprietorship is simple as is leaving one. As a single owner, you can dissolve your business whenever with no formal paperwork required. For instance, assuming that you start a childcare center and wish to fold the business, you can essentially avoid working the childcare and promoting your services.

- Simple arrangement. A sole proprietorship is the most straightforward lawful structure to set up. Assuming your business is possessed by you and just you, this may be the best structure for your business. There is next to no paperwork since you have no partners or executive boards to answer to.

- Tax deduction. Since you and your business are a single entity, you might be qualified for specific business tax deductions, like a health care coverage deduction.

- Minimal expense. Costs differ contingent upon which state you live in, however, for the most part, the main charges related to proprietorship are license fees and business taxes.

Examples of sole proprietorship:

The sole proprietorship is perhaps the most well-known small business legal structure. Numerous well-known organizations began as sole ownerships and at last developed into multi-million dollar organizations. A couple of examples include:

- Marriott Hotels

- JC Penny

- Walmart

Corporation

A corporation is a lawful element that is made to lead the business. The company turns into an entity separate from the people who established it that handle the responsibilities of the association.

Like an individual, the organization can be taxed and can be expected legitimately to take responsibility for its activities. The corporation can likewise create a gain. The vital advantage of corporate status is the evasion of personal liability.

The primary disadvantage is the expense to form a corporation and the broad record-keeping that is expected to keep. While twofold tax assessment is some of the time referenced as a disadvantage to incorporation, the S corporation or Sub-chapter company, a famous variety of the ordinary C corporation stays away from the present circumstance by permitting income or losses to be gone through on individual tax returns, like a partnership.

How to Incorporate a Corporation?

To begin the most common process of incorporating, contact the secretary of state or the state office that is answerable for enlisting organizations in your state. Request guidelines, structures, and fee plans on business incorporation.

It's workable to file for incorporation without the assistance of a lawyer by utilizing books and software to direct you along. Your cost will be the expense of these assets, the documenting charges, and some other expenses related to incorporating in your state.

In the event that you file for incorporation yourself, you'll save the cost of utilizing an attorney, which can cost from $500 to $1,000. The hindrance to going this route is that the process might require some time to achieve. There's additionally an opportunity you could miss some little however significant detail in your state's regulation.

One of the initial steps you should take in the incorporation process is to set up a declaration or articles of incorporation. A few states will give you a printed form for this, which it is possible that you or your lawyer can complete. The data requested incorporates the proposed name of the corporation, the purpose behind the corporation, the names and addresses of the parties incorporated, and the area of the central office of the corporation.

The partnership will likewise require a bunch of ordinances that portray more meticulously than the articles how the organization will run, including the responsibilities of the investors, chiefs, and officials; when stockholder meetings will be held; and other details essential to running the organization. When your articles of incorporation are accepted, the secretary of state's office will send you a declaration of incorporation.

Whenever you're incorporated, make certain to adhere to the guidelines of incorporation. In the event that you don't, a court can penetrate the corporate veil and expect you and other proprietors actually to take responsibility for the business's debts.

It's vital to follow all the corporation guidelines expected by state regulation. You ought to save exact monetary records for the corporation, showing a detachment between the corporation's income and costs and that of the proprietors.

The corporation ought to likewise give stock, record yearly reports, and hold yearly meetings to choose officials and chiefs, regardless of whether they're similar individuals as the investors.

Make certain to keep the minutes of these meetings. On all references to your business, make sure to distinguish it as a corporation, using Inc. or Corp., whichever your state requires. You additionally need to ensure that whomever you manage, like your financier or clients, knows that you're an official of a corporation.

There are a few kinds of corporations, including S corporations, C corporations, B corporations, closed corporations, and nonprofit corporations.

- B corporations, also called benefit corporations, are for-profit entities organized to have a constructive impact on society.

- C corporations, claimed by shareholders, are taxed as separate entities. Since C corporations permit a limitless number of financial backers, numerous bigger organizations, including Apple Inc., Bank of America, and Amazon, file for this tax status.

- S corporations were intended for small businesses and stay away from twofold tax collection, similar to partnerships or LLCs. Proprietors likewise have limited liability protection. Employee compensations are dependent upon the FICA charge, while the distribution of extra profits from the S corporation doesn't bring about additional FICA tax liability.

- Nonprofit corporations exist to help other people somehow and are compensated by tax exemption. These kinds of business structures have one sole reason: focusing on some different option other than turning a profit.

- Closed corporations, normally run by a couple of shareholders, are not publicly traded and advantage of limited liability protection. Closed corporations, sometimes referred to as privately-held organizations, have greater adaptability contrasted with public-traded corporations.

- Open corporations are available for trade on a public market. Some notable organizations, including Microsoft and Ford Motors, are open corporations. Every organization has taken responsibility for the organization and permits anybody to invest.

Benefits of this business structure include:

- Capital. It's a lot more straightforward to raise a lot of capital from multiple financial backers when your business is incorporated.

- Limited liability. Investors are not personally responsible for claims against your corporation; they are just at risk for their personal investments.

- Continuity. Corporations are not impacted by death or the transferring of shares by their proprietors. Your business keeps on working indefinitely, which is liked by financial backers, creditors, and customers.

This sort of business is great for organizations that are further along in their growth, as opposed to a startup based in a lounge room. For instance, assuming that you've begun a shoe organization and have proactively named your business, selected chiefs, and raised capital through investors, the following stage is to become incorporated.

You're basically directing business at a riskier, yet more worthwhile rate. Also, your business could document as an S corporation for the tax cuts related to it.

Examples of corporations

When your business develops to a specific level, it's logical in your greatest interest to incorporate it. There are numerous famous instances of corporations, including:

- Exxon Mobil

- P. Morgan Chase

- Amazon

- General Motors

- Domino’s Pizza

Cooperative

A cooperative (co-op) is claimed by similar individuals it serves. Its offerings benefit the organization's individuals, additionally called user-owners, who vote on the association's central mission and direction and share profits. Benefits that cooperatives offer include:

- Discounts and better assistance. Cooperatives can use their business size, in this manner acquiring discounts on items and services for their individuals.

- Lower charges. Like an LLC, a cooperative doesn't tax its individuals on their income.

- Increased funding. Cooperatives might be qualified for federal grants that assist them with getting everything rolling.

Forming a cooperative is perplexing and expects you to pick a business name that demonstrates whether the co-op is a corporation, for example, incorporated (Inc.) or limited. The filing fee related to a co-op agreement changes by state. In New York, for instance, the documenting charge for an incorporated business is $125.

Examples of cooperatives

Dissimilar to different sorts of organizations, co-ops are possessed by individuals they serve. Striking instances of co-ops include:

- Ace Hardware

- Land O’Lakes

- REI

- Navy Federal Credit Union

- Welch’s

Factors to consider before picking a Business Structure

While settling on a choice about the kind of business to form, there are a few rules you want to evaluate. For new organizations that could fall into at least two of these classifications, it's not generally simple to conclude which structure to pick. You want to consider your startup's monetary requirements, risk, and potential to develop.

It very well may be hard to switch your legal structure after you've registered your business, so give it cautious analysis in the beginning phases of forming your business.

Here are a few significant elements to consider as you pick the legal structure for your business. You ought to likewise plan to talk with your CPA for their recommendation.

Control

Assuming you need sole or essential control of the business and its exercises, a sole proprietorship or an LLC may be the most ideal decision for you. You can haggle such control in a partnership agreement also.

Proprietors doubtlessly want to hold command over business decisions. The partnership again splits the control between many partners. An organization offers adaptability. Thusly, accomplices can choose various rights as well as certain limitations of all.

In organizations, the directors have direct command over functional transactions. Furthermore, hence, in the greater part of the Private Companies, the investor and chiefs are the same. This works in OPC too.

You can plan your degree of control with your expert in your favored structure. Be that as it may, you can gain unified influence just in proprietorship.

Proprietors certainly want to hold command over business decisions. The partnership again splits the control between many partners. A partnership offers adaptability. Accordingly, partners can choose various rights as well as certain limitations of all.

A corporation is built to have a top managerial staff that settles on the significant decisions that guide the organization. A single person has some control over a company, particularly at its beginning, however as it develops, in this way, as well, does the need to operate it as a board-directed entity. In any event, for a small corporation the standards expected for bigger associations - like keeping notes of each significant decision that influences the organization - still apply.

Flexibility

Where is your organization headed, and which kind of legal structure takes into consideration the growth you imagine? Go to your marketable strategy to review your objectives, and see which structure best lines up with those targets. Your entity ought to help the opportunities for development and change, not keep it away from its true potential.

You want to amplify the flexibility of the ownership structure by thinking about the novel requirements of the business as needs might arise of the proprietor or owners. Individual necessities are a critical consideration. No two business circumstances will be something very similar, especially when numerous proprietors are involved. No two individuals will have similar objectives, concerns, or personal monetary circumstances.

Future necessities

Whenever you're initially beginning in business, it's normal to be "made up for lost time at the moment." You're consumed with getting the business going and as a rule, aren't considering what the business could resemble five or ten years down the road. What will befall the business after you die? Consider the possibility that, following a couple of years, you choose to sell your part of a business partnership.

Capital investment

Tax benefits, nonetheless, may not offer an adequate number of advantages to counterbalance different expenses of leading a business as a corporation.

On the off chance that you really want to get outside funding, for example, from a financial backer, investor, or bank, you might be in an ideal situation laying out a corporation. Corporations make an easier time obtain funding outside financing than sole ownership.

Corporations can sell portions of stock and secure extra financing for development, while sole proprietors can get assets through their own records, utilizing their own credit or taking on partners. An LLC can face similar battles, in spite of the fact that as its own entity, it isn't generally vital for the proprietor to utilize their own credit or assets.

The high cost of record-keeping and administrative work, as well as the expenses related to incorporation, is one explanation why entrepreneurs might choose to pick another option- like sole proprietorship or partnership. Dealing with regulatory requirements regularly gobbles up the proprietor's time and in this way makes costs for the business.

Complexity

With regards to startup and functional complexity, nothing is more straightforward than a sole proprietorship. You basically register your name, begin carrying on with business, report the profits, and pay taxes on it as personal income.

Nonetheless, it tends to be hard to obtain outside funding. Partnerships, then again, require a signed agreement to characterize the roles and rates of profits. Corporations and LLCs have different reporting prerequisites with state legislatures and the federal government.

Privacy of documents

Certain business structures expect to make all documents part of the public record, open to all. While documents in the organization are completely open to the public, LLP Agreement stays private. On the off chance that you wish not to reveal the subtleties of your business, select the structure of your business cautiously.

Liability

How much should the proprietor be protected from legal liability? You want to consider whether your business f lends itself to potential liability and, assuming this is the case, in the event that you can personally bear the cost of the risk of that liability.

A corporation carries a minimal amount of individual risk since the law holds that it is its own entity. This implies that creditors and clients can sue the organization, however, they can't get to any private resources of the officials or investors. An LLC offers similar security, however with the tax cuts of the sole proprietorship. Partnerships share the liability among the partners as characterized by their organization agreement.

Licenses, grants, and guidelines

In addition to legally registering your business entity, you might require explicit licenses and grants to work. Contingent upon the kind of business and its exercises, it might be authorized at the local, state, and government levels.

States have various prerequisites for various business structures. Contingent upon where you set up, there could be various prerequisites at the municipal level also. As you pick your structure, comprehend the state and industry you're in. It's anything but a 'one size fits all,' and organizations may not know about what's material to them.

The structures talked about here just apply to for-profit organizations. In the event that you've done your research, you're as yet uncertain which business structure is ideal for you, talk with an expert in business regulation.

Taxes

In light of the individual circumstance and objectives of the entrepreneur, what are the chances to limit tax collection? A proprietor of an LLC pays taxes similarly as: All profit is viewed as personal income and taxed likewise toward the year's end.

As an entrepreneur, you need to stay away from twofold tax collection in the beginning phases. The LLC structure forestalls that and ensures you're not taxed as an organization but as a person.

People in an organization additionally guarantee their portion of the profits as personal income. Your bookkeeper might propose quarterly or biannual advance payments ahead of time to limit the end impact on your return.

A corporation documents its own government forms every year, paying taxes on profits after expenses, including payroll. Assuming you pay yourself from the corporation, you will pay personal taxes, for example, for Social Security and Medicare, on your own return.

Progression of existence

Organizations vigorously rely upon promoters. In any case, it influences the survival of the business. For new organizations, it may not be much significant. Notwithstanding, it is without a doubt significant in the long haul, particularly, for funding. Investment agencies favor business continuity for a more secure venture. It is best presented by Companies and LLPs. Organizations at the pilot stage can pick an informal structure that is not difficult to change over later.

How Deskera Can help You?

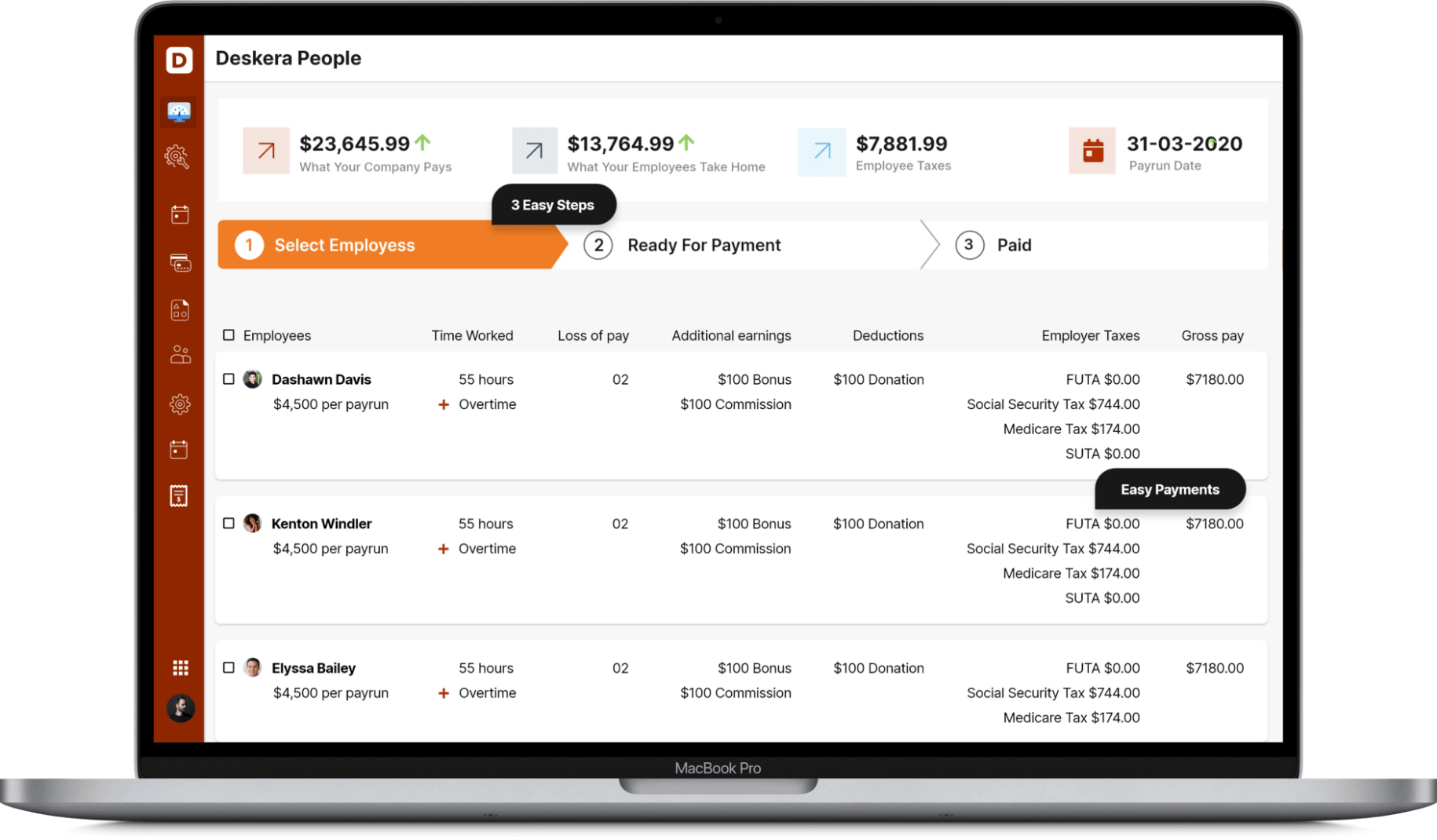

Deskera People provides all the employee's essential information at a glance with the employee grid. With sorting options embedded in each column of the grid, it is easier to get the information you want.

Key Takeaways

• The availability of a specific entity type at first relies upon the number of proprietors. A single owner might work as a sole proprietor, a partnership, or a limited liability company.

Assuming there are at least two proprietors of the business, by definition it can't be a sole proprietorship, however, it tends to be a corporation, limited liability company, general partnership, limited partnership, or, in specific circumstances, a limited liability partnership.

• The five types of business structures are sole proprietorship, partnership, limited liability company, corporation, and cooperative. Picking the right structure relies generally upon your business type. As your business grows, you'll have the option to change constructions to structure its issues.

• Partnerships carry a dual status as a sole proprietorship or limited liability partnership, contingent upon the entity's financing and liability structure.

• Under an LLC, individuals are protected from personal liability for the debts of the business on the off chance that it can't be demonstrated that they acted in an illegal, unethical or irresponsible way in doing the exercises of the business.

• Corporations can offer portions of stock to get extra funding for development, while sole proprietors can get funds through their personal accounts, utilizing their own credit or taking on partners.

Related Articles