The dividend yield ratio is a financial ratio used to estimate the value of shares based on the dividends paid. Investors use the dividend yield ratio to evaluate the return from an investment. The formula for dividend yield ratio is:

Dividend Yield Ratio = (Dividends Paid per Share / Market Price per Share) × 100%

The dividend yield ratio helps compare a company's stock price with its dividends. It provides an idea of how well the company distributes its profit to its shareholders. A high dividend yield ratio indicates that the company is distributing a better share of its profit to its shareholders. However, a low dividend yield ratio may be due to low profitability, heavy debt load, and so on.

Here is an overview of the focal points for Dividend Yield Ratios:

- What is a Dividend Yield Ratio?

- Technical Terminology of Dividend Yield Ratio

- How to Calculate Dividend Yield Ratio?

- Which are the factors affecting the Dividend Yield Ratio?

- How does the Dividend Yield Ratio work for stocks?

- What are the benefits of a low Dividend Yield Ratio?

- Technical Analysis of the Dividend Yield Ratio

- Illustration of an example to calculate the Dividend Yield Ratio

What is a Dividend Yield Ratio?

The dividend yield ratio is important because it allows us to predict whether or not the stock will provide value over time. A higher dividend yield indicates that the company pays out more than 100% of its earnings in dividends, while a lower dividend yield means that there is some room for future growth in dividend payments.

Let's compare two companies with similar earnings and profit margins, but one has a much higher dividend yield ratio. It makes sense to invest in a company with a higher dividend yield since it is likely to make payouts for decades to come.

In general, investors should look for companies whose dividend yields are more significant than their historical averages and more remarkable than their peers. This is important because it tells us that these companies can deliver consistently.

For example, if a company paying $1 per share in annual dividends has a stock price of $10, its dividend yield ratio would be 10%.

Technical Terminology of Dividend Yield Ratio

The dividend yield ratio is the ratio of dividends per share divided by share price. It is a valuable predictor of dividend growth and a measure of how well its earnings cover a stock's dividends.

Dividend yield = dividends per share / current market price

Dividend payout ratio = total annual dividends/earnings per share (EPS)

Dividend cover = dividend payout ratio x 100%

There are two ways to measure the dividend yield ratio:

Gross Dividend Yield Ratio - Calculated by using the gross dividend (the annualized amount of dividends paid out by the company) divided by its market price. The gross dividend yield ratio is calculated before considering the company's taxes on dividends, which can vary depending on the country of incorporation.

D2 = Gross Dividend/Market Price

Net Dividend Yield Ratio - Calculated by using the net dividend (the actual amount received as cash from the company), divided by its market price. The net dividend yield ratio considers the company's taxes on dividends, which vary depending on the country of incorporation and type of shares held by investors. Formulae:

D1 = Net Dividend/Market Price

D2 = Net Dividend/Market Price - Taxable portion of net dividends

How to Calculate Dividend Yield Ratio?

The formula for the Dividend Yield Ratio is:

Dividend Yield Ratio = Dividends per share / Current Market Price of the Stock

The dividend yield ratio is calculated by dividing the dividend by the company's share price. It provides you with an idea of investor sentiment about the company's prospects for growth in the future.

A high yield ratio means that investors value the company based on its fundamentals and growth prospects instead of short-term gains. Dividend yield ratios can be used for both individual stocks and funds and entire sectors and industries.

Example 1: If ABC Ltd. offers $10 annual dividends to shareholders and is trading at $40 per share, its Dividend Yield ratio would be 2 (10/40). This means that for every $1 paid out in dividends, the share price will increase by 2 cents during the following year.

Example 2: Company B pays a $2 dividend per share on each share of stock while it trades at $15. Therefore, its dividend yield ratio would be $2/$15 = 0.133 (or 13.3%).

Which are the factors affecting the Dividend Yield Ratio?

As the name suggests, the dividend yield of security is simply the income generated by the investment per share. This formula is used to determine how much payment an investor will receive from his investment, which depends on three things.

The first and most important factor is the price of the underlying security. If security is priced higher, a more significant income will be generated because more money will be invested.

The second factor that affects the income generated by investment is the period over which it will be invested. If a security is held for two years, there will be twice as much money earned after two years than if it was held for only one year.

The third factor affecting the dividend yield ratio formula is the rate of return or dividend yield. If an investment generates a high rate of return, then there will be more money earned by it than if it generates a low rate of return.

How does the Dividend Yield Ratio work for stocks?

Dividends are an essential part of any investor's portfolio. While they are not guaranteed, few companies cut or eliminate dividends so that investors can rely on this income stream.

However, when it comes to investing in stocks, you must examine the company's ability to pay its dividend. That's where the dividend yield ratio comes into play.

The dividend yield ratio measures a company's dividend payment relative to its share price. Analysts and investors use this ratio to determine whether a stock is undervalued or overvalued. It is also viewed as a general indicator of its financial strength and health. It measures their ability to generate cash flow (through dividends) and pay back their long-term debt (if applicable).

When it comes to dividend stocks, the dividend yield ratio is a good tool and provides an easy way to compare the dividend yields between different companies.

Trying to figure out what a stock is worth can be difficult. The P/E ratio is a popular method of comparing the price of a stock with its earnings (the company's profits).

One problem with the P/E ratio is that it only considers one aspect of a company's valuation. Dividends can also be quite significant -- especially for income-seeking investors.

The Dividend Yield Ratio compares dividends against stock price. It is calculated by dividing the annual dividend yield by the P/E ratio.

What are the benefits of a low Dividend Yield Ratio?

The Dividend Yield Ratio (DY) measures the return on investment in stocks and shares. It is calculated by dividing the dividend per share by the stock price. The dividend expressed in dollars is divided by the stock price expressed in dollars to arrive at the Dividend Yield Ratio. The lower the ratio, the higher the dividend yield and vice versa.

Benefits of High Dividends for Investors

- High dividend payout ratios are generally associated with strong balance sheets, high earnings levels, and investor confidence. Such companies tend to be well established with steady to increased cash flow generation, large cash reserves, and high cash flow coverage ratios, which can be used to fund future dividends or increase capital expenditure and investments

- The higher the dividend yield compared to corresponding market indices, the higher is the income return that an investor can expect from investing in such companies. This results in greater returns on investment over time

For example, if you buy a stock at $10 and pay $2 in annual dividends, your yield ratio will be 20%.

Also, if a stock has an annual dividend of $3 and its current market price is $30, then the stock's dividend yield ratio will be 10%, which is calculated as follows:

Annual Dividend Per Share / Stock Price Per Share = Dividend Yield Ratio

$3 / $30 = 0.1 or 10%

For example, if a company pays $0.50 per share in dividends and the stock price is $32.00, then the Dividend Yield is 0.025 or 2.5%. If you're looking for stocks with high dividend yields, there are three main ways to find candidates: look at historical gains, look at the past five years of dividend payments to see what kind of growth you can expect over that time frame, or look at stocks with high growth rates coupled with low payout ratios.

Technical Analysis of the Dividend Yield Ratio

Technical analysts use the Dividend Yield Ratio to analyze the valuation of a company or stock and compare it with that of its competitors.

In technical analysis, the dividend yield ratio is referred to as DY%. It is calculated by dividing its annual dividend per share by its current share price.

The formula for calculating the Dividend Yield Ratio is as follows:

DY% = Annual Dividend Per Share / Share Price (Ex-Dividend)

For example, if a stock's annual dividend per share is $2 and its current share price is $35, then the Dividend Yield Ratio of this stock would be:

DY% = $2 / $35 = 6%

Conceptually, this means you can expect a 6% return on your investment if you buy this stock today and hold it until next year when they declare another dividend.

Illustration of an example to calculate the Dividend Yield Ratio

The method of valuing stocks compares the price of a share to the earnings per share (EPS) it generates. For example, if a stock has a PE ratio of 10 and pays an annual dividend of $1, you can say that the stock is worth $10 per year in income. If the stock increases in value by 10% every year, you are getting a 10% return on your investment.

Example: Assets with Perfect Capital Markets

If we have Assets with a Perfect Capital Market, which means that investors are always willing to pay the correct value for a firm's assets, then our valuation formula looks like this:

Value = D / (k-g)

where

D = Dividend per Share

k = Cost of Equity

g = Cost of Capital

A ratio greater than one means that the company's dividend yield is higher than the industry average. For example, if a company has a DPS of $0.50 and EPS of $1.00, then the yield ratio will be 3/1 or 3:1, indicating that it has a high dividend yield compared to other companies in the industry.

On the other hand, a ratio less than one means that the company's dividend yield is lower than the industry average. If a company has a DPS of $0.50 and EPS of $2.00, then the yield ratio will be 0.25/1 or 0.25:1, meaning that it has a low dividend yield compared to other companies in the industry.

Wrapping Up

A dividend yield ratio is a number that is calculated by dividing the dividend per share by the stock price per share. It provides an investor with information about how much of its profits will be paid out as dividends to shareholders.

This number can help an investor decide whether or not a particular stock is a good investment candidate, but it isn't always the best way to analyze a stock's dividend yield.

The dividend yield ratio is often used in conjunction with other ratios like debt to equity, price to book value, and earnings per share to determine the actual value of a company.

How can Deskera Help Your Business?

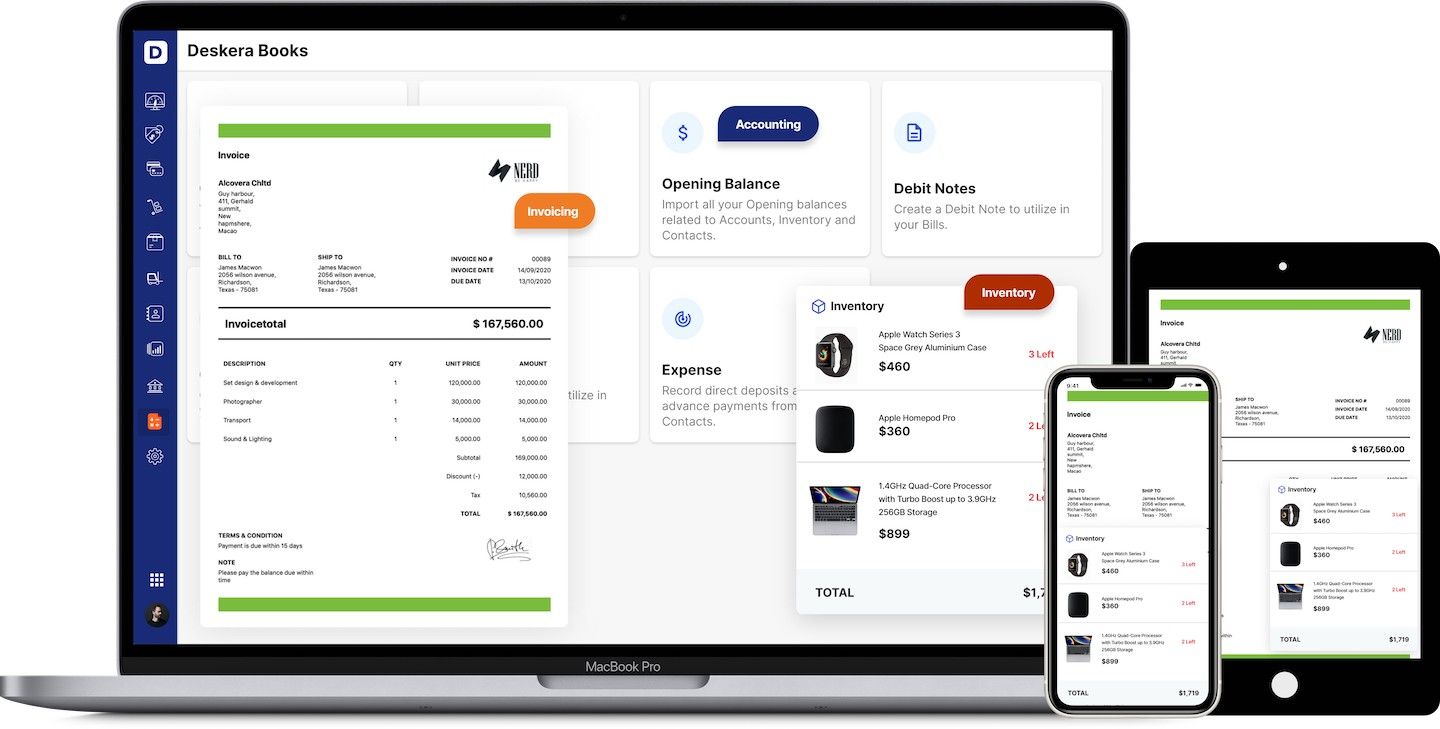

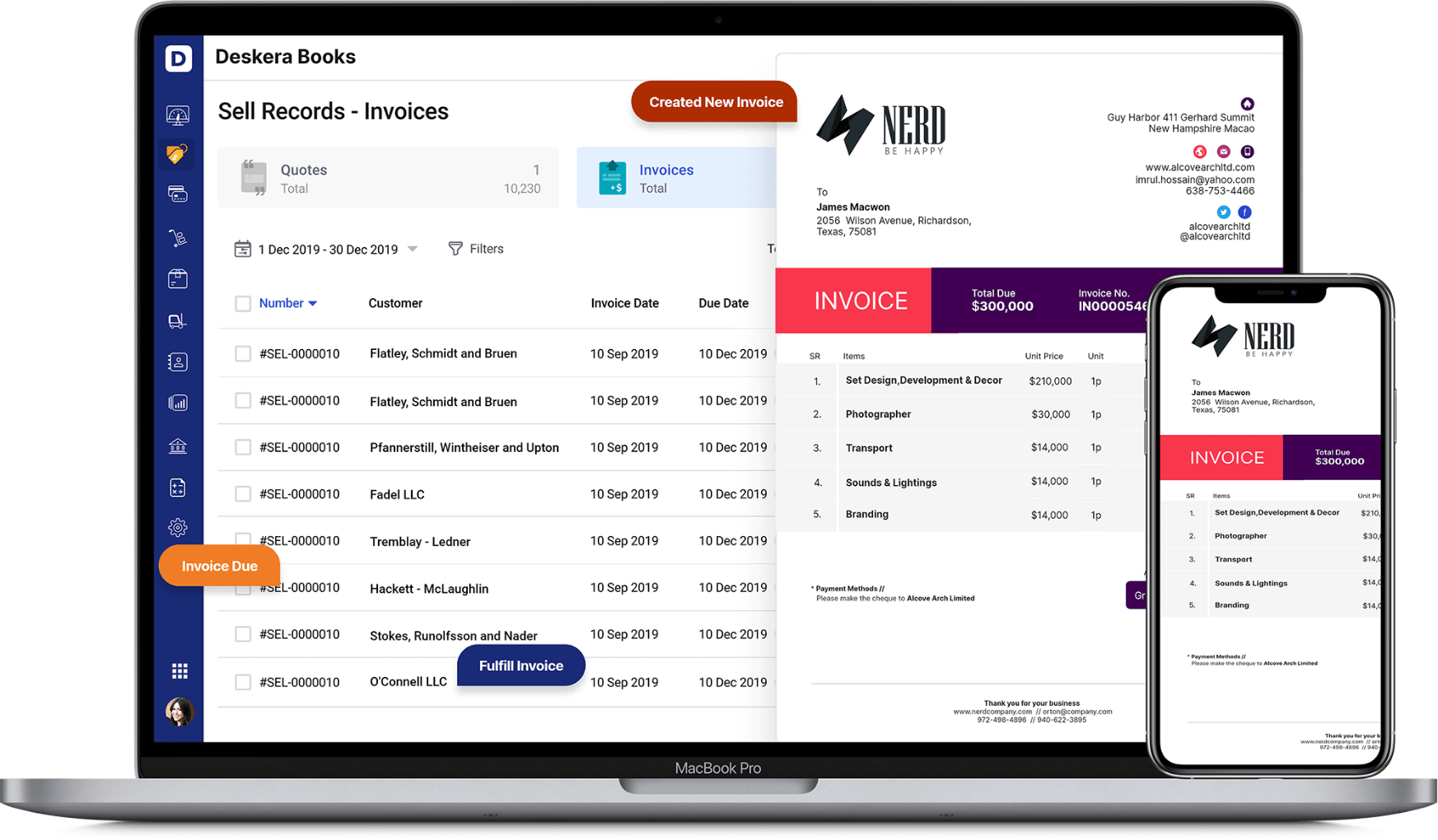

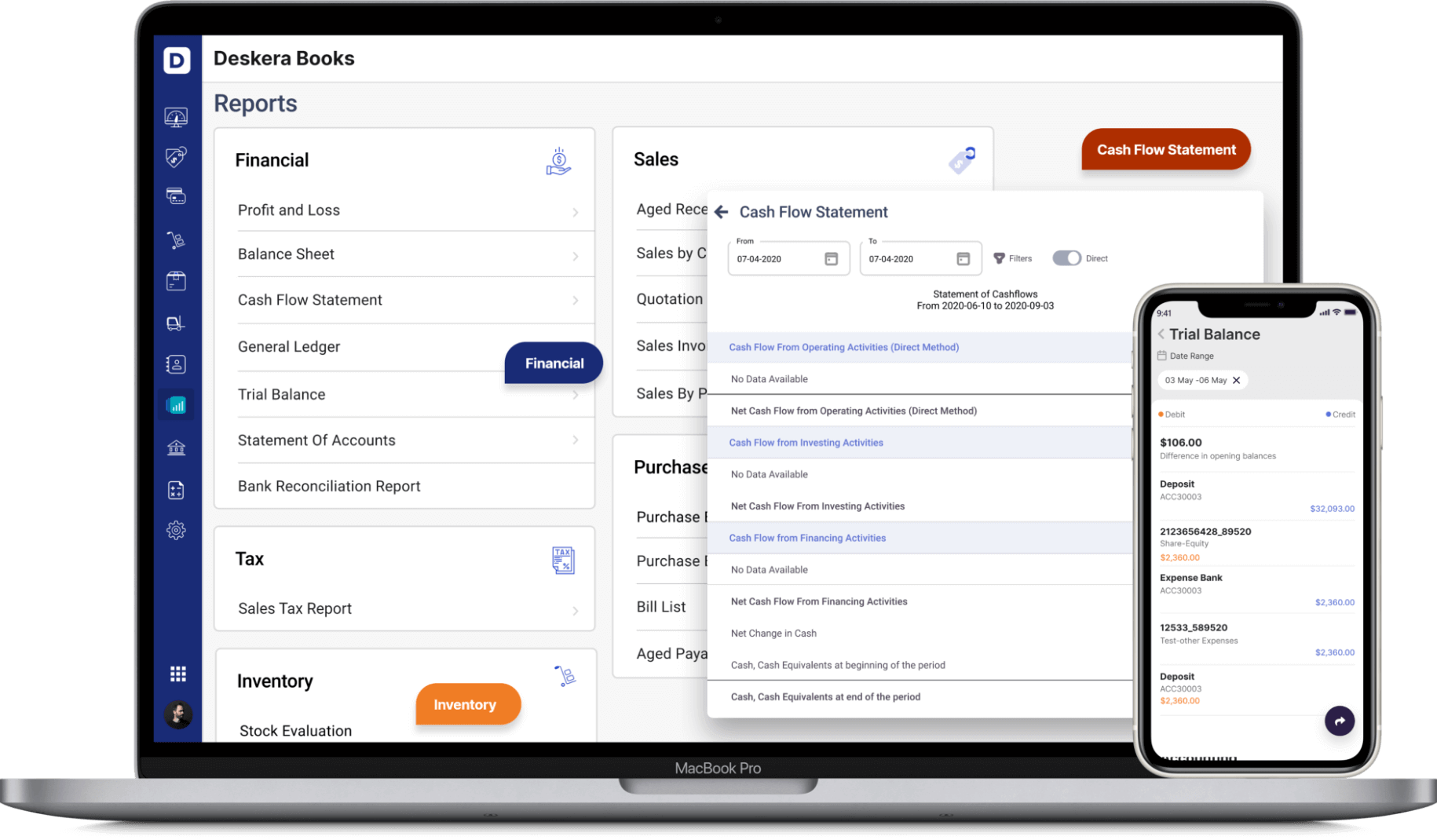

Deskera is a cloud system that brings automation and therefore ease in the business functioning. It reduces the admin time while also increasing efficiency. Deskera Books can be especially useful in improving cash flow for your business.

As a business owner, you can invest in accounting softwares that can help you keep track of your depreciating assets, scrape value, residual value, salvage value, journal entries, balance sheet, inventory and production costs. A successful business needs an efficient financing process that meets its specific needs.

Deskera Books is an online accounting software that your business can use to automate the process of journal entry creation and save time. The double-entry record will be auto-populated for each sale and purchase business transaction in debit and credit terms. Deskera has the transaction data consolidate into each ledger account. Their values will automatically flow to respective financial reports.

Through Deskera Books, reminders can be set with the invoices that are not being paid out, which are then sent out to the customers. Even in the case of recurring invoices, Deskera Books will become very handy especially with a payment link added to the invoice.

All in all, the follow-up system for all the invoices can be passed on to the system of Deskera Books and it will look into it for you. You can have access to Deskera's ready-made Profit and Loss Statement, Balance Sheet, and other financial reports in an instant. Such cloud systems substantially improve cash flow for your business directly as well as indirectly.

Key Takeaways

- The dividend yield ratio is the ratio of the total cash profit provided by a company to the share price. In other words, net income is divided by market capitalization to produce a dividend yield ratio. Investors can use this ratio to determine whether the stock will provide a good return on investment or not

- In finance, the dividend yield ratio is the proportion of earnings paid out in dividends by a company during a specific period. It is equivalent to total annual dividends ÷ current stock price

- For calculating the dividend yield ratio, all you have to do is divide the annual total dividend by the current share price. For example, if you divide $1.00 by $60.00, you will get 0.02, which means 2% of the current share price paid as dividends last year

At Deskera, we know that investors should understand the dividend yield ratio and the various advantages. Once you fully understand what this ratio represents and how it can help your portfolio, you should plan an intelligent asset allocation that suits all your needs.

Related Articles