Decentralized finance, or DeFi, is a buzzword in the financial world, particularly in the United States. The rise of DeFi has been nothing short of phenomenal, with the value locked in DeFi protocols surpassing $40 billion in January 2021.

This represents a more than ten-fold increase in just a few months. DeFi has been driven by a growing interest in cryptocurrencies and blockchain technology, as well as a desire for financial freedom and decentralization.

DeFi offers a range of financial products and services, including lending, borrowing, insurance, and yield farming. The decentralized nature of DeFi protocols means that users can participate in these activities without the need for intermediaries, such as banks or financial institutions.

This eliminates the need for intermediaries, resulting in lower fees, increased accessibility, and more control for the user.

In this complete guide to DeFi, we will provide a comprehensive overview of decentralized finance, including its history, key concepts, benefits, and challenges. We will also examine the various DeFi products and services available, and discuss how to get started with DeFi.

Here's what we shall cover in this post:

- What is Decentralized Finance?

- 6 Benefits of Decentralized Finance

- Impact of Decentralized Finance on the Financial Industry

- Different Types of Decentralized Finance Platforms

- Risks of Decentralized Finance Investments

- Future of Decentralized Finance

- Intersection of Decentralized Finance and Cryptocurrency

- Conclusion

- Key Takeaways

What is Decentralized Finance?

Decentralized finance, or DeFi, is a financial system built on blockchain technology that operates without intermediaries like banks.

- It provides financial services such as lending, borrowing, and investments directly to users, using blockchain and smart contracts.

- DeFi offers several benefits over traditional finance, including greater access to financial services, lower costs, and more transparency.

- It also provides users with more control over their own financial assets and allows them to participate in financial markets directly.

How Does Decentralized Finance Work?

DeFi works through the use of blockchain technology and smart contracts. Smart contracts are self-executing agreements with the terms of the agreement between buyer and seller being directly written into lines of code.

This allows DeFi transactions to be fast, secure, and transparent, without the need for intermediaries.

6 Benefits of Decentralized Finance

DeFi offers a range of benefits to users, including increased access to financial services, lower costs, and more transparency.

Accessibility

One of the key benefits of DeFi is that it provides greater access to financial services to people who might otherwise be excluded from the traditional financial system. This includes people who live in areas without access to traditional banks or those who do not meet the credit requirements for traditional loans.

Lower Costs

DeFi eliminates intermediaries like banks, reducing the cost of financial services. This can result in lower fees and better interest rates for users. Additionally, DeFi eliminates the need for intermediaries, reducing the cost of transactions and making them faster and more efficient.

Transparency

DeFi operates on blockchain technology, which provides a transparent and secure record of all transactions. This transparency makes it easier for users to understand the terms and conditions of financial products, and to track the performance of their investments.

Security

DeFi operates on blockchain technology, which is secure and tamper-proof. This reduces the risk of fraud and hacking, making DeFi a safer option for financial transactions than traditional financial systems.

Innovation

DeFi allows for the creation of new financial products and services, which can help drive innovation in the financial industry. For example, DeFi lending and borrowing platforms offer users new investment opportunities, while decentralized investment platforms provide access to a wider range of assets.

Decentralization

DeFi operates on blockchain technology, which is decentralized, meaning that it operates without a central authority. This decentralization gives users more control over their financial transactions and reduces the risk of a single point of failure.

Impact of Decentralized Finance on the Financial Industry

DeFi has rapidly gained popularity in recent years, and it's having a profound impact on the financial industry. In this section, we'll explore the key ways that DeFi is disrupting traditional finance and transforming the financial landscape.

Empowering Consumers: DeFi gives consumers more control over their financial assets and enables them to participate in financial activities directly, without intermediaries. This includes everything from borrowing and lending to trading and investing.

DeFi also provides greater financial accessibility and inclusion, as it operates on a global scale and is available to anyone with an internet connection.

Reducing Costs: DeFi eliminates intermediaries, which reduces costs for consumers. For example, peer-to-peer lending platforms in DeFi can offer lower interest rates compared to traditional banks, and decentralized exchanges can charge lower fees than centralized exchanges.

DeFi also reduces the need for traditional financial intermediaries, which can lead to cost savings for businesses and other organizations.

Improving Transparency: DeFi operates on transparent, open-source blockchain technology, which makes transactions more transparent and secure. This enhances the overall trust in the financial system and enables consumers to better understand the financial products and services available to them.

DeFi also enables consumers to track their financial transactions and see how their assets are being used.

Increasing Innovation: DeFi has created a thriving ecosystem of innovation, as developers, entrepreneurs, and investors are constantly exploring new use cases and applications.

This has led to the creation of new financial products and services, such as yield farming and stablecoins, that are changing the way that people think about finance. DeFi is also fostering collaboration and competition, as financial services providers look for ways to leverage the technology and stay ahead of the curve.

Disrupting Traditional Finance: DeFi is disrupting traditional finance by providing consumers with new, more efficient, and more accessible financial products and services. As DeFi continues to grow, it's likely that it will play a larger role in the financial industry, and that it will continue to challenge traditional financial intermediaries to innovate and adapt.

While there are still some challenges and risks associated with DeFi, such as security and regulation, its impact on the financial industry is already significant, and it's set to continue to grow in the years to come.

Different Types of Decentralized Finance Platforms

The DeFi ecosystem has grown rapidly and now includes various types of applications and platforms. In this section, we will discuss the different types of DeFi applications and platforms.

Decentralized Exchanges (DEXs)

Decentralized exchanges are decentralized platforms that allow users to trade cryptocurrencies without the need for intermediaries.

They operate on smart contract technology, making the process secure, transparent, and fast. DEXs provide users with more control over their funds and the ability to trade anonymously.

Lending and Borrowing Platforms

Lending and borrowing platforms enable users to lend and borrow funds directly, without the need for intermediaries.

The platforms use smart contract technology to manage the loans, ensuring that they are secure and transparent. The loans are usually backed by assets such as cryptocurrencies or stablecoins, which reduces the risk of default.

Stablecoins

Stablecoins are a type of cryptocurrency that is pegged to a stable asset such as the US dollar. They are designed to maintain a stable value, making them an ideal option for transactions and payments.

Stablecoins also provide users with more stability in the highly volatile cryptocurrency market.

Yield Farming

Yield farming refers to the practice of lending cryptocurrencies to earn interest or rewards. Users can participate in yield farming by depositing their assets into a liquidity pool, which is used to trade on decentralized exchanges.

The rewards generated by the trading activities are then distributed to the depositors.

Decentralized Identity

Platforms Decentralized identity platforms provide users with control over their personal data and digital identity. The platforms use blockchain technology to store the data in a secure and decentralized manner, ensuring that users have full control over their information.

Decentralized identity platforms also provide users with the ability to share their data in a secure and privacy-preserving way.

Risks of Decentralized Finance Investments

Smart Contract Risks

DeFi applications are built on blockchain technology and use smart contracts to automate financial transactions.

Smart contracts are self-executing contracts that contain the terms of the agreement between buyers and sellers. However, smart contracts are susceptible to errors, bugs, and hacks, which can result in the loss of funds.

Liquidity Risks

Another risk associated with DeFi is liquidity risk. DeFi applications are still in the early stages of development and many of them have low liquidity. This means that it can be difficult to sell or buy a specific asset, causing the price to fluctuate rapidly.

Additionally, many DeFi protocols do not have proper liquidity management mechanisms in place, which can cause liquidity problems and result in loss of funds.

Market Risks

Just like traditional financial markets, DeFi markets are also susceptible to market risks such as market volatility, price fluctuations, and sudden changes in market conditions. This can result in significant losses for investors who are not prepared to handle these risks.

Regulatory Risks

DeFi is a decentralized system that operates outside of traditional financial regulations. This lack of regulation can lead to risks such as fraud, money laundering, and other illegal activities.

Additionally, governments around the world are starting to take notice of DeFi and may impose regulations that could negatively impact the DeFi industry.

Security Risks

Finally, DeFi applications are also susceptible to security risks such as hacking, phishing, and other cyber attacks. DeFi investors need to be aware of these risks and take steps to protect their investments, such as using secure wallets and avoiding phishing scams.

Future of Decentralized Finance

With the rise of blockchain technology and the increasing popularity of cryptocurrencies, DeFi has become an attractive option for those looking for financial alternatives outside of traditional banking systems. Here are some of the trends and innovations shaping the future of DeFi.

Growth of DeFi Ecosystems

DeFi ecosystems are growing at an unprecedented rate, with new decentralized finance applications and platforms being developed every day. These ecosystems are built around blockchain technology and allow for financial transactions to occur without the need for a central authority.

As DeFi continues to grow, it will become more accessible and user-friendly, making it a more viable alternative for traditional finance.

Emergence of Decentralized Lending and Borrowing Platforms

Decentralized lending and borrowing platforms are one of the most exciting innovations in the world of DeFi. These platforms allow users to lend or borrow assets without the need for intermediaries, thereby reducing costs and increasing efficiency.

Decentralized lending and borrowing platforms are expected to play a key role in the future of DeFi, providing users with more flexible and accessible financial options.

Adoption of Decentralized Insurance Solutions

Decentralized insurance solutions are a relatively new innovation in the world of DeFi. These solutions use blockchain technology to provide insurance coverage to users without the need for intermediaries.

Decentralized insurance solutions are expected to play an important role in the future of DeFi, providing users with more secure and transparent insurance options.

Use of Decentralized Identity Solutions

Decentralized identity solutions are becoming more important in the world of DeFi. These solutions allow users to securely store and manage their personal and financial information on the blockchain, providing a more secure and transparent way to manage their information.

Decentralized identity solutions are expected to play a key role in the future of DeFi, providing users with more secure and efficient ways to manage their financial information.

Intersection of Decentralized Finance and Cryptocurrency

The intersection of DeFi and cryptocurrency is a natural one, as DeFi relies on blockchain technology and cryptocurrencies are often used as the primary means of exchange in these systems.

DeFi applications, such as decentralized exchanges (DEXs), lending and borrowing platforms, and yield farming, are made possible by the use of cryptocurrencies as the underlying asset.

- The use of cryptocurrencies in DeFi allows for faster, cheaper, and more secure transactions compared to traditional finance.

- Cryptocurrency-based DeFi also opens up financial services to those who are excluded from traditional finance, such as those in developing countries and those without access to bank accounts.

- While the intersection of DeFi and cryptocurrency brings many benefits, there are also risks, such as high volatility, lack of regulation, and security concerns.

- Despite these challenges, the trend towards DeFi and the integration of cryptocurrency is expected to continue, leading to further innovation and the democratization of finance.

- Some experts predict that DeFi will become a key player in the financial industry, offering new opportunities and changing the way we think about and access finance.

The future of DeFi and cryptocurrency remains uncertain, but one thing is clear: the intersection of these two worlds has the potential to greatly impact the financial industry and bring financial freedom to more people around the world.

Role of Blockchain Technology in Decentralized Finance

The rise of Decentralized Finance (DeFi) has been greatly influenced by the advancements in blockchain technology. Blockchain is a secure, decentralized, and transparent ledger of digital transactions that enables the creation of trustless financial systems.

In this section, we will discuss the role of blockchain technology in decentralized finance.

- Trustless

Transactions Blockchain technology eliminates the need for intermediaries, such as banks, in financial transactions. This eliminates the risk of fraud and empowers users to control their own funds.

With blockchain, transactions are validated through consensus algorithms and recorded on a public ledger, making it difficult for a single party to manipulate or tamper with the data.

- Decentralized Apps (Dapps)

Blockchain technology enables the creation of decentralized apps (dapps), which are open-source and run on a decentralized network. These dapps can be used to build various DeFi services such as lending, borrowing, and trading platforms.

- Security

One of the key benefits of blockchain technology is that it is extremely secure. The decentralized nature of blockchain makes it difficult for hackers to tamper with the network, and the use of cryptographic algorithms further enhances security.

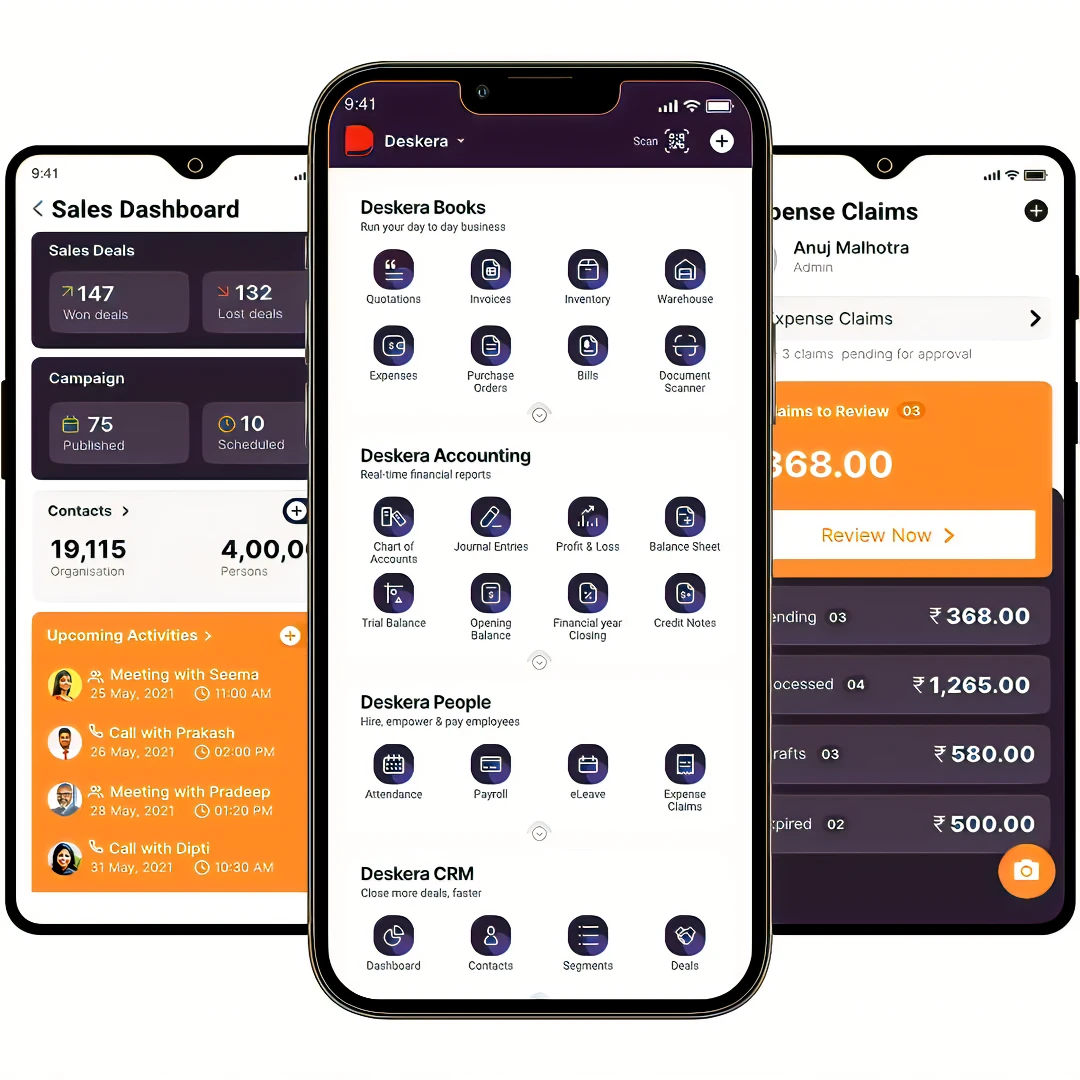

How Deskera Can Assist You?

Deskera's integrated financial planning tools allow investors to better plan their investments and track their progress. It can help investors make decisions faster and more accurately.

Deskera Books enables you to manage your accounts and finances more effectively. Maintain sound accounting practices by automating accounting operations such as billing, invoicing, and payment processing.

Deskera CRM is a strong solution that manages your sales and assists you in closing agreements quickly. It not only allows you to do critical duties such as lead generation via email, but it also provides you with a comprehensive view of your sales funnel.

Deskera People is a simple tool for taking control of your human resource management functions. The technology not only speeds up payroll processing but also allows you to manage all other activities such as overtime, benefits, bonuses, training programs, and much more. This is your chance to grow your business, increase earnings, and improve the efficiency of the entire production process.

Conclusion

Decentralized finance (DeFi) has emerged as a game-changer in the financial industry, offering a more secure, transparent, and accessible alternative to traditional financial services. DeFi operates on decentralized, blockchain-based platforms and aims to provide financial services without the need for intermediaries.

From yield farming and stablecoins to decentralized exchanges and insurance protocols, DeFi has a wide range of financial products and services to offer. While DeFi has many advantages, such as increased security and accessibility, it also has its fair share of risks and challenges, including volatility, lack of regulation, and the threat of hacking.

As DeFi continues to grow and evolve, it is important for individuals to stay informed and make informed decisions when investing in DeFi.

By understanding the basics of DeFi, its key players, and the risks and benefits involved, individuals can make informed decisions and take advantage of the exciting opportunities offered by decentralized finance.

Key Takeaways

- Decentralized finance (DeFi) is a financial system built on decentralized, blockchain-based platforms, offering financial services without intermediaries.

- DeFi is designed to provide increased security, transparency, and accessibility to financial services, making it a more democratic alternative to traditional finance.

- The DeFi ecosystem is made up of various financial products and services, including yield farming, stablecoins, decentralized exchanges, and insurance protocols.

- Yield farming is a way for users to earn high returns on their investments through liquidity provision, where users provide liquidity to DeFi protocols in exchange for rewards.

- Stablecoins, such as DAI, USDC, and Tether, are digital assets pegged to the value of a fiat currency, providing stability and reducing volatility in the DeFi ecosystem.

- Decentralized exchanges (DEXs) are non-custodial trading platforms that allow users to trade cryptocurrencies and other digital assets without relying on intermediaries.

- Insurance protocols, such as Nexus Mutual and Opyn, provide coverage against smart contract failures, offering greater security for users in the DeFi ecosystem.

- DeFi has many advantages, including increased security, transparency, and accessibility. Still, it also comes with its fair share of risks and challenges, such as volatility, lack of regulation, and the threat of hacking.

Related Articles