The most important aspect of the Indian economy is the introduction of Goods and Service Tax(GST), launched on July 1, 2017. GST has subsumed more than 17 taxes under one bracket to make the taxation system easy in the country.

The new tax regime brings in a new set of compliances followed by manufacturers and traders. However, it was a back-breaking task for the start-ups or SMEs to comply with its provisions. Therefore, to lower the stress of these sectors, the government decided to introduce the Composition Scheme under the GST Act.

In this article:

- What is the GST Composition Scheme?

- Who is Eligible for the GST Composition Scheme?

- Who is not Eligible for Composition Under GST?

- The Tax Rate Applicable to a Composition Taxable person

- How a Composite Dealer can be Distinguished from a Normal Taxpayer?

- GST Composition Scheme Rules

- Different Forms for the GST Composition Scheme

- Composition Scheme Under GST: Filing of Returns

- Composition Scheme Billing

- What are the Advantages and Disadvantages of the Composition Scheme?

- Online Procedure to Apply for Composition Scheme under GST Act

- How does the Composition Scheme Apply to Deskera Users?

- Conclusion

What is the GST Composition Scheme?

In India, to reduce the compliance burden for small businesses, the GST composition scheme was introduced. Based on the business turnover, any person who has opted for this scheme will pay taxes at a prescribed rate. Such a system will make sure greater compliance, with less detailed tax record maintenance.

For instance, the regular taxpayer has to submit three monthly returns (GST-1, GST-2, and GST-3), and one annual return(GST-9). But in case you have applied for a composition scheme under GST, filing gets more manageable, as you need to file one quarterly return(GSTR-4) and one annual return(GSTR - 9A).

Under GST, after registering for the composition scheme, you will be eligible to pay tax at a fixed rate of 1% - 6% of your total turnover. So, for example, if you are a manufacturer of ice cream, tobacco, or pan-masala, you are liable to pay 1 % tax based on your turnover, thanks to the composition scheme.

Who is Eligible for the GST Composition Scheme?

Following are the eligibility criteria for any taxpayer to opt for registration under the composition scheme,

- The taxpayer shall be registered under the Composition Act;

- A taxpayer whose turnover is less than Rs. 1.5 crore (CBIC has notified the increase to the threshold limit from Rs 1.0 Crore to Rs. 1.5 Crores).

NOTE: If more than one taxable person is registered on the same PAN number, then the compensation scheme can be availed by only one if all of such taxable persons will avail the same.

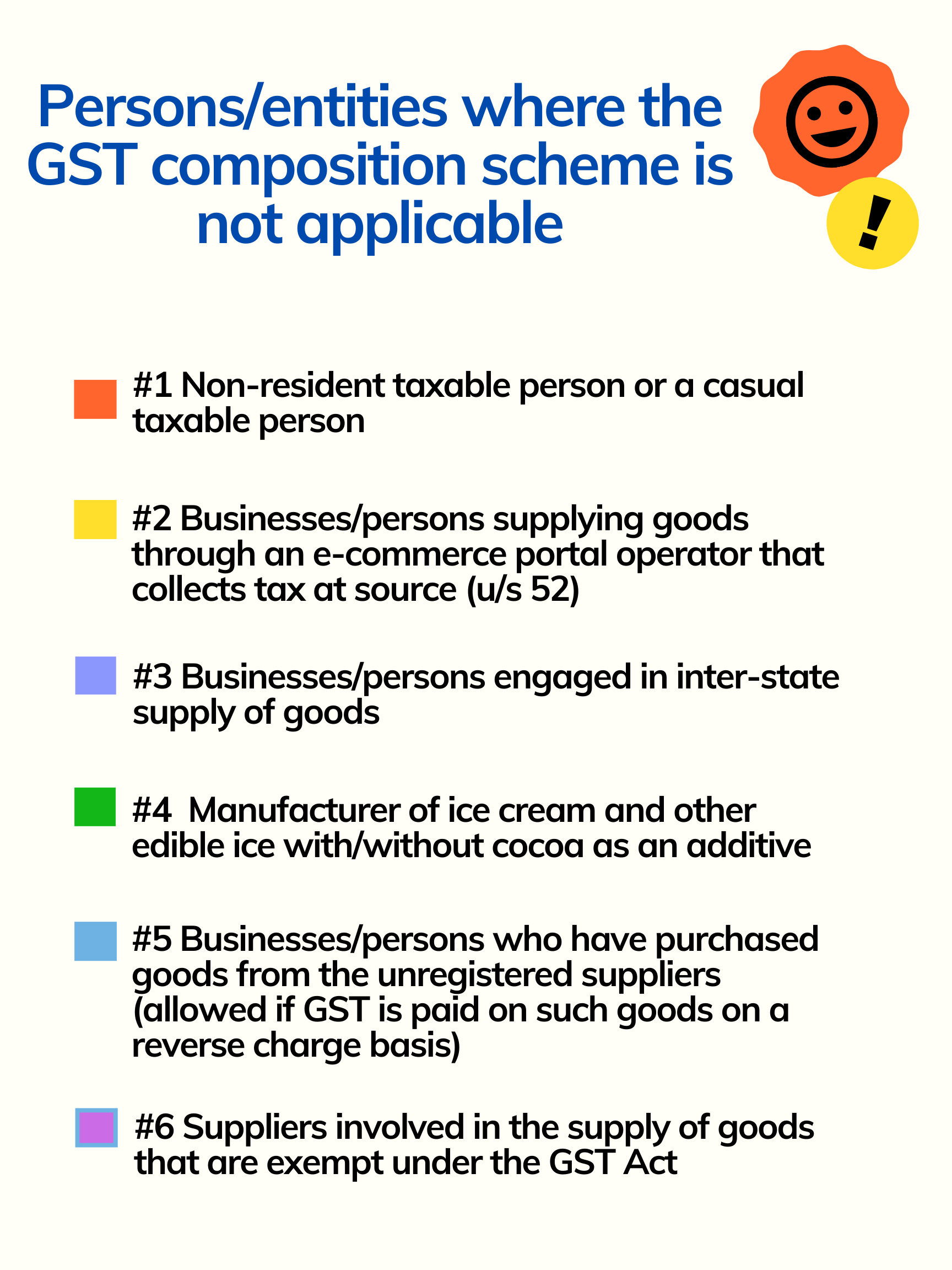

Who is not Eligible for Composition Under GST?

It’s simply that the ones who don’t match the criteria mentioned above are not eligible for a composition scheme under GST. Going in detail, the following are the persons who cannot and in anyhow opt for the GST composition scheme.

- Service providers (other than the person engaged in the supply of food and drinks i.e., restaurant services).

- Producer of pan masala, or tobacco, ice cream.

- A non-resident taxable person, Casual taxable person.

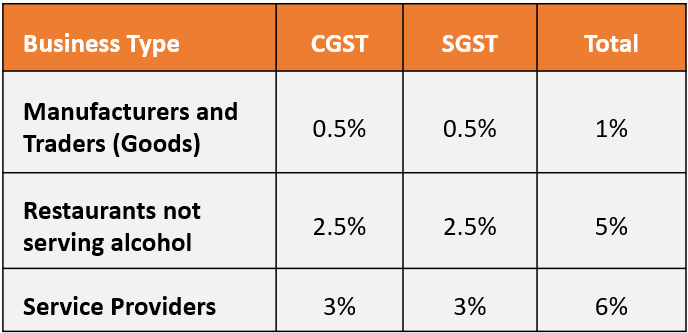

The Tax Rate Applicable to a Composition Taxable person

In Goods and Service Tax, for different suppliers, varied composition rates have been prescribed. The following are the tax rates under the composition scheme as amended by Notification Number 1/2018 – Central tax

How a Composite Dealer can be Distinguished from a Normal Taxpayer?

When compared with the normal taxpayer, a composite supplier has a different and reduced set of compliances. Below listed are the same for better understanding.

GST Composition Scheme Rules

Under the GST act provisions, a range of businesses in the service and manufacturing sectors, including traders and restaurants, will register under the composition scheme. However, the following are the persons/entities where the GST composition scheme is not applicable:

Different Forms for the GST Composition Scheme

Following are the different forms for the GST Composition Scheme:

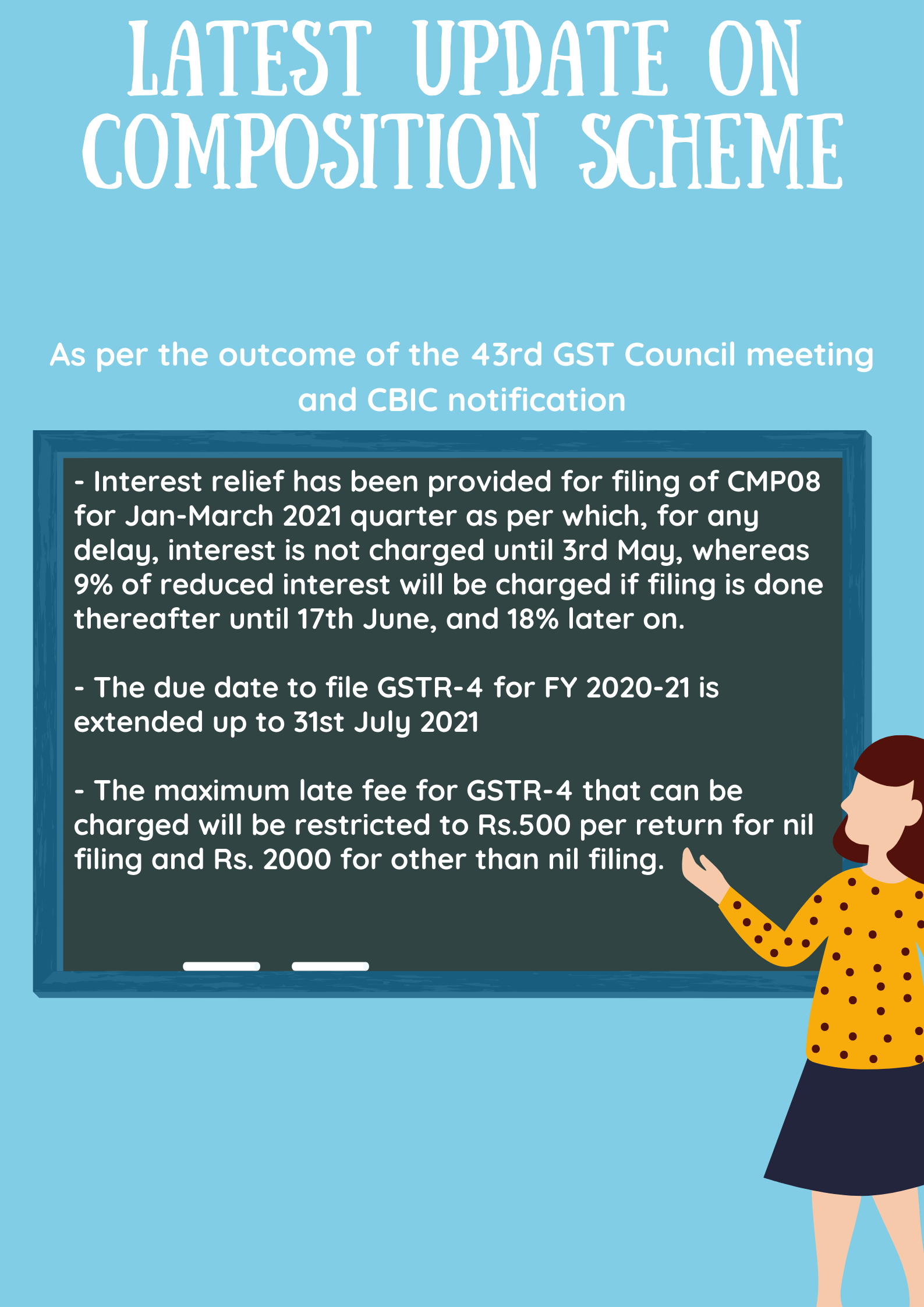

Composition Scheme Under GST: Filing of Returns

- Form CMP-08- For quarterly filing return after the quarter-end

- Form GSTR- 4 – Annual filing of GST return

GSTR-4 is a form of GST Return that needs to be filed by a composition dealer. Generally, a regular taxpayer needs to submit three monthly returns; however, a dealer who has opted for the composition scheme must submit one return, the GSTR-4 form, once a year by 30th April, following the financial year.

Composition Scheme Billing

- As per the composition scheme rules, a dealer cannot issue goods and service tax invoices, as the tax liability is on a taxpayer.

- As per the Composition Scheme rule under GST, a dealer needs to issue a bill of supply. Every bill must mention “composition taxable person, ineligible to receive tax on supplies.”

What are the Advantages and Disadvantages of the Composition Scheme?

Online Procedure to Apply for Composition Scheme under GST Act

Under GST, below are the steps involved to apply for the Composition Scheme.

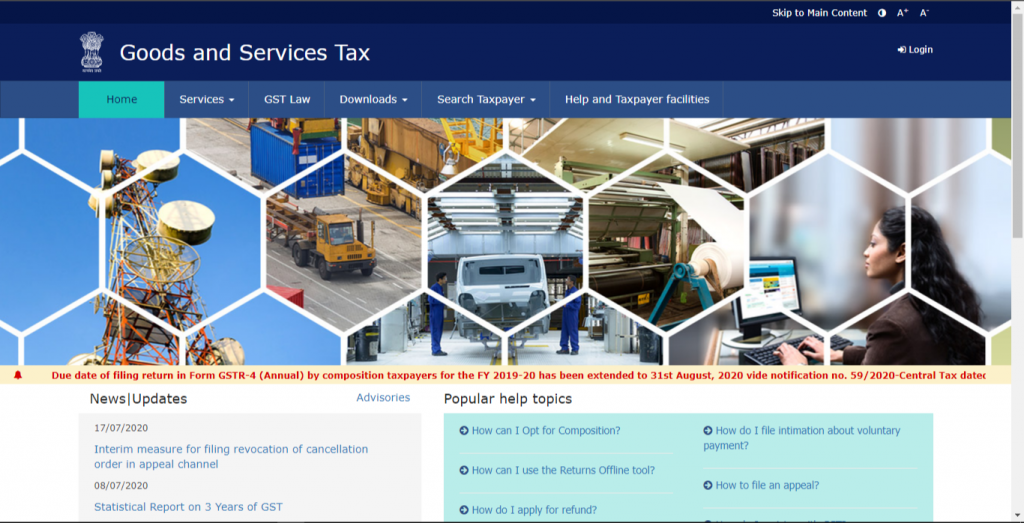

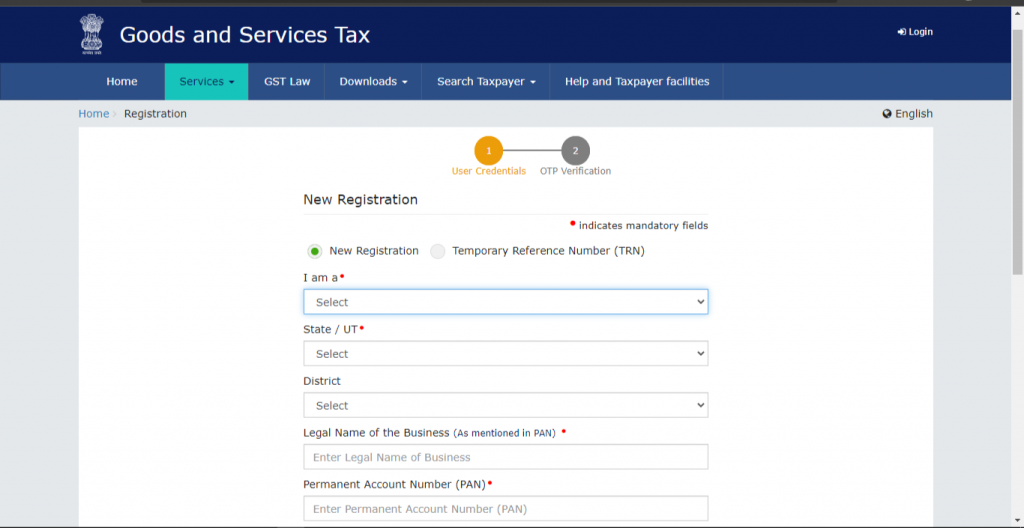

Step 1: Visit Official GST Portal on https://www.gst.gov.in/;

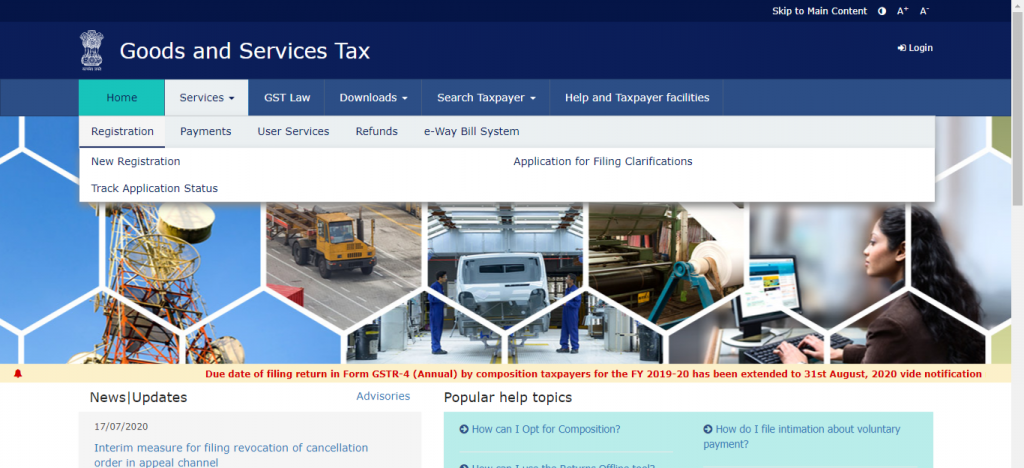

Step 2: Services: On the homepage, click on the “Service” tab. This application procedure includes two parts;

- New Registration;

- TRN (Temporary Reference Number)

Step 3: New Registration: Choose “New Registration” option;

Step 4 :Details: Fill in the below details;

- Type of Taxpayer;

- District and State for which the Composition Scheme registration is needed;

- Business Name;

- PAN Card particulars of the Business or Proprietor;

- Mobile Number and E-mail Address of the Primary Authorised Signatory;

Step 5: One Time Password: Next enter the OTP received on the registered e-mail address and mobile number;

Step 6: Enter OTP: Enter the given OTP and Captcha. Thereafter click on the “Proceed” button;

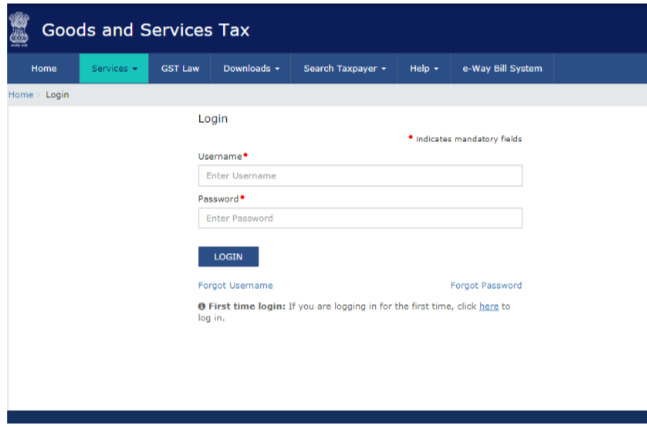

Step 7: Login on GST Portal: Enter the username and password, together with the Captcha in the required place and thereafter click on the “Login” option;

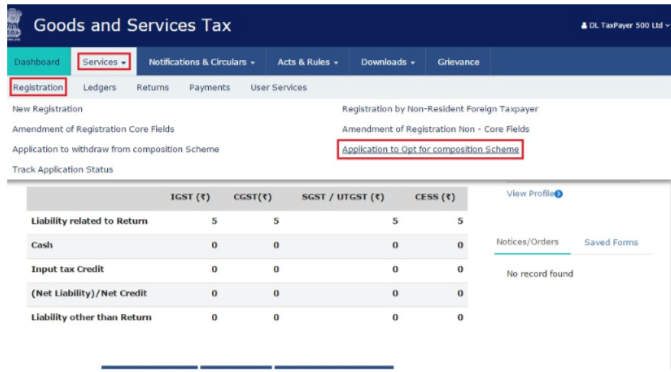

Step 8: Application for Composition Scheme under GST Act: After login into the account, select “Application to opt for Composition Scheme under GST Act”. The applicant can select the same from the “Registration Menu” provided under the “Service” tab on the home page.

Step 9: Review Details Provided: After selecting you will be redirected to the application page. On the form the following details of the applicant will be listed:

- GSTIN (Goods and Service Tax Identification Number);

- Business Name;

- Trade Name;

- Address of the Registered Office;

- Nature of the Business;

- Jurisdiction.

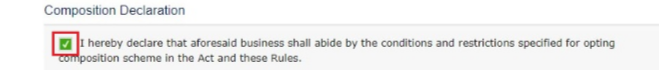

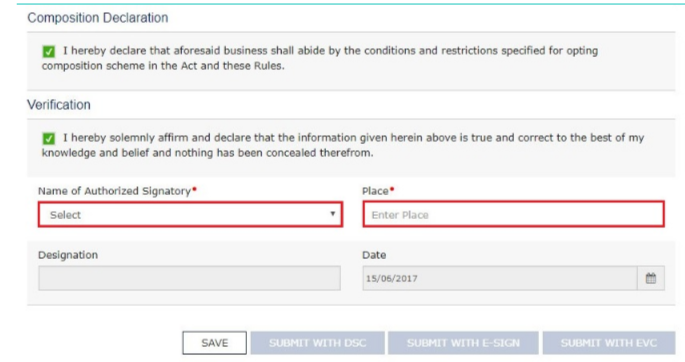

Step 10: Composition Declaration: After all the information provided is checked, tick the Composition Declaration Box given at the end of the application form.

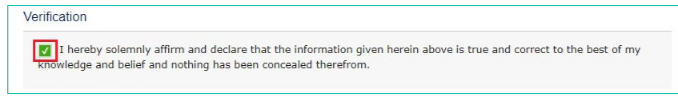

Step 11: Verification Process: After ticking the composition declaration, the applicant needs to check the box of the Verification Process. This box is given just below the Composition Declaration.

Step 12: Other Details: Once the Verification is completed, from the drop-down menu select the Authorized Signatory and also mention the place of filing the application. Now, click on the “Save” button to save the details provided,

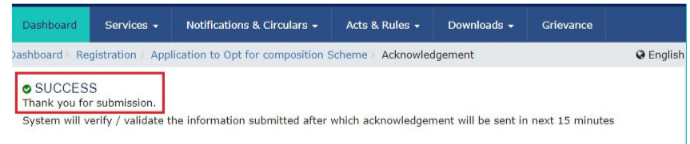

Step 13: Submit the Application Form: After saving the form, the “Submit” option gets activated. Further, the you need to sign the application form. You can either sign it by using DSC (Digital Signature Certificate) or by EVC option.

Step 14: Submit Form after Signing: Lastly, click on the “Submit” option after signing the form.

How does the Composition Scheme Apply to Deskera Users?

When Deskera users are creating their organization in the Deskera Books software, you will come across this section:

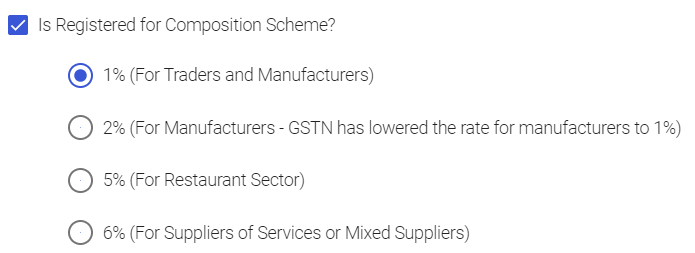

Users are allowed to tick more than one checkboxes, for any fields that apply to them. Once they tick the checkbox that they are registered for Composition Scheme, they will have to select the category of their businesses:

- 1% - For Traders and Manufacturers

- 2% - For Manufacturers: GSTIN has lowered the rate for manufacturers to 1%

- 5% - For Restaurant Sector

- 6% - For Suppliers of Services or Mixed Suppliers)

Conclusion

Under GST Act, the main reason for implementing the Composition Scheme was to provide an alternative way to the small taxpayers. This scheme helps to reduce the tax burden and compliance cost on these taxpayers.

Moreover, this scheme has simplified the lives of small taxpayers, as now they are not required to maintain lots of records. Therefore, it will be correct to mention that the composition scheme under GST Act has turned out very beneficial for small taxpayers.

Related Articles

- How to Register for India GST?

- How to Register for GST on the GST India Portal. A Step by Step Guide

- Complete guide to E-way Bills in India GST

- GST Calculator – Online Goods and Services Tax Calculator

- What is GSTIN?

- What is GSTN?

- Step-by-Step Guide for India GSTR Filing

- Understanding HSN Codes & SAC Codes Under India GST

- All about GST Compensation Cess

- What Is Input Credit (ITC) under GST ?

- Understanding Reverse Charge Mechanism (RCM) in India GST

- Special Economic Zone (SEZ) under GST