Although everyone hopes to be successful when establishing a business, some entrepreneurs, sadly, are unsuccessful. It might be that things aren't going as planned, that you have other life obligations to attend to, or even that you're ready to start a different type of business.

Finding a way to close down a company is never enjoyable, but doing so may also bring peace of mind and create prospects for future business initiatives. What lies on the other side is always a mystery.

Of course, closing down a firm physically also needs to be put down legally. Putting up a sign that reads "Closed" is only one aspect of shuttering a business. Although many business owners are familiar with how to launch a company, including how to incorporate, register trademarks, and prepare business plans, they might not be aware of the proper legal procedure for how to shut down a company.

Use this 10-step guide to efficiently close your business. By taking the appropriate procedures to terminate your firm, you may create a new future for yourself.

But first, let's look at a few potential causes that might lead to the closure of your small firm.

Table of Content

- Possible Reasons To Close Your Business

- A 10-Step Guide to Close Your Business

- Step 1: Create an exit plan

- Step 2: Inform your employees

- Step 3: Gather or sell outstanding receivables

- Step 4: Sell your business assets

- Step 5: File articles of dissolution

- Step 6: Submit other relevant paperwork

- Step 7: Inform your customers and complete any unfinished business

- Step 8: Inform creditors and pay outstanding debts

- Step 9: Pay the taxes and submit final payroll forms

- Step 10: Distribute remaining cash or assets

- Is Filing Bankruptcy An Option?

- Closing Thoughts: Move On

- Key Takeaways

Possible Reasons To Close Your Business

· Poor Management: Undoubtedly a "business killer." According to a survey, incompetent or inexperienced managers are at blame for 76% of business failures.

· Poor Marketing: A firm that does not properly advertise the appropriate product to the right market utilising the right media channels would unavoidably find itself ignored, just like a younger high school kid who tries to talk to females.

· Anaemic Sales Productivity: Businesses frequently neglect to add salespeople and other customer-facing personnel trained to do the right thing for the right customer to their marketing strategy.

· Poor Cash Flow: It is challenging for a firm to satisfy daily working capital requirements owing to low sales income, delinquent accounts receivable, and unanticipated increases in the cost of doing business.

· Inadequate Investment Capital: When companies neglect to keep financial reserves set aside for innovation, infrastructure, and skilled labour, they lose their ability to compete. No honey without money!

· Imprudent Cutbacks: When the economy is weak, business owners sometimes react by sharply reducing their expenditures for staffing, advertising, and expansion. However, instead of enhancing financial health, these panic-driven actions typically invite financial disaster.

· Poor Supply and Delivery Chains: When a company depends too much on one or two material suppliers that went out of business during the recession, it may eventually collapse. Business failure has also been caused by unanticipatedly rapid rises in the cost of transporting goods to clients.

· Rapid Expansion: Businesses that overextend themselves across enterprises that deplete resources eventually go bankrupt.

A 10-Step Guide to Close Your Business

Step 1: Create an exit plan

You don't have to decide to shut down your company on your own. You might have to speak with other owners if you're a partner in a limited liability firm. You might need to speak with your board of directors if you are the owner of a corporation. Create an exit strategy and plan on how to close the firm best with the help of your stakeholders. Then you should think about seeking assistance from tax experts, attorneys, bankers, and accountants as well as your national tax authority.

You can manage the closing process more easily if you create a strategy before deciding to halt operations.

Step 2: Inform your employees

When informing your staff of your closure choice, use your best judgement. However, if your staff are unaware of what is going on, finishing some activities, like selling your assets, might be challenging. How you'll handle employee communication should be a part of your plan.

When you must send each employee their last paycheck is specified under several rules. Also bear in mind that you'll have to pay back any out-of-pocket costs incurred by your staff. The company's assets, such as vehicles, computers, and mobile devices, must also be gathered.

Step 3: Gather or sell outstanding receivables

You must have a collections plan in place if you have unpaid accounts receivable. It may be significantly more difficult for you to recover accounts receivable once you close your firm. Other entrepreneurs could be less eager to pay. Additionally, they could be unable to compensate an individual over a corporate organisation due to their accounting procedures.

However, obtaining unpaid accounts might assist you to have cash in hand when you get ready to shut. To increase your efforts and your likelihood of being compensated:

· Prior to announcing your intention to terminate the firm, make collection efforts. If not, clients can put off making payments or believe they are not required to.

· If your receivables are past due, in particular, provide incentives for quick payments. As the closing date draws near, you can raise the discounts. Sometimes having some money than none at all is preferable.

· Try contacting to collect money rather than only sending out collection letters.

· Consider selling the accounts you are unable to collect to a factoring company. Factoring companies might put some money in your pocket by purchasing outstanding bills at a discount. Although you won't have your entire debt paid back, you will still get paid a portion of the invoice.

Step 4: Sell your business assets

The moment is now to liquidate whatever extra goods you may have. You may be able to get the funds needed to settle any outstanding obligations by selling goods. You may begin by offering things for less money. On websites like eBay, Amazon, or Craigslist, think about selling any leftover stock. Speak to an inventory liquidator if you have a warehouse full of inventory. These businesses either assist in the sale of surplus inventory through other channels or purchase it for a portion of its value.

Step 5: File articles of dissolution

You should submit articles of dissolution now that you have a clearer picture of your finances. Articles of dissolution must be filed in each jurisdiction where you have a business registration. Although the paperwork might differ from area to region, you can often e-file your articles.

Step 6: Submit other relevant paperwork

It's probable that you still have additional company accounts to shut. Licenses, registrations, permissions, and business names are a few examples. Keep in mind that in order to fulfil these requirements, you might need to file documents somewhere other than your Secretary of State's office. The municipal and federal governments may also require you to take this action. Additionally, you can shut your bank and credit card accounts once you've finished making payments and collecting accounts receivable. Rent and utility payments follow the same rules.

Step 7: Inform your customers and complete any unfinished business

You must let your customers know that your firm will be closing. You may release a press release based on the size of your company. You might also make a statement and publish it in the local paper. You might also contact your clients or publish on social media.

You'll also need to take care of any unfinished business. You could be required to repay money paid for ongoing jobs if you are unable to complete them. Or you could have to discuss an early termination. If you can't finish the job, some contracts have a cancellation clause that charges you a price. Paying the charge can be the simplest course of action if it is within your means. Call the client and explain your circumstances if you are unable to pay. Request that the contract be terminated.

Regardless of what you decide, communication is essential at this time. Being open and truthful with clients is preferable. You might be able to use "impossibility of performance" as justification for contract termination if the coronavirus forces you to shut down your firm. Deal impossibility happens when circumstances such as natural catastrophes, governmental orders, or other unforeseen occurrences prevent you from carrying out a contract. If your contracts permit this kind of termination, check with your lawyer.

Step 8: Inform creditors and pay outstanding debts

You'll have to settle any unpaid debts and let your creditors know that your company is shutting down. How you should do this is governed by several laws. Otherwise, bear in mind the following basic rules:

· Just before you shut, let your suppliers and unsecured creditors know. When you receive this message, try to schedule it so that you may keep receiving the goods and supplies you require all the way up to the moment you close.

· Take good care of your bank debts. In some situations, your bank may withdraw the remaining balance of your loan from your business bank account as soon as you notify them that your firm is closing.

· Partnerships and sole proprietorships have the option to inform their creditors in writing that they are shutting and request a final invoice. A limited length of time will pass before your creditors may make a claim against you for unpaid debts.

· Corporations and LLCs may also write letters of notice to creditors. Find out from your local legislation when creditors must file claims, and include this in the letter.

Step 9: Pay the taxes and submit final payroll forms

Make the required business tax contributions as soon as the last paychecks are issued, and then file employment tax forms. If you're short of cash, get in touch with your local tax office to talk about ways to lower your debt.

You must then submit your sales tax reports and any other taxes you may have gathered up until the closing date. At the top of the form, type "FINAL." Then, discuss how to shut your tax account with your local agency. Your national tax agency may have requirements for submitting final income tax returns depending on how you set up your firm.

If you employed workers or independent contractors, you must also complete your final tax returns. By the due dates specified, submit paperwork, pay fees, and mark them as completed.

Step 10: Distribute remaining cash or assets

You can divide the remaining money among owners once all loans, taxes, obligations, and personnel expenses have been covered. You shouldn't proceed unless you are certain that all business obligations have been settled.

Is Filing Bankruptcy An Option?

Even though the majority of small company owners may wind up their operations (and safeguard their personal assets) without declaring bankruptcy, this may be your best or only alternative if you have a significant amount of debt and creditors who won't accept anything less. If you decide to close the deal, filing for bankruptcy will be the first step you take; the remaining actions will come after, influenced by the bankruptcy procedure.

When considering whether to file for bankruptcy and getting assistance with the closure process, a business attorney with experience in business closures may be of great assistance. An attorney can advise you on any potential obligations you haven't thought of or any actions you could omit, in addition to dealing with difficult landlords and other creditors. Seeking the counsel of an accountant or tax specialist may be even more crucial since they can provide you guidance on the tax ramifications of selling assets, the several tax forms you'll need to submit, and the best strategies to utilise your company losses for tax reasons. You can speak with a nearby company attorney for assistance.

Closing Thoughts: Move On

It’s me, not you. You shouldn't assume that closing your firm indicates failure, regardless of the cause. Recall the time your business was first introduced. Then, did you worry about failing? Most likely not. There is no reason to be afraid of failing today because you were instead concentrating on how to make your business profitable. Move on.

How can Deskera Help You?

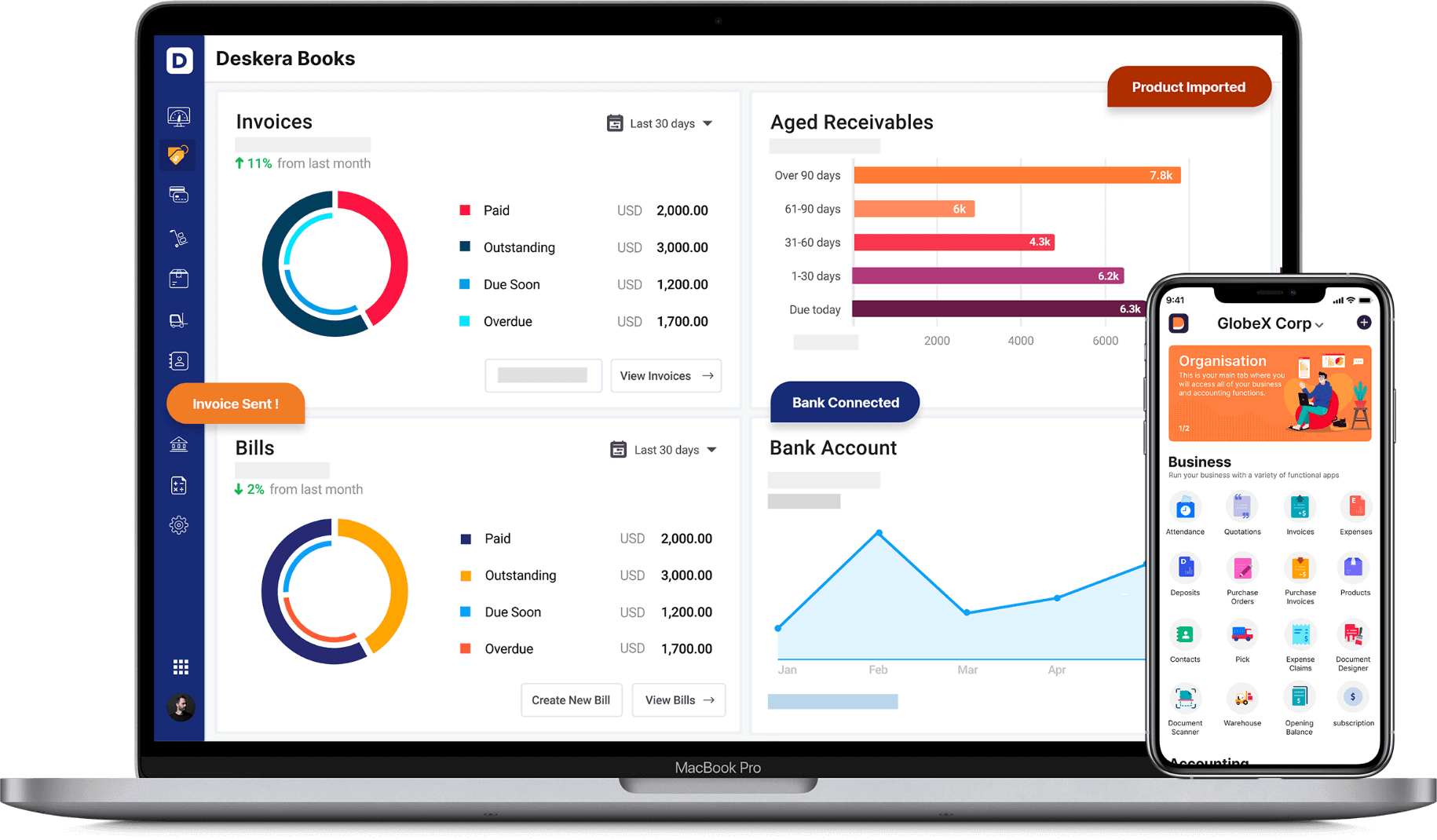

Deskera Books can help you automate and mitigate your business risks. Creating invoices becomes easier with Deskera, which automates a lot of other procedures, reducing your team's administrative workload.

Sign up now to avail more advantages from Deskera.

Learn about the exceptional and all-in-one software here:

Key Takeaways

· You should not only close your business physically but also legally.

· Businesses that overextend themselves across enterprises that deplete resources eventually go bankrupt.

· To shut down your company, you might have to speak with other owners if you're a partner in a limited liability firm.

· When informing your staff of your closure choice, use your best judgement.

· You should submit your articles of dissolution now that you have a clearer picture of your finances.

· Make the required business tax contributions as soon as the last paychecks are issued, and then file employment tax forms.

· Even though the majority of small company owners may wind up their operations (and safeguard their personal assets) without declaring bankruptcy, this may be your best or only alternative if you have a significant amount of debt and creditors who won't accept anything less.

Related Articles