66 percent of small firms report having financial difficulties, with 43 percent saying that paying operating expenditures is the biggest problem.

The saying you must spend money to create money often holds true in the world of entrepreneurship. You need to secure capital to launch your firm after you've produced a value proposition, discovered a market need, and developed an inventive business idea.

Keeping costs as low as possible is essential for business finance. You should also make sure that the money you invest is used to get direction on how to proceed.

Table of contents

- What Is Financing for Businesses?

- Why is it so challenging for small firms to obtain bank loans?

- Who are financiers for startups?

- What are Business cash advances?

- How should small businesses get ready to submit an application for alternative loan options?

- How can you identify choices for company financing?

- How to find a venture capitalist to finance your business?

- How to remain inspired throughout the financing process?

- Mezzanine Capital: What Is It?

- What are the Additional private funding options?

- What do small companies do before approaching investors?

- Key Takeaways

What Is Financing for Businesses?

You'll undoubtedly need access to funds someday through business financing unless your company has Apple's balance sheet. Even a lot of large-cap businesses frequently look for cash to cover short-term needs.

Finding an appropriate funding arrangement is crucial for small businesses. If you borrow money from the incorrect source, you risk losing a portion of your business or being subjected to repayment terms that will hinder your growth for many years to come.

Debt Financing: What Is It?

You probably know more about debt finance for your company than you believe. Do you currently have a mortgage or a car loan? These two are examples of debt finance. The same is true for your company, business financing options. The source of debt funding is a bank or another lending organisation. Although you might be able to get it from private investors, this is unusual.

Options for Small Business Financing

The process of starting your own business can be challenging but rewarding. While having a strong business strategy is essential for entrepreneurs, one of the most significant components a company needs to flourish is money, business financing options.

But for those with bad credit, financing a start-up or small business can be a challenging, protracted procedure, business financing options. Although there is no minimum credit score required to obtain a business loan, conventional lenders typically have a range they deem acceptable.

Consider an alternate loan if your credit is poor and you don't have any assets to pledge as security. This article examines the advantages of alternative lending, provides advice on how to finance your firm, and dissects small business funding methods.

Why is it so challenging for small firms to obtain bank loans?

Small firms find it challenging to obtain capital for a number of reasons. Banks want to lend to small businesses; they are not opposed to doing so, business financing options. However, conventional financial institutions have outmoded, labor-intensive lending procedures and regulations that are unfavourable to neighbourhood stores and small businesses.

Because many small firms requesting for loans are brand-new, it is more difficult to get capital because banks normally require at least a five-year profile of a healthy business (for example, five years of tax data) before making an offer.

Alternative funding - what is it?

Any strategy that allows business owners to raise funds without the help of conventional banks is known as alternative financing, business financing options. A funding option is typically considered an alternative financing technique if it is totally online-based. This term includes finance alternatives including crowdfunding, online lenders, and cryptocurrencies.

Options for financing a business outside of a typical bank

If your small business needs money but isn't eligible for a standard bank loan, you might be able to find the alternative financing you need from one of these lenders. The best financing solutions for new and small enterprises are listed here.

Institutions that finance community development

According to Jennifer Sporzynski, senior vice president for business and workforce development at Coastal Enterprises Inc., there are thousands of nonprofit community development finance institutions (CDFIs) across the nation that all offer capital to small business and microbusiness owners on reasonable terms (CEI).

Every week, a wide range of loan applications, many of them from aspirational startups cross Sporzynski's desk. As a mission-driven non-bank lender, we are aware from experience that many viable small businesses find it difficult to obtain the funding they require to launch, flourish, and grow.

Banks and lenders like CEI are different in a few respects. First off, a lot of lenders want a specific credit score, which disqualifies many companies, Business Financing Options. Banks will nearly always reject a business application if they detect bad credit. Credit scores are also considered by CDFI lenders, but in a different way, business financing options.

For instance, a borrower's accounting may be badly impacted by personal or family illness problems and job losses, yet each of those might be justified, Business Financing Options. Additionally, compared to a regular bank, CDFI lenders do not require nearly as much security. Lack of collateralized assets can be made up for in other ways, business financing options.

Who are financiers for startups?

An external group known as venture capitalists (VCs) acquires a stake in a company in return for funding. The ownership to capital ratios are variable and typically determined by a company's valuation, Business Financing Options.

According to Sandra Serkes, CEO of Valora Technologies, this is an excellent option for companies who don't have physical collateral to serve as a lien to loan against for a bank. But it is only a fit if it has a proven high growth potential and a distinct competitive advantage, such as a patent or a captive audience, business financing options.

A VC offers advantages that go beyond financial gain. A VC relationship can give your company access to a wealth of information, connections in the industry, and a clear course for the future, Business Financing Options.

According to Chris Holder, CEO and founder of the $100 Million Run Group and author of Tips to Success, a lot of entrepreneurs lack the skills needed to grow a business, and even though they can make money through sales, understanding how to grow a company will always be a lost cause in the beginning. The finest thing is advice from an experienced investor group because mentoring is essential for everyone.

Partner financing

With strategic partner financing, a company from your sector invests in expansion in return for exclusive access to your resources, personnel, distribution rights, final sales, or some combination of those. This choice is typically disregarded, according to Serkes, business financing options.

Although it occasionally can be royalty-based, where the partner receives a portion of every product sale, strategic funding acts like venture capital in that it is usually an equity sale - not a loan, the expert continued.

The company you partner with is typically going to be a significant corporation and may even be in a comparable industry or an industry with an interest in your business, so partner financing is a viable choice, business financing options, Business Financing Options.

If your product or service is a compatible fit with what they already offer, which would surely be the case or there would be no incentive for them to invest in you, then you can immediately tap into the larger company's relevant customers, salespeople, and marketing programming, according to Serkes.

Angel investors

There is one noticeable difference between angel investors and venture capitalists that many people overlook. An angel investor is a person who is more likely to invest in a startup or early-stage business that might not have the verifiable growth a VC would expect, as opposed to a venture capital firm, which is typically a large and established organisation that invests in your business in exchange for shares.

Similar to receiving investment from a VC, but on a more personal level, finding an angel investor can also be beneficial, business financing options.

According to Wilbert Wynnberg, a businessman and speaker based in Singapore, not only will they supply the finances, [but] they will typically coach you and assist you along the route. Keep in mind that borrowing money just to lose it later serves no purpose. These seasoned business people will end up saving you a tonne of cash.

Factoring or financing invoices

When you use invoice finance, sometimes referred to as factoring, a service provider advances you cash on your unpaid accounts receivable, which you pay back once consumers have paid their invoices. By doing this, you can ensure that your company has the cash flow it needs to function while you wait for clients to settle outstanding invoices, Business Financing Options.

These improvements, according to Eyal Shinar, CEO of Fundbox, a small business cash flow management startup, enable businesses to reduce the pay gap between billed work and payments to suppliers and contractors, business financing options, Business Financing Options.

Companies can accept new projects more rapidly if the salary gap is closed, according to Shinar. By assuring consistent cash flow, they hope to assist business owners in expanding their enterprises and adding additional employees.

Crowdfunding

Small enterprises may benefit financially from crowdsourcing on websites like Kickstarter and Indiegogo. Instead of looking for a single investment source, these platforms enable businesses to pool small investments from a number of individuals, business financing options.

Igor Mitic, co-founder of Fortunly, said: As an entrepreneur, you don't want to spend your investment alternatives and raise the danger of investing in your business at such a young age. You may raise the initial capital needed to get your firm through the development stage and prepared to pitch investors by using crowdsourcing.

Funds The government may award grants to companies that are involved in science or research. Grants are available through the Small Business Innovation Research and Small Business Technology Transfer programmes of the U.S. Small Business Administration (SBA). Grant recipients must have a strong chance of commercialization and meet federal research and development goals.

Market-based or peer-to-peer lending

Peer-to-peer (P2P) lending is a method of raising finance that connects lenders and borrowers via different websites. Two of the most well-known P2P lending platforms in the United States are Lending Club and Prosper, Business Financing Options.

According to Kevin Heaton, CEO and founder of i3, in its most basic form, a borrower registers an account on a peer-to-peer website that keeps records, transmits cash, and connects borrowers to lenders.

P2P lending, in particular given the post-recession credit market, can be a strong funding alternative for small businesses, according to the SBA. The fact that P2P financing is only accessible to investors in a few states is one disadvantage of this method.

This type of financing, made feasible by the internet, is a cross between marketplace lending and crowdsourcing. When platform lending initially appeared on the market, it enabled those with limited working capital to lend money to peers.

Years later, with their expanded activity, big businesses and banks started to supplant true P2P lenders, Business Financing Options. The phrase marketplace lending is more frequently used in nations with more established financial sectors.

Convertible debt

Convertible debt is when a company borrows money from a group of investors with the understanding that the debt will eventually be converted to equity.

According to Brian Cairns, CEO of ProStrategix Consulting, Convertible debt can be a terrific method to finance both a startup and a small firm, but you have to be comfortable with giving some control of the business to an investor. Until a specific date or an event that triggers an option to convert, these investors are promised a certain rate of return each year.

According to Cairns, another advantage of convertible debt is that it doesn't restrict cash flow while interest is accruing during the bond's duration. This sort of funding has the disadvantage that you give up some ownership or control of your company, Business Financing Options.

What are Business cash advances?

In terms of cost and structure, a merchant cash advance is the antithesis of a small company loan. Cash advances are a rapid way to get money, but due to their hefty costs, they should only be used as a last option. Check with your supplier to see if this might be a source of funding to consider since many of the best merchant services provide this option.

According to Priyanka Prakash, a Fundera loan and credit expert, a merchant cash advance is when a financial institution gives a lump-sum amount of finance and then purchases the rights to a portion of your credit and debit card transactions. The provider takes a tiny percentage of each credit or debit card sale the merchant performs until the advance is repaid, business financing options.

While it can seem easy, cash advances can be very expensive and problematic for your company's cash flow, according to Prakash business financing options. Only then should you think about this choice if you don't meet the requirements for a small company loan or any of the alternatives mentioned.

Microloans

Small loans known as microloans (or microfinancing) are granted to business owners who have little or no collateral. Microloans primarily cover operational expenditures and working capital for equipment, furnishings, and supplies, while they may include restrictions on how you can use the funds, business financing options.

With microloans ranging from $2,000 to $250,000, Kabbage is one example of a small business microlender; read more about it in our Kabbage review. SBA microloans managed by nonprofit organisations are another illustration.

The advantages of nontraditional lending

According to Serkes, there are a few significant advantages for startups when obtaining capital from an unconventional source. She thinks that when a business owner uses alternative financing, they have a strong, committed partner who can connect them to new customers, analysts, media, and other relationships.

Market credibility: Working with a reputable investor gives the business the opportunity to borrow some of the reputation that the strategic partner has developed.

Help with infrastructure: The bigger partner probably has departments for marketing, IT, finance, and HR, all of which a startup may borrow or use at a discount, business financing options.

General business advice: As part of the investment, it's possible that the strategic partner will join your board. Keep in mind that they have a wealth of business expertise, making their counsel and perspective priceless.

A strategic partner is unlikely to be heavily involved in the startup's day-to-day operations because they still have their own businesses to run. They often only need periodic check-ins on your firm, such monthly or quarterly updates.

To succeed, every firm needs working money. Startup businesses are prone to failure without the proper business funding choices. It may seem impossible to avoid using a typical bank loan, but entrepreneurs have access to a wide range of small company funding solutions.

The likelihood that your firm will endure over the long term is increased by collecting the appropriate market data and putting into practise the best financing solution for your organisation.

How should small businesses get ready to submit an application for alternative loan options?

Filling out an application is only one part of the funding application process. Small business entrepreneurs should conduct their research and have a plan in place to improve their chances of receiving financing, business financing options.

Be aware of how much you must borrow beforehand. When you apply for alternative business loans, you'll probably discover that there are many various loan amounts accessible, business financing options. Avoid taking out more debt than you really need to because there could be fees associated with early repayment or not making use of the entire amount.

Create a company strategy with projected financials. Although not all alternative financing sources will insist on seeing your business plan, many do, so you should start putting one together right away.

Do market research and understand the business environment in your sector. In expanding industries, lenders might be more likely to approve borrowers.

As a result, if you can demonstrate why your industry or target market is ideal for your company's growth and success, make sure to address this in your application, business financing options. Additionally, it exhibits your expertise as a business thinker and entrepreneur.

Understand your credit score

Even if your business is well-positioned for quick growth and you're making progress on loan repayment, a credit score below a particular threshold frequently results in an immediate disqualification for loan applications, business financing options. Before requesting funding, find out your credit score and take steps to raise it if it is too low.

Meet with a small business specialist and go to SBA-sponsored training. You shouldn't make this decision alone, as you should with any crucial small business choice, business financing options. Get advice from professionals and training on how to submit winning financing applications to grow your business.

Since lenders will also be looking at this data, you should build a strong online presence for your small business and pay attention to how it appears online, business financing options. Online review platforms like Yelp, Angie's List, and TripAdvisor provide an overview of your operations and act as a gauge for the health of your company as a whole. Social media ties with customers and social connections can influence a lender's choice to extend credit.

How can you identify choices for company financing?

Finding funding for your startup can quickly become a full-time job. Financing is essential to the success of any firm, but it can take a lot of time, including networking with investors and other founders.

However, you may take significant steps toward funding your business by engaging with the appropriate investors and spending the time to craft a focused proposal. It will be challenging, but if you are thorough in your search, you can set yourself up for success.

Casey Berman, managing director of VC firm Camber Creek, asserts that the warm introduction is the secret to getting finance as a business. Entrepreneurs can try to uncover opportunities by looking within their own network, according to Berman, business financing options.

While there are some obvious options here, such as friends and family or other startup founders, it's also critical to take into account the professional services your business uses, business financing options. He explained that if you, for instance, work with a legal advisor or public relations firm, they might be able to assist you in finding money.

The secret, according to Berman, is to collaborate with a business that offers value to your enterprise, whether it's an investment firm or a payroll processing provider.

The friendly introduction actually goes a lot further than any other possible route, he claimed. The first place a company turns to try to get access to venture capital and a friendly introduction should unquestionably be any professionals who are around the company.

This is how you can set your startup apart from the competition. The greatest way to provide your firm with the support it needs is to create a network of people who can lift it up, business financing options.

How to find a venture capitalist to finance your business?

Because venture capitalists have extremely precise investment plans, want to invest for three to five years, and may want to be involved in your company's operations and choices, they may be the hardest to attract, business financing options. Additionally, VCs typically like to invest sums greater than a few million dollars.

The majority of firms receive early seed money from close friends and relations, angel investors, or accelerators. When looking for longer-term finance after moving passed this stage, it's critical to approach VC firms properly. Finding the appropriate investor for the stage your organisation is in, according to Kisch, is essential business financing options. There are a lot of venture capital businesses, so carefully consider your company and the best investors.

The greatest approach to have a successful connection, in Kisch's opinion, is to find the right investor who is at the proper stage for where your company is but [that] also has some exposure to the environment that you're going to be in.

It's time to establish a formal process once you've created a shortlist of venture capitalists (VCs) who invest in your industry and can offer the amount of coaching and additional value you're looking for, business financing options.

Berman advises spending one to two weeks attempting to make that initial contact with the company after you have your list in hand. After making contact, keep the business informed of any business advancements and other details that might be important to that investor, business financing options.

You may cultivate relationships with investors by having this constant conversation. You'll have to pitch the VC firms you've been in frequent contact with when it comes time to raise funds.

In order to locate the ideal partner, Berman advised, the CEO really needs to commit to raising money and executing what's called a roadshow to get in front of a big number of venture funds.

Plan ahead, said Berman, as the entire process from the first conversations to the final deal could take anywhere between 60 and 90 days, if not longer, business financing options. Additionally, he advised searching for money far in advance of your company's requirement.

How to remain inspired throughout the financing process?

The motivational factor plays a significant role throughout this procedure. Rejection is a necessary part of the path for a startup. Although it can be challenging, maintaining motivation during challenging times will be essential to the success of your company, business financing options.

Kisch has worked with several startups and has participated in five rounds of investment. He mentioned that he sought to have low expectations throughout the screening process so that rejection wouldn't overwhelm him as one thing that had been beneficial for him. Kisch views rejection as a necessary step in the process rather than a sign of failure.

He advised thinking of it this way: You're not being rejected because your concept or product is poor; rather, it can be somewhat enhanced, or you lack the expertise to present it in the most persuasive manner, business financing options. This prevents pressure from building up while keeping the responsibility in your hands. Everything is a labour in progress, and even the most prosperous businesses today formerly faced difficulties.

Investing in private equity for small businesses

According to Brian Cairns, CEO of ProStrategix Consulting, the first step for small businesses considering their financing alternatives is to differentiate between debt and equity funding. In contrast to equity funding, which is buying a stake in the company or a portion of the earnings, debt financing involves taking out a loan, business financing options.

Securing funding is particularly appealing for many entrepreneurs because it leaves no liabilities on the balance sheet. The main benefit of equity financing, according to Cairns, is that it has little to no impact on cash flow. Giving up some company control is the primary drawback.

In essence, private funding sources are non-bank lending sources. Family members, angel investors, venture capitalists, or private lending organisations can all be considered. It is a source of funding that a business owner can use to finance operations, expand their company, and take care of cash flow requirements. Small enterprises that might not normally be eligible for a bank loan benefit from the assistance of private finance sources.

Venture capital

Venture capital (VC) companies make financial investments in start-ups, typically in return for stock in the business. Before investing in a portfolio firm, venture capitalists evaluate business strategies, financial statements, and other financial information to estimate the overall expected return on investment.

Since VC firms often want to exit within five years, companies are more likely to obtain venture financing if they have an immediate possibility for growth, according to Cairns. They seek quick expansion since it will increase valuation.

Due to the significant risk associated with such fast-growing businesses, VCs demand a substantially larger return on investment from their portfolio companies than do other private equity firms.

Additionally, venture capitalists frequently offer mentoring, access to sales networks, and other development possibilities to start-up businesses.

Searching for more than just money is crucial if a company is looking for private capital, Berman added. The money may be more expensive in many cases than bank debt. However, the benefits of such cooperation much outweigh the disadvantages of a low interest rate.

Working with a VC firm has the drawback of requiring you to give up a portion of your company, just like any lender seeking equity does. Additionally, it implies that when your company develops and changes, you will have a third party to answer to.

Angel or seed funding

Angel investors finance companies in a similar manner as venture capitalists, typically in exchange for shares in the business. However, unlike venture capitalists, angel investors are private individuals who put their own money into the business.

Angel investors are better suited for slow-growth businesses since they have various ROI needs based on their level of risk tolerance. On the other hand, according to Berman, some venture capitalists anticipate annual growth of 100%.

An angel investor will arrange a deal differently than a venture capitalist, a private equity firm will structure a deal differently than an angel investor, and so on.

Mezzanine Capital: What Is It?

Consider what it would be like to be the lender for a time. The lender seeks to obtain the greatest possible return on its investment with the least amount of risk. Debt financing has the drawback that the lender is not rewarded for the company's performance.

It assumes the risk of default in exchange for nothing more than its money back with interest. By investing standards, that interest rate will not offer a particularly strong return. It's likely to provide returns in the single digits.

The best aspects of equity and debt financing are frequently combined in mezzanine capital. Debt capital typically offers the lending institution the right to convert the loan into an equity interest in the firm if you do not repay the loan on time or in whole, though there is no defined framework for this sort of business financing.

Off-Balance Sheet Financing

Consider your own financial situation for a moment. What if you found a way to establish a legal entity that removes your credit card, school loan, and auto loan debt while you were applying for a new home mortgage? Businesses are able to do that.

Financing that is off-balance sheet is not a loan. It primarily serves as a means of keeping significant investments (debts) off a company's balance sheet, making it appear stronger and less indebted.

For instance, if a business required expensive equipment, it might lease it rather than buy it or set up a special purpose vehicle (SPV) ,one of several alternative families that would carry the acquisition on its balance sheet. In order to make the SPV appear appealing in the event that it needs a loan to service its debt, the sponsoring firm frequently overcapitalizes the SPV.

Family and Friends' Support

If your finance requirements are modest, you might wish to start by looking at less formal lending options. Family members and close friends who support your company can provide favourable and clear repayment terms in exchange for creating a loan model that resembles some of the more formal types. For instance, you might give them equity in your business or repay them through a debt financing arrangement in which you make recurring payments with interest.

What are the Additional private funding options?

Personal investment: Some business owners might prefer to avoid taking on debt; instead, they utilise their savings (or sell an asset like a car) to get started. Some people dip into their retirement funds. It can be dangerous to use your own savings because you could lose them all if your business doesn't work out, business financing options.

Family and friends: Financial support from family or friends may come in the form of a gift, a loan, or an equity position in your company. But be cautious. If the investment doesn't work out or you can't pay back the loan, it could lead to enduring conflict with your loved ones.

Term loans and lines of credit are popular with small business owners. With a term loan, you make a fixed monthly payment to a bank, credit union, or online lender, business financing options. With a line of credit, you can draw money as you need it. How much money you can borrow and at what interest rate depends on your credit rating, number of years in business, and sales volume.

Crowdfunding: Entrepreneurs can raise money for their ideas on a number of crowdfunding websites. On websites like Kickstarter or Indiegogo, investors put money up front in exchange for their assistance in bringing products to market, business financing options.

Typically, the businesses give incentives in exchange for contributions. Although crowdfunding won't make you rich, it can also be used to gauge public interest in your idea.

Alternative financing: Small business entrepreneurs have access to other private funding options from lenders besides term loans and lines of credit. Microloans and merchant cash advances are further choices, business financing options.

Lenders provide money to a business owner in exchange for future sales through a merchant cash advance. Microloans are small loans for businesses that aren't likely to be approved by banks and other traditional lenders. They typically range from $50,000 to under $50,000.

Advantages and disadvantages of private funding:

The use of private lenders has both benefits and drawbacks. Although you might have quicker access to money, the interest rate might be higher, and your payment schedule might be difficult, business financing options.

Advantages of private financing: Small firms benefit greatly from private funding sources' more lenient lending criteria and prompt funding.

The money arrives in your hands much quicker than with bank loans. Bank loans often have drawn-out approval procedures. Usually, private funding choices don't follow the same rules, business financing options.

The additional advantage of being able to seek guidance from individuals who have seen it all exists if you use a venture capitalist or angel investor. Angel and venture capitalist investors frequently have extensive business management experience. When it comes to expertise and resources, they have a lot to give, business financing options.

Cons of private financing

Private business loans are not free; they have a cost. Private-sector loans could have a unique rate structure, extra fees, and other expenditures that aren't common with bank loans. Before signing the loan agreement, Goldenberg highlighted the necessity of reading and understanding it.

Attorneys' fees, collection costs, and other significant fines may be imposed on an account that goes into default, according to some agreements, he said. Some lenders even go as far as asking the borrower to sign a confession of judgement, which would enable the court to quickly rule against the borrower in the case of default without a trial.

Venture capitalists or angel investors might include these terms and conditions in their agreements, and you're more likely to find them in contracts from online private lending institutions.

Additionally, private lenders may have stricter payment terms than a conventional bank loan. Consider the advantages and disadvantages before deciding whether private funding is the best choice for your company.

Additional loan application guidance

Networking is likely to be the key to obtaining a loan from an angel investor or venture capitalist. Although some businesses approach startups, it's a good idea to network and look for investors if you're establishing a business.

Along with conventional short- and long-term loans, if you need money right away you might be able to receive a merchant cash advance, where a lender gives you money against credit card receivables. Depending on the lender you choose, you might not receive the same level of mentoring and care as you would from angel or venture capitalists.

What do small companies do before approaching investors?

Small enterprises that are able to avoid debt may prefer equity finance, but it has the significant drawback of giving up control. However, few small businesses have the credit history or adequate assets to obtain a bank loan.

Small business owners may find alternative internet and fintech lenders to be excellent sources of capital. They offer high-interest, short-term business loans to business owners who want to get money quickly for expansion. However, the main attraction of these lenders is their adaptability.

Like angel investors or venture capital firms, alternative lenders hardly ever demand stock. Instead, they offer loan agreements that are similar to those offered by traditional banks but typically have higher interest rates and considerably more flexible qualification standards.

Invoice factoring, merchant cash advances, lines of credit, and equipment leasing are just a few of the several loan packages and types offered by alternative lenders. Alternative lenders are sometimes the most practical choice for businesses because of their flexibility.

High interest rates and sometimes onerous loan agreements are disadvantages of alternative lenders. Because of this, despite the fact that these loans may be simple to apply for, they work best for companies that have the cash flow to pay back short-term loans.

In comparison to venture capitalists, angel investors, traditional banks, and loans through the U.S. Small Business Administration programme, alternative lenders have the strictest loan terms and agreements. Although this may be a wonderful source of funding, it's crucial to consider the entire risk to your company.

Obtained debt financing

Given that both demand proof of future payback, the counsel for persuading lenders and investors is not dissimilar. Venture capitalists are said to invest more in people than in their ideas, according to a common belief. The same is true for small business lending, according to Alex Kaschuta, Fundsquire's lending manager.

Kaschuta bases her assessment of what she refers to as investability on the manager's reliability, the way they handle their business, and their expertise in the sector.

When it comes to the most typical pitching errors, Kaschuta, like Richardson, is frequently challenged with TMI.

Knowing what you need the money for and which lender makes the most sense for you to work with will help you choose the best sort of financing for your company. A VC firm can provide you with the direction you need to launch your new business. Alternative lenders are the finest choice for quick, expensive loans for any kind of company.

The greatest approach to acquire money, regardless of the kind you require, is through networking and building relationships with different types of investors. After focusing on a select handful, you can associate with the most advantageous one for your company.

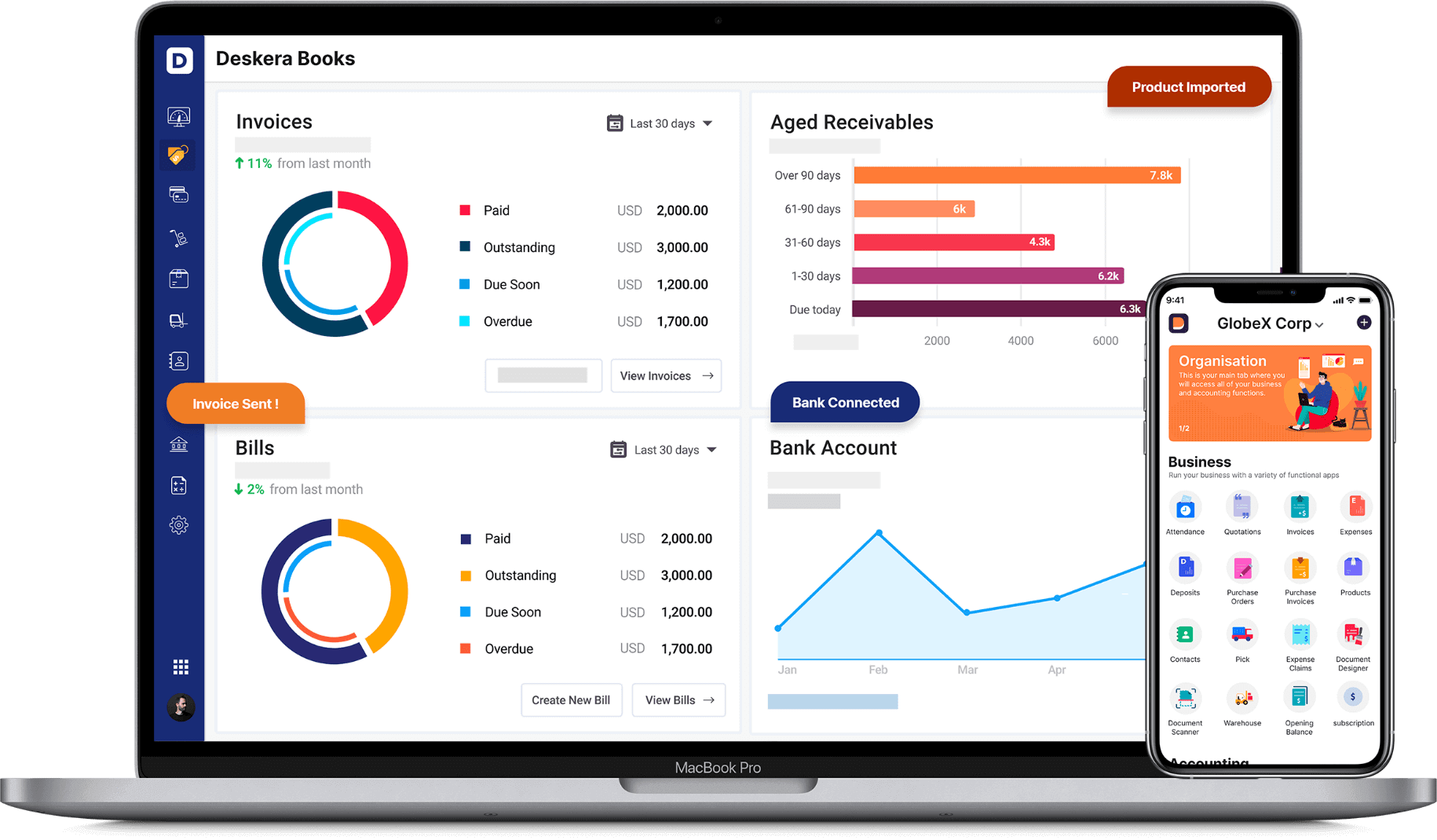

To manage your costs and expenses you can use many available online accounting software.

How Can Deskera Assist You?

Deskera Books can help you automate your accounting and mitigate your business risks. Creating invoices becomes easier with Deskera, which automates a lot of other procedures, reducing your team's administrative workload.

Key Takeaways

- You'll undoubtedly need access to funds someday through business financing unless your company has Apple's balance sheet. Even a lot of large-cap businesses frequently look for cash to cover short-term needs.

- Finding an appropriate funding arrangement is crucial for small businesses. If you borrow money from the incorrect source, you risk losing a portion of your business or being subjected to repayment terms that will hinder your growth for many years to come.

- But for those with bad credit, financing a start-up or small business can be a challenging, protracted procedure. Although there is no minimum credit score required to obtain a business loan, conventional lenders typically have a range they deem acceptable.

- For instance, a borrower's accounting may be badly impacted by personal or family illness problems and job losses, yet each of those might be justified. Additionally, compared to a regular bank, CDFI lenders do not require nearly as much security. Lack of collateralized assets can be made up for in other ways.

- There is one noticeable difference between angel investors and venture capitalists that many people overlook. An angel investor is a person who is more likely to invest in a startup or early-stage business that might not have the verifiable growth a VC would expect, as opposed to a venture capital firm, which is typically a large and established organisation that invests in your business in exchange for shares.

- When you use invoice finance, sometimes referred to as factoring, a service provider advances you cash on your unpaid accounts receivable, which you pay back once consumers have paid their invoices. By doing this, you can ensure that your company has the cash flow it needs to function while you wait for clients to settle outstanding invoices.

- Be aware of how much you must borrow beforehand. When you apply for alternative business loans, you'll probably discover that there are many various loan amounts accessible. Avoid taking out more debt than you really need to because there could be fees associated with early repayment or not making use of the entire amount.

- Consider what it would be like to be the lender for a time. The lender seeks to obtain the greatest possible return on its investment with the least amount of risk. Debt financing has the drawback that the lender is not rewarded for the company's performance.

- It assumes the risk of default in exchange for nothing more than its money back with interest. By investing standards, that interest rate will not offer a particularly strong return. It's likely to provide returns in the single digits.

- Knowing what you need the money for and which lender makes the most sense for you to work with will help you choose the best sort of financing for your company. A VC firm can provide you with the direction you need to launch your new business. Alternative lenders are the finest choice for quick, expensive loans for any kind of company.

Related Articles