Your employees can come across unexpected financial emergencies at any time, and they can claim a 401(k) hardship withdrawal for financial gaps that are not covered by their sources of income.

Did you notice the massive rise in 401(k) hardship withdrawals during 2020?

Owing to the financial crunch that many faced during the COVID-19 Pandemic, many employees were forced to ambush their retirement savings, and use the funds. The new rules to acquire and manage 401(k) hardship withdrawals also got simplified to facilitate emergency payments.

Did you know that:

- Half of the American citizens with severance pay accounts have applied for an early 401(k) hardship withdrawal

- According to a Bankrate study, the majority of Americans jump into their retirement accounts before the golden age

- According to the survey, a whopping 51% of account owners reported early 401(k) hardship withdrawal. This includes 20% during the Covid 19 pandemic. The survey was conducted in October 2022 on a sample of 2,225 American adults

- Gen Z is using its savings at the highest rate. Only 18% withdrew early before the pandemic, while 40% said they withdrew during or after March 2020

- Baby boomers were most likely to keep their accounts pristine in Covid. 34% withdrew early before the pandemic, but only 6% did so during or after March 2020

Managing hardship distribution can be a nightmare for employers if proper procedures and administration are not followed. Advisors recommend employees reserve their 401(k) hardship withdrawal for retirement, but with the ease and feasibility of accessing these funds, many employees use the facility for expenses like medical, home loan closures, burial expenses, etc.

This account is generally used to meet "urgent and important financial needs", and before employees apply, they must qualify for it.

Table of Contents

- What is a 401(k) hardship withdrawal?

- Penalty on 401(k) hardship withdrawals

- Eligibility for 401(k) hardship withdrawals

- Some rules regarding immediate and heavy financial needs and 401(k) hardship withdrawals

- The Employer's role

- Taxes affecting a 401(k) hardship withdrawal

- Other Emergency sources of funds that can be used to meet your needs

- Can you get a 401(k) hardship withdrawal from the IRA?

- 401(k) Hardship Withdrawal vs. 401(k) Loan

- 401(k) Hardship Withdrawal rules and limitations

- How to document 401(k) hardship distributions

- Where should employers keep information on 401(k) hardship withdrawals for employees?

- The relevance of maintaining proper documentation for 401(k) hardship distributions

- What happens if any mistakes are made during the distribution process?

- The disadvantages of taking a 401(k) hardship withdrawal

- What does the 401(k) hardship withdrawal process look like?

What is a 401(k) hardship withdrawal?

The 401(k) hardship withdrawal is an optional financial benefit offered by employers. It is also known as the hardship distribution and is like an employer-sponsored retirement fund (which is generally acquired post-retirement). IRS states that this fund can be acquired before employees reach the age of 59.5 only in case of emergencies and must be approved at the discretion of the plan provider.

Penalty on 401(k) hardship withdrawals

You must note that 401(k) hardship withdrawal can be subject to a 10% withdrawal penalty in addition to the applicable taxes. Here are the conditions in which a penalty should/should not be paid by the employees for using their 401(k) hardship withdrawals:

|

Withdrawal type |

10% penalty |

|

Medical expenses |

No (provided if expenditure exceeds 7.5% of AGI) |

|

Permanent disability |

No |

|

Substantial equal periodic payments (SEPP) |

No |

|

Separation of service |

No |

|

Purchase of principal residence |

Yes |

|

Tuition and educational expenses |

Yes |

|

Preventing foreclosure or eviction |

Yes |

|

Funeral costs or Burial |

Yes |

Eligibility for 401(k) hardship withdrawals

Internal Revenue Services (IRS) defines the eligibility for 401(k) hardship withdrawals as immediate and emergency financial needs which can be availed not only by employees but also for their spouses, dependents, or beneficiaries.

What are immediate and heavy financial needs eligible for 401(k) hardship withdrawals?

These include:

- Certain medical expenses

- Housing Activity Edition for Main Residence

- Tuition and fees for up to 12 months

- Expenses to prevent eviction or foreclosure

- Cost of funeral or burial

- Some of the costs for the repair of accident losses (such as fire, earthquakes, or loss due to flood)

If the employees have other assets/insurance to cover the above-mentioned expenses, then the 401(k) hardship withdrawal will not be applicable. According to the Bipartisan Budget Act passed in 2018, it isn’t necessary to cover the need through a loan from the plan before applying for the 401(k) hardship withdrawal.

For 2020, there were other reasons to retrieve 401(k) hardship withdrawal under the CARES Act – which was getting financially affected due to COVID 19. According to the Tax Cuts and Jobs Act, these emergencies will not be tax-deductible from 2018 to 2025, except for specified federal disaster areas. The act also reduced the personal threshold for more than 7.5% of the adjusted gross income (AGI) in case of medical expenses in the years 2017 and 2018. From 2019 onwards, this threshold increased to 10% of AGI.

Let us look at these emergencies in detail:

1. Medical Expenses

Participants can utilize 401(k) hardship withdrawal for medical expenses provided the amount to pay is not covered by their health insurance. If the medical invoice exceeds 7.5% of the individual, of the AGI, then even the 10% tax penalty is omitted. To avoid penalty rates, 401(k) hardship withdrawal must be conducted in the same year that he has been treated.

2. Proving a Disability

If you are disabled in a "total and permanent" condition, it will be easy to access your 401(k) hardship withdrawal account. In this case, the government makes it possible to get funds without penalty. The employees must prove the disability. Independent payments from social security or insurance operations are usually enough, but your doctor's verification is often required for disability.

3. Other reasons for Withdrawals

You can approve 401(k) hardship withdrawal for your employees as stated under the US tax law, for purchasing primary apartments, paying tuition and fees, or other educational expenses, prevention of foreclosure or prosecution, and the cost of a funeral. It is recommended to consider other options before applying for 401(k) hardship withdrawal if the employees do not reach the age of 59.5. This is because this invites a 10% penalty for acquiring the emergency funds and payment of regular tax payments on this income.

4. Separation of Service

People who retire or lose their jobs at the age of 55 can use 401(k) hardship withdrawal money from funding plans. Under the decisions known as "separation from services", employees can take an early 401(k) hardship withdrawal without worrying about the penalty. However, they will still be subject to paying income tax. If there is a ROTH version of 401(k) hardship withdrawal, there would be no tax liability as they have already been contributing to the plan with post-tax dollars.

5. 401 (k) Loan

A 401 (k) Loan is quite different from a 401(k) hardship withdrawal. According to the IRS, the 401 (k) loan can be taken for up to 50% of their 401(k) hardship withdrawal amount, or up to $ 50,000 (whichever is less). One of the benefits of 401(k) loans is that they are not forced to pay income taxes in the same year or a penalty on the same.

However, be aware that they must repay the loan with interest within 5 years (check that their retirement fund is not exhausted) from October to October of the following year

6. SEPPs When You Leave an Employer

If you leave your employer, the IRS allows employees to receive a virtually equivalent recurring payment (SEPP) exemption, but it's not technically a 401(k) hardship withdrawal. An important caveat is to make these regular withdrawals for at least five years, or up to the age of 59 and a half years, whichever is longer. This means that if you start receiving payments at the age of 58, you will have to continue paying until you reach 63.13. As such, this is not an ideal strategy for meeting short-term financial needs. If you cancel your payment before five years, the previously exempted penalty will be due to the IRS.

Calculating the Withdrawal Amount

There are three different ways you can choose to calculate the value of 401(k) hardship withdrawal:

- Fixed amortization, fixed payment schedule

- Amount based on a fixed annuity, pension, or life expectancy

- Required minimum distribution (RMD), based on the fair market value of the account

A trusted software or a professional financial adviser can help you decide which method best suits your needs. Regardless of which method you use, you are responsible for paying taxes on all income in the year of withdrawal, regardless of interest or capital gains.

Some rules Regarding Immediate and Heavy Financial Needs and 401(k) hardship withdrawals

Employers can identify emergency distribution, and difficult economic requirements based on all relevant facts and situations. It can be predictable and arbitrary cases and financial needs for which the 401(k) hardship withdrawal is helpful. The IRS has laid out some important rules regarding this:

- Medical expenses considered would be deductible under Code Section 213(d), without regard to the limitations in Code Section 213(a). If the medical recipient is not listed in Code Section 213 (A), the recipient is the main beneficiary within the planned frame

- Costs directly related to the purchase of the main residence of employees (except for the payment of mortgages)

- According to Code Section 152 without regard to Code Section 152(b)(1), (b)(2), and (d)(1)(B)), or for a primary beneficiary under the plan, expenses related to spouses, children or dependents in the form of tuition fee for education, tuition payments, related educational fees, and rooms and board expenses

- According to Code Section 152 without regard to Code Section 152(d)(1)(B)), or for a deceased primary beneficiary under the plan, to pay for funeral or burial expenses for parents, spouses, children, or dependents under the plan

- Code section 165 refers to the repair of any kind of damage done to the primary residence of the employee. (regardless of code section 165 (H) (5), and regardless of 10% of AGI)

- According to the Robert T. Stafford Disaster Relief and Emergency Assistance Act, Public Law 100-707, any kind of loss or disaster according to the Federal Emergency Management Agency (FEMA) is covered and extended using general applicability guidance

Source of funds for withdrawals

This plan allows you to fund employee contributions, using employer-qualified nonelective contributions (QNECs), employee contributions, and qualified matching contributions (QMACs). However, to enable 401(k) hardship withdrawal, employers should not use any of these sources.

6 Month Suspension rule removed

According to Code Section 401(a), 403(a), 403(b), or 1.457-2(f), for acquiring the 401(k) hardship withdrawal, before January 1, 2020, there was a need for a plan to suspend employee contributions for six months following 401(k) hardship withdrawal, but this requirement has been removed.

The Employer's role

The conditions under which 401(k) hardship withdrawal can be made are determined by the provisions of the plan document, the proof submitted, and the rules and regulations stipulated by the IRS for 401(k) hardship withdrawals. You are encouraged to review the plan document and the rules of hardship and be prepared to handle the increased 401(k) hardship withdrawals request.

- A Summary Plan Description Agreement (SPD) should be prepared and submitted, which should be professionally percolated to the human resources at your workplace. The SPD contains information about when and under what circumstances you can withdraw from your 401(k) hardship withdrawal account, also using a written explanation

- Employers also have an option to rely on 3rd party administrators to confirm the 401(k) hardship withdrawal. Many employers who don’t cater to 401(k) hardship withdrawal in their employment regime can consider adding the same

- As employers, you are advised not to encourage these 401(k) hardship withdrawals as many invite a 10% penalty, irrevocable taxes on income, and a lack of retirement funds for your employees

Taxes affecting a 401(k) hardship withdrawal

Employees are required to pay taxes on the amount they receive in the form of 401(k) Hardship Withdrawal payments. In addition to the usual income tax, they may also have to pay a 10% penalty.

Few exceptions to avoid the 10% penalty:

- Physically disabled

- The medical debt exceeds 7.5% of AGI

- A court order requires him to give money to his ex-spouse, child, or another dependent

As employees, if you are not eligible for the penalty exemption, then technically, you spend $ 0.30 on taxes for every $ 1 you withdraw. For example, if you withdraw $ 1,000, you may only get $ 700 after tax.

Other Emergency sources of funds that can be used to meet your needs

In a case where the penalty is applied to 401(k) Hardship Withdrawal, it's best to use other sources of funds or assets first. Use a 401(k) Hardship Withdrawal only if it's your last option. To qualify as a difficult case, you need to file a case with your 401(k) Hardship Withdrawal plan administrator. In most cases, they can easily find out if your situation is considered difficult. Some 401(k) Hardship Withdrawal plans may need to provide some form of documentation. Ask your 401(k) Hardship Withdrawal plan provider what you need as proof of difficulty.

Many people are unaware that their 401(k) Hardship Withdrawal money is protected from creditors and bankruptcy. Don't cash your 401(k) Hardship Withdrawal plan if you're facing financial problems and you think you might file for bankruptcy. Your employer will not be able to accept your 401(k) Hardship Withdrawal plan money. Borrowing money may be better than making a difficult 401(k) Hardship Withdrawal.

Can you get a 401(k) hardship withdrawal from the IRA?

The IRS does not allow a 401(k) Hardship Withdrawal from the IRA. IRA owners can withdraw money at any time but are penalized with a 10% penalty if they are under the age of 59 and a half. The exceptions to retrieving funds from your IRA are to pay for educational expenses or to pay for your first primary residence.

401(k) Hardship Withdrawal vs. 401(k) Loan

You can borrow funds from your 401(k) Hardship Withdrawal bulk through a 401(k) Loan which needs to be repaid within 5 years. The interest you pay will return to your account. You're not paying taxes on 401(k) Loans if your loan meets a certain standard.

- Loans are typically covered by half your 401(k) Hardship Withdrawal balance or $ 50,000, and both principal and interest are paid to your retirement account, but you must repay them in interest. It's also worth noting that the CARES Act has raised the borrowing limit from $ 50,000 to $ 100,000. When you default on making a payment, the loan is converted to a 401(k) Hardship Withdrawal with almost the same result as it originated

- 401(k) loans should be repaid along with interest to prevent penalties

- Approximately two-thirds of a 401(k) Hardship Withdrawal also allows for effortless exits. However, this option does not immediately fund urgent needs. Rather, withdrawals can transfer funds to another investment opportunity. However, you can consult your tax or financial advisor to see if this option suits your needs. When considering difficult payments or other steps to receive money immediately, it is wise to seek expert advice to consider your options

- 401 (k) loans can be used for a wider range of purposes than 401(k) Hardship Withdrawal payments. IRS indicates that 401 (k) loan amounts are limited to 50% of the balance of 401(k) Hardship Withdrawal account balances or $ 50,000. In a typical circumstance, the 401 (k) loan must be repaid-with interest rates for five years, but this timeline extends if it is used to buy a house. If the loan has not been completely paid by the due date, IRS treats the remaining debt as a 401(k) Hardship Withdrawal

401(k) hardship withdrawal rules and limitations

1. Safe harbor distributions

As discussed above, if you retrieve funds from 401(k) hardship withdrawal under the 6 reasons (as specified by the IRS), they will be considered as “safe harbor distributions”. As a recap, these include medical costs ( of self, spouse, children, or dependents), tuition fees, or other related educational expenses, purchase of a principal residence, payments to prevent foreclosure or eviction, funeral expenses, and house repair expenses about damage due to calamity or any sudden reason.

2. How much to withdraw

You can withdraw according to your need. The amount is the total of funds required for financial needs plus penalties and taxes. With recent reform, the maximum withdrawal is according to a large portion of the 401 (k) or 403 ( B) plan. According to the old rules when claiming difficulties, you could only deduct your deferred contributions (the amount you withheld from your wages) from your plan. The rules of 401(k) hardship withdrawal also say that you couldn't make a new contribution to your plan for the next six months.

3. Other requirements and restrictions to note

When applying for a 401(k) hardship withdrawal, the employee must prove that he has exhausted all other available means and receives only the exact amount he needs. However, you can include the amount of tax and penalty deductions for distributions. There is no clear limit on the number of withdrawals an employee can receive in a year, but only one is approved and enough funds to cover the withdrawal to a 401(k) hardship withdrawal Is limited.

- Also, some 401(k) hardship withdrawal plans may have more stringent guidelines than the IRS. This means that if an employee has the qualified hardships defined in the IRS but does not follow the planning rules, the hardship payment request will be rejected

- Combining this information with the fact that participants are not allowed to repay the money raised by the benefits of 401(k) hardship withdrawal, most financial professionals recommend avoiding this possibility as much as possible

- Plan providers can choose to add more to the IRS's requirements. Each plan has its own set of rules, so employees who need a hardship deduction should check the benefits manager or 401(k) hardship withdrawal plan document for more details

4. Taking hardship withdrawals from old 401(k) accounts

Not all 401(k) hardship withdrawal plans offer withdrawals. Similarly, your plan may not allow dismissed employees to claim rewards for 401(k) hardship withdrawal.

How to document 401(k) hardship distributions

The 401(k) hardship withdrawal seems easy to understand in theory, but in practice, they are surprisingly difficult to navigate. Be careful when evaluating each request, as employees may try to adapt the rules to their needs. The IRS states that "the plan manager needs to have enough information to make a billing decision." That is the employee must provide proof of reasonable difficulty for the application to be approved. Your words alone are not enough for the IRS to decide to conduct an audit.

The problem is that the agency has not defined the required evidence. This means that you must use your best judgment. Because all situations are different, the documents you need are different. If employees need to include medical expenses, their source documents, medical care, treatment provider's clinics, their names and addresses, medical expenses not eligible for insurance, plus you need other documents that may need to justify your request. You, as an employer are expected to collect the following form of documentation for each difficult distribution application.

- Documentation of difficult requests including your review and approval

- Documents to support employee's economic needs

- Documentation to indicate that deductions follow rules and IRS rules

- Proof that payments were made to employees and reported in Form 1099-R

Where should employers keep information on 401(k) hardship withdrawals for employees?

Employers must provide all the information related to 401(k) hardship withdrawals directly to employees and should include it in the employee's manual. Additional details to be posted are:

- The definition of the 401(k) hardship withdrawals (the main reason)

- The procedure in which the request for 401(k) hardship withdrawals is made by the employees

- Employers need to document the request correctly along with additional information that should be supplied by the employees (bills/invoices/statements etc.)

- Other frequently asked questions in connection with this advantage

- New laws can emerge and change the rules and guidelines of 401(k) hardship withdrawals as they did in the years 2018 and 2020

- Employers are required to update the guidelines for 401(k) hardship withdrawals plans before the start of every financial year. These should further be percolated by all plan participants accordingly

The relevance of maintaining proper documentation for 401(k) hardship distributions

It is the organization's responsibility to ensure that 401(k) hardship distribution planning procedures are followed and that proper documentation is maintained even if you outsource benefits management and human resources.

- Employers must keep records, collect and store the paperwork submitted by each employee; in case the IRS conducts an audit

- If you outsource benefits management, make sure your company adheres to planning policies and always has access to documentation

- If the IRS conducts an audit and finds that the company does not maintain proper documentation, the IRS may disqualify the company's pension system and terminate the company's tax incentives. This means that employees will be taxed for their contributions and any contributions you make to your employees’ plans will not be tax-deductible

What happens if any mistakes are made during the distribution process?

Plan failures are inevitable because the 401(k) hardship distributions plan is packed with rules and regulations. For this reason, the IRS has dedicated an entire page to helping employers to fix errors. If you encounter an error, you should fix it as soon as possible from the IRS website. Otherwise, if the IRS discovers this during the audit, the IRS may disqualify your plan and you will lose the relevant tax incentives. The error must then be corrected before the agency can resume planning.

Visit the IRS website for solutions to other common 401(k) hardship distribution plan errors. In difficult times, it's easy to give up future benefits for immediate relief. However, because of the risks associated with a difficult 401(k) hardship distributions withdrawal, this option should only be considered in the case of serious financial distress. Whenever possible, advise your employees to work with a financial adviser to find an alternative to their situation.

The disadvantages of taking a 401(k) hardship withdrawal

Besides the possibility of a 10% penalty, employees cannot return the amount of money they earn through 401(k) hardship withdrawal, even if they have the resources to do so. This is due to the annual contribution limit imposed on these retirement plans.

For example – an employee needs to withdraw $ 50,000 from their account. The 2021 tax year has a maximum contribution of $ 19,500, and if his age exceeds 50, an additional $ 6,500 can contribute, for a total of $ 26,000 per year.

- Even if you maximize your 401(k) hardship withdrawal for the year, at that rate it will take two years for workers over the age of 50 to exchange their funds, and three years for those under the age of 50

- Next In addition, employees claiming 401(k) hardship withdrawal may sell their investments in declining markets or miss compound interest profits

- When funds are withdrawn, employees lose potential future income

- Employees should be educated about these shortcomings and they should be encouraged to consider other options (such as traditional loans or 401 (k) loans if offered) before making a 401(k) hardship withdrawal

What does the 401(k) hardship withdrawal process look like?

- Step 1 - You (or the plan manager) will provide employees with the appropriate documentation to complete

- Step 2 - Apply along with the relevant documents

- Step 3 - The plan manager reviews the employee's planning and 401(k) hardship withdrawal forms, as well as all support documents, to ensure that his or her application complies with the 401(k) hardship withdrawal planning rules

- Step 4 - If the application is approved, employees receive the desired money

This process may take several weeks from beginning to end but will eventually vary depending on the plan. Employees will continue to contribute to the 401(k) hardship withdrawal account and maximize contributions as soon as possible.

Conclusion

If employees have the dire need to utilize their retirement savings absolutely, the 401 (k) is the first way for normal tracking before applying for the 401(k) hardship withdrawal. However, if borrowing is not optional, then it is a great resource to fulfill emergency financial requirements.

The big disadvantage is that you cannot pay the money that you withdraw in your 401(k) hardship withdrawal plan and there is always a risk to violate your pension savings permanently. Check the IRS initiated plan and be careful about what situations consider the 10% penalty and then make the final decision. Think of smarter options and keep a good fund for your retirement.

How Deskera Can help You?

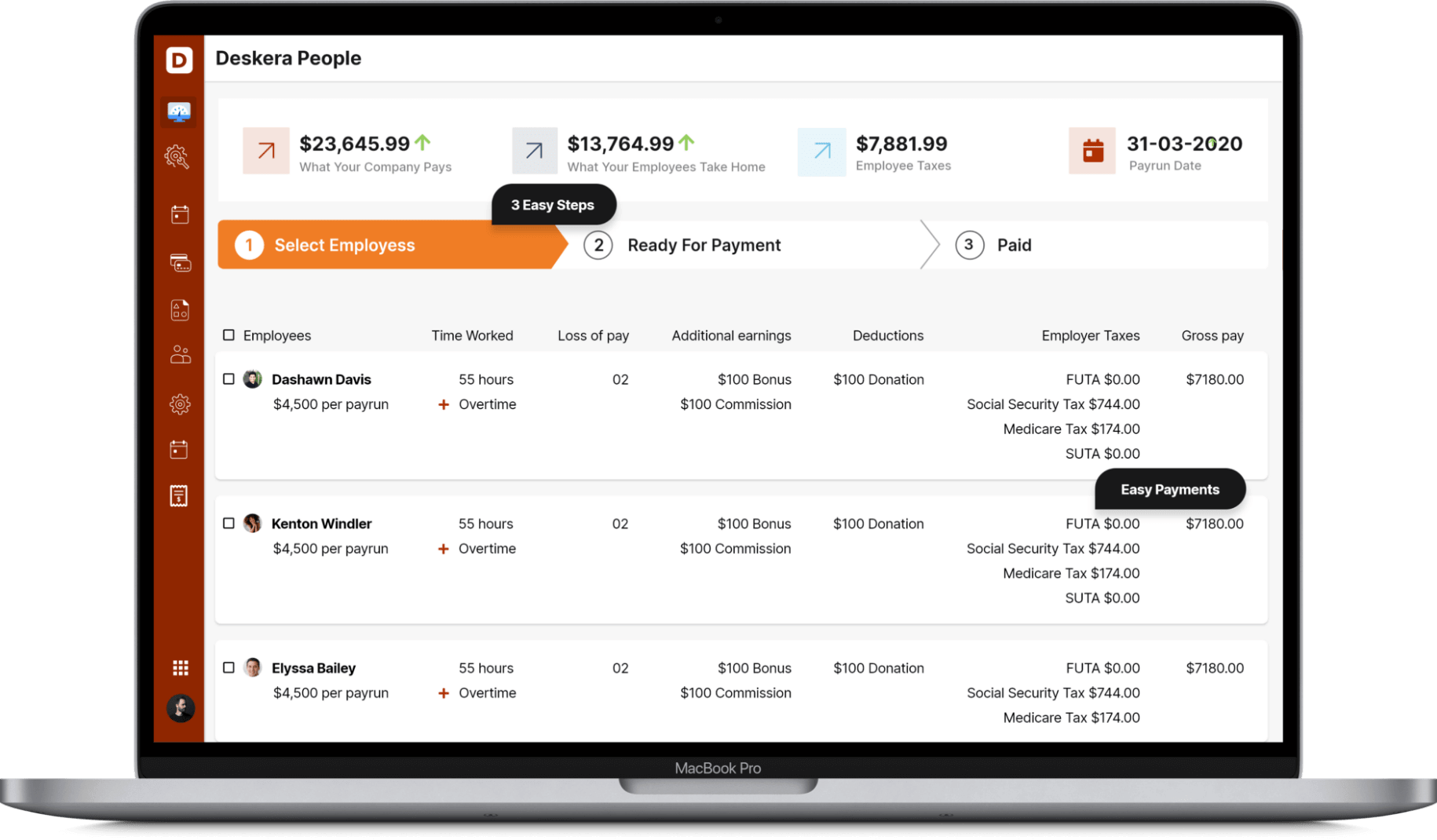

Deskera People provides all the employee's essential information at a glance with the employee grid. With sorting options embedded in each column of the grid, it is easier to get the information you want.

Key Takeaways

- 401(k) hardship withdrawal is a retirement account that can be used by employees in case of financial emergencies as directed by the IRS

- Unlike a 401 (k) loan, you don't have to repay the 401(k) hardship withdrawal funds. But you must pay tax on the payment amount

- 401(k) hardship withdrawal benefits can provide pension benefits without penalty but can be withdrawn early (till age 59.5) only for certain costs such as medical inconvenience or disability

- The Bipartisan Budget Act passed in January 2018 created a new rule that makes it easier to withdraw more money as a 401(k) hardship withdrawal or 403 (b) plan

- Since 2020, the CARES Act has provided particularly generous 401(k) hardship withdrawal conditions for people affected by COVID 19

- The IRS has general guidelines, but the provisions of individual 401(k) hardship withdrawal plans determine whether 401(k) hardship withdrawal payments are allowed under certain conditions

- A 401(k) hardship withdrawal is quite different from a 401 (k) loan

- You may be fined 10% if you use the money to buy a new home, pay for education, avoid foreclosure, or pay for funeral expenses

- The main drawback of 401(k) hardship withdrawal is the inability to repay the money to the plan

Related Articles