What does it really cost to acquire a new system, tool, or asset? At first glance, the answer seems simple—the purchase price. But in reality, that number barely scratches the surface. From vendor evaluation and implementation to training, integration, and operational disruption, acquisition costs quietly accumulate long before value is realized. This is where Total Cost of Acquisition (TCA) comes into play, offering a more complete and realistic view of what businesses actually spend to acquire something new.

Total Cost of Acquisition (TCA) goes beyond upfront pricing to capture every cost incurred throughout the acquisition journey. It includes pre-purchase efforts, direct procurement expenses, and indirect costs that often go unnoticed until they affect budgets and timelines. In an era of tight margins and increased scrutiny over spending, understanding TCA helps organizations make informed decisions, avoid cost overruns, and align investments with long-term business goals.

For modern enterprises, TCA has become a strategic metric rather than a financial afterthought. As businesses adopt complex technologies, multi-vendor ecosystems, and subscription-based models, acquisition decisions now have ripple effects across finance, operations, IT, and compliance. Evaluating TCA enables leaders to compare alternatives objectively, forecast true financial impact, and ensure that short-term savings don’t lead to long-term inefficiencies.

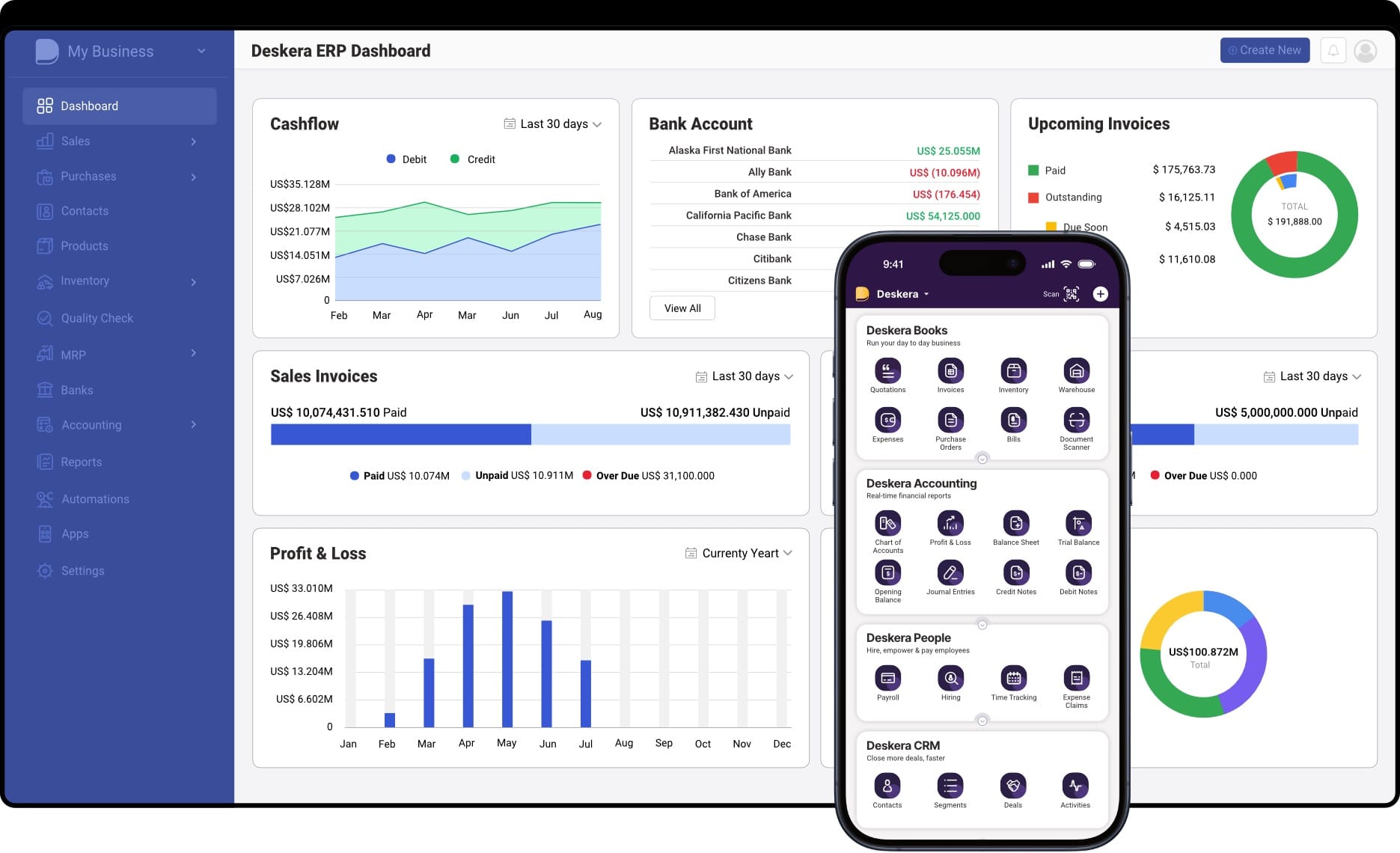

This is where intelligent ERP platforms like Deskera ERP play a critical role. Deskera centralizes procurement, vendor management, and financial data, giving businesses real-time visibility into acquisition-related costs. By automating workflows, tracking expenses across departments, and providing actionable insights, Deskera ERP helps organizations reduce hidden costs, improve acquisition planning, and ultimately lower their total cost of acquisition.

What Is Total Cost of Acquisition (TCA)?

Total Cost of Acquisition (TCA) is a managerial accounting concept that represents the complete cost incurred when acquiring goods, services, or assets—not just the sticker price. In simple terms, TCA looks at what an organization actually spends to bring an item from the decision stage to the point where it is ready for use. This makes TCA far more comprehensive and reliable than evaluating acquisition decisions based on purchase price alone.

At its core, TCA includes the net purchase price plus all additional costs required to acquire and deploy the asset. These costs often span pre-acquisition and transaction-related expenses such as research and vendor evaluation, accounting and legal fees, commissions, transportation, preparation, and installation. The goal of TCA is to capture every cost directly tied to acquiring the asset and making it operational. However, it typically excludes post-acquisition operational expenses like employee training or system integration, which are often categorized separately.

TCA is closely related to—but distinct from—the broader concept of acquisition cost (AC). Acquisition cost refers to the total expense incurred when purchasing assets, acquiring customers, or even taking over another company. This includes not only the purchase price but also supporting costs such as shipping, installation, marketing, and sales expenses. Understanding acquisition cost is critical for informed financial planning, as unusually high acquisition costs may signal inefficiencies in procurement, marketing, or investment strategies and can directly impact profitability and investor confidence.

From a business perspective, acquisition costs are commonly analyzed across three major contexts: fixed assets, customer acquisition, and mergers and acquisitions (M&A). For fixed assets, acquisition cost includes all expenses needed to bring the asset to a usable condition and is capitalized on the balance sheet. For customers, it forms the basis of Customer Acquisition Cost (CAC), a key metric for evaluating marketing efficiency and long-term profitability. In M&A scenarios, acquisition cost extends beyond the purchase consideration to include transaction, legal, financing, and advisory costs. Together, these views reinforce why TCA is essential—it provides a clearer, more accurate picture of the real financial commitment behind every acquisition decision.

TCA vs Purchase Price vs TCO: Key Differences Explained

Types of Total Acquisition Cost Businesses Must Consider for TCA Analysis

When evaluating Total Cost of Acquisition (TCA), businesses must look beyond isolated expenses and consider every cost that contributes to acquiring an asset, customer, or entity and making it ready for use. These acquisition costs vary by context, but each plays a role in shaping the true financial impact of a decision. Understanding the different types of total acquisition cost helps organizations build more accurate TCA models, avoid hidden expenses, and make better long-term investment choices.

Fixed Asset Total Acquisition Cost

Fixed asset total acquisition cost includes all expenses incurred to purchase and prepare long-term assets—such as machinery, equipment, buildings, or vehicles—for operational use. Along with the purchase price, this includes transportation, customs duties, installation, setup, legal fees, and regulatory charges. These costs are capitalized and depreciated over the asset’s useful life, making them a foundational component of TCA analysis for capital-intensive businesses.

Inventory Total Acquisition Cost

Inventory total acquisition cost captures the full cost of procuring goods intended for resale or production. Beyond supplier pricing, it includes freight charges, insurance, customs duties, inspection costs, and handling fees required to bring inventory to a sale-ready or production-ready state. Accurately accounting for these costs ensures reliable inventory valuation and prevents margin erosion caused by underestimating procurement expenses.

Customer Total Acquisition Cost

Customer total acquisition cost reflects the complete spend required to convert prospects into paying customers. This includes marketing and advertising expenses, sales commissions, promotional discounts, research costs, and supporting operational efforts. In a TCA framework, customer acquisition costs are often evaluated alongside customer lifetime value (LTV) to determine whether growth strategies are sustainable and profitable over time.

Mobile App User Acquisition Cost

Mobile app user acquisition cost is a specialized category of customer acquisition cost focused on attracting and activating app users. It includes digital advertising spend, app store promotions, referral incentives, influencer campaigns, and the technology or personnel required to track and manage installs. For app-based businesses, incorporating these costs into TCA analysis helps balance user growth with long-term engagement and retention goals.

Mergers and Acquisitions Total Acquisition Cost

In mergers and acquisitions, total acquisition cost extends beyond the purchase consideration paid to shareholders. It also includes due diligence expenses, legal and advisory fees, investment banking charges, financing costs, and integration-related transaction expenses incurred up to the point of ownership transfer. Including these costs in TCA analysis provides a more realistic view of deal value and reduces the risk of post-acquisition financial surprises.

Total Acquisition Cost for Capital Gains and Compliance

From a tax and compliance perspective, total acquisition cost determines how capital gains are calculated when assets are transferred or sold. It typically includes the asset’s purchase price and all costs incurred to make it ready for use, with specific treatments depending on scenarios such as inheritance, amalgamation, demerger, or asset conversion. Accurately identifying these costs is essential for regulatory compliance and for maintaining financial accuracy within a broader TCA framework.

Total Cost of Acquisition (TCA) Formula and How to Calculate It

Understanding how to calculate Total Cost of Acquisition (TCA) helps businesses move beyond surface-level pricing and evaluate the true financial impact of an acquisition decision. While the exact components may vary by industry or asset type, the calculation follows a clear and practical structure.

Total Cost of Acquisition Formula

TCA = Purchase Price + Pre-Acquisition Costs + Acquisition & Deployment Costs

Where:

- Purchase Price is the base cost of the asset, service, or solution

- Pre-Acquisition Costs include expenses incurred before buying

- Acquisition & Deployment Costs cover everything required to make the asset ready for use

Key Cost Components Included in TCA

To calculate TCA accurately, businesses should account for the following categories:

- Pre-Acquisition Costs: Vendor research, evaluations, RFP processes, legal reviews, accounting fees, and internal approval efforts.

- Purchase Costs: The negotiated price of the asset or solution, including licenses or contract fees (net of discounts).

- Transaction & Logistics Costs: Shipping, customs duties, insurance, handling, commissions, and closing fees.

- Setup & Installation Costs: Installation, configuration, testing, and preparation required to bring the asset to a usable state.

Note: TCA typically excludes post-acquisition operational costs such as long-term maintenance, training, or system upgrades—these fall under Total Cost of Ownership (TCO).

Step-by-Step: How to Calculate TCA

- Identify the acquisition scope: Define what is being acquired—equipment, software, inventory, customers, or a business entity.

- List all pre-purchase activities: Capture costs related to research, vendor selection, legal checks, and internal resource time.

- Add the purchase price: Use the final negotiated price, factoring in discounts or incentives.

- Include all deployment-related expenses: Account for logistics, installation, setup, and any costs required to make the acquisition operational.

- Sum all costs: Combine every identified expense to arrive at the total acquisition cost.

Simple TCA Calculation Example

If a company acquires a system with:

- Purchase price: $25,000

- Pre-acquisition costs (research, legal, approvals): $3,000

- Installation and setup costs: $4,000

Total Cost of Acquisition (TCA) = $32,000

This figure represents the true cost to acquire and deploy the system—not just what appears on the invoice.

Using a structured TCA formula ensures acquisition decisions are based on financial reality rather than assumptions. It improves budget accuracy, strengthens vendor comparisons, and prevents cost overruns that often surface after the purchase decision has already been made.

Why Total Cost of Acquisition Matters for Businesses

Understanding Total Cost of Acquisition (TCA) is essential for businesses that want to make financially sound, low-risk acquisition decisions. By looking beyond the purchase price and accounting for all acquisition-related costs, TCA provides a clearer picture of the true investment involved and its long-term implications.

Enables Informed Investment Decisions

TCA helps businesses evaluate whether an acquisition truly aligns with their financial and strategic goals. By factoring in costs such as research, transportation, installation, legal fees, and setup, decision-makers can compare alternatives more accurately and avoid investments that appear affordable upfront but become expensive in practice.

Improves Budget Accuracy and Cost Control

Hidden and underestimated acquisition costs are a common cause of budget overruns. TCA brings these costs to the surface early in the decision-making process, enabling better financial planning, more realistic budgeting, and tighter control over capital and procurement spending.

Supports Depreciation Planning and Tax Efficiency

The total acquisition cost of a capital asset directly determines its depreciation base. A higher or more accurate acquisition cost can lead to larger annual depreciation expenses, which may reduce taxable income and improve tax efficiency. This makes TCA an important consideration for both accounting accuracy and tax planning.

Strengthens Asset Valuation and Resale Decisions

Knowing the full acquisition cost helps businesses assess an asset’s true value over time. When assets are sold, transferred, or replaced, the original acquisition cost provides a reliable benchmark for estimating residual value and setting competitive resale prices that reflect wear, usage, and remaining utility.

Enhances Risk Assessment and Mitigation

TCA enables organizations to evaluate the risks associated with acquisitions more effectively. By understanding the total financial commitment upfront, businesses can better assess risks such as underperformance, obsolescence, or unexpected costs and apply these insights to future acquisition strategies.

Improves Financial Reporting and Transparency

Acquisition costs directly influence how assets are recorded on financial statements. They affect total asset value, depreciation expenses, equity, and overall financial ratios. A well-defined TCA approach ensures accurate reporting, improves audit readiness, and enhances transparency for stakeholders and investors.

Encourages Long-Term, Strategic Thinking

Rather than focusing on short-term savings, TCA pushes businesses to think strategically about acquisitions. It supports smarter vendor selection, better capital allocation, and more sustainable growth by ensuring that every acquisition decision is evaluated in the context of its true financial impact.

Common Challenges in TCA Calculation

While Total Cost of Acquisition (TCA) offers a more accurate view of acquisition spending, calculating it correctly is not always straightforward. Many organizations struggle with incomplete data, unclear cost ownership, and short-term decision-making, which can lead to underestimated or misleading TCA figures.

Hidden and Overlooked Costs

One of the biggest challenges in TCA calculation is identifying indirect or less-visible costs. Expenses such as internal labor time, legal reviews, vendor evaluations, approvals, and transition activities are often excluded because they are not invoiced directly. Over time, these hidden costs can significantly inflate the true acquisition expense.

Data Silos Across Departments

TCA-related costs are typically spread across multiple teams—procurement, finance, IT, operations, and legal. When data resides in disconnected systems or spreadsheets, it becomes difficult to consolidate all acquisition-related expenses into a single, accurate view. This lack of visibility often results in partial or inconsistent calculations.

Inconsistent Cost Definitions

Different teams may interpret “acquisition cost” differently. Some may include setup and logistics costs, while others focus only on the purchase price. Without standardized definitions and clear guidelines, TCA calculations can vary widely across projects, making comparisons unreliable.

Difficulty Separating Acquisition and Operational Costs

Distinguishing between one-time acquisition costs and ongoing operational expenses is another common hurdle. Costs such as training, integration, or initial support are often misclassified, leading to confusion between TCA and Total Cost of Ownership (TCO). This blurring of boundaries can distort both short-term and long-term cost assessments.

Limited Historical Data and Poor Cost Tracking

Accurate TCA calculation depends on access to reliable historical data. Many organizations lack detailed records of past acquisition expenses, especially for indirect costs. Without historical benchmarks, businesses may rely on estimates or assumptions, increasing the risk of under- or over-calculation.

Short-Term Cost Focus

Organizations under pressure to reduce upfront spending may prioritize the lowest purchase price rather than the lowest total acquisition cost. This short-term mindset often leads to decisions that appear cost-effective initially but result in higher overall expenses once hidden acquisition costs are accounted for.

Changing Requirements and Scope Creep

Acquisition requirements often evolve during the evaluation and implementation phases. Changes in scope—such as additional features, compliance needs, or customization—can introduce new costs that were not part of the original TCA estimate, making it difficult to maintain accuracy.

Lack of Automation and Analytical Tools

Manual spreadsheets and ad-hoc calculations increase the likelihood of errors and omissions. Without automated tools or ERP systems to track and aggregate acquisition-related costs, businesses struggle to scale TCA analysis consistently across projects.

Best Practices for Optimizing Total Cost of Acquisition

Optimizing Total Cost of Acquisition (TCA) is not about cutting corners—it’s about making smarter, more informed acquisition decisions. By improving visibility, standardizing processes, and using data effectively, businesses can reduce hidden costs and maximize the value of every acquisition.

Look Beyond the Purchase Price

One of the most effective ways to optimize TCA is to evaluate vendors and options based on total impact rather than upfront cost. A lower purchase price may come with higher logistics, setup, or compliance costs. Comparing alternatives using a TCA framework ensures decisions are driven by long-term value, not short-term savings.

Standardize Acquisition and Evaluation Processes

Establishing consistent procurement and evaluation processes helps reduce variability in acquisition costs. Standard templates for vendor assessments, approval workflows, and cost categories make TCA calculations more accurate and easier to compare across projects and departments.

Identify and Track Hidden Costs Early

Hidden costs—such as internal labor, legal reviews, approval delays, and transition efforts—often account for a significant portion of TCA. Proactively identifying these costs during the planning stage prevents underestimation and allows teams to address inefficiencies before they escalate.

Align Finance, Procurement, and Operations

TCA optimization requires cross-functional collaboration. Finance teams bring cost discipline, procurement ensures vendor competitiveness, and operations provide insights into deployment requirements. Aligning these teams ensures all relevant costs are captured and evaluated collectively.

Use Data and Historical Benchmarks

Leveraging historical acquisition data helps businesses build more realistic TCA estimates. Comparing past acquisitions reveals patterns, uncovers recurring cost drivers, and improves forecasting accuracy for future investments.

Leverage Technology and ERP Systems

Automated systems significantly improve TCA visibility and control. ERP platforms centralize procurement, vendor management, and financial data, enabling real-time cost tracking and reducing reliance on manual spreadsheets. This leads to more consistent and scalable TCA optimization.

Negotiate Based on Total Value, Not Just Price

Vendor negotiations should focus on the full acquisition lifecycle. Businesses can reduce TCA by negotiating bundled services, implementation support, reduced setup fees, or flexible delivery terms rather than focusing solely on discounts on the purchase price.

Review and Refine TCA Post-Acquisition

TCA optimization doesn’t end once the purchase is complete. Reviewing actual acquisition costs against estimates helps identify gaps, refine assumptions, and continuously improve future TCA calculations.

When Should Businesses Perform a TCA Analysis?

A Total Cost of Acquisition (TCA) analysis is most effective when it is applied at the right moments in the decision-making lifecycle. Performing TCA only after a purchase often limits its value, while using it proactively helps businesses avoid cost overruns and make more strategic choices.

Before Making Major Capital Investments

Businesses should conduct a TCA analysis before purchasing high-value assets such as machinery, equipment, property, or enterprise software. Evaluating the full acquisition cost upfront helps determine whether the investment aligns with financial goals and prevents surprises related to setup, compliance, or deployment costs.

During Vendor Comparisons and Selection

TCA analysis is critical when comparing multiple vendors or solutions. While one option may appear cheaper based on purchase price alone, another may offer lower overall acquisition costs due to reduced implementation, logistics, or support requirements. TCA enables objective, apples-to-apples comparisons.

Before Implementing New Technology or ERP Systems

Technology acquisitions often involve hidden costs related to configuration, data migration, integrations, and onboarding. Conducting a TCA analysis before selecting or upgrading systems—such as ERP platforms—ensures that businesses understand the true cost of deployment, not just licensing fees.

During Contract Renewals and Renegotiations

Contract renewals provide an ideal opportunity to reassess acquisition-related costs. A TCA review helps identify inefficiencies, evaluate whether existing vendors still deliver value, and strengthen negotiation positions by highlighting cost drivers beyond pricing.

When Scaling or Expanding Operations

Expansion into new markets, locations, or product lines often requires significant acquisitions. Performing a TCA analysis during scaling initiatives ensures that growth-related purchases remain cost-effective and aligned with long-term profitability.

Before Mergers, Acquisitions, or Strategic Partnerships

In M&A scenarios, TCA analysis helps capture transaction costs, legal and advisory fees, and other acquisition-related expenses that may not be immediately visible. This leads to more accurate deal valuation and reduces post-acquisition financial risk.

After Previous Cost Overruns or Budget Misses

If past acquisitions exceeded budgets or delivered lower-than-expected returns, it’s a clear signal that a more structured TCA approach is needed. Performing TCA analysis in future decisions helps correct gaps in cost estimation and improves financial discipline.

How Deskera ERP Helps Reduce Total Cost of Acquisition

Using an integrated ERP like Deskera ERP can significantly lower your Total Cost of Acquisition (TCA) by streamlining processes, eliminating inefficiencies, and improving visibility across key business functions.

Here’s how Deskera ERP supports smarter, cost-aware acquisition decisions:

1. Centralized Procurement and Vendor Management

Deskera ERP consolidates procurement, vendor information, purchase orders, and supplier performance in one platform. This unified view helps procurement teams compare suppliers based on total costs, negotiate better terms, and avoid duplicate or unnecessary purchases. With vendor scorecards and performance insights, you can choose suppliers that deliver better value—not just lower prices—reducing TCA.

2. Real-Time Visibility and Inventory Control

By tracking inventory levels and movements in real time, Deskera prevents stockouts and excess inventory, which often lead to rush orders or overstocking—both of which inflate acquisition costs. Accurate demand forecasting and automated reorder alerts ensure you buy the right quantity at the right time, trimming waste and minimizing storage costs.

3. Automated Workflows That Reduce Manual Errors

Deskera’s automation features—such as automated purchase requisitions, approvals, and order creation—remove tedious manual steps that slow down procurement and introduce errors. This reduces administrative overhead, accelerates acquisition cycles, and tightens control over acquisition spending.

4. Integration Across Finance, Operations, and Supply Chain

With Deskera ERP, procurement decisions are informed by accurate, real-time financial data—procurement spend, committed costs, and budget utilization. This financial integration helps teams avoid overcommitments and better align acquisition activities with company budgets. It also supports more accurate TCA calculations by ensuring all related expenses are captured.

5. Predictive Planning and Cost Forecasting

Deskera’s built-in demand forecasting uses historical data and trends to anticipate inventory and acquisition needs. This predictive capability allows businesses to plan purchases strategically, reducing the risk of emergency procurements that typically carry premium costs.

6. Lower Upfront and Ongoing Costs with Cloud ERP

As a cloud-based solution, Deskera ERP helps businesses avoid large upfront IT infrastructure investments and reduces ongoing maintenance costs associated with on-premises software. The scalable SaaS pricing model allows organizations to pay for what they use, improving cash flow and lowering acquisition overhead.

7. Enhanced Collaboration and Faster Decision-Making

Deskera’s mobile accessibility and shared data environment ensure stakeholders across departments—procurement, finance, operations—can access up-to-date information anytime. This collaboration reduces delays, prevents miscommunication, and streamlines approval cycles, ultimately lowering acquisition lead times and related costs.

By bringing procurement, inventory, financials, and analytics into a single platform, Deskera ERP not only improves operational efficiency but also supports smarter, cost-efficient acquisition strategies—helping businesses reduce the total cost of acquisition and make better investment decisions.

Key Takeaways

- Total Cost of Acquisition (TCA) goes far beyond the purchase price, capturing every direct and indirect cost incurred from evaluation to full operational readiness.

- Understanding the different types of acquisition costs—such as procurement, implementation, training, integration, and compliance—helps businesses avoid cost blind spots during decision-making.

- Comparing TCA vs purchase price vs TCO highlights why upfront costs alone are misleading and why a broader financial lens is essential for long-term value assessment.

- Using a structured TCA formula ensures consistent cost evaluation by quantifying both visible and hidden expenses across the acquisition lifecycle.

- Common challenges in TCA calculation, including incomplete data, underestimated indirect costs, and short-term bias, can significantly distort investment decisions if left unaddressed.

- Following best practices for optimizing TCA, such as standardizing cost models, involving cross-functional teams, and leveraging automation, leads to more accurate and defensible outcomes.

- Businesses should perform a TCA analysis at key decision points—before major purchases, system upgrades, vendor switches, or scaling initiatives—to minimize financial risk.

- Deskera ERP reduces Total Cost of Acquisition by consolidating procurement, finance, inventory, and operations into a single platform, eliminating integration overhead and improving cost visibility from day one.