Some of the largest companies in the US stock market by market capitalization (as of February 2023) include Apple, Microsoft, Amazon, Google parent Alphabet, and Facebook.

Stocks are often portrayed in the media as a fast-paced world full of adrenaline-pumping highs and heart-wrenching lows. Images of traders screaming orders, stock tickers flashing numbers, and charts resembling roller coasters come to mind.

While these depictions may seem accurate at times, they only represent a small part of the world of stocks. In reality, stocks are a fundamental part of the financial market and an essential tool for investors looking to grow their wealth. Whether you're a seasoned investor or a curious beginner, understanding stocks is crucial for making informed financial decisions.

In this article, we'll explore the definition of stocks, the different types available, and the various ways to invest in them. We'll also discuss the benefits and risks of investing in stocks and provide tips for those looking to dive into the world of stock investing.

So, fasten your seatbelt, and let's take a closer look at the exciting world of stocks.

- What are Stocks?

- Importance of Stocks in Finance

- What is Shareholder Ownership?

- Role of Stocks in Financial Market

- Types of Stocks

- Features of Stocks and Voting Rights

- Common Stocks Vs. Preferred Stocks

- Investing in Stocks: Benefits and Risks

- Stocks FAQS

- How can Deskera Help You?

- Key Takeaways

- Related Articles

What are Stocks?

Stocks, also known as equities or shares, represent ownership in a corporation. When you buy a stock, you are buying a small piece of ownership in the company. In return, you are entitled to a share of the company's profits, as well as voting rights in some cases.

When a company wants to raise capital, it can issue stocks to the public. The stocks are sold on stock exchanges, such as the New York Stock Exchange (NYSE) or the NASDAQ. Investors can buy and sell stocks through a brokerage account, either online or through a traditional broker.

The price of a stock is determined by supply and demand. If there are more buyers than sellers, the price will go up, and if there are more sellers than buyers, the price will go down. The stock price can also be affected by a variety of other factors, such as the company's financial performance, industry trends, and global economic conditions.

There are two main types of stocks: common and preferred. Common stockholders have voting rights and are entitled to a share of the company's profits in the form of dividends, but they are last in line to receive payment if the company goes bankrupt. Preferred stockholders, on the other hand, have priority over common stockholders when it comes to receiving dividends and getting paid in the event of bankruptcy, but they do not have voting rights.

Investing in stocks can be a way to build wealth over the long term, but it also involves risks. The stock market can be volatile, and the value of your investments can go up or down based on a variety of factors. It is important to do your research, diversify your investments, and have a long-term investment strategy when investing in stocks.

Importance of Stocks in Finance

Stocks are an important part of finance because they play a crucial role in the economy and in individual investors' portfolios. Here are some of the key reasons why stocks are important in finance:

- Capital formation: Stocks allow companies to raise capital by selling shares to investors. This capital can be used for a variety of purposes, such as expanding the business, investing in new technologies, or paying off debt. This, in turn, can lead to economic growth and job creation.

- Wealth creation: Stocks have historically provided higher returns than other asset classes over the long term, making them an important tool for wealth creation. By investing in stocks, individuals can grow their wealth over time and achieve their financial goals, such as retirement or buying a house.

- Liquidity: Stocks are highly liquid, meaning that they can be bought and sold quickly and easily. This makes them a valuable asset for investors who need to access their money quickly or want to take advantage of market opportunities.

- Diversification: Investing in a range of stocks can help investors diversify their portfolios and reduce their overall risk. By spreading their investments across different companies and sectors, investors can protect themselves from the risks of investing in a single stock or sector.

- Information and transparency: Publicly traded companies are required to provide regular financial reports and disclosures, making stocks a source of valuable information about the companies in which investors are investing. This information can help investors make informed decisions about their investments.

- Market signals: The performance of the stock market can provide important signals about the overall health of the economy. When the stock market is rising, it can be a sign of economic growth and confidence in the future. When the market is falling, it can be a sign of economic weakness and uncertainty.

Stocks are important in finance because they allow companies to raise capital, provide a way for investors to grow their wealth, offer liquidity and diversification, provide valuable information and transparency, and act as a market signal for the overall health of the economy.

What is Shareholder Ownership?

Shareholder ownership refers to the ownership of shares of stock in a corporation. When an individual or institution purchases shares of stock in a company, they become a shareholder and own a portion of that company. The amount of ownership is proportional to the number of shares owned relative to the total number of shares outstanding.

As shareholders, individuals and institutions have certain rights and responsibilities. They are entitled to a share of the company's profits in the form of dividends and have voting rights on certain matters, such as the election of the board of directors or major corporate decisions like mergers or acquisitions. Shareholders also have the right to attend shareholder meetings and express their opinions on the company's performance and strategy.

Shareholders can benefit from the growth of the company, as the value of their shares can increase over time if the company performs well. However, they also bear the risks of investing in the company, as the value of their shares can decline if the company does not perform as expected or if economic conditions change.

Overall, shareholder ownership plays an important role in corporate governance and in the relationship between companies and their investors. Shareholders of a company's stock have a vested interest in its success and are incentivized to monitor and advocate for the company's performance and strategy.

Role of Stocks in Financial Market

Stocks play an important role in the financial market because they allow companies to raise capital and investors to purchase ownership in those companies.

The following are some of the important roles that stocks play in the financial market:

- Capital raising: Stocks are one of the primary ways that companies can raise capital from investors. Companies can raise funds by selling stock to the general public in order to finance their growth, expand their operations, or invest in new technologies. This capital can help to drive economic growth and create jobs.

- Trading and liquidity: Stocks are traded on stock exchanges, which provide a marketplace for buyers and sellers to come together and exchange shares. This creates liquidity in the market, making it simple for investors to buy and sell stocks quickly.

- Price discovery: The price of a stock is decided by supply and demand in the market, reflecting the perceived value of the company and its future prospects. This price discovery mechanism helps to allocate capital to the most promising companies and industries.

- Portfolio diversification: Stocks provide investors with a way to diversify their portfolios, spreading their risk across different companies and sectors. This can help to reduce the overall risk of their portfolio and improve their returns.

- Economic indicators: The performance of the stock market can be an important indicator of the health of the economy. A rising stock market can indicate economic growth and confidence in the future, while a falling stock market can indicate economic weakness and uncertainty.

- Corporate governance: Shareholders have certain rights and responsibilities, including the right to vote on important corporate decisions and to receive a share of the company's profits in the form of dividends. This gives shareholders a voice in the governance of the company and can help to align the interests of shareholders and management.

Overall, stocks play a critical role in the financial market, providing a way for companies to raise capital, for investors to buy ownership in those companies, and for markets to allocate capital efficiently.

Types of Stocks

Primarily, there are two main types of stocks: common stock and preferred stock. Here's a brief explanation of each:

Common Stock

Common stock is the most common type of stock issued by companies. When an individual buys shares of common stock, they become a part-owner of the company and have the right to vote on corporate matters, such as electing the BoD or board of directors and approving major decisions.

Common stockholders also have the potential to receive dividends, which are payments made by the company to its shareholders. However, dividend payments are not guaranteed and may fluctuate depending on the company's financial performance. Additionally, common stockholders are last in line to receive assets if a company goes bankrupt.

Preferred Stock

Preferred stock is a kind of stock that has features of both equity and debt. Unlike common stockholders, preferred stockholders do not have voting rights, but they have a higher claim on the company's assets and receive a fixed dividend payment before common stockholders.

Preferred stock may also have other features, such as the ability to be converted into common stock, callability (the ability of the company to redeem the stock), and cumulative dividends (the requirement to pay all missed dividends before paying common stock dividends). Preferred stockholders generally have less potential for capital appreciation than common stockholders, but they also have less risk in the event of a company's bankruptcy.

In addition to these main types of stocks, there are also subclasses of common and preferred stock, which are Class A and Class B common stock, which may have different voting rights or dividend payment structures. Companies may also issue other types of securities, such as convertible bonds, that have features of both debt and equity. It's important for investors to understand the different types of stocks and securities to make informed investment decisions.

Features of Stocks and Voting Rights

Stocks can have various features, including voting rights, which give shareholders a say in the company's management and decision-making processes. Here are some key features of stocks and voting rights:

Ownership

When an individual buys stocks, they become a part-owner of the company. The number of shares they own determines their percentage of ownership in the company.

Dividends

Companies may pay dividends to shareholders, which are a share of the company's profits. Dividends can be paid in cash, additional shares of stock, or other forms.

Voting rights

Common stockholders typically have the right to vote on important corporate matters, such as electing the board of directors, approving mergers or acquisitions, and other major decisions. The number of votes a shareholder has is usually proportional to the number of shares they own.

Classes of stock

Companies may issue different classes of stock, with different voting rights and dividend payment structures. For example, Class A shares may have more voting rights than Class B shares.

Proxy voting

If a shareholder is unable to attend a shareholder meeting, they can appoint a proxy to vote on their behalf.

Cumulative voting

Some companies may allow for cumulative voting, which allows shareholders to concentrate their votes on a single candidate, increasing their chances of being elected.

Overall, voting rights can play an important role in corporate governance and give shareholders a voice in the company's management and decision-making processes. However, the impact of voting rights may be limited, as majority shareholders may have greater influence and control over the company. It's important for investors to understand the features of stocks and voting rights when making investment decisions.

Common Stocks Vs. Preferred Stock

Common stock and preferred stock are the types of stocks that companies can issue. Here are some key differences between common stocks and preferred stocks:

- Voting rights: Common stockholders typically have voting rights, which allow them to vote on company matters such as the election of the board of directors and major decisions. Preferred stockholders do not typically have voting rights.

- Dividend payments: Common stockholders may receive dividends, which are a portion of the company's profits distributed to shareholders. Dividend payments, however, are not guaranteed and may vary depending on the company's financial performance. Preferred stockholders usually receive a fixed dividend payment, which is paid out before common stock dividends.

- Priority in asset distribution: In the event of bankruptcy or liquidation, preferred stockholders have priority over common stockholders in receiving the company's assets. Preferred stockholders are considered creditors and are paid before common stockholders.

- Price stability: Preferred stock tends to have more stable prices than common stock because it offers a fixed dividend payment. Common stock prices may be more volatile because they depend on the company's earnings and growth prospects.

- Conversion: Preferred stock may be convertible into common stock at the option of the shareholder. This feature allows preferred stockholders to benefit from potential price appreciation of the common stock.

Investing in Stocks: Benefits and Risks

Investing in stocks can be a potentially lucrative way to grow the wealth over time, but it is essential to understand the benefits and risks involved. Here are some of the key benefits and risks of investing in stocks:

Benefits

- Potential for high returns: Historically, stocks have offered some of the highest returns of any asset class over the long term. By investing in well-managed companies with strong fundamentals, you can potentially earn significant returns on your investment.

- Diversification: Stocks offer a way to diversify your investment portfolio, which can help reduce overall risk. By investing in a variety of different companies across different domains, you can spread your risk and potentially increase your chances of earning positive returns.

- Ownership: When you invest in a stock, you are buying a share of ownership in the company. This means that you have a say in how the company is run and can potentially benefit from any profits or growth the company experiences.

- Liquidity: Stocks are highly liquid, which means that you can buy and sell them quickly and easily. This makes it easy to adjust your portfolio as needed and take advantage of market opportunities.

Risks

- Volatility: Stocks are inherently volatile and can experience sharp price swings in response to changes in market conditions, economic factors, or company-specific news. This can make it difficult to predict future returns and can result in significant losses if you are not careful.

- Market risk: The stock market as a whole can be subject to risks that are beyond your control, such as global economic conditions, political instability, or natural disasters. These factors can cause broad market declines that can negatively impact your investments.

- Company risk: Investing in individual stocks carries the risk that the company may experience financial difficulties or management issues that lead to declines in stock price. This risk can be mitigated by investing in a diversified portfolio of stocks.

- Time horizon: Stocks are a long-term investment and require a time horizon of several years or more to realize their potential returns. Short-term fluctuations can be significant, but over the long term, well-managed companies with strong fundamentals tend to perform well.

Stocks FAQS

Here are some frequently asked questions about stocks and their answers:

Q: What is a stock?

A: A stock, also known as a share or equity, is a type of investment that represents ownership in a company. When you buy a stock, you are buying a small piece of ownership in that company.

Q: How do I buy stocks?

A: You can buy stocks through a brokerage account. You will need to open an account, fund it with cash, and then place an order to buy the stocks you want.

Q: What factors should I consider before buying a stock?

A: Before buying a stock, you should consider factors such as the company's financial health, management team, competitive position, growth prospects, and valuation. You should also consider your own investment goals and risk tolerance.

Q: How do I know when to sell a stock?

There are many reasons you might sell a stock, such as if the company's financials deteriorate, the stock becomes overvalued, or you need to rebalance your portfolio. It is important to have a plan in place for when to sell a stock and to stick to that plan.

Q: What is diversification?

A: Diversification is a strategy of spreading your investments across multiple asset classes, sectors, and companies to reduce risk. By diversifying your portfolio, you can potentially earn higher returns while minimizing your exposure to individual stock or sector risk.

Q: What is a dividend?

A: A dividend is a payment made by a company to its shareholders, usually in the form of cash or additional shares of stock. Companies typically pay dividends out of their profits, and dividend payments can be a sign of a company's financial health and stability.

Q: What is a stock split?

A: A stock split is when a company increases the number of shares outstanding by issuing additional shares to its existing shareholders. This is usually done to make the stock more affordable for individual investors and can result in a lower share price.

Q: What is a stock market index?

A: A stock market index is a benchmark that tracks the performance of a specific group of stocks. Examples of stock market indexes include the S&P 500, the Dow Jones Industrial Average, and the Nasdaq Composite. Investors can use these indexes to track the performance of the overall stock market or a specific sector.

How can Deskera Help You?

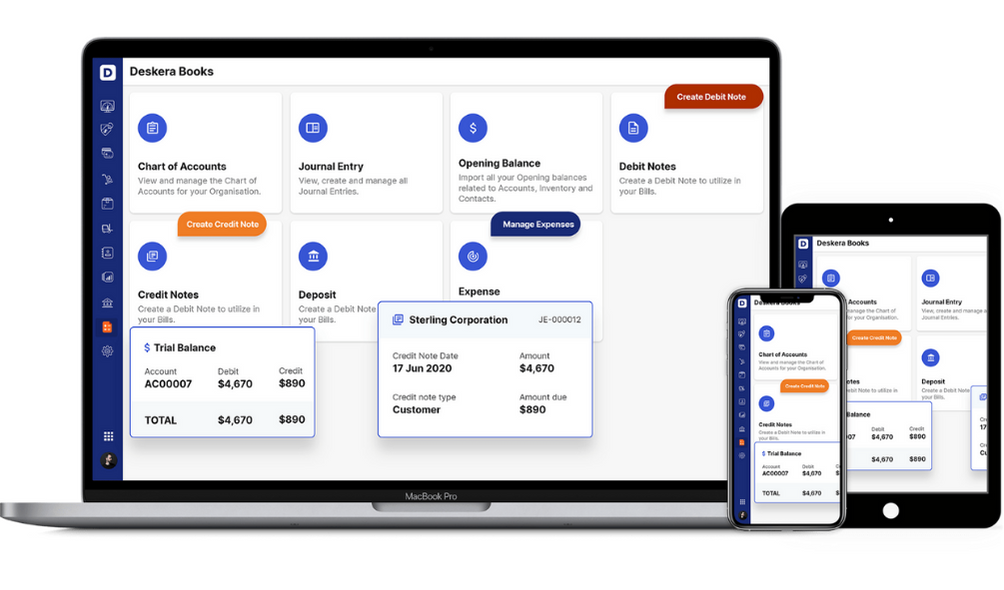

Deskera is a cloud-based software that provides an extensive suite of business tools, including accounting, CRM, inventory management, and payroll management. While Deskera is not specifically designed to manage trusts, it can help with certain aspects of trust management, such as record-keeping and financial reporting.

For example, Deskera Books can be used to track income and expenses related to the trust, while its reporting tools can generate financial statements for the trust.

Additionally, Deskera's CRM module can be used to manage communication with beneficiaries and other stakeholders, while its inventory management module can help track physical assets held in the trust.

Key Takeaways

- Stocks represent ownership in a company. When you buy a stock, you are buying a small piece of ownership in that company.

- Stocks are traded on stock exchanges, such as the New York Stock Exchange or Nasdaq. To buy stocks, you need to open a brokerage account and place an order.

- Stocks can offer potentially high returns over the long term, but they are also subject to market volatility and company-specific risks.

- It is important to do your research before investing in stocks. You should consider factors such as the company's financials, management team, competitive position, and growth prospects.

- Diversification is an important strategy for minimizing risk when investing in stocks. By spreading your investments across multiple companies and sectors, you can reduce your exposure to individual stock or sector risk.

- There are different types of stocks, including common stocks and preferred stocks. Common stocks give investors voting rights and the potential for capital appreciation, while preferred stocks offer a fixed dividend payment but limited voting rights.

- Dividends are a form of income paid to shareholders by some companies. Dividend payments can be a sign of a company's financial health and stability.

- Stocks can be bought and sold quickly and easily, but they are a long-term investment that requires patience and discipline. It is important to have a plan in place for when to buy and sell stocks based on your investment goals and risk tolerance.

Related Articles