Quick ratios are the liquidity ratios used to provide the number of current assets paid out of the current liabilities. Cash and cash equivalents are included in existing assets, while all other items are included in current liabilities. This quick ratios formula consists of only three line items: current assets, current liabilities, and net working capital.

The primary purpose of calculating this ratio is identifying companies whose assets can quickly be converted into cash to pay their short-term liabilities when they become due for payment. The higher the value of the quick ratio, the better it is for an investor since it shows low risk.

Here is a snapshot of the points involved:

- What are Quick Ratios?

- How do the Quick Ratios help in Determining the Profitability of a Business?

- What is the importance of cash flow in Quick Ratios?

- How do you calculate Quick Ratios?

- What are the steps to follow while calculating Quick Ratios?

- What are the different types of quick ratios?

- Illustration of Quick Ratios with an Example

What are Quick Ratios?

Quick ratios are very popular with analysts looking at the liquidity of a business. Quick ratios have an advantage over the current ratio in that they exclude inventory from the equation. This is because inventory is an asset that might be difficult to convert into cash.

The "quick" in the name excludes inventory from current assets since inventory cannot be converted quickly into cash. The quick ratio can be calculated using either current or non-current assets. Calculating the quick ratio using non-current gives a more accurate picture of liquidity.

When it comes to having a profitable business, using cash wisely is necessary. One of the ways to do so is to maintain high Quick Ratios (QRs).

Tapping into your cash isn't always bad, but if you're dipping into your cash reserves too often, the consequences can be dire.

If your business doesn't generate enough income to cover its expenses, you'll run out of cash and bankrupt. To ensure this doesn't happen, examine your Quick Ratios and use them as a starting point for evaluating whether or not your business has sufficient cash flow.

It is also called the "acid-test" or "penny value" ratio because it measures a company's ability to pay its current liabilities with its most liquid assets.

How do the Quick Ratios help in Determining the Profitability of a Business?

Profitability is the final piece of a company's financial puzzle. Profitability looks at a company's bottom line or net profit. It measures the size of the company's success by revealing how much the company has earned after accounting for all expenses.

This means that profitability matters to your potential investors and lenders because it provides a clear picture of how much cash a business generates and whether or not it can service its debt. The quick ratios solve this problem by considering only short-term assets.

If you have ever been to a company's financial statements, you may have noticed that there are two kinds of ratios – liquidity ratios and profitability ratios. A liquidity ratio analyzes the ability of the firm to pay its liabilities, while a profitability ratio analyzes how profitable a company is.

Quick Ratios is also called "Current Ratio", it is also known as "acid test ratio" as it tests a business's short-term solvency. As the name suggests, quick ratios measure the ability of a company to convert its short-term assets into cash immediately (quickly).

What is the importance of cash flow in Quick Ratios?

Cash flow is an essential metric in evaluating the health of a business. Investors and analysts can use quick ratios to determine whether a company has enough cash on hand to cover its current expenses—a key sign of financial health.

Cash flow is one of the critical factors that any business owner should pay attention to. It is simply the amount of money coming in and the amount going out.

Quick Ratios (also known as Acid Test Ratio) is a liquidity ratio that measures a company's ability to meet its short-term obligations with its most liquid assets. The quick ratios look at the current assets available to cover current liabilities.

It is also known as the "acid test" because it measures how quickly a company can convert its most liquid current assets into cash to pay off its debt obligations.

The rationale behind excluding inventory is that companies can sell off their inventories before meeting their other obligations in case of any liquidation. Hence, inventory should not be considered cash equivalents and should be excluded from current assets.

Note that, unlike the current ratio, the quick ratio does not include inventory and other non-current assets as it excludes inventories in its calculation.

How do you Calculate Quick Ratios?

Quick ratios are very common in accounting, and it is used to determine whether or not a business has enough liquid assets to cover its short-term liabilities. Sometimes referred to as the acid test, the quick ratios are often considered more accurate than the current ratio because it excludes inventory from its calculation.

The quick ratios formula is calculated by dividing cash on hand and deposits with banks by current liabilities. If the resulting figure is less than one, it means that the company in question does not have sufficient liquid assets to cover its current liabilities.

Quick ratio calculation:

Quick Ratio = Quick Assets / Current Liabilities

Quick Assets = Cash + Short Term Investments + Accounts Receivable

Current Liabilities = Short Term Debt + Accounts Payable

The higher the quick ratio, the stronger a company's liquidity position is. A low quick ratio signals that current liabilities are greater than or equal to existing assets. The company might be in trouble if it cannot meet its immediate obligations.

The quick ratio or the acid test ratio is a liquidity ratio used to measure a company's ability to pay its short-term obligations. It is calculated by dividing the amount of cash in a company's current assets (cash, marketable securities, accounts receivable, and inventory) by its total current liabilities.

The acid test ratio can also be calculated as

Acid Test Ratio = (cash + short term investments)/ (current liabilities + long-term debt)

To understand more about quick ratios, let's take an example of XYZ Inc. XYZ Inc has $50 million in cash and total current liabilities of $200 million. So, the quick ratio = (1/2) = 0.5, which means it has enough money to pay half of its current liabilities.

If we compare this number with the quick ratios of other companies, we will know how good it is compared to others. Hence, we can say that the higher the value of this ratio, the better it is for a company.

If quick ratios are more significant than one, it implies that the company will have sufficient cash and cash equivalent and marketable securities to meet its short-term obligations. If not, then the company might face liquidity problems in the future.

What are the steps to follow while calculating Quick Ratios?

Quick ratios are not very useful for comparing companies in different industries. Each industry has a different set of working capital requirements, making this ratio challenging to reach. However, if you want to compare two companies in the same industry, this ratio can help determine which one has better liquidity.

Here are the steps for Calculating Quick Ratios:

- First of all, add together all of the company's quick assets that can be converted into cash within one year. This would include checking accounts, savings accounts, marketable securities and investments, and other liquid assets. Do not include items that cannot be converted into cash, such as land, building, and equipment

- Once you have added up all of the company's quick assets, total up all its current liabilities, which are short-term obligations such as accounts payable and interest on short-term debt

- Divide the sum of the company's quick assets by its current liabilities to arrive at the quick ratio

- Compare this number with industry peers to get an idea of whether the company is earning a competitive amount or not. The industry average for most businesses is between 1:1 and 2:1. Still, if it is much higher or lower than this range, it may indicate some problems in its financial situation

What are the different types of quick ratios?

Quick ratios measure liquidity on its most liquid items. There are five types of ratios widely accepted by accrual basis accounting. Using Quick ratios, we can understand the company's short-term credit rating of company Liquidity refers to too much cash and quick assets than total current liabilities.

The purpose of this ratio is to determine how capable a firm is of paying off its short-term obligations with its liquid assets on hand. The quick ratio measures the number of liquid assets compared to the number of current liabilities, giving an idea of how easily a company can pay off existing debt obligations.

It provides a more accurate picture than the current ratio since it only considers assets converted into cash within one year. Unlike the current ratio, which includes all existing assets, the quick ratio only consists of that considered liquid or quickly convertible into cash.

This means inventory and other non-liquid current assets are not included in this calculation. Since these items take longer than one year to be converted into cash, they should not be considered part of a company's ability to pay off its current liabilities.

The five different types of quick ratios are:

- Acid Test Ratio - Current Assets/Current Liabilities = 1.3 (Sufficient)

- Cash Ratio - Current Cash/Current Liabilities = 0.1 (Insufficient)

- Cash Plus Receivables Ratio - Current Cash + Receivables/Current Liabilities = 0.2 (Better)

- Total Liquid Ratio - Current Assets-Receivables + Stock/Current Liabilities = 0.8 (Good)

- Receivable Turnover - Sales/Average Accounts Receivables = 1 (Excellent)

Illustration of Quick Ratios with an Example

Quick ratios are usually calculated for the current period and compared with quick ratios from previous periods. The following is an example of a quick ratio calculation for XYZ Corporation for year-end March 31, 2021:

XYZ Corporation Quick Ratio Calculation

Current Assets $200,000

Fixed Assets (net of depreciation) 150,000

Current Liabilities 150,000

Net Working Capital 100,000

The quick ratio is calculated by deducting the fixed assets from the current assets. Then divide the result by net working capital. The resulting number is multiplied by 100 to get the percentage.

For XYZ Corporation it's: ($200,000 - $150,000) / $100,000 = 0.85 or 85%. If we were comparing this with the previous year's quick ratio we would divide it by 1.10 (1.10 = (1 / 0.85) * 100).

This would give us a quick ratio of 84% compared to last year's 91%.

The higher the quick ratio number, the better because a high number indicates little risk involved.

Wrapping Up

Quick ratios are defined as current assets divided by current liabilities. It represents the proportion of current assets available to cover current liabilities. A liquidity ratio measures a company's ability to meet its short-term obligations with its most liquid assets. It is also known as the "acid test" ratio, which was coined by Benjamin Graham, a father of security analysis.

Originally, quick ratios were used to determine the safety of investments. Its proponents argued that it could be used to distinguish between highly liquid companies and those that were not. This would allow investors to avoid investing in companies with insufficient liquidity and focus on those that could pay their short-term debts quickly.

How can Deskera Improve Cash Flow for Your Business?

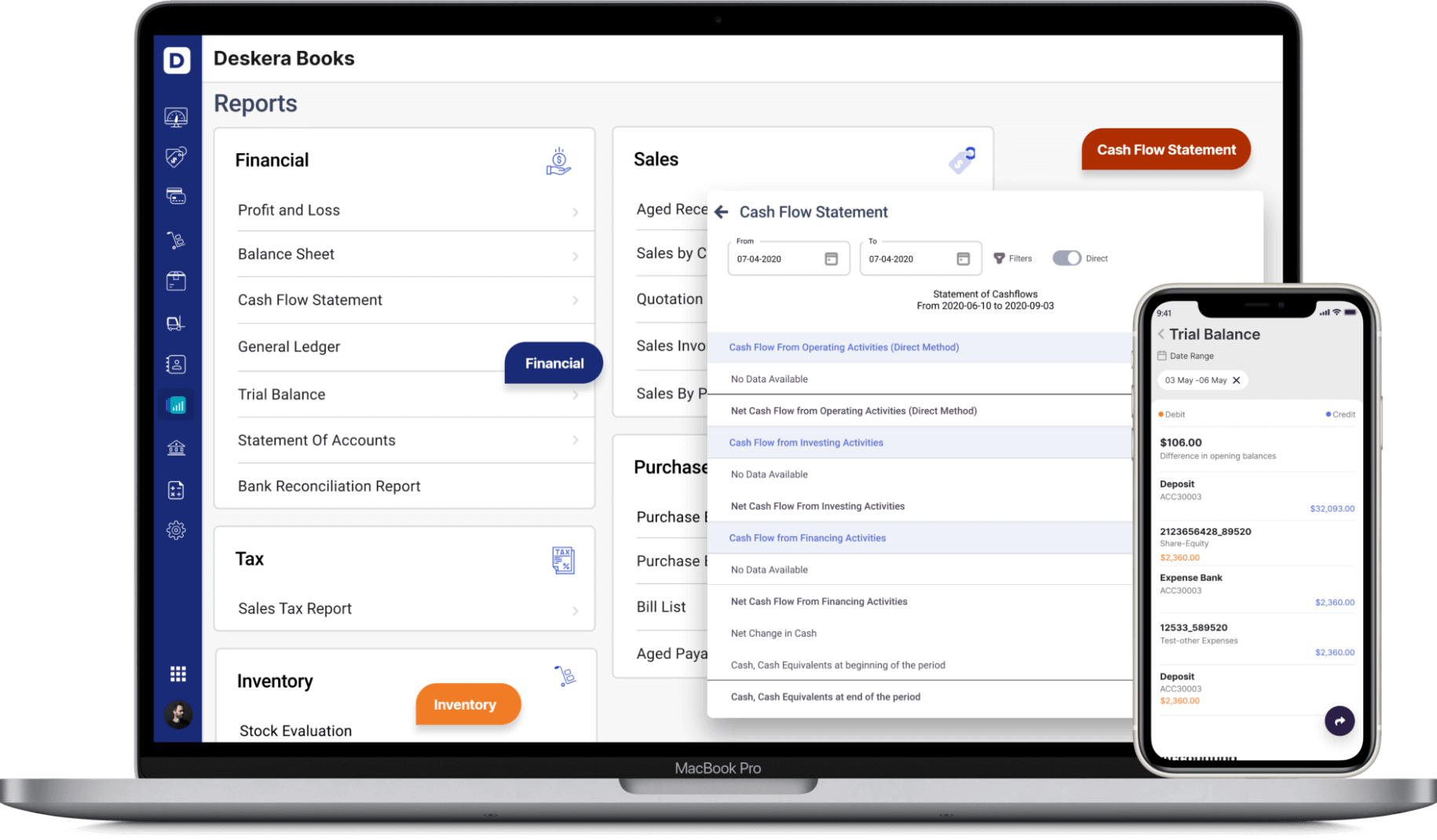

Deskera is a cloud system that brings automation and therefore ease in the business functioning. It reduces the admin time while also increasing efficiency. Deskera Books can be especially useful in improving cash flow for your business.

As a business owner, you can invest in accounting softwares that can help you keep track of your depreciating assets, scrape value, residual value, salvage value, journal entries, balance sheet, inventory and production costs. A successful business needs an efficient financing process that meets its specific needs.

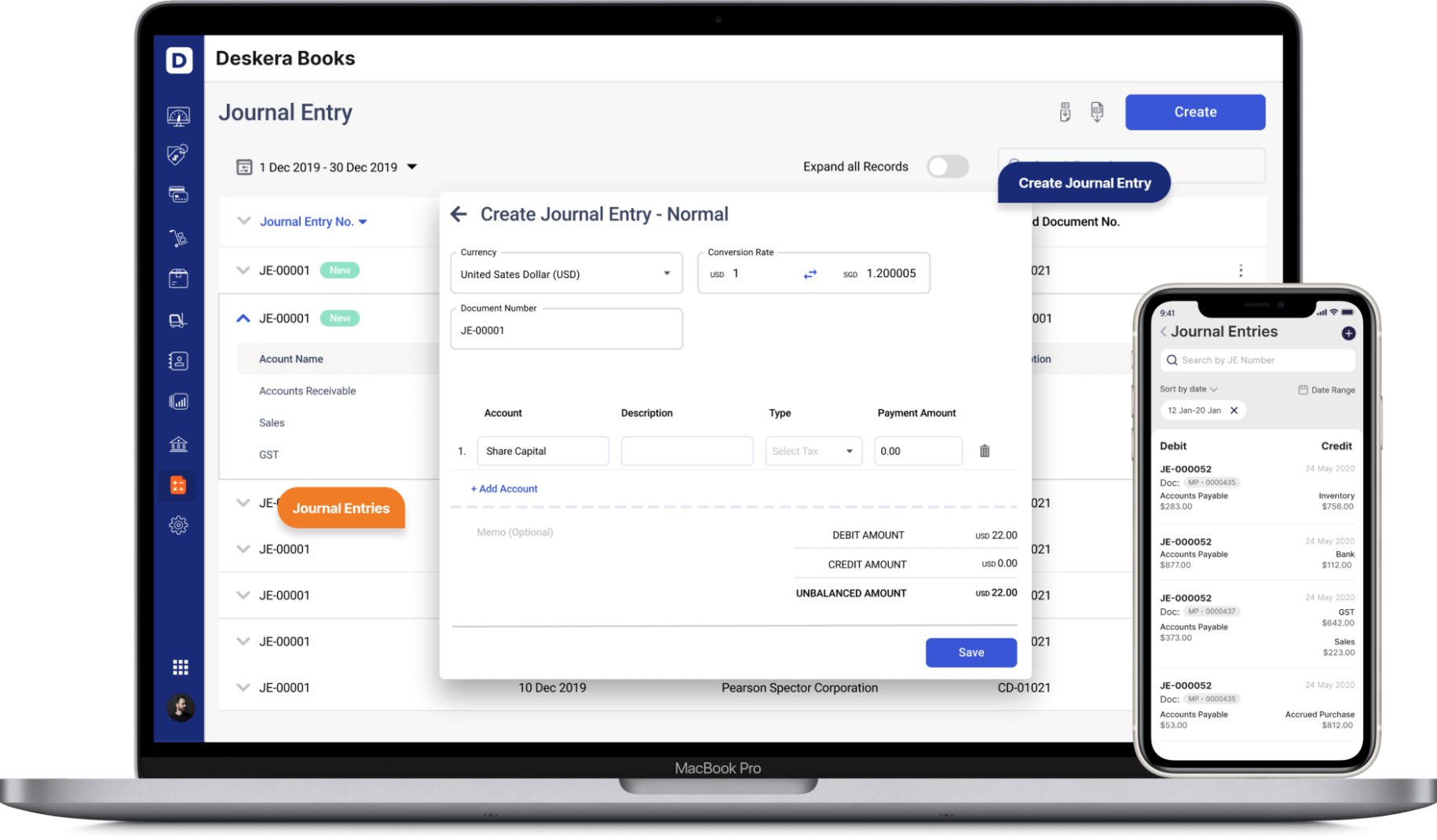

Deskera Books is an online accounting software that your business can use to automate the process of journal entry creation and save time. The double-entry record will be auto-populated for each sale and purchase business transaction in debit and credit terms. Deskera has the transaction data consolidate into each ledger account. Their values will automatically flow to respective financial reports.

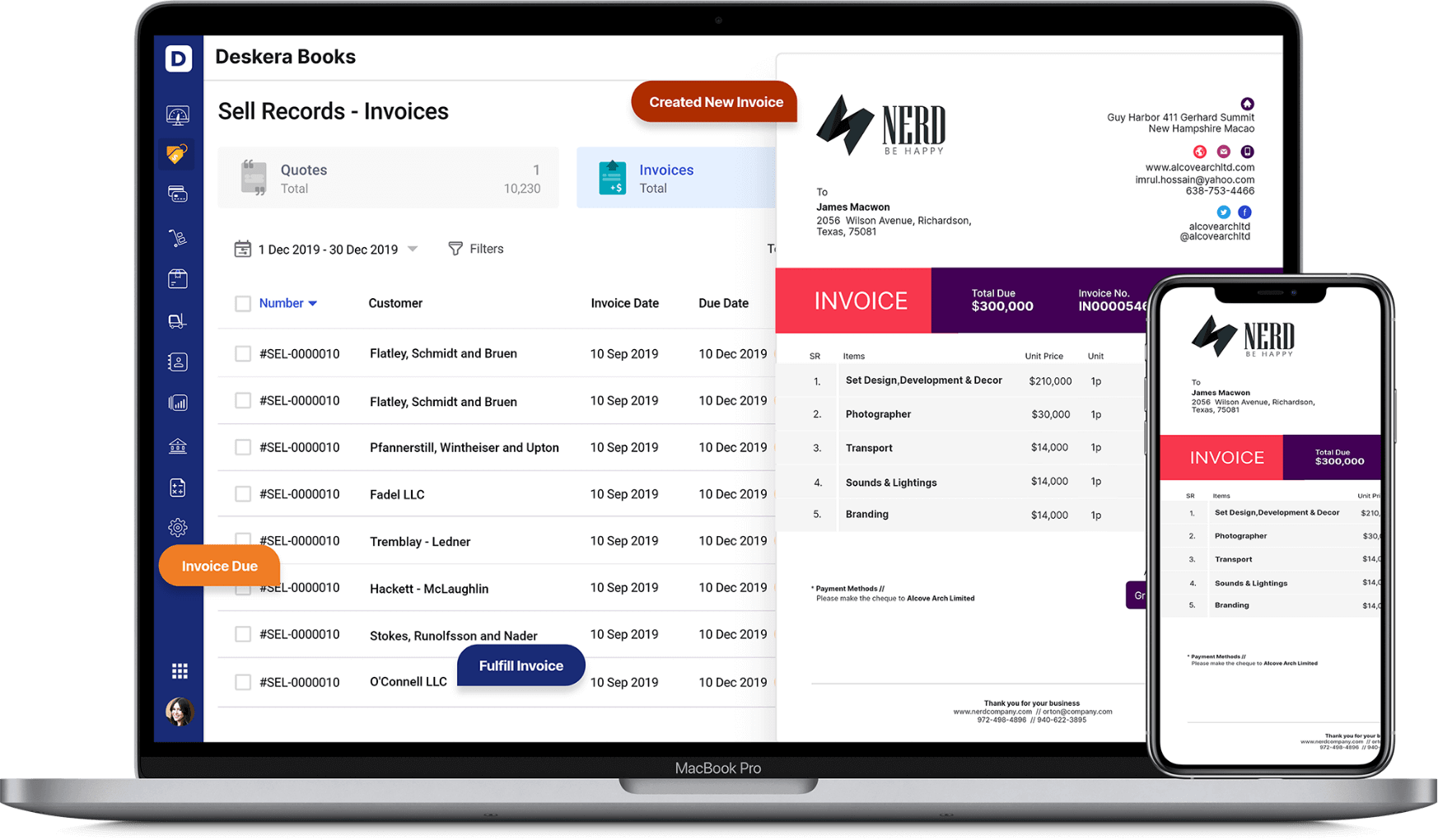

Through Deskera Books, reminders can be set with the invoices that are not being paid out, which are then sent out to the customers. Even in the case of recurring invoices, Deskera Books will become very handy especially with a payment link added to the invoice.

All in all, the follow-up system for all the invoices can be passed on to the system of Deskera Books and it will look into it for you. You can have access to Deskera's ready-made Profit and Loss Statement, Balance Sheet, and other financial reports in an instant. Such cloud systems substantially improve cash flow for your business directly as well as indirectly.

Key Takeaways

- Quick ratios are a tool that helps measure a company's ability to pay short-term obligations. It is used in conjunction with the current ratio to determine its overall liquidity

- The quick ratio, also known as "acid-test," is sometimes considered a more accurate reflection of an organization's current liquidity than the current ratio because it excludes inventory and prepaid expenses from the current assets figure. It also disregards any long-term assets such as property, plant, and equipment, which are not readily converted into cash

- Taken together, the quick ratio and current ratio help you identify how much available cash a company has at its disposal to meet its short-term obligations. For example, if a company has $150 in cash and $100 in accounts receivable, it will have $250 in total liquid assets to meet its short-term obligations of $200. In this situation, the quick ratio alone would indicate that the company has 50 percent of its short-term obligations covered by actual cash on hand

At Deskera, we know that the quick ratios indicate how easily a company can pay off all liabilities with just its cash and equivalents available for immediate use.

Related Articles