If you are an employer registered under the Annual Profession Tax Act, you must file the returns declaring every month salaries paid by you to your employees. Managing business expenses and taxes together is a tough job and employers in Karnataka are aware of this; however, if you wonder how to go about it, where to find the forms, and how to file them, this article is for you.

We shall be answering all your queries regarding the Profession Tax Form 5 through this article. Here is what we shall cover:

- Overview of Karnataka Tax on Professions, Trades, and Employment Rules of 1976

- Important Definitions within the Rules

- What is the Karnataka Form 5 for Annual Profession Tax Return?

- Procedure to File Karnataka Form 5 for Annual Profession Tax Return

- Class of Persons and Rate of Tax

- How can Deskera Help You?

- Key Takeaways

Overview of Karnataka Tax on Professions, Trades, and Employment Rules of 1976?

Every month, all employers registered under the Profession Tax Act must submit a Form 5-A Statement with details of the pay and wages provided to their employees. Along with this, they must also include the amount of tax deducted. This Statement must be provided on or before the 20th day of the following month, coupled with the total amount of tax due based on the Statement.

The said employer must additionally file an annual return in Profession Tax Form 5 within 60 days of the year's end. In addition, he must pay the whole amount of tax due based on the return; They can subtract any tax already paid in Form 5-A.

If the amount of the monthly deducted tax is less than Rs. 5,000, the employer must submit Form 5-A and tax payment within 20 days of the quarter's end.

Important Definitions within the Rules

The section explains the terms and their definitions as used in the context of the profession tax.

Quarter refers to a duration of three months that concludes on either of these days:

- the 31st day of May

- 31st day of August

- 30th day of November

- 28th or 29th day of February.

Wages or Salaries mean the pay received by the employers. The pay includes receiving arrears, dearness allowance, bonuses, and any profits shared by the company.

Profession tax is the tax that is levied on the employers under the provisions of the Profession Tax Act.

Levy and Tax charge is the tax collected from the professions, trades, and employment for the benefit of the State.

What is the Karnataka Form 5 for Annual Profession Tax Return?

This section will help us to understand the diverse aspects concerning the annual professional tax return. Let’s walk through them one by one.

Registration and Enrolment

The first step is to register under the Profession Tax Act. Every employer except the government officers who pay tax under section 4 must obtain a registration form from the authorities for enrollment. This also applies to every individual who is liable to pay tax under section 4.

Every employer or individual must obtain this certificate of registration within ninety days from the date the Act commenced.

OR

If any employer or individual were not involved with any profession or trade, then they must obtain the registration certificate within thirty days from the commencement of their respective trade or profession.

OR

Any person who is referred to in subsection (2) must obtain the certificate of registration within thirty days of becoming eligible to pay tax.

Once the application is made, the concerned official will review it and grant them the certificate within thirty days after the receipt of the application.

In the case where the reviewing authority finds that the applicant has deliberately provided incorrect or false information while applying, the officer may impose a penalty of not more than Rs.1000. Yet, the applicant will be given a considerable opportunity to speak and defend their side.

Returns

All the employers enrolled under the Act must furnish returns in the prescribed format to the concerned official within sixty days of the expiry of the year. The returns must include all the wages paid by them and the corresponding tax amount deducted in the previous year.

Before submitting the returns under subsection (1), the employers must pay the full amount of tax in advance on the basis of a reduced return that has been lowered due to a previously paid tax under section 6A. Along with the return, the employer must also submit credible proof of the payment of such tax. The tax must be assumed to have been paid once the final assessment is made.

Payment of Tax in Advance

A Statement comprising the details of the salaried paid by them must be submitted by the employers to the authorities within the twenty days of the expiry of a month. This should be done in the prescribed format along with the tax deducted by them during the month exactly prior to this month.

However, this requires that the tax amount deducted has not exceeded Rs. 5000, and the registered employer must provide the Statement within twenty days of the expiry of the quarter. All these Statements must be coupled with a treasury challan in the proof of payment.

In case the employer fails to submit the Statement or provides incorrect or incomplete details, the assessing authority may order another assessment provisionally for that particular month.

Based on the assessment, the authority may demand to gather the tax amount.

Payment of tax by enrolled individuals

The employers registered under the Act must ensure that the tax is paid in the prescribed manner in the stipulated time. The amount must be paid by the tax-payer in the following format:

Consequences of failing to deduct or to pay tax

The guidelines suggest that if an employer does not deduct the tax while paying the salaries or fails to pay tax after the deductions, they may have to face the consequences.

Penalty for non-payment of tax

Like any other government procedure, failure or delay in paying the Karnataka profession tax can attract penalties. If such a thing happens without the employer being able to provide a good reason, the concerned authority may impose a fine or a penalty of up to 50% of the amount of the due tax. The penalty amount would be in addition to the amount payable as interest mentioned under subsection (2), (3) of section 11.

Recovery of tax

Any kind of amounts pertaining to taxes, penalties, or interest under the Act must be collected from the enrolled employer or individual in the following format:

- As an arrear of revenue or land OR

- Aligning with the application to any magistrate when the fine is imposed by them.

Authorities overseeing the Implementation of the Act

The State government appoints certain officers who oversee and estimate if the Act has been implemented correctly. The officers that may be appointed are as follows:

- Officer for the entire State of Karnataka who would be the Commissioner of Profession Tax

- One or more officers for the post of the Additional Commissioner

- Joint Commissioner, Deputy Commissioner, and other officers for the purpose of Profession Tax

It must be noted that all the officers will be supervised and controlled by the State government and the commissioner.

Exemptions

Let’s look at the exemptions under the Act:

- An employer cannot deduct or pay any tax from an employee who has reached the age of 65.

- If an employee is engaged for less than 120 days in any year, no tax is deducted or due by the employer.

- Certain types of employees, such as those with a single child, those who are physically disabled, and combatant members of the armed services, are also excused according to the criteria and circumstances set forth in the relevant announcements.

Procedure to File Karnataka Form 5 for Annual Profession Tax Return

The registered employer now has the option of submitting the monthly Statement in Form 5 –A and the yearly return in Profession Tax Form 5 electronically. Such an employer may also pay the tax electronically via the internet. Here are the detailed steps you can follow to file the profession tax return:

- A username and password are given to each registered employer. If the login and password have not been communicated yet, the jurisdictional Profession Tax Officer can provide them (PTO).

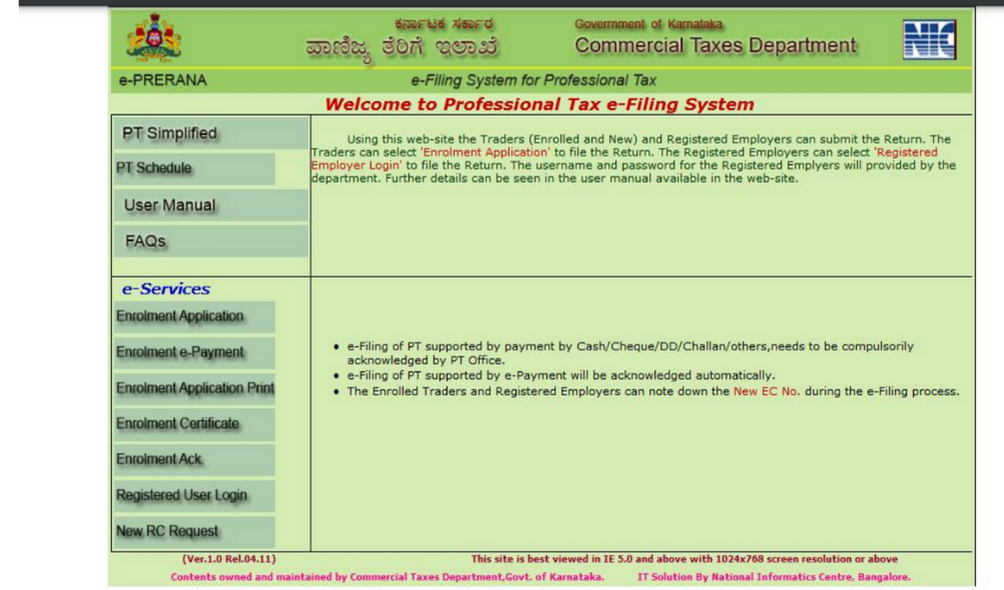

- Visit http://ctax.kar.nic.in or http://pt.kar.nic.in/ to arrive at the page as shown in the image below:

- Click e-Services that display seven options available: I. Enrolment application II. e-Payment III. Application print IV. Enrolment certificate V. Enrolment Ack. VI. Registered User’s Login VII. New RC Request.

- Click on Registered User Login

- Now enter your login id and password as communicated by the PTO.

- Once you are on the welcome screen, move ahead by clicking Next.

- Enter the details in the following fields: Contact person’s name, address, contact number, fax number, mobile number, e-mail id, and website

- Click Next.

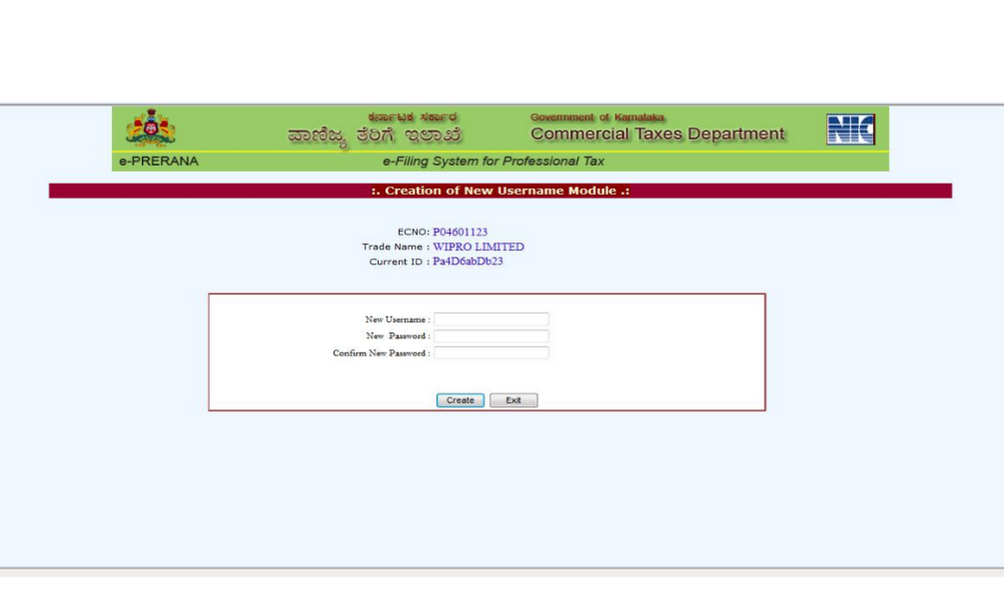

- This screen will require you to create your username and password with a minimum of eight characters and a maximum of fourteen characters. You must ensure that it has at least one special character, one capital letter, one small letter, and one number.

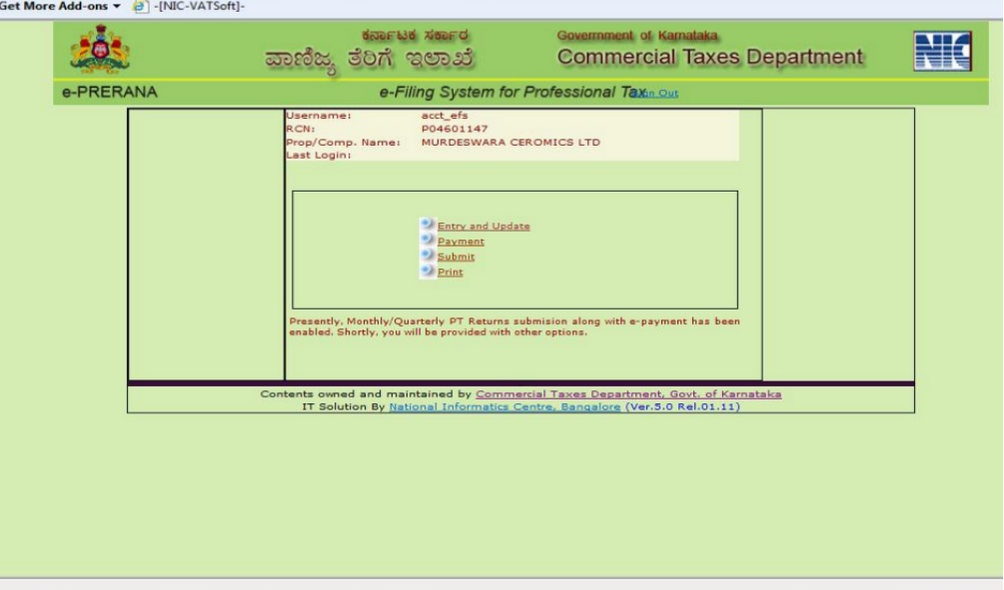

- Once the login id and password are created, exit from the screen and log back in with the new username and password. You shall arrive at the following screen:

- The e-return will offer the following options: Entry and update, Payments, Submit, Print.

- Click on Entry and Update.

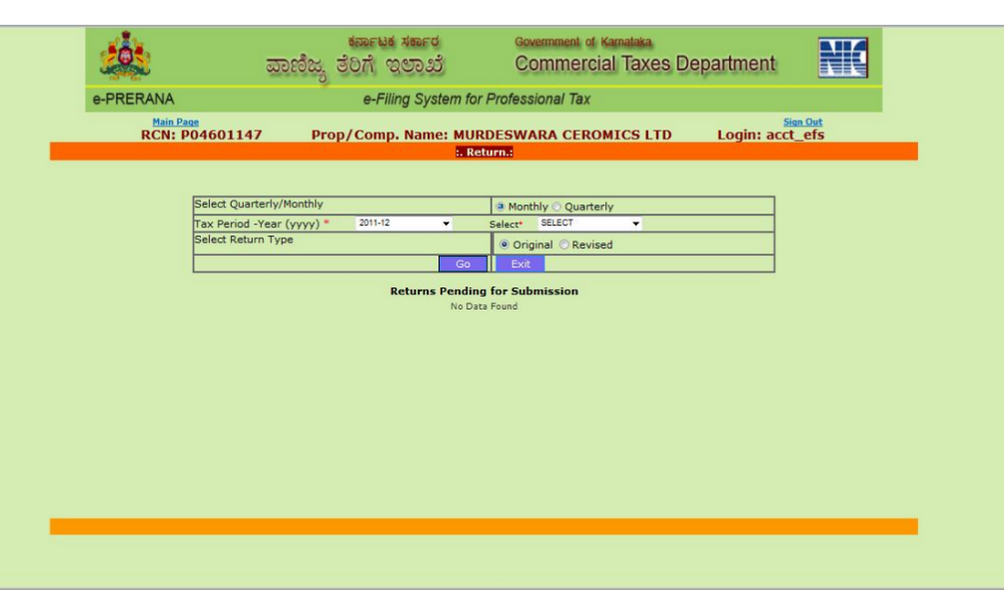

- Select the buttons as applicable: monthly or quarterly under Tax Period.

- Next, select the month and year. Also, select the Return Type.

- Click Go.

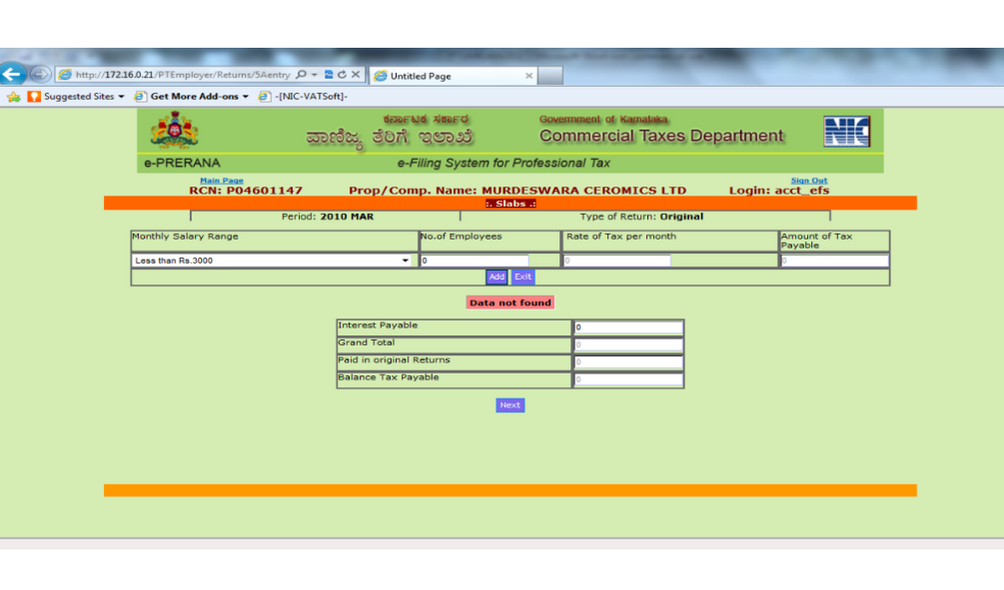

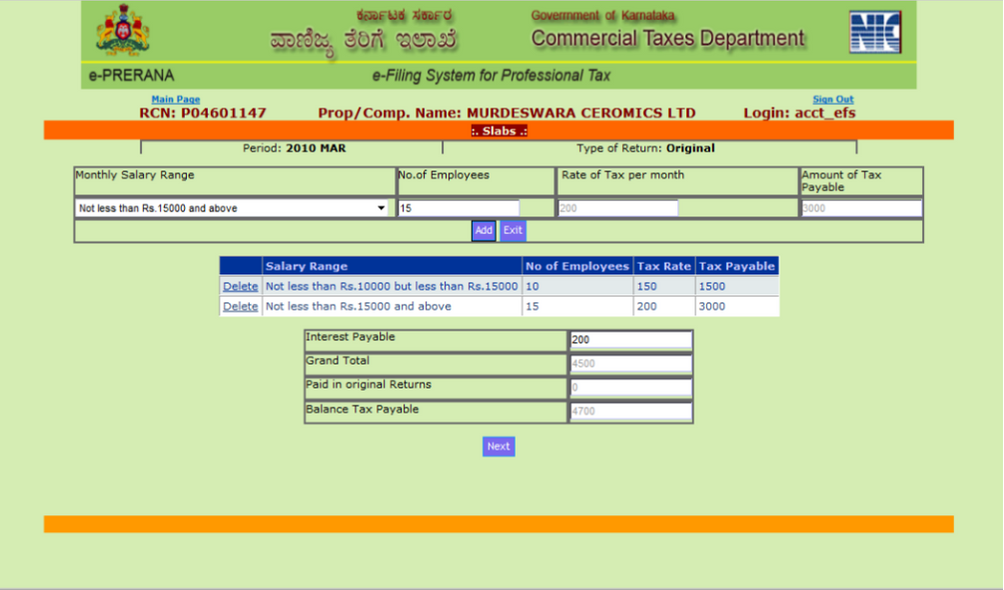

- On the next screen you shall see options for entering the monthly salary range, number of employees, tax rate per month, and the amount of tax payable. Add the details as applicable.

- Once you have added all the details, the system will generate the interest payable, grand total, paid in original returns, and balance tax payable.

- Click Next.

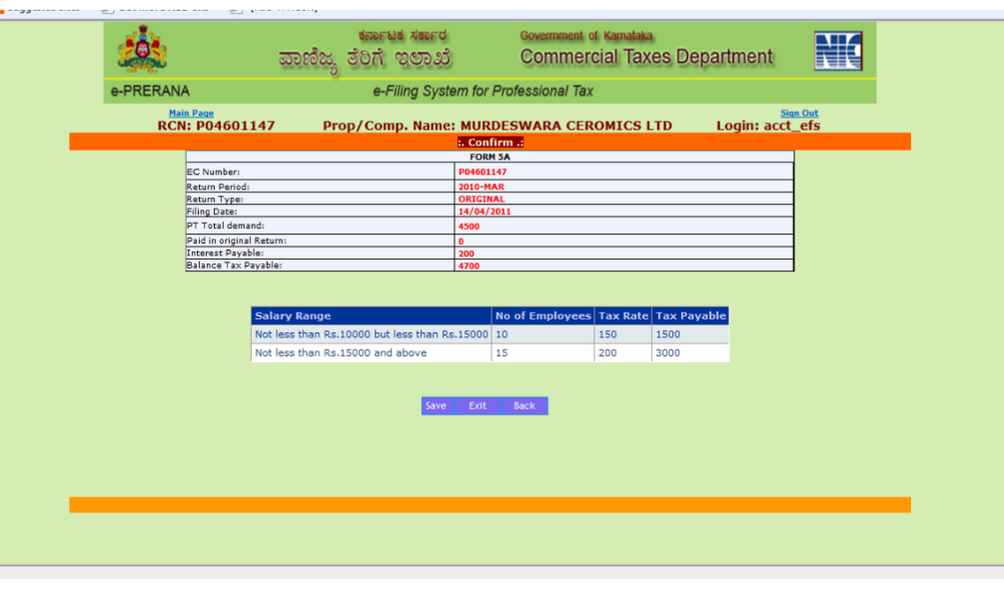

- All the important details required in Form 5A will be presented on your screen now.

- Review the information provided by you and click Save. You can make changes by clicking Back. Make fresh and correct entries and click Save.

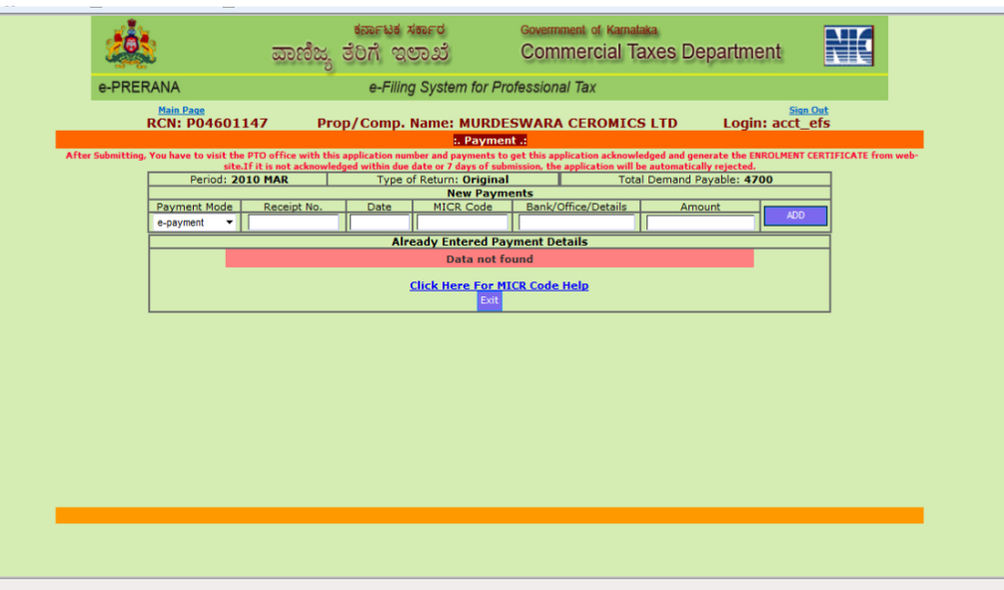

- You can choose to make the payment through e-payment or Cash/DD/Challan/Cheque.

Option to Pay Electronically: E-payment Procedure

In this case, https://vat.kar.nic.in/epay is the website for the e-Payment system. This is an open website that does not require user authentication. This website can be accessed via a link on the CTD's website (http://vat.kar.nic.in). The procedure for making an e-payment is as follows.

- The Employer goes to the e-payment website and chooses Profession Tax from the nine categories of Commercial Taxes.

- The employer inserts the number on his Registration Certificate. The system validates the RC No., and the CTD database populates the name, address, and office of the PTO where he is registered.

- Next, the employer fills in the remaining information: Tax Period, Tax Amount, and Interest.

- Now, the employer chooses an e-Payment bank from a drop-down menu.

- The system shows which banks have integrated their e-payment process with the Department of Commercial Taxes.

- After the employer has been asked to verify and confirm the information provided, they will be requested to click the submit button. The system records these facts and generates a unique number known as the CTD Reference Number, which is displayed to the employer. This number will be saved by the employer for future reference.

- The system subsequently sends the payment data entered by the employer to the selected bank's website.

- The bank's login page will open, and the employer will authenticate by providing his credentials, username, and password, as provided by the bank.

- The tax category, RC number, CTD reference number, and payment amount are now shown on the bank's website.

- The transaction will be completed in the main banking system once the employer confirms payment. After completing the transaction successfully, the employer must wait thirty to forty seconds.

- The bank's website will revert to the previous State after the payment procedure is completed and share the details with the CTD website.

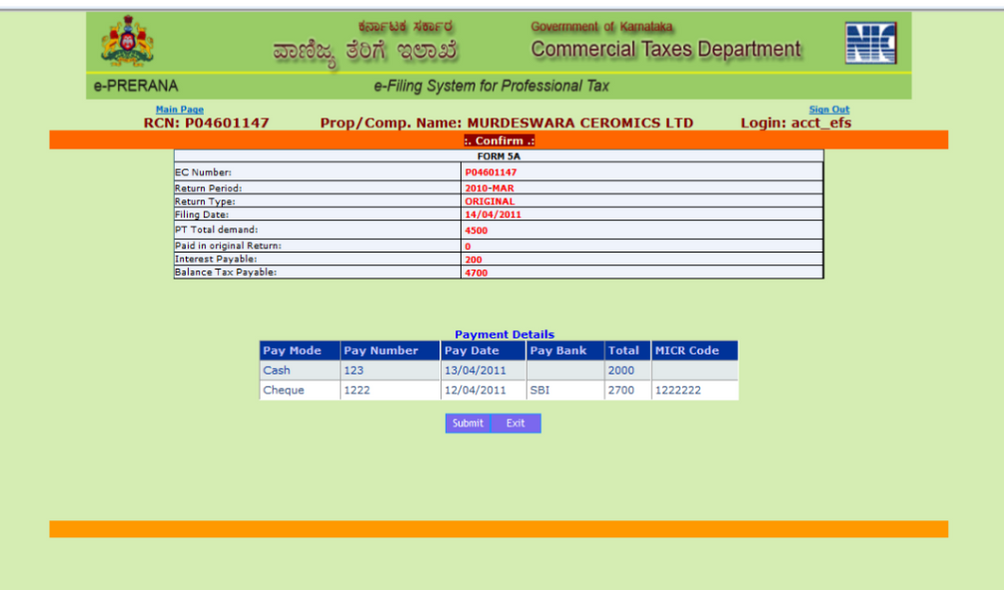

- The employer needs to log back in on the http://pt.kar.nic.in website. Once logged in, they can set the record for the month for which the payment has to be done. They shall reach the following screen:

- Select e-payment as the mode of payment. Once the system verifies data from the CTD database, following which it presents the date and amount automatically. Now click Add. This will save the payment particulars for the month due for payment. Click Exit.

- Click Submit while you select the return which is to be filed. All payment particulars will be displayed.

- Review again before clicking Submit.

- After submitting, you shall receive a Statement in Form 5A with a unique PTR.

- If you select this e-payment method, your Form 5A will be considered as an acknowledgment by the jurisdictional PTO. This way, you can avoid visiting the office physically.

Making Payments

If you choose to make the payment through cheque or DD, or a challan, follow the steps mentioned here:

- You will be required to enter the information like the cheque date, cheque number, MICR code, amount, and finally click Add.

- This will save the payment particulars and will be added to the return for the said month. Then click Exit to go on the main menu.

- Click Submit and choose the return you want to submit. You will be able to see all the details such as RC number, payment details, tax payable, and so on, on your screen.

- Following submission, a Form 5 –A Statement will be prepared, with a unique number attached to it. By selecting Print from the main menu, a print of such a Statement with a unique number can be downloaded from the system (Figure 3). Make a note of the one-of-a-kind number.

- To have this Statement acknowledged by the concerned PTO, go to the jurisdictional PT office with this unique number and physically deposit the Cheque/DD/Cash/Challan.

- It should be noted that the Statement in Form 5-A provided electronically will only be recognized as acknowledged after the jurisdictional PTO receives the relevant channel and acknowledges it online.

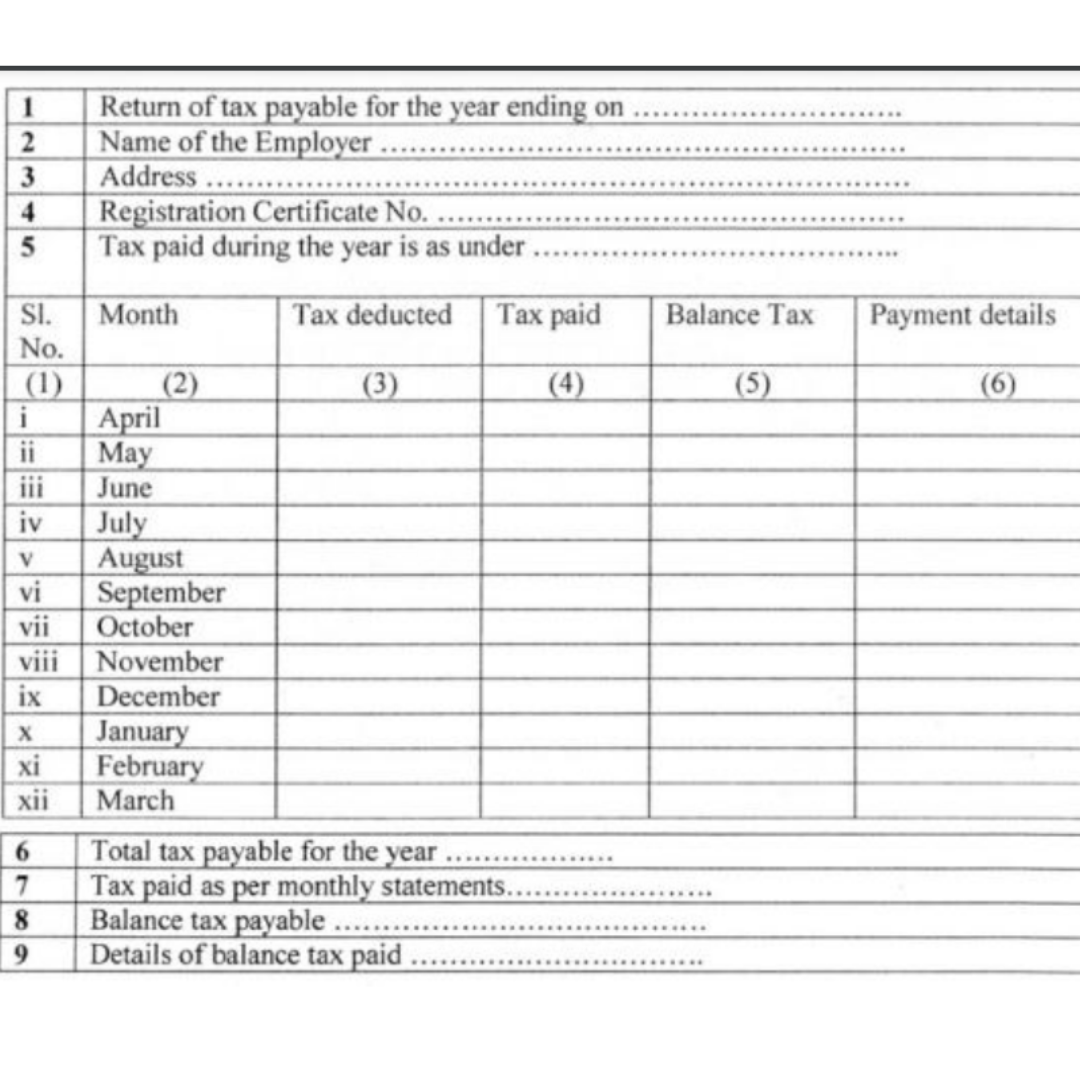

Format of Form 5 for Karnataka Profession Tax Return

The image depicts the format of Form 5 for the profession tax return. Here is the information that goes into the form:

- The first row is meant for the year for which the returns are submitted.

- Next is the name of the employer.

- Address of the employer

- Registration certificate number

- The amount of tax paid for the year

Next, we have the table which has fields which are as follows:

- Serial number

- Month

- Tax deducted

- Tax paid

- Balance Tax

- Payment Details

Below the table, you would also need to input the following information:

- Total Tax payable for the year

- The amount of tax paid based on monthly Statements

- Balance tax payable

- Information about the balance tax paid

Class of Persons and corresponding Rate of Tax

How can Deskera help you?

Deskera People has the tools to help you manage your payroll, leaves, employee onboarding process, and managing employee expenses, all in a single system. With features like a flexible pay schedule, custom payroll components, detailed reports, customizable pay slips, scanning, and uploading expense, creating new leave types, and more, it makes your work simple.

Key Takeaways

Every employer who is registered under the Profession Tax Act must file a Form 5 annual return within 60 days of the year's end. In addition, the employer is required to pay the full amount of tax due on the basis of such return, less any tax already paid, together with a monthly Statement in Form 5A.

- Every month, all employers registered under the Profession Tax Act must submit a Form 5-A Statement with details of the pay and wages provided to their employees

- They must also include the amount of tax deducted. This Statement must be provided on or before the 20th day of the following month, coupled with the total amount of tax due based on the Statement

- The said employer must additionally file an annual return in Form 5 within 60 days of the year's end. In addition, he must pay the whole amount of tax due based on the return; They can subtract any tax already paid in Form 5-A.

- If the amount of the monthly deducted tax is less than Rs. 5,000, the employer must submit Form 5-A and tax payment within 20 days of the quarter's end.

- The first step is to register under the Profession Tax Act. Every employer except the government officers who pay tax under section 4 must obtain a registration form from the authorities for enrollment.

- Every employer or individual must obtain this certificate of registration within ninety days from the date the Act commenced.

- In the case where the reviewing authority finds that the applicant has deliberately provided incorrect or false information while applying, the officer may impose a penalty of not more than Rs.1000.

- All the employers enrolled under the Act must furnish returns in the prescribed format to the concerned official within sixty days of the expiry of the year.

- A Statement comprising the details of the salaried paid by them must be submitted by the employers to the authorities within the twenty days of the expiry of a month. This should be done in the prescribed format along with the tax deducted by them during the month exactly prior to this month.

- If the employer defaults on the timely payment of the tax, the concerned authority may impose a fine or a penalty of up to 50% of the amount of the due tax.

- Any kind of amounts pertaining to taxes, penalties, or interest under the Act must be collected from the enrolled employer or individual in the following format: As an arrear of revenue or land OR Aligning with the application to any magistrate when the fine is imposed by them

- An employer cannot deduct or pay any tax from an employee who has reached the age of 65. Also, if an employee is engaged for less than 120 days in any year, no tax is deducted or due by the employer.

- The Karnataka Profession tax can be submitted by visiting http://ctax.kar.nic.in or http://pt.kar.nic.in/

Related Articles