Josh recently started his own business of books and stationery. He invested $5000 and has been running his business diligently for 3 months. He bought a few goods on credit and also made some lucrative sales. He wants to expand his business and add other school supplies to his shop.

To ascertain if his business allows him for such expansion, without having him to invest his own capital, he must calculate his Net Working Capital.

The Net Working Capital is the perfect solution for you to assess your business funds and if you can invest them in the growth of your business and other income-generating activities. You can use the Net Working Capital formula to evaluate the liquidity of your company and whether it can meet costs that exceed your liabilities.

Starting a new business is difficult, and entrepreneurs must analyze the financial situation of their business, especially in the early stages. Working capital provides a way to assess whether a company can repay short-term debt.

Table of Contents

- What is Net Working Capital?

- Definition of Net Working Capital

- What is Operating Working capital

- What is Working capital Ratio

- Example of Net Working Capital

- What is included in Net Working Capital?

- Other Net Working Capital formulas

- Why is Net Working Capital so important?

- How to improve Net Working Capital

- Set a Net Working Capital schedule

- Common Factors Used for Net Working Capital Accounts

What is Net Working Capital?

Net Working Capital considers items specified in the balance sheet and is the difference between a company's current assets and current liabilities. The larger the Net Working Capital, the better it is. Net Working Capital indicates a healthy business, its operational efficiency, liquidity, short-term financial position, and its ability to meet its current obligations.

It is a measure of a company's liquidity and ability to fulfill its short-term obligations and fund management. A positive Net Working Capital helps you predict the future and make wise investment decisions. If your company's current assets do not surpass current liabilities, it can be difficult to repay creditors. You may go bankrupt.

What is a Current Liability?

It's a company debt that you have to pay within a year. Here are some examples:

- Accounts payable

- Short-term loans

- Unpaid sales tax

- Income tax payable

- Payroll tax

- Interest expense

- Accrued expenses

These obligations are settled in current assets, which are as follows.

- Cash

- Stock

- Prepaid Expenses

- Accounts Receivables

- Easy-to-liquidate investments or cash equivalents (i.e., government bonds, listed stocks, investment trusts, etc.)

The level of working capital of a company indicates how liquid your business is and determines your ability to convert your assets into cash to pay your debt.

Definition of Net Working Capital

Working capital is the amount remaining after current liabilities have been deducted from current assets. It is used to determine if a company has sufficient assets to repay its debt to be paid within a year.

Let us understand this with the help of an example:

Suppose a small business has current assets of $20000 and current liabilities of $10000. Net Working Capital is Assets – Liabilities - $10,000.

Once the Net Working Capital is calculated, you can scrutinize how you can use the balance – whether you want to make improvements in your current business or make other operational adjustments.

What is Operating Working Capital?

Operating Working capital is a variant of working capital. The main difference is that the operating working capital focuses specifically on accounts receivable and inventories, not total current assets. It provides an up-to-date snapshot of performance and financial status.

The formula is:

Operating Working Capital = Current Assets (Accounts Receivable + Inventory Value) - Current Liabilities (Creditors/Accounts Payable)

What is a Working Capital Ratio?

The working capital ratio, also called the current ratio, is used to calculate the ability of a company to pay current assets and current liabilities. It is also a good measure of the overall health of your business.

Working capital ratio = current assets ÷ current liabilities

The following is the range used to assess the working capital ratio:

- If the working capital ratio is less than 1 – it means your business is suffering from potential financial and liquidity issues

- If the working capital ratio is between 1.2 and 2 – it means your business has a decent Net Working Capital Ration

- If the working capital ratio is more than 2 – it means a surplus, profitability, and a healthy business

Net Working Capital management is important for building and maintaining good relationships with creditors and debtors, suppliers, and lenders. It provides an overview of your organization's financial position and is a great indicator of when resources and operations need to be coordinated.

Another Example of Net Working Capital

Company ABC has $10,000 in cash, $20,000 in accounts receivable, and $25,000 in total inventory. These values must be added together to calculate the total of current assets. It will be as follows. $10,000 + $20,000 + $25,000 = $ 55,000

Next, you need to calculate your current liabilities. Let's say ABC company has a $17,000 short-term loan, $2,000 in debt, and $12,000 in outstanding debt. To find the total current liabilities: $17,000 + $2,000 + $12,000 = $31,000

Net Working Capital will be:

$55,000 - $31,000 = $24,000 Net Working Capital

Net Working Capital ratio would be:

$55,000/$ 31,000 = 1.77 which shows profitable activities.

What is included in Net Working Capital?

Net Working Capital is a good indicator of the financial position of SMEs that indicates the liquidity of a company by subtracting current liabilities from current assets.

These are the balance sheet items used to calculate Net Working Capital.

- Current assets - Current assets are all those business assets that can be converted to cash or liquidity, such as cash, accounts receivable, inventories, down payments, and other assets that can be liquidated or converted to cash within one year

- Current Liabilities: Current liabilities are all those expenses that need to be paid within a year, and other payments for rent, utilities, accounts payable, wages, accrued taxes, and long-term debt

Other Net Working Capital formulas

There are several ways to calculate Net Working Capital, depending on what analysts include or exclude from the analysis:

- Net Working Capital = Current Assets – Current Liabilities

- Net Working Capital = Current Assets (less cash) – Current Liabilities (less debt)

- Net Working Capital = Accounts Receivable + Inventory – Accounts Payable

The first expression above is the widest (because it contains all accounts), the second expression is narrower, and the last expression is the narrowest (because it contains only three accounts).

Why is Net Working Capital so important?

Net Working Capital is important because companies need to maintain solvency. Theoretically, it shows the liquidity of the company and whether the company has enough cash to cover its short-term debt.

- Businesses can't purely depend on paper profits to pay invoices. These invoices must be paid in cash. If the Net Working Capital is zero or greater, the company can fulfill its current obligations

- In general, the larger the Net Working Capital, the more ready the company is to meet its short-term obligations. Companies must always have sufficient capital access to cover all bills for one year

- Suppose a company has accumulated $10000 in cash from retained earnings from the previous year. If a company invests an entire $10000 million at a time, it may face sufficient working capital to pay its current liabilities

- It is most useful when used to compare how numbers change over time. This allows you to spot liquidity trends in your company and see if they are improving or decreasing. If your company's Net Working Capital is essentially positive, it's a good omen that you can fulfill your financial obligations in the future. If it is negative, it indicates that your business is unable to make the next payment and may go bankrupt

- Net Working Capital also provides information on how fast a company can grow. If your company has a large capital reserve, you may be able to grow your business fairly quickly; for example, by investing in better equipment

How To Improve Net Working Capital?

If you want to improve your Net Working Capital in your small or medium-sized enterprise, you must make or add specific changes to their operations. Some of these adjustments are:

- Change the payment conditions to reduce the accounting cycle, and frequently pay for goods and services

- You can collect late payments quickly as you can follow up more diligently as soon as the invoice is due

- Send unused inventory to the provider so that you can receive expense refunds

- If you want to be able to load without slow rates, extend the provider's payment period

Other Methods:

- Long-term asset sale - Long-term assets include land, machinery, equipment, etc. By selling unused long-term assets, you can increase your cash and net movement capital

- Eliminating or refinancing the short-term debt can improve Net Working Capital – it helps to lower your current liabilities, helps you get rid of debt faster, and improves your Net Working Capital

- Increased inventory turnover - Inventory is a current asset, which is not as liquid as cash and is included in the NWC formula. However, it has the potential to build in cash for you and increase your Net Working Capital. For example, if you run a jewelry business and your inventory has a wholesale price of $10000, a retail price of $1,5000, and you sell at that price, your NWC will increase by $5000

- Negotiate new terms with suppliers - The more you can negotiate better credit terms with your suppliers, the more cash you will have

- Providing incentives for invoices - Provide incentives for customers who pay invoices on time. You can also prevent your account from expiring too early by identifying and addressing late payments early. Avoid dealing with customers who haven't paid their invoices on time in the past

- Accounts Receivable Automation - Automating accounts receivable makes it easier to track receipts and issues. It also makes it easier to get the attention of the default customer. Reward team members if they can effectively collect payments

- Check interest payments - Check the interest rate on your loan and see if you can change it so that you can pay a fixed amount lower than each month. You can add extra cash to your working capital by saving money on mortgage payments

Set a Net Working Capital schedule

Below are the steps analysts take to predict the Net Working Capital using automation:

Step 1 – You must have the income and costs of the goods sold at the top of the table from the income statement for all relevant periods. These will later be used to calculate the impetus for forecasting working capital accounts

Step 2 - Create an appropriate balance sheet account and divide current assets and current liabilities into two sections. You must exclude cash from current assets and the current portion of liabilities from current liabilities. Arrange the accounts in the order they appear on the balance sheet for clarity and consistency

Step 3 - Create subtotals for all non-cash current assets and total non-debt current liabilities. Subtract the latter from the former to get the total working capital. If the following is useful, create another row to calculate the increase or decrease in Net Working Capital from the previous period to the current period

Step 4 - Enter historical data in the statement by referring to the appropriate data on the balance sheet or by entering the hard-coded data in the Net Working Capital statement. If you have already created a balance sheet with a future forecast period available, refer to the balance sheet and enter the forecast data in your plan as well

Step 5 - If future periods are not available for account verification, create a section outlining key asset drivers and assumptions. Use historical data to calculate driving factors and assumptions for future periods. Use the prepared driver and assumptions to calculate the future value of the line item

Common Factors Used for Net Working Capital Accounts

Here are a set of assumptions used that help to predict the Net Working Capital:

- Accounts receivable: Days of accounts receivable

- Inventory: Days in stock

- Other current assets: percentage of sales, growth rate, fixed or increased

- Accounts payable: Days of accounts payable

- Other Current Liabilities: Sales Percentage, Growth Rate, Fixed Amount, etc.

You can calculate receivables, inventories, and payables by referring to past trends and estimating future value. Increase Receivables, Inventory Dates, and Payment Dates are all calculated based on sales or the cost of goods sold.

How Can Deskera Assist You?

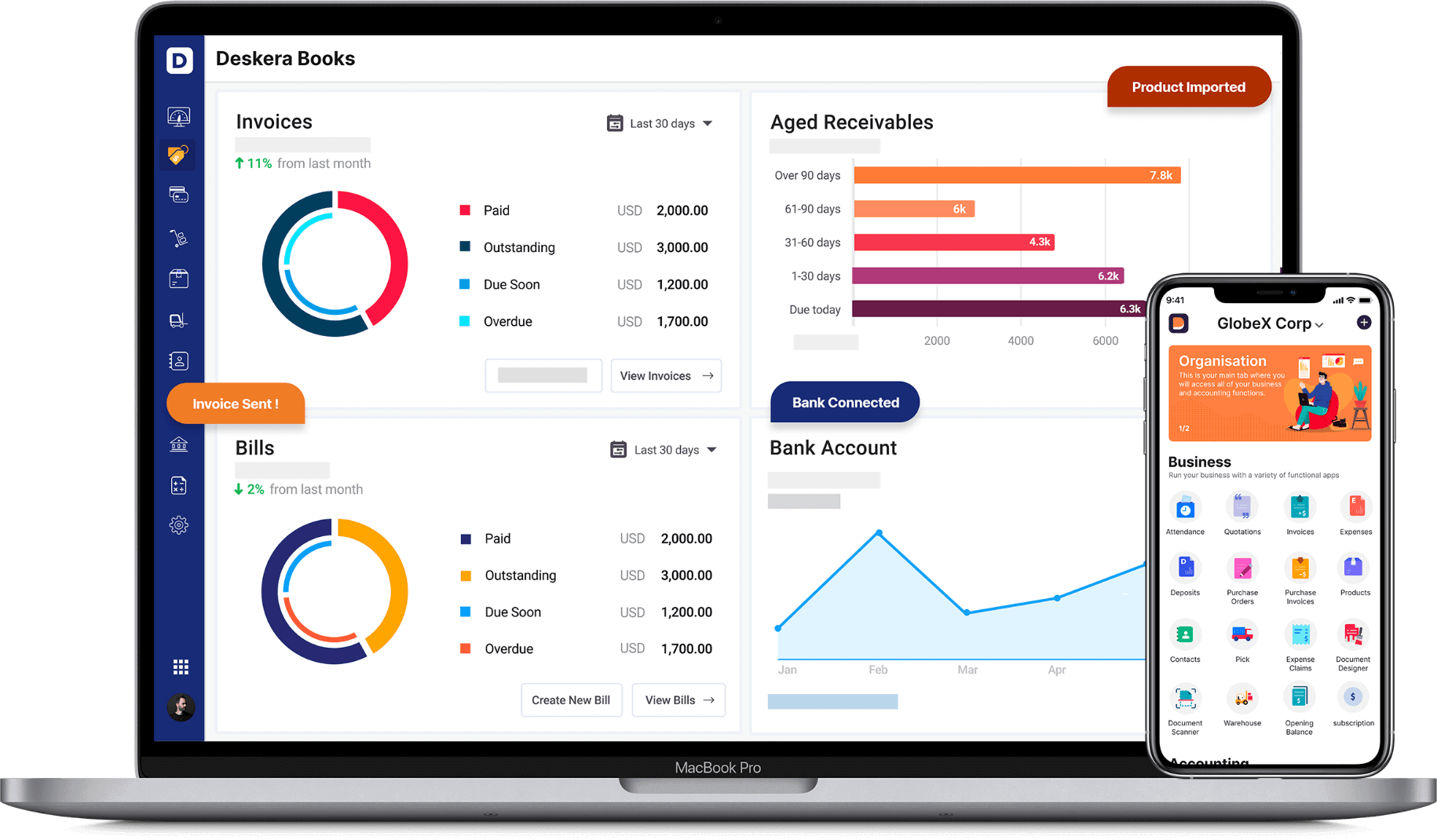

Deskera Books can help you automate your accounting and mitigate your business risks. Creating invoices becomes easier with Deskera, which automates a lot of other procedures, reducing your team's administrative workload.

Conclusion

To summarise it all, Net Working Capital (NWC), is a highly useful way to estimate the current success or failure of your business. The numbers, data points, and balance sheet items will change over time, but if you quickly need to assess the position of your business, Net Working Capital (NWC), is a great formula to estimate that.

Key Takeaways

- Net Working capital, also known as NWC, is the difference between a business’s current assets and current liabilities

- Net Working Capital is an indicator of a company's liquidity and short-term financial position

- If the ratio of current assets to liabilities is less than 1, the Net Working Capital of the company will be negative

- A positive Net Working Capital indicates that a company can invest in future growth and fund its current business

- A high Net Working Capital is not always a good thing. This may indicate that the company is in stock too much or has not invested surplus cash

Related Articles