If your small business has employees working in Missouri, you'll need to withhold and pay Missouri income tax on their salaries. This is in addition to having to withhold federal income tax for those same employees. In this article we will tell you all you need to know about Missouri payroll taxes.

This article covers the following:

- Requirements for Missouri payroll tax

- Taxes on employees’ wages

- Missouri employers with non-resident employees

- Missouri tax withholding

- Voluntary withholding

- Taxes on vacation pay

- Taxes on tips

- Employer compensation for employees

- Records to be kept by employers for taxation

- Annual report

- How can Deskera assist you?

Requirements for Missouri Payroll Tax

Here is all that you require for filing payroll taxes in Missouri:

Get an EIN

If your small business has employees working in the United States, you'll need a federal employer identification number (EIN). You should obtain your EIN as soon as possible and, in any case, before hiring your first employee.

The IRS issues eINs, and you'll need one first and foremost for federal taxes. In addition, some states use the federal EIN for state withholding tax purposes. Other states (like Missouri) issue separate state tax ID numbers. You'll need an EIN to register with the state (see below).

You can apply for an EIN at the IRS website (www.irs.gov). Generally, if you apply online, you will receive your EIN immediately.

Register With the Department of Revenue

Apart from your EIN, you also need to establish a Missouri withholding tax account with the Missouri Department of Revenue (DOR). You set up your account by registering your business with the DOR either online or on paper.

To register online, go to the Missouri Business Portal. To register on paper, use Form 2643, Missouri Tax Registration Application. If you register online, you'll initially receive a confirmation number, and then it will take 5-8 days to process your application.

If you register by mail, it should take about ten days to process your application. There is no fee to register your business with DOR.

Have New Employees Complete a State Tax Form

All new employees for your business must complete both a federal Form W-4 and the related Missouri Form MO W-4, Employee's Withholding Allowance Certificate. You can download blank Form MO-W-4s from the Forms & Manuals section of the DOR website. You should keep the completed forms on file at your business and update them as necessary.

File Scheduled Withholding Tax Payments and Returns

In Missouri, there are four primary payment schedules for withholding taxes: quarter-monthly, monthly, quarterly, or annually. In addition, if your business is only open for several months out of the year, you can register with the DOR as a seasonal employer (not covered here).

Your payment schedule will depend on the average amount you hold from employee wages over time. The more you withhold, the more frequently you'll need to make withholding tax payments. As a newly-registered employer, you will initially be assigned a payment schedule based on your estimation of future withholdings.

The exact threshold dollar amounts for the different payment schedules, as well as other rules, may change over time, so you should check with the DOR at least once a year for the latest information.

After you register with the DOR, you will be sent a pre-printed voucher booklet with information specific to your business and due dates for your filing frequency.

Here are the due dates for the various payment schedules:

- Quarterly-monthly: Payment is due within three banking days for the periods ending the 7th, 15th, 22nd, and last day of a month. Other rules also currently apply to quarterly-monthly filers regarding the amounts to be paid and whether another payment schedule may be used.

- Monthly: For months that are not the end of calendar quarters, payments are due by the 15th day of the month following the month the tax was withheld. For the four months that are also the end of calendar quarters (March, June, September, and December), payments are due by the last day of the month following the month in which the tax was withheld.

- Quarterly: Payments are due by the last day of the month following the end of the calendar quarter.

- Annually: Payment is due by the last day of January.

Note: If a payment is due on a Saturday, Sunday, or legal holiday, the due date is extended to the next business day. A payment is considered timely if postmarked by the due date.

You must include a return with each of your payments. You must file a return even if you owe no money for a particular pay period. You can file returns on paper or online. When filing on paper, use Form MO-941, Employer's Return of Income Taxes Withheld.

You can also make payments online by going to the Business Tax Section of the DOR website. However, additional convenience charges apply for online payments. Quarter-monthly filers must make payments online but still use Form MO-941 to file monthly reports (also known as reconciliations), which are due on the 15th of the month following the month taxes are collected. The reconciliations can be filed online.

The DOR provides several different methods for calculating how much tax to withhold. For more information, download Form 4282, Employer's Tax Guide, from the Forms & Manuals section of the DOR website.

Complete an Annual Report Form

After the end of the year, you must file an annual report form with the DOR that summarizes the employee taxes you've withheld during the year. The annual report is in addition to providing each of your employees with a federal form W-2 summarizing the employee's withholding for the year.

Use Form MO W-3, Transmittal of Tax Statements. You should include copies of the federal W-2s sent to all of your employees working in Missouri. Employers with fewer employees can submit copies of W-2s on paper, CD, or flash drive.

Larger employers must submit copies of W-2s on CD or flash drive. The annual report and all W-2s are due on or before the last day of February. As with tax payments and returns, if the report is due on a Saturday, Sunday, or legal holiday, the due date is extended to the next business day, and reports and W-2s are considered timely if postmarked by the due date.

Independent Contractors are Not Employees

This article is only concerned with employees, not independent contractors. In general, different tax rules apply to independent contractors.

Taxes on Employees' Wages

Taxes on employees’ wages has the same meaning as federal withholding. Wages include all pay given to an employee for services performed.

The pay may be in cash or in other forms. Wages include salaries, vacation allowances, bonuses, and commissions, regardless of how measured or paid.

Nonresident Employees Subject to Withholding If a nonresident employee performs all services within Missouri, tax shall be withheld from all wages paid to them as in the case of a resident if services are performed partly within and partly without the state.

In that case, only wages paid for services performed within Missouri are subject to Missouri income tax withholding, provided the employee files with the employer a Certificate of Nonresidence or Allocation of Withholding Tax (Form MO W-4A).

The employee may determine the portion of wages allocable to Missouri on the basis of the preceding year’s experience. Suppose only a portion of an employee’s wages is subject to Missouri income tax withholding.

In that case, the amount of Missouri tax required to be withheld is calculated using a percentage of the amount listed in the withholding tables. The calculation begins by determining the amount that would be withheld if all the wages were subject to Missouri withholding. This amount is then multiplied by a percentage determined by dividing the wages subject to Missouri withholding by the total federal wages.

Example: A nonresident earns $20,000 in wages, $12,000 from Missouri sources. Missouri withholding would be 60 percent ($12,000 / $20,000 equals 60 percent) of the withholding required on $20,000.

Therefore, if $100 per month should be withheld for an individual earning $20,000, then $60 should be withheld each month ($100 x 60 percent = $60). A resident of Missouri Employed in Another State A Missouri employer must withhold Missouri tax if its Missouri resident employee performs services in a state with an income tax rate that is lower than Missouri’s.

The employer will withhold and remit to Missouri the difference between the states’ withholding requirements unless the employee has completed Form MO W-4C, Withholding Affidavit for Missouri Residents.

This form relieves the employer of filing and submitting the difference to Missouri and places the responsibility on the employee. The MO W-4C is not a required form; if the employee chooses not to complete the form, the employer is responsible for reporting the appropriate amount of withholding to Missouri.

Suppose only a portion of an employee’s wages is subject to Missouri withholding tax. In that case, the amount of Missouri tax required to be withheld is calculated using a percentage of the amount listed in the withholding tables.

The calculation begins by determining the amount that would be withheld if all the wages were subject to Missouri withholding. This amount is then multiplied by a percentage determined by dividing the wages subject to Missouri withholding tax by the total federal wages.

Employee Completes W-4C Example: The employee performs 40 percent of their services in Kansas. The remaining 60 percent of the employee’s services are performed in Missouri. If the total withholding on all earnings is $40 per month, the actual withholding for Missouri would be $24 ($40 x 60 percent = $24).

Missouri Employer with Nonresident Employees

If a nonresident employee performs all services outside Missouri, their wages are not subject to Missouri withholding. A nonresident employee performing services in more than one state is subject to withholding as Interstate Transportation Employees A. Rail, Motor, and Private Motor Carriers 49 USC Sections 11502 and 14503 limit state taxation on wages of rail employees, motor, and private motor carriers.

Missouri Tax Withholding is Required on the Rail, Motor, and Private Motor

Missouri withholding is required on the rail, motor, and private motor carrier employees whose state of residence is in Missouri. Employees of rail carriers and motor carriers who perform regularly assigned duties in more than one state are subject to state income tax only in their state of residency.

Air And Water Carriers

Air and Water Carriers 49 USC Section 40116 limits taxation on wages of employees of air and water carriers to the employees’ state of residence and to the state in which the employees earn more than 50 percent of the wages paid by the air or water carrier, if different from the state of residence.

Voluntary Withholding

Voluntary Withholding A. Voluntary Withholding on Retirement, Pension, or Annuity Income Every Missouri resident receiving retirement, pension, or annuity income in this state, may elect to have an amount withheld as a payment of state income tax provided such income is taxable in this state.

The recipient should determine the amount to be withheld and file a Withholding Certificate for Pension or Annuity Statements (Form MO W-4P) with the administrator of their retirement, pension, or annuity plan.

Voluntary Withholding for Civil Service Annuitants Civil service annuitants may elect to have state income taxes withheld from their regular annuity payments.

Supplemental Wage Payments, Vacation Pay, Tips, Lump Sum, and Periodic Distributions. Supplemental Wage Payments If supplemental wages are paid (such as bonuses, commissions, severance pay, overtime pay, back pay, including retroactive wage increases, or reimbursements for nondeductible moving expenses) in the same payment with regular wages, withhold Missouri income tax as if the total of the supplemental and regular wages were a single wage payment for the regular payroll period.

Suppose supplemental wages are paid in a payment separate from regular wages. In that case, the method of withholding Missouri income tax depends partly on whether you withhold income tax from the employee’s regular wages.

If you withhold Missouri income tax from the employee’s regular wages, you may choose one of two methods for withholding income tax on the supplemental wages:

1) Withhold a flat percentage rate of 5.4 percent of the supplemental wages.

2) Add the supplemental wages to the regular wages paid to the employee within the same calendar year for the payroll period and determine the income tax be withheld as if the aggregate amount were one payment.

Subtract the tax already withheld from the regular wage payment and withhold the remaining tax from the supplemental payment.

If you have not withheld income tax from the regular wages, you must use the method covered in Section 7, A.2. Add the supplemental wages to the regular wages paid within the same calendar year for the payroll period and withhold income tax on the total amount. The supplemental wages and regular wages were one payment for a regular payroll period.

Vacation Pay

Vacation Pay If an employee receives vacation pay for an absence, the vacation pay is subject to Missouri income tax withholding as if it were a regular wage payment made for the payroll periods during the vacation.

If vacation pay is paid and regular wages for the vacation period, the vacation pay is treated as a supplemental wage payment. The vacation pay of an employee who is not a resident of Missouri, but works in Missouri, is subject to Missouri income tax withholding.

Tips

Tips Employers must withhold Missouri income tax based upon total tips reported by the employee. Withhold Missouri income tax on tips using the same options indicated for withholding on supplemental wage payments in Section 7.A. in Section 4A. Note: Missouri does not have a reciprocity agreement with any other state.

Household Employees

Household Employees Missouri follows federal guidelines regarding Household Employee(s). If the employee elects to have withholding tax withheld on their wages, complete the Tax Registration Application (Form 2643) found on our website at http://dor.mo.gov/business/ in order to report the taxes withheld on the Employer’s Return of Income Taxes Withheld (Form MO-941).

Exemption For Nontaxable Individuals Exemption from withholding for nontaxable individuals is valid only if an employee submits to the employer a completed Form MO W-4 certifying that the employee has no income tax liability from the previous year and expects none for the current year.

Employees must file a Form MO W-4 annually if they wish to continue the exemption. Military Spouses Residency Relief Act Missouri income for services performed by a non-military spouse of a nonresident military servicemember is exempt from Missouri income tax.

To qualify for this exemption, the spouse must reside in Missouri solely because the military servicemember is stationed in Missouri under military orders and be a permanent resident of another state.

Suppose a non-military spouse of a nonresident servicemember completes a new Form MO W-4 to claim an exempt status because of the Military Spouses Residency Relief Act. In that case, employers must receive verification from the non-military spouse that they are a resident of another state and are living in Missouri because of military orders before the exempt status can be granted.

Verification of military status can be a Leave and Earnings Statement of the nonresident military servicemember; Form W-2 issued to the nonresident military service member, a military identification card, a married military identification card, or specific military orders received by the servicemember.

Verification of residency can be in the form of a copy of a prior year’s state income tax return filed in their state of residence, a prior year’s property tax receipt from the state of residence, a current driver's license, vehicle Return, and Payment of Taxes Withheld Every employer withholding Missouri income tax from employees’ wages is required by statute to report and remit the tax to the state of Missouri on Form MO-941.

According to your assigned filing frequency, a separate Form MO-941 must be filed for each tax period. A pre-printed voucher booklet detailing the employer’s name, address, employer identification number, filing frequency, and due date is provided to each active account on a monthly, quarterly, or annual filing frequency.

Quarter-monthly filers are required to file and pay by an alternative method. (See page 2.) If an employer misplaces damages or fails to receive the necessary reporting forms, replacement forms should be requested, allowing sufficient time to file a timely return. If a blank form is used, the employer’s name, address, and Missouri Tax I.D.

The number must appear as filed on previous returns, and the period that the remittance is made must be indicated. Failure to receive reporting forms does not relieve the employer of the responsibility to timely report and remit tax withheld.

If an employer temporarily ceases to pay wages or is engaged in seasonal activities, a return must be filed for each period even if no tax was withheld. Failure to do so will result in the issuance of Non-Filer Notices.

All returns and remittances should be mailed to the Missouri Department of Revenue, P.O. Box 999, Jefferson City, MO 65108-0999. See address labels in voucher books. Returns and payments are due on the dates shown in Section 11. registration, or voter identification card from the state of residency.

Active Duty Members of the Armed Forces of the United States Income earned as a member of any active duty component of the Armed Forces of the United States that is eligible for the military income deduction on Form MO-1040 is exempt from withholding.

Filing Frequency Requirements Missouri income tax withholding returns must be filed by the due date as long as an account is maintained with the Department, even if there was no payroll for the reporting period.

Returns must be filed each reporting period, even though there may not have been any tax withheld. If no tax was withheld, file a zero withholding tax return online at https://mytax.mo.gov/rptp/portal/home/business/ file-withholding-tax-return.

There are three filing frequencies: monthly, quarterly, and annually. A newly registered employer is initially assigned a filing frequency on the basis of his or her estimation of future withholdings.

If the assigned filing frequency differs from the filing requirements established by statute, it is the employer’s responsibility to notify the Department immediately. The time for filing is as follows:

1) Monthly — Employers required to withhold $500 per month for at least two months during the preceding 12 months shall file every month;

2) Quarterly — Employers not required to file and pay taxes withheld on a monthly basis who withhold at least $100 per quarter during at least one-quarter of the preceding four quarters shall file on a quarterly basis;

3) Annually — Employers required to withhold less than $100 during each of the preceding four quarters shall file annually. Regardless of the employer's filing frequency, only one Form MO-941 return should be filed per tax period. In the event an additional amount of tax must be paid, please refer to Section 13.

Quarter-Monthly Any employer who withheld $9,000 or more in each of at least two months during the prior 12 months shall remit payment to the Director of Revenue on a quarter-monthly basis. One of the alternative payment methods on page 2 must be used.

A quarter-monthly period means:

1) The first seven days of a calendar month

2) The eighth to the fifteenth day of a calendar month

3) The sixteenth to the twenty-second day of a calendar month

4) The twenty-third day through the last day of a calendar month.

The employer must make a payment, at the end of each quarter-monthly period to pay 90 percent of the withholding due for the filing period. The payment must be made within three banking days following the end of the quarter-monthly period or deposited in a depository designated by the director within four banking days after the end of the quarter-monthly period.

Banking days shall not include Saturday, Sunday, or legal holidays. The compensation authorized in Section 143.261, RSMo, may be taken by the employer against the payment required to be made only if such payment is made on a timely basis. As a quarter-monthly remitter, you have the option to

1. Pay 100 percent of the estimated quarter-monthly amount, as determined by the Department, within three banking days after the end of each quarter-monthly period (four times a month); or

2. Pay at least 90 percent of the actual tax due by the due date of that particular quarter-monthly period. If there is no payroll during a quarter-monthly period, no quarter-monthly payment voucher is necessary.

Any additional tax due at the end of the month must be paid on or before the due date of the monthly tax return.

Example: An employer has a semi-monthly payroll cycle that falls on January 15 and on January 31. The actual Missouri income tax withholding for the January 15 payroll is $12,000.

The employer must remit at least 90 percent of the $12,000 ($10,800) with the 2nd quarter-monthly payment due no later than January 19. The actual Missouri income tax withholding for the January 31 payroll is $15,000.

The employer must remit at least 90 percent of the $15,000 ($13,500) with the 4th quarter-monthly payment due no later than February 3. Because the employer did not have a payroll during the 1st or 3rd quarter-monthly periods, a quarter-monthly payment does not need to be submitted for those two periods.

Example: An employer has only one monthly payroll period, and it falls on January 20. The actual Missouri income tax withholding for the January 20 payroll is $30,000. The employer must remit at least 90 percent of the $30,000 ($27,000) with the 3rd quarter-monthly payment due no later than January 25. Because the employer did not have a payroll during the 1st, 2nd, or 4th quarter-monthly periods, a quarter-monthly payment does not need to be submitted for those three periods.

The withholding tax return is due by the 15th day of the following month, except for the third month of a quarter, which is due on the last day of the following month. If a balance is due, pay the remaining amount using TXP or online filing. Submit a withholding tax return by printing and mailing a Form MO-941 or online.

Any employer who has been placed on a quarter-monthly payment frequency that has not withheld $9,000 or more in two months of the prior 12 months may request permission from the Department to file and pay on a less frequent basis.

An employer must file and pay on a quarter-monthly basis for 12 months before requesting a change in filing frequency.

Employer Compensation

Employers, except the United States, the state of Missouri, and all agencies and political subdivisions of the state of Missouri or the United States Government, may deduct and retain as compensation from remittances made to the Director of Revenue on or before the respective due dates for the payment involved, the following percentages of the total amount of tax withheld and paid annually.

The employer is not entitled to compensation if payment is not made on or before the due date. If the compensation deduction is allowable, the deduction must be deducted on each return filed. Notice to Quarter-Monthly Remitters: The compensation deduction authorized in Section 143.261, RSMo, may be taken against the payment required to be made as long as the payment is made by the employer on a timely basis as provided in Section 143.851, RSMo.

Statements for Employees

Two copies of the Wage and Tax Statement (Form W-2) shall be provided to each employee to whom wages were paid and were subject to withholding tax whether or not tax was withheld from such payments.

Wages include sickness or injury payments made by an employer under wage continuation plans, whether paid in cash or otherwise. The Form W-2 supplied by the Internal Revenue Service must be used for this purpose unless the employer uses a substitute form approved in writing by the Department.

If it becomes necessary to correct Form W-2 after it has been issued to an employee, two corrected Form W-2s should be issued to the employee and a copy mailed to the Department.

The new copies must be clearly marked “Corrected by Employer.” In case a Form W-2 is lost or destroyed, a substitute copy must be issued to the employee and must be clearly marked “Reissued by Employer.”

Form W-2 and the Distributions From Pensions, Annuities, Retirement or Profit-Sharing Plans, IRAs, Insurance Contracts, etc. (Form 1099-R), must be provided to the employee on or before January 31 of the following calendar year for which the Form W-2 or Form 1099-R applies.

File Form 1099-R for each person to whom you have made any designated distribution from profit-sharing or retirement plans, IRAs, annuities, pensions, etc., whether or not you withheld Federal or Missouri income tax.

Records to be Kept by Employers

The following records must be retained for all employees:

1) Name, address, social security number, and period of employment;

2) Amounts and dates of all wage payments subject to Missouri income tax withholding; 3) Employee’s state income tax withholding certificate;

4) Employer’s state income tax withholding registration number;

5) Record of quarter-monthly, monthly, quarterly, and annual returns filed, including dates and amounts of payments;

6) Records that would assist the Department in auditing the employer’s records. All records should be kept for at least three years after the date the taxes to which they relate become due, or the date the taxes are paid, whichever is later. In addition to the records listed above, all records of the allocation of working days in the state of Missouri must be retained for all nonresident employees.

Annual Report

Annual Report Annually, each employer must file copies of all withholding statements, Form W-2 or Form 1099-R, Copy 1, for the year and the Transmittal of Tax Statements (Form MO W-3). Employers with 250 or more employees must submit these items electronically (see item B) by the last day of January.

Paper filers must submit copies of all withholding statements by the last day of February. Paper filers must also be accompanied by a list, preferably an adding machine tape or a computer printout, of the total amount of the income tax withheld as shown on all “Copy 1s” of Form W-2 and Form 1099-R.

Send Form W-2(s) and Form 1099-R(s) and Form MO W-3 to the Missouri Department of Revenue, P.O. Box 3330, Jefferson City, MO 65105-3330 inconvenient size packages.

Each package must be identified with the name and account number of the employer, and the packages must be consecutively numbered. Your compact disc(s) or flash drive(s) must contain an external label containing the tax year, Missouri I.D. Number, Business Name, and Return Address.

If you are submitting more than one (1), put a label on each, and number them according to the order, they should be processed. If you wish to password protect your compact disc or flash drive, label your item as “Password Protected” and the date the password was sent to the Department prior to mailing.

The password must be e-mailed to elecfile@dor.mo.gov. The subject of your e-mail must read “Compact Disc or Flash Drive Password.” Your e-mail will contain all of the information displayed on the label of your compact disc or flash drive.

Any employee copies of Form W-2(s) or Form 1099-R(s) that were returned to the employer as undeliverable must be kept by the employer for at least four years. Failure to file a timely duplicate Wage and Tax Statement (Form W-2) is subject to a penalty of $2 per statement not to exceed $1,000 unless the failure is due to reasonable cause and not willful neglect per Section 143.741(2), RSMo.

Paperless Reporting

Employers with 250 or more Form W-2s must file their annual reports electronically. The Department’s paperless reporting format conforms with the Specifications for Filing Forms Electronically (EFW2) format used by the Social Security Administration with some Missouri-specific modifications as outlined on our website at https://dor.mo.gov/business/withhold/EFW2.php.

Employers with fewer than 250 W-2s can also file through our electronic filing method. For more information, visit our website at (https://dor.mo.gov/business/withhold/EFW2.php)

If you have additional questions, you may contact the Department’s Electronic Services Section by e-mail at elecfile@dor.mo.gov or by telephone at (573) 751-8150. Suppose you already include the RS records on your Social Security Administration file, and you are not required to file electronically and do not wish to file electronically. In that case, you may copy that information onto a compact disc or flash drive and send it to the Department.

If you do not include the RS records in your SSA file, you must add the RS records before submitting your Missouri file via compact disc or flash drive. The additional data specifications for paperless reporting required by the state of Missouri are listed on our website at https://dor.mo.gov/business/withhold/EFW2.php.

If you have any questions regarding the reporting of your Form W-2s, please call (573) 751-8150 for information regarding Form MO-99 MISC. Reporting, please visit http://www.dor.mo.gov/faq/business/withhold.php.

The Department will not provide notification when paperless information is processed, nor will the Department return compact discs or flash drives to the employer. C. Form W-2 Corrections If, after you have filed your Form W-2(s) and Form MO W-3, you discover an error in Line 17 or the original W-2(s) and need to file a Form W-2C(s), you must correct it by remitting an amended Form MO-941.

This form must be used to increase or decrease ten of any previously reported tax amounts. Attach a copy of the Form W-2C(s) to the amended Form MO-941 and Form W-3.

If you have discovered an incorrect figure was indicated on the original Form MO W-3; however, no changes need to be made to the amount of withholding: submit a new Form MO W-3 with the correct figures and check W-3 Corrected on the top left corner.

Note: Do not send copies of W-2C(s) if there is no change in withholding tax liability. D. Combined Federal/State Filing (CF/SF) Program with the Internal Revenue Service Missouri does participate in the Combined Federal/State Filing (CF/ SF) Program which allows you to only file miscellaneous income to the Internal Revenue Service.

Through the program, the Internal Revenue Service Information Returns Branch (IRS/IRB) will forward original and corrected information returns filed electronically to the Department free of charge for approved filers. Separate reporting to Missouri is not required.

How Can Deskera Assist You?

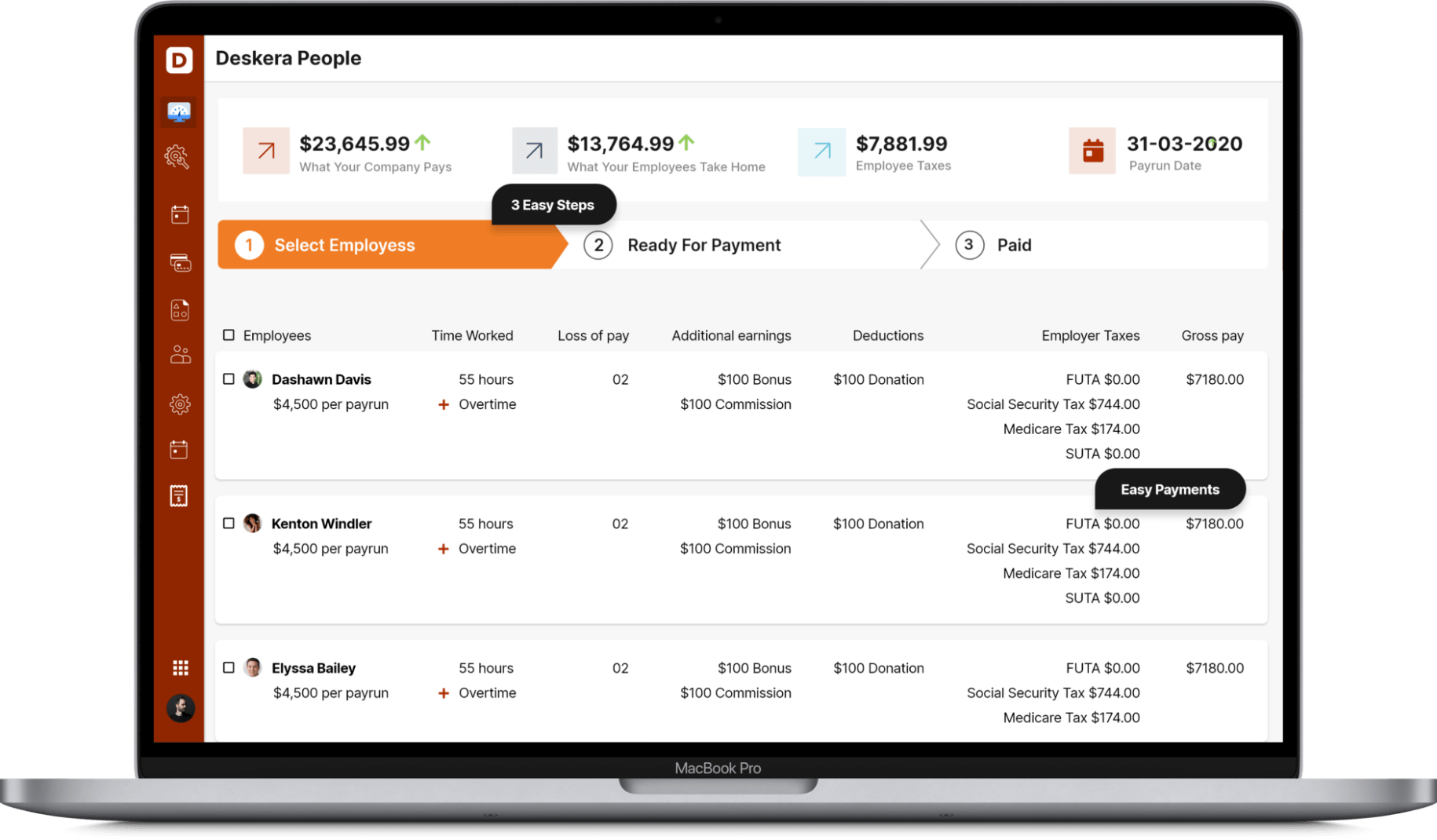

When it comes to filing taxes for your company, you need a system that can help you with it without having to go through a hassle. With Deskera, you have an automated system to file your taxes. Apart from that, managing payroll is another responsibility on your shoulder that takes a lot of work, but with the Deskera payroll system, you can do it hassle-free.

Key Takeaways

- Taxes on employees’ wages has the same meaning as federal withholding. Wages include all pay given to an employee for services performed.

- Only wages paid for services performed within Missouri are subject to Missouri income tax withholding, provided the employee files with the employer a Certificate of Nonresidence or Allocation of Withholding Tax.

- If a nonresident employee performs all services outside Missouri, their wages are not subject to Missouri withholding.

- Missouri withholding is required on the rail, motor, and private motor carrier employees whose state of residence is in Missouri.

- Suppose only a portion of an employee’s wages is subject to Missouri withholding tax. In that case, the amount of Missouri tax required to be withheld is calculated using a percentage of the amount listed in the withholding tables.

Related Articles