If you are considering starting your business in Malaysia, or expanding your headcount, or , just want to understand how payroll works in Malaysia, this article is for you.

Malaysia is a Southeast Asian (SEA) country, with a population of more than 32 million, it is the 44th most populous country globally. It consists of multi-ethnic and cultural people, including Malaysian Chinese, Malay, indigenous peoples, and Indian Malaysians.

The Malaysian payroll has various components, and we will be covering all aspects in this article, including the different types of components, work-permits, levies, contributions, taxes, forms and also show you how to file them in a timely manner.

Did you know, you can sign up for Deskera People and automate the entire Malaysian payroll?

Deskera People is a ready-to use, out-of-the-box Payroll system for Malaysia and will save you a lot of time automating payroll calculations of taxes, levies, contributions and will also generate all the statutory documents, forms and files you'd need for filing and compliance.

So let us jump into the details of understanding Malaysia payroll and what you need to be aware of as a business owner or an HR personnel to make sure you are compliant with and follow the Malaysia statutory guidelines.

By the time you finish this article, you would have learned:

- Work permits needed in Malaysia

- Types of employees you can have on payroll in Malaysia

- Types of remunerations in Malaysia payroll

- Different perquisites and benefits-in-kind (BIKs)

- Statutory tax deductions & Employer Contributions in Malaysia

- PCB and MTD

- EPF (Employee Provident Fund) in Malaysia

- Social Security Organization (SOCSO) Contribution

- Employment Insurance System(EIS)

- HRDF Levy

- Payroll Statutory Forms

- Steps to file taxes, contributions and submit forms

Work Permits For Malaysia

It is essential to know about the different employee work permits legally needed to operate in Malaysia before launching a business.

You will need to sponsor all foreign workers through your local entity or get an organization with a local entity to sponsor workers.

After your workers get sponsored, they can apply for a work permit, which is also known as an employment pass. Work permit validity is generally between six months and five years. This validation depends on the work contract and the type of visa.

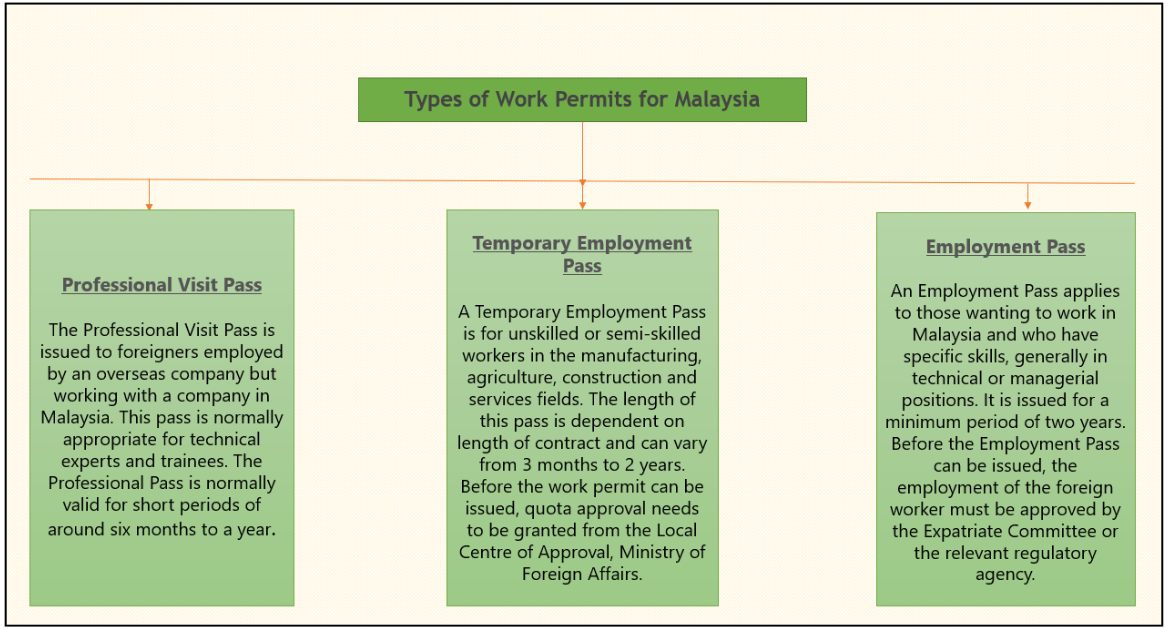

What Are the Types of Work Permits for Malaysia?

The Malaysian Government issues three different types of work permits,

What Are the Documents Required for Work Permit Application?

Following are the documents required when applying for a work permit for Malaysia:

- Letter of Appointment/Employment contract

- Original payment receipts of application

- Employee's passport copies (all pages, including cover)

- Passport photos with blue background

- Employee's Resume

- Copy of education certificates and qualifications

- Medical report from the employee's country of origin approved by the Malaysian Ministry of Health (dependent on industry)

Note :

- The documents may need to be attested if not in English or Malay.

- The application process and liaising with the relevant government agencies in Malaysia will take 1 - 2 months for the application approval.

Furthermore, you need to apply for more than one work permit if your business requires workers to travel within Malaysia. There are four main work permit regions in Malaysia viz, Peninsular / West Malaysia (i.e., Kuala Lumpur), Labuan, Sabah, and Sarawak.

What Are the Types of Employment in Malaysia?

Full-Time Workers

- Working hours are as specified in the employment contract. According to the Employment Act, working hours are limited to 48 hours per week.

Part-Time Workers

- The normal hours of work of a part-time employee do not exceed seventy percent of full-time employees' normal hours of work.

- They have similar rights to full-time employees.

Contract Workers

- Employment for a fixed period.

- In the contract, working hours, remuneration, and other benefits should be stated

Freelancers

- Project-basis. Freelancers are generally hired to solve a short-term problem and are often paid based on the number of hours worked.

- They are not considered employees, and statutory deductions are not required. Withholding tax may apply in some cases if the freelancer is not a tax resident in Malaysia.

What Are Types of Remuneration in Malaysia Payroll?

A). Basic Salary

Part Month

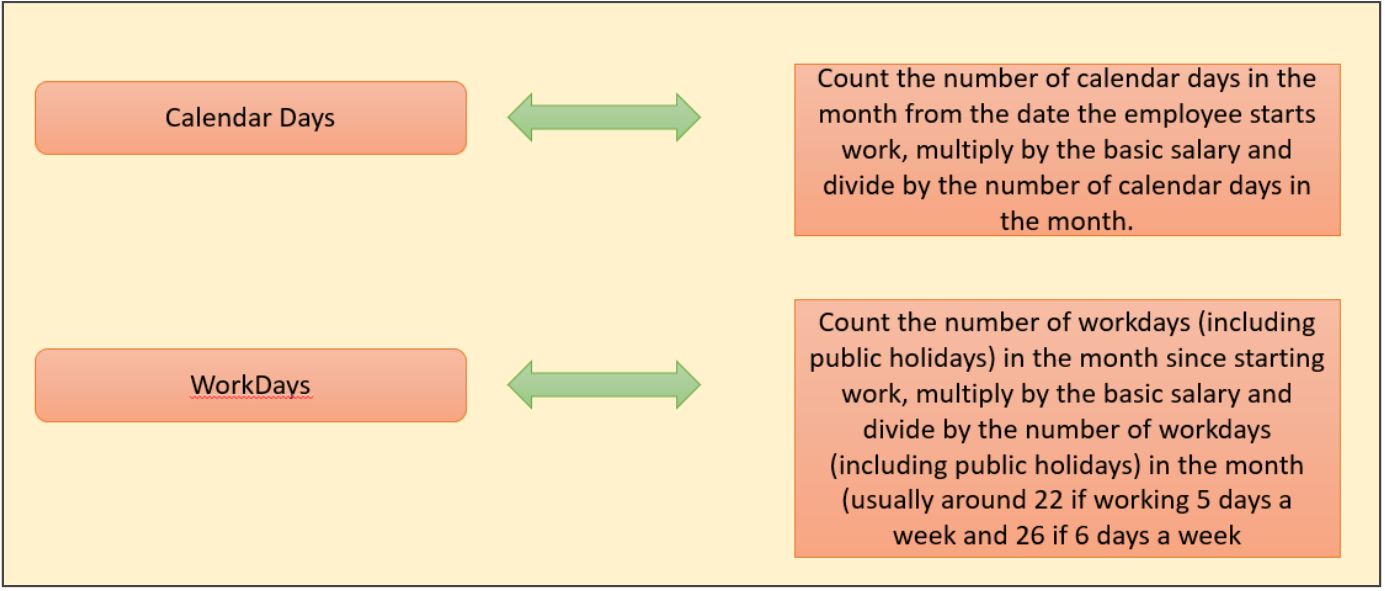

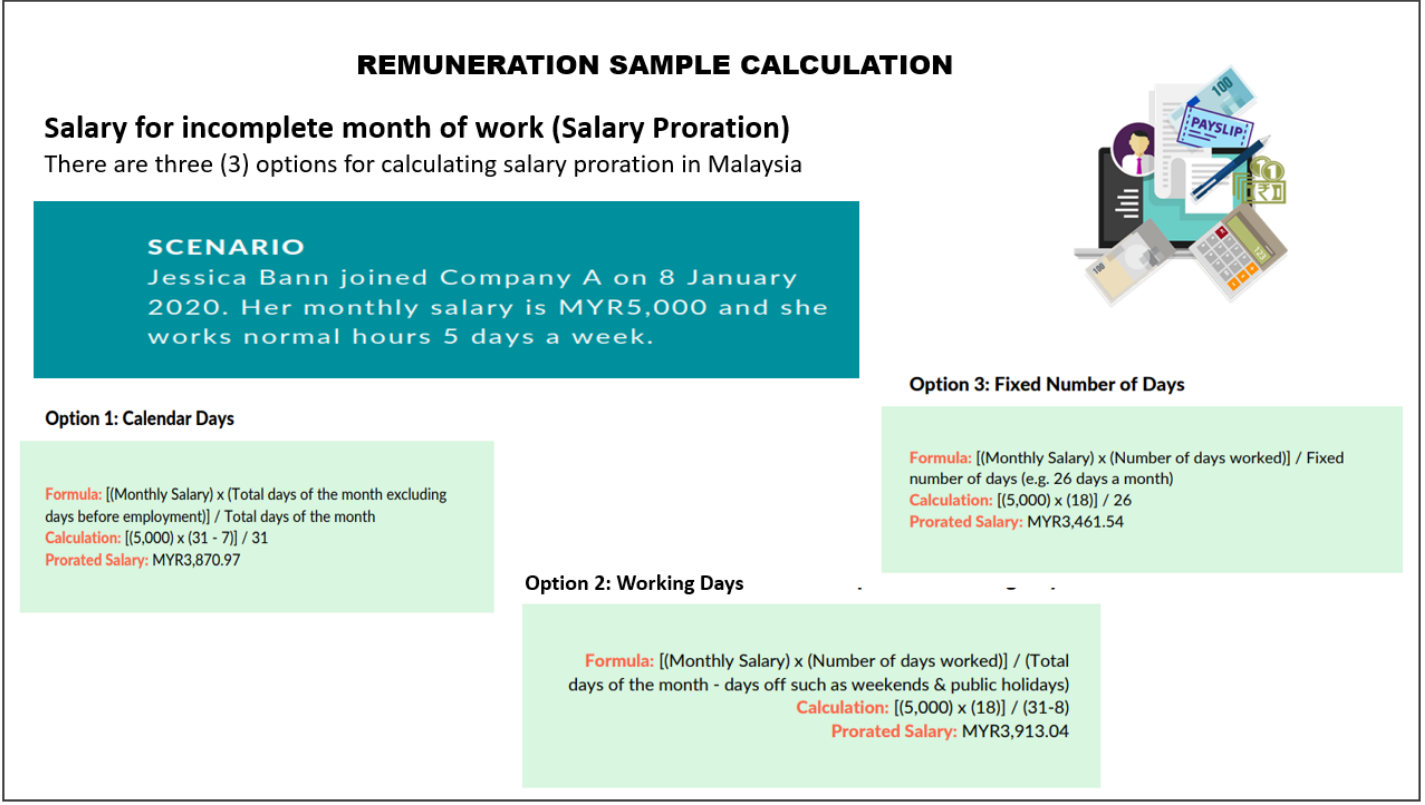

A set of a fixed amount paid every month is usually known as a basic salary. What happens if the employee starts or discontinues work partly through the month? Employers will usually use either below of these methods to prorate the employee's salary;

Remuneration Example:

B). Unpaid Leaves

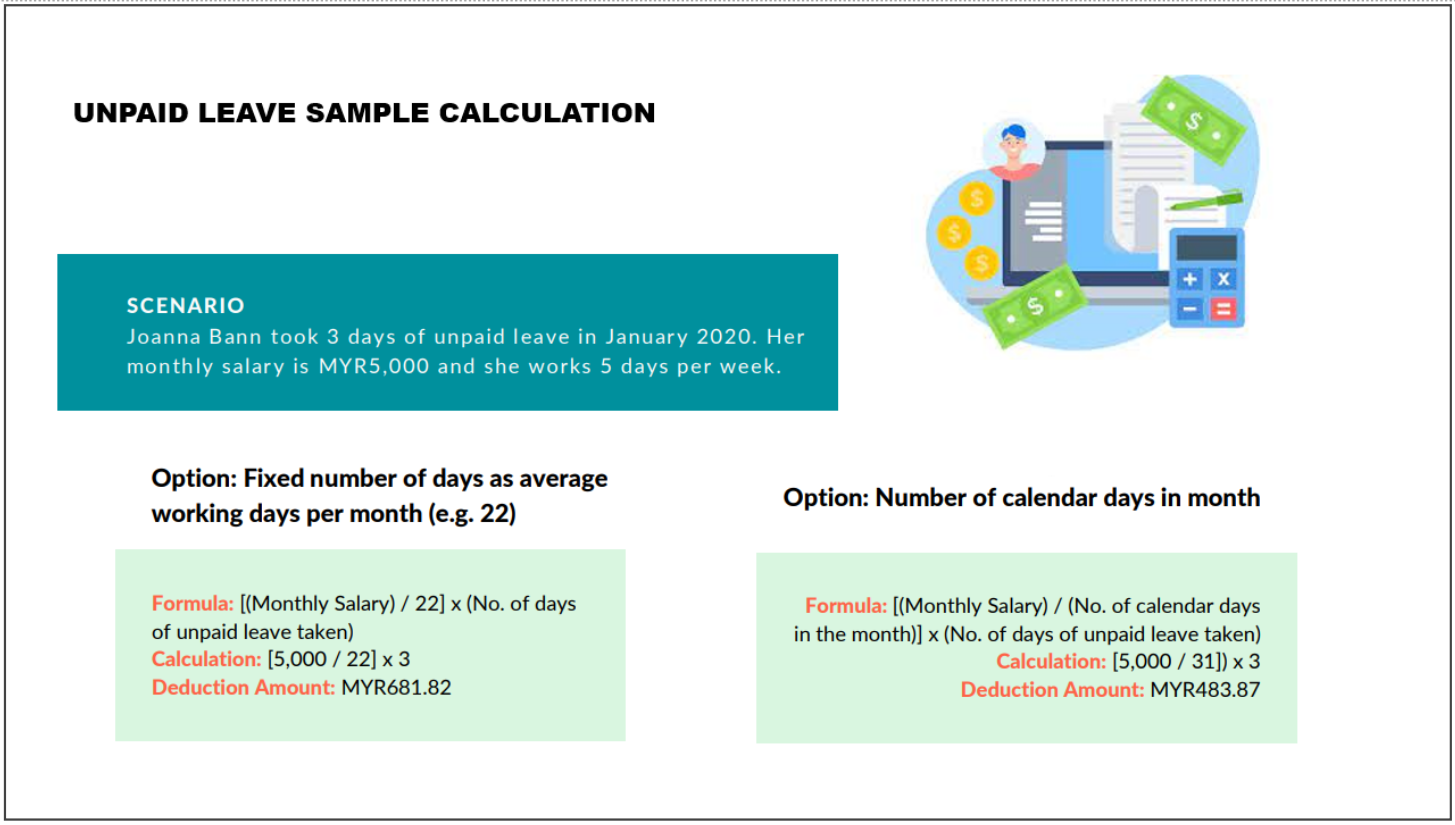

Suppose an employee has overutilized his/her available accrued annual leave or has zero leave balance, in that case, the amount equivalent to the number of days of unpaid leave taken needs to be deducted from gross salary.

For calculating the unpaid leaves, there is no specific formula. The usual methods are as follows:

Monthly salary divided by the number of working days of the month during which unpaid leave was taken (including public holidays),

• around 22 workdays if the employee works 5 days a week;

• around 26 workdays if they work 6 days a week;

• it is also possible to use the average figures of 22 and 26 for the workdays;

• if preferred, you can divide by the number of calendar days in the month instead of workdays.

Unpaid Leave calculation Example

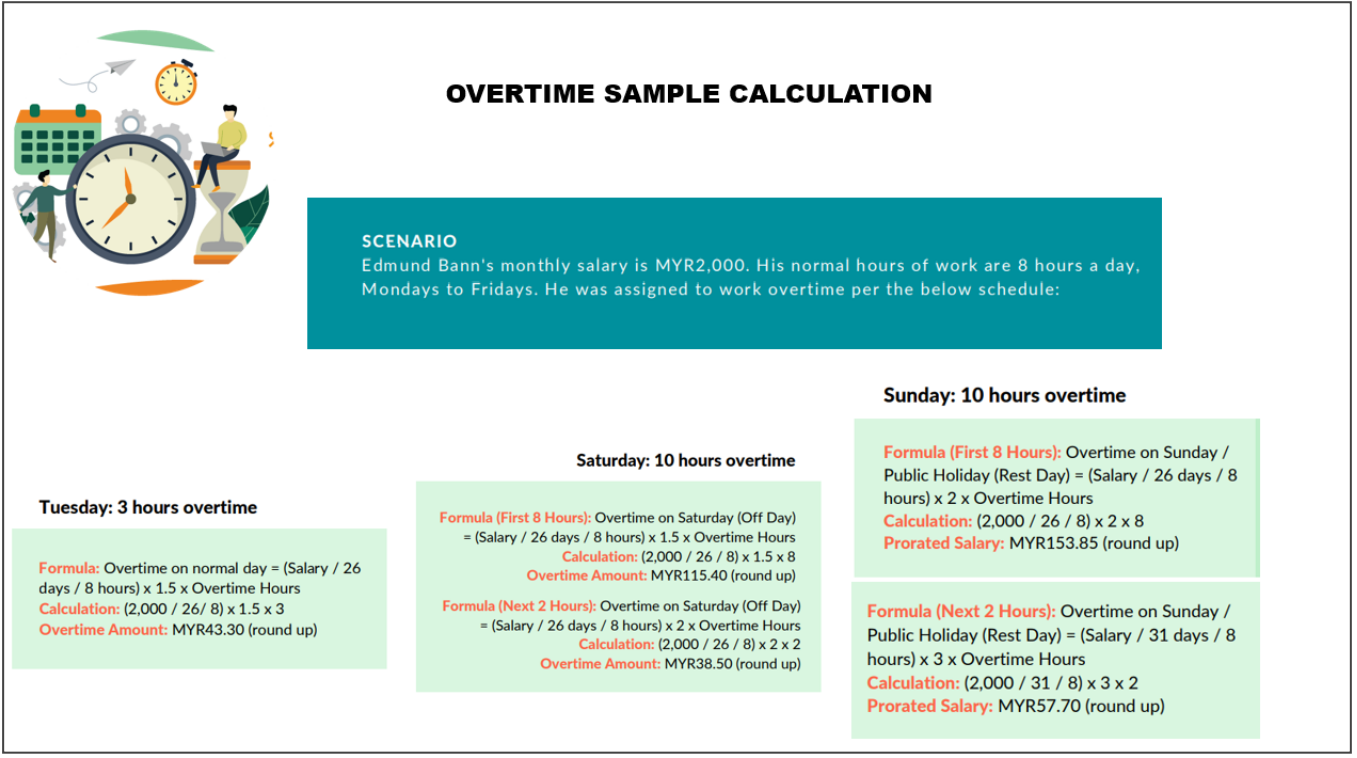

C). Overtime

As defined in the employee's employment contract, the basic salary will usually be based on the fixed minimum number of hours. In some cases, if the basic monthly salary of employees does not exceed RM 2000, then the employer is legally obliged to pay Overtime for those exceeding those minimum hours.

The basic minimum guidelines for overtime pay are:

- 1.5 x hourly rate of pay for regular workdays.

- 2 x hourly rate for rest days.

- 3 x hourly rate for public holidays.

The hourly rate can be calculated as follows:

According to the Malaysia employment act, if the employee is required to work additional hours to his/her regular working hours, then the minimum overtime pay is calculated based on the Hourly Rate using the 26 days formula.

- Hourly Rate Calculation: Salary / 26 / 8 hours*

- *Maximum normal working hours per day is 8 hours

Tips: You will come across Ordinary Rate terms when calculating Overtime. The Ordinary Rate is an employee's daily rate that is calculated based on Salary / 26

Overtime Calculation Example

D). Incentive Pay

In Malaysia incentives are performance-based payments and include:

- Bonus - Non-fixed remuneration, which is paid on a quarterly or yearly basis

- Commission - Pad monthly and based on sales.

- Profit Share - Payments dependent on company profitability

- Gratuity - Non-fixed remuneration or any additional payment added to monthly fixed income Usually paid to service workers.

These incentive cash payments will be added to the employee's payslips to make up total gross pay.

All the different payment components can be managed easily with Deskera People, which comes pre-configured with the most common payroll component settings. You can sign up for Deskera People and start running your payroll in a matter of minutes.

What are Perquisites and Benefits-in-Kind (BIKs) in Malaysia?

Everyone is now familiar with the terms basic salary, bonus, Overtime, unpaid leave, incentive pay, but can you tell the exact difference between a prerequisite and a benefit-in-kind?

Let us look below at the difference between a prerequisite and a benefit-in-kind with examples.

Perquisites

Perquisites are benefits in kind or cash that can be converted into money. Example, petrol allowance, gift vouchers, a driver employed by the employee but paid for by the employer, professional subscriptions

The most common type of perquisite is a traveling allowance.

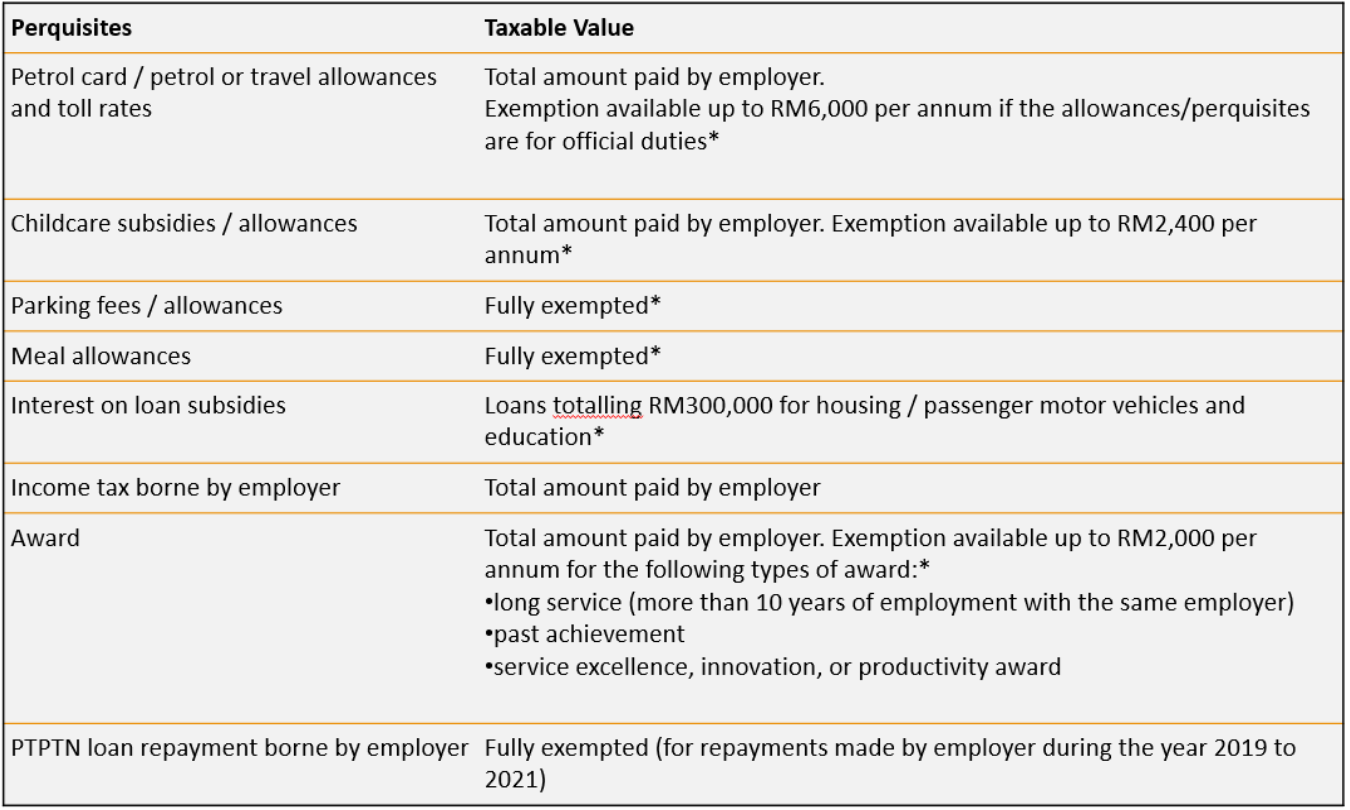

Which Perquisites Are Tax Exempt?

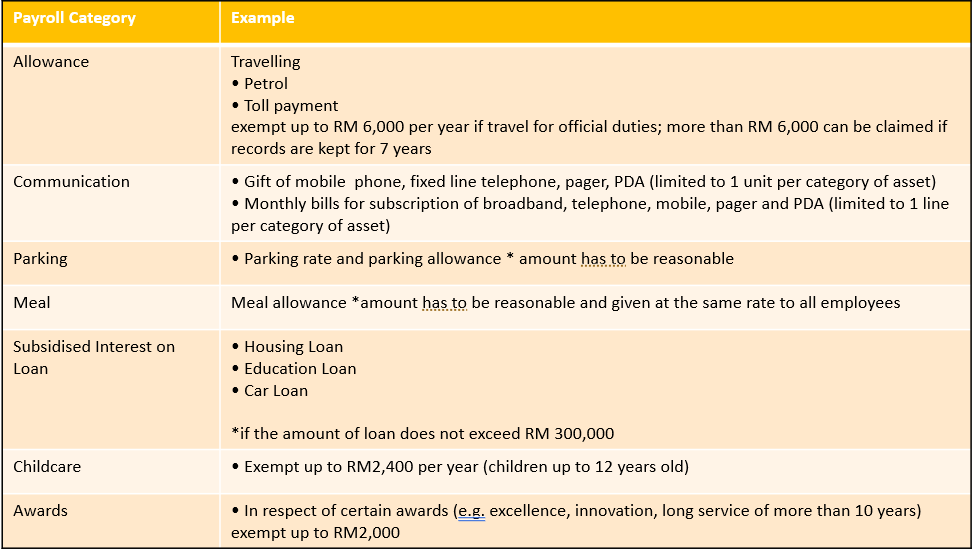

The IRB issued Public Ruling 5/2019 for the valuation of perquisites given to employees. Below are some examples of perquisites

Allowances

Allowance adds up to an employee's gross pay amount. It can be paid either on a recurring or non-recurring basis.

Allowances are paid to the employees to cover certain expenses incurred during the performance of their employment duties. It is usually paid on yearly basis (this might vary based on the company).

Example of allowances commonly paid in Malaysia,

- Travel allowance (prerequisite)

- Meal allowance (prerequisite)

- Phone allowance (prerequisite)

- Acting allowance (taxable): an allowance paid to employees during the period said employee is acting on additional or different roles

Allowances that are cash payments will be included in the payslips to arrive at the employee's total gross pay.

Benefits-In-Kinds

The benefits which are not convertible into money are known as BIKs. Examples, phone provided by the employer or company car, driver and, medical benefits. BIKs will not always appear on the employee's payslips as they are not cash payments. The BIK value may need to be determined for tax purposes.

LHDN specifies two methods to determine the value of BIKs:

- formula method, or

- prescribed value method

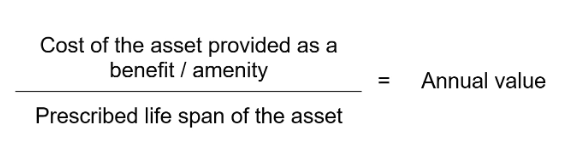

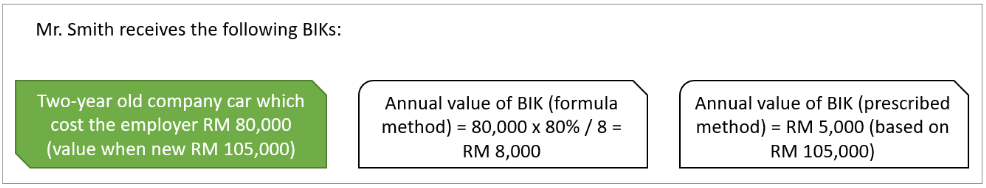

Formula Method

Under the formula method, the annual BIK value provided to an employee is computed using the following formula:

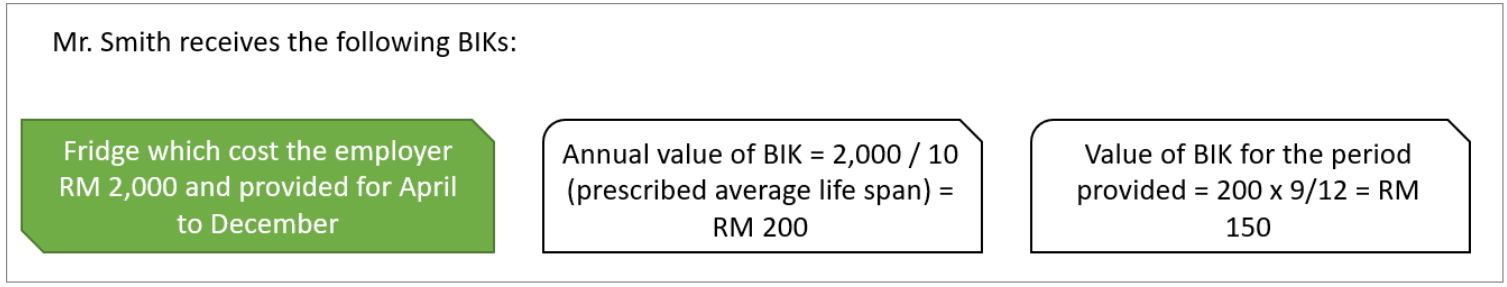

Example:

The Prescribed Value Method

Under the prescribed value method, BIK value provided to the employee by the employer can be abated if the BIK is –

- Provided for less than a year

- Shared with another employee

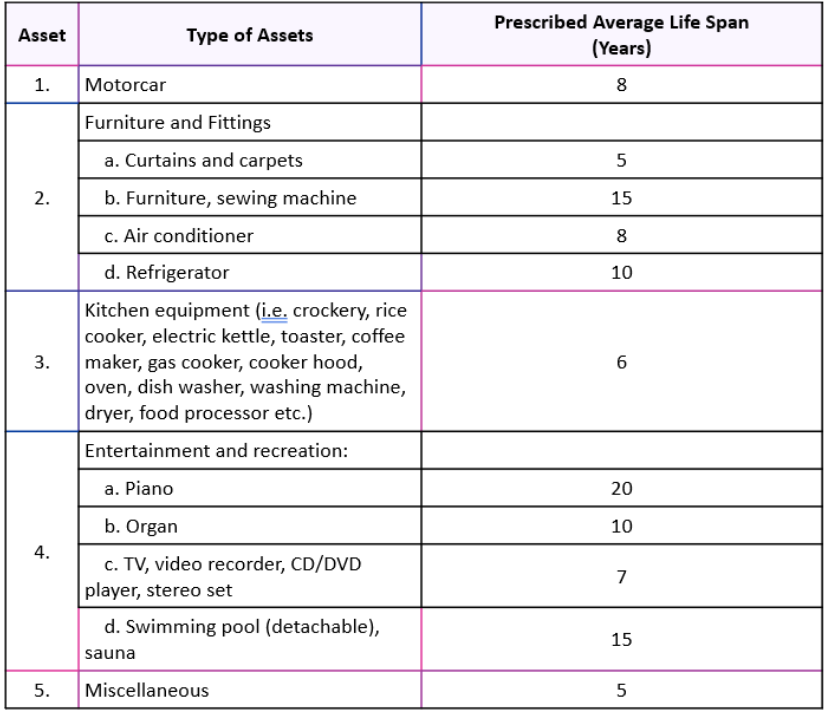

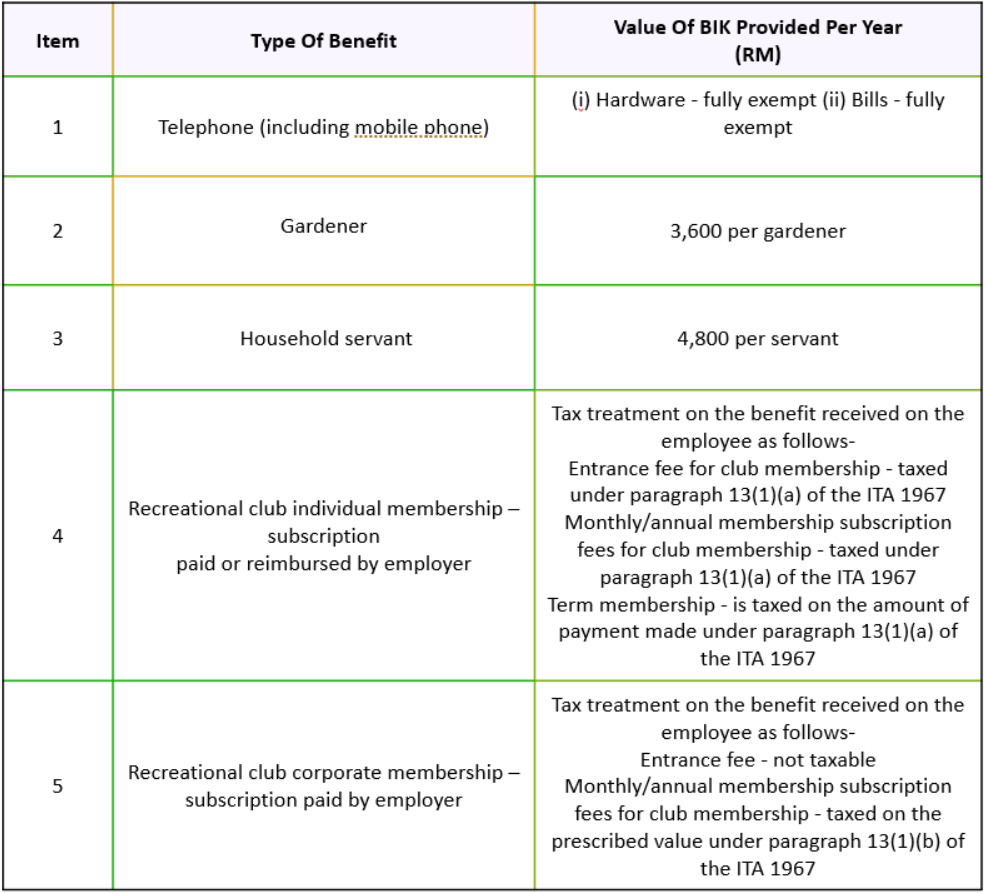

Listed below is the Prescribed value of BIKs,

A). Prescribed average life span (Years)

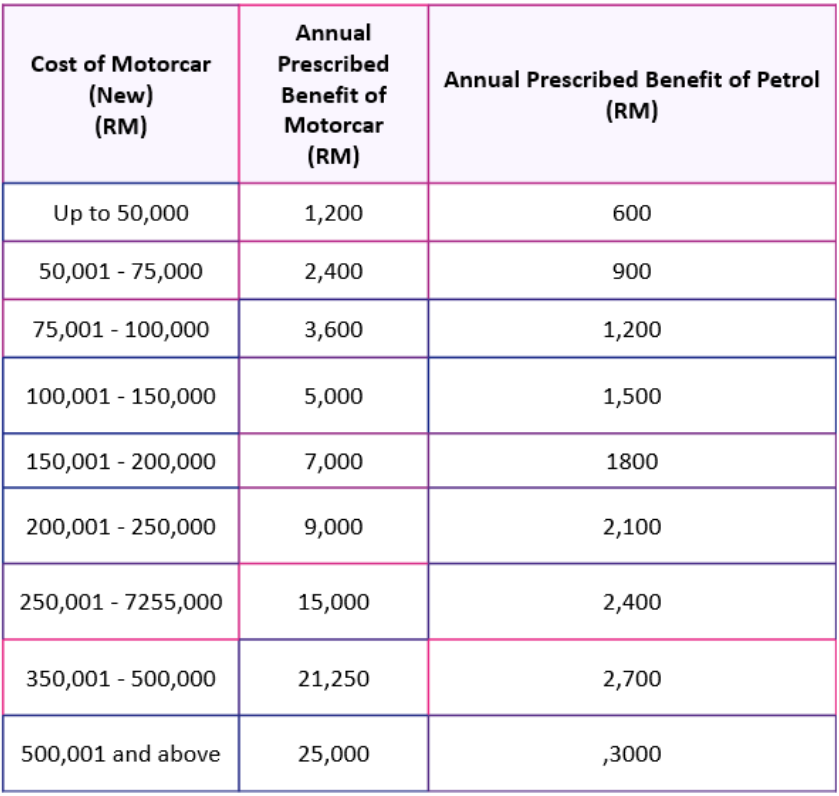

B). Prescribed value of motorcar and its other benefits

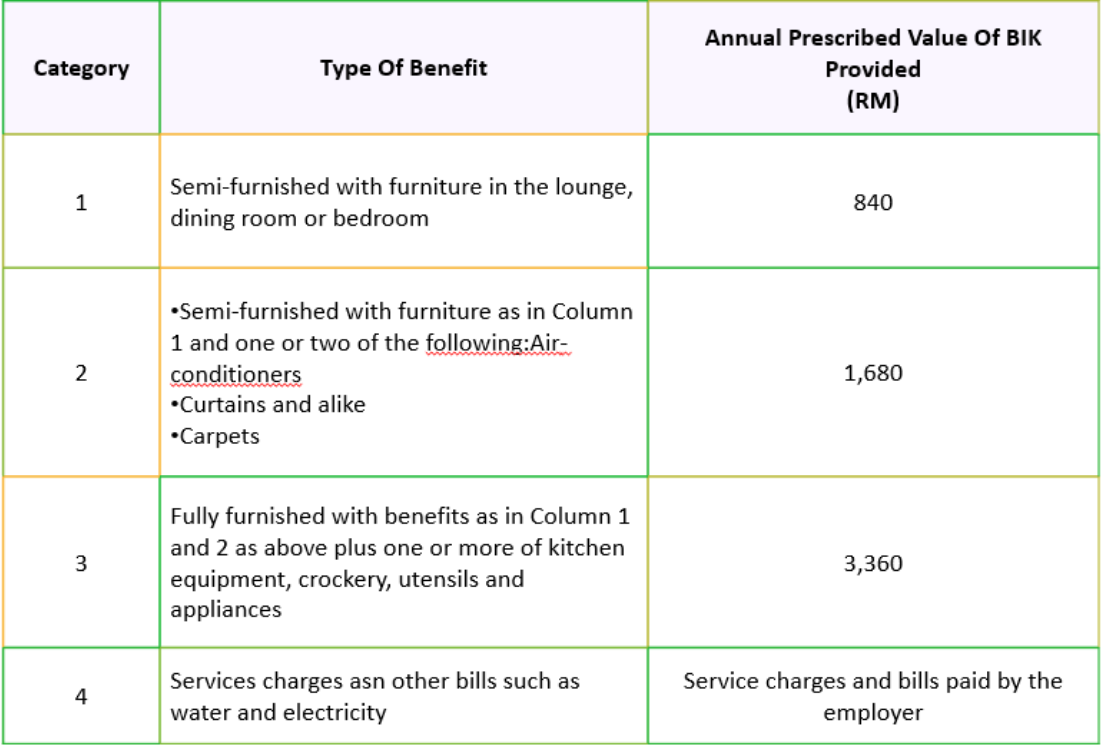

C). Prescribed value of housing furnishing, apparatus and appliances

D). Prescribed values of other benefits

Example,

Which Benefits-in-Kind Are Tax Exempt?

There are certain benefits-in-kind that are either exempted from tax or are stated as not taxable.

- Child-care benefit

- Dental benefit

- Free Food & drink provided

- Free transportation pick-up and drop-off points to home and place of work.

- Insurance premiums for foreign workers as a SOCSO contributions replacement.

- Insurance premium to workers group in the event of an accident

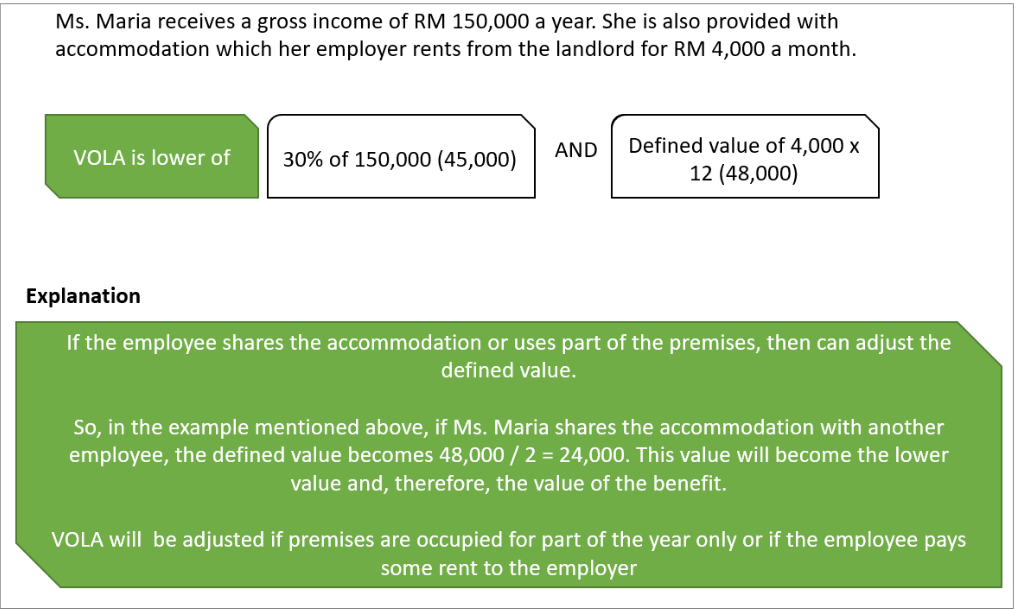

Value of Living Accommodation

The living accommodation is a benefit-in-kind that is not convertible into money. This benefit is provided for the employees by these employers. VOLA amount needs to be added as the gross income of the employee from the employment.

In Malaysia, the VOLA amount to be taken into account is the employees' amount of use or enjoyment.

Below list are the VOLA categories:

Category 1 - Living accommodation provided to employee/service director

The value of the accommodation(VOLA) benefit is calculated as follows:

- Defined VOLA value

- Thirty percent of the gross income from employment, including wages, allowances, perquisites but not benefits-in-kind, and share options prerequisite.

- Whichever is lower.

Category 2: Living accommodation provided for directors of controlled companies

- Director includes:

- A manager of the company

- A beneficial owner of 20% or more of the ordinary share capital of the company

- The computation of VOLA will be the defined value of the living accommodation.

Category 3: Hostel living accommodation for employee or service director

- Where the living accommodation provided for employee or service director is:

- in a hostel, hotel, or related premises

- any premises in a forest or plantation

- any premises which, although in the rateable area, are not subject to rates

- 3% of the amount equal to the gross income from employment.

VOLA Calculation Example,

How does BIK/VOLA Work In Deskera People?

With Deskera People, you can determine the BIK/VOLA value, which is used to calculate MTD/PCB.

To understand it better as how it works, please read the below article,

BIK/VOLA calculations are managed by Deskera People when you run your payroll. You can sign up for Deskera People and start running your payroll in a matter of minutes.

Statutory Tax Deductions & Employer Contributions in Malaysia

Scope of Taxable Income

From Malaysia, Employment Income is derived from subject to Malaysian Tax where the employee,

- Practices employment in Malaysia;

- is on paid leave and is attributable to the employment in Malaysia;

- employee performing duties outside Malaysia which is incidental of employment in Malaysia;

- is a company director and a resident in Malaysia;

- employed to work on a ship operated or either onboard an aircraft by a person who is a Malaysian resident.

Tax in Malaysia for Residents

Some Workers in Malaysia are rotating in and out of Malaysia may still qualify for a tax rate residency if they fit into one of the following criteria;

- As per calendar days, if you have been in Malaysia for 182 days.

- As per calendar days, if they have been in Malaysia for less than 182 days, however, they still have been in the country for consecutive 182 days from the year preceding that calendar year immediately.

- In a calendar year for three of the four preceding years, if they have been in Malaysia for at least 90 days.

As per the above criteria, when they are classified as residents, they are not liable to pay their income tax. Only if they are employees are employed for fewer than 60 days per year in Malaysia.

Please who will be exempt from the income tax are, retired people aged above age 55, those receiving the pension from their employment in Malaysia, and those living off the bank interest,

Many contractors believe that they get to benefit from day one by qualifying as a resident of Malaysia. However, automatically they will be classed as a non-resident for the first six months in Malaysia and remain liable to pay 30% tax from their first day of work.

Tax for Expats in Malaysia

In Malaysia, the tax year runs from January 1st to December 31st. For non-residents currently, the tax rate is flat 30%, and for residents is on a sliding scale from 0-30%, depending on the income slabs they fall. Usually, for an average paid worker, the resident is at 14%

Few businesses will pay the taxes on their staff's behalf, and some will ask their workers to submit the payment themselves. For a non-resident, there is also a fixed monthly SOCSO( (Social Security Organization) deduction fee of RM49.4, which is similar to the national insurance fee.

Registering Employees with a Tax Number in Malaysia

Before starting to work in Malaysia, the company needs to register its employees with a tax number. To do this, you will need the following information from your employees:

- A copy of the latest salary statement (EA/EC form) or latest salary slip

- A copy of identification documents

- A copy of marriage certification (if applicable)

Process to Register for Income Tax Number in Malaysia

If you don't have an Income Tax number , you need to follow the below steps,

Register Online Through e-Daftar

Step 1 - Go to Inland Revenue Board of Malaysia website.

Step 2 - Click on ezHASiL

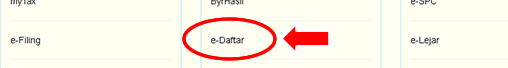

Step 3 - Then, click on e-Daftar

Step 4 - Read the instructions carefully.

Step 5 - After that, click on the e-Daftar icon or link.

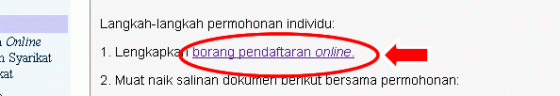

Step 6 - Click on the link, borang pendaftaran online

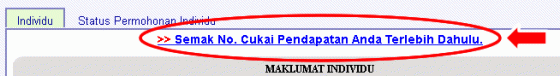

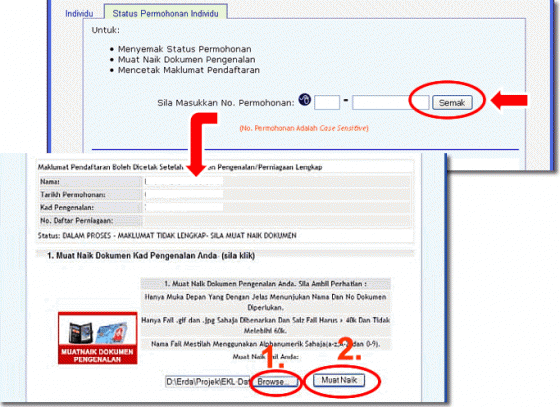

Step 7 - If you need to check whether an Income Tax Number has already been issued to you, click on Semak No. Cukai Pendapatan Anda Terlebih Dahulu.

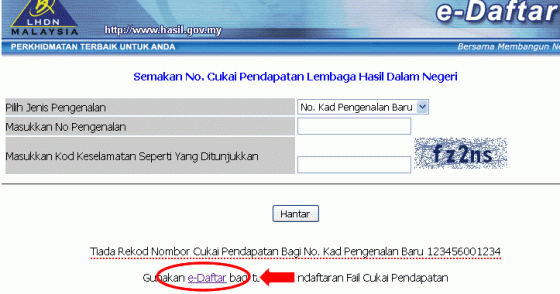

Step 8 - Next, as shown on the page, Enter your MyKad number and Security Code and, then, click Hantar.

Step 9 - Click on the e-Daftar link if no matched record is found against your MyKad number

Step 10 - Complete and submit the registration form.

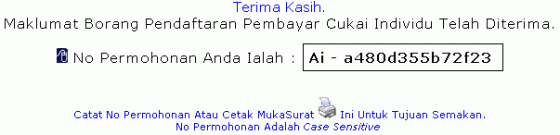

Step 11 - Upon successful registration, an Application or Registration Number will be assigned to you. This number is required to check your application status and to submit your supporting documents.

Step 12 - Within 14 days from your registration date, supporting documents can be uploaded online or by fax.

Step 13 - Step 13 - Within 3 working days, you will receive an email containing your Income Tax number.

Step 14 - With in the stipulated time, if you did not receive your Income Tax number, you need to check your application status via e-Daftar using your application number

All Malaysia payroll tax calculations and report generation is done by Deskera People when you run your payroll. You can sign up for Deskera People and start running your payroll in a matter of minutes.

What is PCB/MTD?

PCB stands for Potongan Cukai Bulanan, also known as Monthly Tax Deduction (MTD). Hence, you may use MTD and PCB interchangeably.

Your MTD/PCB is a series of monthly deductions that go towards paying the taxes with your employment income.

Inland Revenue Board of Malaysia (IRBM) / The Lembaga Hasil Dalam Negeri Malaysia (LHDN) first introduced MTD/PCB on January 1st. 1955

What Are the Conditions Required to File Tax Returns in Malaysia?

If you meet the following conditions, you can choose not to file a tax return. By completing these conditions, your MTD/PCB that is paid will be considered as a final tax:

- In a calendar year, Jan 1 to Dec 31, if you serve under the same employer for 12 months.

- Under Section 13 of the Income Tax Act 1967, if your employment income is prescribed;

- if your PCB/MTD is under the Income Tax (Deduction from Remuneration) Rules 1994;

- From your salary, if your employer is deducing MTC/PCB correctly;

- If your employer does are not borne taxes;

- With your spouse, if you have not opted for a joint assessment.

If any of the above exemptions do not meet, the exemptions will not apply. In this case, you need to file a tax return.

For more info, refer to Inland Revenue Board of Malaysia official portal.

Personal Income Tax Rates in Malaysia

Following are the income tax rates for personal income tax in Malaysia YA 2020

Click here to get the Tax Rate Assessment for the year on the official LHDN portal.

Tax Exemptions

Most of the compensation components are liable to PCB, but some of the perquisites and BIKs are either fully/partially exempt.

Full list of Tax Exemptions list

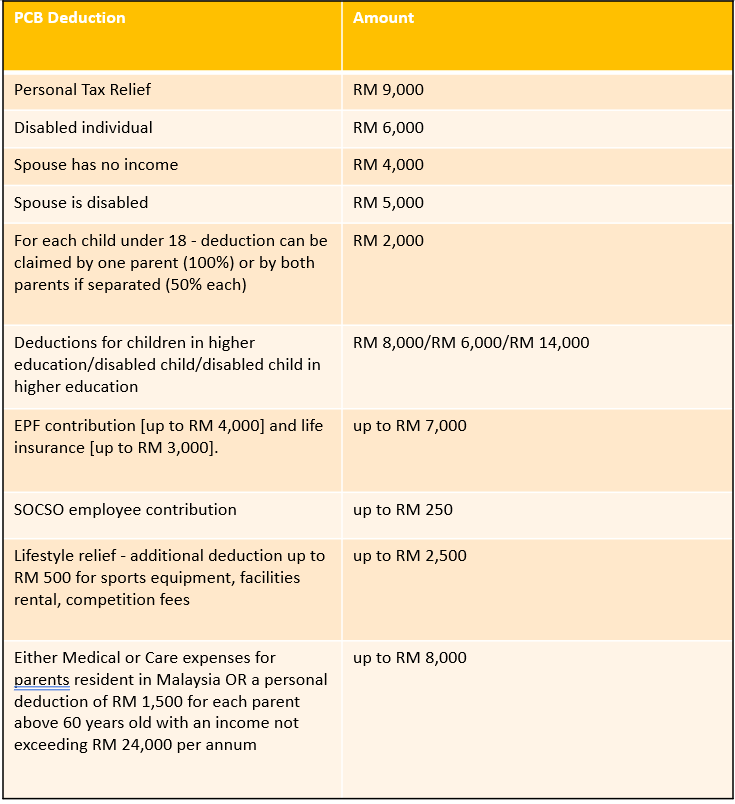

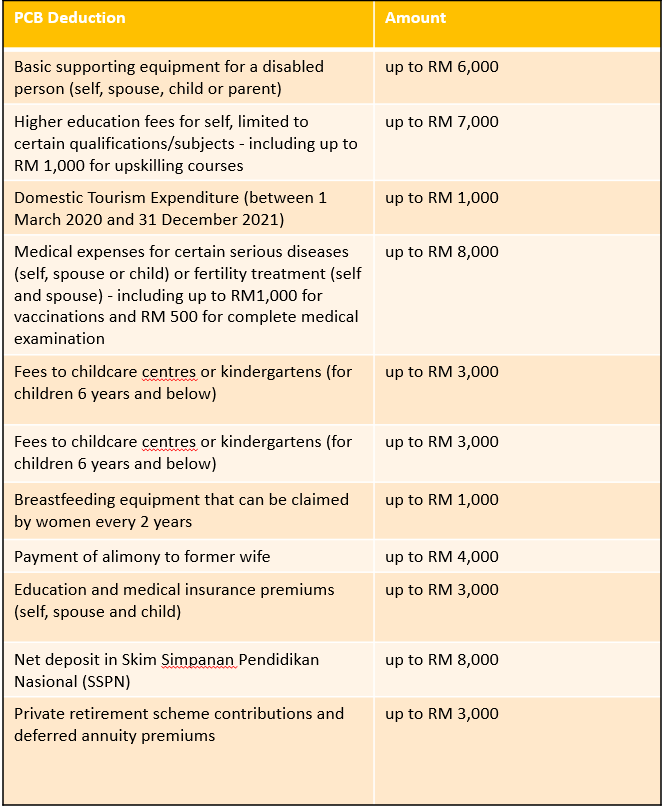

Tax Deductions

Some deductions are available based on the employee's marital status, the total number of children, or any particular payments the employee made during the year. Up to a certain limit, these deductions can be claimed.

The amounts are deducted from taxable income to arrive at the employee's chargeable income. the employee should submit Form TP1 to their employer to claim PCB deductions on their expenses.

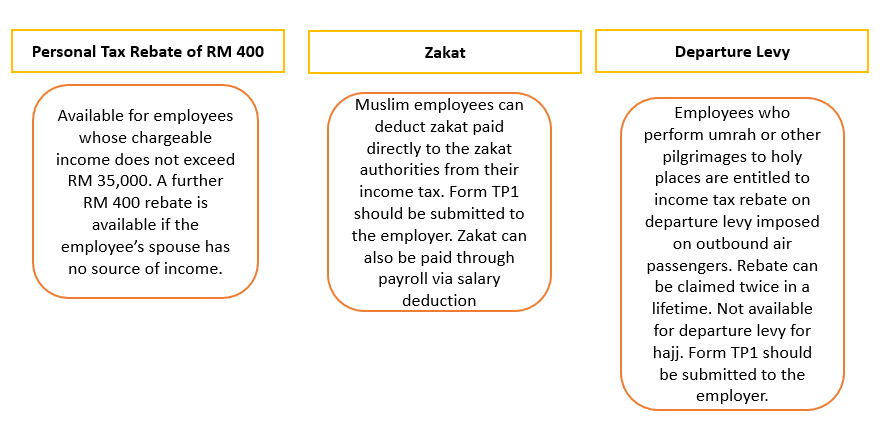

Tax Rebate in Malaysia

Tax rebates are different from tax deductions. Tax deductions reduce the chargeable income while tax rebates are deducted from the tax amount itself.

There are three different types of Tax Rebates

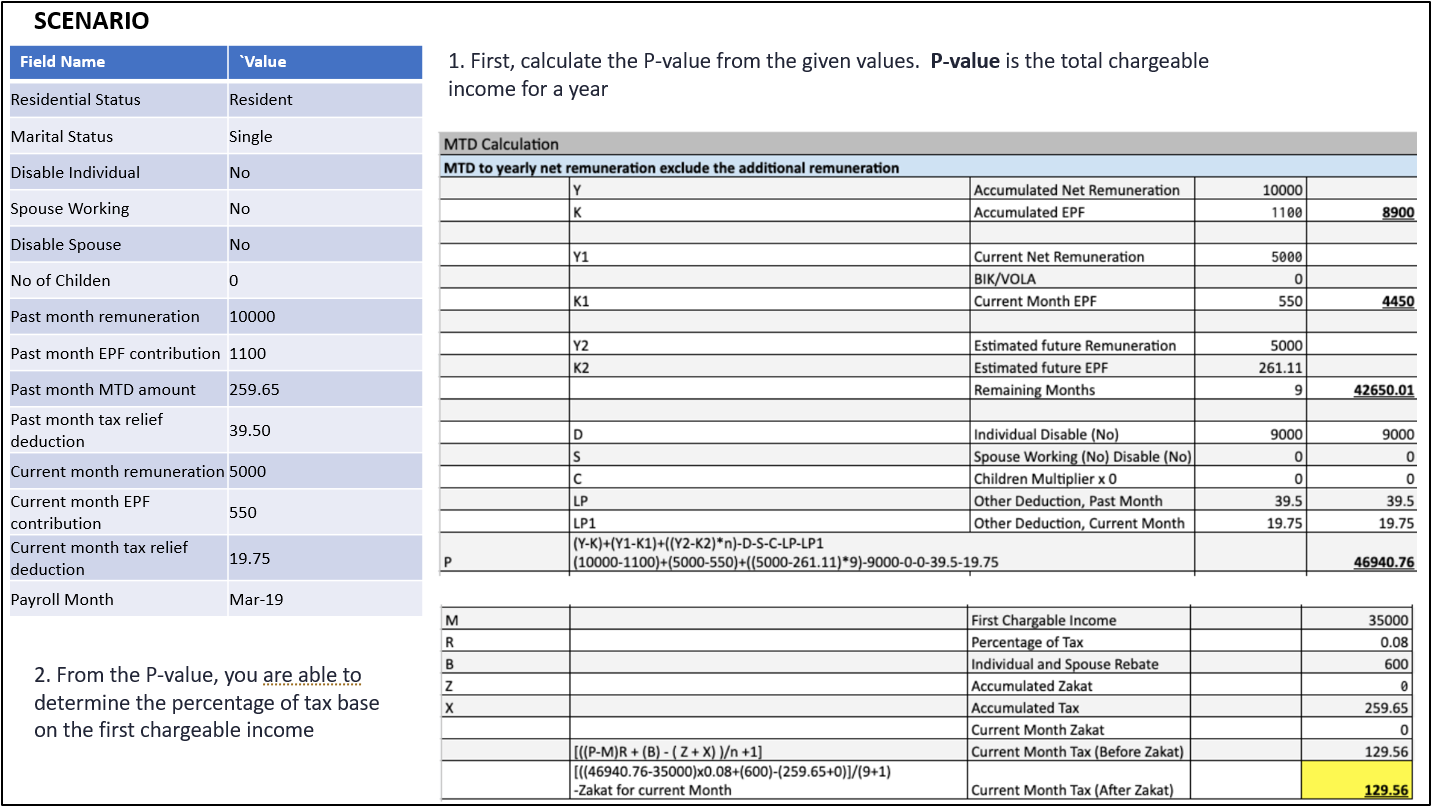

How to Ensure Accurate MTD/PCB Calculation in Malaysia?

To obtain an accurate PCB result, there are a couple of values needed.

Before you start the employees MTD/PCB computation, you need to identify employees status and some information as stated below

- Residential Status

- Marital Status

- Disable Individual

- Spouse Working

- Disable Spouse

- No of Children

- Past month remuneration - If the employee worked before in the current year

- Past month EPF contribution - Maximum 4000 relief per year

- Past month MTD amount - If any

- Past month tax relief deduction - If any

- Current month remuneration

- Current month EPF contribution

- Current month tax relief deduction

Below is the MTD/PCB computation example

How to Calculate MTD/PCB Using Deskera People?

With Deskera People, you can make sure that the Monthly Tax Deduction (or Potongan Cukai Bulanan) for your employees is accurate with lesser errors.

To understand it better as how it works, please read the below article,

You can verify the calculated MTD/PCB calculation with the help of government calculator from LHDN Official Calculator (MTD Calculation)

PCB/MTD calculations for Malaysia are managed by Deskera People when you run your payroll. You can sign up for Deskera People and start running your payroll in a matter of minutes.

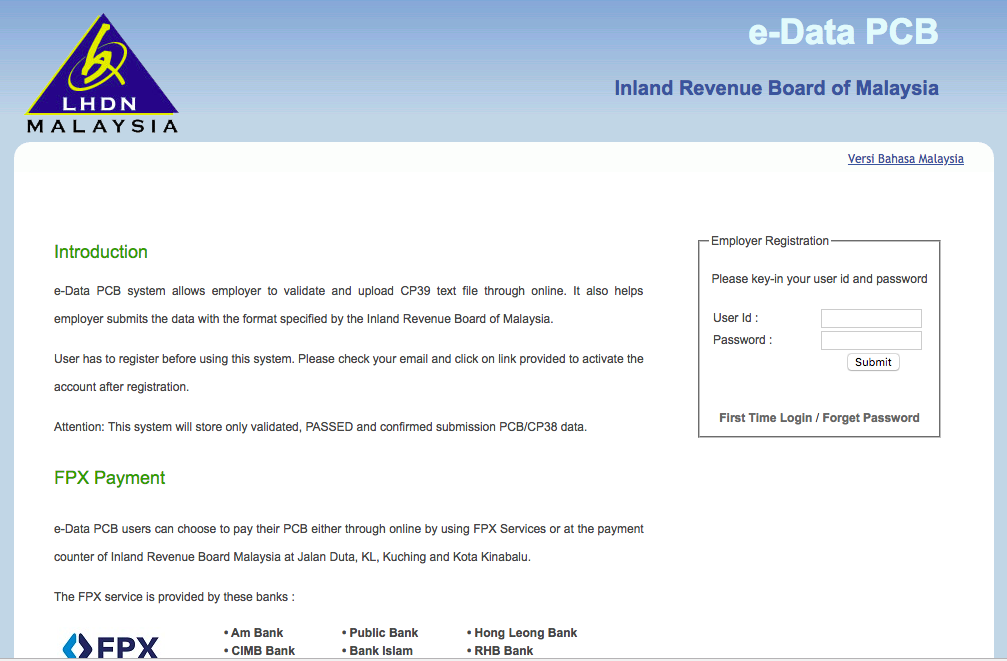

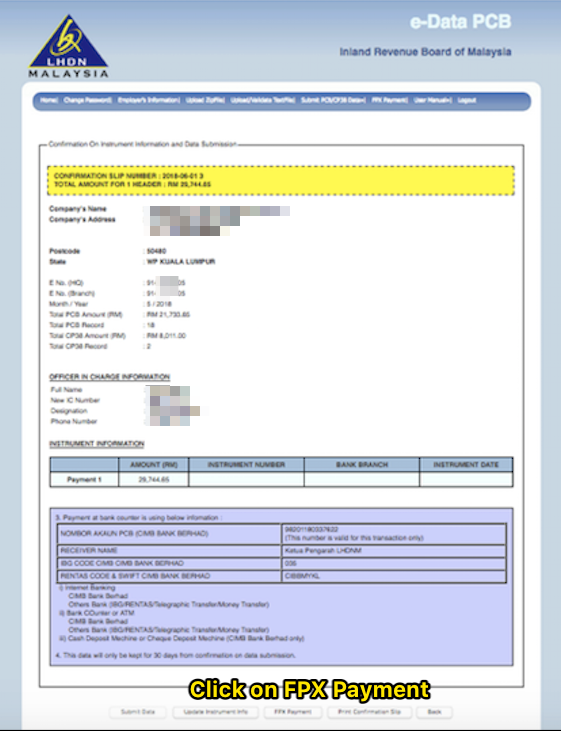

Step-by-Step Guide to Make MTD/PCB Payment Submission

Visit LHDN website to complete the PCB/MTD submission process.

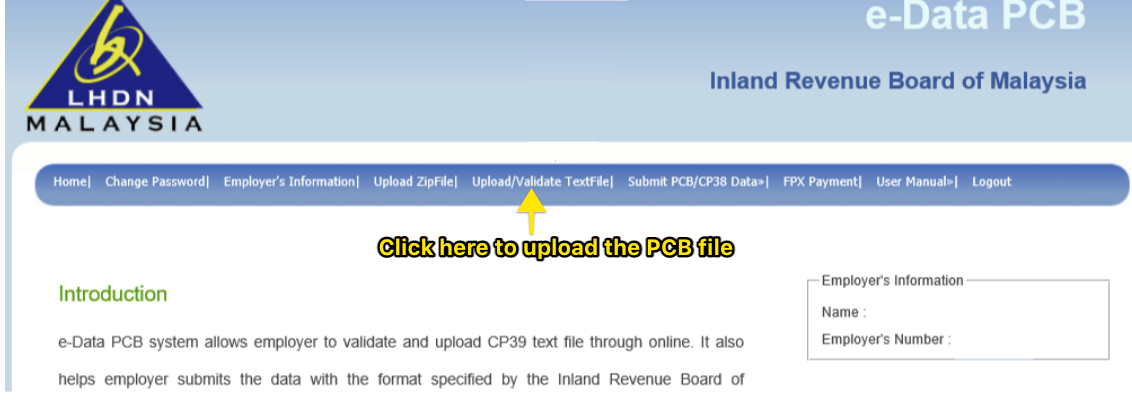

Step 1 - With your existing employer ID, login to e-Data. If you do not have the login, you can apply with your employer E number directly

Step 2 - Next, click on Upload/Validate Text File

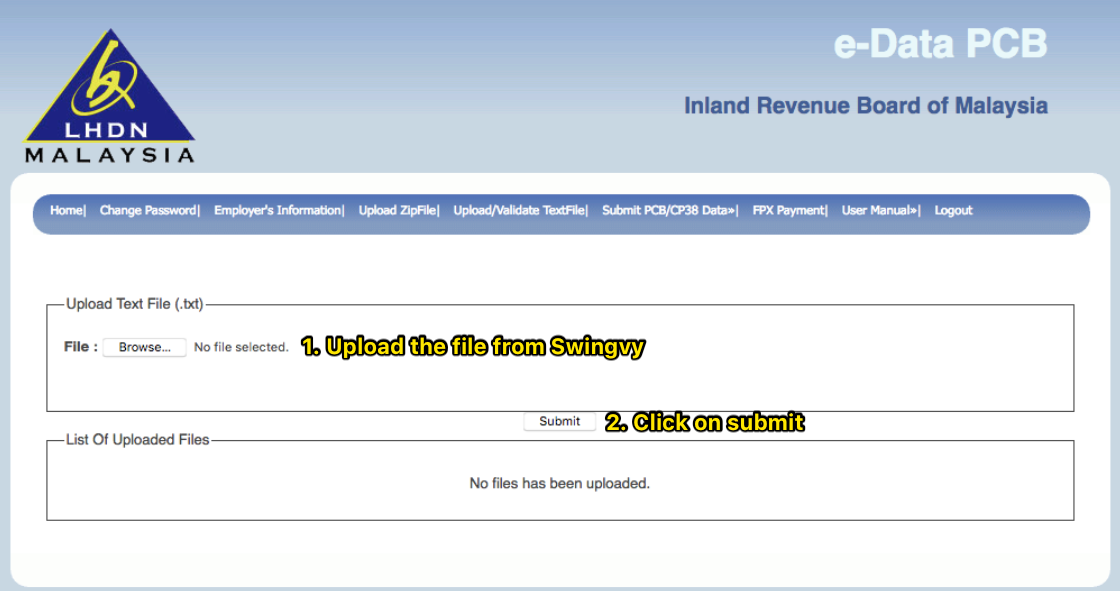

Step 3 - Browse the txt file, then click on submit button to upload

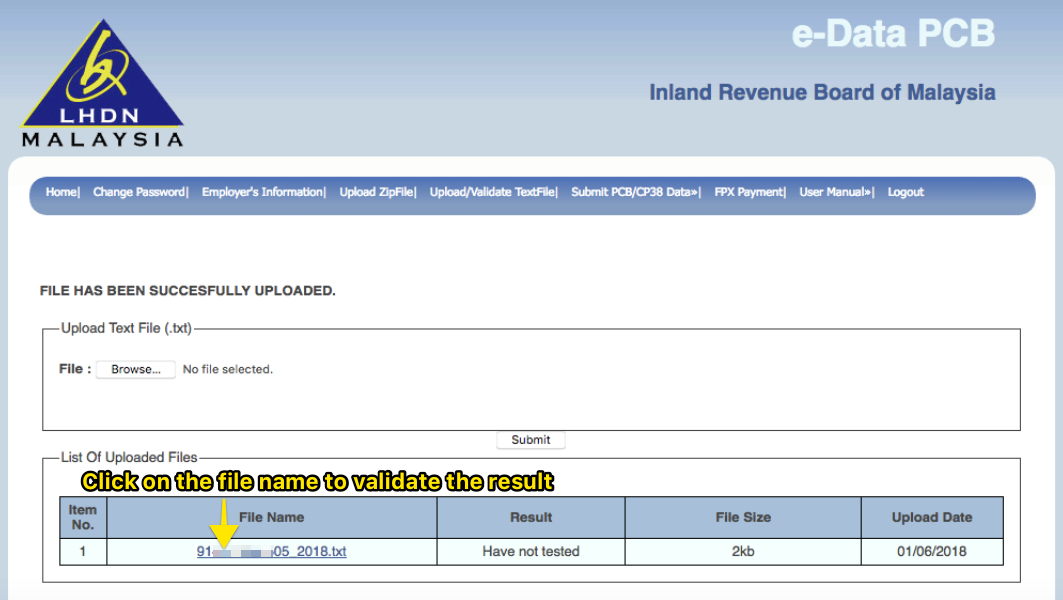

Step 4 - Click on the file name to validate the result after the file is successfully uploaded

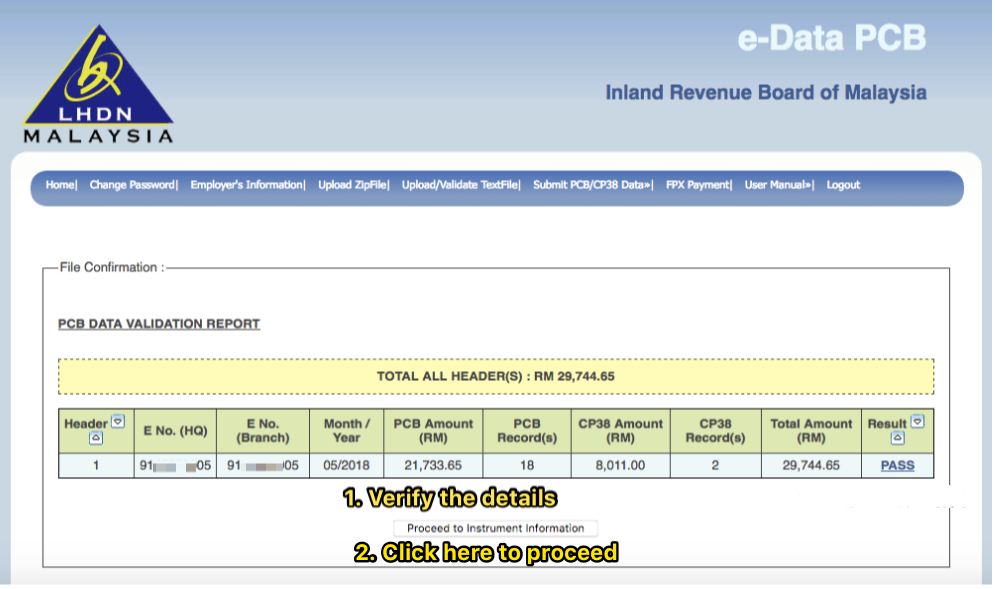

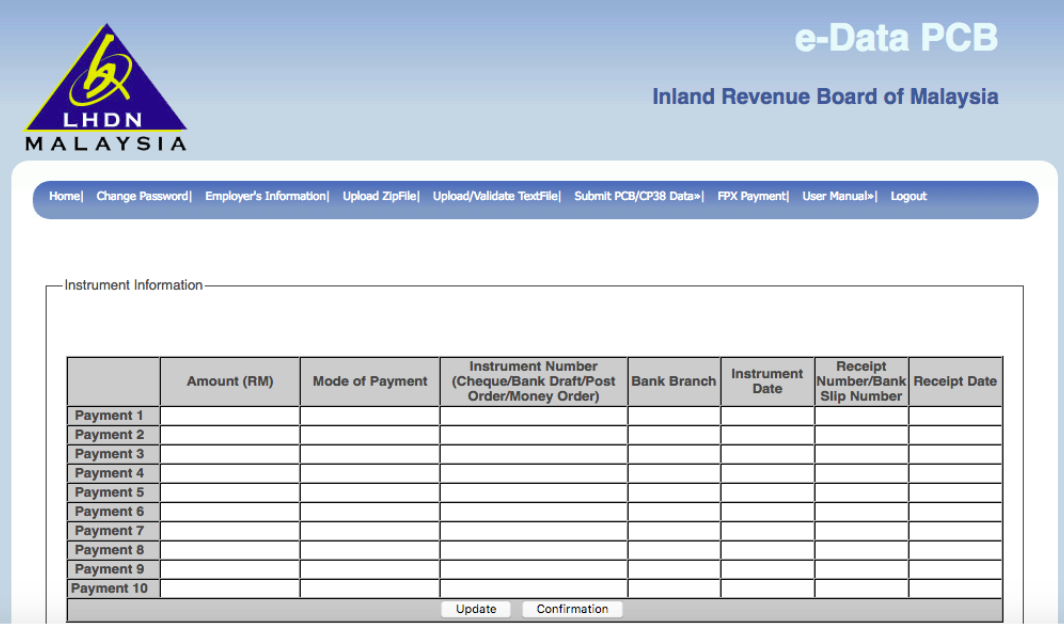

Step 5 - In this page the PCB/MTD summary will be shown. After the data is verified, click on "Proceed to Instrument Information"

Step 6 - Then click on update

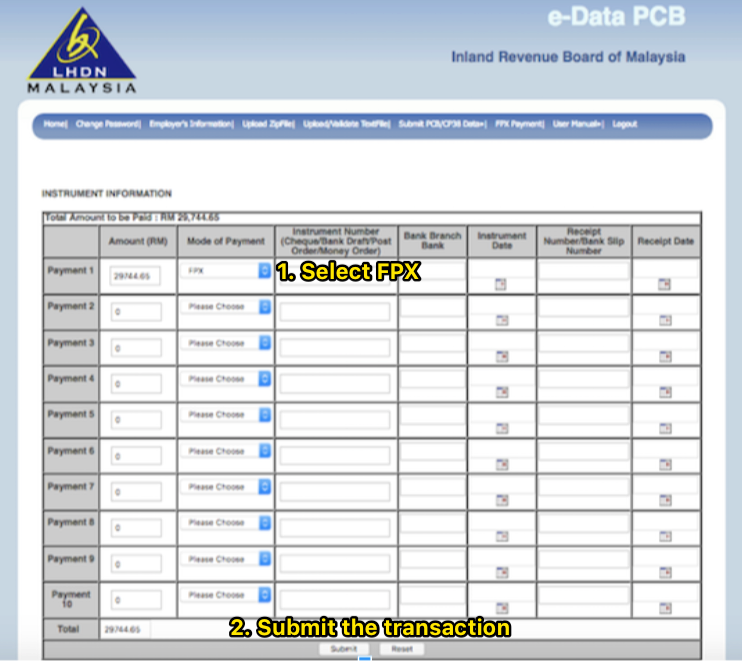

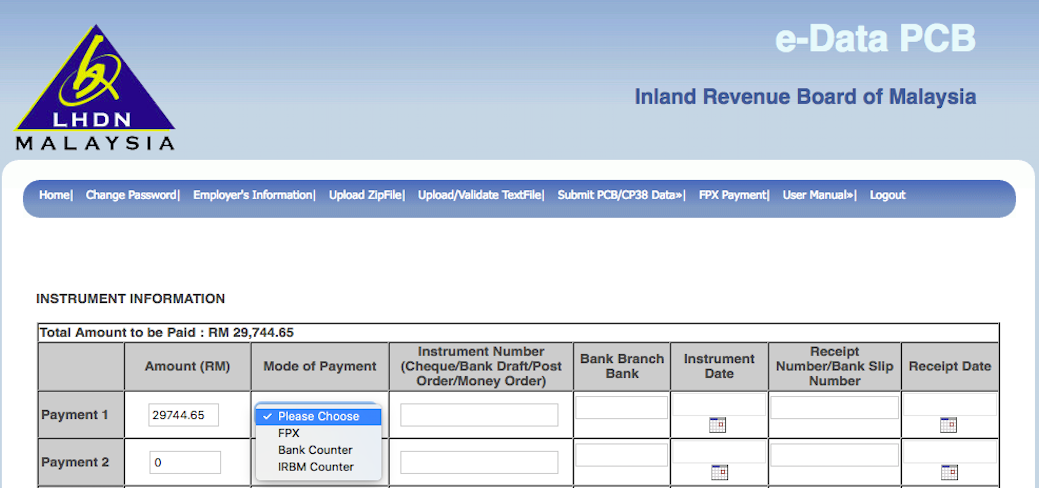

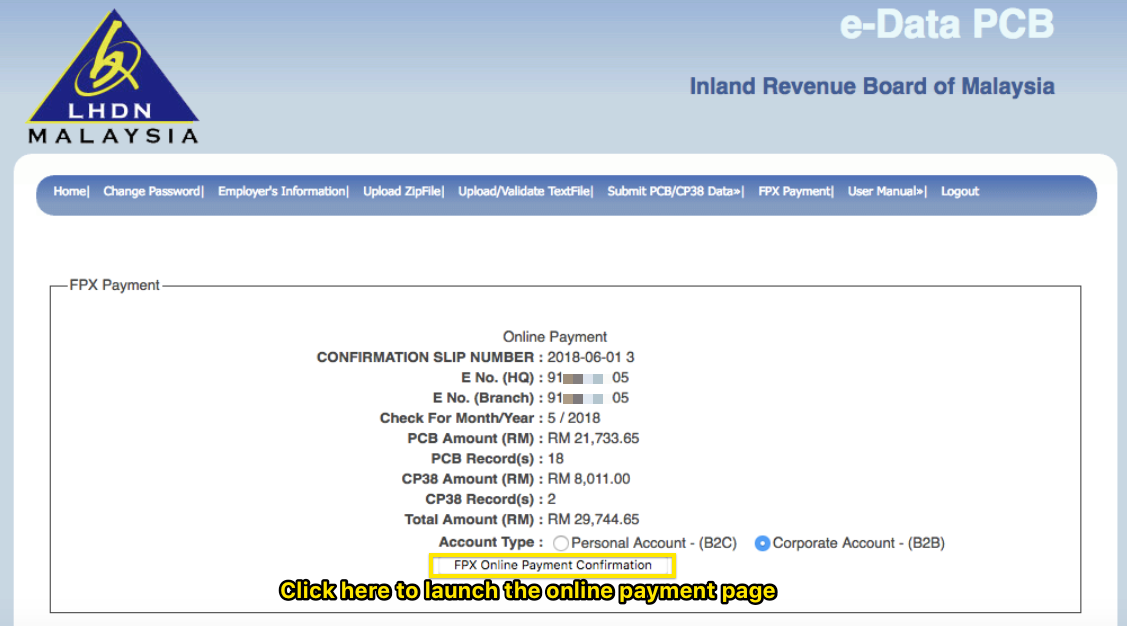

Step 7 - Next, select the payment mode. This will guide to demonstrate the payment via FPX

** Apart from making the payment via FPX, paying over the IRB counter or bank is also possible by selecting one of it

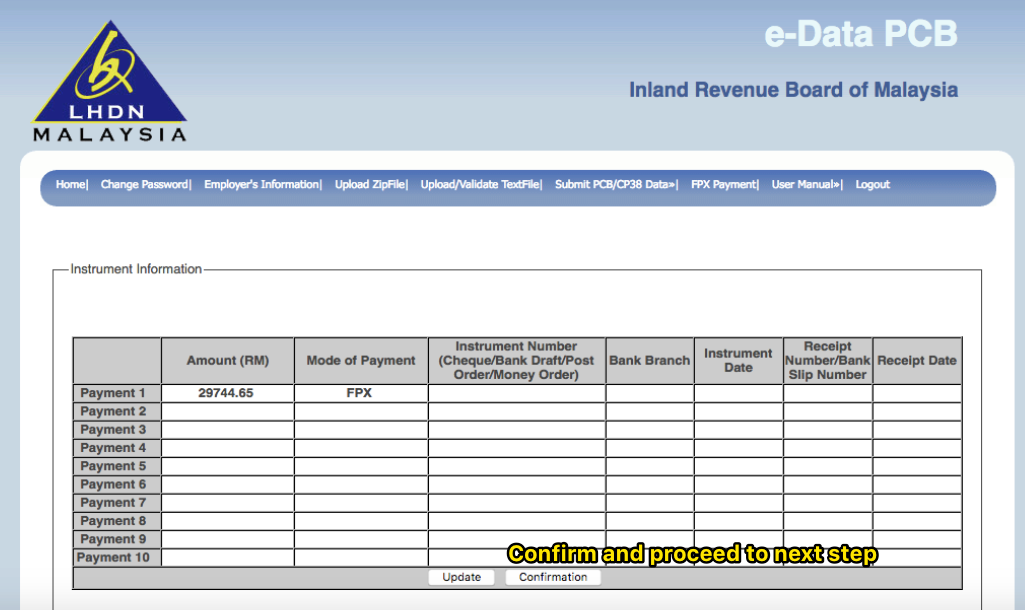

Step 8 - Next, click on the confirmation to process with the payment

Step 9 - Click on FPX payment for final confirmation. To make the transfer it will redirect to the bank login page.

Step 10 - Now proceed to the payment gateway

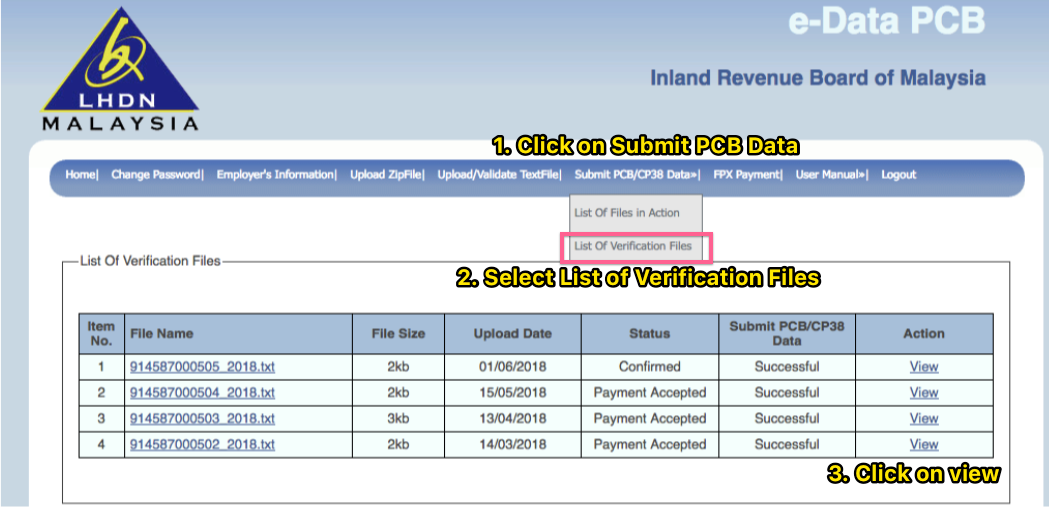

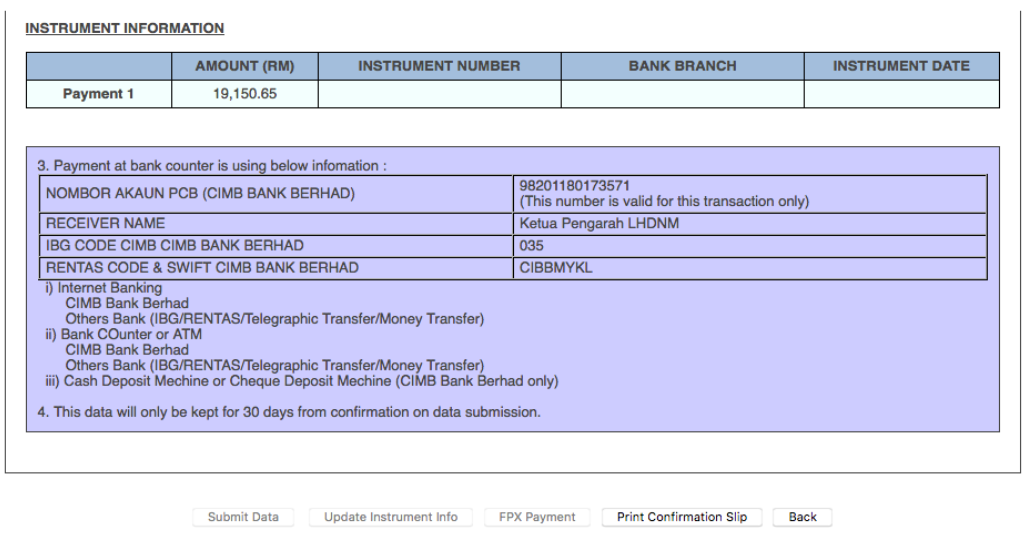

Step 11 - Next you can also generate the payment confirmation receipt

- To print the payment receipt for filing purposes follow the below instructions

- To download the receipt in PDF format, click on the print confirmation slip

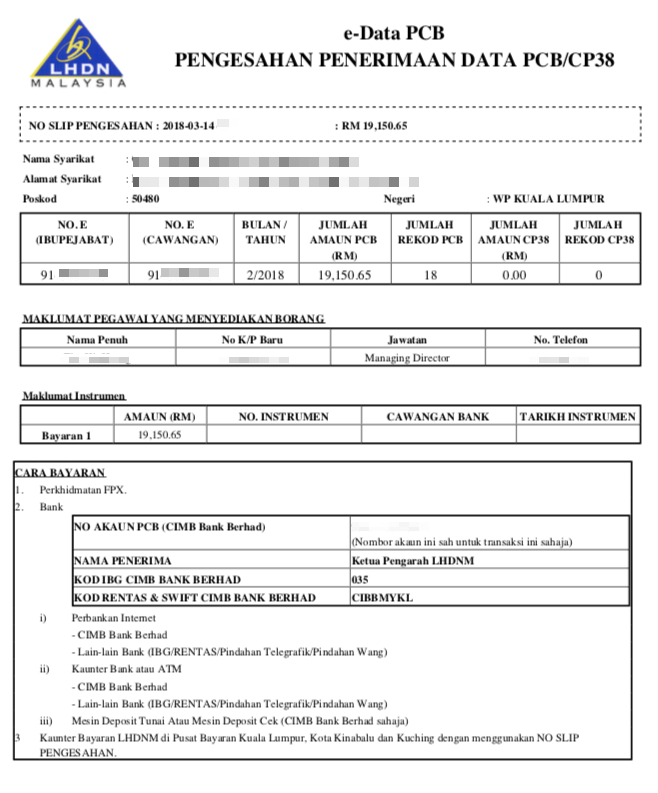

- Sample PCB Payment Receipt

What is the Penalty for Late PCB/MTD Payment?

If an employer fails to make the MTD/PCB payment on or before the 15th of the following month, he/she can be fined with the minimum fine of,

- RM200 and not more than RM20,000

- or six months imprisonment or both.

If an employee forgets to deduct the MTD or deducts but fails to remit it to IRBM can be charged in civil court. This MTD, if not deducted, becomes a debt to the government.

What Is EPF in Malaysia?

EPF is governed under the Employee Provident Fund Act 1991. In Malaysia, EPF(Employee Provident Fund) is a retirement saving scheme for eligible employees who contribute to EPF. The EPF savings contributed is managed under Simpanan Konvensional or Simpanan Shariah. The EPF saving consists of both employee's and employer's monthly contributions and dividends earned yearly.

Payments Subject to EPF Contribution

Monetary payments

- Salaries

- Bonuses

- Payment unutilized for annual/medical leave

- Commissions

- Incentives

- Allowances (with some exceptions)

- Wages arrears

- Wages for Study leave, maternity leave, half-day leave

- Other contractual payments or otherwise

Payments Exempted From EPF Contribution

- Service charges like tips

- Overtime payments, payments for work carried out on public holidays and rest days

- Gratuity (amount payable at the end of a service period or upon voluntary resignation)

- Payment in place of notice of termination of service (a payment is given when an employee's service is terminated)

- Retirement /Termination benefits

- Travel allowances, Director's fee

- Cash payments including gifts for holidays like Hari Raya, Christmas, etc.

- Benefits-in-kind and non-monetary perquisites

What Is the Employer's Responsibility on EPF Contribution?

- Within seven days upon hiring the first employee, Register with the EPF as an employer

- To keep the employee's information updated, register them as EPF member

- To employees, provide the salary statements

- Submit your employee’s EPF contribution to EPF along with the employer's share.

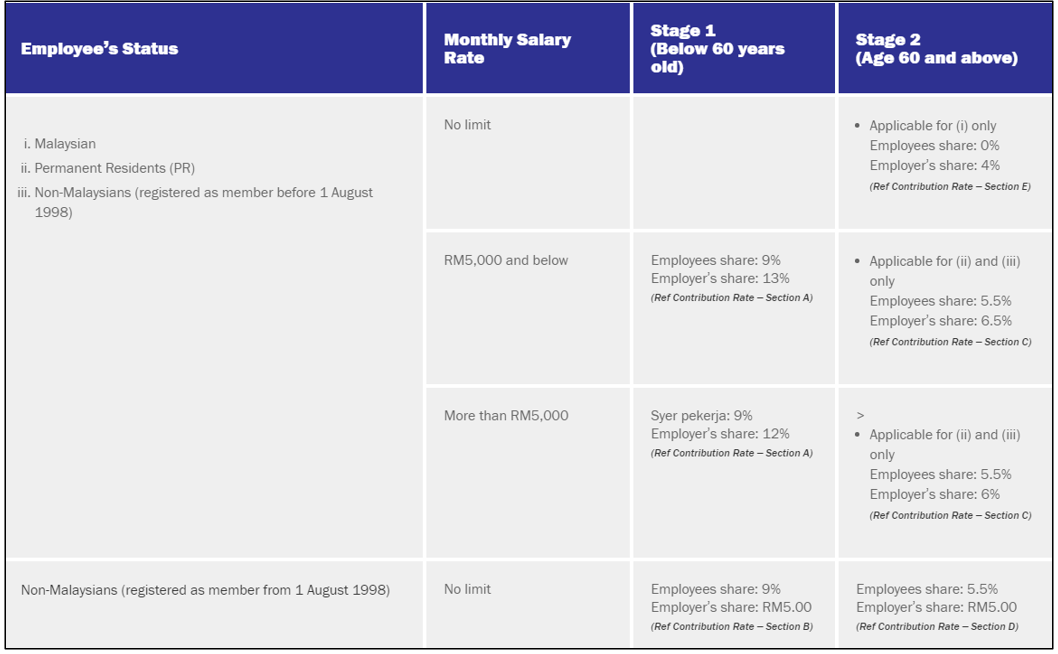

EPF Contribution Rates of Employer's and Employees (As of the year 2021) in Malaysia

EPF contributions are payable by both employee and employer under the EPF rules. From the employee's salary, employee contributions are deducted and paid to KSWP along with the employer contributions. Generally, the contribution rates are featured as a percentage of salary. Refer to the EPF Contribution Table for percentage and actual contribution to be taken

As per the above EPF contributions rate table, the rates differ as per the employee's age, whether they are Malaysian/Permanent Resident. For foreigners, the contribution is not mandatory, and different rates may apply.

Please note - Effective from January 2021 to December 2021, the EPF contribution rate was reduced from 11% to 9% for employees aged under 60. However, if employees want to contribute their EPF at 11%, they can continue to do so. To maintain the contribution rate at 11%, employees need to fill up Borang KWSP 17A (Khas 2021), which their employer will submit to EPF. Refer to the previous EPF Contribution Table if you have maintained your EPF at 11%.

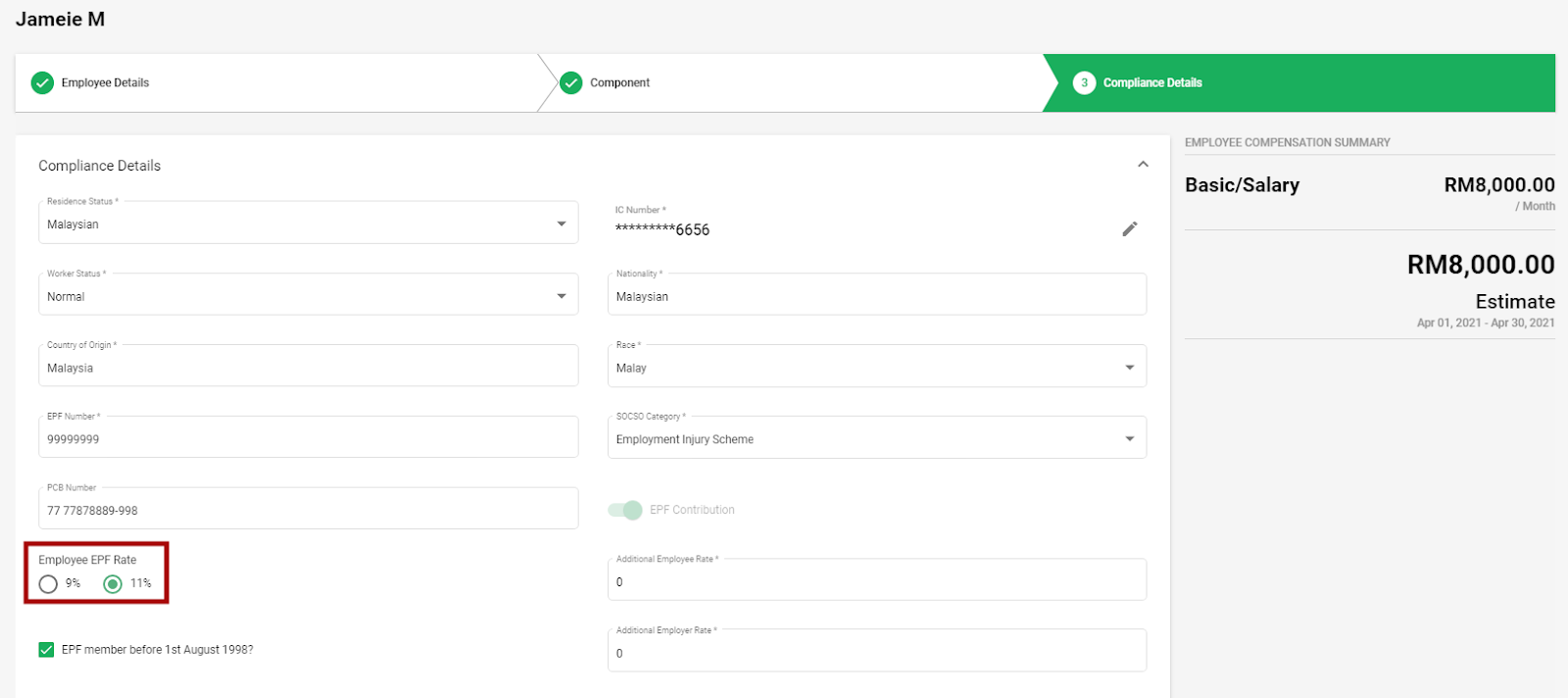

How Is EPF calculated in Deskera People?

Using Deskera People, you can auto-calculate the EPF for employees and employers by selecting the EPF rates - 11% OR 9 %.

EPF Voluntary Contribution in Malaysia

Both employee and employer can choose to increase their EPF contribution at a higher rate than the minimum rate as specified in the EPF contribution table. However, approval is required from KSWP before increasing the EPF contribution.

How to Apply For Voluntary EPF Contribution to KWSP

- Increased EPF contributions for an Employer:

If the employees want to contribute a higher percentage of EPF, they need to fill in Form KWSP 17 (MAJ) and further submit it to KSWP. After this Form is submitted, the employer is eligible to contribute to the new EPF rate.

- Increased EPF contributions for an Employee:

In case the employee wants to contribute EPF at a higher rate than his current statutory rate, then he needs to submit a notice of election first by using Form KWSP 17A (AHL).

How to Revert to the EPF Contribution Rates

To revert the minimum EPF rates, the employer/employee must submit a cancellation notice using Form KWSP 18 (MAJ) / Form KWSP 18A (AHL), respectively. After KSWP receives and processes this cancellation request, the EPF contribution will be reverted as per the previous rate.

Click here to understand in detail regarding EPF Voluntary Rate Contribution

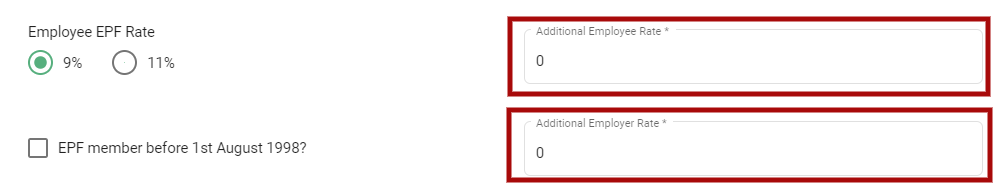

How to Increase EPF Rates Using Deskera People?

Using Deskera People, you can add an additional EPF rate if the employee or employer wishes to increase their contribution.

For example, if the employee’s current EPF contribution rate is 9% and you want to increase it to 11% you should add 2% as Additional Rate on the Employee EPF Rate.

Step-by-Step Guide to Make EPF Payment in Malaysia

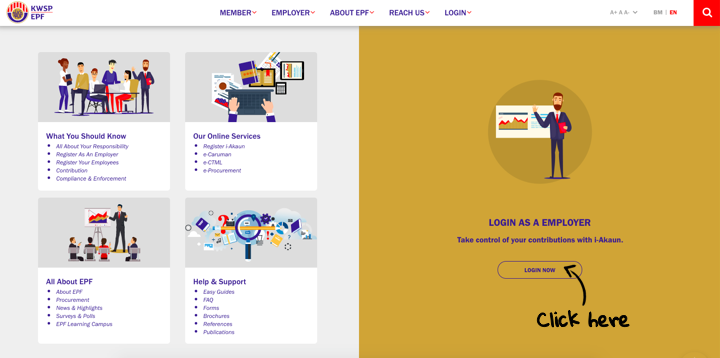

Below are the steps to make online payment via KWSP i-Akuna,

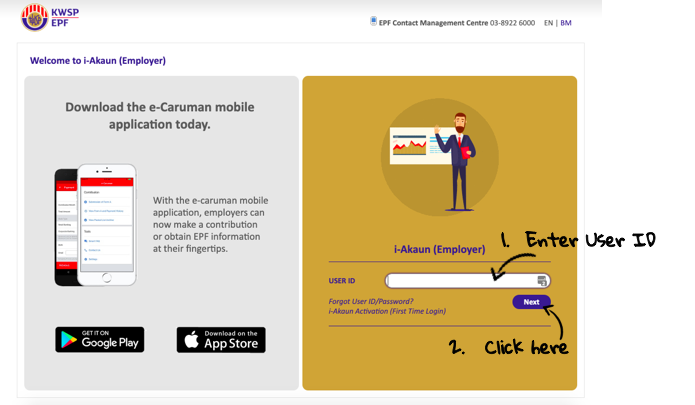

Step 1- Login to KWSP i-Akaun (Employer) website.

Step 2 - Enter your user ID and, ten click on Next

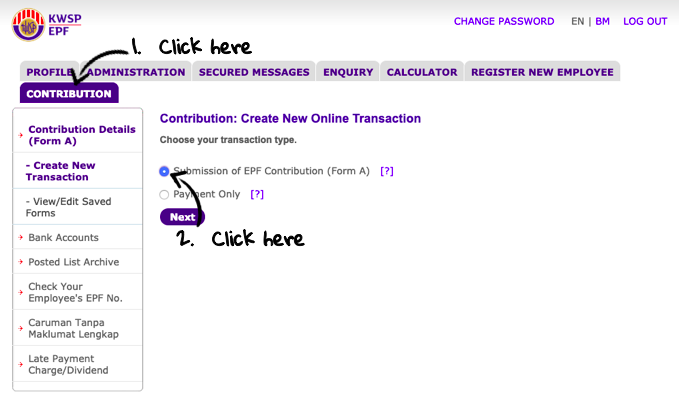

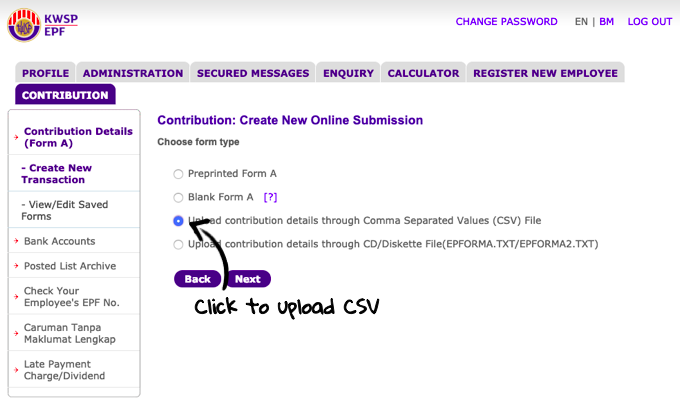

Step 3 - Select “Submission of EPF Contribution (Form A)” under contribution

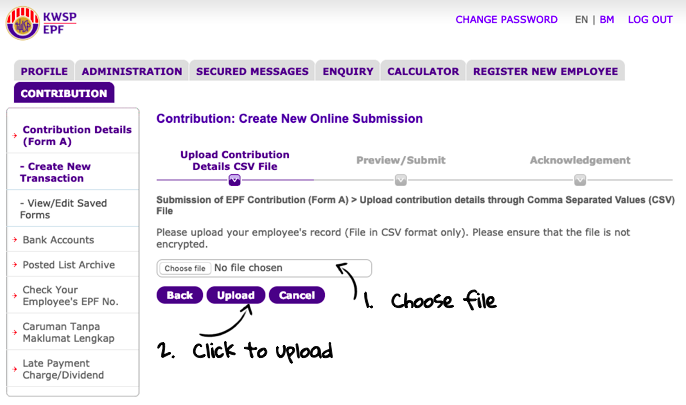

Step 4 - Then, select the third option for uploading the EPF contribution via CSV file

Step 5 - Browse the EPF file from Deskera and click on Upload

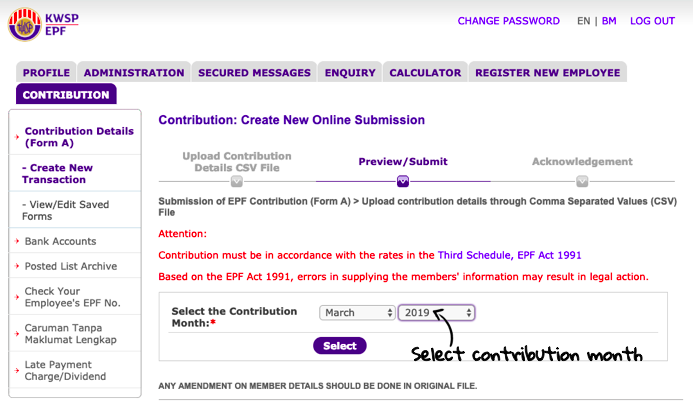

Step 6 - Then, select the correct ‘Contribution Month’ after uploading the file

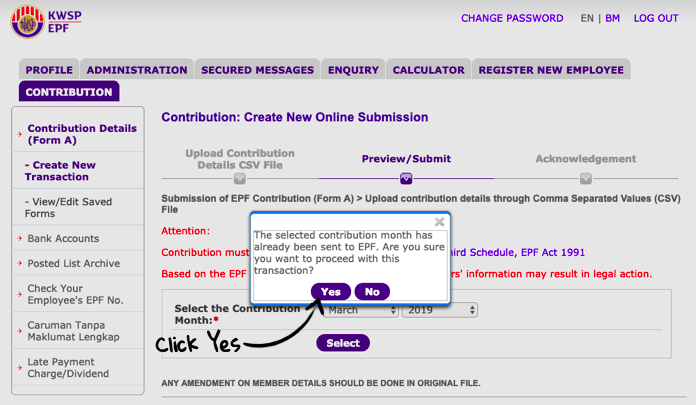

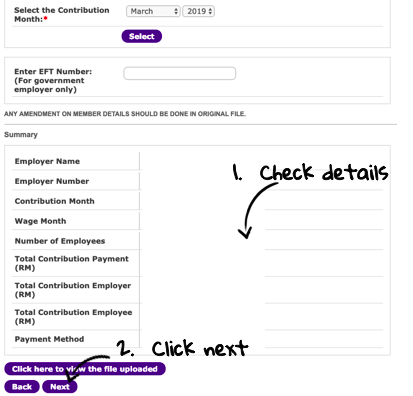

Step 7 - Click ‘Yes’ after the contribution month is set,

Step 8 - Confirm the details, then click on Next to proceed

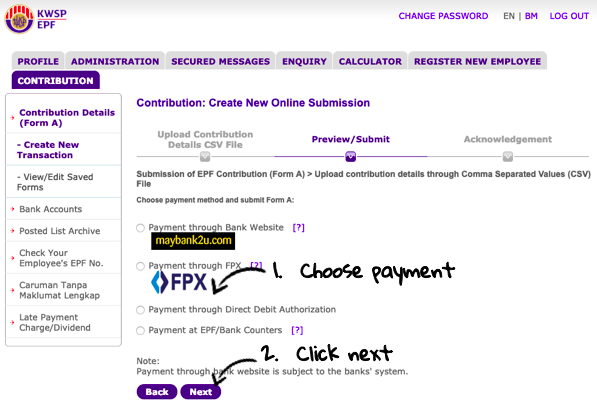

Step 9 - Lastly, you have make the EPF payment via, FPX or any other mode of payment

What Is EPF Contribution Deadline and Penalty for Late Submission?

EPF contribution must be paid every 15th of the following month.

Late Payment Charge:

If EPF payment is delayed, the minimum charge of RM10 is imposed. The late payment charge imposed will be rounded up to the nearest Ringgit denomination.

Example:

If the late payment charge imposed is RM14.21 and this amount must be rounded up to RM15.

All EPF calculations for Malaysia are managed by Deskera People when you run your payroll. You can sign up for Deskera People and start running your payroll in a matter of minutes.

What Is the Social Security Organization (SOCSO) Contribution in Malaysia?

Under the Employees' Social Security Act 1969, 2 schemes are governed, 1. The Employment Injury Scheme, which protects employees against disease or occupational accident, 2. The Invalidity Scheme makes sure that an employee who cannot work due to untreatable/unlikely to be cured conditions or death.

SOCSO contribution is compulsory for all Malaysians and Permanent Resident employees; it is mandatory to register with SOCSO except for State and Federal permanent government employees, self-employed, and those who are domestic servants. Since Jan 2019, even foreign workers are protected under SOCSO.

Payments Subject to SOCSO Contribution

Monetary payments :

- Commissions

- Overtime Pays

- Salaries

- Maternity leave wages, study leave, and half-day leave

Payments Exempted From SOCSO Contribution

- Contribution towards any pension or provident fund payable by the employer

- Gratuity

- Any sum paid to cover expenses incurred by the employee in the course of his duties

- Bonuses and travel allowances

- Cash payments including gifts for holidays like Hari Raya, Christmas, etc.

What Is the Employer's Responsibility on SOCSO Contribution?

- Within 30 days upon hiring the first employee, register yourself as an employer.

- To keep the employee's information updated and register them as SOCOS members.

- Within 48 hours, report all work-related accidents on the worker's behalf

- Maintain employees monthly record and keep the info updated

- Submit your employee's SOCSO contribution along with the employer's share.

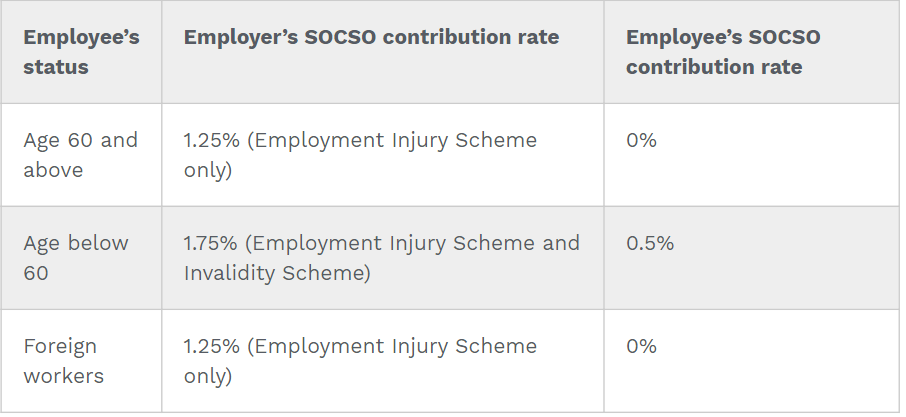

SOCSO Contribution Rates of Employer's and Employees in Malaysia

In the table mentioned above, the SOCSO contribution rates stated do not apply to employees aged 55 years and above and who have no prior contribution.

In this case, they are covered only under the Employment Injury Scheme. Employees aged 60 years and above do not need to contribute to the employee's share to SOCSO.

The SOCSO contribution amount is calculated based on the contribution rate as stated in the contribution table on the SOCSO website. The monthly SOCSO contribution is capped at a monthly salary of RM4,000.

When Is the Deadline for SOCSO Contribution?

The monthly payment of SOCSO shall be paid by the 15th of every month for both employee and employer. If payment is delayed, an interest rate of 6% per year will be imposed for each contribution day not paid.

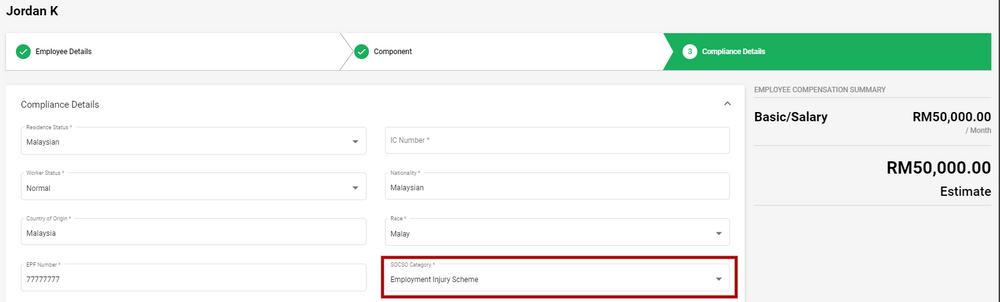

How Is SOCSO Applicable in Deskera People?

Using Deskera People, you have an option to select the SOCSO category applicable for the employee which will auto-calculate the SOCSO amount in the system

- Employment Injury Scheme and the Invalidity Scheme

- Employment Injury Scheme

With the in-built SOCSO rates implementation in the Deskera People, after the SOCOS category is selected the employee and employer SOCSO calculation is auto calculated after the payrun is processed.

All SOCSO calculations and reports are managed by Deskera People when you run your payroll. You can sign up for Deskera People and start running your payroll in a matter of minutes.

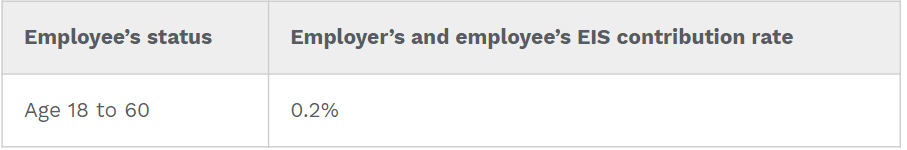

What Is the Employment Insurance System(EIS) Contribution in Malaysia?

The EIS is governed under the Employment Insurance System Act 2017 and is also administered by SOCSO. EIS protects the employees aged from 18 to 60 years and who have lost their jobs except in the Voluntary retirement, contract expiry, project completion, and dismissal due to misconduct.

What Is the Employer's Responsibility on EIS Contribution?

The employees will automatically get entitled to EIS after the SOCSO registration of members is done.

EIS Contribution Rates of Employer's and Employees in Malaysia

In the table mentioned above, the EIS contribution rates stated do not apply to the new employees aged 57 years and above and who have no prior contribution.

The EIS contribution amount is calculated based on the contribution rate as stated in the Second Schedule on the Employment Insurance System Act, 2017. The monthly SOCSO contribution is capped at a monthly salary of RM4,000.

When Is the Deadline for EIS Contribution?

The employees and employees EIS contribution share is paid together with SOCSO contribution.

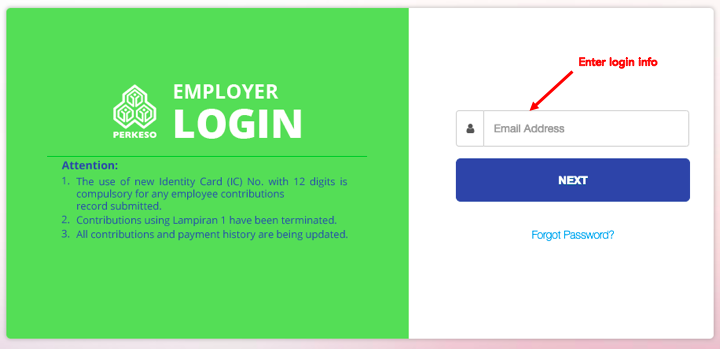

Step-by-Step Guide to Make EIS and SOCSO Payment in Malaysia

Here is the step-by-step guide to make online EIS and SOCOS payment via PERKESO ASSIST Portal:

Step 1 - Log in to portal PERKESO ASSIST

.

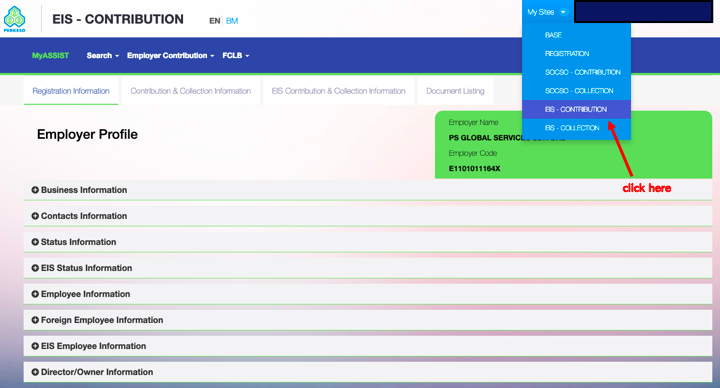

Step 2 - Under My Sites, select EIS - CONTRIBUTION if you want to make EIS payment and if you want to make SOCSO payment select SOCSO-CONTRIBUTION

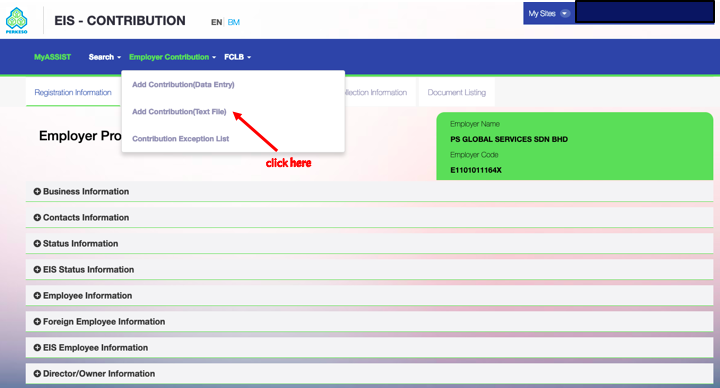

Step 3 - After this, under Employer Contribution, click on Add Contribution (Text File)

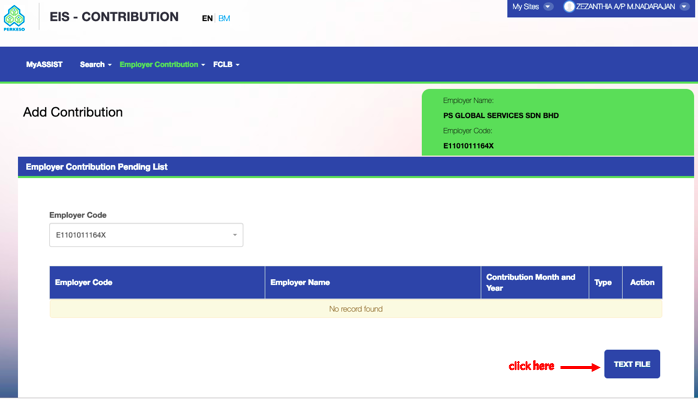

Step 4 - To upload the EIS file that you have exported from Deskera People, click on Text File

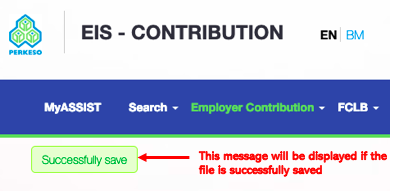

Step 5 - A message will appear to indicate successful EIS file upload

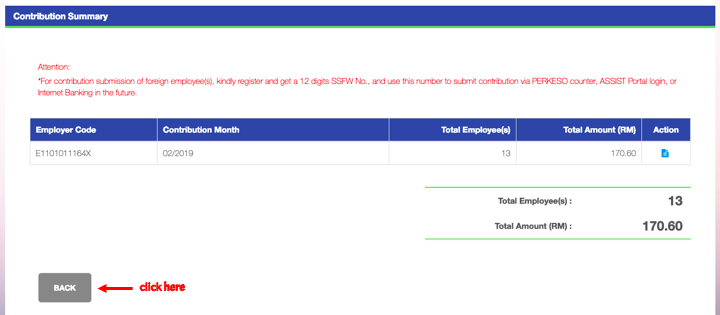

Step 6 - click on the Back button at the contribution summary

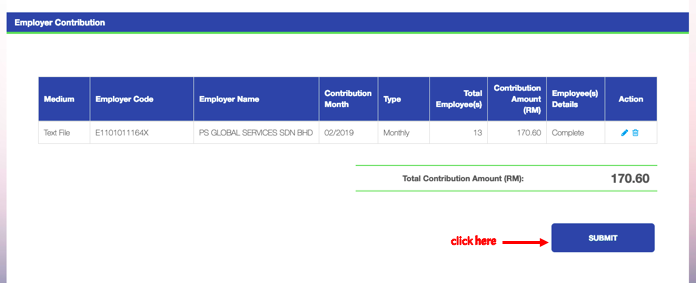

Step 7 - Next click on the Submit button

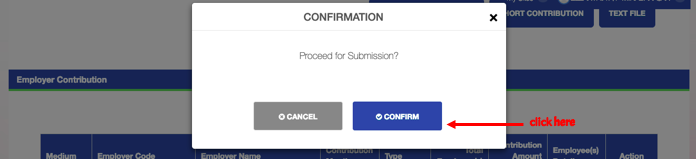

Step 8 - To proceed with the submission check on the Confirm button

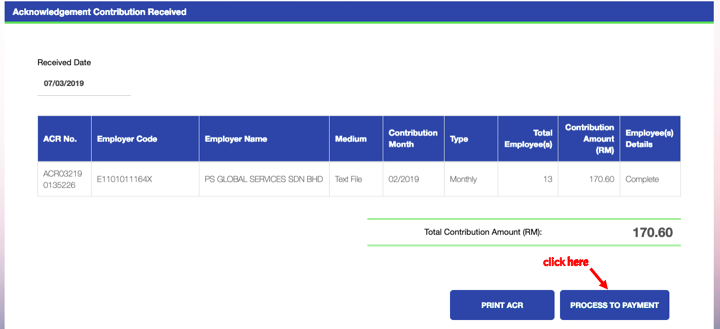

Step 9 - Proceed to process payment, after the submission

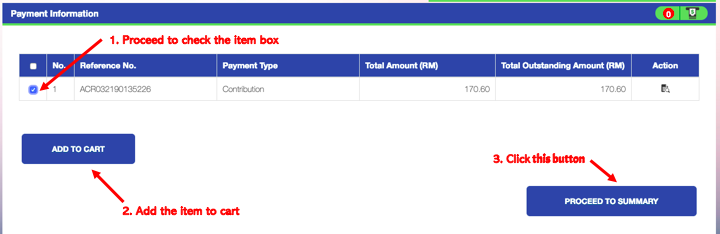

Step 10 - Proceed with the following 3 steps at the payment information page

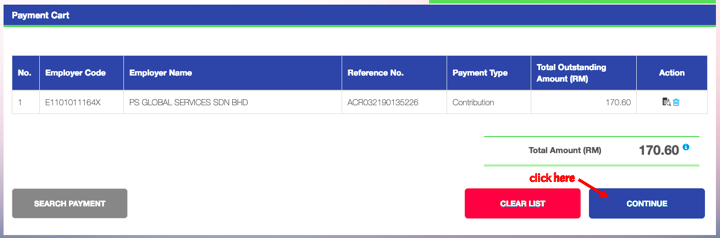

Step 11 - At the Payment Cart page,click to continue

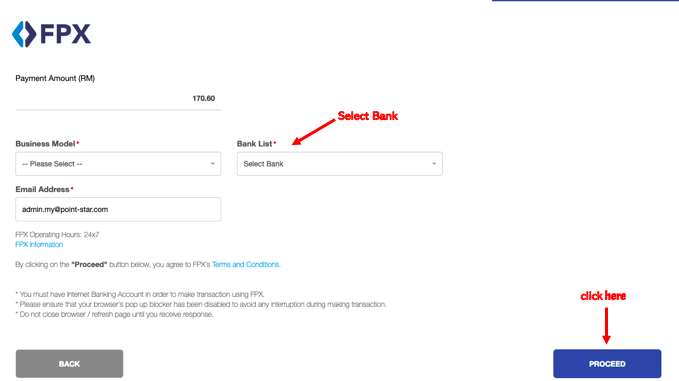

Step 12 - Lastly, you can make your payment via FPX.

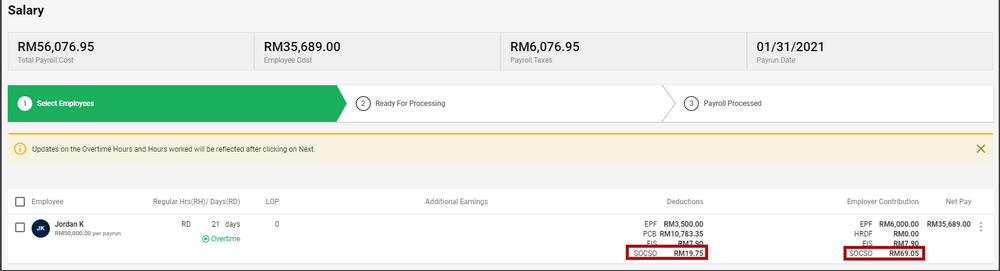

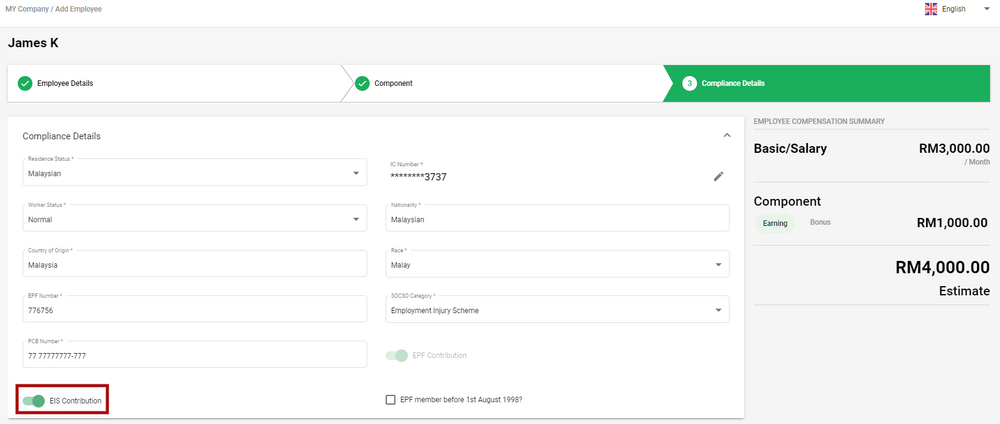

How Is EIS Contribution Applied In Deskera People?

Using Deskera People, you have an option to enable the EIS contribution for the employee which will auto-calculate the EIS amount in the system,

With the in-build EIS contribution rates implemented in the Deskera People, after the EIS button is enabled the employee and employer EIS calculation is auto calculated after the payrun is processed,

EIS calculations and reports are managed by Deskera People when you run your payroll. You can sign up for Deskera People and start running your payroll in a matter of minutes.

What is the HRDF Levy In Malaysia?

HRDF levy is imposed on employers from all industries and is a mandatory levy payment collected by Human Resources Development Fund(HRDF, also known as PSMB). It will enable employee training and upgrade the skill of the workforce in Malaysia.

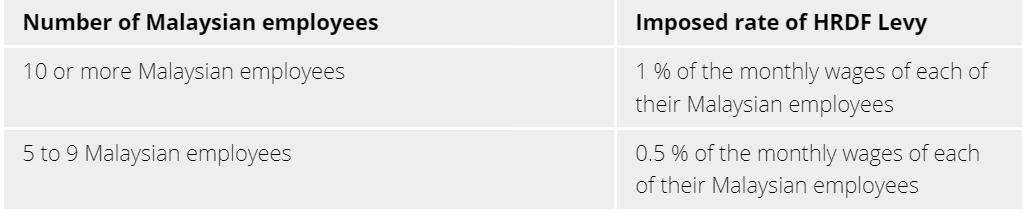

Who Is Eligible to Register with HRDF?

From March 1, 2021, HRDF is expanded to all industries. Companies with ten or more local employees are eligible to register. At the same time, companies with 5-9 local employees have the option to register.

If an employer eligible to register for HRDF does not register is fined up to RM10,000 or imprisonment for almost a year.

From March 1 to May 31, 2021. employers under newly included industries are exempted from the HRDF levy for three months.

How Is HRDF Calculated?

HRDF for each Malaysian employee is calculated as HRDF Levy% x (Basic Salary + Fixed Allowances)

Please note - Once you reach the employees count to 10, then as per the HRDF regulations, you shall continue to contribute at 1% for the whole calendar year, even if the headcount falls less than 10 employees during the year.

You need to make an HRDF payment no later than the 15th of the following month.

Click here to read in detail on which allowances to include in the calculation.

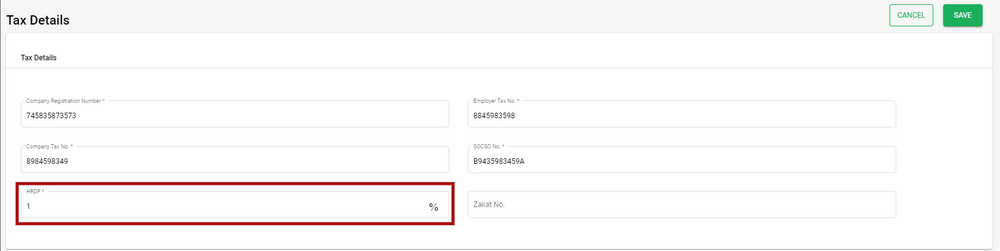

How Is HRDF Applicable in Deskera People?

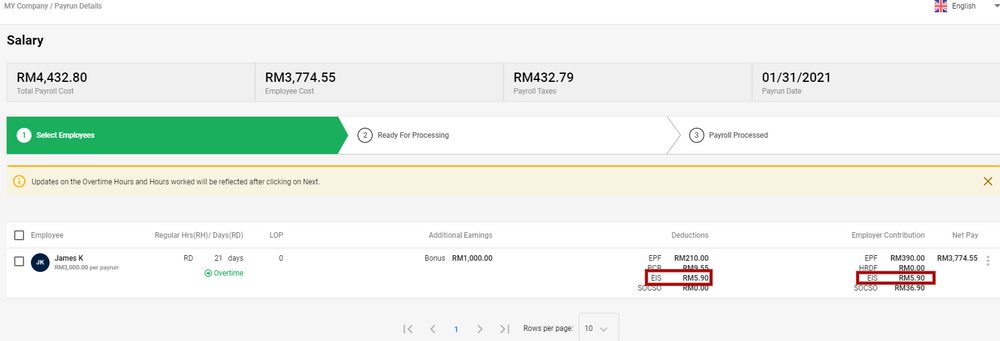

Using Deskera People, an employer can enter the relevant HRDF percentage of contribution in the system,

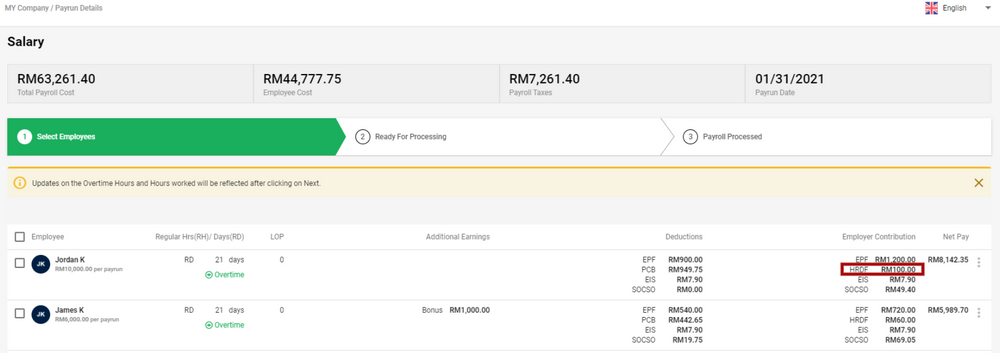

This will auto-calculate the HRDF amount in the system, after the payrun is processed,

All HRDF calculations are managed by Deskera People when you run your payroll. You can sign up for Deskera People and start running your payroll in a matter of minutes.

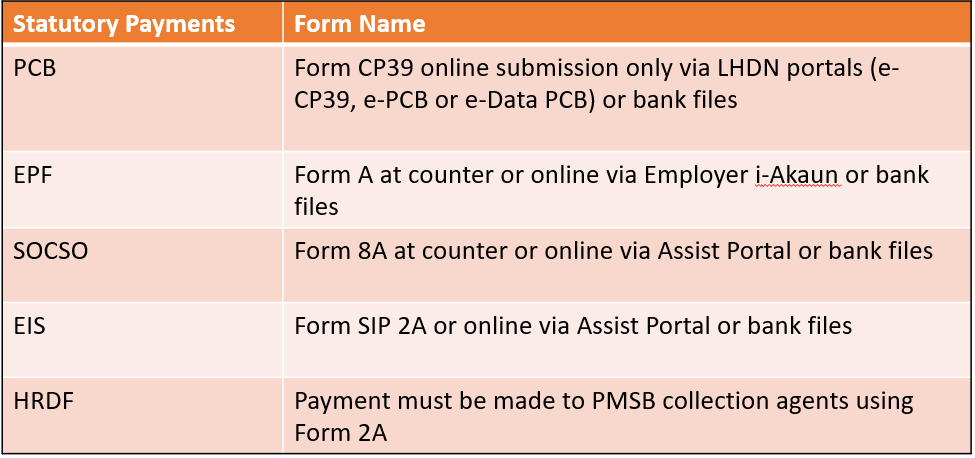

Payroll Statutory Forms in Malaysia

Payroll forms, together with appropriate payments, must be submitted monthly for all statutory contributions by the specified deadline. Failure to make payment on time will lead to fines/imprisonment. Payments can be made at LHDN/EPF/SOCSO counters, bank or post office, or through online banking.

Monthly Forms

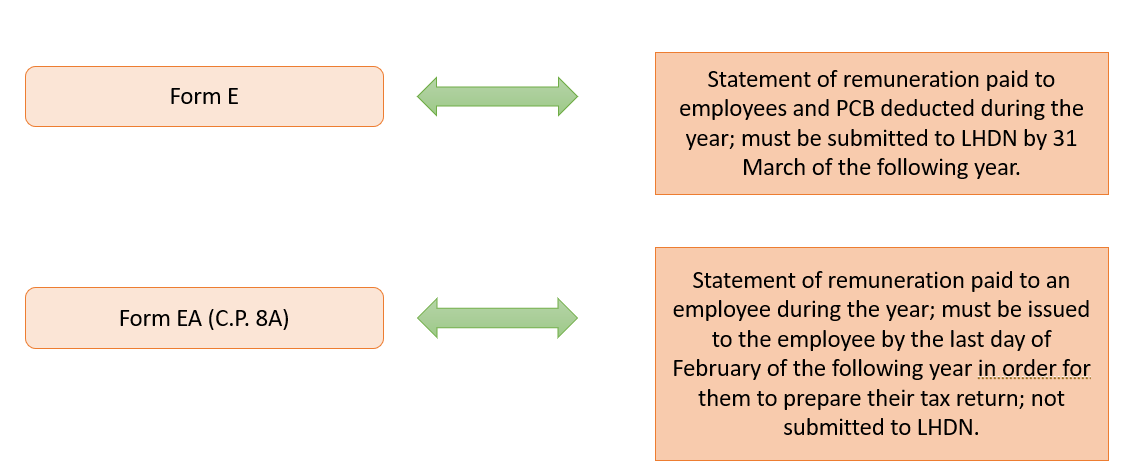

Annual Forms

The following annual forms are required by LHDN:

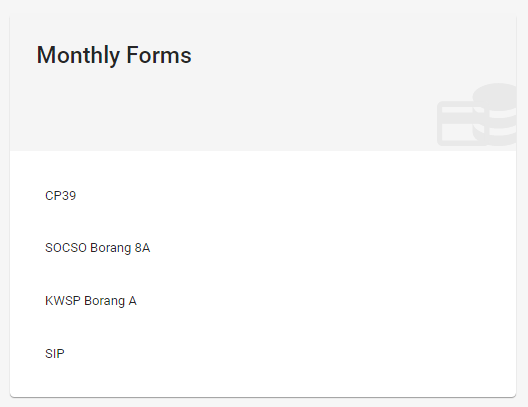

Malaysia Payroll Statutory Reports Available Under Deskera People

Using Deskera People, you are able to generate below Payroll Compliance monthly reports for Malaysia,

CP39 Report:

With Deskera People, you generate CP39 form/Txt file for submitting the monthly MTD/PCB to the LHDN.

For more information, please refer to below article,

SOCSO Borang 8A Report:

With Deskera People , you can generate a SOCSO Borang 8A file directly from the system. This downloaded TXT file can be uploaded into SOCSO Assist Portal for making the payment.

For more information, please refer to below article,

EPF KWSP Borang A Report:

With Deskera People, you generate KWSP Borang A form and Txt file for submitting the monthly EPF to the KWSP.

For more information, please refer to below article,

SIP EIS Report :

With Deskera People , you can generate EIS SIP form directly from the system. This downloaded TXT file can be uploaded into SOCSO Assist Portal for making the payment.

For more information, please refer to below article,

All tax and payroll reporting with calculations is managed by Deskera People when you run your payroll. You can sign up for Deskera People and start running your payroll in a matter of minutes.

The Tax Highlights of Malaysia Budget 2021

Following are the tax highlights for budget 2021:

- Personal Income Tax Reduction

The tax rate will be reduced by one percentage with effect from the year of assessment 2021, tax resident individuals within the chargeable income band of RM50,001 to RM70,000, the tax rate will be reduced by one percentage. - Changes to contribution rate in Employee Provident Fund (EPF)

From 1 January 2021 to 31 December 2021, the employee’s minimum EPF contribution rate will be reduced from 11% to 9%. - Preferential tax rate

- For non-Malaysian citizens holding key positions in companies and who relocate their operations to Malaysia under the PENJANA incentive package, a tax rate of 15% is proposed for five consecutive years.

- For a non-resident, this tax incentive is limited to five individuals per company.

- From 7 November 2020 until 31 December 2021, it is applicable for the Malaysian Investment and Development Authority applications.

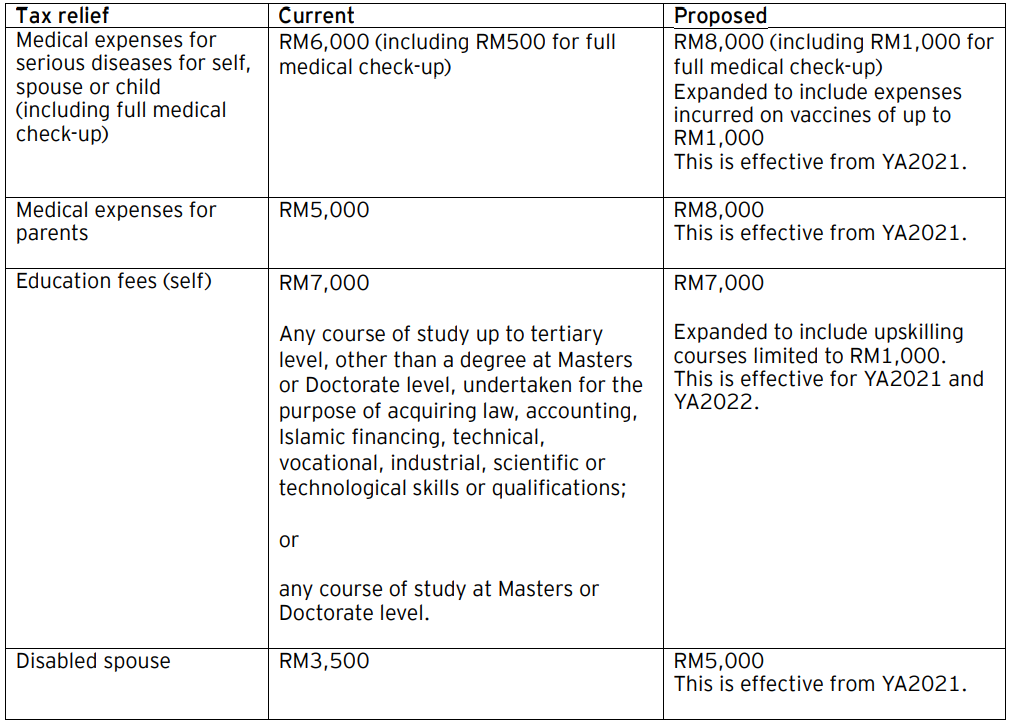

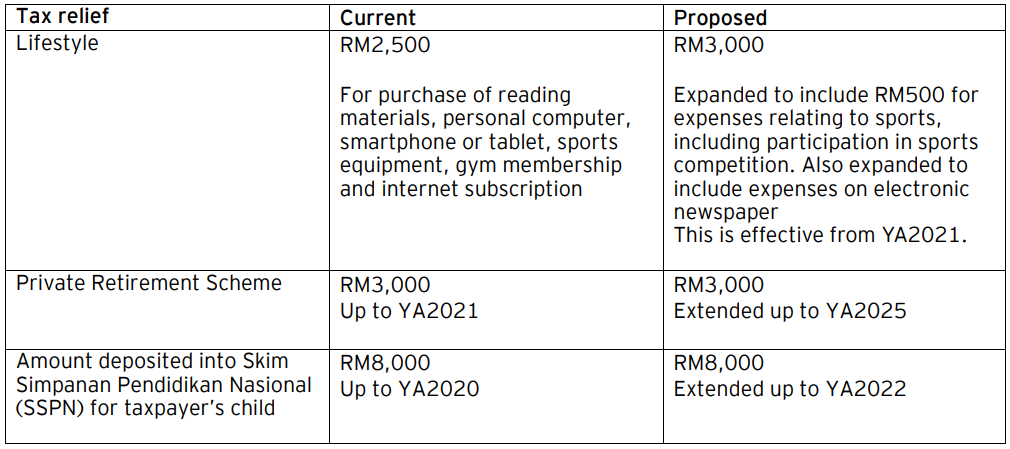

- Increase of existing personal tax relief

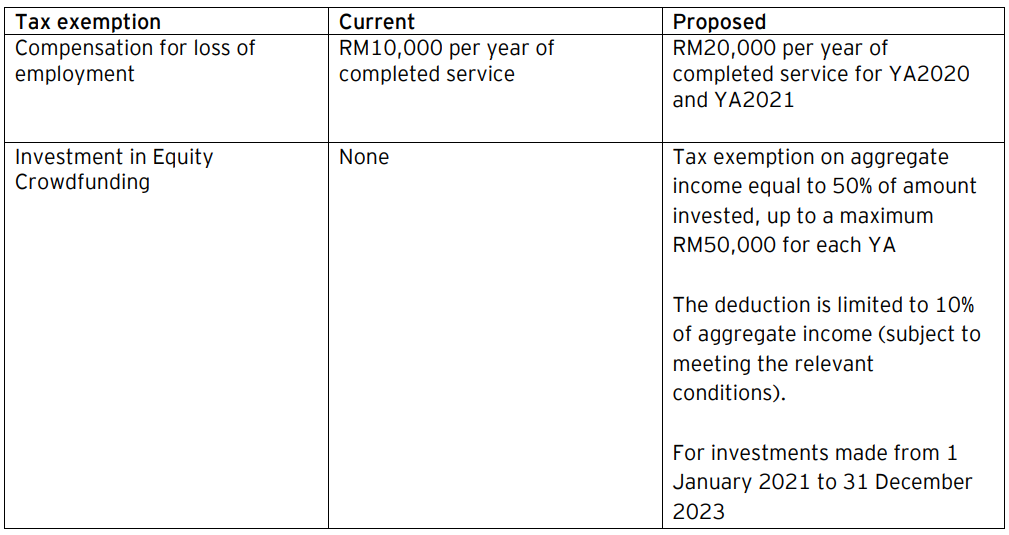

- Increase of existing personal tax exemption

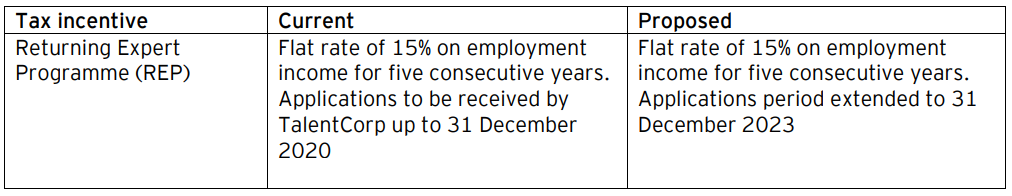

- Returning Expert Program

Key Takeaways

And that's a wrap.

By now you would have developed the understanding of how Malaysia payroll works and what the the various work-permits, employee types, contributions, levies and forms that you need to be aware of. We covered the following topics in the article:

- Work permits needed in Malaysia

- Types of employees you can have on payroll in Malaysia

- Types of remunerations in Malaysia payroll

- Different perquisites and benefits-in-kind (BIKs)

- Statutory tax deductions & Employer Contributions in Malaysia

- PCB and MTD

- EPF (Employee Provident Fund) in Malaysia

- Social Security Organization (SOCSO) Contribution

- Employment Insurance System(EIS)

- HRDF Levy

- Payroll Statutory Forms

- Steps to file taxes, contributions and submit forms

Malaysia payroll can be complicated, with the various taxes, rules, contributions and forms. It is highly recommended to opt for an out-of-the-box solution for managing your payroll and

Deskera People is a payroll software developed especially for small and medium enterprises (SME). Deskera People also supports auto computation for various contributions, like, EPF, SOCSO, EIS, and PCB Tax deductions. All these contributions submission to the respective statutory bodies are made easy with the readily available auto-generated reports from the system.