Have you ever wondered how global businesses manage to maintain stable pricing even when tariffs fluctuate unexpectedly? The answer often lies in the way they handle inventory costing—particularly through methods like Moving Average Costing (MAC). As global trade dynamics become increasingly complex, with shifting tariffs and import duties reshaping cost structures, companies are under constant pressure to protect their profit margins while keeping prices competitive.

Tariff volatility can create significant financial uncertainty. Sudden increases in import costs can raise the price of raw materials, disrupt production budgets, and make it difficult to forecast profitability. In such conditions, relying on static costing methods like FIFO or LIFO may not reflect true inventory value, leading to skewed financial insights. Businesses, therefore, need a cost management strategy that adapts to changing market realities while providing an accurate picture of operational expenses.

That’s where Moving Average Costing proves invaluable. By continuously recalculating inventory costs as new purchases occur, MAC smooths out price fluctuations caused by tariffs or currency shifts. This enables businesses to maintain consistent cost of goods sold (COGS), improve forecasting accuracy, and make more informed financial decisions. It’s not just an accounting method—it’s a strategic tool for ensuring cost stability and resilience in unpredictable market conditions.

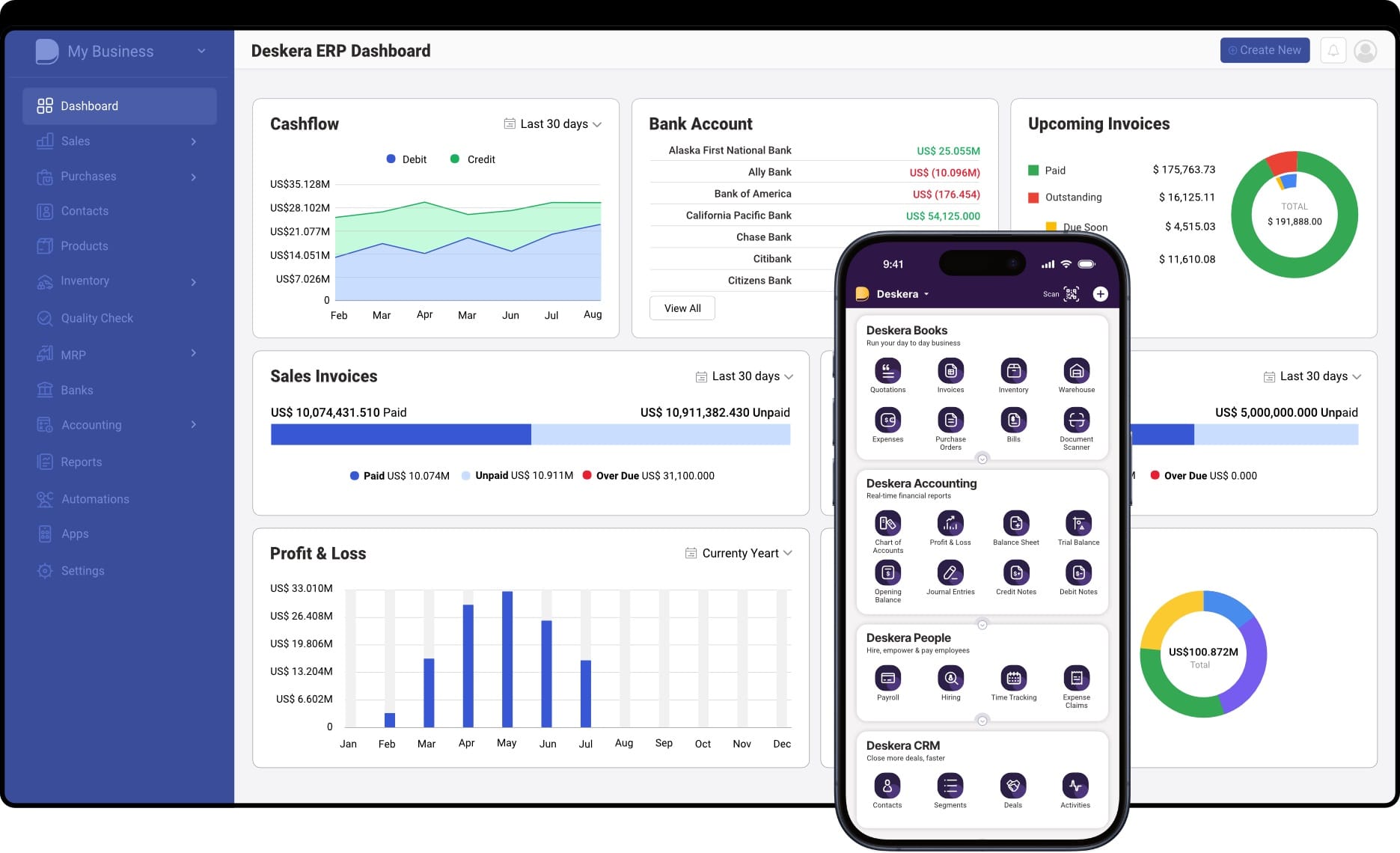

To make this process seamless, solutions like Deskera ERP empower businesses with automated moving average cost calculations. Deskera’s integrated ERP platform updates inventory values in real time, ensuring that every transaction reflects the most accurate cost data. With features like AI-powered forecasting (David), built-in accounting, and intelligent reporting, Deskera helps companies navigate tariff uncertainty confidently—streamlining cost control and enhancing overall financial agility.

What Is the Moving Average Cost (MAC)?

Moving Average Cost (MAC) is an inventory valuation method that continuously updates the average cost of goods every time new inventory is purchased. Unlike FIFO (First-In, First-Out) or LIFO (Last-In, First-Out)—which value inventory based on the order of purchase—MAC calculates a weighted average cost for all units available in stock. This approach helps businesses maintain a consistent and realistic view of their inventory costs, especially in markets affected by frequent price changes or tariffs.

In simpler terms, every time a new batch of goods is purchased at a different price, the total cost of inventory is recalculated by adding the cost of the new stock to the existing stock value and dividing it by the new total quantity. This results in a new average cost per unit that reflects current market conditions.

For example, if a business purchases 100 units at $10 each and later buys another 100 units at $12 each, the moving average cost becomes $11 per unit. This ensures that cost fluctuations caused by external factors—like tariff hikes—are distributed evenly across all items in inventory rather than impacting only specific batches.

The MAC method is widely used because it simplifies cost tracking, ensures smooth cost recognition in financial statements, and provides a more stable cost base for pricing and profitability analysis. It’s particularly beneficial for industries with continuous production or frequent material purchases, where maintaining accurate and up-to-date inventory valuation is crucial for sound financial decision-making.

The Impact of Tariff Volatility on Business Costs

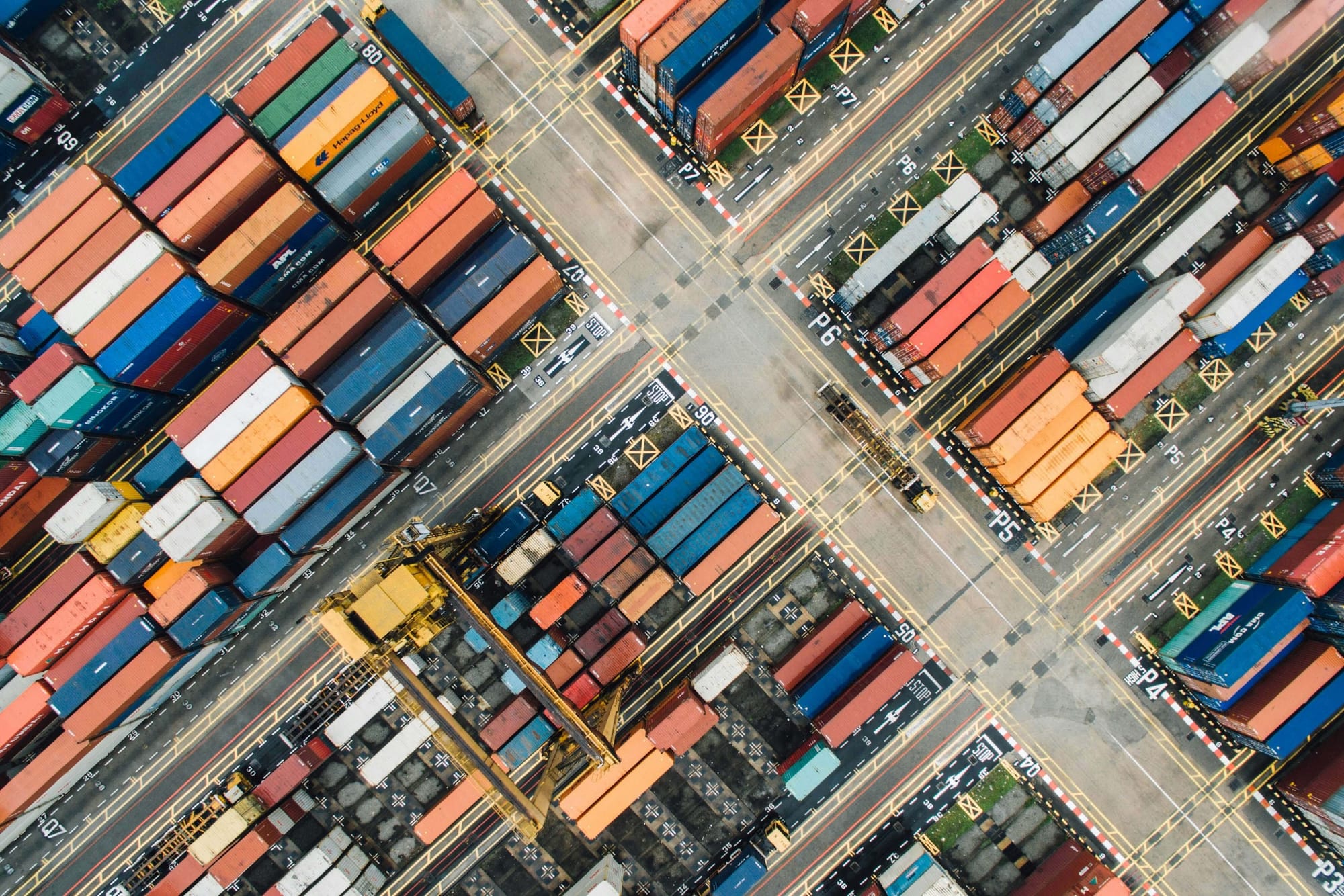

In an increasingly globalized economy, tariffs have become a major factor influencing cost structures and profitability. When trade policies shift or new tariffs are introduced, businesses often face unpredictable fluctuations in their expenses. These changes can ripple through the entire supply chain—from procurement to pricing—making cost control a significant challenge.

Below are the key areas where tariff volatility impacts business operations and financial stability.

1. Rising Procurement and Sourcing Costs

Tariff volatility directly affects procurement budgets by increasing the cost of imported materials and components. Businesses that rely on global suppliers may face sudden spikes in purchase prices, forcing them to reallocate resources or seek alternative sources.

This can disrupt supply chain continuity and make it harder to maintain consistent quality or delivery schedules. As a result, procurement teams must balance cost efficiency with supply reliability, often under tight financial constraints.

2. Fluctuating Inventory Valuation and Financial Uncertainty

When tariffs change frequently, the cost of goods in inventory no longer reflects their true market value. Traditional costing methods like FIFO or LIFO can lead to overstated or understated inventory valuations, causing inaccuracies in the cost of goods sold (COGS) and profit margins.

This inconsistency makes financial forecasting difficult and can distort business performance metrics. To maintain financial accuracy, companies need a more dynamic costing method that adapts to real-time changes—such as Moving Average Costing (MAC).

3. Pressure on Pricing Stability and Competitiveness

Unstable tariffs make it challenging for businesses to maintain steady pricing in the market. Frequent cost changes can erode profit margins or force price increases that may reduce competitiveness.

Companies selling in price-sensitive markets often struggle to pass on the added costs to customers, resulting in lower profitability. Implementing adaptive costing strategies helps smooth out these cost variations, enabling firms to offer stable prices without sacrificing margins.

4. Strategic Need for Cost Adaptability

In volatile trade environments, flexibility in cost management becomes essential. Businesses that rely solely on static costing systems risk making decisions based on outdated or inaccurate data.

By adopting Moving Average Costing, organizations can spread the effects of tariff fluctuations over time, ensuring that cost assessments remain realistic and reflective of current market conditions.

This approach not only enhances financial visibility but also strengthens long-term strategic planning and resilience against tariff-driven disruptions.

How Moving Average Costing Helps Manage Tariff Volatility

Managing costs effectively in a tariff-driven market requires a system that adapts as fast as conditions change. Moving Average Costing (MAC) provides exactly that—an agile and transparent approach that helps businesses maintain cost stability despite fluctuating import prices or trade duties.

By recalculating inventory costs with each new purchase, MAC creates a dynamic cost base that reflects the real impact of tariffs without letting short-term spikes distort financial performance.

Below are the key ways in which Moving Average Costing supports businesses in managing tariff volatility:

1. Promotes Cost Stability

When tariffs rise or fall, purchase prices can vary widely from one shipment to the next. MAC helps mitigate these fluctuations by averaging costs across all inventory units, ensuring that the cost of goods sold (COGS) changes gradually instead of sharply. This smooths out cost variations, allowing businesses to maintain consistent profit margins and financial reports even during unpredictable tariff shifts.

2. Enhances Pricing Accuracy and Customer Confidence

Price volatility caused by tariffs often forces companies to adjust their selling prices frequently. With MAC, businesses have a more stable understanding of their true cost base, enabling them to set consistent and competitive prices. This not only improves pricing accuracy but also builds customer trust, as clients experience fewer price changes due to external market disruptions.

3. Improves Financial Forecasting and Planning

Accurate cost data is vital for effective financial planning—especially when tariffs are in flux. Since MAC continuously updates the average cost of inventory, it provides real-time visibility into cost trends, supporting better forecasting and budgeting. Finance teams can make informed decisions about future pricing, procurement, and margin strategies, ensuring greater resilience against unpredictable trade policies.

4. Strengthens Decision-Making and Inventory Control

By offering a more realistic view of inventory costs, MAC allows managers to make data-driven decisions on purchasing, production, and stock management. It minimizes the risk of overvaluation or undervaluation that can occur under volatile tariff conditions. This transparency enables businesses to adjust inventory strategies promptly—whether it’s increasing stock before a tariff hike or sourcing alternative materials to balance cost pressures.

5. Ensures Long-Term Financial Resilience

Ultimately, Moving Average Costing isn’t just a cost calculation method—it’s a strategic tool for financial stability. By spreading the impact of tariff changes over time, MAC helps businesses sustain profitability and plan with confidence, even in uncertain trade environments. When integrated into an ERP system, it provides the automation and analytics needed to keep operations agile and resilient in the face of tariff volatility.

Key Considerations When Applying Moving Average Costing in a Volatile Market

While Moving Average Costing (MAC) offers a reliable way to manage price fluctuations and tariff volatility, its effectiveness depends on how well it’s implemented.

In a rapidly changing market, even a small error in data entry, timing, or calculation can distort inventory valuation and profitability. To fully benefit from MAC, businesses must focus on accuracy, automation, and alignment with their operational realities.

Here are the key considerations to keep in mind when applying Moving Average Costing in a volatile business environment:

1. Ensure Data Accuracy and Timely Updates

MAC relies heavily on the accuracy of purchase and inventory data. Any delay in recording new inventory receipts or purchase costs can lead to incorrect cost averages. Businesses should establish real-time data entry and reconciliation processes to ensure every transaction—purchase, sale, or adjustment—is reflected immediately in the cost calculation. Regular audits and data validation checks further strengthen reliability.

2. Invest in Software that Supports Automated Cost Recalculation

Manual calculation of moving average costs can be time-consuming and error-prone, especially when dealing with large or frequent transactions. Using an ERP system that automates cost recalculation after each purchase or stock movement helps maintain up-to-date cost values effortlessly. Tools like Deskera ERP streamline this process by automatically updating inventory costs and reflecting the latest data across accounting, procurement, and reporting modules.

3. Maintain Compliance with Accounting Standards

Before adopting MAC, companies must ensure that it aligns with local accounting and financial reporting standards. Some regions or industries may require specific valuation methods for tax or compliance purposes. Consulting with financial advisors or auditors ensures that the chosen method meets both internal control needs and regulatory expectations, preventing discrepancies during audits.

4. Evaluate Industry Suitability and Cost Dynamics

Moving Average Costing is best suited for industries with continuous production cycles or frequent material purchases, such as manufacturing, wholesale, or retail. For businesses with infrequent or high-value transactions, MAC may not provide the most accurate reflection of true costs. Evaluating your industry’s pricing behavior, purchasing frequency, and inventory turnover is essential before full-scale adoption.

5. Balance Simplicity with Strategic Insight

While MAC simplifies cost tracking by averaging fluctuations, businesses must ensure it doesn’t oversimplify their financial analysis. It’s important to pair MAC with detailed cost reporting and analytics to identify long-term trends and areas for optimization. Leveraging ERP-driven dashboards can help management visualize cost movements and make informed strategic decisions based on real-time data.

By carefully addressing these considerations, organizations can maximize the advantages of Moving Average Costing—ensuring accurate inventory valuation, compliant reporting, and sustainable cost stability in even the most volatile market conditions.

How Deskera ERP Helps You Adapt to Tariff-Driven Cost Increases

In today’s unpredictable trade environment, businesses must adapt quickly to changing tariffs and cost pressures. Deskera ERP provides an intelligent, automated solution that enables companies to manage these fluctuations with precision and confidence. By integrating real-time inventory management, accounting, and analytics, Deskera ensures that every cost change—whether from new tariffs, supplier adjustments, or currency shifts—is accurately captured and reflected across your business operations.

1. Automated Moving Average Cost Calculation

Deskera ERP automatically updates your Moving Average Cost (MAC) whenever new inventory purchases occur, eliminating manual recalculations. This means every tariff-driven cost increase is seamlessly integrated into your inventory valuation and cost of goods sold (COGS). The result is greater cost accuracy, improved transparency, and faster response to global market changes.

2. Real-Time Visibility into Cost Fluctuations

With Deskera’s real-time dashboards and analytics, businesses gain instant visibility into how tariffs impact their material, production, and sales costs. Decision-makers can monitor trends, identify cost drivers, and evaluate profitability at any moment. This continuous insight empowers finance and operations teams to adjust sourcing, pricing, or procurement strategies before cost surges affect margins.

3. AI-Powered Forecasting and Financial Planning

Deskera’s built-in AI assistant, David, enhances forecasting by analyzing historical data and predicting how future tariff changes might influence costs. This proactive insight enables finance leaders to plan for potential cost escalations, evaluate alternative sourcing options, and strengthen budgeting accuracy. With AI-driven forecasting, businesses can move from reactive to strategic cost management.

4. Seamless Integration Across Accounting and Procurement

Tariff changes don’t affect just inventory—they impact your entire financial workflow. Deskera ERP integrates accounting, procurement, and inventory modules to ensure that cost changes automatically flow through to purchase orders, invoices, and financial reports. This integration helps businesses maintain accuracy across departments while saving time on manual reconciliations.

5. Strengthening Cost Control and Strategic Decision-Making

Beyond automation, Deskera provides data-driven insights that help businesses identify areas of inefficiency and improve cost control. By consolidating all cost-related information in one platform, leaders can make strategic decisions based on accurate, up-to-date data. Whether it’s renegotiating supplier contracts, adjusting pricing models, or optimizing inventory levels, Deskera helps you stay agile amid tariff volatility.

In a world where tariffs can shift overnight, Deskera ERP acts as a stabilizing force—automating cost updates, improving visibility, and empowering businesses to adapt without compromising profitability. By leveraging its advanced features and AI-driven intelligence, companies can not only withstand tariff-driven cost increases but also turn them into opportunities for smarter financial and operational management.

Key Takeaways

- Tariff fluctuations can significantly disrupt cost structures and profitability. Implementing a dynamic costing approach like Moving Average Costing (MAC) helps businesses stabilize their financial performance and make informed decisions despite unpredictable trade conditions.

- Moving Average Costing continuously recalculates the average cost of inventory with each purchase, providing a more accurate and stable view of product costs—especially useful in markets affected by frequent price or tariff changes.

- Tariff volatility raises procurement expenses, distorts inventory valuation, and challenges pricing stability. Businesses need adaptive costing strategies like MAC to maintain accurate cost visibility and financial control under fluctuating trade conditions.

- MAC smooths out the financial impact of tariff changes by averaging costs over time. This ensures consistent pricing, reliable financial forecasting, and improved decision-making, helping businesses remain resilient in uncertain global markets.

- To implement MAC effectively, companies must ensure data accuracy, leverage automation tools, comply with accounting standards, and assess industry suitability—ensuring the method delivers both accuracy and strategic insight.

- Deskera ERP simplifies moving average costing through automation, real-time analytics, and AI-powered forecasting. It enables businesses to manage tariff-driven cost changes seamlessly, improve financial visibility, and strengthen long-term cost control.

Related Articles