So, your employee has received a Jury Duty summon, and you have a lot of questions related to your rights and duties as an employer. Undoubtedly, you will have to look for people to shoulder responsibilities in the employee’s absence. Such a scenario poses diverse sets of questions in terms of providing employee benefits, insurance coverage, salaries, overtime wages, and paid leaves while they are on jury duty.

This article helps you find answers to a lot of questions surrounding the subject of Jury Duty.

Let’s dive deeper into what we shall learn:

- What is Jury Duty?

- How does Jury Duty Work?

- Jury Duty Selection Process

- Juror Qualifications

- Jury Duty Exemptions

- How soon must the employees inform you about the summon?

- Can the Employers ask the Employees to use sick, personal, or vacation leave?

- What happens if the employer receives a summon for jury duty?

- Time-off and Wages for Jury Duty

- Paid leave in Jury Duty

- Jury Duty Policy Guidelines for Employers

- FAQs

- How can Deskera Help You?

- Key Takeaways

What is Jury Duty?

U.S. citizens summoned to jury duty are required to appear at a particular time and date on a particular day to serve on a jury. American citizens are required to serve as jurors during court proceedings. As a juror, they must ensure that defendants get an impartial jury while upholding their rights.

The court can hold an individual in contempt of court if they fail to appear for jury duty. In accordance with the Fair Labor Standards Act (FLSA), an employee is not required to be paid for time not worked, including time spent reporting for jury duty.

It is mandatory to serve on a jury in both criminal and civil cases. Defendants in criminal cases must be proved guilty by the government. The verdict must then be agreed upon by the entire jury. In a civil lawsuit, the preponderance of the evidence is the standard of proof, and unless specifically directed differently, the jury verdict must be unanimous.

How does Jury Duty Work?

Jury duty works by summoning individuals to be available for the duty at a predecided time and place. Once the individual reaches the court, they must participate in the selection process by filling out a questionnaire.

Whether a person accepts the jury duty on being summoned or not can be decided later. As a matter of fact, there could be multiple outcomes in this kind of scenario. They may request a postponement which may be granted to them depending on their situation. If they state that postponing it to another time and date would be more comfortable and convenient for them, the court may allow them to do so. The individual will have to call up and fill up a form or a questionnaire to inform about their situation and the better time when they will be available to serve as the juror.

The conditions and regulations for postponement or a delay can vary between states, so it is always better to find out how it will function in your state. Also, requesting for postponement does not necessarily guarantee that you will be granted permission to delay the duty.

Medical reasons could be the grounds on which one may request to defer their jury duty completely. The court may consider the case and grant them a deferral. Full-time students, caregiver responsibilities, or any other hardships could also be the reasons why someone may seek an exemption to serve as a juror. For medical reasons, however, one must produce a valid note from a medical practitioner as proof.

Having learned about that, we must know that all the states have a different set of rules when it comes to jury duty; therefore, if you are summoned, then you must enquire how the duty rolls out in your state.

Jury Duty Selection Process

Now that we have an overview of jury duty, let’s walk through the process of selection of the jurors. Potential jurors may be questioned by attorneys for both sides throughout the jury selection process; if a potential juror exhibits bias or a conflict of interest, they may be excluded from the jury pool.

If a full jury has been seated, a settlement has been reached, or a plea agreement has been reached, the court may also remove potential jurors if they are no longer required. An employee may be expected to come back to work for the rest of the day if they are let go quite early in the day.

The potential juror could then be chosen to serve on the jury. If that occurs, the trial could be brief and straightforward, or it could drag on for months. They might even be isolated from their regular lives until the trial is over and a decision is made.

All of these scenarios must be taken into account in your company's jury duty policy. Employees who are participating in jury service, which is their civic duty, must be treated properly under the policy. However, the policy must also safeguard the needs of the employer, who depends on continued employment.

Juror Qualifications

Legally, an individual must fulfill the following criteria in order to qualify to serve as a juror:

- have no disqualifying mental or physical conditions;

- be a citizen of the United States;

- be at least 18 years old;

- live primarily in the judicial district for at least a year;

- be proficient enough in English to complete the jury qualification form;

- not be currently facing felony charges carrying a sentence of more than a year in prison;

- never have been charged with a crime.

Jury Duty Exemptions

Primarily, the three groups that are exempted from serving the jury duty are as enlisted in the following points:

- Personnel on the duty of the armed services;

- professionals working in fire and police departments;

- public officers employed full-time by the federal, state, or local councils are serving as public responsibilities.

Personnel who work full-time in any of these categories are not permitted to serve on federal juries despite wanting to do so.

How soon must the employees inform you about the summon?

You can ask your employees to inform you beforehand about when they will be away for jury duty. As proof, you may also ask them to submit a copy of the summon. The strictness imposed by states about informing the employer varies.

Some states like Alabama and Tennessee prescribe and mandate notifying within a day after receiving the summons, whereas some others like Louisiana are a bit relaxed.

Can the Employers ask the Employees to use sick, personal, or vacation leave?

While the Federal law does not restrict you from asking the employees to take sick, personal, or vacation leave, some states may restrict you, though. This subject, too, is state-dependent, and you will have to check with the laws in your state that apply to you in this context.

Alabama, Arizona, Indiana, Ohio, New Mexico, Nevada, Nebraska, and Oklahoma are some of the states that mandate employers to use specific kinds of leaves or restrict them totally.

What happens if the employer receives a summon for jury duty?

Unfortunately, there are no exceptions for self-employed people or the business-owners; therefore, everything that applies to your employees applies to you as well. If you have too much at stake financially, you may request a delay or postponement.

Some states like Massachusetts and Virginia may excuse the individuals whose businesses may suffer badly or would shut down in their absence. They may consider exempting such people completely.

Yet, you must look for what the laws in your state have to say about this.

Time-off and Wages for Jury Duty

Some states favor the worker and forbid employers from deducting any jury duty time from a worker's salary. Additionally, time-off requirements differ depending on whether a worker is employed by the federal, state, local, or private sector. Employers in virtually every state are legally compelled to give an employee time off from work so that they can fulfill their civic duty since jury duty availability is required by law.

Federal law forbids employers from firing staff members who are obligated to report for jury duty. Harassment, threats, or attempts to pressure the employee into skipping jury duty are examples of adverse conduct. Additionally, a worker must be permitted to return to work after serving on a jury.

Here’s a list of states where the employers are not allowed to demand that staff members use their personal, sick, or vacation time for jury duty:

- Alabama

- Arizona

- Arkansas

- Indiana

- Louisiana

- Mississippi

- Missouri

- Nebraska

- Nevada

- New Mexico

- Ohio

- Oklahoma

- Utah

- Vermont

- Virginia

Paid leave in Jury Duty

57% of workers in the private sector get paid time off for jury duty, whereas 94% of state government employees receive paid jury duty leave, according to the Bureau of Labor Statistics (BLS). 85% of workers who are employed by local governments are paid for jury service time off. While serving on a jury, federal employees are paid their usual wages.

While this is true, an important point here is that an individual’s job role or position, level, the sector they work in, location, and type of work plays a major role in deciding their paid jury duty leaves.

Furthermore, states usually leave the matter of employees’ jury duty policy with the employer largely. However, the following eight states have mandated that employers pay the employees while they are on jury duty. These are as follows:

- Alabama

- Colorado

- Connecticut

- Louisiana

- Massachusetts

- Nebraska

- New York

- Tennessee

Some states have requirements for what the company must pay an employee, which is typically the same as jury duty compensation for a predetermined number of days. The state court system then pays the employee the standard jury duty wage for any additional days of jury duty. Other states provide that an employee reporting for jury duty shall receive their usual pay.

Jury Duty Policy Guidelines for Employers

It is recommended for an employer to put together a jury duty policy. This way, they can draw clear lines of conduct that the employees can follow. As is known, paid time off and jury duty pay are benefits that employees enjoy. The number of benefits you provide will be mostly decided by you.

Businesses have to deal with numerous policies. If you are looking to compile a jury duty policy and the points that will help you in the process, then ask the following questions:

- How do you want the employee to document their jury duty for you?

- How soon should the employee report the summons to jury duty they received?

- How do you expect the employee to carry out the duties on a partial day at court?

- What ways can guarantee an employee does not suffer any dire outcomes for serving jury duty?

- How will you deal with the jury duty payment provided by the court?

- How will you provide the unpaid leave that will stretch beyond the paid leave?

The answers to these questions will most certainly offer you a way to draft a policy that provides clear directions to both you and your employees. These shall let both parties set the right expectations right at the beginning.

FAQs

The following FAQs will guide both the employers and employees in cases when the employee is asked to serve as a juror.

Q: I have received a summon for jury duty which coincides with a crucial time owing to seasonal business. Is there an exemption I can claim, and should I defer jury service if my employer requires it?

A: The judge may grant an exemption to the people who have presented a genuine hardship or inconvenience to the person in question or their families. Whether a court will grant an excuse from jury service depends on the balance between the public need for juries and the individual circumstances offered as a justification. You cannot be discharged or retaliated against for performing jury duty.

However, it is important to note that you may not be able to defer your jury duty time and again. An individual who requests another deferral must furnish a list of at least ten dates within the next six months on which the individual would be available to perform jury duties.

Q: Does the law mandate my employer to pay my wages when I am on jury duty?

A: While some employees do provide regular wages to persuade their employees to fulfill their societal obligations, they are not legally bound to do so. If the employers do not pay regular wages as a benefit, it is prohibited for such employers to require hourly or salaried exempt employees to use vacation leave, sick leave, or other annual leave to attend jury duty.

In the case of an employee who has been absent from work due to jury duty, employers may offset the jury fees he or she receives against the salary owed for the particular week without losing the exemption.

Q: Does my employer continue to provide health insurance if I am serving on jury duty which may last several months?

A: If the employer has more than ten employees, then they must continue to provide health care coverage during the time when the employee is away to fulfill jury duty. A small-employer exemption is possible; however, it completely depends on the employer policy to state how and when an employee would qualify for insurance coverage.

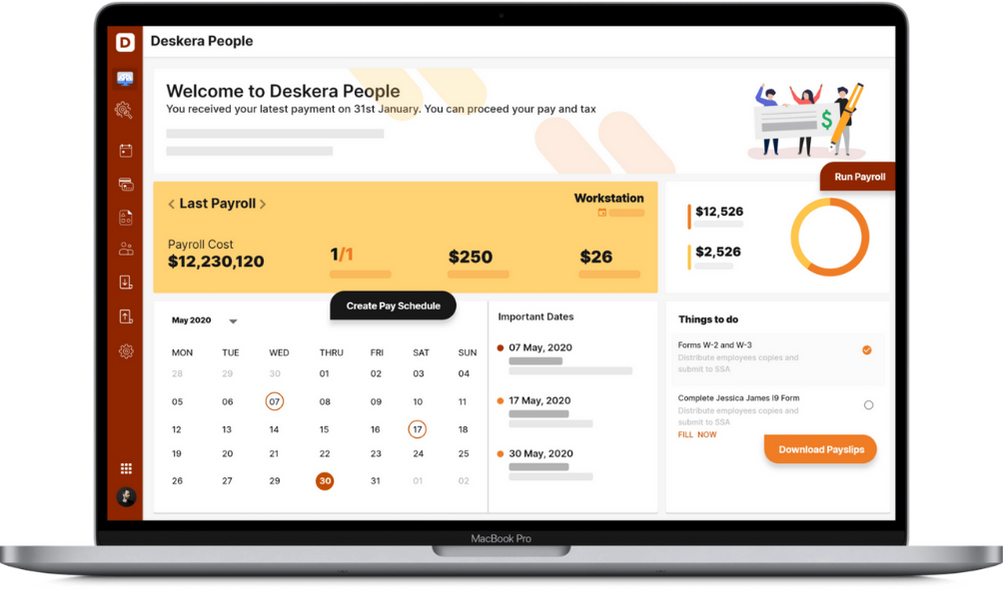

How can Deskera Help You?

Deskera People has the tools to help you manage your payroll, leaves, employee onboarding process, and managing employee expenses, all in a single system. With features like a flexible payment schedule, custom payroll components, detailed reports, customizable pay slips, scanning, and uploading expenses, creating new leave types, and more, it makes your work simple.

Key Takeaways

- When a citizen of the United States is called to a jury in a legal procedure, this is known as jury duty.

- While some state laws do demand that employees be paid while performing jury duty, federal law does not require an employer to do so. This includes time spent on jury service.

- Employees cannot be fired for missing work to serve on a jury.

- Jury duty works by summoning individuals to be available for the duty at a predecided time and place. Once the individual reaches the court, they must participate in the selection process by filling out a questionnaire.

- They may request a postponement which may be granted to them depending on their situation. If they state that postponing it to another time and date would be more comfortable and convenient for them, the court may allow them to do so.

- Medical reasons could be the grounds on which one may request to defer their jury duty completely.

- Potential jurors may be questioned by attorneys for both sides throughout the jury selection process; if a potential juror exhibits bias or a conflict of interest, they may be excluded from the jury pool.

- Juror qualifications include them being a U.S. citizen, having no mental or physical conditions, and never being charged with a crime.

- Personnel of armed forces, police and fire departments and full-time public officers are completely exempted from jury duty.

- States usually leave the matter of employees’ jury duty policy with the employer largely. However, the following eight states have mandated that employers pay the employees while they are on jury duty.

- It is recommended for an employer to put together a jury duty policy. This way they can draw clear lines of conduct that the employees can follow.

Related Articles