Filing the tax returns requires you to have complete knowledge of the process. For the convenience of the taxpayers, the Income Tax Department categorizes the ITR forms into seven different types: ITR1, ITR2, ITR3, ITR4, ITR5, ITR6, and ITR7.

This article comprises of all the information related to the ITR6. By the end of this article, we should have covered the following points:

- Brief Look at ITR

- What is ITR6?

- Eligibility for filing ITR6

- Individuals ineligible for filing

- Structure of ITR6

- Prominent modifications for the year 2021-22

- We shall also learn how to fill out and file the ITR6 form

- We will learn about the important instructions for filing the ITR6

Brief Look at ITR

ITR or the Income Tax Return is the process of filing tax by the eligible taxpayers. The ITR form should be submitted to the Income Tax Department of India. Fundamentally, the ITR form aims at collecting entire information of the taxpayer’s income for a particular fiscal year.

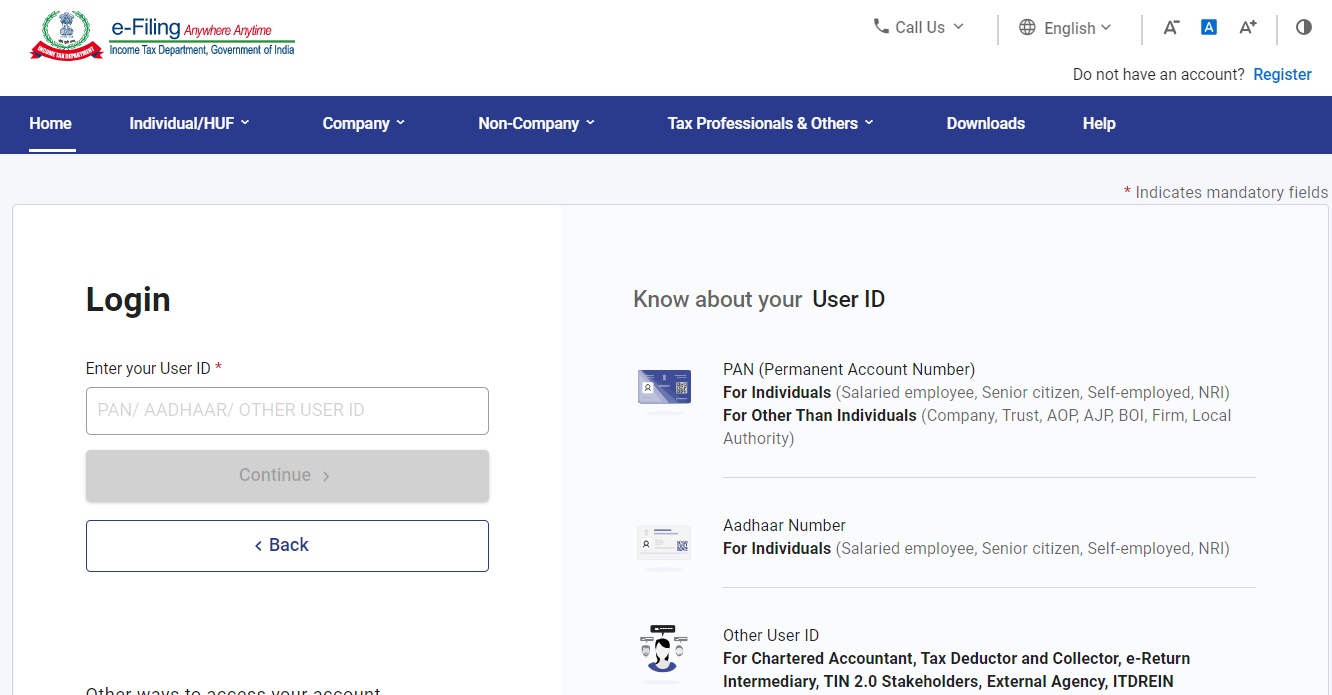

You can log in to the income tax website through the following link:

https://eportal.incometax.gov.in/iec/foservices/#/login

What is ITR6?

All the companies irrespective of their registered structure with the Companies Act 2013 or 1956, must file ITR6.

But we must note that the companies that claim an exemption in accordance with section 11 are not required to file the ITR6 form.

What companies fall under section 11?

The companies who have earnings from a property that carries out religious or charitable causes fall under Section 11. These companies can claim an exemption and are not required to file ITR6.

Eligibility for filing ITR6 form

ITR 6 Form must be rendered by the companies for the purpose of e-filing of the income tax returns in the case where they don’t claim an exemption under Section 11 of the Income Tax Act 1961.

Individuals Ineligible to File ITR6

The companies that claim an exemption under Section 11 of the Income Tax Act need not file the ITR6.

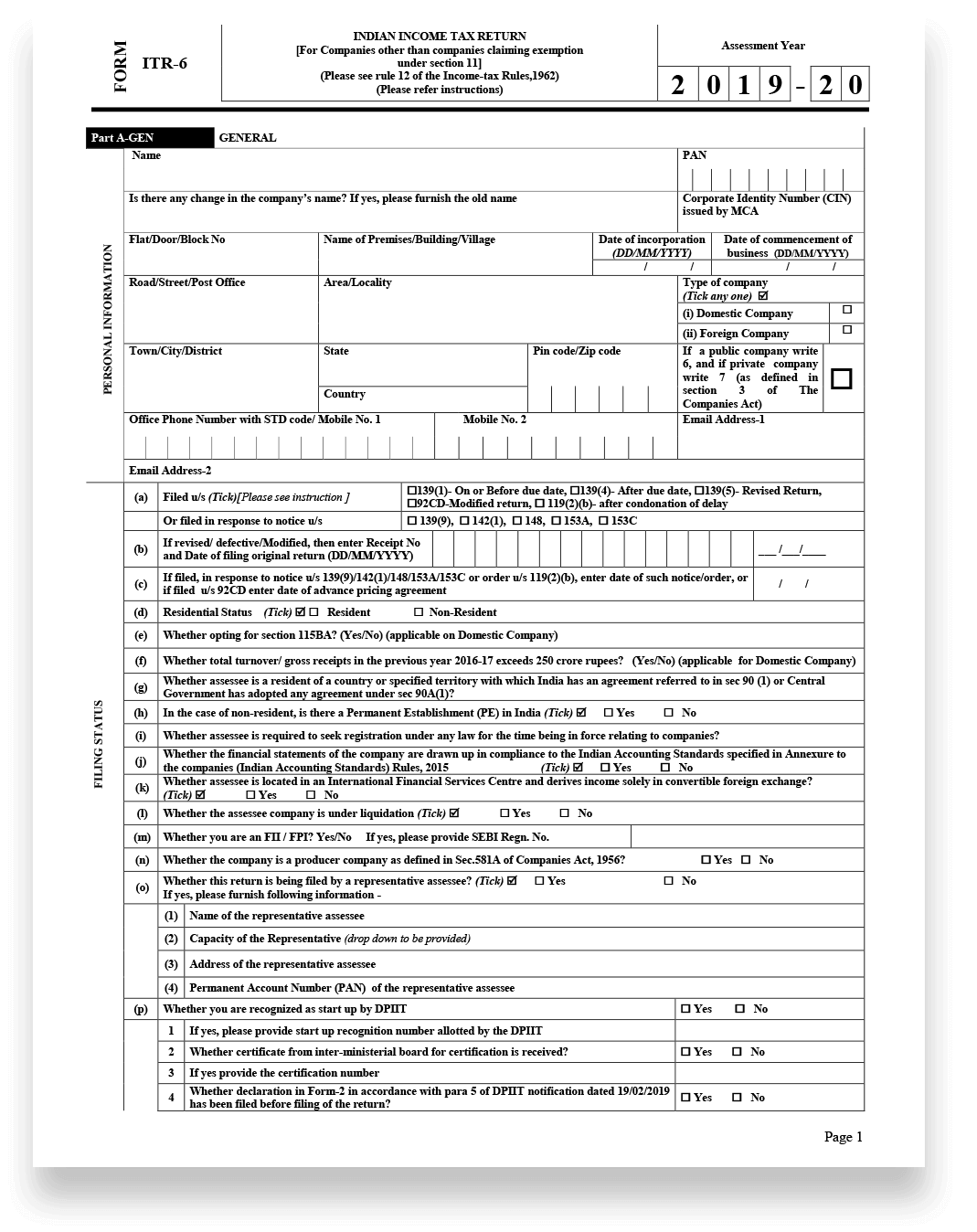

Structure of ITR6

The structure of ITR6 is constituted by 2 Parts: Part A and Part B. It also has numerous sub-sections. Additionally, there are multiple schedules that aim at acquiring all the information regarding the income of the taxpayer.

Let’s look at the details in this table:

Prominent Modifications in ITR6 for the Year 2020-21

In AY 2020-21, the following key changes were made to the ITR-6 Form:

- Schedule 112A is a separate schedule for evaluating the long-term capital gains on the sale of equity shares or units of a business trust that are subject to STT.

- Section 92CE(2A) provides details about the secondary adjustments to transfer prices.

- Information about tax deductions for investments or payments or expenditures made between 1 April 2020 and 30 June 2020.

How to Fill out the ITR6?

You can follow the sequence described here for filing ITR6. This is the recommended sequence by the Income Tax Department for filing.

- Part A along with all its subsections followed by All the Schedules

- Part B along with all its subsections followed by the Verification

How to File ITR6?

In order to file this income tax return online, the taxpayers must attach their digital signature. ITR 6 Form is a form that is devoid of any annexures and appendices. When filing Form ITR 6, no document needs to be attached. Tax deducted, collected, and remitted data must be calculated based on Form 26 AS.

Instructions for Filing ITR6

Let’s look at the instructions for filing the ITR6 form:

- Be sure to sign the verification before providing the return.

- The Verification document must be filled out with all required information. Remove any information that isn't relevant.

- Specify the designation of the person signing the return.

- If a false statement is made by any person in the return, it may lead to prosecution under section 277 of the Income Tax Act, 1961.

How can Deskera Help You with Tax Filing?

Deskera People helps digitalize and automate HR processes like hiring, payroll, leave, attendance, expenses, and more.

Simplify payroll management and generate payslips in minutes for your employees.

In addition to a powerful HRMS, Deskera offers integrated Accounting, CRM & HR Software for driving business growth.

Key Takeaways

Before we wrap up the article, let’s take a quick look at the key points discussed:

- For the convenience of the taxpayers, the Income Tax Department categorizes the ITR forms into seven different types: ITR1, ITR2, ITR3, ITR4, ITR5, ITR6, and ITR7.

- All the companies irrespective of their registered structure with the Companies Act 2013 or 1956, must file ITR6 except the ones claiming exemption under Section 11.

- The structure of ITR6 is constituted by 2 Parts: Part A and Part B with the respective subsections.

Related Articles