Filing income tax returns could make people nervous, especially those who are filing for the first time. Filing returns is the responsibility of all Indians; however, it must be done carefully by identifying the correct form that applies to an individual. If you, too, are wondering which is the right form for you and which form should you be filing, then this article will help as a guide in the process to file your taxes.

This article focuses on the details pertaining to the ITR5 form. Here is what we shall cover here:

- A brief look at ITR

- What is ITR5?

- Eligibility for filing the ITR5

- Ineligibility to file ITR5

- Structure of ITR5

- How to file ITR5?

- We shall also see the prominent changes in the ITR5 for the year 2021-22

- Details of how to fill out the ITR5 form.

- We shall also see some important instructions that assist in filling out the form.

Brief Look at ITR

ITR or the Income Tax Return is a form that should be filed by all those who are eligible. It should, then, be submitted to the Income Tax Department of India. Fundamentally, it is a form that comprises all the information of your income for a particular fiscal year.

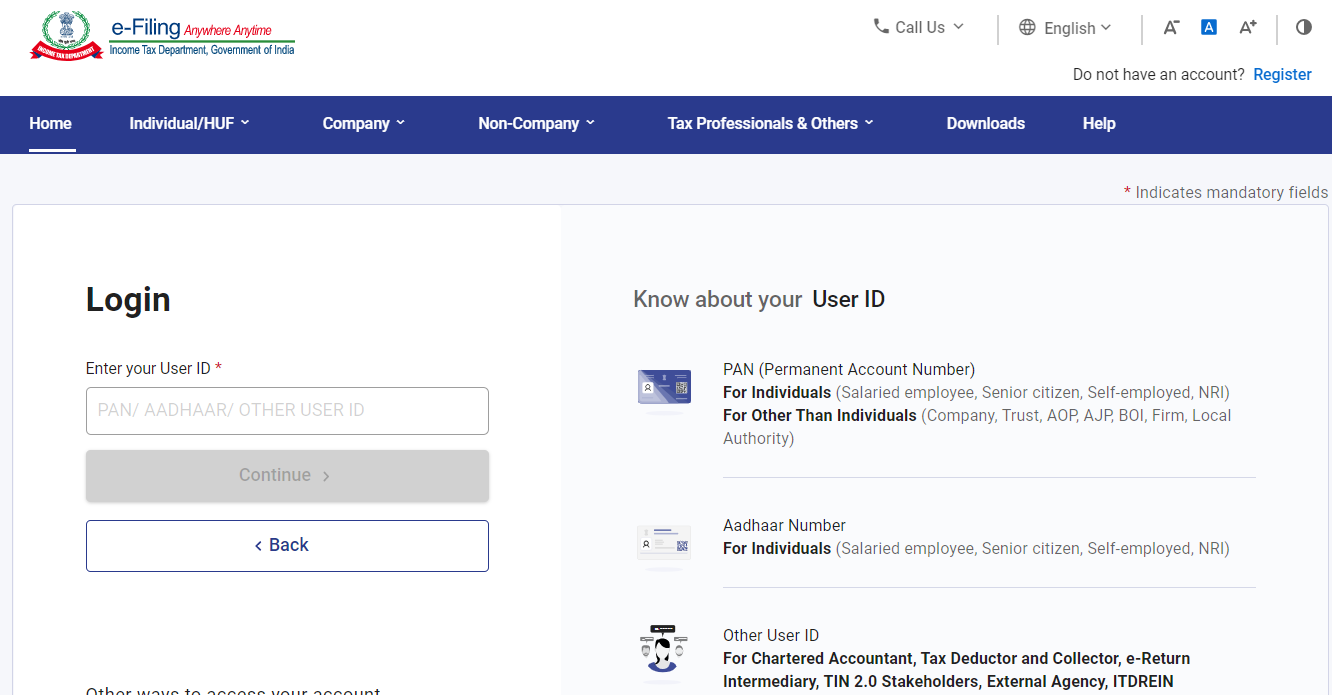

You can log in to the income tax website through the following link:

https://eportal.incometax.gov.in/iec/foservices/#/login

The Income Tax Department has introduces 7 types of ITR forms: ITR1, ITR2, ITR3, ITR4, ITR5, ITR 6, and ITR 7. Based on the type of income, people are required to file the ITR form that applies them. The sources of income could be the following:

- Salary

- Income from business and profession

- House property income

- Capital gains

- Other sources of earnings such as interest on deposits, royalty earning, dividends, earnings from lotteries, and so on.

What is ITR5?

The ITR5 form applies to the LLPs (Limited Liabilities Partnerships), firms, BOIs (Body of Individuals), AOPs (Association of persons), Artificial Juridical Person (AJP), Estate of insolvent, Estate of deceased, Business trust, and investment fund.

Eligibility for filing ITR5 form

The ITR5 is to be filed and submitted by the following individuals:

- LLPs

- Firms

- AOPs

- BOIs

- Artificial Juridical Individual who is referred to in section 2(31)(vii)

- Estate of insolvent

- Estate of deceased

- Investment fund and Business trust

- Local authorities

- Cooperative societies

However, it must be noted that an individual who files the return of income under section 139(4A) or 139(4B) or 139(4C) or 139(4D), will not have to file ITR5.

Individuals Ineligible to file ITR5

Here is a list of categories who are not required to file the ITR5 form:

- Individuals

- Hindu Undivided Family (HUF)

- Company

- Taxpayers who have to file tax returns in Form ITR-7, under Sections 139(4A), 139(4B), 139(4C), 139(4D), 139(4E) or 139(4F

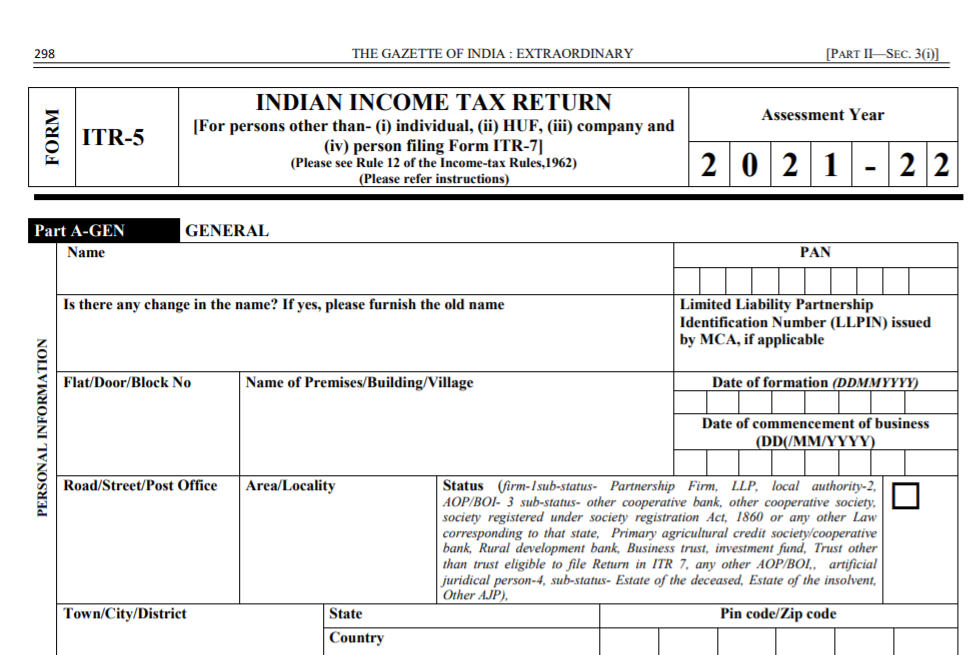

Structure of ITR5

ITR5 form has 2 parts: Part A and Part B. It also consists of schedules that are meant to obtain a panoramic view of your income.

Part A

This requires the following details:

- General information

- Balance sheets details as on the last day of the fiscal year

- Trading Account details

- Profit and loss details

- Manufacturing account details

- Other relevant information

Part B

This part requires you to provide all the information pertaining to the calculation of your total income along with the calculation of the tax liability on your income.

Schedules

- Schedule HP – Information about income from house property

- Schedule CG – Details of all the capital gains income

- Schedule BP – Details about the calculation of business income

- Schedule DCG – Information about income from any capital gains from the sale of a depreciable asset

- Schedule DOA – Details regarding the asset depreciation

- Schedule DPM – Information about the machinery depreciation

To view the latest ITR-5 form from the Income Tax Department, Click here.

E-filing audit reports

A taxpayer who has to issue an audit report under sections 10(23C)(iv), 10(23C)(v), 10(23C)(vi), 10(23C)(via), 10A, 10AA, 12A(1)(b), 44AB, 44DA, 50B, 80-IA, 80-IB, 80-IC, 80-ID, 80JJAA, 80LA, 92E, 115JB or 115VW shall submit the report electronically on or before to the due date for submitting the return of income from AY 2013-14.

How to File ITR5?

You can choose to file the ITR5 form online or offline. You can also e-file your income tax returns. Lets see the steps involved in the two procedures:

Online

- Visit the Income Tax Department’s official e-filing portal www.incometaxindiaefiling.gov.in.

- Transfer the data electronically through the return form.

- Add your digital signature for verification.

- If verifying electronically, is not possible, then you must get two copies of print-outs of the ITR-V Form (Verification form).

- Duly sign the document. After which, you need send one of the copies to this address: Post Bag No. 1, Electronic City Office, Bengaluru–560500 (Karnataka) for verification.

- Keep the other copy for your ITR record.

Offline

- Bar-coded returns must be submitted

- Then, you must submit the hard copy or the physical paper form for the acknowledgement you received from the Income Tax Department.

You can easily verify your returns after the electronic information transmission through:

- Adding your digital signature

- Verifying the submission through the EVC or electronic verification code. Alternatively use Aadhaar OTP to get it verified.

- You can also take a print of the hard copy of the ITR-V form. Thereafter, post the signed document to the Centralized Processing Centre (CPC) in Bangalore.

Remember: It is mandatory that your ITR-V reaches the CPC within 120 days from the date of e-filing. But, in the case where your returns are to be audited in accordance with Section 44AB, you must verify ITR-5 electronically with a digital signature.

Prominent Modifications in ITR5- the Year 2021-22

The important changes in the ITR5 Form in AY 2020-21 are summarized below:

With regards to the unlisted equity shares, the information to be provided includes:

- the name of the share

- the type of the company

- investments made throughout the financial year

- your PAN

- 112A is a separate schedule that includes calculation of your long-term capital gains on the sale of equities of a business trust based on the securities transaction tax (STT)

You must also mention the following:

- Secondary adjustments to transfer prices under Section 92CE(2A)

- Claims for tax deductions against investments or spending made between 1 April 2020 and 30 June 2020, in accordance with Chapter VIA of the Income Tax Act, 1961. This includes:

- Section 80C (LIC, PPF, NSC, etc.)

- 80D (health insurance)

- 80G (donations)

Deposits in current accounts, foreign travel expenses, and electricity bills paid

How to Fill-out the ITR5?

Now, lets discover the steps required to fill out the ITR5 form:

- You must enter all the essential details required.

- Ensure that the information entered is accurate, such as:

- Name

- Address

- PAN

- contact details

- Audit information

- Filing status

- Income details

- Tax liability

- Taxes paid

- You must also accomplish that the document has been duly signed.

- At the end, you must include the designation of the individual who is overlooking the signing or verification of the return.

Instructions for Filing ITR-5 Form

This section assists you with how to fill the form. Following are the points you need to be mindful of:

- Enter all the vital information accurately in the fields.

- The fields that do not apply to you, mention ‘NA’.

- While denoting a zero, you need to mention ‘NIL’.

- You must indicate any negative values using a “-“ (minus sign).

- You are also required to present the rounded off figures, where necessary.

- Incorrect or inaccurate information can imply prosecution per the Section 277 of the ITA. Therefore, it is best to avoid making errors while filling up the form.

How can Deskera make Filing Easy for You?

Deskera People is a platform that enables you to expedite and simplify the process through its automated HR processes like hiring, payroll, leave, attendance, expenses, and more.

Deskera People helps digitalize and automate HR processes like hiring, payroll, leave, attendance, expenses, and more.

Simplify payroll management and generate pay slips in minutes for your employees.

In addition to a powerful HRMS, Deskera offers integrated Accounting, CRM & HR Software for driving business growth. Do not forget to check out our articles on running payroll for India and best practices in HR.

Key Takeaways

In order to help you understand the details of filing the ITR 5 form, we have provided the details step-by-step for an easier understanding. Here are the important points mentioned in the article:

- Fundamentally, ITR is a form that comprises all the information of your income for a particular fiscal year.

- The Income Tax Department has introduces 7 types of ITR forms: ITR1, ITR2, ITR3, ITR4, ITR5, ITR6, and ITR7 based on the type of income.

- The ITR5 form applies to the LLPs (Limited Liabilities Partnerships), firms, BOIs (Body of Individuals), AOPs (Association of persons), Artificial Juridical Person (AJP), Estate of insolvent, Estate of deceased, Business trust, and investment fund.

- ITR5 form has 2 parts: Part A and Part B. It also consists of schedules that obtain all the information of your income.

Related Articles