There are two different types of income statement that a company can prepare such as the single-step income statement and the multi-step income statement.

There are two methods that businesses can use to prepare the income statement.

Firstly, you can use the single-step approach to prepare your income statement. Second of all, you can also prepare the income statement using the multi-step methodology.

With ERP.AI, businesses can automatically generate both single-step and multi-step income statements, tailored to their structure and needs, saving time and reducing errors.

Before choosing the right type of income statement for your business, you will need to understand your company's nature, types, and sizes.

Single-Step Income Statement

As the name suggests, a single-step income statement is a simplified version of the income statement compared to the multi-step income statement.

Net Profit= Total Revenue - Total Expenses

When preparing the single-step income statement, this statement displays the company's expenses and revenues without breaking down into further sub-categories. To calculate the single-step income statement's net income, you will have to subtract the company's total revenue from the total expenses.

The single-step income statement is commonly used by small-sized businesses or those in sole-proprietorship companies.

Comparatively to a multi-step income statement, the single-step income statement is more straightforward and relatively easier to prepare and understand.

Multi-Step Income Statement

The multi-step income statement is the standard format of an income statement prepared by big corporations and all publicly listed companies.

Three equations are used to derive the net income using the multi-step income statement. Companies that prepare their income statement using the multi-step approach will typically breakdown their revenues and expenses into operating and non-operating business activities.

The three accounting equations that are used to arrive at the net income are stated below:

Gross Profit= Net Sales - Cost of Goods Sold

Operating income = Gross Profit - Operating Expense

Net Income = Operating Income + Non Operating Items

Hence, the multi-step income statement is a more comprehensive financial report compared to the single-step income statement. It provides a more significant and in-depth analysis of a businesses' financial performances that is hugely beneficial for potential investors and external readers.

How AI Enhances Financial Management

AI-driven automation helps streamline tasks such as invoice processing, budgeting, and income statement generation. It reduces manual errors by automatically categorizing transactions, applying accounting rules, and reconciling discrepancies in real time.

AI also improves cash flow forecasting by analyzing historical patterns and current data to predict future financial performance. With smart dashboards and predictive analytics, financial leaders gain a clear, real-time overview of profitability, expenses, and trends.

Generate Your Income Statement Using Deskera Books

Deskera Books is one of the accounting software that enables businesses to generate their income statement conveniently.

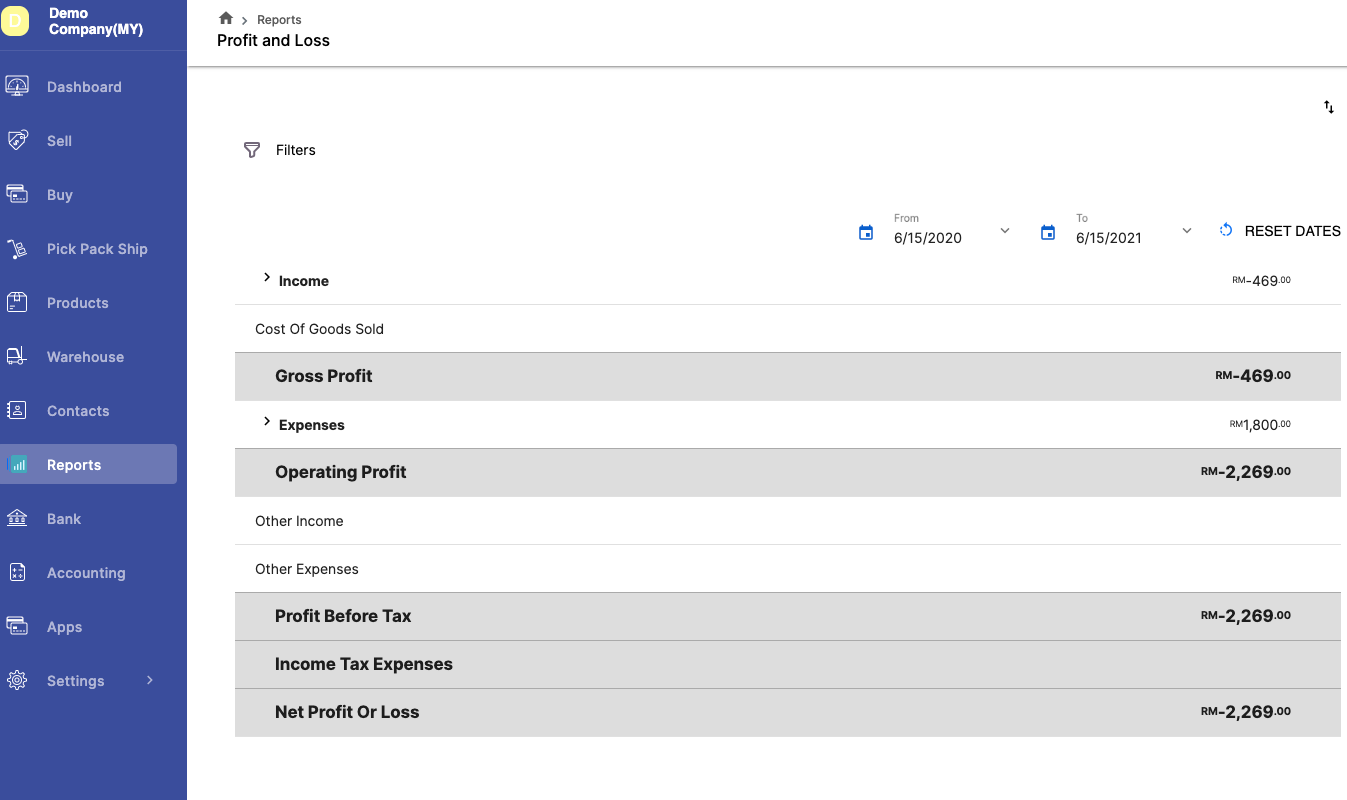

Here's the snapshot of Deskera Books' multi-step income statement.

Thanks to automation, using Deskera Books enables you to sit back, relax, and let the automation work for you. There's no need to scratch your head and burn the midnight oil preparing the income statement manually.

All the accounts in the Profit and Loss Report will be auto-populated based on the business activities performed in the system. Therefore, it helps to reduce your manual workload and save time.

Visit Deskera's website today to find out more about Deskera's products, subscription plans, or even sign-up for the 30 days free trial.

Related Articles