Do you know how much it truly costs your business to hold inventory before it’s sold? While most companies account for the cost of purchasing goods, many overlook the hidden expenses of storing and maintaining them. These ongoing costs — known as inventory holding costs — can significantly impact your bottom line and overall operational efficiency. Understanding what contributes to these costs is essential for optimizing cash flow and improving profitability.

On average, businesses spend between 20% and 30% of their total inventory value each year on holding costs alone. Industry reports suggest that 25% is a common benchmark, though this figure can vary based on several factors such as the number of items sold, the company’s size, and its inventory turnover ratio. For example, fast-moving consumer goods may have lower carrying costs compared to specialized equipment or seasonal inventory that sits longer in storage. These variations make it crucial for businesses to analyze their specific situation rather than rely on a one-size-fits-all estimate.

Inventory holding costs go beyond warehouse rent and utilities. They include capital costs, depreciation, insurance, obsolescence, and even risks of damage or theft. Each of these elements quietly drains resources, affecting pricing strategies and long-term competitiveness. A clear understanding of these components helps companies make informed decisions about how much inventory to hold, when to reorder, and how to reduce unnecessary expenses without compromising service quality.

This is where Deskera ERP plays a transformative role. With real-time inventory tracking, demand forecasting, and automated cost analysis, Deskera helps businesses accurately calculate and reduce holding costs. Its AI-powered assistant and integrated accounting modules provide complete visibility into your inventory’s financial impact, enabling smarter decision-making and improved efficiency. By adopting such a system, companies can not only control their inventory but also unlock capital that drives sustainable growth.

What Are Inventory Holding Costs?

Inventory holding costs, also known as carrying costs, refer to all the expenses a business incurs to store and maintain unsold goods over a period of time. These costs represent a significant part of overall inventory management expenses and can directly affect profitability. In essence, holding costs are the price a company pays for having inventory sitting on its shelves — waiting to be sold or used in production.

These costs typically include warehouse rent, utilities, labor, insurance, taxes, equipment maintenance, and security expenses. Additionally, holding costs also account for depreciation, obsolescence, spoilage, and opportunity costs — the capital tied up in unsold stock that could otherwise be used for other business investments. When a product remains unsold, its value can decrease over time due to market changes or product aging, further increasing total carrying expenses.

While holding costs form a substantial portion of total inventory expenses, their proportion varies greatly across industries. Factors such as business size, product type, sales volume, and inventory turnover rate play a major role in determining how much a company spends to store goods.

For instance, a manufacturer dealing with heavy machinery will incur higher storage and insurance costs than a fast-moving consumer goods (FMCG) retailer with quicker stock rotation. Understanding these differences allows businesses to identify where their biggest cost drivers lie and take proactive measures to minimize them.

Accurately tracking these costs is essential for maintaining financial efficiency and operational balance. Modern ERP solutions like Deskera ERP simplify this process by automating inventory valuation, cost tracking, and real-time analysis. With features such as demand forecasting and AI-powered insights, Deskera helps businesses manage optimal stock levels, lower carrying costs, and free up working capital — all while improving overall supply chain performance.

Components of Holding Costs

Inventory holding costs consist of several interrelated components that together represent the total expense of storing unsold goods. Understanding these components helps businesses identify where their money is being spent and where optimization opportunities exist.

Each element contributes differently to the overall cost, depending on the type of products, industry, and operational setup. Below are the key components that make up inventory holding costs.

1. Storage Costs

Storage costs include all expenses related to maintaining a warehouse or storage facility. These encompass rent or lease payments, utilities, repairs, security, and general maintenance. As inventory levels rise, so do these costs, since more space and resources are required to manage the stock efficiently. Effective warehouse management and layout optimization can significantly reduce this portion of holding costs.

2. Insurance and Taxes

Insurance protects inventory from losses due to theft, fire, damage, or natural disasters, while taxes are levied on the value of stored goods. Both of these costs ensure that inventory remains financially protected but can quickly add up, especially for high-value or perishable items. Businesses should routinely review their insurance coverage and local tax regulations to ensure cost efficiency.

3. Depreciation and Obsolescence

Depreciation refers to the gradual reduction in inventory value over time, while obsolescence occurs when products become outdated or no longer in demand. This is particularly common in industries like technology, fashion, and consumer electronics, where trends and models change rapidly. Monitoring demand patterns and adopting just-in-time (JIT) inventory strategies can help minimize losses from aging stock.

4. Opportunity Cost

Opportunity cost represents the potential return a business forfeits by keeping capital tied up in inventory instead of investing it elsewhere — such as in marketing, R&D, or new product development. High inventory levels may appear safe but often reduce liquidity and flexibility. Businesses that maintain lean inventory systems can reallocate funds toward higher-yield opportunities, improving overall financial performance.

5. Handling and Labor Costs

Handling costs include labor wages, equipment usage, and operational expenses related to moving, organizing, and managing inventory. This includes employees who receive shipments, conduct stock audits, or prepare goods for dispatch. Automating inventory operations or using ERP systems with barcode scanning and real-time updates can help reduce labor-intensive tasks and associated costs.

Together, these components form the backbone of inventory holding costs. By understanding and managing each of them effectively, businesses can reduce waste, enhance profitability, and maintain a leaner, more efficient inventory system.

Factors That Affect Holding Costs

Inventory holding costs are not fixed — they fluctuate based on several operational and logistical factors. Understanding these variables helps businesses better estimate expenses, plan inventory strategies, and identify cost-saving opportunities. From warehouse location to inventory turnover, each element plays a role in determining how much it costs to store goods over time.

Here are the key factors that influence holding costs:

1. Warehouse Location

The location of your warehouse significantly impacts holding costs. Facilities in urban or high-demand industrial areas typically come with higher rental rates, taxes, and utilities compared to those in rural regions. While urban warehouses offer faster access to key markets and shorter delivery times, they increase operational expenses due to premium real estate costs.

2. Size and Weight of Products

The physical dimensions and weight of the items you store also affect total storage expenses. Larger or heavier products require more space and specialized handling equipment, resulting in higher warehousing and labor costs. In contrast, smaller, lightweight goods are easier and cheaper to store, allowing better space optimization within the facility.

3. Number of SKUs (Stock Keeping Units)

A higher number of SKUs means more variety in products — and with variety comes complexity. Each unique product needs its own space for identification, tracking, and retrieval. Managing multiple SKUs increases labor, storage, and administrative costs, as more organization and monitoring are required to prevent stock mismatches or inefficiencies.

4. Inventory Volume

The quantity of inventory you keep directly influences your holding costs. Storing a large volume of goods for long periods ties up more space, capital, and resources. Conversely, maintaining a lean inventory through better demand forecasting can significantly reduce overhead and free up working capital for other business operations.

5. Inventory Turnover Rate

The speed at which inventory sells or moves through the warehouse has a direct effect on holding costs. Fast-moving goods spend less time in storage, resulting in lower carrying expenses. Slow-moving or obsolete stock, on the other hand, increases depreciation, obsolescence, and opportunity costs, impacting profitability.

6. Type of Orders Processed

The order type — whether direct-to-customer (DTC) or business-to-business (B2B) — influences storage needs. DTC orders typically involve smaller quantities with higher picking frequency, whereas B2B operations often require palletized, bulk storage solutions. The handling complexity and order structure both contribute to cost variations.

7. Facility Services and Features

The nature of the storage facility also plays a role. A basic warehouse that only provides storage will cost less than one offering value-added services such as packaging, labeling, returns management, or climate control. While these services increase convenience and efficiency, they also add to total holding costs.

By analyzing these factors, businesses can pinpoint the areas contributing most to their holding expenses. With an intelligent platform like Deskera ERP, companies can automate inventory tracking, evaluate cost drivers, and optimize stock management based on data-driven insights—helping minimize unnecessary holding costs while maintaining supply chain efficiency.

How to Calculate Inventory Holding Costs

Calculating inventory holding costs helps businesses understand how much they spend to store and maintain inventory over a given period. This calculation is crucial for making decisions about purchasing, warehousing, and pricing strategies. While some companies use a simple estimate based on storage costs, others prefer a more detailed formula that provides better accuracy. Let’s explore both methods below.

1. Simple Calculation Method

The simplest way to calculate holding costs is by focusing on basic storage expenses. This includes the total cost of renting warehouse space, utilities, and insurance over a set period.

For example, if a company outsources its storage to a third-party logistics (3PL) provider, it might pay a flat fee per bin, shelf, or pallet used. In this case, the total storage fees represent the company’s holding costs.

Example: A retailer stores its inventory with a 3PL and pays ₹1,00,000 annually for storage space.

Inventory Holding Cost = ₹1,00,000

While this approach provides a quick estimate, it doesn’t consider other essential cost elements like depreciation, labor, or opportunity costs. For a more complete understanding, businesses should use the detailed method below.

2. Detailed Calculation Method (Formula-Based)

A more comprehensive approach includes all major cost components — such as storage, labor, opportunity, and depreciation costs — relative to the total inventory value.

Use the following formula:

Inventory Holding Cost (%) = [(Storage Costs + Employee Salaries + Opportunity Costs + Depreciation Costs) / Total Value of Annual Inventory] × 100

This formula expresses holding costs as a percentage of total inventory value, giving a clear view of how efficiently inventory is being managed.

Example: A lighting manufacturer wants to calculate its holding costs for the past year:

- Storage Costs (rent, utilities, insurance): ₹20,000

- Employee Salaries: ₹30,000

- Opportunity Costs (missed sales potential): ₹15,000

- Depreciation Costs: ₹10,000

- Total Value of Annual Inventory: ₹1,00,000

Inventory Holding Cost (%) = [(20,000 + 30,000 + 15,000 + 10,000) / 1,00,000] × 100

Inventory Holding Cost (%) = 75%

In this case, the holding cost is 75%, which is significantly above the recommended 20–30% benchmark. This suggests inefficiencies such as overstocking or slow-moving items, which the business should address.

3. Simplified Formula for Quick Estimates

For quick calculations, many businesses use a simplified version:

Holding Cost = Average Inventory Value × Holding Rate

Example: If your average inventory value is ₹10,00,000 and your estimated holding rate is 20%, then:

Holding Cost = 10,00,000 × 0.20 = ₹2,00,000

This approach helps companies get a fast snapshot of inventory expenses, though it’s best used alongside detailed analysis for more accurate decision-making.

Modern tools like Deskera ERP simplify these calculations by automatically tracking expenses, valuing inventory in real time, and generating cost reports. With built-in analytics and AI-driven forecasting, Deskera enables businesses to not only calculate but also reduce holding costs, ensuring leaner operations and improved cash flow.

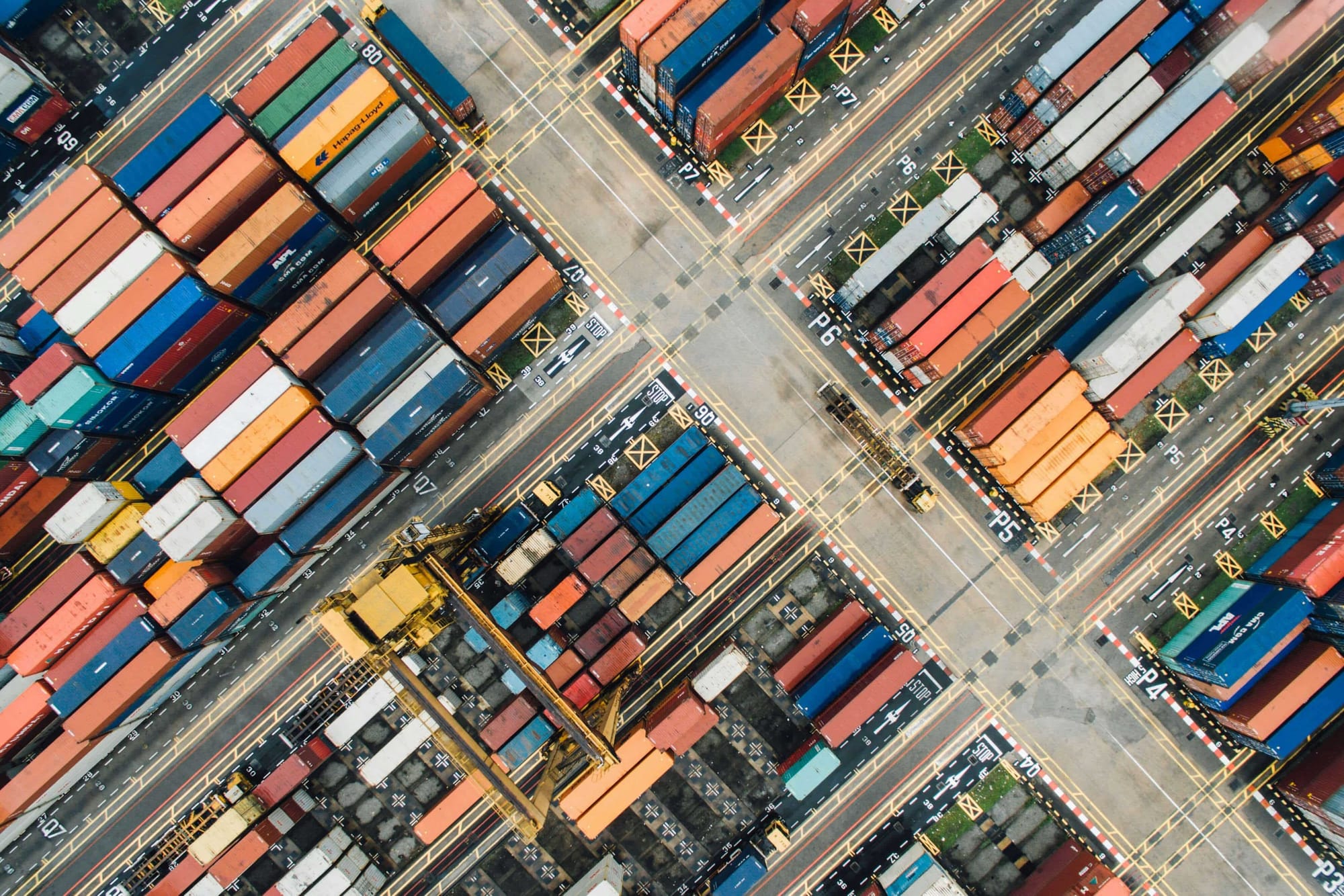

Where You Will Encounter Holding Costs

Inventory holding costs arise wherever unsold goods are stored, handled, or managed before being sold or used in production. These costs are an inevitable part of the supply chain and affect businesses of all sizes—from startups storing products at home to enterprises managing multi-location warehouses.

While small businesses may initially operate with minimal storage expenses, holding costs tend to increase as inventory volumes grow and more sophisticated storage solutions become necessary.

Below are three common storage options where holding costs typically occur:

1. Warehouses

Warehouses are large storage spaces—often spanning 1,000 square feet or more—rented, purchased, or built specifically for storing inventory. Businesses dealing with high inventory volumes often choose warehouses because they offer better organization, security, and scalability.

However, warehouse operations involve several holding cost elements, including rent, insurance, maintenance, and utilities. Specialized requirements, such as climate control, cold storage, or high-level security systems, can further increase expenses. While warehouses offer economies of scale for bulk storage, they also require efficient management to prevent overstocking and excessive costs.

2. Storage Units or Facilities

When home-based operations outgrow their space, many small businesses turn to storage units or facilities as a short-term or transitional solution. These facilities typically rent out smaller spaces, making them ideal for companies in early growth stages or those between warehouse leases.

Storage units come with costs like monthly rental fees, security, and insurance, which contribute to holding expenses. While they offer flexibility and easy setup without long-term commitments, storage units are not ideal for businesses managing large or fast-moving inventories due to space and accessibility limitations.

3. Fulfillment Centers

Fulfillment centers are specialized facilities operated by third-party logistics (3PL) providers that handle the entire order fulfillment process—from inventory storage to picking, packing, and shipping. These centers are designed for efficiency, ensuring consistent order management across multiple locations using standardized technology, processes, and SLAs.

While outsourcing fulfillment can reduce in-house operational overhead, it comes with higher holding costs due to service fees, handling charges, and premium storage rates. However, the trade-off is often worthwhile for businesses that want to focus on growth and customer experience rather than warehouse management.

Modern tools like Deskera ERP help businesses manage and monitor holding costs across all these storage options. With real-time inventory tracking, automated cost allocation, and demand forecasting, Deskera enables companies to optimize stock levels, reduce storage overhead, and make smarter decisions about where and how to store inventory efficiently.

Advantages of Monitoring Inventory Holding Costs

Monitoring inventory holding costs isn’t just about controlling expenses — it’s about making smarter business decisions that improve efficiency, profitability, and financial flexibility. By keeping a close eye on these costs, businesses can identify inefficiencies, optimize stock levels, and make informed choices that drive long-term growth.

Here are the key benefits of tracking and managing your inventory holding costs effectively:

1. Frees Up Working Capital

When too much cash is tied up in inventory, it limits your ability to invest in other growth areas of the business. By regularly monitoring and reducing holding costs, companies can order more strategically—stocking only what’s needed based on accurate demand forecasts.

This frees up working capital that can be redirected toward product development, marketing initiatives, or expanding operations, rather than being locked in unsold goods.

2. Improves Profitability

Inventory that sits too long in storage eats into profits through rent, utilities, insurance, and depreciation. By tracking holding costs, businesses can pinpoint which products are driving up expenses and act quickly — whether by discounting slow movers, adjusting purchasing plans, or improving demand forecasts. Reducing excess stock directly lowers carrying costs, which in turn increases overall profitability by keeping the cost of goods sold (COGS) under control.

3. Maintains Optimal Inventory Levels

High holding costs often indicate overstocking, while very low costs might signal stockouts or missed sales opportunities. By monitoring holding costs, businesses can maintain an ideal balance between supply and demand — ensuring they have enough stock to meet customer needs without overinvesting in storage. This balance leads to faster inventory turnover, reduced waste, and a more resilient supply chain.

4. Enhances Demand Forecasting and Planning

Tracking holding costs gives you a clearer picture of how your inventory behaves over time. By understanding which products incur higher costs or turnover slower, businesses can refine their demand forecasting models and purchasing strategies. This results in more accurate order quantities, fewer storage inefficiencies, and better planning for seasonal or market-driven fluctuations.

5. Reduces Risk of Obsolescence and Shrinkage

Regularly monitoring holding costs helps identify slow-moving or obsolete stock early, allowing you to take corrective actions before those items lose value. It also supports better inventory rotation practices (FIFO or LIFO), reducing risks from spoilage, damage, or outdated inventory.

6. Improves Operational Efficiency

Understanding where and why holding costs rise allows you to streamline operations — whether it’s renegotiating warehouse leases, optimizing storage layouts, or adopting automation tools for better stock visibility. This operational efficiency not only reduces costs but also enhances warehouse productivity and accuracy.

7. Enables Data-Driven Decision Making

Monitoring holding costs transforms raw financial data into actionable insights. Businesses can identify trends, set benchmarks, and make data-backed decisions about purchasing, pricing, and logistics strategies. Ultimately, this leads to more agile operations and better alignment between inventory management and overall business objectives.

8. Supports Financial Stability and Growth

By optimizing holding costs, companies achieve better cash flow management and greater financial resilience. A leaner inventory structure reduces unnecessary debt or financing needs, ensuring the business remains stable and adaptable — especially during market fluctuations.

When paired with a smart inventory management system like Deskera ERP, monitoring holding costs becomes effortless. Deskera’s automated tracking, AI-driven insights, and real-time reporting empower businesses to minimize waste, maintain optimal stock levels, and maximize profitability — all from a single integrated platform.

Disadvantages of Overlooking Inventory Holding Costs

Ignoring or underestimating inventory holding costs can severely impact a company’s financial health and operational efficiency. These costs, though often indirect, accumulate quickly and can erode profitability if not carefully tracked and managed. Businesses that fail to monitor them may find themselves facing cash flow constraints, wasted resources, and strategic setbacks.

Here are the key disadvantages of overlooking inventory holding costs:

1. Reduced Cash Flow and Working Capital

When inventory holding costs go unnoticed, businesses may end up stocking more goods than necessary, tying up substantial amounts of capital. This reduces liquidity and limits the ability to invest in growth initiatives such as product development, marketing, or technology upgrades. Over time, poor cash flow management can lead to financial strain and reduced agility in responding to market changes.

2. Increased Risk of Obsolescence and Waste

Failing to monitor holding costs often results in excess inventory — especially for products with short life cycles, seasonal demand, or technological relevance. Without regular evaluation, such stock can become obsolete, damaged, or expired, leading to direct losses. The longer items remain unsold, the higher the risk of depreciation, forcing businesses to sell at a discount or write them off entirely.

3. Hidden Operational Inefficiencies

Overlooking holding costs masks inefficiencies within warehouse operations. Businesses may not realize how much they spend on rent, utilities, labor, and equipment until these expenses become overwhelming. Unmonitored inventory also leads to poor space utilization, unnecessary storage expansion, and higher labor costs — all of which drain resources and reduce overall efficiency.

4. Lower Profit Margins

Holding costs directly influence the cost of goods sold (COGS). If these costs are not factored into pricing and financial planning, products may be sold at lower margins or even at a loss. This lack of visibility can distort profitability metrics, making it difficult to identify which products are truly generating returns and which are silently eroding profit.

5. Poor Inventory Planning and Forecasting

When holding costs aren’t tracked, businesses lose critical insights into inventory performance. This can lead to inaccurate demand forecasting, resulting in overstocking or stockouts. Without understanding the financial impact of inventory decisions, companies struggle to balance supply with demand, often leading to missed sales opportunities or excessive carrying expenses.

6. Increased Financial and Strategic Risk

Neglecting inventory holding costs creates a false sense of financial stability. Managers may assume the company is performing well while, in reality, profits are being drained by hidden storage and depreciation costs. This lack of visibility makes it harder to respond to external challenges such as market downturns, supply chain disruptions, or inflation-driven cost increases.

7. Ineffective Pricing Strategies

Without factoring in holding costs, businesses may set product prices too low to cover total expenses. This results in underpriced products that fail to reflect their true cost structure. Over time, this weakens profitability and undermines competitiveness in the market.

8. Strained Supplier and Customer Relationships

When holding costs spiral unnoticed, businesses may delay reorders or fail to fulfill customer demand on time due to poor inventory planning. This can lead to stockouts, delayed deliveries, and dissatisfied customers, ultimately harming brand reputation and supplier reliability.

9. Missed Opportunities for Process Improvement

Monitoring holding costs often reveals areas where automation, outsourcing, or layout optimization could reduce expenses. By ignoring these costs, businesses miss opportunities to implement smarter warehouse practices, adopt ERP systems, or use demand forecasting tools — all of which could enhance operational efficiency and reduce waste.

10. Difficulty in Long-Term Strategic Planning

Overlooking holding costs limits the ability to evaluate true product profitability and overall business health. Without clear data, long-term financial and operational strategies become guesswork rather than data-driven planning. This can lead to misallocation of resources, poor investment decisions, and reduced competitiveness in the long run.

To avoid these pitfalls, businesses should implement robust inventory management systems like Deskera ERP, which provides real-time visibility into storage, depreciation, and capital costs. Deskera’s intelligent reporting and analytics tools help identify cost drivers, optimize inventory levels, and prevent inefficiencies — ensuring every unit in storage contributes to profitability, not loss.

What Leads to Higher Inventory Holding Costs?

Inventory holding costs can escalate quickly when businesses fail to maintain the right balance between supply, demand, and storage capacity. While holding some stock is necessary to ensure smooth operations, poor planning or external disruptions can push these costs beyond control — directly affecting cash flow and profitability. Below are the major factors that lead to higher inventory holding costs.

1. Obsolescence Risk

One of the most significant contributors to rising holding costs is inventory obsolescence — when products lose value before being sold. Industries like technology and fashion face this risk frequently, as rapid innovation or shifting trends can render existing stock irrelevant. For example, a new smartphone release can instantly devalue previous models, turning high-value inventory into unsellable or heavily discounted goods. The longer these obsolete items stay in storage, the higher the financial burden on the business.

2. Seasonal Demand Fluctuations

Products with seasonal demand patterns often create costly inventory management challenges. During peak seasons, businesses must build enough stock to meet demand, but once the season ends, unsold items continue to incur storage, insurance, and depreciation costs. For instance, holiday decorations or winter apparel may sit idle for months, consuming space and tying up capital. Striking the right balance between stock availability and storage efficiency is crucial to avoid excessive holding costs.

3. Excessive Safety Stock

Safety stock serves as a cushion against demand spikes or supply delays, but overstocking beyond reasonable limits can backfire. Holding too much safety stock leads to higher storage expenses, capital lock-in, and increased obsolescence risk, especially for products with limited shelf life or fast-changing trends. Businesses should use data-driven forecasting and ERP tools to determine optimal safety stock levels, ensuring protection without unnecessary financial strain.

4. Poor Forecasting Accuracy

Inaccurate demand forecasting is a primary cause of inflated holding costs. When forecasts overestimate demand, companies end up overstocking, resulting in unsold goods and higher carrying costs. Conversely, underestimating demand can lead to stockouts and missed sales opportunities. Both situations reflect inefficiency — highlighting the importance of real-time data analytics and automated demand planning systems to align stock levels with actual market trends.

5. Supply Chain Disruptions

Even the most well-planned inventory systems can be disrupted by supply chain interruptions such as shipment delays, quality issues, or supplier shortages. To mitigate these uncertainties, companies often build up buffer inventory, which can temporarily protect operations but also inflate holding costs. Long-term disruptions — like geopolitical instability or port congestion — exacerbate the issue, forcing businesses to store larger-than-normal inventory volumes for extended periods.

6. Inefficient Warehouse Management

Poor warehouse organization, lack of automation, and inefficient layout designs can also lead to higher inventory holding costs. Disorganized storage increases handling time, labor costs, and error rates, while inefficient space utilization may require renting additional storage facilities. Implementing warehouse management software (WMS) or integrated ERP systems can streamline processes, improve visibility, and significantly reduce unnecessary storage expenses.

7. Rising Cost of Capital and Storage

When interest rates or utility costs rise, so do inventory holding expenses. Capital costs, such as financing or opportunity costs of money tied up in stock, can quickly compound. Similarly, increased rent, energy, or insurance costs directly raise the total carrying cost per unit of inventory.

To manage these factors effectively, businesses can leverage Deskera ERP, an integrated platform designed to optimize inventory management. With real-time demand forecasting, automated stock tracking, and cost analytics, Deskera helps identify inefficiencies early, reduce excess inventory, and maintain the right stock balance — all while keeping holding costs under control.

Top Strategies to Reduce Inventory Holding Costs

Reducing inventory holding costs is vital for improving cash flow, optimizing storage space, and maximizing profitability. Businesses can achieve this by combining accurate demand forecasting, automation, and smart purchasing strategies. Below are eight proven strategies to minimize inventory holding costs while maintaining operational efficiency.

1. Calculate the Economic Order Quantity (EOQ)

Determining the right order quantity is the foundation of efficient inventory management. The Economic Order Quantity (EOQ) formula helps calculate the most cost-effective amount of inventory to order, balancing holding and ordering costs.

Formula: EOQ = √((2DO) / H)

Where:

- D = Annual unit demand

- O = Ordering cost per purchase

- H = Holding cost per unit

By ordering quantities that align with real demand, businesses can minimize excess stock and reduce storage costs. Automating EOQ calculations using ERP software like Deskera ERP ensures real-time accuracy and saves time compared to manual recalculations.

2. Implement Accurate Demand Forecasting

Accurate demand forecasting enables businesses to purchase the right amount of inventory—no more, no less. Analyzing historical data, sales trends, and seasonal demand patterns helps prevent overstocking and stockouts.

Tools like Deskera’s demand forecasting module leverage real-time sales data to generate accurate forecasts, allowing timely purchasing decisions and minimizing storage of unsold items.

3. Optimize Safety Stock Levels

Safety stock acts as a buffer against demand fluctuations, but keeping too much can unnecessarily inflate holding costs. Regularly review and adjust safety stock based on:

- Forecast accuracy

- Supplier lead times

- Market demand volatility

By setting data-driven safety stock thresholds, businesses can balance customer satisfaction with cost efficiency.

4. Streamline Warehouse Organization

A well-organized warehouse minimizes wasted space and handling time. Strategies include:

- Placing fast-moving items near dispatch zones

- Using vertical storage to maximize floor space

- Labeling and categorizing SKUs efficiently

Implementing warehouse management systems (WMS) helps track stock in real time and reduces manual errors, ensuring a leaner inventory setup.

5. Increase Inventory Turnover Rate

Improving inventory turnover ensures products move quickly through the supply chain, reducing the time they spend in storage. Ways to boost turnover include:

- Running promotions or bundles for slow-moving stock

- Prioritizing high-demand items in purchasing plans

- Reviewing reorder frequency to match sales velocity

Faster turnover translates directly into lower carrying costs and improved liquidity.

6. Negotiate Better Supplier Terms

Collaborate with suppliers to establish flexible terms that minimize unnecessary inventory buildup. Businesses can:

- Negotiate smaller minimum order quantities (MOQs)

- Request shorter lead times

- Explore consignment or vendor-managed inventory (VMI) models

Such arrangements allow you to receive stock closer to actual demand, shifting some holding responsibility back to suppliers.

7. Use Just-In-Time (JIT) Inventory Management

The Just-In-Time (JIT) approach ensures inventory arrives only when needed for production or sales, minimizing the cost of holding excess goods. While effective, this method requires:

- Reliable suppliers

- Strong logistics coordination

- Real-time inventory visibility

Deskera ERP supports JIT operations by synchronizing procurement and production schedules, reducing idle stock levels.

8. Automate Inventory Monitoring and Reporting

Manual tracking often leads to errors, overstocking, and missed reorder opportunities. Automating inventory monitoring with Deskera ERP provides real-time insights into stock levels, carrying costs, and turnover rates. Automation not only ensures timely replenishment but also helps identify high-cost SKUs, enabling proactive cost control and improved decision-making.

Reducing holding costs isn’t about slashing inventory—it’s about optimizing it. By leveraging data-driven tools, automating calculations, and building strong supplier relationships, businesses can achieve the ideal balance between cost efficiency and product availability. With Deskera ERP, companies gain a centralized platform for real-time inventory tracking, accurate forecasting, and cost management—empowering them to keep holding costs in check while boosting profitability.

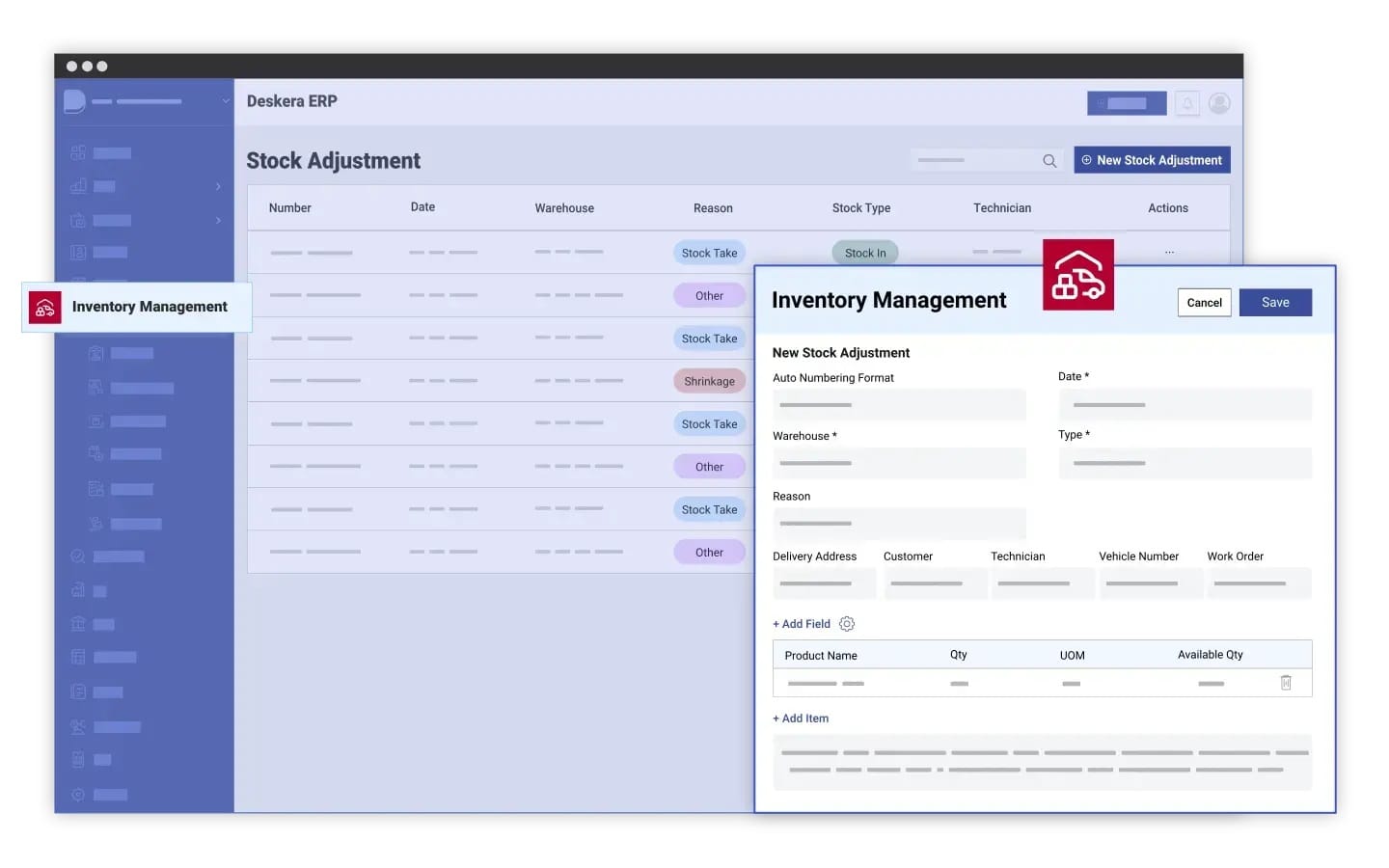

How Deskera ERP Simplifies Tracking of Inventory Holding Costs

Managing and tracking inventory holding costs manually can be both time-consuming and error-prone. Businesses often struggle to monitor the different cost components—such as warehousing, insurance, depreciation, and obsolescence—especially as inventory volumes grow. This is where Deskera ERP offers a streamlined, data-driven solution to simplify the process and help businesses make informed decisions.

Here’s how Deskera ERP makes tracking inventory holding costs more efficient and transparent:

1. Real-Time Inventory Visibility

Deskera ERP provides real-time visibility into your inventory across all locations—warehouses, retail outlets, or distribution centers. This transparency allows you to monitor stock levels, identify slow-moving items, and calculate how long products remain in storage. By knowing exactly what you have and where it’s located, you can make proactive decisions to reduce unnecessary holding costs.

2. Automated Cost Tracking and Allocation

With Deskera ERP, you can automatically track and allocate holding costs like storage, insurance, depreciation, and labor to specific SKUs or categories. The system calculates these costs based on real-time data, ensuring accuracy without manual effort. This automation helps you identify which items contribute most to holding expenses—so you can focus on optimizing or liquidating them.

3. Integrated Financial and Inventory Modules

One of Deskera ERP’s biggest advantages is its integration between accounting and inventory management. All inventory-related transactions—purchases, transfers, depreciation, or write-offs—are automatically reflected in your financial statements. This means you get a complete view of how holding costs impact your overall profitability and working capital.

4. Demand Forecasting and Smart Reordering

Deskera’s built-in AI-driven demand forecasting tools analyze historical data, sales trends, and seasonality to predict future demand accurately. Based on this, the system recommends optimal reorder quantities using the Economic Order Quantity (EOQ) and Just-In-Time (JIT) models. These intelligent reorder points prevent overstocking and reduce the time goods sit idle in storage, effectively lowering holding costs.

5. Automated Reporting and Analytics

Deskera ERP generates detailed inventory cost reports and dashboards that visualize your holding cost trends over time. You can easily track metrics such as inventory turnover ratio, carrying cost percentage, and days inventory outstanding (DIO). These insights help you monitor performance and identify opportunities to improve efficiency and cut costs.

6. Support for Multi-Warehouse and Multi-Channel Operations

For businesses operating across multiple warehouses or sales channels, Deskera ERP centralizes all data into a single unified dashboard. This ensures consistent tracking of inventory movement, costs, and performance—regardless of location. With better control over distributed inventory, businesses can avoid duplicate stock, excess ordering, and inflated storage fees.

7. Seamless Integration with Procurement and Sales

Deskera ERP connects procurement and sales data to your inventory system, enabling end-to-end traceability. Every purchase order, goods receipt, and sales transaction updates stock levels and associated costs in real-time. This synchronization ensures accurate cost tracking, reduces data redundancy, and provides a complete picture of how holding costs evolve across your supply chain.

Deskera ERP takes the complexity out of tracking and managing inventory holding costs. Through real-time visibility, automation, and intelligent forecasting, it empowers businesses to make data-backed decisions that improve cash flow and profitability. By centralizing inventory, accounting, and procurement in one platform, Deskera enables companies to maintain optimal stock levels, minimize storage costs, and operate with greater financial precision.

Key Takeaways

- Inventory holding costs represent all expenses tied to storing unsold goods, including rent, utilities, insurance, and depreciation. Tracking these costs helps businesses maintain profitability and make data-driven inventory decisions.

- The four key components—capital costs, storage costs, service costs, and risk costs—collectively determine the total carrying cost. Knowing these helps identify where expenses can be minimized.

- Holding costs are typically incurred in warehouses, storage units, and fulfillment centers, each varying in cost structure based on space, services, and handling needs.

- Location, SKU count, inventory volume, product size, and turnover rate all influence how much a business spends on holding inventory. Strategic control over these factors helps reduce excess costs.

- Regularly tracking holding costs enables companies to free up working capital, boost profitability, and maintain optimal inventory levels, ensuring a leaner and more agile operation.

- Ignoring holding costs can lead to excess inventory, reduced cash flow, lower profit margins, and inefficient storage utilization, weakening financial stability over time.

- Poor forecasting, excess safety stock, seasonal fluctuations, obsolescence, and supply chain disruptions are major contributors to inflated holding costs and inventory inefficiencies.

- Implementing tactics such as Economic Order Quantity (EOQ) calculations, demand forecasting, JIT inventory, warehouse optimization, and vendor negotiation can significantly lower carrying costs.

- Deskera ERP automates cost tracking, integrates accounting and inventory data, and provides real-time visibility, analytics, and AI-driven demand forecasting—helping businesses minimize holding costs and maximize efficiency.

Related Articles