The vast majority of small businesses - nearly 60% - do not have adequate accounting systems knowledge. This lack of awareness has led small businesses to maintain their books of accounts using a system that is widely characterized as a single-entry bookkeeping system.

Imagine an economy where a majority of businesses don't know how to manage their accounts. Imagine the inefficiencies. In terms of resources, efforts, time, and money. For small businesses - this is a reality. According to a report, the vast majority of small businesses - nearly 60% - do not have adequate accounting systems knowledge. This lack of awareness has led small businesses to maintain their books of accounts using a system that is widely characterized as a single-entry bookkeeping system. Or, as those in the accounting business call it, accounting with incomplete records.

The single-entry system's defining characteristic is recording only one side of the transactions while often not accounting for non-cash transactions. While it is possible to finalize accounts using this bookkeeping (i.e., preparing Trading and Profit & Loss accounts and balance sheets), these final accounts indicate only an approximate position of the business.

The Pro & The Cons of Single-Entry

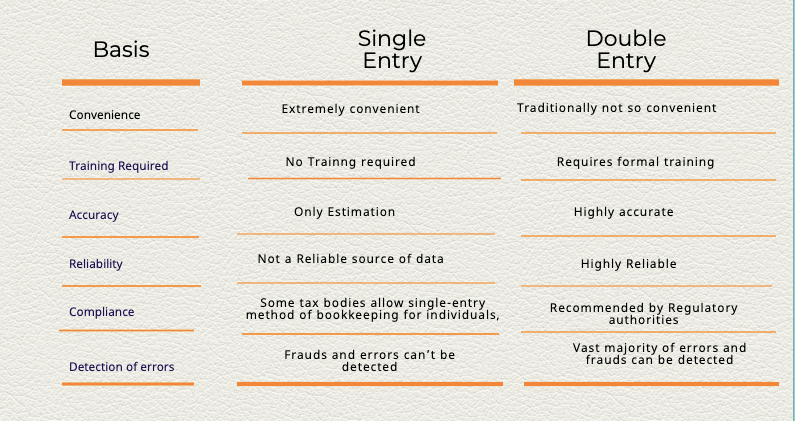

The single-entry method of bookkeeping used to have only two real advantages over the double-entry method of bookkeeping:

- You needn't have a formal accounts training, which was traditionally required when you had to maintain the books under the double-entry system

- The other real advantage was the pure convenience that the single-entry system offers, which was not traditionally the case with the double-entry system

Thus, the single-entry system is primarily used because of its convenience and how intuitive it can be to record just the cash expenses and incomes. But this system can severely deter the entity's ability to truly represent and analyze its financial position. Following the single entry system makes detection of frauds and errors extremely challenging and can often hamper the businesses' ability to extract the maximum information from the financial records.

The single entry system also completely ignores the principle of duality (more on that, below), and sometimes wholly ignores real and nominal accounts, making any information obtained from this system unreliable.

In fact, it is mandatory for companies and limited liability corporations across various countries to adhere to the double-entry system because of how unreliable the data obtained otherwise can be.

Double-Entry: A Brief Summary

The Double-Entry method of bookkeeping is a system of accounting developed over the centuries to ensure a proper and adequate record of financial transactions. It is the method which is predominantly followed by organizations looking to extract maximum information from their business data.

The double-entry system is designed to ensure that all effects of a transaction are carefully recorded and ensures that the final accounts are extremely accurate. Nominal accounts are maintained, and non-cash transactions are recorded as well.

All the regulatory frameworks and financial authorities unanimously agree that the double-entry style of bookkeeping is the best way to maintain your books of accounts.

The double entry system of bookkeeping is based on the principle of duality. According to the principle, each transaction causes two changes in the books of accounts - one in the records of credits, and one in the records of debits. This is also known as the 'rules of debit and credit'. In double-entry accounting:

- Every credit entry must have a corresponding debit entry and

- Every debit entry must have a corresponding credit entry.

For example, if a business purchases $10,000 worth of electronic equipment - laptops, smartphones, etc. - for its employees, the transaction would be recorded in this way:

- The company would have a decrease of $10,000 in its cash balance, and

- It would see an increase of $10,000 in the value of its assets - in this case, electronic equipment like laptops and smartphones.

Like we just said, the double-entry system has been around for centuries. The earliest evidence of double-entry bookkeeping appears in the years 1299-1300 AD. A money lending company adopted this system of accounting, understanding the many benefits that such a system entails.

However, it wasn't till much later, in the year 1494, when Luca Pacioli, often referred to as the father of accounting and bookkeeping, laid out a formal set of rules to be followed when maintaining books of accounts under this system, in his book "Summa de Arithmetica, Geometria, Proportioni et Proportionalità". These rules are the very core principles, which are followed under this system even today, some 500 years later.

Double Entry System: The benefits

More than anything else, a double-entry system, since it is the "formal" way of maintaining books of accounts, ensures uniformity in accounting policies, which is crucial when making any decisions based on the data from the books of accounts.

Accounts maintained under this system are extremely reliable, can help detect frauds and errors, and ensure a consistent and comparable set of financial data for the users over a period of time and across various entities.

Most laws require that several types of organizations adhere to the double-entry method of bookkeeping. Compliance is one of the most crucial things that a business should look at while deciding which accounting system to use.

However, the predominant factors that stop businesses from maintaining the books under this method are

- Training

- Extra time and effort required to maintain books under this system

Current Scenario: Tech in Accounting

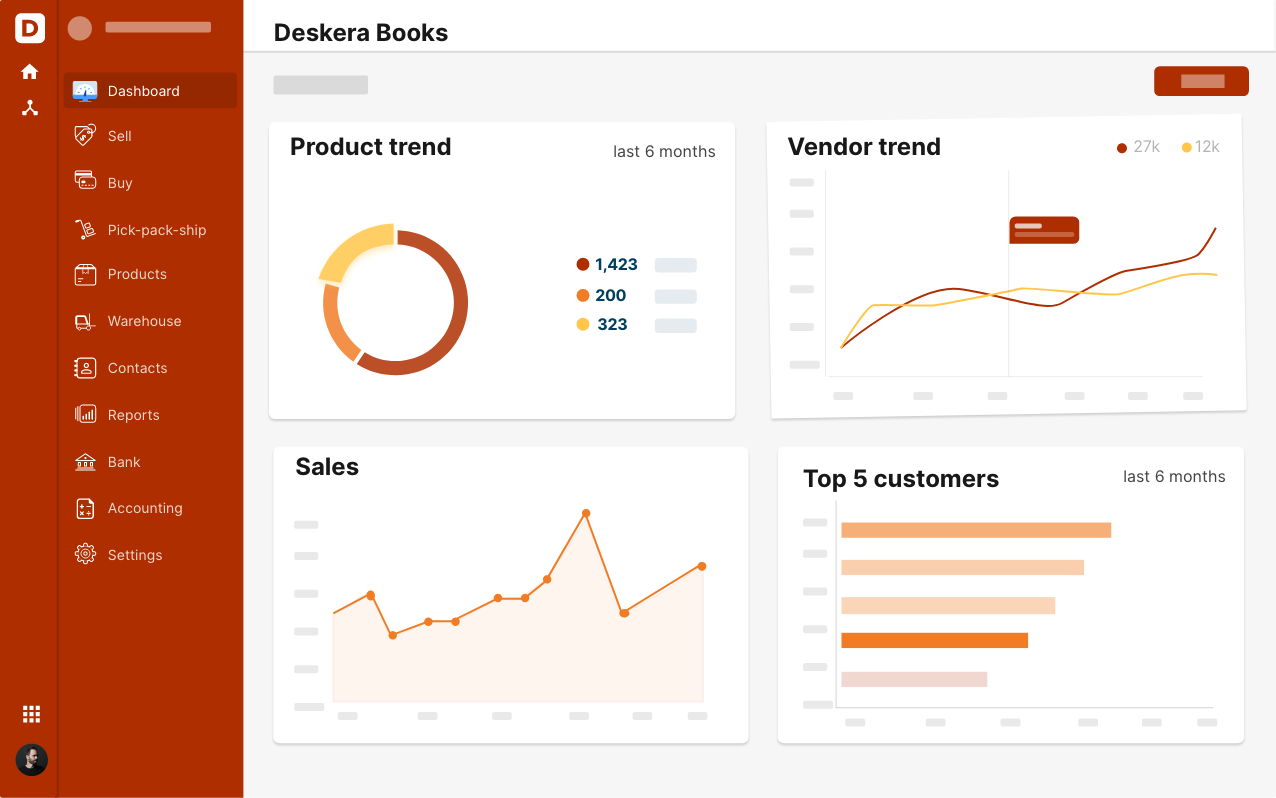

The primary reasons that drove businesses to opt for the single-entry system traditionally are now obsolete, thanks to the rapid growth of technology over the years. It is now extremely convenient to use the double-entry system of accounting using accounting software, and there is no requirement of formal training to use these tools.

However, a learning curve is to be expected when transitioning to any new technological advances. At Deskera, we offer support and training on how to use the software to enable your business stays abreast of the latest trends and developments and use double-entry bookkeeping without much friction.

Recent trends indicate 90% of accountants preferring a shift towards cloud-based accounting software. Coupled with 200,000+ new businesses from 38 countries having signed on to Deskera in 2020 alone, you can be rest assured that signing up to Deskera is one of the best decisions that you'll make for your business.