Understanding Australian Payroll basics can help your business succeed, and ensure that you are following all legal requirements. Deskera People has a strong feature-packed Payroll and HR management solution to help your business with every aspect in your business in Australia.

A land of diversity, Australia is a country filled with natural resources and a booming trade economy. The rich and diverse spread of natural resources has helped build a thriving economy around Agriculture, Mining, Trading, and Manufacturing.

Australia is known for being a migrant-free country and is associated with many opportunities as land opportunities. However, a flourishing economy coupled with employee-friendly business opportunities has led to the emergence of a multi-cultural, multi-cultural workforce entering the region.

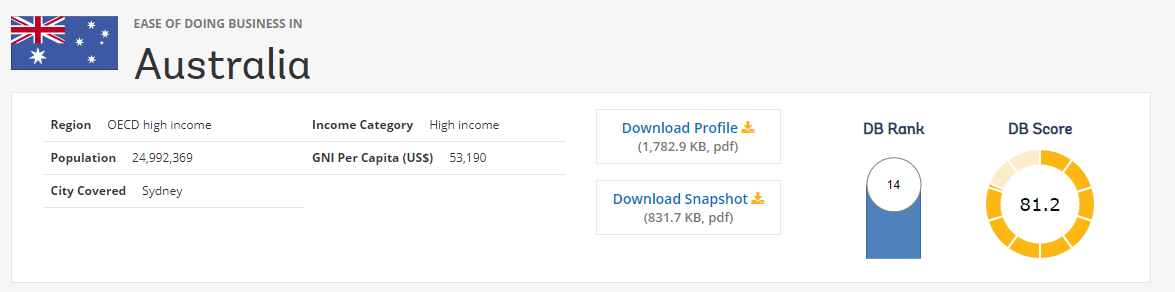

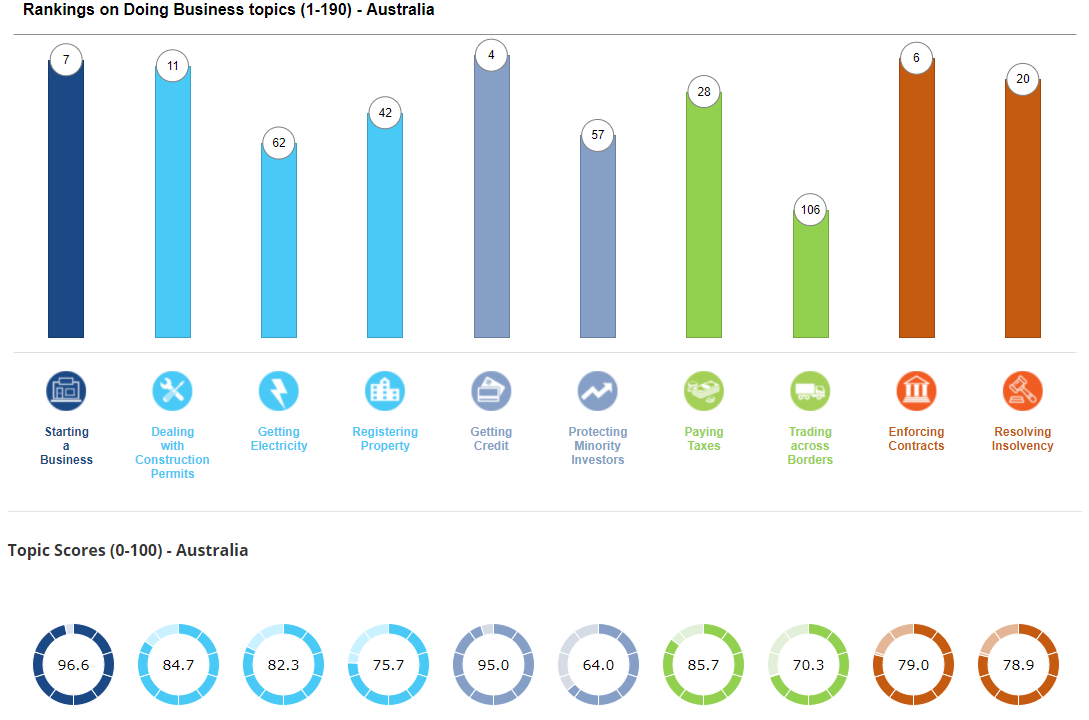

According to the World Bank, , Australia has ranked 14 among the 190 economies in the ease of doing business. The Australian rank improved to 14 in 2019 from 18 in 2018.

Click here to see all reforms made by Australia

For multinational business Australia offers:

Doing Business in Australia

Foreign companies may establish an Australian subsidiary by registering a new company or by acquiring a recently incorporated shelf company which has not yet engaged in trade. Companies are incorporated with the Australian Securities and Investments Commission (ASIC). Companies incorporated in Australia will be issued with a unique 9-digit Australian Company Number (ACN).

The corporation Act 2001 provides that a company may be:

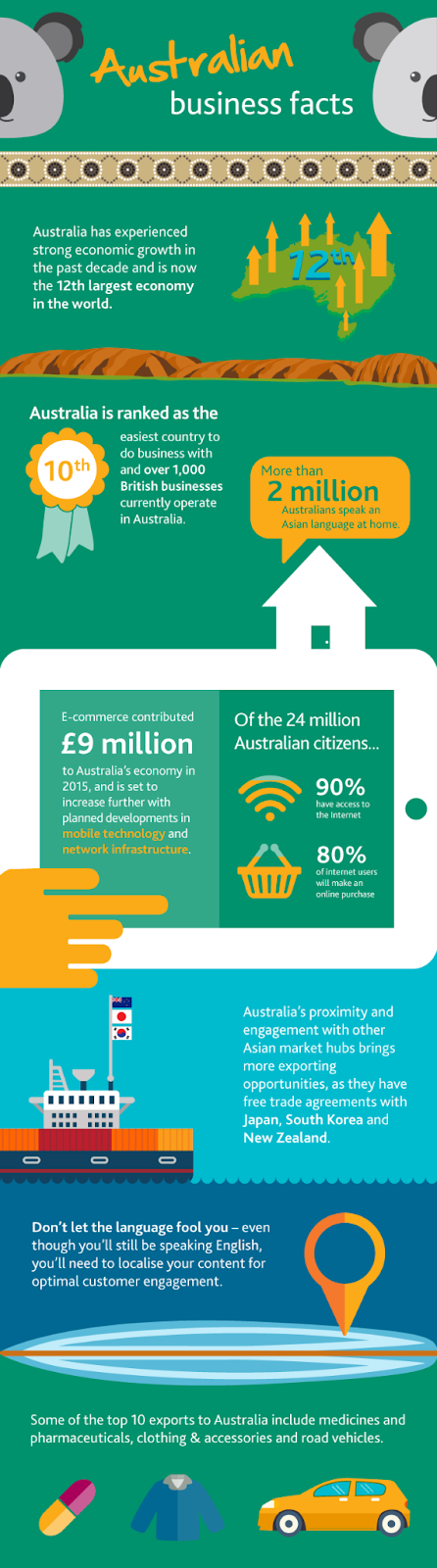

Australian Business Facts

How To Start a Business in Australia

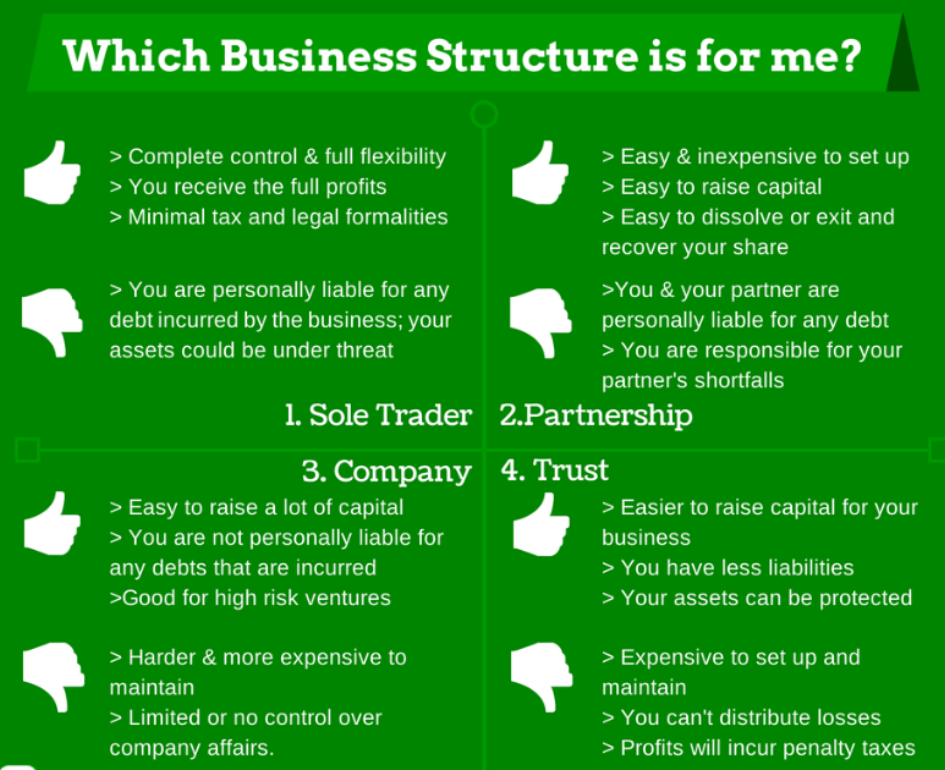

Step 1: Choose Your Business Structure

You need to choose the correct structure for your business, which has a direct effect on things like,

- The tax amount you need to pay

- Your level of control

- Regulatory obligations

- In the workplace, health and safety requirements

- The level of personal liability you will incur

In Australia, you can build your business in 4 structures as below,

Step 2 - Pick a Business Type

Once you have decided on the structure, you need to better understand the business type you need. Some the main business types includes,

- A franchise

- An online business

- Independent contractor

It is difficult to pick the type of business that suits the best for your industry, as each business has a different set of legal regulations and obligations requirements.

Step 3 - Apply For an Australian Business Number (ABN) and Register Your Business Name

In Australia, you cannot legally start a business unless you own an ABN, a unique 11-digit number, and acts as a government identifier for your business.

After you get an ABN, you can,

- Register business name

- Claim taxes such as GST

- Identify your business to other entities for things such as ordering goods and services or invoice sending

- Avail for credits like energy grants

Before you go and create your logo, website URL, etc., it is always good to decide on your business name to avoid any later changes.

If you wish, you can register your ABN and business name separately; however, it is easier to apply for both at the same time here.

Step 4 - Register Your Domain Name

In this step, after you have secured your name of business and ABN as it is possible only to get a .com.au address if you are a registered Australian business. The domain name shall always be related to your business and make it easy for customers to recognize and find.

Many sites can help you with finding a domain name -- here’s one of them to give you a head start.

Step 5 - Identify Your Funding Source

Cash flow will be the primary concern, in case you are like the majority of new startups. However, as there are not many government grants to help you start your business, there are plenty of specific options to every state in Australia. For eg , if you’re starting a business in Adelaide, you can apply for an excellent $20,000 Small Business Development Fund.

There are other grants based on:

- Taking your idea to market

- Marketing and sales

- Buying equipment

- Importing and exporting

- Employing people

For a complete list of grant types that can help fund parts of your venture Check out this page.

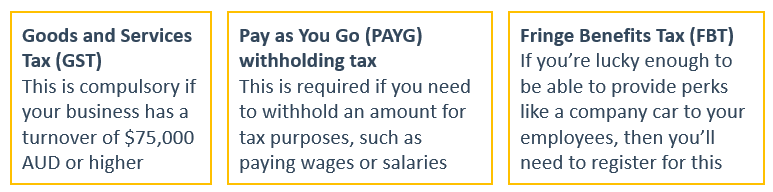

Step 6 - Register For the Correct Taxes

In Australia, if you start a business, you must mandatorily register for the correct taxes.The taxes depend on the type of business. Below listed are some of the examples,

By clicking here you can get more details on tax types.

What Is Australian Business Number and Tax File Number?

An Australian Business Number (ABN) is an 11-digit unique number that will identify your business. Companies that carry out business in Australia need to apply for an ABN.

In Australia, if you carry out business and fail to quote an ABN, then customers may be required to withhold 47% of withholding tax from payments.

Non-resident individuals and companies are required to provide copies of certificates of specific proof of identity documents when applying for an ABN.

For more information regarding how to register for ABN click here

A Tax File Number (TFN) is a unique identifier number that is issued by an Australian Taxation Office (ATO) to the taxpayers in Australia and is usually used for taxation and superannuation purposes.

In Australia, a business will have both ABN and TFN.

For more information regarding how to register for TFN click here

Types Of Australia Work Visas

For a variety of professions, Australia offers several types of work visas. These professions include skilled workers, specialized workers, short-term trainers, and experienced business people. Most likely your employees will fall under skilled professionals category and can apply for the following work visas,

Employer Nomination Scheme (ENS) Visa

This visa allows skilled employees who their employers select to stay and work permanently in the country.

Regional Sponsored Migration Scheme (RSMS) Visa

In regional Australia, this visa allows skilled employees selected by their employers to stay and work permanently in the country.

Skilled Independent Visa

This visa allows skilled invited workers and New Zealand citizens to stay and work anywhere in Australia permanently.

Skilled Nominated Visa

This visa allows selected skilled workers in Australia to stay and work as permanent residents.

Temporary Skill Shortage Visa

When an Australian is not available, a temporary visa enables an employer to sponsor a suitably skilled worker.

Skilled Regional (Provisional) Visa

This visa is a temporary visa that allows skilled workers to stay and live in regional Australia.

Temporary Work (Short Stay Specialist) Visa

This visa will allow you to work on a short-term basis and work highly-specialized in the country.

Temporary Work (International Relations) Visa

To work in particular circumstances, this visa helps in improving Australia's international relations.

Distinguished Talent Visa

This visa is permanent for those who have a recognized international record of outstanding achievement in a profession like arts, sports, research, or academia.

Business Talent (Permanent) Visa

Meant for developing or establishing a new or existing company.

Australia’s Minimum Wage 2021

As per the Annual Wage Review 2021, the Fair Work Commission has declared an increase of minimum wage in Australia to 2.5%.

The latest national minimum wage per hour will be $20.33 or $772.60 per week. It will apply from the first full period on or after 1 July 2021. On the basis of the 38-hour week, the hourly rate is calculated for a full-time employee, equivalent to an increase of 18.80 per week to the weekly rate or per hour 49 cents to the hourly rate.

With effect from 1 July 2021, the annual wage review considers the Super Guarantee increase and removal of threshold eligibility of the $450 per month for mandatory superannuation contributions.

There is also an increase by 2.5% for the Modern award minimum wages, and due to covid-19 the hard-hit industries have been given some relief under the Annual Wage Review.

The increase to minimum award rates will occur in 3 stages:

- Wages in the following awards will increase from 1 November 2021:

- Wages in the General Retail Industry Award will increase from 1 September 2021.

- Wages in all other Awards will increase from 1 July 2021.

Click here to know more about Minimum Wages in Australia.

How Do I Set Up Payroll For the First Time in Australia?

Setting up your payroll for the first time may seem like a daunting task; however, our checklist will be helping you to get off to a good start.

As a new employer in Australia, making the payroll process a little easier lets us get started with our helpful checklist. With this, you can run your payroll with minimum errors.

Should You Outsource or In-House?

Do you have enough time to handle payroll by yourself? It may give you more control and save money.

If you do not want to run payroll in-home, alternatively, you can outsource it to a reliable accountant, bookkeeper, or payroll service provider.

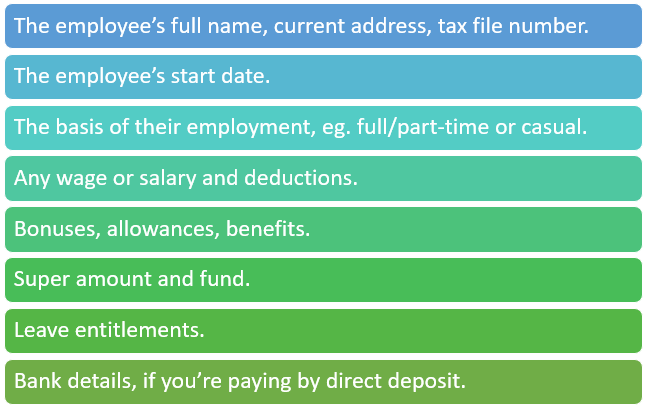

Gather the Employee Records You need

Essential information includes:

Check You Are Paying the Correct Wages/Entitlements

For employees, make sure you are meeting the minimum entitlements. For that you needs to understand,

TIP: Not sure what should be going into your employees’ pay packets? If they’re covered by a modern award, try using the Fair Work Ombudsman’s Pay and Conditions Tool (PACT) to calculate their pay rate, shift work and leave entitlement.

Work Out What Tax You Need to Deduct from Your Employee’s Pay

You will need to meet your PAYG withholding obligations, to stay on the right side of the ATO..

Are you not sure how much tax to collect? The Tax withheld for individuals' calculators can help.

Calculate Your Employee’s Super Entitlement

For your employees you will need to identify which super fund will need to be used as default, in case they do not have a preferred provider. So before they start, it is mandatory to keep this ready.

The superannuation obligations will include paying the super guarantee. To help you work out on the correct entitlements the ATO has a guarantee contributions tool .

Understand Your Obligations Under Single Touch Payroll (STP)

STP means you need to report payroll information to the ATO in real-time with each pay run. To help you get onboard, the ATO has made concessions for employers with less headcount (1-4 employees).

Know the Difference Between an Employee and Contractor

For super purposes and tax, employees and employers are treated differently. Getting it wrong can incur penalties.

Use the ATO’s employee/contractor decision tool to know where a worker fits.

Decide Pay-Schedule

Payment schedules can either be weekly, fortnightly or monthly. To make sure you are not late in making payments, set reminders or schedule recurring payments by direct deposit.

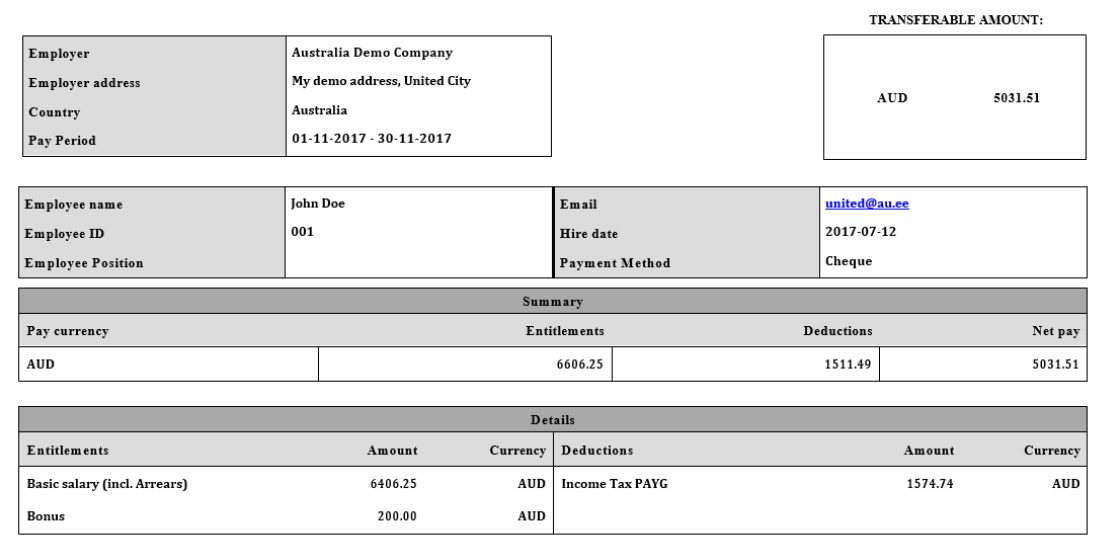

Get Across Your Payslip Responsibilities

After each payrun, the employer shall issue payslips to their employees.

- In electronic form or hard copy.

- Within one working day of pay day.

- With specific details included.

Payslip Example

Record Keeping

For all your employees, under the workplace laws you have to keep accurate and complete records for 7 years, even if any employee leaves. Ensure that your payroll system backups your data.

Employment Laws In Australia

Annual Leave

An employee accumulates 4 weeks of paid annual leave for each year of service with the employer. Thus, an employee's entitlement to annual leave accumulates continuously based on the number of ordinary hours they work. Annual leave continues to be paid when an employee takes a period of paid annual leave or paid personal leave.

Parental Leave

A parent can get a parental leave pay for up to 18 weeks. Parental leave pay is currently $740.60 per week before tax. It is based on the weekly rate of the national minimum wage. A partner may also be eligible for dad and partner pay for up to 2 weeks. It means a family can receive a total of up to 20 weeks' pay.

Sickness

Sick and carer's leave let the employee take time off to help them deal with personal illness, caring responsibilities, and family emergencies. For example, sick leave can be used when an employee is ill or injured. Full-time and part-time employers get 10 days of sick and carer's leave for each year of employment.

Compassionate and Bereavement Leave

All employees are entitled to 2 days of compassionate leave each time an immediate family or household member dies or suffers a life threatening illness or injury. The compassionate leave can be taken as,

- A single continuous 2 days period, or

- 2 separate period of 1 days each, or

- Any separate periods the employee and the employer agree.

Family and Domestic Violence Leave

An employee is entitled to 5 days of unpaid leave each year under the NES. All employees are entitled to 5 days unpaid family and domestic violence leave each year. The entitlement to unpaid family and domestic violence leave comes from the National Employment Standards(NES).

Long Service Leave

An employee gets long service leave after a long period of working for the same employer. Most employees' entitlement to long service leave comes from long service leave laws in each state or territory.

These laws set out,

- How long an employee has to be working to get long service leave

- How much long service leave the employees get

Payroll Tax (PayG) and Income Tax In Australia

Calculating payroll tax can be difficult & often results in underpayments, fines & penalties. Alternatively, many companies are unaware that they qualify for government relief, concessions & incentives that could save them thousands.

What is Payroll Tax (PayG) in Australia?

Payroll tax is a tax imposed on the wages payable or paid to the employees and when their total Australian wages exceed the threshold. In addition, some states have weekly, monthly and yearly thresholds, so make sure you are registering for payroll tax wherever necessary.

Recently, efforts have been taken in Australia to harmonise payroll tax for more administrative flexibility for businesses in multiple states and territories.

It's also important to note that if you are a member of a group of employers, it is essential to note that the threshold calculation is based on the combined annual Australian taxable wages.

What Is Considered Taxable Wages?

What Is Not Considered Taxable Wages?

- Paid maternity, adoption or primary carer leave

- Paid parental leave

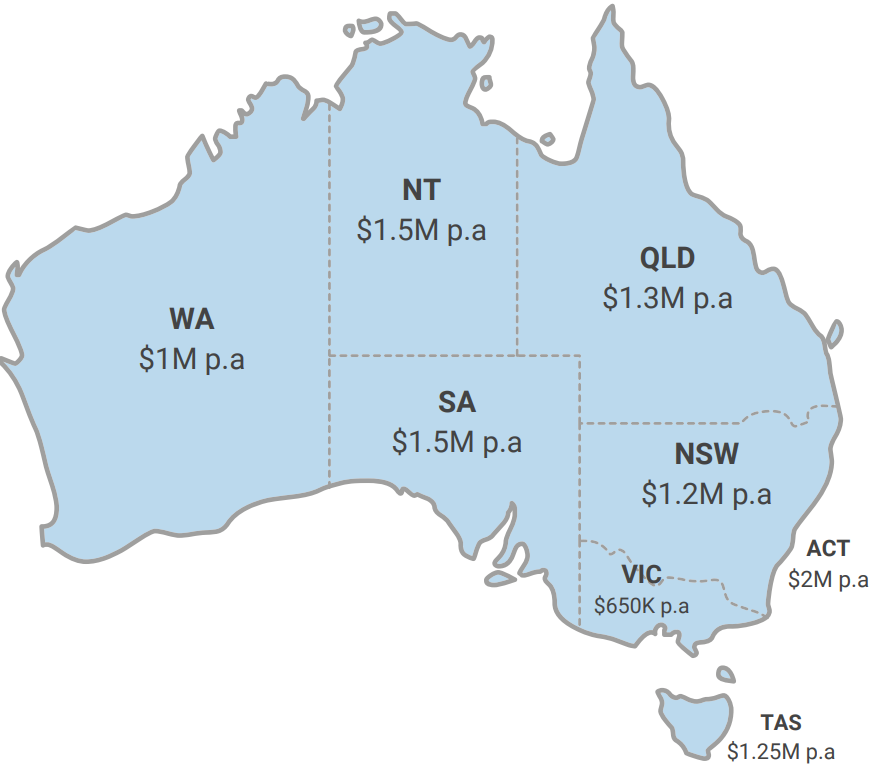

Payroll Tax Rates and Thresholds 2020-21

The own rates of payroll tax and the thresholds are set by each territory and state, which must be surpassed for payroll tax to be paid or payable. Below are the applicable rates and thresholds,

How Often Do I Need to Pay Payroll Taxes?

By the 7th of each following month, most states require you to lodge and pay the payroll tax. Based on specific criteria, some states allow quarterly, half-yearly, or annual filing.

How to Register for Payroll Tax?

The following information is required to register for payroll tax in Australia:

- your business ABN;

- For the current financial year total Australian wages;

- The business operates in wages paid in each state or territory;

- an estimate of next year's wages; and

- if your business is part of a group, you will need the group's total Australian and state or territory-based wages.

Each state and territory has its application process – please refer to your state or territory's Revenue Office website for details.

Click here to know more about the registration process for each state and territory in Australia.

Ways to Pay Payroll Tax in Australia

Electronic Payment Authority (EPA)

If you make payment via EPA, all payment is made via electronic fund transfer from your authorized bank account. Within RevenueSA Online, the electronic payment is initiated and authorized by a user after submitting a monthly or annual return.

This facility makes sure that each month your tax is allocated to your account correctly, thereby avoiding penalties/interests for incorrect allocation.

Click here to find out more about making payments using the Electronic Payment Authority.

Electronic Funds Transfer (EFT)

From RevenueSA, online payment advice is generated after submitting your return. You can use the information from the payment advice to make a payment through EFT with your financial institution.

Click here to find out more about making payments using Electronic Funds Transfer.

BPAY

From RevenueSA, Online payment advice is generated after submitting your return. Ensure that the correct biller code and reference number are printed on the payment advice used if you make payment by BPAY.

It will male the correct allocation of the payment. If an incorrect number is used, the payment may not be allocated and will intend penalties/interests.

Please note for each return, the payment reference number will be different.

Click here to find out more about making payments using BPAY.

Cheque

From RevenueSA, Online payment advice is generated after submitting your return. The cheque must be payable to the Commissioner of State Taxation if you make payment by cheque.

Via mail, the cheque payment can be made. In all instances, the cheques can be accompanied by a payment advice slip.

Click here to find out more about making payments using a cheque.

Different Forms for Payroll Tax

Register for payroll tax online

Register for Payroll Tax Online

RevenueSA Online

Change to RevenueSA Online Administrator Notification Form

Payroll Tax Electronic Payment Authority (EPA) Application

Apply for an exemption

Payroll Tax Exemption Application

Apply for a grouping exclusion

Application for Grouping Exclusion

Apply to receive a payroll tax refund by direct credit

Payroll Tax Refund Direct Credit Form

Employment agency contract declarations

Employment Agency Contracts – Chain of On-hire Declaration

Employment Agency Contracts – Declaration by Exempt Client

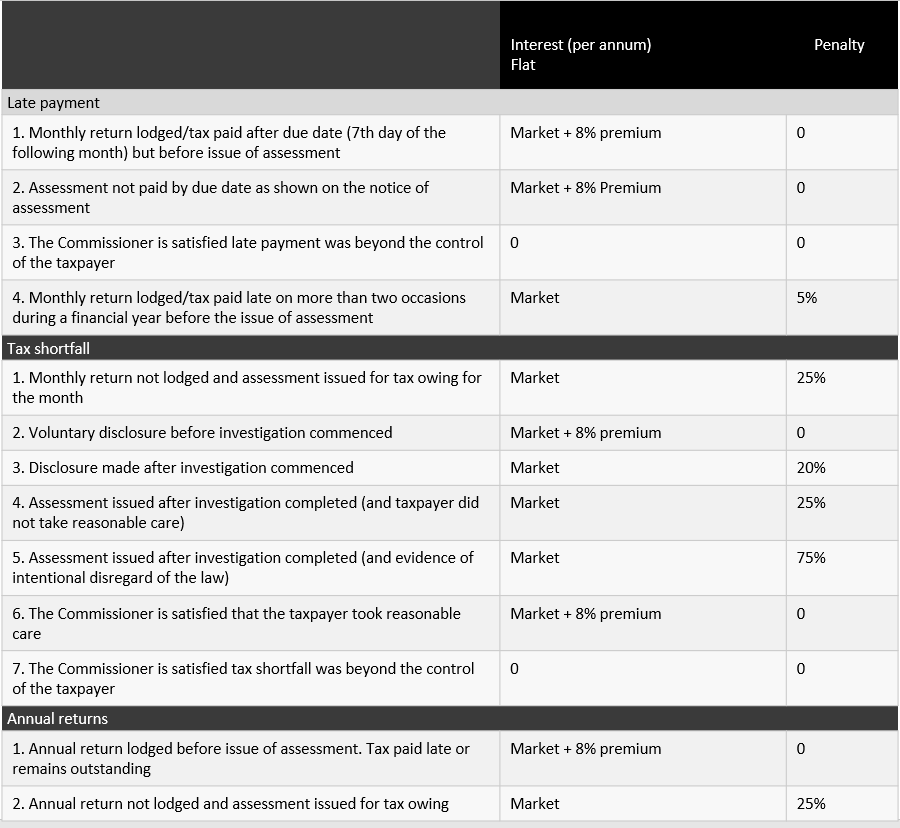

Payroll Tax Penalties and Interests in Australia

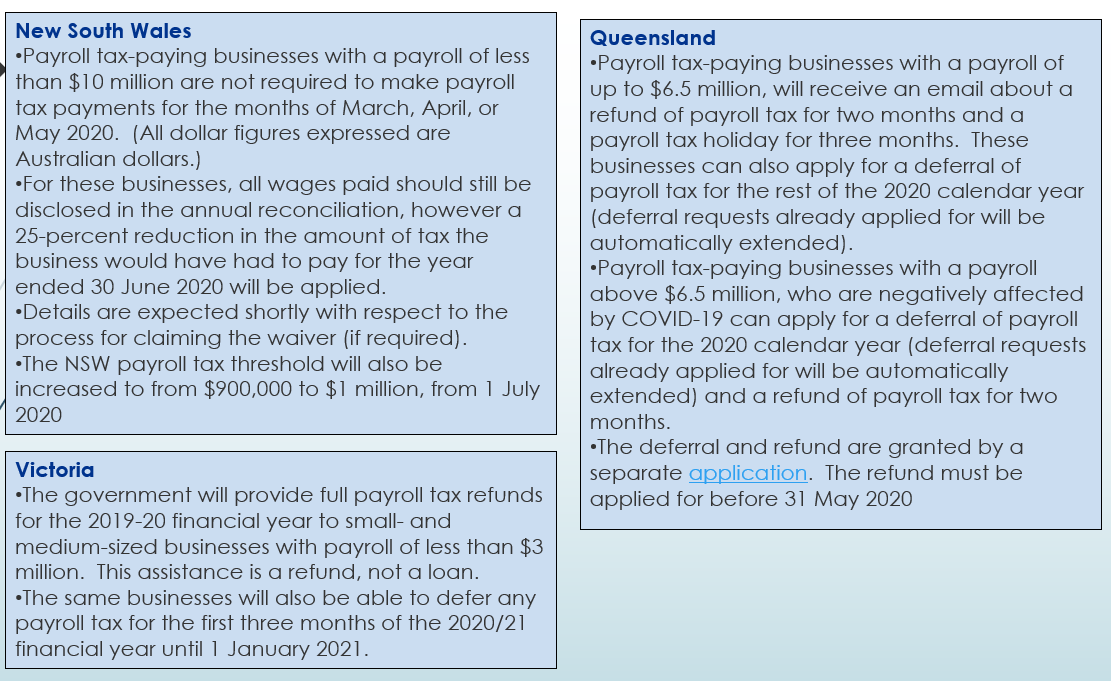

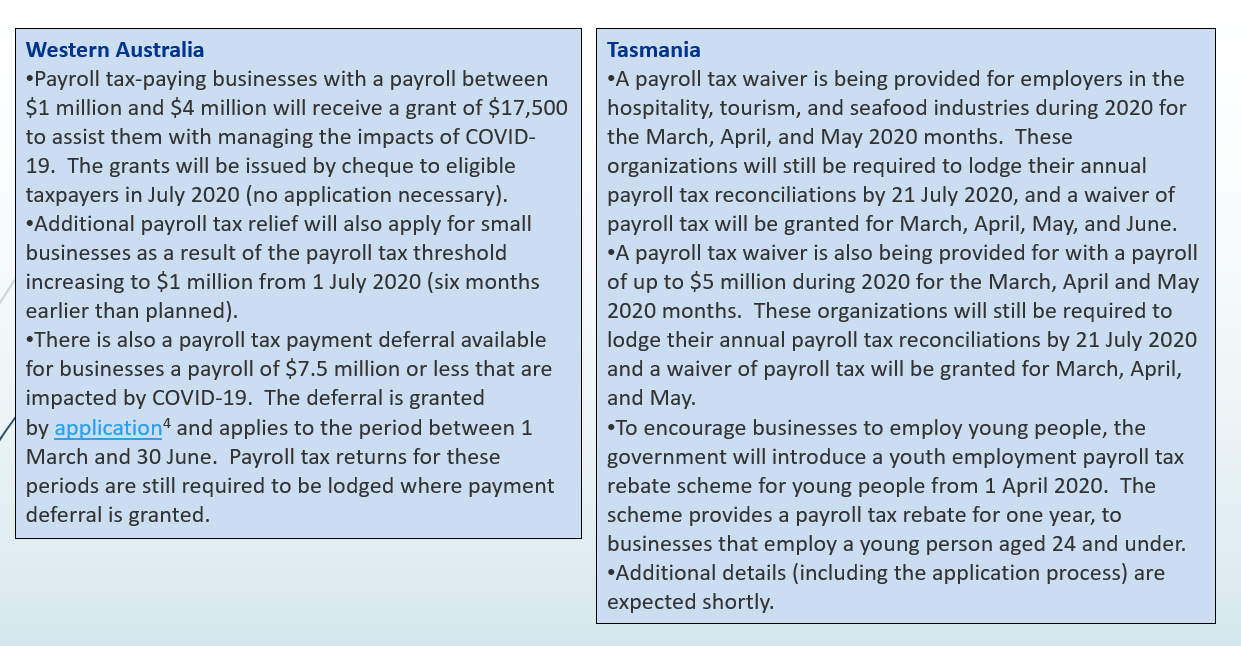

Tax Relief in Australia & Additional Information

The Australian Taxation Office (ATO) and State Revenue authorities are working with both the federal and state governments to implement a broad range of measures and provide relief to employers.

The various payroll tax-related measures will bring welcome relief for businesses. While most measures are targeted at affected industries (such as tourism and hospitality), small to medium enterprises and not-for-profits, there are some measures which apply to all affected businesses (e.g., deferrals in Queensland). Each state and territory approach is different, so it will be important that tax and finance teams are able to clearly communicate to their business what support may be available.

Click here to understand more about Payroll Tax in Australia

How Is PayG Applicable to Deskera People?

In Deskera People The Pay as you go(PayG) withholding is the income tax being withheld every pay run for each employee.

Income Tax In Australia

In the tax system income tax is the most significant stream of revenue and consists of 3 main pillars:

- Personal earnings

- Business earnings

- Capital gains

To an individual’s taxable income, income tax is applied and is paid in all forms of income. This will include wages from business profits and returns from investment, your job. Income tax can also be payable to assets such as if you sell your house or assets.

Each year without paying income tax, each individual is allowed to have income of upto $18,200, which is known as the tax-free threshold. However, if your income is more than $18,200 then you will need to pay income tax.

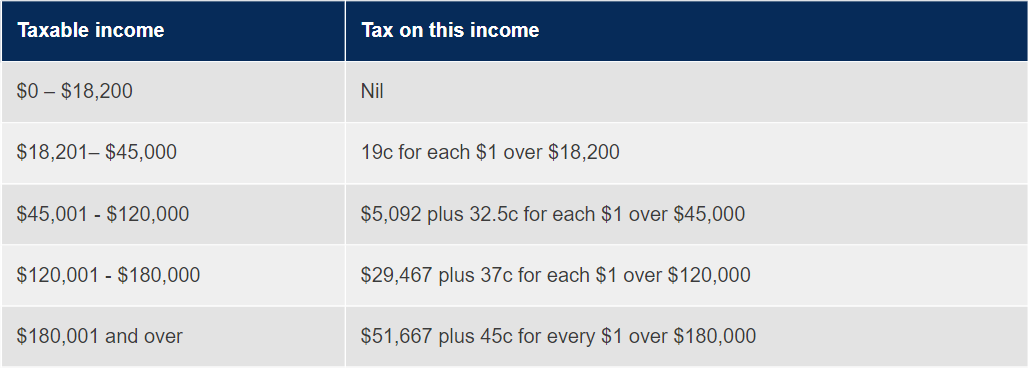

Income Tax Rates

Australia has a progressive tax system, which means that the higher your income, the more tax you pay.

Each financial year income tax from working Australians is collected by the Australian Tax Office (ATO. Financial years in Australia run from 1 July to 30 June of the following year.

Residents Income Tax Rates For 2021/2022

Note: This table does not include the Medicare levy of an additional 2% of taxable income, which applies to most residents. An additional Medicare levy surcharge of between 1% and 1.5% applies to certain higher income taxpayers not covered by health insurance for private patient hospital cover. Special rates apply to unearned income of children below the age of 18 years at year end where that income is more than AUD 416.

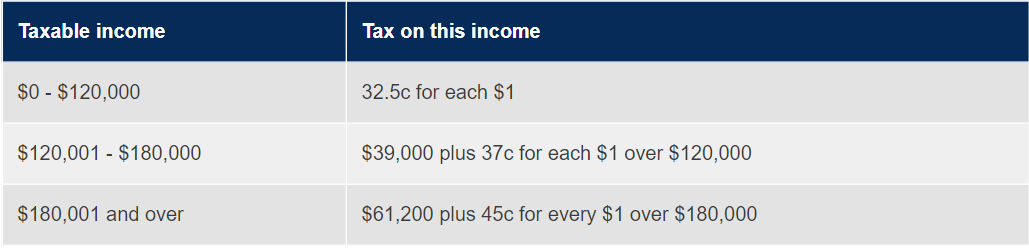

Non-Resident Income Tax Rates 2021/2022

Note: Non-residents are not required to pay the Medicare levy in Australia.

Children

If you are under 18 years of age, and get an unearned income (for example, investment income), special tax rates apply.

Lean more

Your income if you are under 18 years old

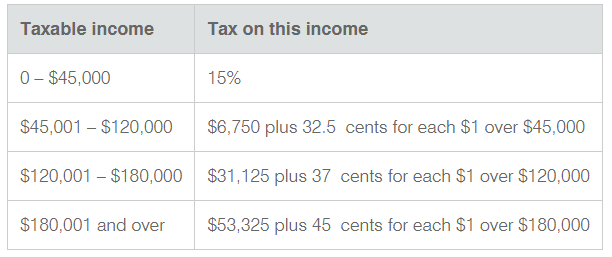

Working Holiday Makers

These rates apply to working holiday maker income regardless of residency for tax purposes.

You are a working holiday maker if you have a visa subclass:

- 417 (Working Holiday)

- 462 (Work and Holiday).

Working holiday maker tax rates 2021–22

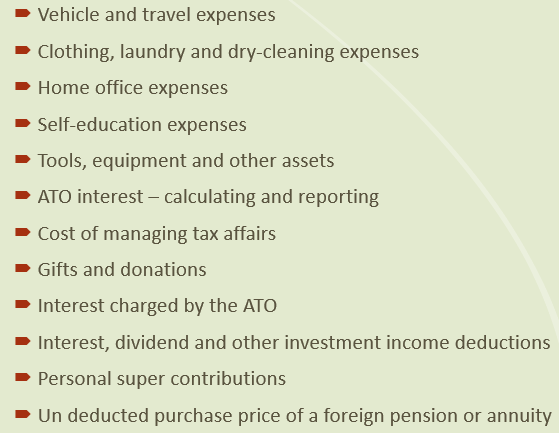

Deductions You Can Claim

Apart from recording your income, during the year you can also use tax returns to claim deductions for specific expenses incurred by work. These deductions will reduce your taxable income and this is the reason many people get a tax refund when they lodge their tax return.

The very common deductions are those related to money spent as part of your work. Example, if you spend money in order to do your job, like paying for travelling, purchasing uniforms or ongoing education expenses, you may be entitled to claim that cost as a tax deduction.

Examples of some of the deductions you may be able to claim include:

To learn more about claiming your deductions click here

Who Has to File a Tax Return?

Taxpayers who must submit a tax return include:

- For the income year, the resident individuals whose total income is more than $18,200 tax-free threshold.

- Regardless of income or loss, every individual carries on a business or profession.

- Any resident taxpayer earning less than $18,200 who has had tax withheld from that income through their job

Read more about lodging for the first time.

How to Pay Income Tax in Australia?

The quickest and simplest way to pay tax is with BPAY or a credit/debit card.

Ensure that every time you make a payment, you provide the correct unique payment reference number (PRN) in the reference field. This guarantees your money goes to the right account without delay.

BPAY

Biller code: 75556

Reference: Your payment reference number (PRN)

Credit/Debit Card

You will need:

- your payment reference number (PRN)

- a Visa, MasterCard or American Express card.

A card payment fee will apply.

To make a one-off payment, you can now add and update stored credit or debit card details on ATO online

Pay online

Online services

At any time online services are convenient, accessible and secure .At one place you can access a range of tax and super services by registering with Online services

Individuals and sole traders

Log in using myGov account linked to the ATO

Businesses

Log into Online services for business

Tax and BAS agents

Log into Online services for agents

Government EasyPay

Pay now with the Government EasyPay service

Pay by Phone

Phone the Government EasyPay service on 1300 898 089.

There are also other payment options available.

Deadline to Pay Tax Returns and Penalties for Late Tax Returns

Deadline

You need to lodge your tax return as soon as possible after 30 June and no later than 31 October each year.

Penalty

The Australian Taxation Office (ATO) may apply a "failure to lodge on time penalty" (FTL). The penalty is calculated at the rate of one penalty unit for each period of 28 days or part thereof that the return is overdue, up to a maximum of five penalty units.:

- 1-28 Days Past Deadline = $222

- 28-56 Days = $444

- 57-84 Days = $666

- 85-112 Days = $888

- 113 Days or more = $1,110

This FTL penalty calculation applies for small businesses only. Taxpaying businesses classified as medium (assessable income of more than $1 million and less than $20 million) will have the fine factor multiplied by two and entities classified as large (assessable income over $20 million) will have the fine amount multiplied by five.

The ATO is more likely to apply a penalty if:

- you have more than one tax return outstanding

- you have a poor lodgement history, or

- you have not complied with a request to lodge your tax return.

Study Training and Support Loans(STSL) in Australia

The government provides financial assistance (in the form of loans) like STSL to people undertaking higher education, trade apprenticeships and other training programs.

Information on the different types of loans that fall into the STSL category can be found here. From 1 July 2019, all study and training loans were consolidated into one set of thresholds and rates. In addition, the hierarchy in which compulsory repayments are applied to study and training loans (relevant to employees who have more than one type of loan) was changed to the following:

- Higher Education Loan Program (HELP);

- VET Student Loans (VSL);

- Student Financial Supplement Scheme (SFSS);

- Student Start-up Loan (SSL);

- ABSTUDY Student Start-up Loan (ABSTUDY SSL);

- Trade Support Loan (TSL).

The withholding amounts for employees who have a study and training support loans debt can be expressed in a mathematical form.

Study and training loan repayment thresholds and rates 2021-2022

Note repayment income (RI) is taxable income plus any total net investment loss (which includes net rental losses), total reportable fringe benefits amounts, reportable super contributions and exempt foreign employment income.

To learn more about STSL click here.

How Is STSL Implemented in Deskera People?

Deskera People has implemented STSL calculation in the system, which will auto calculate your STSL amount and make it easier for your tax calculation.

Social Security in Australia

In Australia, there are no social security taxes, however, taxpayers make contributions to the National Health Scheme (Medicare) and for retirement benefits (Superannuation).

What Is Superannuation?

Employer supported and self-employed contributions to 'complying' superannuation entities and retirement savings accounts (RSAs) in Australia play a role similar to that of social security levies.

Every employee in Australia has to participate in a superannuation fund. The fund is supported and backed by the government. Employers and employees have to contribute a fixed amount to the fund every quarter. The law is applicable for both part-time and full-time salaried employees.

Superannuation Rate

Employers must contribute on behalf of their employees' superannuation a set minimum percentage of the employee's earnings base, subject to limited exceptions, or be liable to a superannuation guarantee charge.

Since 1 July 2014, the rate of super guarantee (SG) has been set at 9.5%. However from 1 July 2021, it increases to 10%, and has been legislated to rise incrementally each year until it reaches 12% in 2025. This is good news for workers receiving superannuation.

This will progressively increase up to 12% as follows:

Your employer must pay super contributions,under the the superannuation guarantee at the rate of 10% of the employee’s ordinary time earnings, under the following conditions:

- when an employee is paid $450 or more before tax in a month and is:

- over 18 years, or

- under 18 years and works over 30 hours a week.

The examples below show how a rise to 10% could have a significant impact on your retirement outcome.

Click here to learn more about Super or Superannuation in Australia

How Is Superannuation(SG) Implemented in Deskera People?

In Deskera People Superannuation(SG) is paid to the employee’s fund while processing every payrun for each employee, so that it is accurately withheld from the company.

Medicare Levy

The Medicare levy surcharge (MLS) is applied to the income of Australian taxpayers who do not have an appropriate level of private healthcare cover.

For most Australians healthcare is essentially free. If you get sick and you need to go to the hospital, you can and it won’t cost you a cent. That’s because we have the Medicare Levy which most people pay each week out of their salary. This levy goes towards funding hospitals, doctors, nurses and other health related costs that come with providing free healthcare to all Australians.

Who Pays the Medicare Levy?

In most of the recent tax year, if you earn more than $28,501, you will need to pay the Medicare Levy at 2&% of your taxable income.

Using some very simple numbers:

How Much Is the Medicare Levy Surcharge?

Singles earning more than $90,000 a year and couples, families and single parents earning more than $180,000 a year may have to pay the Medicare Levy Surcharge. The surcharge rate increases with your income, as the table below shows.

Click here to learn more about Medicare Levy.

Single Touch Payroll (STP) Reporting

Using STP, employers can report their employees’ salaries and wages, pay as you go (PAYG) withholding and super information, at the same time they pay their employees.

Single Touch Payroll (STP) is a new way of reporting tax and super information to the ATO. It is a government initiative to streamline employer reporting obligations.

How Does It Work?

When you start reporting:

For the first time, through STP, you will be reporting super liability information. Super funds will also be reporting to ATO. When you make payment to the employees, they will let ATO know to choose or default fund. This step will make sure that employees are paid their correct entitlements.

To the employer and employee record, the ATO system will match the STP information. You will no longer have to give your employees a payment summary for the information you’ve reported and finalized through STP. Once you finalize your data, your employees or their registered agent will be able to lodge their income tax return using the STP information available in ATO online.

When It Begins?

From 1 July, 2018, Single Touch Payroll is mandatory, if you have employees 20 or more.

From 1 July, 2018, Single Touch reporting is mandatory if you have 19 employees or less.

The Australian Income Tax year ends on 30 June.

Start reporting any time from 1 July – 30 September 2019.

For more information about Single Touch Payroll click here.

Refer to the video tutorial for how to set up a Australian Payroll in Deskera People

Selling in the Australia? Head over to our guide on GST and BAS Reporting in the Australia.

Conclusion

Deskera People is a payroll software developed especially for small and medium enterprises (SME). Deskera People also supports auto computation for Australian PayG Withholding Tax, Income Tax, and Superannuation Contributions.

Sign up for a free trial of Deskera People now!