Are you running a shop or a commercial establishment in Andhra Pradesh? Or are you involved in the HR compliance of one? Then you will need to know your Shops and Establishments' compliances. One of these compliances is the Andhra Pradesh Form XII Register of Advance of Wages.

Most commercial establishments come under the Shops and Establishments Act. The Act regulates different aspects of running a business, including wages, work hours, holidays, and leaves. You will need to know the requirements of your state's Shops and Establishments Act and Rules for your HR compliances.

The Form XII Register of Advance of Wages is a register you must maintain under these rules.

This article will help you understand:

- What Is the Andhra Pradesh Form XII Register of Advance of Wages?

- Does the Form XII Register of Advance of Wages Apply to Your Business?

- Why Do You Have to Maintain the Form XII Register of Advance of Wages?

- What Are the Requirements for the Form XII Register of Advance of Wages?

- What Are the Details Needed for the Form XII Register of Advance of Wages?

- Register of Advance of Wages: What Are the Related Registers to be Maintained?

- A Register of Employment in Form XXII

- A Register of Wages in Form XXIII

- A Register of Leave in Form XXV

- Form XII Register of Advance of Wages: Related Compliances

- A Notice of Holidays

- A Notice of the Shops and Establishments Act and Rules

- Form XII Register of Advance of Wages: Things to Keep in Mind

- Form XII Register of Advance of Wages: Best Practices

- Wrapping Up

- Key Takeaways

What Is the Andhra Pradesh Form XII Register of Advance of Wages?

The Form XII Register of Advance of Wages is a record that you must maintain of all advances made to employees and the details of repayments of advances. It is a compliance requirement for shops and establishments operating in Andhra Pradesh. It is laid down by Rule 18 of the Andhra Pradesh Shops and Establishments Rules.

The details of this must be maintained in the Register of Advance of Wages in Form XII.

Does the Form XII Register of Advance of Wages Apply to Your Business?

The Form XII Register of Advance of Wages applies to your business or establishment if it comes under the Shops and Establishments Act.

A business comes under the Shops and Establishments Act if it fits into the category of a shop or establishment under the Act. A shop is any premises where goods are sold, or services are rendered to customers. This could include an office, workplace, or a place where goods are stored.

A commercial establishment refers to a premise where a trade, business, profession, or related work is made. This could include:

- theaters and cinemas

- restaurants

- hotels

- places of public amusement or entertainment

- a society

- printing and media establishments

- contractors

- private educational institutes

- a place where banking, insurance, or stock-related business is carried on

Why Do You Have to Maintain the Form XII Register of Advance of Wages?

The Form XII Register of Advance of Wages is required by Rule 18 (4) of the Andhra Pradesh Shops and Establishments Rules. The Register of Advance of Wages is a way to record the details of advances of wages paid to employees and ensure clear records are maintained regularly.

Rule 18 lays down certain conditions and regulations for the advance of wages paid by an employer to an employee. The Register of Advance of Wages in Form XII records the details of advances to preserve these records for Rule 18 compliances.

These are:

- The advance of wages should not exceed the employees' wages of the past 2 months or (in case he has not worked for 2 months prior) the wages of the next 2 months

- An advance made may be recovered by making deductions from the employee's wages in regular installments

- The installments should not be more than one-fourth of the wages for a wage period

- The amounts of the advances and repayments should be recorded in the Register of Advance of Wages in Form XII

What Are the Requirements for the Form XII Register of Advance of Wages?

When keeping the Form XII Register of Advance of Wages, you will have to follow certain compliances. These are:

- The details of the amounts of all advances and the repayments of the advances shall be entered in the Register of Advance of Wages in Form XII

- For all register and records, including the Register of Advance of Wages, the entries for a particular day have to be made that day itself and should receive the employer's signature for validation

- Any entries to do with overtime work shall be made for both the date when overtime work begins and the date when overtime work ends

- The Register of Advance of Wages in Form XII has to be kept for 3 years after the final entry

- The entries made in the registers and records should be in English or the language spoken by most of the employees

- The Inspector will check that all the required registers and records are maintained

- A Visit Book must be kept for when the Inspector visits the shop or establishment so that he can enter any comments about any non-compliances or convey instructions for records and documents

What Are the Details Needed for the Form XII Register of Advance of Wages?

The details needed for the Form XII Register of Advance of Wages are as follows:

- Name of the employee

- Name of the employee's father

- Amount of the advance given

- The reason for which the advance was given

- The number of installments through which the advance will be recovered

- Details of any postponement given for the advance, the date on which it was allowed, and the date on which the full amount was repaid

Register of Advance of Wages: What Are the Related Registers to be Maintained?

In addition to the Form XII Register of Advance of Wages, various related registers need to be maintained by the employer of a shop or commercial establishment. These include:

A Register of Employment in Form XXII

This contains details of all the employees and includes information like:

- The names and addresses of the employees

- The duration of employment

- The start date and end date of their employment

- The nature of their employment

- Other factors like the gender and age of the employee

A Register of Wages in Form XXIII

This contains details of the wages paid to each of the employees. It includes details like:

- Name of the employee

- The date that they were appointed or employed

- Rate of wages - the rate of wages paid for the work done

- Normal wages earned - this is the basic salary or wages without including other monetary benefits

- Wages earned for overtime work - this is the amount of wages earned for any overtime work done

- Gross wage payable - this includes not just the salary but all monetary benefits such as advances and incentives as well as the cash value of non-monetary benefits like a gift

- Deductions, if any, and reasons for it - this refers to the deductions made from wages

- Actual wages paid - the amount of wages paid to the employees after deductions and taxes

- Date of payment - the dates of the various payments made

A Register of Leave in Form XXV

This contains details of leave given to employees and includes information like:

- The name and address of the shop or establishment

- The name of the employee

- The name of the employee's father or husband

- The date that the employee was appointed

- The date on which he or she requested for leave

- The date on which the leave request was approved

- The start date and end date of the leave taken by the employee

- The number of days or duration of the leave granted

- The number of days of leave which the employee is entitled to during the calendar year

- The reason that was given for applying for leave

Form XII Register of Advance of Wages: Related Compliances

In addition to the Form XII Register of Advance of Wages and other registers to be kept, there are related compliances. These notices must be maintained to ensure that the employees are informed about important HR policy that concerns them. These notices include:

A Notice of Holidays

The Andhra Pradesh Shops and Establishments Rules require an employer to put up a notice of holidays in Form XXIV

- This notice must mention the day or days of the week on which the employees will be given a holiday

- It should be put in a place where it is visible to all the employees whom it concerns

- It should be put up in the week just before the week that it will start to take effect

A Notice of the Shops and Establishments Act and Rules

This is a notice that an employer has to put up, displaying the Shops and Establishments Act and Rules.

- It should contain the abstract of the Andhra Pradesh Shops and Establishment Act and Rules

- It should mention any further rules or directions passed by the government under the Act

Form XII Register of Advance of Wages: Things to Keep in Mind

There are certain things to keep in mind when you maintain the Form XII Register of Advance of Wages. These are as follows:

- The Form XII Register should be kept complete and up-to-date

- It should be kept with an officer who is nearby or who works in the establishment

- If the Inspector requests to check the Form XII Register, it should be produced for his inspection

Form XII Register of Advance of Wages: Best Practices

Maintaining HR records and registers is not just obligatory compliance. It's also a helpful business practice.

Recording details about employees and payments made to them is a good way to keep track of HR information, payroll expenses, and information that is useful for payrolls and taxes.

Keeping the Form XII Register of Advance of Wages helps you keep track of important payment details such as:

- All the advances you have extended to employees

- The exact amount of each advance of wages

- The date when the advance was granted

- How much of the advance has been repaid

- Whether it has been repaid in total

- The date when it was repaid in total

- The reason the employee gave for asking for an advance

It is helpful for a business to keep track of details such as:

- The mode of repayment of advances

- The number of installments in which the advance was repaid

- The amount of each installment

- The employee's history of taking advances or whether he or she has requested an advance before and how many advances have been requested

- Name, address, and contact of the employee who requested an advance

In addition, the Form XII Register ensures that there is regular entering of details about advances so that no details are omitted or forgotten, and the register is kept updated.

Wrapping Up

The Andhra Pradesh Shops and Establishments Act and Rules lay down certain compliance requirements for shops and commercial establishments in Andhra Pradesh. The Form XII Register of Advance of Wages is one of these compliances. It is a register that an employer needs to maintain of all the advances granted to employees, along with the repayment details.

Maintaining the Form XII Register of Advance of Wages is also helpful as a good HR practice as it helps record important details of payments made as advances to employees.

How can Deskera Help You?

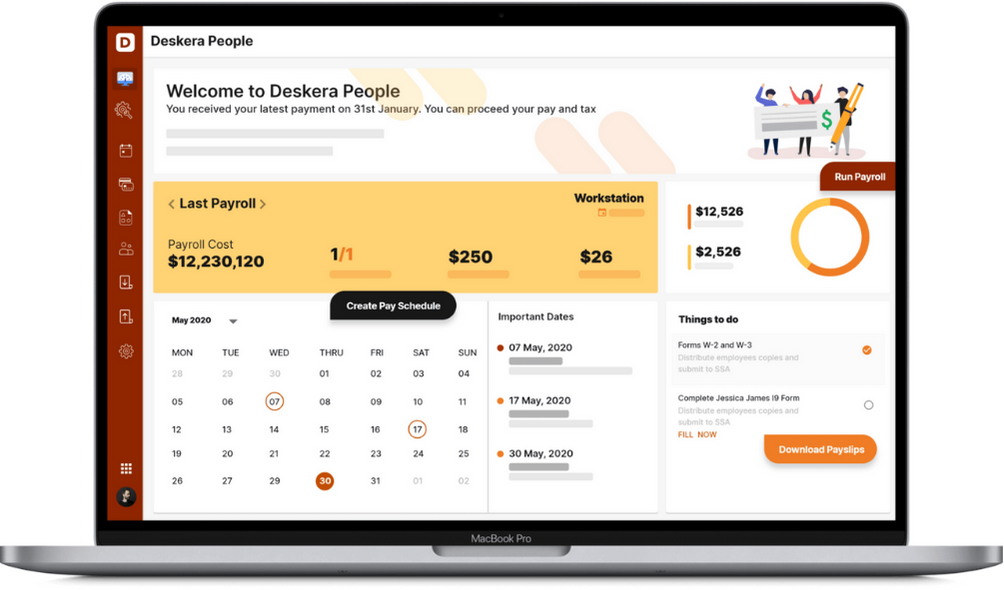

Deskera People has the tools to help you manage your payroll, leaves, employee onboarding process, and managing employee expenses, all in a single system. With features like a flexible payment schedule, custom payroll components, detailed reports, customizable pay slips, scanning, and uploading expenses, and creating new leave types, it makes your work simple.

Key Takeaways

- The Form XII Register of Advance of Wages is a record of wages advanced to employees that you need to maintain as an employer

- The Form XII Register is a requirement under Rule 18 of the Andhra Pradesh Shops and Establishments Rules

- It requires various details about advances, such as the amounts of advances given to employees, the dates they were given, and the reason for requesting an advance

- Along with the Form XII Register of Advance of Wages, other registers and notices form a part of the Shops and Establishments compliances

- These include a Register of Employment, Register of Wages, and Register of Leave

Related Articles