Businesses have a lot of finances going around as they operate. Accounting keeps track of every penny that moves in the ecosystem of a business, making it easier to understand resource allocation and file for taxes. Filling out accounting forms also requires that businesses trace their funds properly.

Forms 1099-MISC and 1099-NEC are also two forms used in accounting, both for different purposes. Both these forms are prescribed by the IRS – and businesses that fulfill a certain criteria need to fill out both these forms and send them in along with other accounting documents.

Form 1099-MISC stands for Miscellaneous Information, and form 1099-NEC is the short form for Non-Employee Compensations. Businesses that have expenses that can’t be categorized as regular or recurring are usually filed under these two forms (for example, expenses incurred for availing of services from a consultancy; expenses are one-off and won’t be incurred again soon). Both these forms generally account for payments made by the business, not a person.

Let’s cover the following topics to understand Form 1099-MISC vs. Form 1099-NEC in a better light:

- What is Form 1099-MISC?

- How to File Form 1099-MISC

- Current Status of Form 1099-MISC

- What is Form 1099-NEC?

- How to File Form 1099-NEC

- Submitting Form 1099-NEC to The Contractor

- Submitting Form 1099-NEC to The State

- Who Needs to File Form 1099-NEC?

- What is The Deadline for Form 1900-NEC?

- Penalties for Delaying Form 1099-NEC

- How Can Deskera Help you?

What is Form 1099-MISC?

The “MISC” in the form title denotes Miscellaneous Information regarding compensation that business makes to entities other than the regular expenses of the business. For example, compensation paid towards healthcare payments, awards or prize money, rents or payments made to a legal counsel / attorney can be considered as expenses that need to be included in 1099-MISC form.

Before the tax year of 2020 began, businesses were required to fill out their 1099-MISC form to reflect compensations made to independent parties (like freelancers, contractors, sole proprietors, self-employed professionals and similar professionals). However, a separate form has now been introduced to inform the IRS of such payments – businesses need to fill out the new form for non-employee based compensations. The form 1099-MISC no longer covers these numbers; it, however, still needs to be filled out for other information.

It does increase the number of forms that a business needs to fill out by stipulated deadlines; however, things have become more sorted with two dedicated accounting forms reflecting different nature of compensations that go out from the accounts of a business.

Form 1099-MISC, although discontinued for non-employee based payments, still needs to be filled out and sent to the IRS.

How to File Form 1099-MISC

Form 1099-MISC is downloadable from the IRS website. The latest, updated form 1099-MISC consists of the following parts:

- Copy A, which is displayed in red ink and is not supposed to be filled out by the business – this copy is intended for IRS use only

- Copy 1, which is supposed to be filled by the business and goes to the sales tax arm of the business

- Copy B, which is sent to the entity to whom the compensation was made (contractor, freelancer, etc.) for their record

- Copy 2, which is also supposed to be sent to the recipient to help them with their tax return filings

- Copy C, which is supposed to be retained by the business for their own record

The Copy 1 of Form 1099-MISC requires the following information to be filled out by the business:

- Name and complete address, along with the ZIP code, of the payer. The SSN (Social Security Number) may also need to be given

- Details of the recipient

- Details of the kind of incomes gained (rents, royalties, other incomes, fishing boat proceeds, crop insurance proceeds, etc.)

- Details of the kind of compensation made, like medical or healthcare payments, proceeds paid to an attorney, deferrals, withheld Federal income tax, etc.

Current Status of Form 1099-MISC

As of the beginning of the tax year 2020, form 1099-MISC has been modified a little bit. Although businesses still do need to fill it out, the details to be furnished therein have changed. Earlier, this form required businesses to enlist the miscellaneous compensations made to non-employed individuals from which services were availed – now, there is a separate form to fill these details. The form 1099-MISC deals purely in compensations made towards other expenses that do not fall under employee-related or non-employee related (such as rents, awards and prizes, etc.)

However, this doesn’t mean that the form is discontinued – only certain information that earlier was a part of this form now has its own dedicated form. The Form 1099-NEC is the new form for enlisting non-employee compensations. Let’s learn about that now.

What is Form 1099-NEC?

NEC is the acronym for Non-Employee Compensation. The form 1099-NEC records the payments that a business makes to non-employed professionals from whom the business has availed of services. The 1099-NEC form was introduced in the tax year of 2020, after discontinuing the filing of these details in the form 1099-MISC (these details were supposed to be filled into Box-7 of 1099-MISC earlier).

Form 1099-NEC is a reworked design of the same form that was in use in the year 1982. There were two good reasons behind deciding to introduce a separate form for non-employee related details.

- The 1099-MISC form had different deadlines for non-employee compensation portion and other payment types, creating confusion among the payers – this needed to be addressed

- The second reason was frequent fraudulent filings practiced by businesses. The same form addressed higher quanta of withholdings and meager employee compensations, which led to the individuals claiming higher refunds than were legally and logically due to them. There was no way for the IRS to tally recipient details with the one in the form. This needed to be corrected, thus a separate form was reintroduced

Form 1099-NEC not only helps the IRS prevent fraudulent refunds as far as possible, but also helps businesses keep their books clean.

How to File Form 1099-NEC

Form 1099-NEC is available for download from the Internal Revenue Services (IRS) website. The latest form dated January 2022 contains a total of 8 pages and 5 sheets to be filled with relevant information. These five sheets are:

- Copy A, which is displayed in red ink and is not for the business to fill out. This form is for informational purposes only and is meant for use by the IRS

- Copy 1, which is meant to be sent to the sales tax department

- Copy B, which is meant for the recipient

- Copy 2, meant to be filed with the state sales tax when it is due to be filed

- Copy C, meant to be retained by the payer for record

Form 1099-NEC is required to be filed in two copies, A & B, with the same information – one of which goes to the IRS and one to the contractor. To file the form, you would require the following information ready at hand:

- Full and current address

- Identification number for the business – TIN/SSN/EIN

- Business entity, whether corporation, sole propriety, partnership, etc.

- Legal name of the business

As a contractor providing services to a business, you don’t need to fill 1099-NEC as the business will fill it and provide you with your copy.

Filing Physically

If you are opting to file Form 1099-NEC physically, you will first need to obtain a physical copy of the form. This can be done by sending in a request to the IRS on their website. Choosing to submit a physical form 1099-NEC also requires you to submit form 1096 as a cover sheet. Ensure that both the forms are filled out accurately before you mail them to the IRS.

Filing Electronically

Form 1099-NEC can also be filed electronically. The catch is that you are going to need a software or service provider that creates the electronic file in the accepted format, as scanned copies of physical documents are not accepted. Additionally, you will also need the Transmitter Control Code, which can be obtained by either mailing or faxing to the IRS the form 4419, 30 days prior to the deadline. The IRC will then provide you with your TCC, which you can use to register on FIRE for filing form 1099-NEC. On the IRS’s FIRE (Filing Information Returns Electronically) system, you can submit your form 1099-NEC.

Submitting Form 1099-NEC to The Contractor

In order to send the form 1099-NEC by email, you will need to obtain a consent from the contractor to send the form over email. If the contractor does not consent, or if the consent can’t be obtained, then you will need to physically mail it to the contractor.

Submitting Form 1099-NEC to The State

You will need to check with your CPA to find out whether businesses in the area are required to file form 1099-NEC with the State as well. When done electronically, IRS simply forwards the form; however, certain states do participate in this program.

Who Needs to File Form 1099-NEC?

Form 1099-NEC is required to be filled up by all businesses that compensated another non-employed professional over $600 annually in return for their services. It could be fees, prizes, rewards, commissions or even awards offered to contractors, cash payments made to fishermen in exchange for fish, fee of attorneys, etc.

Businesses must also fill this form in case they have withheld Federal income tax from a person. It is convenient to hire an agency to handle all these filings, as the details involved can get a little overwhelming to handle by yourself.

What is The Deadline for Form 1099-NEC?

The IRS stipulates that the Form 1099-NEC should be filed and submitted before January the 31st of the following year. In case this date falls on an official holiday, the deadline moves to the very next business day. This is applicable to the Copy A of the form – the copy to be sent in to the IRS.

For the Copy B of Form 1099-NEC, the deadline is also January 31st of the following year, so that they may also complete their formalities on time.

It is imperative to send Form 1099-NEC on time to save on the penalties otherwise. Let’s see what the penalties are.

Penalties for Delaying Form 1099-NEC

The penalties laid out for delaying the submission of Form 1099-NEC depend on how late the form came through. Based on that, the following penalties are levied:

- If you are late by 30 days, the penalty is $50

- If you are late by 30 days by file before August the 1st, the penalty is $100

- If you send the application on August the 1st or any later, the penalty is $260

It is handy to know that you can file for an extension by filling up Form 8809 and sending it to IRS. This gets you an extension, but the contractors must still get their Forms 1099-NEC by January the 31st.

How Can Deskera Help you?

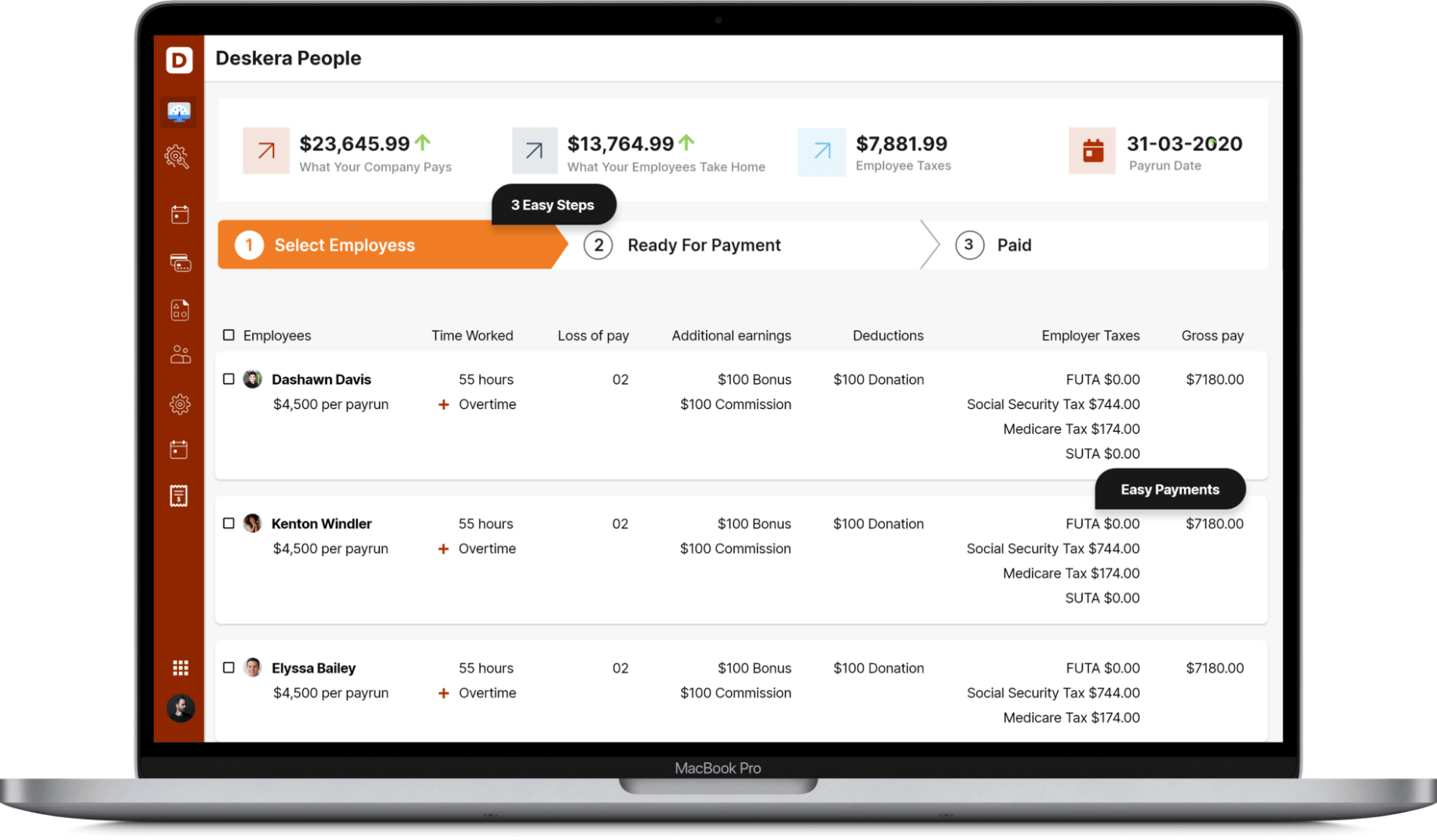

Deskera People is a cloud-based software that will help to create and assign custom pay components to an employee in light of your requirements.

Deskera People will distinguish those components assigned to the employee and naturally compute the wages taking in the specific conditions which can be designed in each component like pre and post-tax deductions.

Key Takeaways

It is understood that Form 1099-MISC and Form 1099-NEC are required to be sent to the IRS to inform them of any payments or proceeds that a business deals in that aren’t related to its employees or people on the payroll. Form 1099-MISC was modified to exclude non-employed compensation information, with a view to reduce the confusion pertaining to deadlines and fraud.

Form 1099-NEC now contains exclusively the information on Non-Employed Compensation payouts by businesses - for example, payments made to sole proprietors, freelancers, independent contractors, fishermen, etc. This form needs to be sent to the IRS and the contractor as well in two identical copies. It can be filled either electronically, or be sent physically. The last date is usually January the 31st; you may file for an extension if needed. However, the contractors still need form 1099-NEC on time - that is, by January 31st.

There is penalty if the business delays submission of Form 1099-NEC. It depends on how late the submission has been – the later the date, the higher the penalty. It starts from $50, and builds up to $260.

Related Articles