As investors and business owners alike know, financial markets are never predictable. From sudden market shifts to unexpected expenses, there is always a degree of uncertainty that makes financial planning a challenging task.

In finance, hedging has become a popular tool for managing this unpredictability. But what exactly is hedging, and how does it work?

In this article, we will explore the concept of hedging in-depth, examining its benefits, risks, and strategies. Whether you're a seasoned investor or just starting, understanding hedging can help you navigate the ever-changing landscape of the financial world with greater confidence and success.

- What is a Hedge?

- How does Hedging Work?

- Importance of Understanding Hedge in Investing

- Hedging with Derivatives

- Advantages of Hedging

- Disadvantages of Hedging

- How to Implement a Hedge?

- Common Mistakes to Avoid when Implementing a Hedge

- How can Deskera Help You

- Key Takeaways

- Related Articles

What is a Hedge?

In finance, a hedge refers to a strategy used to manage the risk of adverse price movements in an asset or investment. Essentially, a hedge is an investment made to offset the potential losses of another investment.

This can be done by investing in assets that are negatively correlated with the original investment, meaning that if the value of the original investment goes down, the value of the hedge investment should go up.

Hedging can be used in a variety of financial markets, including stocks, bonds, currencies, and commodities. The goal of a hedge is not necessary to make a profit, but rather to protect against potential losses. Hedging strategies can involve buying options contracts, futures contracts, or other derivatives and investing in other assets such as real estate or precious metals.

One of the key benefits of hedging is that it can help investors and businesses manage the risks associated with their investments or operations. For example, a business that relies on a particular commodity for its products may use hedging strategies to protect against price increases for that commodity. Similarly, an investor may use hedging strategies to protect against market volatility or to minimize potential losses in a particular investment.

While hedging can be an effective tool for managing risk, it is important to note that it also comes with its own set of risks and costs. Hedging strategies can be complex and require a deep understanding of financial markets, and they may only sometimes be successful in offsetting potential losses. Additionally, hedging can be expensive, as the cost of the hedge investment can eat into potential profits from the original investment.

How does Hedging Work?

Hedging in investing is used to manage risk by offsetting potential losses in one investment with gains in another. The goal of a hedge is not necessarily to make a profit, but rather to protect against potential losses.

There are several different types of hedging strategies that investors can use, including:

- Options: An options contract gives the holder the right, but not the obligation, to buy or sell an underlying asset at a predetermined price at a future date. Investors can use options to protect against potential losses in an asset by purchasing a put option, which gives them the right to sell the asset at a predetermined price if the price drops below that level.

- Futures contracts: A futures contract is an agreement between two parties to buy or sell an underlying asset at a predetermined price at a future date. Investors can use futures contracts to protect against potential losses in an asset by selling futures contracts to lock in a selling price.

- Short selling: Short selling involves borrowing shares of a stock from a broker and selling them in the market with the hope of buying them back at a lower price in the future. Investors can use short selling to protect against potential losses in a stock by shorting it.

- Diversification: Diversification involves investing in a variety of assets to reduce risk. By spreading investments across multiple asset classes, sectors, and regions, investors can hedge against potential losses in any one asset or sector.

It is important to note that hedging strategies can be complex and may only sometimes be successful in offsetting potential losses. Additionally, hedging can be expensive, as the cost of the hedge investment can eat into potential profits from the original investment.

Therefore, it is important for investors to carefully consider the risks and costs associated with different hedging strategies before implementing them in their investment portfolios.

Importance of Understanding Hedge in Investing

Understanding hedging is important for investors because it can help them manage risk and protect against potential losses. By using hedging strategies, investors can offset potential losses in one investment with gains in another. This can help them to mitigate the impact of market volatility and other unpredictable events that can impact their investment portfolios.

Another important reason to understand hedging is that it can help investors make more informed decisions about their investments. By understanding the different types of hedging strategies and their associated risks and costs, investors can determine which strategies are most appropriate for their individual needs and goals. This can help them build more diversified and resilient investment portfolios better equipped to withstand market fluctuations.

In addition to managing risk, hedging can also be used to generate returns. For example, some hedge funds use a range of strategies to try to generate positive returns regardless of market conditions. Understanding these strategies can be beneficial for investors who are looking to maximize returns while minimizing risk.

Hedging with Derivatives

Hedging with derivatives is a common strategy used by investors to manage risk and protect against potential losses. Derivatives are financial instruments that derive their value from an underlying asset or benchmark, such as a stock, bond, commodity, or currency. Common derivatives used for hedging purposes include options contracts, futures contracts, and swaps.

Options Contracts

These are one of the most common types of derivatives used for hedging. An options contract gives the holder the right, but not the obligation, to buy or sell an underlying asset at a predetermined price at a future date. F

or example, an investor who holds a stock that they are concerned may decrease in value can purchase a put option, which gives them the right to sell the stock at a predetermined price if the stock price drops below that level. This can help offset potential losses in the stock, providing insurance against downside risk.

Futures Contracts

These are another popular type of derivative used for hedging. A futures contract is an agreement between two parties to buy or sell an underlying asset at a predetermined price at a future date.

For example, a farmer who is concerned that the price of corn may decrease before their harvest can sell a futures contract for the delivery of corn at a predetermined price. If the corn price decreases, the farmer will be protected by the futures contract, which will allow them to sell their corn at the predetermined price.

Swaps

These are another type of derivative used for hedging purposes. A swap is an agreement between two parties to exchange cash flows based on a predetermined benchmark, such as an interest rate or currency exchange rate.

For example, a company that has issued debt in a foreign currency may use a currency swap to exchange the foreign currency cash flows for their domestic currency, protecting against potential currency fluctuations.

While derivatives can be powerful tools for hedging and managing risk, they can also be complex and carry their own set of risks. Therefore, investors need to have a deep understanding of the mechanics of different derivatives and the risks and costs associated with using them for hedging purposes.

By doing so, investors can make informed decisions about when and how to use derivatives to manage risk in their investment portfolios.

Advantages of Hedging

Here are some of the key advantages of hedging:

- Risk Management: One of the most significant advantages of hedging is that it allows investors to manage risk. Using hedging strategies, investors can offset potential losses in one investment with gains in another. This can help to mitigate the impact of market volatility and other unpredictable events that can impact their investment portfolios.

- Diversification: Hedging can also be used as a way to diversify an investment portfolio. By using a variety of hedging strategies across different asset classes, investors can spread their risk across multiple investments, reducing their exposure to any single asset or market.

- Increased Flexibility: Hedging can provide investors with increased flexibility when it comes to managing their investments. By using derivatives such as options, futures, and swaps, investors can create customized investment strategies that are tailored to their individual needs and goals.

- Potential for Higher Returns: While hedging is primarily used as a risk management tool, it can also be used to generate returns. For example, some hedge funds use a range of strategies to try to generate positive returns regardless of market conditions. This can be beneficial for investors who are looking to maximize returns while minimizing risk.

- Protection against Market Volatility: Hedging can also protect against market volatility. By using hedging strategies, investors can protect their portfolios from sudden market downturns, reducing the impact of market volatility on their investment returns.

Disadvantages of Hedging

While hedging can provide a number of advantages to investors, it's also important to be aware of the potential disadvantages and risks associated with this strategy. Here are some of the main disadvantages of hedging:

- Increased Costs: Hedging can be expensive, especially when using complex derivatives such as options and futures. Investors who use hedging strategies may need to pay fees and commissions to brokers and dealers and other transaction costs.

- Reduced Returns: While hedging can help to reduce risk, it can also reduce potential returns. By hedging against potential losses, investors may miss out on potential gains in the market, which can limit their overall returns.

- Complexity: Hedging can be complex, and requires a deep understanding of financial markets, as well as the mechanics of different hedging strategies and derivatives. Investors who need to become more familiar with these concepts may find it difficult to implement hedging strategies effectively.

- Counterparty Risk: Hedging strategies often involve contracts with other parties, such as brokers, dealers, or other investors. These contracts can carry counterparty risk, meaning that the other party may not be able to fulfill their obligations under the contract, potentially leading to losses for the investor.

- Limited Protection: While hedging can provide protection against some types of risk, it cannot protect against all types of risk. For example, hedging strategies may not be effective in the event of a major market downturn or other catastrophic event.

How to Implement a Hedge?

Implementing a hedge can be a complex process that requires careful planning and execution. Here are some key steps to follow when implementing a hedge:

- Identify the Risk: The first step in implementing a hedge is identifying the specific risk you want to hedge against. This could be market risk, credit risk, interest rate risk, or any other type of risk that is relevant to your investment portfolio.

- Determine the Hedge Strategy: Once you have identified the risk, you will need to determine the most appropriate hedge strategy to use. There are many different types of hedge strategies, including using derivatives such as options, futures, and swaps, as well as more complex strategies such as long/short equity and global macro.

- Evaluate the Costs and Benefits: Before implementing a hedge, it's important to carefully evaluate the costs and benefits of the strategy. This includes considering the potential costs of using derivatives, such as fees and commissions, as well as the potential benefits of reducing risk or generating returns.

- Implement the Hedge: Once you have determined the hedge strategy and evaluated the costs and benefits, you can implement the hedge. This may involve purchasing options or other derivatives, entering into contracts with other parties, or other activities that are specific to the hedge strategy being used.

- Monitor and Adjust the Hedge: After implementing the hedge, monitoring its performance and adjusting the strategy as needed is important. This may involve modifying the hedge to reflect changes in market conditions, adjusting the size or structure of the hedge, or taking other steps to ensure that the hedge remains effective in managing the targeted risk.

Common Mistakes to Avoid when Implementing a Hedge

Here are some common mistakes to avoid when implementing a hedge:

- Failing to Understand the Risk: One of the biggest mistakes investors make when implementing a hedge is failing to fully understand the underlying risk they are trying to hedge against. Before implementing a hedge, it's important to carefully evaluate the risk and ensure that the hedge strategy being used is appropriate for that risk.

- Using Complex Derivatives: Another common mistake is using complex derivatives without fully understanding the mechanics of how they work. This can lead to unexpected losses or other problems if the investor is not able to accurately predict market movements or other variables.

- Over-reliance on Hedging: While hedging can effectively manage risk, it's important not to rely too heavily on this strategy. Over-hedging can limit potential returns and may not provide the level of protection that the investor is looking for.

- Ignoring Transaction Costs: When implementing a hedge, it's important to factor in the transaction costs associated with buying and selling derivatives. Ignoring these costs can lead to unexpected losses or reduced returns.

- Failing to Monitor and Adjust the Hedge: Finally, one of the biggest mistakes that investors make is failing to monitor and adjust the hedge over time. Market conditions and other variables can change quickly, and it's important to adjust the hedge as needed to ensure that it remains effective in managing the targeted risk.

How can Deskera Help You?

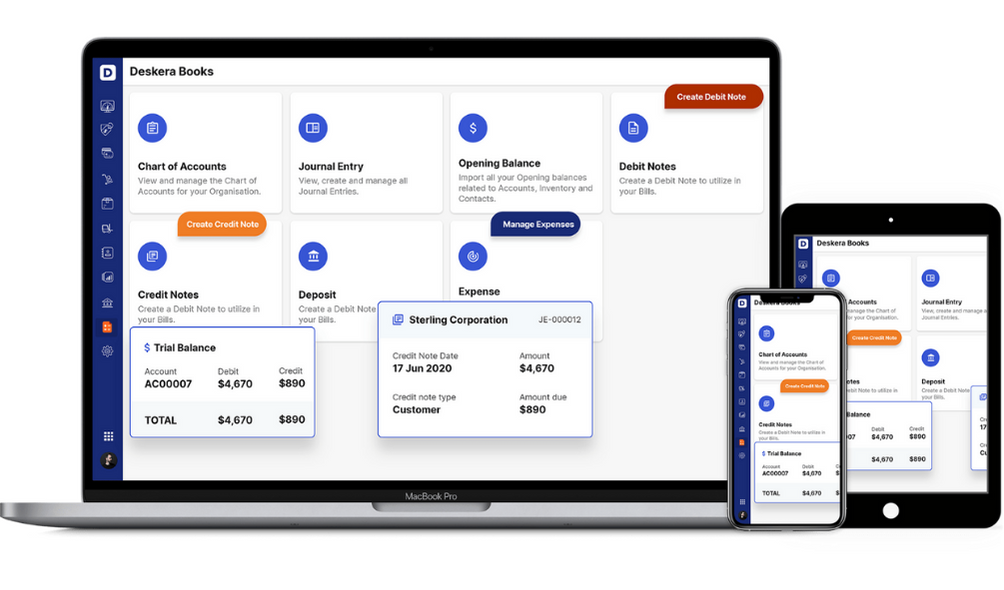

Deskera offers unified financial planning tools to assist investors in effective planning and tracking of their investments. It can assist them in making more precise and timely decisions.

Deskera Books can assist you in automating accounting and reducing business risks.

The platform also helps you with many other processes, including invoice generation, reducing your team's administrative workload.

Deskera also provides integrated applications to assist businesses with the management of their finances, inventory, and operations.

Deskera also offers administrative tools for services like HR (Deskera People), CRM (Deskera CRM), and ERP (Enterprise Resource Planning) (Deskera ERP).

Key Takeaways

- Hedging is a risk management strategy used by investors to reduce or mitigate the impact of potential losses in their investment portfolio.

- The most common way to implement a hedge is through the use of derivatives such as options, futures, and swaps.

- Hedging can help investors protect against a wide range of risks, including market, credit, interest rate, and currency risks.

- While hedging can provide a number of benefits, it is not without its drawbacks. Investors should carefully consider the costs and benefits of hedging before implementing a strategy.

- Some common mistakes to avoid when implementing a hedge include failing to understand the risk being hedged, over-reliance on hedging, and ignoring transaction costs.

- Implementing a hedge can be a complex process that requires careful planning, analysis, and execution. Investors not experienced with hedging strategies may want to consult with a financial advisor or other professional to ensure that they fully understand the risks and potential benefits of using a hedge in their investment portfolio.

Related Articles