In this article, we explain in details the definition of the multi-step income statement with examples, and also explain the type of business that uses the multi-step approach.

Last Update: 4th Aug, 2020

In this article, we will cover the definition of the multi-step income statement (also known as profit and loss statement), the example of a multi-step approach, the equations and calculations used and whether they are useful for all businesses.

This article focuses on multi-step income statement. For detailed information on income statements in general, check out this article on Income Statement.

Here are the topics that we will cover below:

- What is a Multi-Step Income Statement?

- Example of Multi-Step Income Statement

- What Is the Structure of Multi-step Income Statement?

- Types of Business that Use Multi-Step Income Statement

- Conclusion

What Is a Multi-step Income Statement?

A multi-step statement is an income statement prepared to report a company’s sales and revenue, expenses and overall profit or loss for any given period. It is a detailed report unlike the single-step income statement and utilizes multiple accounting equations to calculate net profit for a business.

Unlike the single-step income statement that uses only one accounting equation to compute the net profit, businesses will need to use multiple accounting equations to derive at the bottom line.

The report will reflect the breakdown of the company's revenue and expense accounts into operating and non-operating business activities in every multi-step income statement. Hence, it provides readers in-depth details of the income and expenses incurred during business operations.

Here are the main three accounting equations used in the multi-step approach:

- Gross Profit = Net Sales - Cost of Good Sold

- Operating Income = Gross Profit - Operating Expense

- Net Income = Operating Income + Non-Operating Items

Example of Multi-Step Income Statement

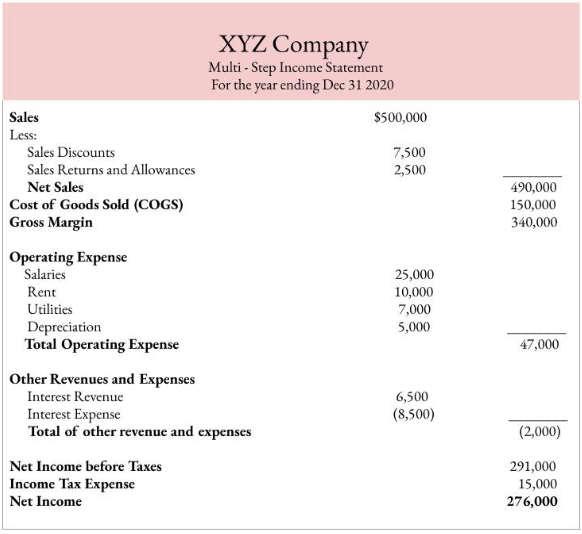

Here is one example of a multi-step income statement format for XYZ Company for the year 2020.

The labels that you observe in the image above, e.g. Sales, Salaries, Rent, Interest Revenue etc, are all stored in your chart of accounts. It is important to set the chart of accounts correctly to get the right report.

Gross Profit = Net Sales - Cost of Good Sold

At the top section of this income statement, to compute the gross margin, subtract the cost of good from the net sales. For instance, the gross margin of XYZ Company is a total of $340,000 ($490,000 - $150,000).

Operating Income = Gross Profit - Operating Expense

In the midsection of this report, you will need to compute the operating income. The computation of the total operating income involves deducting the total operating expense from the gross margin. Thus, the total operating revenue for this company is $293,000 ($340000 - $47,000).

Net Income = Operating Income + Non-Operating Items

Right after computing the total operating income, the other revenues and expenses section is the revenue and expense incurred from non-operating activities. The non-operating income for XYZ Company shows a deficit of $2,000.

You will arrive at the net profit figure at the bottom of the report. By adding the operating income and non-operating income, you should be able to compute the company's bottom line after deducting the income tax expense.

XYZ Company's Net Profit = [($293,000+ (-$2,00) - $15,000)]

= $291,000 - $15,000

= $276,000

What Is the Structure of Multi-step Income Statement?

Let us take a look at what you can find inside a multi-step income statement.

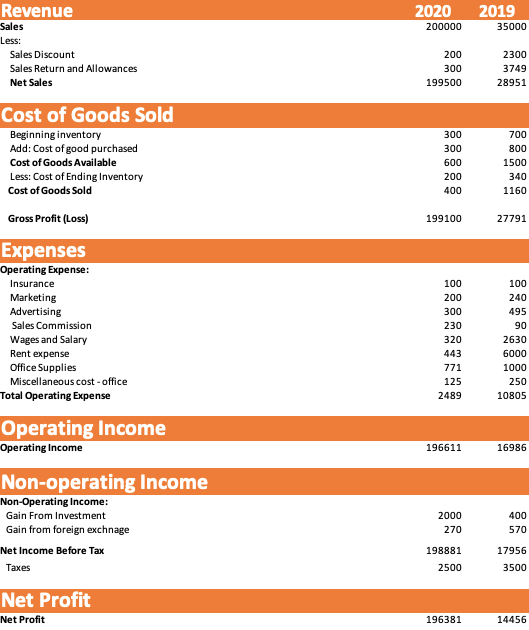

Revenue

The first thing you will come across is the Revenue account. The Revenue account shows the revenue generated by normal business activities that includes any deductions and discounts given to customers.

In the revenue section, you should be able to view the company's sales and net sales.

Read more below to find out the explanation for each of the accounting terms:

Sales

The sales account is the total amount of sales derived from selling the company's goods and services.

Net Sales

Net Sales = Sales - Sales Return and Allowances - Discounts

In any business, customers can return the goods as the product might be broken, faulty, or may malfunction. Such transactions are what you observe under Sales Return and Allowances account.

The company's Net Sales can be computed by deducting the Sales amount from the Sales Return and Allowances, or any discounts given to the customers.

Cost of Goods Sold

The next line item after the Net Sales is the Cost of Goods Sold.

To formula to calculate the Cost of Goods Sold is:

Cost of Goods Sold = Beginning Inventory + Cost of Goods Purchased - Ending Inventory

The cost of goods sold refers to the direct cost associated with producing the products sold by the company. Direct costs are expenses incurred from producing goods such as direct labor, direct materials, and manufacturing supplies.

There are two methods to calculate the Cost of Good Sold such as by using periodic method or perpetual method. In the above example, we follow the periodic format to compute the Cost of Goods Sold. In a perpetual system, the Cost of Goods Sold is added at the time of the transaction instead of using a periodic difference.

Find out more about different inventory valuation methods here.

Gross Profit

Also known as Gross Margin, the Gross Profit measures the company's profitability after deducting the cost of good sold.

Gross Profit = Net Sales - Cost of Goods Sold

Expenses

Operating Expenses

Operating expenses are the cost incurred from running the daily business operations. Stated below are some of the examples of operational expenses:

Marketing and Advertising: The cost incurred from promoting, advertising, and launching marketing campaigns to boost the products' awareness.

Distribution Expense: The cost associated with delivering goods from one warehouse to another, or from the warehouse to the customer's doorstep.

Sales Commission: Businesses will have to pay the sales commission for hiring salespeople to sell their products. Whenever the salesperson hit their sales target, commission payout is given to them.

Office Rental: Expenses associated with occupying the office's space to run the business operations.

Wages and Salary: The cost associated with hiring employees to perform specific business functionality.

Office Supplies: Any expenses related to purchasing office supplies such as stationery, printers, printers' ink, papers for printing, etc.

Operating Income

Following the operating expense, the next line item you can view is the company's operating income.

Operating Income = Gross Profit - Operating Expenses

To compute the operating income, you can follow the accounting equation stated above.

Non-Operating Income

The next line items that you will come across are stated below:

Gain or loss from investments: Some of the investing activities performed by the company include shares, bonds, index funds investment. Typically, these investments will generate profit or losses depending on the difference between the selling price and purchasing price.

Foreign exchange rate: If a company sells its good in foreign currency, it can profit from the foreign exchange gain from the conversion of foreign currency to the base currency.

Sales of Assets: Income generated from selling the company's assets includes plant, property, trade names, leaseholds, or any inventory.

Income Before Tax

Moving forward, you should be able to compute the company's Net Income before tax by adding the sum of operating income with non-operating income.

Follow the accounting equation below to compute the net income before tax:

Net Income before Tax: Operating Income + Non-operating Income

Income Tax Expense

Each company will have to pay income tax to the government depending on the tier's of income that they fall into.

For instance, if your business is charged with 10% of tax expense from a total of $60,000 of net income, thus, your business will have to bear $6,000 of tax expense.

Net Profit

Net Profit = [Operating Income + Non-Operating Income] - Income Tax

The net profit is also known as the company's bottom line. The net profit shows the company's net profitability after deducting the operating expenses and expenses such as taxes and interest paid on debts.

Types of Business that Use Multi-Step Income Statement

The multi-step income statement is the standard format used by major corporations and publicly traded companies.

Big corporations tend to prepare the multi-step income statement due to the size and complexity of their businesses. These businesses, such as large manufacturing companies and giant retailers, usually have various revenue streams, and they will need to record down the income in different accounts.

Also, its compulsory for publicly traded companies to prepare the multi-step income statements based on the government's requirements for statutory compliance.

Conclusion

Preparing the multi-step income statement is beneficial for medium to big corporations to keep track of their income. As the revenue and expenses are segregated into operating and non-operating accounts, it provides greater insight into the company's financial performance.

Hence, the potential investors and creditors will gain better clarity of your company's financial footing, which helps boost your chances of getting funding and bank loans.

Are You Looking For an Accounting Software?

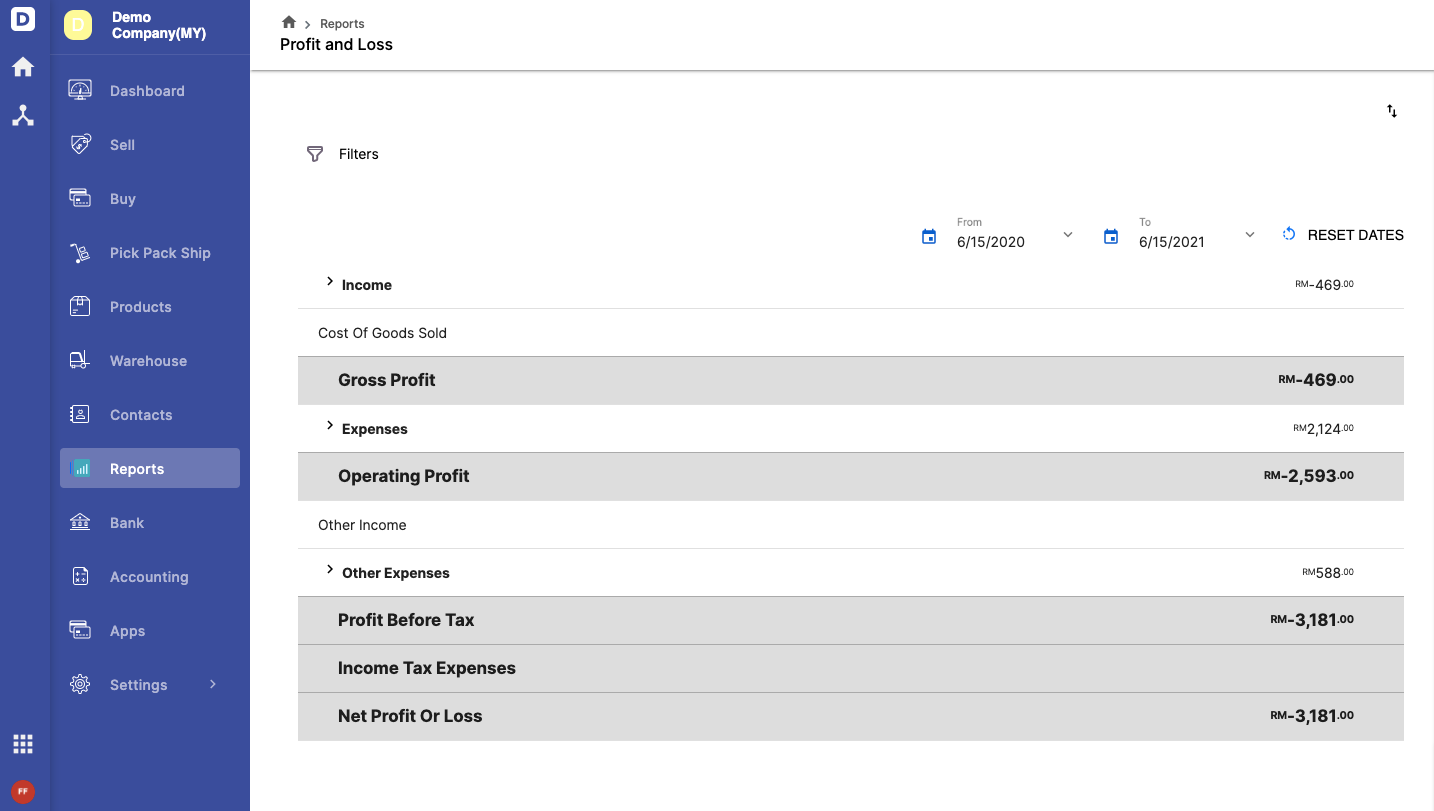

If you looking for accounting software that helps you to generate your income statement report with a click of a button, look no further!

Deskera Books can help you generate the income statement report effortlessly and without much hassle. If you wish to try out Deskera Books, you can start a free 30-day trial today!

Related Articles