Have you ever wondered why leases that once stayed off the balance sheet are now front and center in financial statements? The answer lies in the concept of Right of Use (ROU) assets. With the introduction of modern lease accounting standards such as IFRS 16 and ASC 842, businesses are required to recognize the economic reality of leasing—acknowledging not just lease payments, but the actual right to use an asset over a defined period.

At its core, a Right of Use (ROU) asset represents a lessee’s legal and economic right to use an underlying asset for the lease term. Whether it’s office space, manufacturing equipment, or vehicles, ROU assets ensure that long-term lease commitments are transparently reflected on the balance sheet. This shift has significantly changed how organizations report assets, liabilities, and expenses, making lease accounting more accurate—but also more complex.

Understanding ROU assets is no longer optional for finance and accounting teams. These assets directly impact key financial metrics such as EBITDA, leverage ratios, and return on assets, while also influencing investor perception and compliance outcomes. Without a clear grasp of how ROU assets are recognized, measured, and disclosed, businesses risk errors, audit challenges, and non-compliance with evolving accounting standards.

This is where Deskera ERP plays a vital role. Deskera ERP helps businesses manage lease accounting efficiently by automating ROU asset calculations, lease liability tracking, and compliance reporting under IFRS 16 and ASC 842. With centralized lease data, real-time financial visibility, and seamless integration with accounting modules, Deskera simplifies complex lease processes and supports accurate, audit-ready financial reporting.

What Is a Right of Use (ROU) Asset?

In lease accounting, a Right of Use (ROU) asset represents a lessee’s legal right to use an underlying asset for a specified lease term. Rather than owning the asset outright, the lessee gains the authority to access, operate, or occupy an asset owned by another party and derive economic benefits from its use. Common examples include leased office spaces, vehicles, machinery, and equipment. This concept reflects the economic substance of leasing—control over usage—rather than legal ownership.

Under modern lease accounting standards, most leases must now be recognized on the balance sheet in the form of an ROU asset and a corresponding lease liability. ROU assets are considered intangible assets because they represent a contractual right rather than physical ownership of property, plant, or equipment. Accounting teams measure these assets based on the present value of future lease payments, adjusted for initial direct costs and other applicable factors, and then amortize them over the lease term.

Right of Use Asset Under ASC 842

Under ASC 842, issued by the Financial Accounting Standards Board (FASB), an ROU asset is defined as the lessee’s right to use a specified asset for an agreed period. Lessees are required to recognize both an ROU asset and a lease liability on the balance sheet for most leases.

ASC 842 distinguishes between operating leases and finance leases. While both require balance sheet recognition, the expense recognition pattern differs. ROU assets are amortized over the lease term unless ownership transfers at the end of a finance lease, in which case amortization occurs over the asset’s useful life.

Right of Use Asset Under IFRS 16

IFRS 16 adopts a single lease accounting model, treating nearly all leases as finance leases. Under this standard, lessees must recognize an ROU asset and a corresponding lease liability for all leases, except for short-term leases and leases of low-value assets. Unlike ASC 842, IFRS 16 does not differentiate between operating and finance leases for lessees, resulting in a more uniform and transparent balance sheet presentation.

Lease Asset Under GASB 87

For U.S. public sector entities, GASB 87 governs lease accounting. Similar to IFRS 16, GASB 87 uses a single model and requires lessees to recognize both a lease liability and an ROU lease asset (commonly referred to as a “lease asset”). GASB 87 focuses on enhancing financial transparency in governmental reporting and applies primarily to leases with terms longer than one year, with fewer exemptions compared to IFRS 16.

Overall, the introduction of ROU assets by standard-setting bodies such as FASB, IASB, and GASB has fundamentally changed lease accounting. By bringing lease obligations onto the balance sheet, ROU assets provide a more accurate representation of a company’s financial position and long-term commitments.

ROU Assets vs Owned Assets: Key Differences

While both Right of Use (ROU) assets and owned assets provide economic benefits to a business, they differ significantly in terms of ownership, accounting treatment, and financial impact.

Understanding these differences is essential for accurate financial reporting and informed decision-making.

Ownership and Control

Owned assets give a company full legal ownership and long-term control over the asset, including the right to sell, modify, or pledge it as collateral. In contrast, an ROU asset represents only the right to use an asset for a specified lease term. Legal ownership remains with the lessor, and the lessee’s control is limited to the terms defined in the lease agreement.

Balance Sheet Recognition

Owned assets are recorded on the balance sheet as property, plant, and equipment (PPE) at their purchase cost. ROU assets, however, are recognized as intangible assets along with a corresponding lease liability. While both appear on the balance sheet, ROU assets are directly linked to contractual lease obligations, whereas owned assets are not.

Expense Recognition

Owned assets are typically depreciated over their useful lives, with depreciation expense recognized in the income statement. ROU assets are amortized over the lease term or the asset’s useful life if ownership transfers at the end of the lease. Additionally, ROU assets involve interest expense on the related lease liability, which does not apply to owned assets.

Financial Ratios and Metrics

ROU assets and lease liabilities can significantly affect financial ratios such as leverage, return on assets, and EBITDA. Leases increase both assets and liabilities, potentially impacting debt covenants and borrowing capacity. Owned assets, while increasing total assets, do not create a corresponding liability unless financed through debt.

Flexibility and Risk

Leasing assets through ROU arrangements offers greater flexibility, allowing businesses to adapt to changing operational needs without long-term ownership commitments. Owned assets, on the other hand, expose companies to risks related to obsolescence, maintenance, and disposal but may offer greater long-term value and control.

Overall, the choice between ROU assets and owned assets involves trade-offs between flexibility, financial impact, and control, making it a critical consideration in both accounting and strategic planning.

Why ROU Assets Matter in Modern Accounting

Right of Use (ROU) assets have transformed the way organizations account for leases by shifting the focus from legal ownership to economic control. With the adoption of standards such as ASC 842, IFRS 16, and GASB 87, leases are no longer treated as off-balance-sheet arrangements.

Instead, ROU assets ensure that lease commitments are transparently reflected in financial statements, improving accuracy, comparability, and accountability in financial reporting.

Improved Financial Transparency

ROU assets bring greater visibility to a company’s lease obligations by recognizing both the asset being used and the related liability on the balance sheet. This transparency helps stakeholders clearly understand how extensively a business relies on leased assets and the long-term commitments associated with them, reducing the risk of hidden liabilities.

More Accurate Financial Position and Ratios

By capitalizing leases through ROU assets, companies present a more realistic picture of their financial position. Key metrics such as leverage ratios, return on assets, and EBITDA are directly affected, enabling analysts and investors to make more informed comparisons across companies and industries.

Enhanced Compliance and Audit Readiness

Modern accounting standards require consistent and well-documented lease accounting practices. ROU assets support compliance by standardizing how leases are recognized and measured, making financial statements easier to audit and reducing the risk of regulatory scrutiny or reporting errors.

Better Decision-Making for Management

Recognizing ROU assets allows management teams to evaluate the true cost of leasing versus owning assets. With clearer insights into lease commitments and asset utilization, businesses can make more informed strategic decisions related to capital allocation, budgeting, and long-term planning.

Increased Investor and Stakeholder Confidence

Transparent reporting of ROU assets strengthens trust among investors, lenders, and other stakeholders. When lease obligations are clearly disclosed and consistently accounted for, it enhances credibility and supports more confident investment and lending decisions.

What Is Included in a Right of Use (ROU) Asset?

A Right of Use (ROU) asset is a central element of lease accounting under standards such as ASC 842 and IFRS 16. It represents the total cost of a lessee’s right to use an underlying asset over the lease term. Rather than being a single figure, an ROU asset is made up of several components that together reflect the true economic value of the lease arrangement.

Lease Liability

The lease liability forms the foundation of the ROU asset. It is measured as the present value of future lease payments that the lessee is obligated to make over the lease term. These payments typically include fixed lease payments, variable payments tied to an index or rate (such as inflation), and amounts expected to be paid under residual value guarantees. The lease liability captures the contractual payment obligation associated with the lease.

Initial Direct Costs

Initial direct costs incurred by the lessee to obtain the lease are also included in the ROU asset. These are costs that would not have been incurred if the lease had not been executed. Common examples include legal fees, broker commissions, and other directly attributable expenses related to negotiating and securing the lease agreement. Including these costs ensures the ROU asset reflects the full cost of accessing the leased asset.

Lease Incentives

Lease incentives provided by the lessor reduce the value of the ROU asset. These incentives may take the form of cash payments, reimbursements of certain costs, or payments made by the lessor on behalf of the lessee, such as covering moving expenses or leasehold improvements. Lease incentives also include situations where a lessor assumes the lessee’s existing lease obligations with another party. These incentives are deducted because they lower the overall economic cost of the lease to the lessee.

Together, these components determine the initial measurement of a Right of Use asset on the balance sheet. By incorporating lease liabilities, initial direct costs, and lease incentives, ROU assets provide a complete and transparent view of the financial impact of leasing arrangements.

Types of Leases That Create ROU Assets

Under modern lease accounting standards such as ASC 842, IFRS 16, and GASB 87, most lease arrangements result in the recognition of a Right of Use (ROU) asset on the balance sheet. However, the classification and treatment of these leases can vary depending on the applicable standard.

Below are the primary types of leases that create ROU assets.

Operating Leases

Operating leases allow a lessee to use an asset for a specified period without transferring ownership or substantially all the risks and rewards of ownership.

Under ASC 842, operating leases still require recognition of an ROU asset and a corresponding lease liability, even though lease expenses are recognized on a straight-line basis in the income statement. This represents a significant change from older standards, where operating leases were often kept off the balance sheet.

Finance Leases

Finance leases transfer substantially all the risks and rewards associated with ownership of the underlying asset to the lessee. These leases also create an ROU asset, which is amortized over the lease term or the asset’s useful life if ownership transfers at the end of the lease. Under ASC 842, finance leases result in separate recognition of interest expense and amortization expense, similar to traditional capital leases.

Leases Under IFRS 16

Under IFRS 16, lessees apply a single lease accounting model, meaning nearly all leases are treated as finance leases. As a result, most leases create an ROU asset and a lease liability, with expenses recognized through depreciation of the ROU asset and interest on the lease liability. This approach eliminates the operating versus finance lease distinction for lessees.

Leases Under GASB 87

For public sector entities in the United States, GASB 87 requires recognition of an ROU lease asset (often referred to as a lease asset) for most leases. Similar to IFRS 16, GASB 87 uses a single model and generally treats all leases as finance leases, emphasizing transparency in governmental financial reporting.

Short-Term and Low-Value Lease Exemptions

Certain leases do not create ROU assets due to specific exemptions. Short-term leases (typically with a lease term of 12 months or less) and low-value asset leases (under IFRS 16) may be excluded from balance sheet recognition. Instead, lease payments for these arrangements are expensed as incurred, simplifying accounting for smaller or short-duration leases.

Together, these lease types define when and how ROU assets are recognized, ensuring that lease accounting reflects the economic reality of asset usage across different accounting standards.

How to Recognize a Right of Use (ROU) Asset

Recognizing a Right of Use (ROU) asset is a critical step in lease accounting under standards such as ASC 842, IFRS 16, and GASB 87. The process ensures that a lessee’s right to use an asset and the related payment obligation are properly reflected on the balance sheet. Recognition typically occurs at the lease commencement date, when the asset is made available for use by the lessee.

Identify Whether a Contract Contains a Lease

The first step is determining whether a contract qualifies as a lease. A contract contains a lease if it conveys the right to control the use of an identified asset for a period of time in exchange for consideration. Control exists when the lessee has the right to obtain substantially all economic benefits from the asset and the ability to direct how and for what purpose the asset is used.

Determine the Lease Term

Once a lease is identified, the lessee must determine the lease term. This includes the non-cancellable period of the lease, along with any extension or termination options that the lessee is reasonably certain to exercise. Accurately determining the lease term is essential, as it directly affects the measurement of both the ROU asset and the lease liability.

Measure the Lease Liability

The lease liability is calculated as the present value of future lease payments over the lease term. These payments may include fixed payments, variable payments based on an index or rate, and amounts expected to be paid under residual value guarantees. The payments are discounted using the rate implicit in the lease or, if not readily determinable, the lessee’s incremental borrowing rate.

Calculate the Initial ROU Asset

The ROU asset is initially measured based on the lease liability, adjusted for other relevant components. This includes adding any initial direct costs incurred by the lessee and subtracting any lease incentives received from the lessor. The resulting amount represents the total cost of the lessee’s right to use the asset over the lease term.

Record the ROU Asset at Lease Commencement

Finally, the ROU asset and the corresponding lease liability are recognized on the balance sheet at the lease commencement date. From this point forward, the ROU asset is amortized over the lease term (or useful life, if applicable), and the lease liability is reduced as lease payments are made.

By following these steps, organizations can ensure consistent, compliant, and transparent recognition of Right of Use assets in their financial statements.

Measurement of ROU Assets

The measurement of Right of Use (ROU) assets ensures that lease arrangements are accurately reflected throughout the lease term. Under standards such as ASC 842, IFRS 16, and GASB 87, ROU assets are measured at initial recognition and then adjusted over time through amortization, impairment, and remeasurement when lease terms change.

Initial Measurement of ROU Assets

At the lease commencement date, an ROU asset is initially measured based on the lease liability, adjusted for specific costs and obligations associated with the lease.

Lease Liability Calculation

The lease liability is calculated as the present value of future lease payments over the lease term. These payments typically include fixed lease payments, variable payments based on an index or rate, and amounts expected to be paid under residual value guarantees.

The payments are discounted using the rate implicit in the lease or, if that rate cannot be readily determined, the lessee’s incremental borrowing rate. This discounted amount forms the core of the ROU asset’s initial value.

Included Costs

In addition to the lease liability, several costs are included in the initial measurement of the ROU asset. Initial direct costs, such as legal fees and commissions directly attributable to securing the lease, are added to the ROU asset. Lease payments made at or before the commencement date, minus any lease incentives received, are also included.

Additionally, restoration or dismantling obligations—costs the lessee expects to incur to return the asset to its original condition at the end of the lease—are incorporated, ensuring the ROU asset reflects the full economic cost of the lease.

Subsequent Measurement of ROU Assets

After initial recognition, ROU assets are adjusted over the lease term to reflect usage, impairment, and changes in lease terms.

Amortization of ROU Assets

ROU assets are typically amortized on a straight-line basis over the lease term. If ownership of the underlying asset transfers to the lessee at the end of the lease, or if the lease includes a purchase option that the lessee is reasonably certain to exercise, the ROU asset is amortized over the asset’s useful life. Amortization reduces the carrying value of the ROU asset over time.

Impairment Considerations

ROU assets are subject to impairment testing in accordance with applicable accounting standards. If events or changes in circumstances indicate that the carrying amount of an ROU asset may not be recoverable—such as reduced asset usage, business restructuring, or unfavorable market conditions—the asset must be tested for impairment and written down if necessary.

Reassessment and Remeasurement Triggers

ROU assets must be remeasured when certain changes occur in the lease arrangement. Common triggers include modifications to the lease term, changes in lease payments due to revised indices or rates, or reassessment of options to extend or terminate the lease. When remeasurement is required, both the lease liability and the corresponding ROU asset are adjusted to reflect the updated lease terms.

Together, these measurement principles ensure that ROU assets remain accurate, compliant, and reflective of a company’s ongoing lease obligations throughout the life of the lease.

ROU Asset Accounting: Journal Entries, Presentation, and Disclosure Requirements

Accounting for Right of Use (ROU) assets goes beyond initial recognition and measurement. Organizations must also record accurate journal entries and ensure proper presentation and disclosure in financial statements in accordance with IFRS 16 and ASC 842. These requirements help provide clarity on how leases affect a company’s financial position, performance, and cash flows.

Journal Entries Explained

At the lease commencement date, a lessee records both the ROU asset and the corresponding lease liability on the balance sheet. The journal entry typically debits the ROU asset and credits the lease liability for the present value of future lease payments, adjusted for any initial direct costs or lease incentives.

In subsequent periods, journal entries reflect amortization of the ROU asset and interest expense on the lease liability. For finance leases, amortization and interest are recorded separately. For operating leases under ASC 842, a single lease expense is recognized in the income statement, while the underlying accounting still reduces the ROU asset and lease liability over time.

Balance Sheet Presentation

ROU assets are presented as non-current assets, separate from owned property, plant, and equipment or disclosed within a distinct line item. The corresponding lease liabilities are split between current and non-current portions based on payment timing. This presentation ensures lease obligations are clearly visible and distinguishable from other assets and liabilities.

Income Statement Impact

The income statement treatment depends on the applicable standard and lease classification. Under ASC 842, operating leases result in a single lease expense, while finance leases recognize amortization expense and interest expense separately. Under IFRS 16, all leases follow a finance lease-style approach, with depreciation of the ROU asset and interest on the lease liability reported separately, often resulting in higher expenses in earlier periods.

Cash Flow Statement Classification

Lease payments affect the cash flow statement differently depending on the lease type and accounting standard. Generally, the principal portion of lease payments is classified as a financing activity, while the interest portion may be classified as either operating or financing, depending on the standard applied. This classification provides insight into how lease obligations impact cash flow and liquidity.

Disclosure Requirements Under IFRS 16 and ASC 842

Both IFRS 16 and ASC 842 require extensive disclosures to enhance transparency. These include qualitative descriptions of leasing arrangements, quantitative details of ROU assets and lease liabilities, maturity analyses of lease payments, and information about variable lease payments and lease options. These disclosures help users of financial statements understand the nature, timing, and financial impact of leasing activities.

Together, accurate journal entries, clear presentation, and comprehensive disclosures ensure that ROU asset accounting aligns with regulatory requirements and provides meaningful insights to stakeholders.

Key Differences Between IFRS 16, ASC 842, and GASB 87 for ROU Assets

Although IFRS 16, ASC 842, and GASB 87 all require the recognition of Right of Use (ROU) assets, they differ in scope, lease classification, exemptions, and presentation. Understanding these differences is essential for organizations operating across jurisdictions or reporting under multiple accounting frameworks.

Lease Classification Model

IFRS 16 and GASB 87 follow a single lease accounting model for lessees, treating nearly all leases as finance leases. As a result, ROU assets and lease liabilities are recognized for most lease arrangements without distinguishing between operating and finance leases.

In contrast, ASC 842 retains a dual model, classifying leases as either operating or finance leases. While both types result in ROU asset recognition, the income statement treatment differs.

Income Statement Treatment

Under IFRS 16 and GASB 87, lessees recognize depreciation (or amortization) of the ROU asset and interest expense on the lease liability separately. This often results in a front-loaded expense pattern.

Under ASC 842, operating leases result in a single lease expense recognized on a straight-line basis, while finance leases follow a depreciation-and-interest approach similar to IFRS 16.

Exemptions and Scope

- IFRS 16 provides exemptions for short-term leases and low-value assets, allowing lessees to expense these leases without recognizing ROU assets.

- ASC 842 allows a short-term lease exemption but does not include a specific low-value asset exemption.

- GASB 87 has fewer exemptions overall and generally applies to leases with terms longer than one year, reflecting its focus on transparency in public sector reporting.

Measurement and Amortization

All three standards measure ROU assets initially based on the present value of future lease payments, adjusted for initial direct costs and incentives. However, amortization approaches differ.

Under IFRS 16 and GASB 87, amortization follows a finance lease-style model, while under ASC 842, amortization mechanics differ between operating and finance leases, even though balance sheet recognition is required for both.

Disclosure Requirements

- IFRS 16 emphasizes comprehensive qualitative and quantitative disclosures to help users assess the impact of leases on financial performance and cash flows.

- ASC 842 includes detailed disclosure requirements, particularly around lease terms, discount rates, and maturity analyses, often considered more granular.

- GASB 87 focuses on disclosures that enhance accountability and transparency for governmental entities, including lease terms, payment schedules, and changes in lease obligations.

Applicability and Reporting Entities

- IFRS 16 applies to international entities reporting under IFRS.

- ASC 842 applies to U.S. private and public companies following US GAAP.

- GASB 87 applies exclusively to U.S. state and local government entities.

In summary, while all three standards aim to improve transparency by recognizing ROU assets on the balance sheet, their differences in classification, exemptions, and expense recognition can significantly impact financial reporting and comparability across entities.

Common Challenges in ROU Asset Accounting

While Right of Use (ROU) assets improve financial transparency, they also introduce new complexities for accounting and finance teams. Complying with standards such as IFRS 16, ASC 842, and GASB 87 requires careful judgment, accurate data, and robust processes.

Below are some of the most common challenges organizations face in ROU asset accounting.

Identifying and Extracting Lease Data

One of the biggest challenges is identifying all contracts that contain leases and extracting accurate lease data. Lease agreements are often decentralized, stored across departments, or embedded within service contracts, making it difficult to capture complete and consistent information required for ROU asset recognition.

Determining the Correct Lease Term

Assessing the lease term requires judgment, especially when leases include renewal, termination, or purchase options. Determining whether an option is “reasonably certain” to be exercised can be subjective and may significantly impact the measurement of both the ROU asset and lease liability.

Selecting the Appropriate Discount Rate

Choosing the correct discount rate—either the rate implicit in the lease or the incremental borrowing rate—can be complex. Many organizations struggle to estimate an accurate incremental borrowing rate, particularly when leases vary by geography, asset type, or lease duration.

Managing Lease Modifications and Reassessments

Lease modifications, such as changes in scope or consideration, require reassessment and remeasurement of ROU assets and lease liabilities. Tracking these changes and applying the correct accounting treatment can be time-consuming and prone to errors without strong controls.

Handling System and Process Limitations

Many legacy accounting systems were not designed to handle ROU asset accounting. Manual spreadsheets increase the risk of calculation errors, inconsistent assumptions, and audit challenges, especially for organizations with large lease portfolios.

Ensuring Ongoing Compliance and Disclosures

Maintaining compliance over time requires continuous monitoring of leases, accurate amortization schedules, and detailed disclosures. Preparing audit-ready reports and meeting disclosure requirements under multiple standards can be resource-intensive without automation and standardized workflows.

Addressing these challenges effectively often requires a combination of clear policies, strong internal controls, and technology-enabled lease management solutions.

Best Practices for Managing ROU Assets

Effectively managing Right of Use (ROU) assets is essential for maintaining compliance, improving financial accuracy, and gaining better visibility into lease obligations. As lease accounting standards such as IFRS 16, ASC 842, and GASB 87 continue to emphasize transparency, adopting best practices can help organizations reduce risk and streamline lease management.

Centralize Lease Data and Documentation

Maintaining a centralized repository for all lease agreements ensures consistency and completeness. Centralized lease data makes it easier to identify leases, track key terms, and support accurate ROU asset calculations, while also improving audit readiness.

Standardize Lease Accounting Policies

Clear and consistent lease accounting policies help reduce judgment-related errors. Standardizing assumptions around lease terms, discount rates, and reassessment triggers ensures uniform application of accounting standards across the organization.

Perform Regular Lease Reviews

Periodic reviews of lease agreements help identify changes such as renewals, terminations, or modifications that may require remeasurement of ROU assets. Regular reviews also help ensure that lease data remains accurate throughout the lease lifecycle.

Strengthen Internal Controls

Robust internal controls are critical for managing ROU assets effectively. This includes approval workflows for new leases, documented review processes for key estimates, and segregation of duties to minimize the risk of errors or non-compliance.

Automate Lease and ROU Asset Management

Using automated systems or ERP solutions reduces reliance on manual spreadsheets and minimizes calculation errors. Automation enables accurate amortization schedules, real-time tracking of lease liabilities, and consistent compliance with accounting standards.

Align Lease Management with Financial Planning

Integrating ROU asset management with budgeting, forecasting, and financial planning allows organizations to better assess the long-term impact of leasing decisions. This alignment supports more informed decisions around leasing versus purchasing assets.

By following these best practices, organizations can turn ROU asset accounting from a compliance burden into a strategic advantage, improving both operational efficiency and financial transparency.

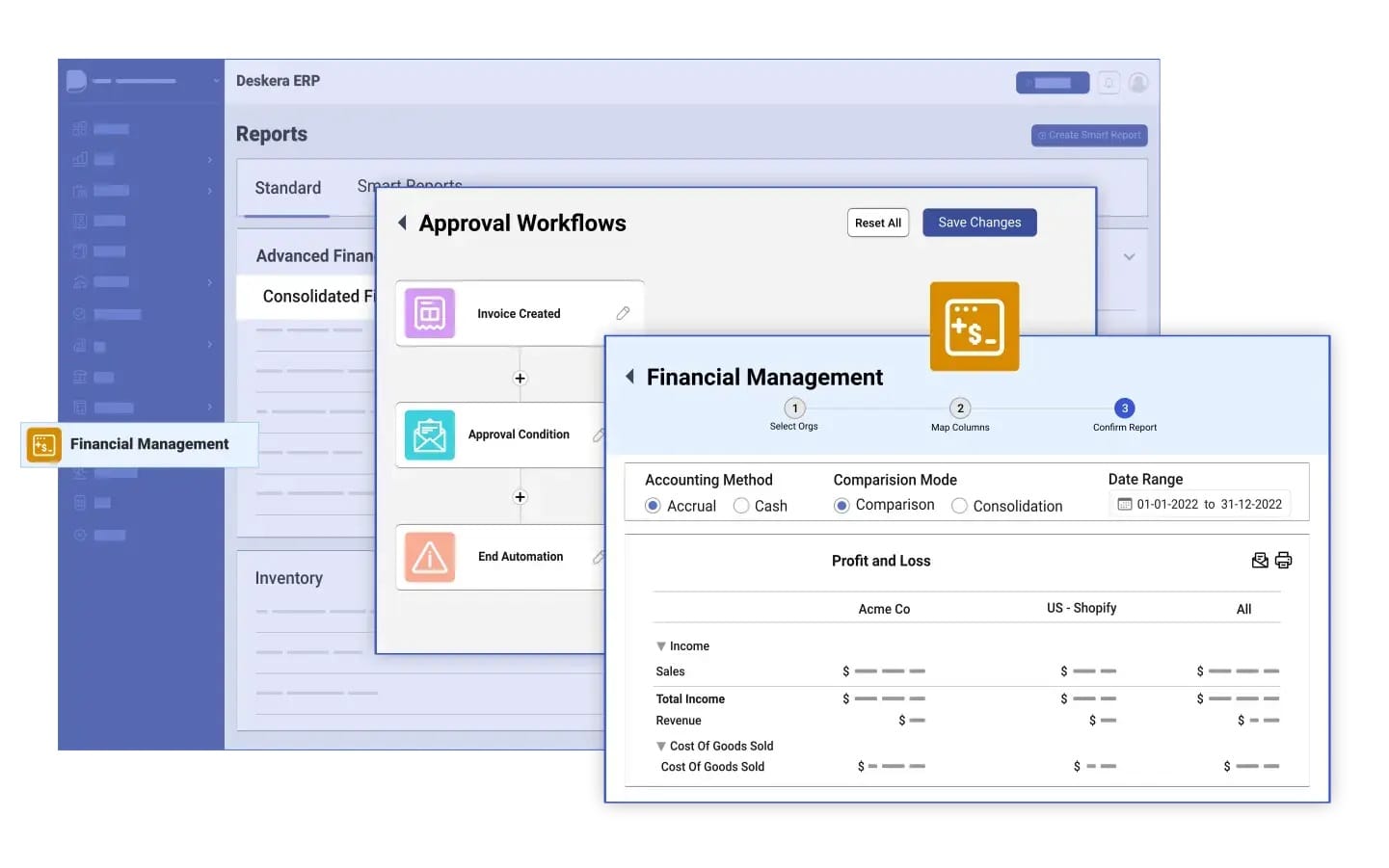

How Deskera ERP Simplifies ROU Asset Accounting

Managing Right of Use (ROU) assets and associated lease accounting can be complex, especially under standards like ASC 842, IFRS 16, and GASB 87. While specialized lease accounting tools exist, Deskera ERP helps streamline and simplify many of the core processes involved in ROU asset accounting within an integrated financial system.

Centralized Lease-Related Financial Data

At the heart of accurate ROU asset accounting is reliable and complete financial data. Deskera ERP’s General Ledger acts as a centralized repository for all financial transactions, including lease-related entries. This means lease liabilities, ROU assets, amortization, and interest expenses can be tracked consistently alongside other financial activities, reducing errors and fragmentation.

Automated and Flexible Journal Entry Management

Deskera lets you create and manage journal entries for lease accounting events—such as initial recognition of lease liabilities and ROU assets, periodic amortization, and interest expenses. Recurring entries can be automated, which significantly reduces manual effort and the risk of errors during month-end and year-end closing activities.

Integrated Financial Reporting and Compliance Support

With built-in reporting tools, Deskera ERP enables you to generate financial statements (balance sheets, income statements, cash flow reports) that automatically reflect lease-related accounting entries. This improves compliance with reporting requirements under IFRS 16 and ASC 842 and provides clear visibility of ROU assets and lease liabilities in audit-ready formats.

Multi-Currency and Multi-Entity Capabilities

For businesses operating across borders or multiple subsidiaries, Deskera’s support for multi-currency and multi-entity accounting ensures that lease transactions in different currencies are correctly converted and consolidated. This helps maintain consistency and accuracy in global financial reporting.

Integration With Fixed Asset and Amortization Functions

Although Deskera’s fixed asset module focuses on owned assets, it can be leveraged alongside lease entries to monitor and report ROU assets in the broader context of total asset management. Additionally, Deskera’s amortization reporting features help schedule and allocate amortization of lease costs over time, supporting accurate expense recognition.

Real-Time Financial Visibility and Audit Trails

Deskera ERP provides real-time dashboards and financial insights, allowing you to monitor the impact of lease accounting on key metrics instantly. Built-in audit trails ensure that every adjustment and journal entry is traceable, supporting internal controls and external audits.

In summary, while Deskera ERP may not have a dedicated lease accounting engine like specialized solutions, its centralized ledger, automated journal entries, comprehensive reporting, multi-currency support, and integration across financial modules help finance teams manage ROU asset accounting efficiently within a unified ERP environment.

Key Takeaways

- An ROU asset represents a lessee’s right to use an underlying leased asset for a specified period, reflecting economic control rather than legal ownership.

- ROU assets include the lease liability, initial direct costs, and adjustments for lease incentives or restoration obligations, capturing the full economic cost of the lease.

- ROU assets enhance financial transparency, improve accuracy of financial ratios, support compliance, and provide management with better insights for decision-making.

- Types of Leases That Create ROU Assets – Operating leases, finance leases, and most leases under IFRS 16 and GASB 87 create ROU assets, while short-term and low-value leases may be exempt.

- How to Recognize a Right of Use (ROU) Asset – Recognition involves identifying a lease, determining the lease term, calculating the lease liability, and recording the ROU asset at the lease commencement date.

- Measurement of ROU Assets – ROU assets are initially measured based on the lease liability and included costs, then subsequently amortized, tested for impairment, and remeasured when lease terms change.

- ROU assets require specific journal entries, clear balance sheet presentation, proper income statement and cash flow classification, and detailed disclosures under IFRS 16 and ASC 842.

- ROU assets reflect the right to use rather than ownership, are amortized instead of depreciated, and affect financial ratios differently compared to owned assets.

- Key Differences Between IFRS 16, ASC 842, and GASB 87 for ROU Assets – These standards differ in lease classification, income statement treatment, exemptions, and disclosure requirements, impacting how ROU assets and lease liabilities are reported.

- Common Challenges in ROU Asset Accounting – Challenges include identifying leases, determining lease terms, selecting discount rates, handling modifications, managing processes, and maintaining ongoing compliance.

- Best Practices for Managing ROU Assets – Centralize lease data, standardize policies, perform regular reviews, strengthen internal controls, automate processes, and align lease management with financial planning.

- Deskera ERP streamlines ROU asset accounting through centralized lease data, automated journal entries, integrated reporting, multi-entity support, amortization tracking, and real-time dashboards.

Related Articles