After achieving independence, India has seen some very turbulent times providing employment and the correct corresponding wages. In any under-developed or developing nation, the labour can be hired at extremely low rates. A large majority of workers face the risk of being exploited at the hands of their employers.

The Minimum Wages Act came into effect to address these grave issues that threatened the integrity of the wage earners.

People witnessed the introduction and enactment of the minimum wage in 1943. The Indian Constitution realized the significance of providing an ecosystem to protect the employees from unfair and extremely low wages.

The Indian Labour Conference and the Standing Labour Committee set an investigation committee in 1943. It monitored the minimum wages paid to the workers. On 15th March 1948, the Parliament of India enacted the Minimum Wages Act 1948.

The Act was applied across the states in the country. We will be learning about the Rajasthan Minimum Wages Rules, 1959, and its various components in this article.

Here are the points covered in this article:

- What is the meaning of Minimum Wage?

- What is Rajasthan Minimum Wages Rules, 1959?

- Calculation and Payment of Wages

- Mode of Computing the Wages

- Time and Conditions of Payment of Wages

- Deductions and Terminations

- Hours of Work Considered under Rajasthan Minimum Wages Rules, 1959

- Provisions for Employees for number of Hours at Work

- Night Shifts

- Overtime Wages

- Holidays Considered under Rajasthan Minimum Wages Rules, 1959

- Weekly Holidays

- Weekly Day of Rest

- Wage Registers and Slips To be Maintained by Employers

- Preservation of Registers

- Protecting Other Records

- Repealing of Earlier Laws and Rules

- List of Scheduled Employment

- Minimum Wages for Rajasthan 2020

- Minimum Wages for Rajasthan 2021

- Rajasthan First State to Introduce Minimum Wage for Part-time Workers

- Forms

What is Minimum Wage and Why was it Introduced?

Minimum wages refer to the least amount or the minimum amount of wages an employer pays to the employees or the workers for the work done in a given time frame. Importantly, this minimum wage cannot be lowered by an individual contract or collective agreement.

The minimum wages are fixed by an authority or statute. The objective of the minimum wages act is to ensure that no employee or worker is exploited by the employer in terms of wages. Therefore, it aims to eliminate any occurrence of unduly low wages being paid to a worker.

The minimum wages act focuses on fighting the pay disparity between men and women, and therefore, is an act that combats social disparity. The primary aim of the minimum wages is to reduce poverty and help workers earn the wages they deserve.

What is Rajasthan Minimum Wages Rules, 1959?

Rajasthan Minimum Wages Rules, 1959 laid down the rules and guidelines to be followed by the employers in the scheduled employment scenario across the state of Rajasthan. It is usually termed as ‘rules’ and takes references from the ‘Act’ which is the Minimum Wages Act, 1948.

The document of rules comprises 7 chapters, each of which touches upon the diverse aspects of the scheduled employment including:

- Wages

- Hours of work for men, women, children, and adolescents

- Weekly offs and time of rest or interval

- Overtime wages

- Maintenance of registers by the employers for inspection

These points are, however, just an overview of the entire set of provisions defined by the Act. It is essential that all the employers understand these points and implement them for ensuring a conducive and comfortable environment of work.

The document underlines the importance of having a balanced ecosystem at work so that no worker feels exploited or demotivated in terms of their wages. The act aims to ascertain the correct and corresponding wages for all employees irrespective of the gender; thereby, ensuring a social balance as well.

The oncoming sections give details of the minutes incorporated in the Rajasthan Minimum Wages Rules, 1959.

Calculation and Payment of Wages

The calculation and payment of wages under the rules 1959 are as explained in this section:

Mode of Computing the Wages

Under the Rajasthan Minimum Wages Rules, 1959, the calculation and payment of wages is determined as:

- The prevalent retail prices from the closest market shall be considered in computing the cash value of wages paid in kind. This is followed by supplying essential commodities at concession rates. This computation shall be per the directions issued by the State Government from time to time

- Workers receive concessions in the form of essential commodities at a concessional rate. The concessions are based on the wages set under the Act as long as the difference between the retail price of commodities and the price charged by the employer to such workers is equal to the cash value of the concession

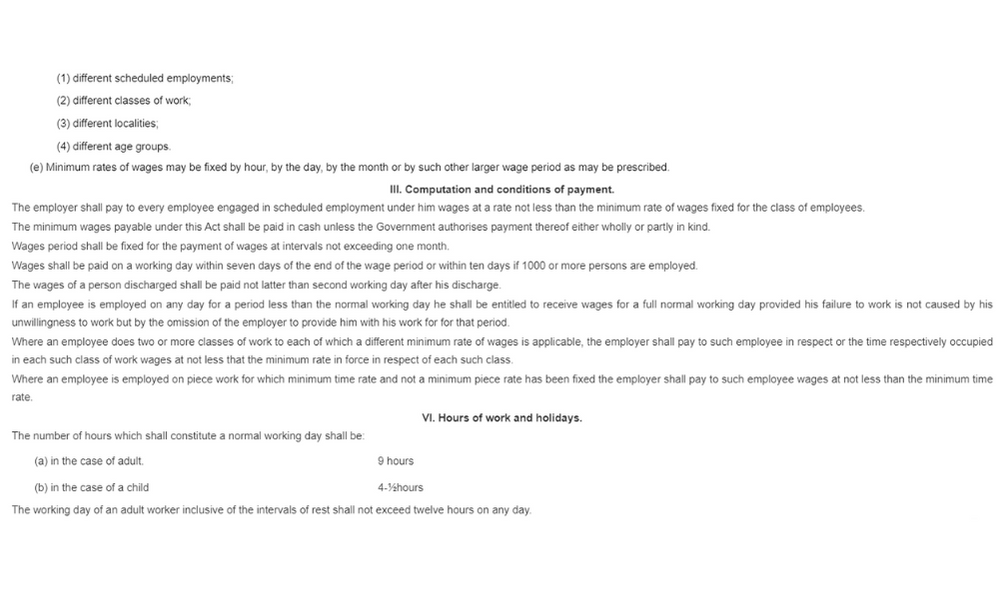

Time and Conditions of Payment of Wages

- The wage period shall not overstep the duration of one month and the worker must receive the wages by the 7th of the month

- The wages of any employee terminated by or on behalf of the employer shall be paid before the end of the second working day following the termination of the employee's employment

- Employed persons shall receive their wages without deduction except as authorized by these rules

- The employer must clearly display the notices regarding the days on which the wages will not be paid in English or any language understood by the workers. The notice must be issued at least two months in advance

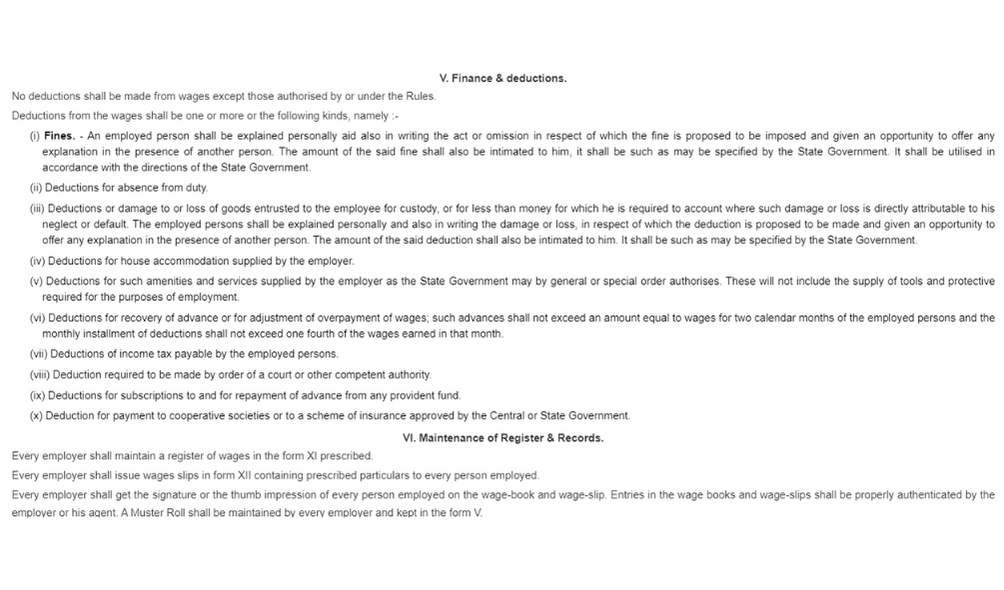

Deductions and Terminations

Every payment made by the workers to the employer for the purpose of fulfilling these rules will be deemed as deduction from wages.

The workers may face wage deductions in the following scenarios:

- Fines: Unless specified by the government, no employer can impose fines on the workers

- Deductions: These are made for absence from duty

- Deduction will be made when a worker has led to damage or loss of goods or money to his neglect

- Deductions will be made for house accommodation supplied by the employer or the State Government or Municipality or Housing Board and other authorities

- Deductions for the services and facilities which are provided by the employer

- Deductions made for recovery of advances or for adjustment of over payments of wages

- Deductions towards the income tax to be paid by the worker/employee

- Deductions required to be made on court’s orders

- Deductions for subscriptions and for repaying the advances from any provident fund to which the Provident Fund Act, 1925 applies or any recognized provident fund as defined in section 58-A of the Indian Income Tax Act, 1922

- Deductions towards the payment to co-operative societies or to insurance scheme approved by the Government

- Deductions for recovery of adjustment of amounts other than wages paid to the employed person in error or in excess of what is due to him

- Deductions made for the payment of a premium on his policy Insurance Corporation of India set up under the life Insurance Corporation Act, 1956 or for the purchase of securities of the Government of India or any State Government or for being deposited in any Post Office Savings Bank

Hours of Work Considered under Rajasthan Minimum Wages Rules, 1959

Like in any other sector, workers under the scheduled employment have a fixed set of working hours. They receive corresponding wages for the hours at work.

Provisions for Employees for Number of Hours at Work

All employers must maintain and display the information of working hours at places easily visible and can be read by all employees.

Number of Hours Comprising a Normal Working Day

- Adult workers will work for not more than 9 hours a day with an interval and 48 hours a week

- Child worker will work for not more than 412 hours

- Adolescent workers who will be first certified to work by a medical practitioner will have to complete work hours of 9 or 412 hours accordingly

- For an adult worker, the work period must be so fixed that no period shall be more than 5 hours. Also, no worker shall work for more than five hours before they have had an interval of at least 30 minutes

- Also, the duration of work of an adult worker shall be so arranged that they do not work for more than 1012 hours in a day including the intervals for rest

- No women will work after 6 p.m. and before 6 a.m. from 1st September to the end of February OR before 7 a.m. beyond 7.00 p.m. from the 1st March to 31st August

- Workers will not be allowed to work for a period of more than fourteen days continuously without resting for 24 consecutive hours

- An employee shall be entitled to a substituted rest day within a fortnight of the rest day on which they can work. The worker must intimate the Inspector to reach him at least 24 hours before the substituted rest day is allowed

- No worker in any establishment shall be required or allowed to work for more than 9 hours a day and 48 hours in any week if the total number of hours of work including overtime shall not exceed ten hours on any working day. Also, when the total number of overtime hours of any worker shall not exceed 50 hours in a quarter.

- The payment for the work done in excess of the normal working hour, fixed in rule 24 shall be made at the overtime rate fixed by the State Government

- A notice of overtime work shall be exhibited in the premises of the employment before the commencement of the work mentioning the purpose, the names of the persons put on overtime work, and duration of the overtime work. A copy of this notice shall also be sent to the inspector concerned within 24 hours of the start of the work.

Night Shifts

Night shifts are the durations of work when it extends beyond the midnight. Here are the provisions when the workers are required to work on night shifts:

- a holiday for the whole day after his shift ends

- the following day for him shall be deemed to be the period of twenty four hours beginning when such shift ends, and the hours he has worked after mid-night shall be counted towards the previous duty

Overtime Wages

When a worker works for more than 9 hours a day or over 48 hours a week, he is entitled to receive extra wages for the overtime work done. Here are the provisions for the same:

- In the case of employment in Agriculture, the workers receive overtime wages at one and a half times the current salaries

- Under any other scheduled employment, the workers receive overtime wages at double the ordinary rate of wages

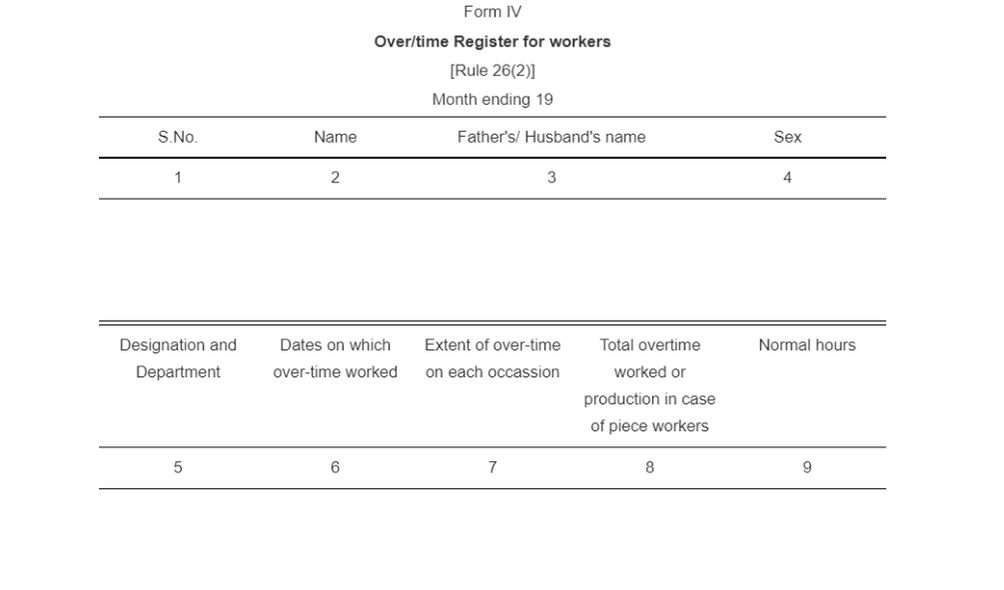

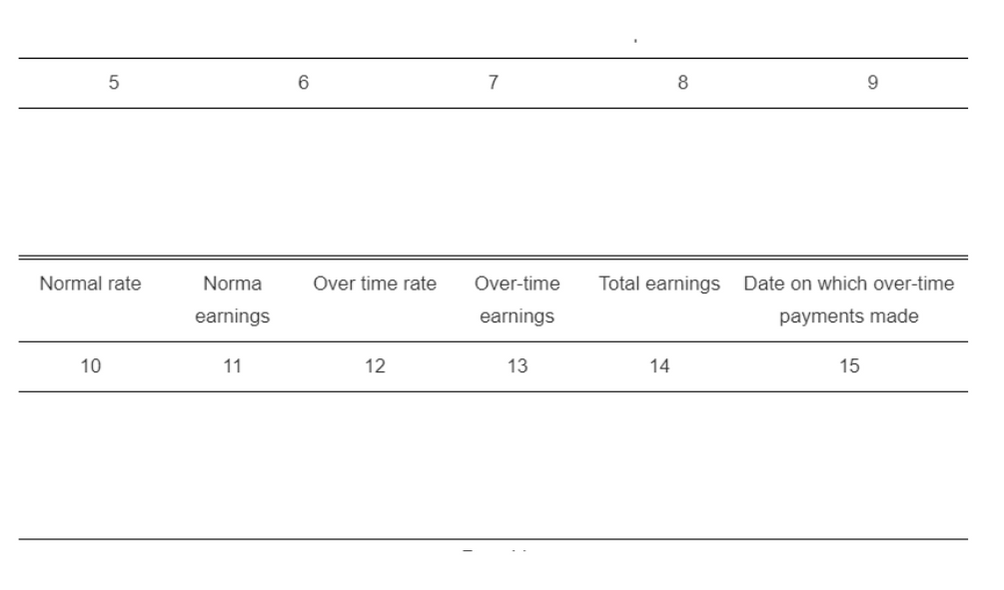

- The details of the overtime payments shall be maintained in Form IV

Note:

The expression 'ordinary rate of wages' means the basic wage plus allowances including the cash equivalent of the advantages. The advantages can be in the form of giving concessions to the worker for purchasing food grains and other essentials. However, it does not include a bonus.

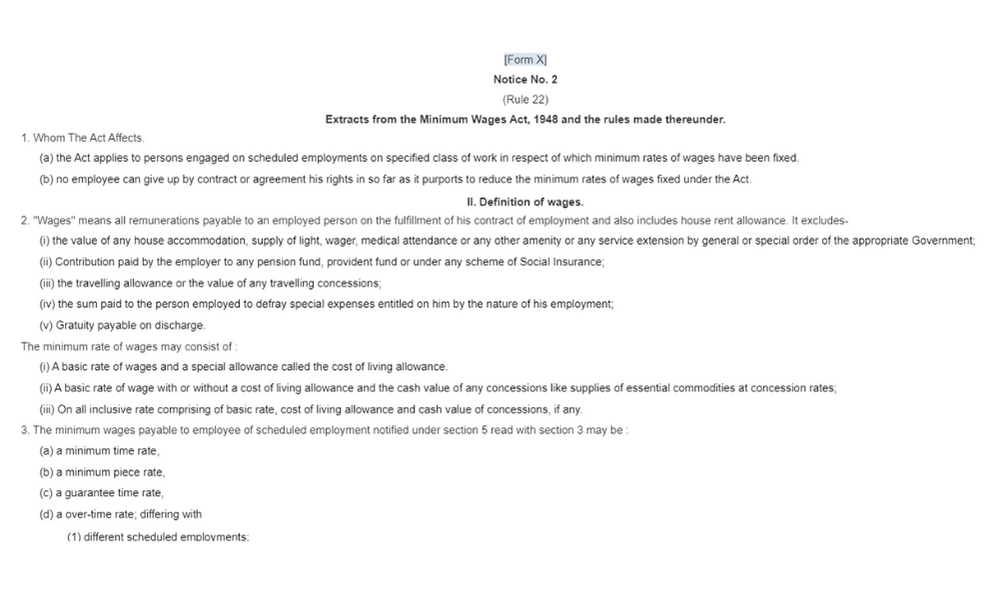

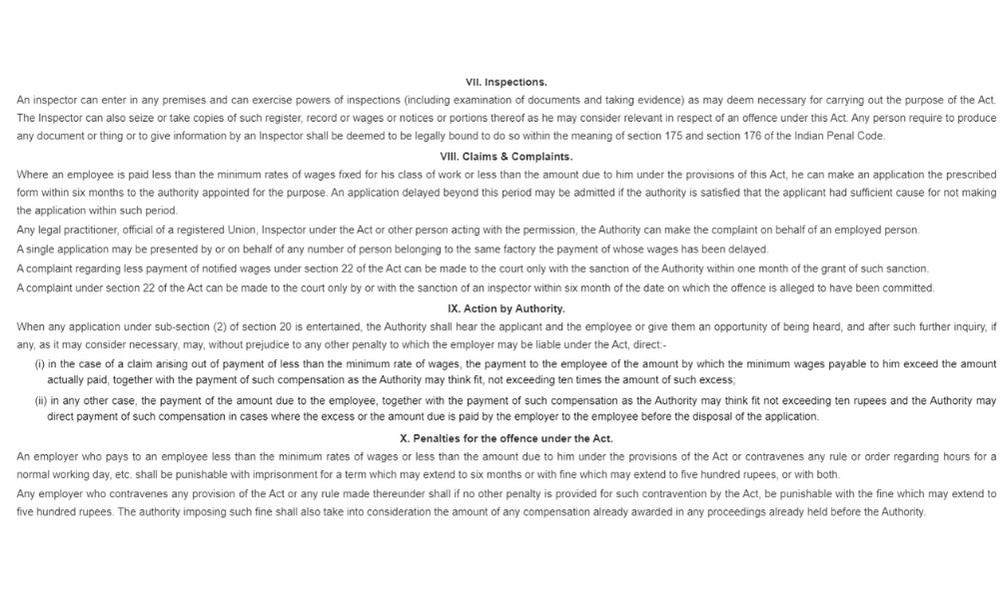

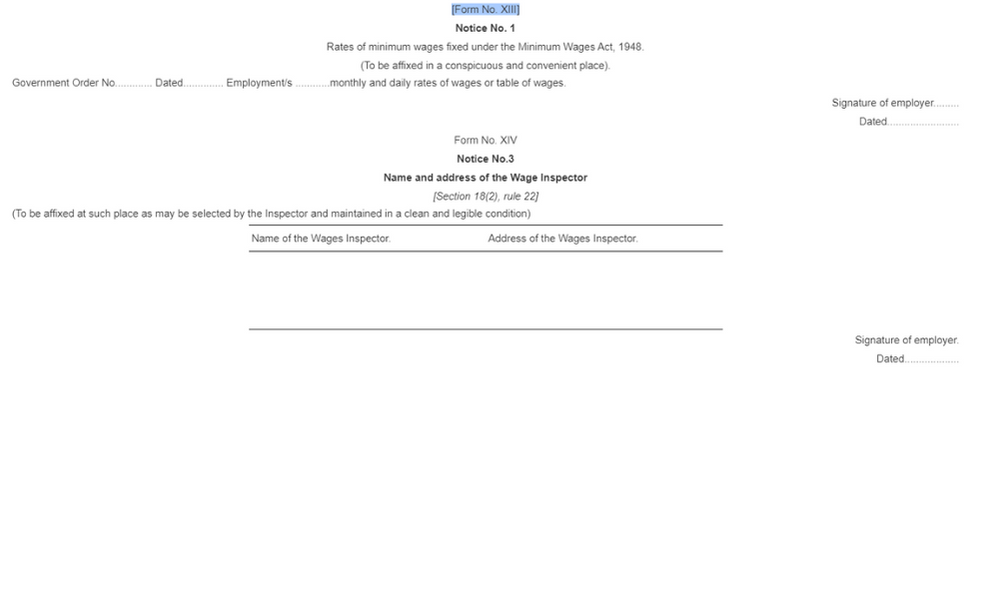

Notice Lists that Employer Should Exhibit

Here is the list of notices that the employer must exhibit at conspicuous places within the premises of place of work for the workers to understand:

- Notice No. I: Rates of Minimum Wages fixed under the Minimum Wages Act, 1948 (Form X III)

- Notice No. 2: Abstract of the Minimum Wages Act, 1948 under the Rajasthan Minimum Wages Rules, 1959 (Form X)

- Notice No. 3: Name and address of the Inspector concerned (Form XIV)

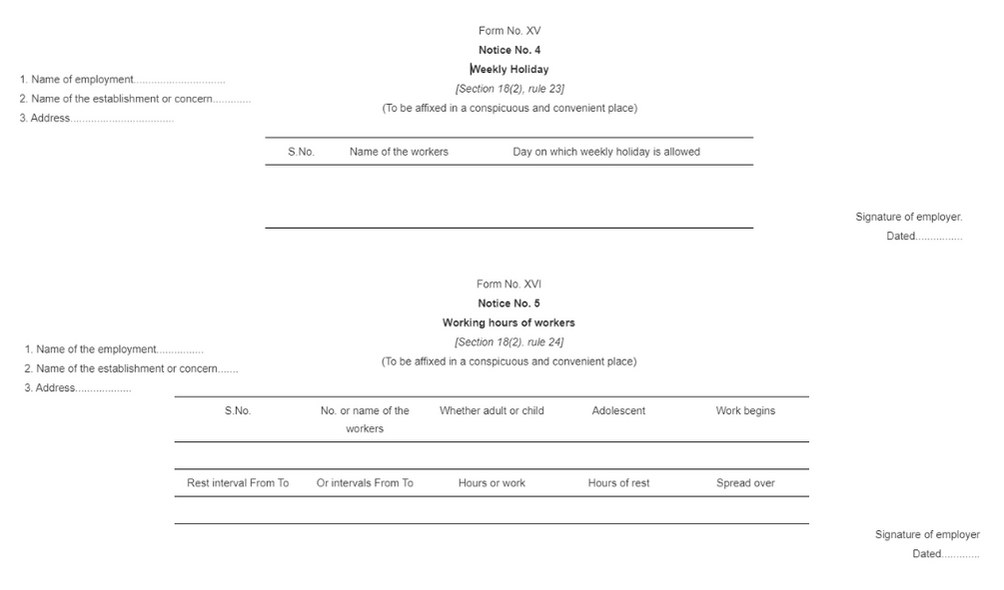

- Notice No. 4: Weekly holidays (Form XV)

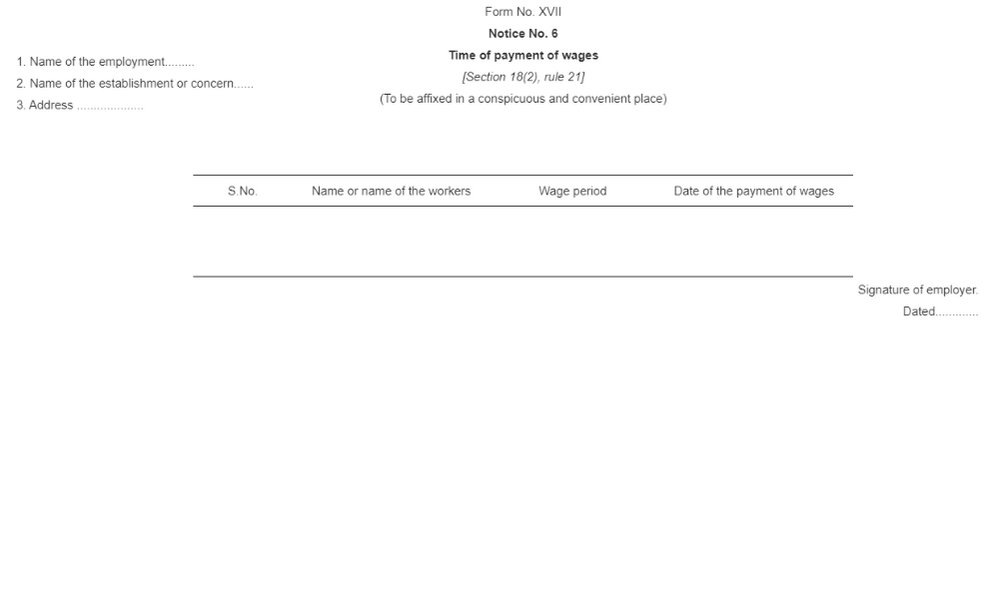

- Notice No .5: Working hours of employees (Form XVI) 6. Notice No. n. Time for payment of Wages (Form XVII)

If the employment is in the public motor transport then Notice number 4, 5, and 6 corresponding to Forms XV, XVI, and XVII shall also be conspicuous on every vehicle.

Holidays Considered under Rajasthan Minimum Wages Rules, 1959

This section explains the weekly holidays and the rest days prescribed by the minimum wages rules, 1959.

Weekly Holidays

Unless otherwise permitted by the State Government, workers shall not be required or allowed to work on the first day of the week (referred to as the ‘said day’). The only exception is when he has a holiday on one of the three preceding or following days of the ‘said day’, for which he shall receive a payment equal to his average daily wage during the preceding week.

The conditions here are:

- Another day may be substituted for the weekly holiday

- A substitution shall not result in any employee working for more than ten consecutive days without a holiday

According to subrule (I), if a worker works on said day but has a holiday within five days, then the said day is included in the previous week when calculating his weekly work hours.

Weekly Day of Rest

Under the scheduled employment, if a worker has worked for an employer for a period of not less than six days, then the worker is entitled to receive a day of rest every week, which will ordinarily be a Sunday.

The conditions for applying this rule are:

- Provided that the employer may fix any other day of the week as the rest day for any workers or class of workers in that scheduled employment

- Provided further that worker will be informed of the day fixed as the rest day and of any other change in the rest day before the cbange is effected, by a notice at a place specified by the Inspector

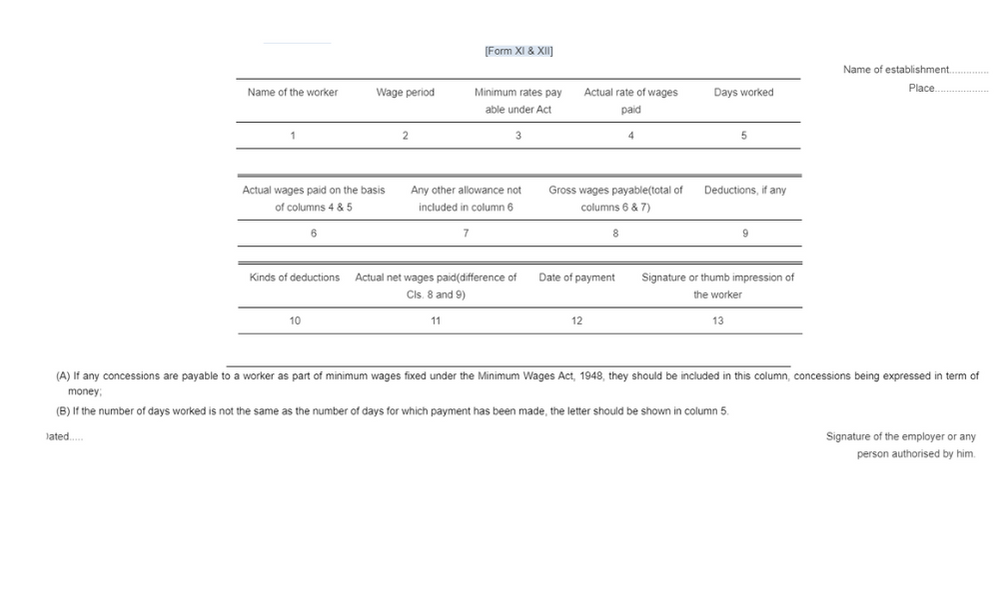

Wage Registers and Slips To be Maintained by Employers

A register of wages is to be preserved by the employer.

These registers must include the following information as prescribed by the government:

- The gross wages of each worker of each wage period

- All deductions made from wages

- The wages paid to each worker for each wages period and the date of payment

- Rates of wages payable

- A register of wages must be maintained by every employer at the work spot in Form XI

The Wage Slips

The Wage slips have to be maintained by every employer in Form XII . This is to be done for every person employed by the employer at least a day before giving out the wages.

- Every employer must get the signature or the thumb impression of every employee on the wage book and wage slip

- Entries in the books and the wage slips must be authenticated by the employer or any person authorized by him on his behalf

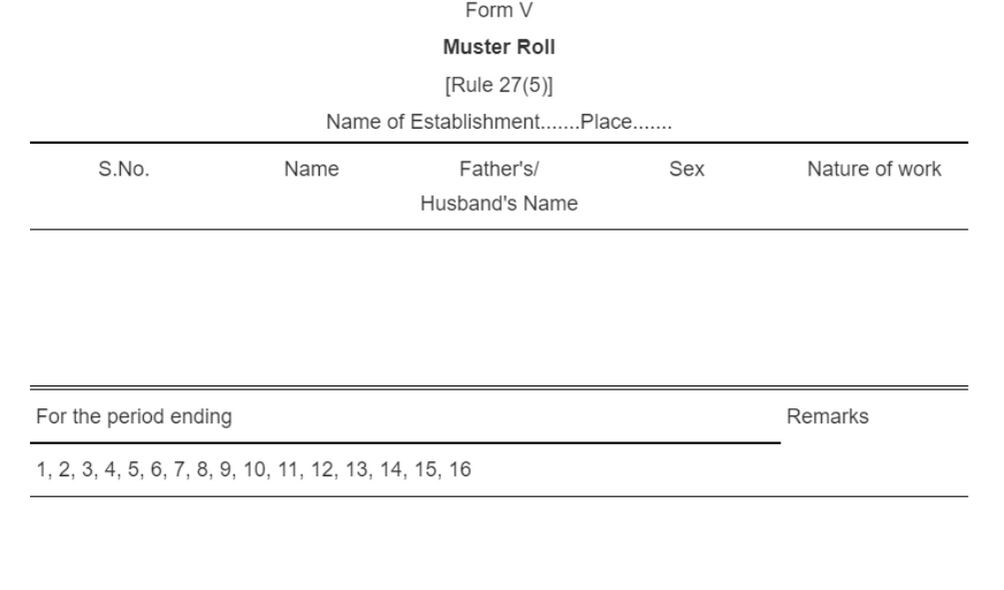

- A Muster Roll must be maintained by every employer at the work spot and kept in form V

Note:

An important point here is that an employer who employs for construction of roads or agriculture may not be required to maintain these registers or forms. However, such employers must fulfill the following criteria:

- The owner builds a house for own use, the value of which does not exceed Rs. 30,000 or repairs or alters his own house, the value of which does not exceed Rs, 10,000 at a time

- The owner of the cultivated land, owns a land, acreage of which is not above 25 acres

Situations of Lesser Working Hours

An employee working less than the requisite number of hours constituting a normal working day is not entitled to receive Wages for a normal working day in the following cases and circumstances:

- Tempest, fire, rain, epidemic, civil commotion or other cause beyond the control of the employer

- Where an employee works for less than 4 hours a day

- Strike or stays in strike

In case of storm, fire, epidemic or civil commotion, an employee who has started his work before the interval of the day must be paid wages at half the minimum rates. In case the interruption occurs after the interval for midday rest, he shall be paid wages for a full normal working day.

Note:

If the interruption is caused by power-cut, effected by government, then the employees will receive wages for such day in proportion to the number of hours they worked.

Preservation of Registers

All these important registers and the muster roll must be maintained and preserved by the employer for any future reference. These are to be preserved for a a span of 3 years from the time of the last entry made in the register.

Protecting and Producing Other Records

The documents are to be protected in the case there is an inspection. All these documents preserved by the employer must be produced when an inspector demands.

Repealing of Earlier Laws and Rules

The Rajasthan Minimum Wages Rules, 1959 has repealed all the earlier laws which are:

- The Rajasthan Government Minimum Wages Rules, 1951

- The State of Ajmer Minimum Wages Rules, 1950

- All other rules corresponding to these rules to force to any part of the State of Rajasthan

List of Scheduled Employment

It is essential to learn about the areas or sectors included under the Scheduled Employment. Here is a list that gives out the names:

Minimum Wages for Rajasthan 2020

Minimum Wages for Rajasthan 2021

The following table presents the data on the revised minimum wages for Rajasthan. The data is valid for January 2022.

The Rajasthan government announced an increase of Rs. 27 per day for each category. These rates of wages have come into effect from July 1, 2020.

Rajasthan- First State to Introduce Minimum Wage for Part-time Workers

Rajasthan introduced a minimum wage for part-time workers in July 2016.

According to the notification, an employee who works for less than four hours a day has to receive 50% of the daily minimum wage. Part time workers are now covered by the Minimum Wages Act 1948 as a result of the notification.

The notification has been issued by the Labour Department of Rajasthan.

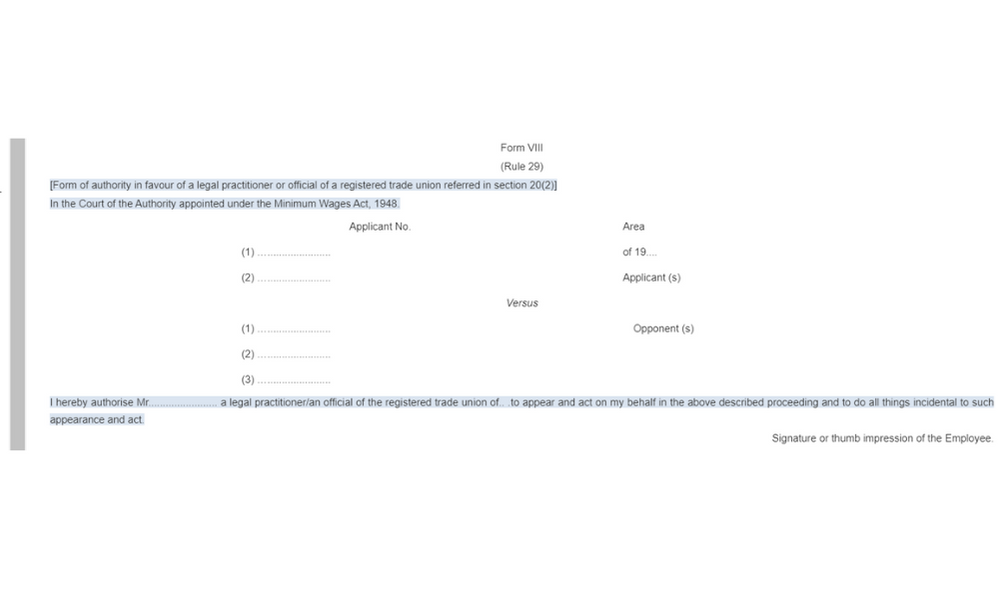

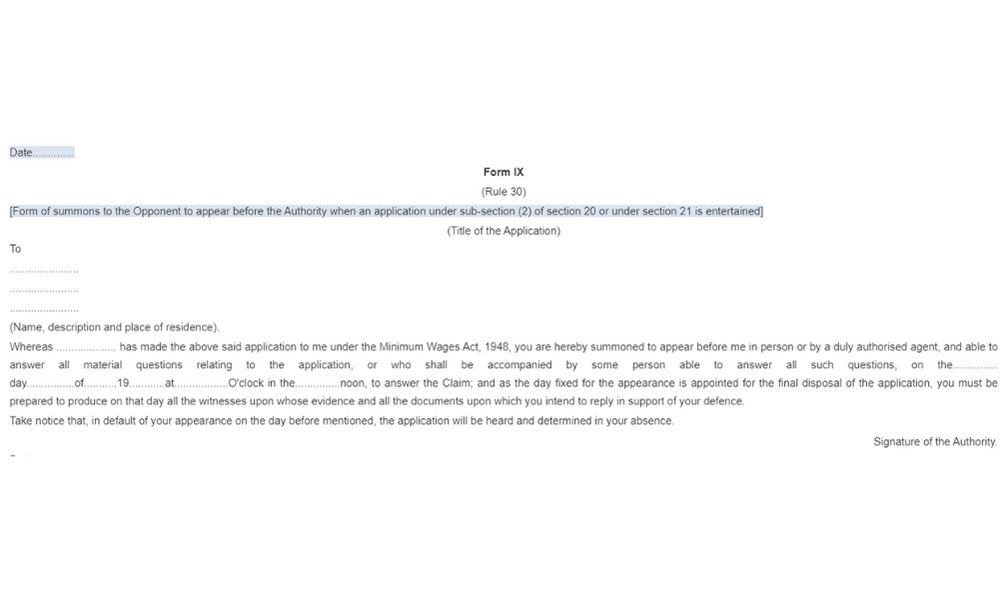

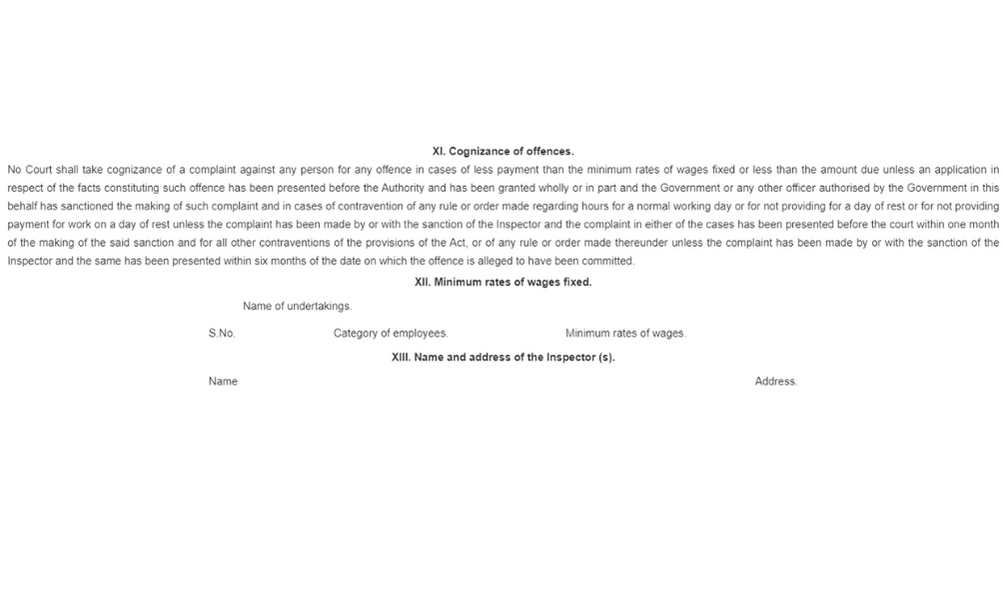

Forms

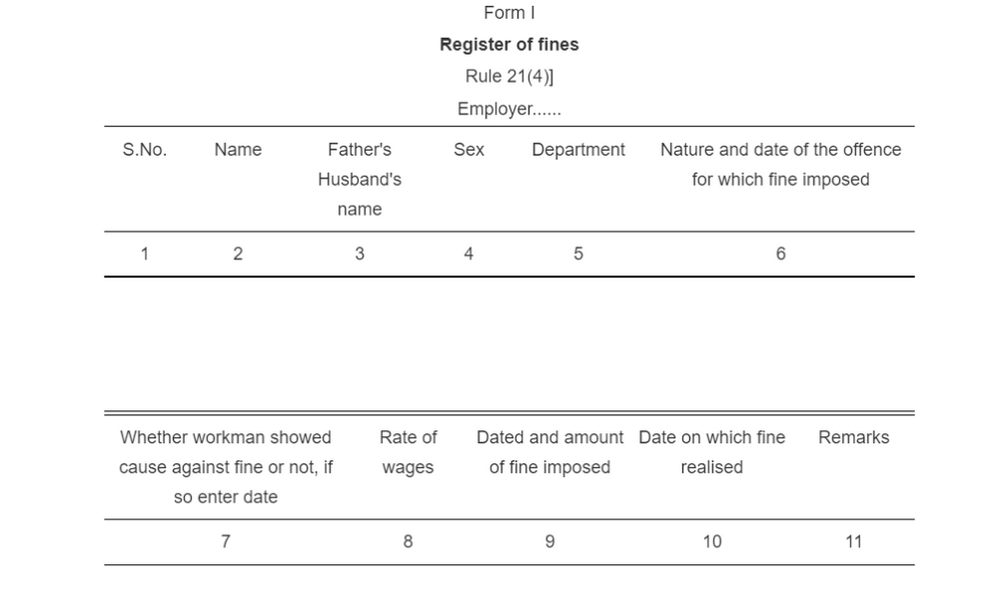

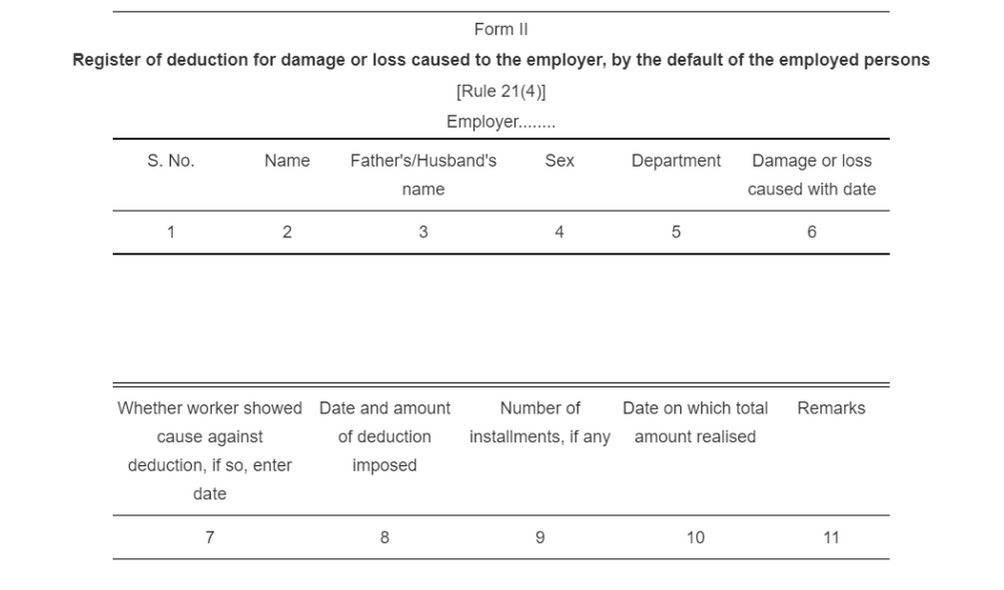

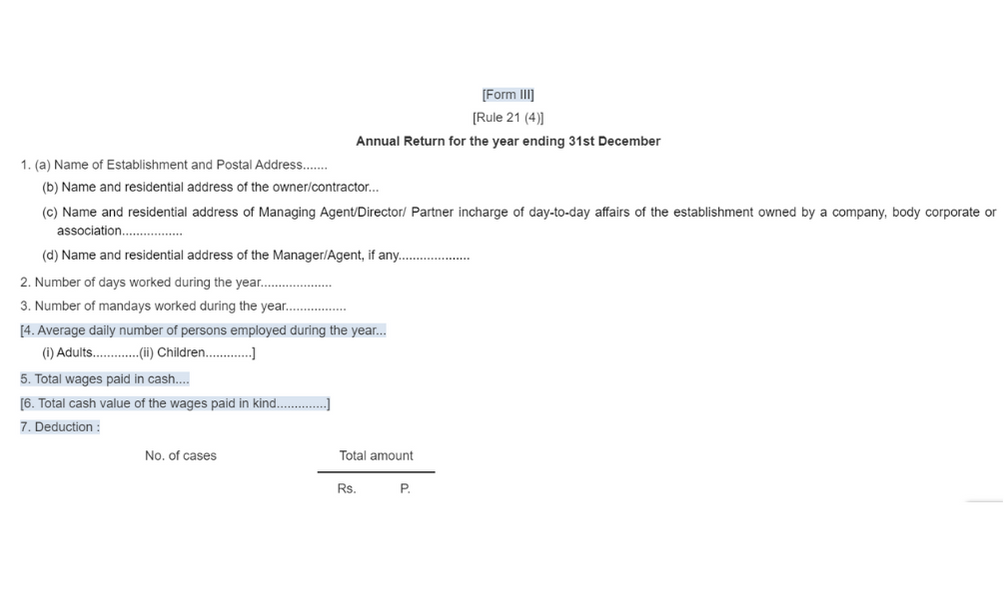

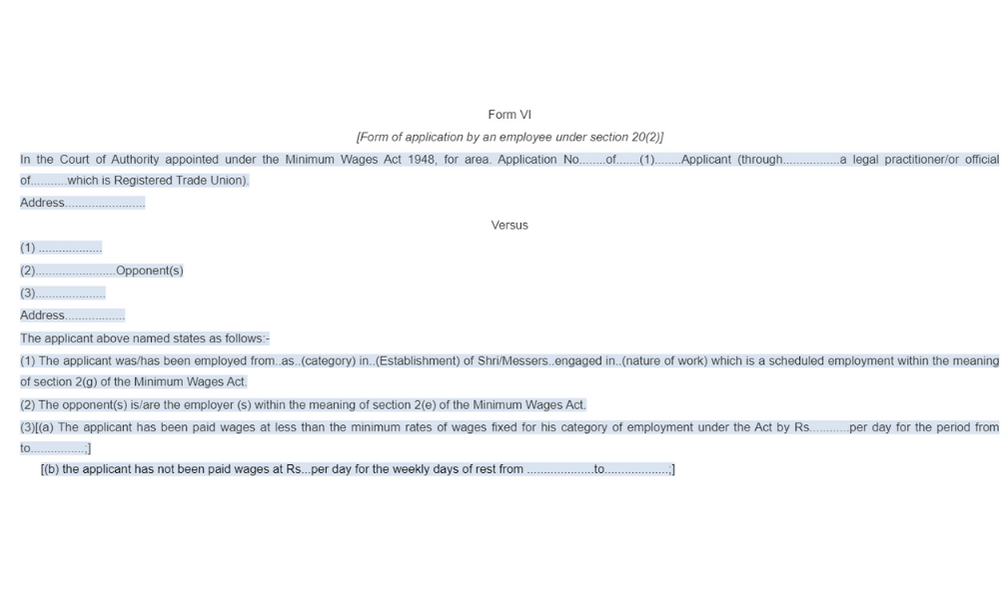

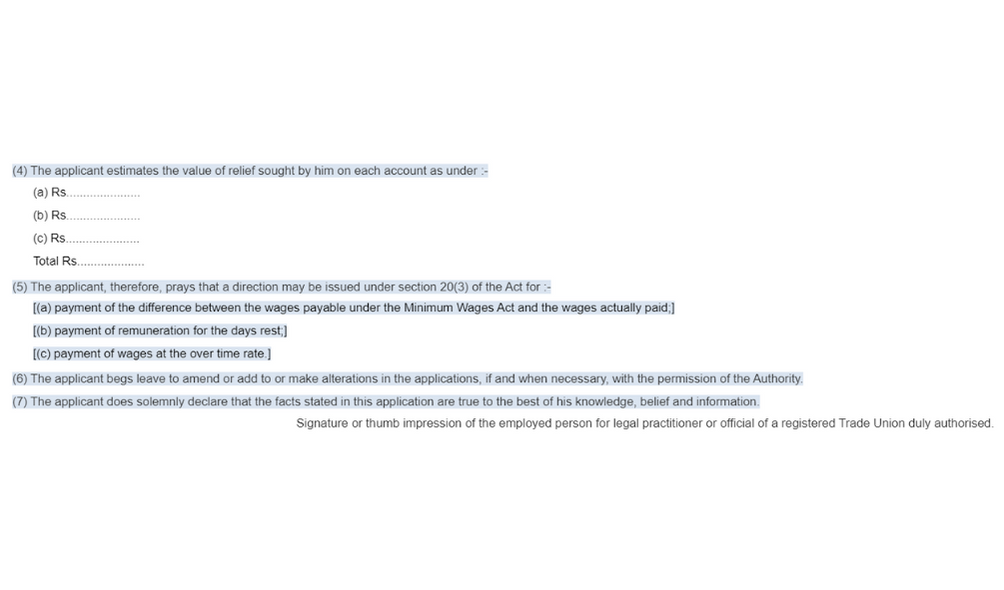

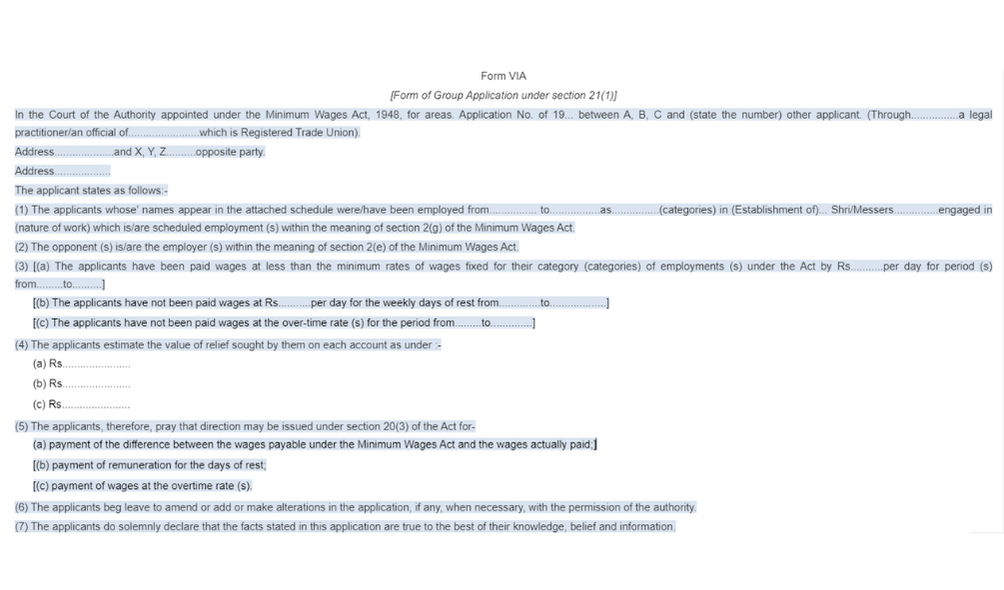

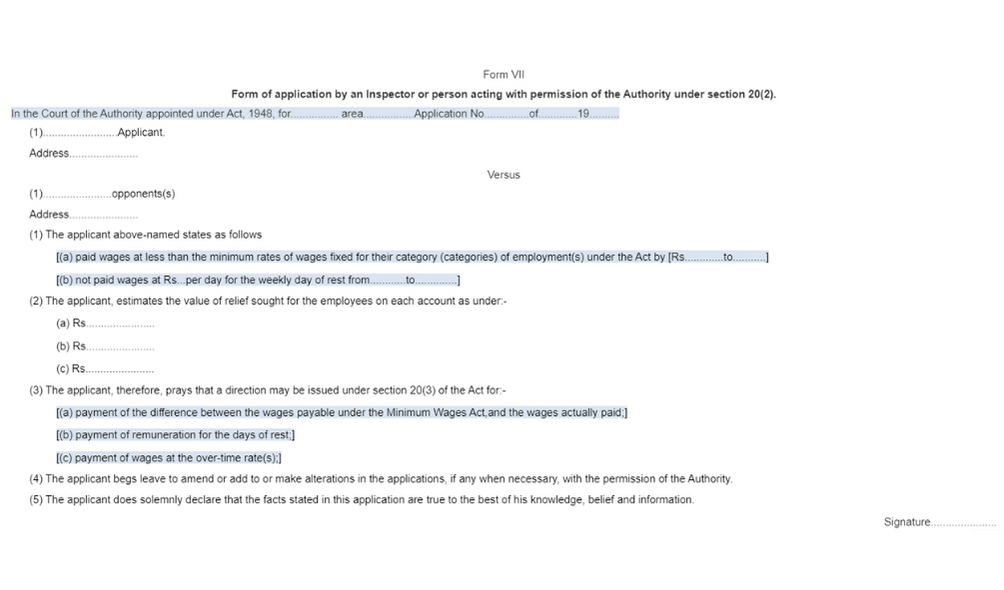

This section comprises of all the forms under the Act.

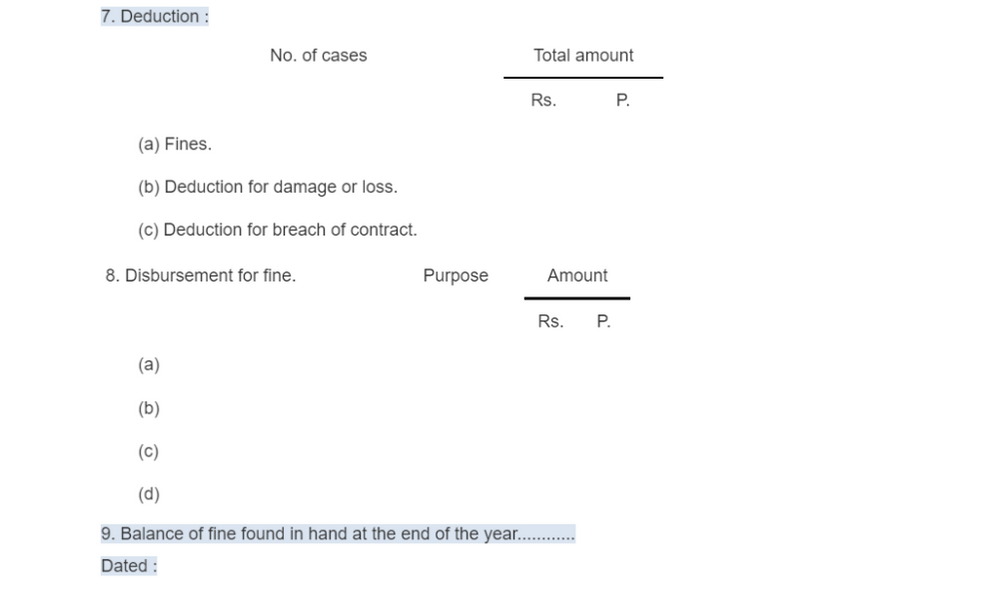

Form 1: Register of Fines

Form 2: Deductions Register

Form 3: Annual Returns

Form 4: Overtime Register

Form 5: Muster Roll

Form 6

Form 6A

Form 7

Form 8

Form 9

Form 10

Form 11 and 12

Form 13 and 14

Form 15 and 16

Form 17

Rajasthan Minimum Wages Rules Form

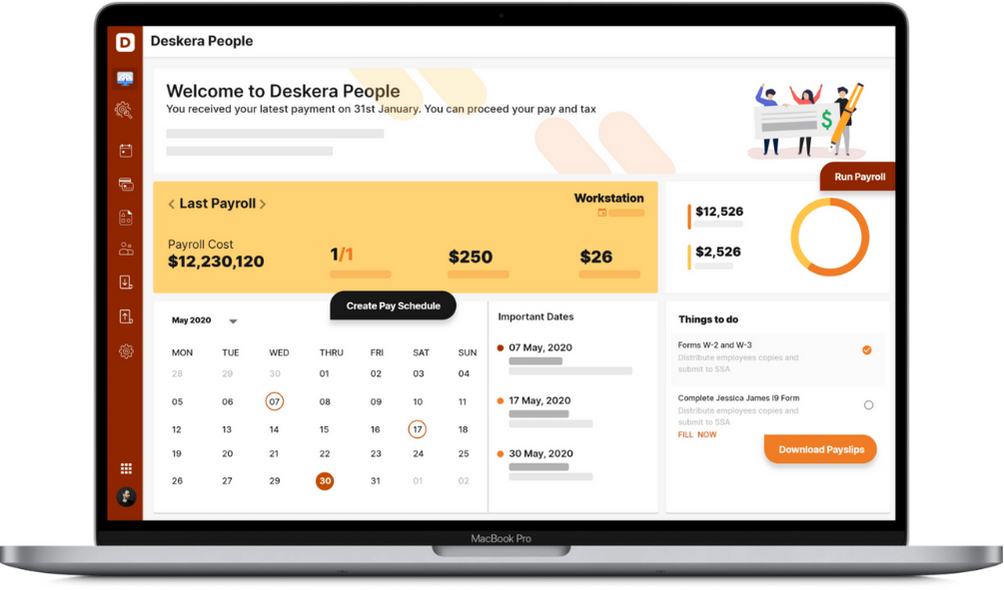

How can Deskera Help You?

Payroll management and employee management are integral to any organization. If you are looking for a comprehensive and automated tool to manage payroll, employees, expenses, contractor management, Deskera People could be the apt solution.

Key Takeaways

Let’s walk through the significant points discussed in the article:

- The Indian Labour Conference and the Standing Labour Committee set an investigation committee in 1943

- On 15th March 1948, the Parliament of India enacted the Minimum Wages Act 1948

- Minimum wages refer to the least amount or the minimum amount of wages an employer pays to the employees or the workers for the work done in a given time frame

- The minimum wages are fixed by an authority or statute

- The objective of the minimum wages act is to ensure that no employee or worker is exploited by the employer in terms of wages. Therefore, it aims to eliminate any occurrence of unduly low wages being paid to a worker

- Rajasthan Minimum Wages Rules, 1959 laid down the rules and guidelines to be followed by the employers in the scheduled employment scenario across the state of Rajasthan

- It is usually termed as ‘rules’ and takes references from the ‘Act’ which is the Minimum Wages Act, 1948

- There are various modes and criteria to compute the minimum wages

- The rules also prescribe the time and conditions for the payment of the wages

- The workers are also subject to deductions and terminations. The details of these are described in the document

- The document also details the hours of work, night shifts, overtime wages

- The employees or workers also get weekly holidays and days of rest as prescribed by the document

- Wage registers and slips are to be maintained by the employer in Form XI and Form XII

- The Rajasthan Minimum Wages Rules, 1959 has repealed all the earlier laws

Related Articles