As per the Bureau of Labor Statistics, the percentage of private sector employees enrolled in defined benefit plans declined from 35% in 1990 to 10% in 2019. As of 2020, public sector defined benefit plans in the US had a combined funding shortfall of $1.4 trillion, up from $1.2 trillion in 2019. (Source: Pew Charitable Trusts)

However, as per Milliman, in 2020, the average funded status of corporate defined benefit plans increased from 84% to 94% due in part to strong investment returns. Additionally, Defined benefit plan sponsors in the US paid out a total of $162 billion in benefits to retirees in 2020. (Source: Pension Benefit Guaranty Corporation)

In 2019, the average annual benefit payment from a defined benefit plan was $27,270 for private-sector retirees and $32,442 for public-sector retirees. (Source: National Institute on Retirement Security)

A defined benefit plan is a retirement plan in which the employer promises to pay a specific benefit amount to employees upon retirement based on a formula that takes into account factors such as salary and years of service.

While the above-mentioned statistics illustrate some of the trends and challenges facing defined benefit plans today, including declining enrollment in the private sector, and funding shortfalls for public plans, they also illustrate the significant financial impact of these plans on retirees and employers alike.

It is thus vital to have a complete understanding of defined benefit plans. This article will help you thereby covering the following topics:

- What is a Defined Benefit Plan?

- Differentiate Between Defined Benefit Plan vs. Defined Contribution Plan

- Differentiate Between Defined Benefit Plans and 401(k) Plans

- What are the Different Types of Defined Benefit Plans?

- How does a Defined Benefit Plan Work?

- How are Pension Benefits Calculated in Defined Benefit Plans?

- What are the Defined Benefit Plan Payment Options?

- What are the Contribution Limits for Defined Benefit Plans?

- What are the Advantages of Defined Benefit Plans?

- What are the Disadvantages of Defined Benefit Plans?

- How to Save for Retirement Outside of Defined Benefit Plans?

- FAQs related to Defined Benefit Plans

- How can Deskera Help with Defined Benefit Plans?

- Key Takeaways

- Related Articles

What is a Defined Benefit Plan?

A defined benefit plan is a type of retirement plan in which an employer promises to pay employees a specific amount of retirement income based on a formula that takes into account factors such as salary history and years of service.

The employer is responsible for making contributions to the plan, investing the funds, and assuming the investment risk. The amount of retirement income that an employee will receive is predetermined, or "defined," by the formula of the plan, hence the name "defined benefit plan."

In contrast to a defined contribution plan, such as a 401(k) plan, where the employee is responsible for making contributions and managing the investment risk, in a defined benefit plan, the employer bears the investment risk and is required to provide the promised benefits to eligible employees.

Defined benefit plans were once common in the private sector, but in recent years, many employers have shifted to defined contribution plans because of their lower cost and the reduced financial risk they pose to employers.

Differentiate Between Defined Benefit Plan vs. Defined Contribution Plan

A defined benefit plan and a defined contribution plan are two types of retirement plans that differ in several key ways:

- Benefit Promise: A defined benefit plan promises a specific retirement benefit, while a defined contribution plan does not. In a defined benefit plan, the employer bears the investment risk and guarantees the retirement benefit, while in a defined contribution plan, the employee bears the investment risk, and the retirement benefit depends on the performance of the investments in the account.

- Contributions: In a defined benefit plan, the employer makes contributions to the plan, while in a defined contribution plan, the employee (and sometimes the employer) makes contributions.

- Investment Risk: In a defined benefit plan, the employer bears the investment risk and is responsible for managing the investments to ensure that the plan is adequately funded. In a defined contribution plan, the employee bears the investment risk and is responsible for managing the investments in their account.

- Portability: Defined contribution plans are typically more portable than defined benefit plans. In a defined contribution plan, the employee owns the account and can take it with them when they leave the employer. In a defined benefit plan, the employee may have to leave some or all of the promised benefits behind when they leave the employer.

- Regulatory requirements: Defined benefit plans are subject to more stringent regulatory requirements than defined contribution plans. This includes requirements related to funding, vesting, and benefit security.

Overall, defined benefit plans offer a guaranteed retirement benefit, while defined contribution plans offer more flexibility and investment control to employees. Each type of plan has its advantages and disadvantages, and the choice between the two will depend on the employer's goals, budget, and workforce needs.

Differentiate Between Defined Benefit Plans and 401(k) Plans

A defined benefit plan and a 401(k) plan are two types of retirement plans that differ in several key ways:

- Benefit Promise: A defined benefit plan promises a specific retirement benefit, while a 401(k) plan does not. In a defined benefit plan, the employer guarantees a specific retirement benefit, while in a 401(k) plan, the employee's retirement benefit depends on the performance of the investments in the account.

- Contributions: In a defined benefit plan, the employer makes contributions to the plan, while in a 401(k) plan, the employee (and sometimes the employer) makes contributions.

- Investment Risk: In a defined benefit plan, the employer bears the investment risk and is responsible for managing the investments to ensure that the plan is adequately funded. In a 401(k) plan, the employee bears the investment risk and is responsible for managing the investments in their account.

- Benefit Portability: 401(k) plans are typically more portable than defined benefit plans. In a 401(k) plan, the employee owns the account and can take it with them when they leave the employer. In a defined benefit plan, the employee may have to leave some or all of the promised benefits behind when they leave the employer.

- Contribution Limits: 401(k) plans have contribution limits that may change every year. In 2022, the contribution limit for a 401(k) plan was $20,500 per year ($27,000 if you're age 50 or older). Defined benefit plans have no contribution limits, but the amount of benefits that can be earned is limited by IRS rules.

- Employer responsibility: In a defined benefit plan, the employer is responsible for ensuring that the plan is adequately funded to pay the promised benefits. In a 401(k) plan, the employer may make contributions to the plan, but the responsibility for managing the investments and ensuring adequate retirement income falls on the employee.

Overall, a defined benefit plan provides employees with a guaranteed retirement benefit, while a 401(k) plan provides more flexibility and investment control to employees. Each type of plan has its advantages and disadvantages, and the choice between the two will depend on the employer's goals, budget, and workforce needs.

What are the Different Types of Defined Benefit Plans?

There are several types of defined benefit plans, including:

- Traditional Defined Benefit Plan: This is the most common type of defined benefit plan. It promises a specific retirement benefit based on a formula that takes into account an employee's salary history and years of service.

- Cash Balance Plan: This is a hybrid plan that combines the features of a defined benefit plan with those of a defined contribution plan. With a cash balance plan, the employer contributes a specified amount to each employee's account each year, which earns interest. Upon retirement, the employee receives the accumulated balance as a lump sum or an annuity.

- Unit Benefit Plan: This type of defined benefit plan promises a retirement benefit based on a fixed dollar amount per year of service. The benefit is typically expressed as a percentage of the employee's salary, with the percentage increasing as the employee's years of service increase.

- Floor-Offset Plan: This type of defined benefit plan is often used in conjunction with a defined contribution plan, such as a 401(k). It provides a minimum level of benefits that are guaranteed regardless of investment performance. If the benefits from the defined contribution plan are less than the minimum level, the defined benefit plan will make up the difference.

- Pooled Employer Plan: This is a new type of defined benefit plan that allows multiple employers to participate in a single plan. This can reduce administrative costs and increase investment options.

The specific features and benefits of each type of defined benefit plan can vary, and it is important to review the plan documents and seek professional advice before making any decisions.

How does a Defined Benefit Plan Work?

A defined benefit plan works by promising employees a specific retirement benefit based on a formula that takes into account factors such as the employee's salary history and years of service. Here's how it typically works:

- Employer Contributions: The employer sets up and contributes to the defined benefit plan. These contributions are invested with the goal of generating a return that will fund the promised benefits.

- Benefit Formula: The employer determines a benefit formula, which calculates the employee's retirement benefit based on a variety of factors, including the employee's years of service and salary history. The formula is typically expressed as a percentage of the employee's average salary over a certain number of years.

- Vesting: The employee may need to work for the employer for a certain number of years to become vested in the plan. This means that the employee has earned the right to receive the promised benefit even if they leave the employer before retirement.

- Retirement: When the employee retires, they start receiving a retirement benefit from the plan, based on the benefit formula. The benefit is usually paid out as a monthly annuity, although some plans may offer other payout options.

- Funding: The employer is responsible for ensuring that the plan is adequately funded to pay the promised benefits. This may involve making additional contributions to the plan, adjusting the benefit formula, or taking other steps to manage the plan's investments and expenses.

Overall, a defined benefit plan provides employees with a guaranteed retirement benefit but places the investment and financial risk on the employer. This type of plan is less common in the private sector today but is still used by some public-sector employers and certain large corporations.

How are Pension Benefits Calculated in Defined Benefit Plans?

Pension benefits in defined benefit plans are calculated using a formula that takes into account various factors, such as an employee's salary history, years of service, and age. The formula used to calculate the pension benefit can vary from plan to plan but generally involves the following components:

- Accrual Rate: This is the percentage of an employee's salary that is used to calculate their pension benefit for each year of service. For example, if the accrual rate is 2%, an employee who earns $50,000 per year and works for ten years would be entitled to a pension benefit of $10,000 per year (2% x $50,000 x 10 years).

- Final Average Pay: This is the average of an employee's salary over a certain number of years, typically the last 3-5 years of service. For example, if an employee's final average pay is $60,000 and they have a 2% accrual rate and 20 years of service, their annual pension benefit would be $24,000 (2% x $60,000 x 20 years).

- Vesting: This is the period of time an employee must work before they are entitled to receive their full pension benefit. Vesting periods can vary but are typically 5-10 years. If an employee leaves the company before becoming fully vested, they may still be entitled to a partial pension benefit based on the number of years they worked.

- Early Retirement Reductions: If an employee chooses to retire before reaching the plan's normal retirement age, their pension benefit may be reduced to account for the longer period of time over which it will be paid.

- Cost-of-Living Adjustments: Some defined benefit plans provide for cost-of-living adjustments to pension benefits to help protect against inflation.

Overall, the formula used to calculate pension benefits in a defined benefit plan can be complex and may take into account a variety of factors. Employees should review their plan documents carefully to understand how their benefits will be calculated and what factors may affect their pension income.

However, it is important to note that there is no single method defined benefit plans use to calculate employee benefits.

The calculation may be based on the employee's average salary during the previous three or five years of employment. It may also be determined by the employee's average annual salary during the course of their employment with the organization, or it may be a set financial amount, such as $800 for each year of service.

Businesses typically receive tax benefits for making contributions to these plans, but they are also responsible for making the promised payments to beneficiaries, regardless of how the underlying investments in the plan might fare.

This is one of the key differences between pension plans and 401(k)s, whose future benefits are wholly dependent on uncertain investment performance.

Furthermore, the Pension Benefit Guaranty Corporation, a federal insurance provider, safeguards the benefits in the majority of defined benefit plans, subject to specific restrictions (PBGC).

What are the Defined Benefit Plan Payment Options?

Defined benefit plans typically offer several payment options for retirees to choose from. The most common payment options include the following:

1.Single Life Annuity: With this option, the retiree receives a monthly benefit for their lifetime only. Upon the retiree's death, the pension payments stop, and no further payments are made to any beneficiary.

2.Joint and Survivor Annuity: This option provides a reduced monthly benefit to the retiree but guarantees a survivor benefit for the retiree's spouse or designated beneficiary after the retiree's death. The survivor benefit is typically a percentage (such as 50% or 75%) of the retiree's benefit and continues for the survivor's lifetime.

a. 50% joint and survivor- Your surviving spouse will get lifetime payments that are equal to 50% of your initial annuity after your passing.

b. 100% joint and survivor- Your surviving spouse will get lifetime payments that are equal to 100% of your initial annuity when you pass away.

3. Lump Sum Payment: Some defined benefit plans offer the option of a lump sum payment instead of a monthly annuity. This allows the retiree to take the entire value of their benefit in a single payment. However, once the lump sum is received, the retiree is responsible for managing and investing the funds to ensure they last for the rest of their life.

4. Period Certain Annuity: This option guarantees the retiree a monthly benefit for a set period of time, such as 10 or 20 years, regardless of whether they live for the entire period. If the retiree dies before the end of the period, their designated beneficiary will receive the remaining payments.

5. Cash Balance Plan: Some defined benefit plans, known as cash balance plans, offer a hybrid approach that combines the features of a defined benefit plan with those of a defined contribution plan. With this option, the retiree receives a monthly benefit for their lifetime, but the benefit is defined in terms of a hypothetical account balance that accumulates over time.

Overall, the choice of payment option will depend on the retiree's individual circumstances, financial goals, and risk tolerance. You'll often receive lesser monthly payments if you add extra restrictions to your annuity.

But, choosing annuity payments will often be most advantageous if you're in good health and anticipate living a long life. A lump sum can be the best option if your health is weak and you anticipate a brief retirement.

It is important to review the plan's payment options carefully and seek professional advice before making a decision.

What are the Contribution Limits for Defined Benefit Plans?

For defined benefit plans, there are still yearly limits, even though employees often have little control over their benefits. The yearly benefit for an employee cannot be greater than $265,000 in 2023, or 100% of the average salary for their best three consecutive calendar years of earnings. It's an increase from $245,00 in 2022.

What are the Advantages of Defined Benefit Plans?

There are several advantages to defined benefit plans, including:

- Guaranteed Retirement Income: Defined benefit plans provide retirees with a guaranteed stream of income for life. This can provide peace of mind and reduce the risk of outliving retirement savings.

- Professional Investment Management: The responsibility for investing and managing the plan's assets rests with the employer or plan trustee, who are typically financial professionals with experience and expertise in managing large investment portfolios. This can help ensure that the plan's assets are invested in a diversified and prudent manner, which can help maximize returns and minimize risk.

- Employer Contributions: In most cases, the employer is responsible for funding the plan and bears the investment risk. This can help ensure that employees receive a consistent and reliable retirement benefit, even if investment returns are lower than expected.

- Tax Advantages: Contributions to a defined benefit plan are tax-deductible, which can provide significant tax savings for the employer. Additionally, employees typically do not pay taxes on their contributions or the plan's investment earnings until they receive payments from the plan.

- Social Security Integration: Defined benefit plans can be designed to integrate with Social Security benefits, which can provide additional retirement income for participants.

Overall, defined benefit plans can provide a secure and reliable source of retirement income for employees while also offering tax advantages and professional investment management. However, the cost and administrative complexity of these plans can make them less attractive to some employers.

What are the Disadvantages of Defined Benefit Plans?

There are several potential disadvantages of defined benefit plans, including:

- High Cost: Defined benefit plans can be expensive to administer and require significant contributions from employers. The cost of providing a guaranteed retirement benefit can be difficult to predict and can vary depending on investment performance, interest rates, and other factors.

- Complexity: Defined benefit plans are often more complex than other retirement plans, such as defined contribution plans. They require actuarial calculations and professional investment management, which can be challenging for smaller employers or those without financial expertise.

- Limited Portability: Defined benefit plans are typically tied to a specific employer and may not be portable. This can make it difficult for employees to take their benefits with them if they change jobs or leave the workforce.

- Investment Risk: Although employers bear most of the investment risk in a defined benefit plan, poor investment performance can still impact the plan's funding level and the retiree's benefit amount.

- Benefit Reductions: In some cases, employers may need to reduce or freeze pension benefits if the plan's funding level falls below a certain threshold. This can result in a significant reduction in retirement income for employees.

Overall, the advantages and disadvantages of defined benefit plans will depend on the specific circumstances and goals of the employer and employees. It is important to carefully evaluate the costs and benefits of any retirement plan before making a decision.

How to Save for Retirement Outside of Defined Benefit Plans?

There are several ways to save for retirement outside of defined benefit plans, including:

- Individual Retirement Accounts (IRAs): IRAs allow individuals to save for retirement on a tax-deferred basis. There are two main types of IRAs: traditional and Roth. Traditional IRAs allow contributions to be deducted from taxable income, while Roth IRAs are funded with after-tax dollars and provide tax-free withdrawals in retirement.

- 401(k) Plans: 401(k) plans are a type of defined contribution plan that allows employees to save for retirement through pre-tax contributions. Many employers offer 401(k) plans as a benefit to their employees.

- Simplified Employee Pension Plans (SEPs): SEPs are retirement plans that are designed for small businesses and self-employed individuals. They allow contributions of up to 25% of compensation, up to a maximum of $58,000 in 2021.

- Health Savings Accounts (HSAs): HSAs are tax-advantaged accounts that can be used to save for healthcare expenses in retirement. Contributions to an HSA are tax-deductible, and withdrawals for qualified medical expenses are tax-free.

- Non-Qualified Accounts: Non-qualified accounts, such as brokerage accounts or mutual funds, can also be used to save for retirement. While they do not offer the tax advantages of retirement-specific accounts, they offer greater flexibility in terms of investment options and withdrawal rules.

It is important to consult with a financial advisor or tax professional to determine the best retirement savings strategy for your individual needs and circumstances. The key is to start saving early and consistently and to have a well-diversified investment portfolio that is aligned with your retirement goals.

FAQs related to Defined Benefit Plans

- What is a defined benefit plan?

A defined benefit plan is a retirement plan in which the employer promises to pay a specific benefit amount to employees upon retirement based on a formula that takes into account factors such as salary and years of service.

- How are defined benefit plans funded?

Defined benefit plans are funded by employer contributions, which are invested in a pool of assets to generate returns that can be used to pay retirement benefits.

- Who is responsible for managing a defined benefit plan?

The employer or plan trustee is responsible for managing the plan's assets, making investment decisions, and ensuring that there are sufficient funds to pay benefits to retirees.

- How are pension benefits calculated in defined benefit plans?

Pension benefits in defined benefit plans are typically calculated based on a formula that takes into account factors such as salary, years of service, and age at retirement.

- What happens if a defined benefit plan is underfunded?

If a defined benefit plan is underfunded, the employer may be required to make additional contributions to the plan to bring it back to a fully funded status. In some cases, benefits may need to be reduced or frozen to ensure that the plan can continue to pay benefits to retirees.

- Are defined benefit plans insured by the government?

Yes, defined benefit plans are insured by the Pension Benefit Guaranty Corporation (PBGC), which is a government agency that provides protection for certain private sector pension plans.

- Are defined benefit plans portable?

Defined benefit plans are typically tied to a specific employer and are not portable. However, some plans may offer vesting schedules that allow employees to earn a portion of their benefits over time, even if they leave the employer before retirement.

- Can employees contribute to defined benefit plans?

In most cases, employees do not contribute directly to defined benefit plans. The plan is funded entirely by employer contributions.

- Can defined benefit plans be converted to defined contribution plans?

In some cases, employers may choose to freeze or terminate a defined benefit plan and replace it with a defined contribution plan, such as a 401(k) plan. This can allow employees to have more control over their retirement savings.

- What happens if an employer goes bankrupt and has an underfunded defined benefit plan?

If an employer goes bankrupt and has an underfunded defined benefit plan, the PBGC may assume responsibility for the plan and provide benefits to retirees up to certain limits.

- What is a cash balance plan?

A cash balance plan is a type of defined benefit plan in which benefits are calculated based on a hypothetical account balance rather than a traditional pension formula.

- Are defined benefit plans taxable?

Defined benefit plans are tax-deferred, meaning that contributions and investment earnings are not taxed until benefits are paid to retirees.

- Can employees take lump-sum payments from a defined benefit plan?

In some cases, employees may be able to take a lump-sum payment from a defined benefit plan instead of receiving monthly pension payments. However, this option may not be available for all plans.

- What happens to defined benefit plan benefits if an employee dies before retirement?

In most cases, defined benefit plans offer survivor benefits to spouses or beneficiaries in the event of an employee's death before retirement.

- Can employees receive Social Security benefits in addition to defined benefit plan benefits?

Yes, employees can receive Social Security benefits in addition to defined benefit plan benefits, although the amount of Social Security benefits may be reduced if the employee is also receiving a pension.

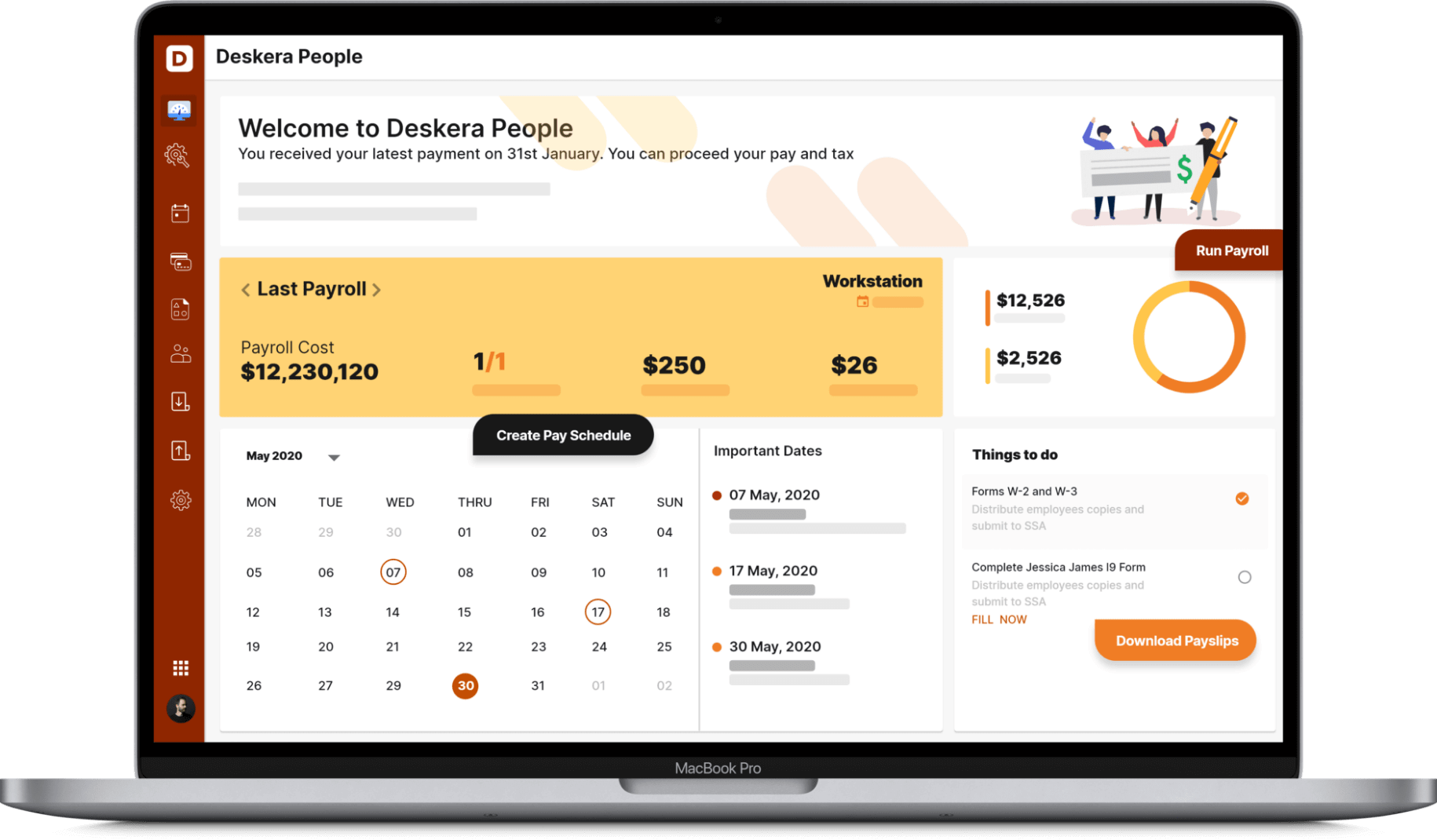

How can Deskera Help with Defined Benefit Plans?

Deskera offers comprehensive HR management software, i.e., Deskera People, that can help with managing defined benefit plans.

Some of the features of Deskera People that can assist with defined benefit plans include:

- Benefit tracking: Deskera HR management software allows employers to track and manage employee benefits, including defined benefit plans.

- Reporting: Deskera HR management software provides powerful reporting capabilities that can help employers keep track of plan funding status, plan expenses, and employee participation.

- Compliance: Deskera HR management software can help ensure that employers are in compliance with applicable laws and regulations governing defined benefit plans.

- Employee self-service: Deskera HR management software offers a self-service portal that allows employees to view their benefits information, including their defined benefit plan benefits.

- Integration: Deskera HR management software can integrate with payroll systems, making it easy to track and manage employee benefits alongside other HR functions.

Overall, Deskera People can help streamline the administration of defined benefit plans, making it easier for employers to manage these complex retirement plans and provide employees with accurate and up-to-date information about their benefits.

Key Takeaways

- A defined benefit plan is a type of retirement plan that promises to pay a specific benefit amount to employees upon retirement.

- The benefit amount is typically based on a formula that takes into account factors such as years of service and salary history.

- Defined benefit plans are funded by employers, who are responsible for ensuring that there is enough money to pay the promised benefits.

- Employers must comply with various rules and regulations governing defined benefit plans, including funding requirements and reporting requirements.

- There are different types of defined benefit plans, including traditional pension plans, cash balance plans, and floor-offset plans.

- Defined benefit plans offer several advantages, including guaranteed retirement income and professional investment management.

- However, they also have some drawbacks, including the potential for underfunding and the lack of flexibility in benefit design.

- Employees who are not eligible for a defined benefit plan or who want to supplement their retirement savings may consider contributing to a defined contribution plan, such as a 401(k) or IRA.

- Employers can use HR management software, such as Deskera People, to help manage their defined benefit plans, including tracking and reporting on plan funding and compliance.

Overall, defined benefit plans are a complex but valuable retirement savings vehicle that can provide employees with a reliable source of retirement income. Employers should carefully consider the advantages and disadvantages of these plans and work with their HR and financial advisors to design and manage them effectively.

Related Articles