A debenture is a medium to long term debt tool used by large businesses to borrow money, at a fixed rate of interest. In corporate finance, a debenture is a debt instrument or a type of bond that is not secured by collateral.

Debentures have no collateral backing, hence debentures must rely on the issuer's creditworthiness and reputation for support. A debenture is like a loan bond or certificate of loan, signify that the business is liable to pay the amount with interest included.

Governments and corporations frequently issue debentures to raise capital or funds.

What are Debentures?

Debentures are documented in an indenture like many types of bonds. An indenture is a legal, binding contract between bond issuers and bondholders. Like most bonds, debentures may pay periodic interest payments called coupon payments.

A debenture contract specifies features of a debt offering, such as the method of interest calculation, the timing of interest, the maturity date, coupon payments and other features.

Government bonds are considered low-risk investments and have the backing of the government issuer. Governments usually issue long-term bonds—those with maturities of longer than 10 years.

Corporations use debentures as long term loans. However, the debentures of corporations are usually unsecured. These have the backing of only the financial viability and creditworthiness of the underlying business. The debt instruments pay an interest rate and are redeemable or repayable on a fixed date.

A company usually makes these scheduled debt interest payments before they pay stock dividends to shareholders. Debentures are more advantageous for businesses as they have lower interest rates and longer repayment dates as compared to other loan types and debt instruments.

What are Convertible and Non-convertible Debentures?

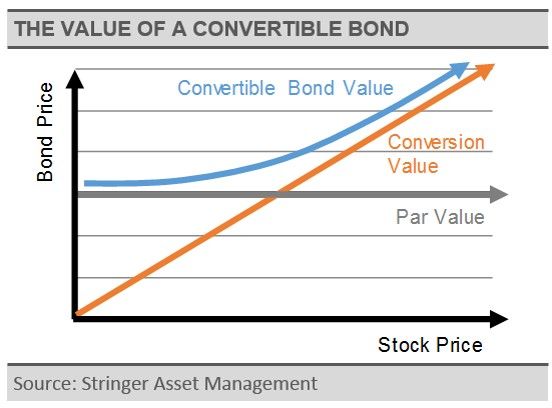

Convertible debentures are bonds that we can convert into equity shares of the issuing corporation after a specific period.

Convertible debentures are mixed financial products with the benefits of both equity and debt. Companies use debentures as fixed rate loans and pay fixed interest payments.

Holders of convertible debenture have the choice of holding on to the loan till maturity date, and to receive interest payments or to eventually convert their loan into equity shares.

Convertible debentures are more attractive to investors who want to convert to equity if they believe the companies stock will rise in the long term. The ability to convert your debenture to equity comes at a price since convertible debentures pay a lower interest rate compared to other fixed rate investments.

Nonconvertible debentures are more traditional debentures that cannot be converted into equity of the issuing corporation. To compensate for the lack of convertibility, the investors are rewarded with higher interest rates as compared to convertible debentures.

What are the Features of Debenture?

When we start issuing a debenture as a first step, a trust indenture should be drafted. Usually the first trust is an agreement between the issuing corporation and the trustee which manages the interest of investors.

Interest Rate

The coupon rate is considered based on what is the rate of interest the company is willing to pay the investor or debenture holder. The coupon rate can be floating or fixed. Floating rate may be tied to a benchmark like the yield of the 10 year Treasury bonds and will change as the benchmark changes overtime.

Credit Rating

The business's credit ratings and the debenture's credit ratings impact the interest rate that investors will receive. Credit rating agencies measure the creditworthiness of corporate and government issues. These agencies provide investors with an overview of the risks involved in investing in debt with the company.

The date of maturity for non-convertible debentures is an important feature. This is because the date dictates when the company must pay back the debenture holders.

The business has options on the kind of repayment they will take. Usually it is taken as redemption from the capital. This is where the issuer pays just a lump sum amount of money on maturity of the debt.

Another way is that the payment is used as a redemption reserve. This is where the company pays a certain amount each year until the full repayment on the maturity date.

Pros

- Convertible debentures are converted to equity shares after a certain period of time, hence making them more appealing

- Debenture pays regular interest rate or coupon rate return to investors

- In the event of business's bankruptcy the debenture is usually paid before the common stock shareholders

Cons

- Debentures have inflationary risk if the coupon paid cannot keep up with the rate of inflation.

- Fixed-rate debentures have interest rate risk exposure in environments where the market interest rate is rising

- Credit worthiness is important when considering the chance of default risk from the underlying issuer's financial viability

What are the Debenture Risks to Investors?

Debenture holders always face inflationary risk. The inflation risk is that the debt's interest rate paid may not keep up with the rate of inflation. Inflation measures economy-based price increases.

Let's say the inflation causes prices to increase by 3%. If the debenture coupon pay at 2% then the holders will see it as a net loss.

Debentures also carry interest rate risk. In this kind of scenario, investors hold fixed-rate debts during times of rising market interest rates. Investors may find their debt returning less in such a case.Hence, the debenture holder earns a lower yield in comparison.

Debentures can also carry credit risk and default risk. As mentioned, debentures are only as secure as the issuer's financial strength.

If the company is struggling financially due to macroeconomic factors, investors are at risk of default on the debenture. A debenture holder would be mostly repaid before common stock shareholders in the event of bankruptcy.

Key Takeaways

- Debenture is a type of debt that usually has a term greater than 10 years and is not backed by any collateral

- The main features of a debenture are the interest rate, the credit rating and the maturity date

- Debentures are backed by creditworthiness and reputation of the issuer

- Governments and Corporations usually issue debentures to raise capital or funds

- Some of the debentures can convert to equity shares while others cannot