All business entities will need to Register under GST and obtain a unique 15-digit Goods and Service Tax Identification Number (GSTIN). It will replace the previously existing Tax Identification Number (TIN), allotted to businesses for registering under VAT.

Introduction

The GST (The Goods and Services Tax), came into the picture on 1 July 2017 in a historic event in the Parliament to simplify the existing tax structure of India. The aim of launching this new tax regime is one market, one tax, one nation. New GST now replaces a dozen state and central levied taxes such as excise, VAT, and service tax.

As a result of this, all business entities will need to Register under GST and obtain a unique 15-digit Goods and Service Tax Identification Number (GSTIN). It will replace the previously existing Tax Identification Number (TIN), allotted to businesses for registering under VAT.

All registered taxpayers will be consolidated on a single platform in the new GST regime for compliance and administration purposes and registered under an only authority. Around 8 million taxpayers were migrated from various platforms on to GST.

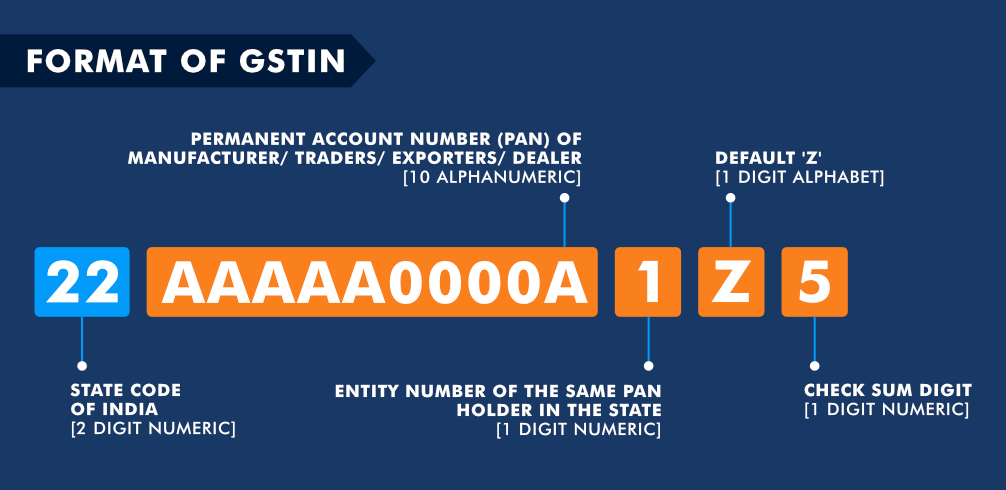

1. Structure of GSTIN

Each taxpayer is assigned a unique code known as GSTIN., which will be PAN based and state wise. The breakdown of the 15-digit GSTIN format is as below,

- Every Union territory or state has a unique code. The first two digits of the GSTIN indicates the state code as per the Indian Census,2011. For example, 09 is for Uttar Pradesh, and 27 stands for Maharashtra.

- The next ten digits are the PAN number of the business house or the taxpayer

- The 13th digit will be the registration number for the same PAN in a state. It is an alpha-numeric digit (first 1-9 and then A-Z)

- By default, the 14th digit will be alphabet 'Z.'

- The last 15th digit will be a check code that will be used for the detection of errors.

2. How to Apply for GSTIN?

To apply for the GSTIN, it is part of the GST Registration process. Once the GST officer approves the application, a unique GSTIN is allocated to the dealer.

Below are the two ways to register for GST:

a. GST Seva Kendra set up by Govt of India, or

b. via GST Online Portal

Below details are required to apply for GST

3. How is GSTIN Different From GSTN?

GSTIN and GSTN are two different numbers. Under GST, GSTIN is a tax registration tax.

Whereas, the GSTN (Goods and Service Tax Network) is an institution that manages the entire IT system of the GST portal. The Government of India will use this portal to track every financial transaction. It will provide taxpayers with all services – from registration to filing taxes and maintaining all tax details.

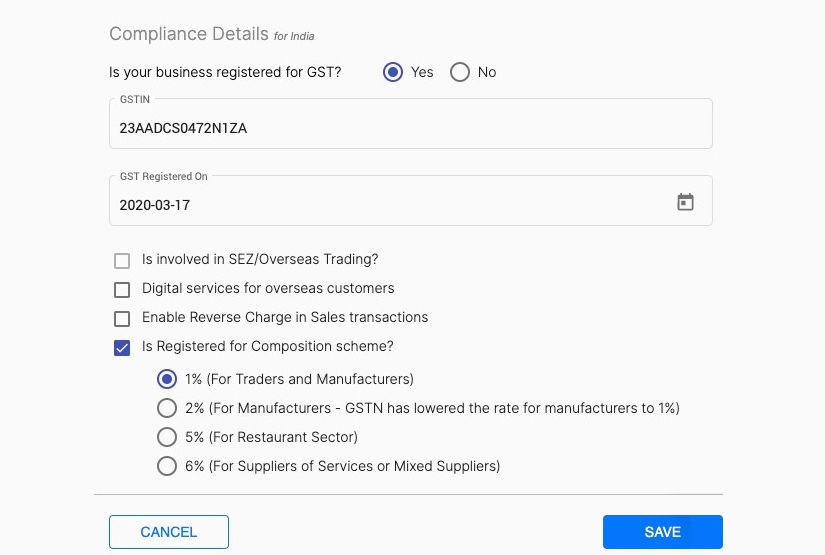

GSTIN Under Deskera Books

If you are a GST-registered business, using Deskera Books you have an option to fill in the GSTIN field. You can choose more than one field that applies to your organization. Selecting the right field enables us to compute the accurate Goods and Service Tax that you'll have to pay to the Government.

Sign up with Deskera today to make GST calculation and filing easier.