One of the few accessible small-business loans designed exclusively for startups is the SBA Microloan Program. Businesses, both new and established, are eligible to borrow up to $50,000 to expand.

The microloan programme, in contrast to other SBA loans, is managed by a network of nonprofit community-based lenders rather than traditional banks and is entirely funded by the U.S. Small Business Administration.

The SBA microloan programme intends to connect with these lenders in order to assist lower-income areas and enterprises that are frequently disregarded by regular lenders. For instance, women-owned firms received over 47% of SBA microloans during the 2020 fiscal year.

Table of contents

- What is an SBA microloan?

- Who can obtain an SBA microloan?

- Practical Advice for Creating a Successful Startup with the help of SBA Microloan Program

- How can you lessen the likelihood that your startup will fail?

- Do banks offer loans to new businesses?

- Will banks lend money to new business ventures?

- Can I acquire a bank loan as a startup for technological research and development?

- Are there any specific loans or schemes for startups?

- How should a business seek money from a bank?

- What benefits may a new company expect from obtaining a bank loan?

- How to apply for an SBA loan?

- How Will a Small Business Loan Help My Company?

- Advantages and disadvantages of SBA microloans

- Key Takeaways

What is an SBA microloan?

The Small Business Administration provides funding for the SBA Microloan Program, which are smaller-scale loans. Although loans can be up to $50,000 for qualified small-business owners, they are usually significantly smaller. The average SBA microloan in fiscal year 2020 was $14,434 and had a 6.5 percent interest rate.

While the SBA Microloan Program funds the microloans, an intermediate lender, typically a nonprofit community development corporation, handles the bulk of the work. The lender maintains the loan, distributes loan funds, and processes applications. With direction from the SBA Microloan Program, each intermediary lender is free to determine its own interest rates and eligibility standards, resulting in a range of rates, fees, and minimum loan amounts.

In order to protect themselves against default, lenders frequently demand collateral. If you obtain a microloan to buy equipment, that item will act as security for the loan. In most circumstances, you must additionally put your name to a personal guarantee that you will pay back the debt.

Small enterprises and startups that are underserved by conventional funding options can get loans of up to $50,000 under the SBA microloan programme. The microloans are provided by nonprofit organisations all across the country; each one serves a particular geographic region and has its own rates, conditions, and prerequisites for the microloans. SBA Microloan Program District Offices can help you locate a microlender in your area that has been approved by the SBA.

The majority of SBA Microloan Program microlenders focus on a particular geographic area, which might range from a part of the country to particular counties in a state. You can also get more information on local microlenders by contacting your local SBA office. The SBA Microloan Program keeps a list of lenders that are available in each state.

Who can obtain an SBA microloan?

The SBA Microloan Program is open to all for-profit small businesses as well as some nonprofit child care facilities. It is targeted at startups and early-stage businesses, with 30% of microloans issued in fiscal year 2020 going to startups.

SBA Microloan Program, in contrast to many standard loans, are accessible to small-business owners with poor credit histories and low incomes. The programme is also targeted at businesses that aren't often handled by traditional banks, such as those owned by women, minorities, and low-income communities.

In addition to these broad criteria, each lender will have different eligibility requirements. There is a minimum credit score requirement for some intermediary lenders, but not for others. Some community-based financial institutions and charitable organisations provide microloans that aren't insured by the SBA Microloan Program. More details about a few nonprofit microlenders can be found here.

SBA Microloan Program will typically make loans to companies that are not bankable, or don't meet the requirements for bank financing. This includes start-ups, firms with a lack of expertise, businesses with poor credit histories or financial records, and business owners with poor or mediocre credit.

Many SBA Microloan Program have little (or no) requirements for the business's age, its credit rating, or the owner's personal credit rating. For instance, Accion Opportunity, one of the bigger microlenders, welcomes applications from entrepreneurs with bad credit as well as from startups with outside industry experience and companies with only $50,000 in annual revenue.

We advise borrowers to speak with their microlender directly to learn more about qualifying requirements as they differ so greatly amongst lenders. Depending on the organisation, the complete application and funding process can take up to 120 days after loan acceptance.

As a need for approval or as part of the application process, you might need to finish training. Though most of these organisations provide lectures, workshops, and one-on-one mentorship on a range of subjects, including creating a business plan, sales tactics, and accounting, you are not obligated to attend training. We advise business owners to use these tools, particularly when launching a new enterprise.

Practical Advice for Creating a Successful Startup with the help of SBA Microloan Program

Starting your own business is never an easy task. It's difficult to achieve your goal of creating the best workplace in the world. You must fortify your internet reputation and safeguard against libel. To ensure that you can finance expansions and take your business to the next level, you must additionally continuously improve the value of your sales.

Start with a sound strategy

Every successful business begins with a solid plan. It can be intimidating to write a business plan for the first time, but all it really requires is that you put on paper what was initially in your thoughts, SBA Microloan Program. It ought to outline both your immediate and long-term goals.

Your business plan's short-term section should contain specifics about what you'll do and how you'll do it. The long-term strategy for fast expanding your firm can be more flexible, but you should strive to make it as precise as you can.

Note that there is no reason why you can't alter the plan at a later time. In fact, it's likely that you'll alter your future intentions. That is the fundamental idea behind pivoting, and it is what can lead to a successful startup.

Networking should start as soon as possible

The best course of action is professional networking. The relationships you have in business determine how far your organisation may advance thanks to your network. Word-of-mouth advertising is more powerful than ever. 88 percent of individuals currently trust internet consumer reviews exactly as much as they do personal recommendations from friends and family. For all the correct reasons, you must begin networking.

Start networking as well because you'll soon discover a lot of fantastic talent that way. The best talent typically works for large corporations because it never reaches the open market. They are there to seize this talent before anyone else can and headhunt it.

So how do you begin networking?

Create a LinkedIn account first, then join groups there. In your location, you should also make an effort to go to certain networking events in person.

Collaborate with the appropriate individuals

It takes a lot of work to run a business, so you need to surround yourself with the appropriate people. During this early growth stage, mentors and strategic partners will become extremely important. You can achieve much more with the proper team than you can on your own.

You need the appropriate group of people if you want to transform your company. Networking has a role, but it's also important to choose the proper employees when hiring. Create a collaborative environment where everyone can contribute to forming a positive business culture. You two are capable of achieving a lot together.

Stay ahead of everyone else

You must be flexible and up to date with trends if you want to succeed. Numerous businesses fail simply because they were unable to keep up with developments in their industry. Make sure you're researching your rivals and the key trends in your sector. Although you don't have to respond to every change, in order to succeed you must accept it when it is the correct change.

Guide for Business Startup Entrepreneurs

Understanding and managing a variety of difficulties related to legal, financial, sales and marketing, intellectual property protection, liability protection, human resources, and other areas are necessary when starting a firm.

However, there has never been more enthusiasm in entrepreneurship. Additionally, several early stage startups have achieved amazing success and grown into multi-billion dollar businesses, including Uber, Facebook, WhatsApp, Airbnb, and many others.

Organize Your Business as a Corporation or LLC to Protect Your Personal Assets

Never launch a firm as a sole proprietorship, as this could expose your personal assets to the debts and liabilities of the company. You should almost always register your firm as a S corporation to benefit from favourable flow-through tax treatment, a C corporation to satisfy the expectations of the majority of venture capitalists, or a limited liability company (LLC).

None of those are especially pricey or challenging to set up. To start the business as a S corporation, which can then easily be changed to a C corporation as you attract investors and issue different classes of stock, is how I personally prefer to do it.

However, a lot of business owners are mistakenly under the notion that by submitting a Certificate of Incorporation for a corporation, they are totally shielded from personal liability. That is untrue. The simple act of incorporation does not give business owners total protection.

Create a Catchy Name for Your Company

The success of your startup can be significantly impacted by the name you choose. The improper name could lead to insurmountable business and legal obstacles.

Concentrate on Creating a Great Product, But Launch It Quickly

Your initial offering of a good or excellent product or service is required. It must meaningfully and significantly differ from the products offered by your rivals. This fundamental idea is the basis for everything else. Get your product out there as soon as possible because early client input is one of the finest ways to help you improve it. Of course, you want to start with a minimum viable product (MVP), but even that product needs to be excellent and stand out from the competitors.

Research the relevant markets

First, take into account the market niche(s) that your startup concept can target. What are the requirements of the market and its clients? Are there any issues that the sector is still dealing with? Will your business plan help to resolve the issue and enhance the situation?

To be constantly up to date with the most recent trends, you might consult authoritative websites that are industry-specific. For instance, Techcrunch is a top-notch technology blog that discusses the newest products and gives the most recent information in the field. Additionally, it lists emerging start-ups and profiles recent additions to the business world.

TED is a fantastic place to find inspiration because of its well-known tagline, Ideas Worth Spreading. It is a veritable gold mine of knowledge about every conceivable topic, SBA Microloan Program. It started as a conference where specialists from different fields gathered to give their perspectives on topics that could lead to disclosures and increase awareness.

Typically, presenters have around 18 minutes to discuss their subject, and the presentation's focus might range from the most recent developments in a particular discipline to societal issues they hope to raise public awareness of. You will leave the presentations or watch the videos feeling more inspired than ever, SBA Microloan Program.

Write down your thoughts and develop them

You may have already recognised needs or potential improvement areas at this point. Make a note of them using a programme like Evernote. You may save web pages, images, and even associated documents and PowerPoint slides with Evernote.

You can make a number of notes and arrange them according to genres and subjects, SBA Microloan Program. There are many platforms through which you can use Evernote, including Windows, iOS, and Android. Your notes will be synchronised across all platforms with only a single click of the sync button.

Create a business model

Leancanvas and Canvanizer are wonderful tools to use if the thought of writing a business plan seems too laborious and cumbersome. These are models that resemble a one-page business plan. The model is simple to add to and change, SBA Microloan Program.

The following nine components of your business model are also clearly outlined for you: customer groups, value propositions, channels (to reach customers), customer relationships, income streams, key resources, value-creating activities, important partners, and cost structure.

Mock up your product, design it, and then test it

The period when you had to scribble all over the place and do sketches on a whiteboard has long since passed. You can develop wireframes online using programmes like Balsamiq and Framebox, and then export them in a variety of file types like jpg or pdf.

You may easily put together your sketch by selecting from a variety of web application buttons or components, SBA Microloan Program. Want to receive comments on your mockup without being distracted or confused? The best option is InfluenceApp.

You can add your design in a variety of formats and combine it with the other papers to create a full presentation. Then, you can easily share the finished prototype with your team members by sending them a URL, and they can give input by leaving comments directly on the design's individual components. It's that simple!

Run a market analysis

A market analysis should always be carried out before starting a new firm. You can construct an online survey and transmit the URL to your intended audience using websites like Survey Monkey, SBA Microloan Program. When compared to an on-field survey, this crosses regional borders, which gives you a bigger, more comprehensive perspective.

Another option is to hold a focus group meeting either before or after your Minimum Viable Product is finished. Here, you ask members of your intended target audience to take part in a discussion group on the goods or services.

Obtaining customer feedback and gauging the success of your firm

A business is full of unknowns, but what if you could find the answers to the urgent questions you have if things aren't going as planned? You may connect with your audience with the aid of Kissinsights. You can install it on your website, and whenever a visitor is taken to your home page, they will be asked two questions.

You have the freedom to decide who is subjected to the survey. Kissmetrics is a different tool that you should not overlook. It keeps track of the browsing and purchasing habits of your customers and gives you useful details like their origin. This useful information enables you to enhance site navigation and further develop your marketing strategy.

How can you lessen the likelihood that your startup will fail?

A global enterprise often only lasts for two years on average before failing or ceasing to exist for various reasons. We can find poor management, uncontrollable finances, and a lack of vision for the future among them. In the upcoming top 8, we will be able to provide you with some advice on how to keep your company from failing and even grow it.

Do Market Research

The first step that every entrepreneur or business owner should take is probably market research. This kind of technology, used in surveys, assessments, and file information, enables understanding of consumers' true demands, as well as their tastes, preferences, and profiles.

It should be done in order to understand how the competition is growing, what kinds of clients they are targeting, and what chances exist for them to build a strong business. It is possible to construct and modify workable business models, which are already optimistic for the future, by having this information very precisely recognised.

Organize your finances

To be able to fund the entire organisation and keep it from failing, financial resource management is crucial. The regulations that must be adhered to include regular evaluation of the financial statements, measurement of expenses and income, and consideration of the eventual need for funding.

In other words, if a company wishes to speed its expansion, it must acquire the necessary financial resources. Only 40% of entrepreneurs devote their resources to tactics that can generate long-term value, according to one of the research on credit and growth.

Establish objectives and goals

In order to have your goals and objectives outlined and to know where your firm needs to go, it is crucial that you follow the guidelines in your business plan. In other words, this informs you of the steps you and your team must follow to advance the business.

You can use work techniques where everyone is aware of their responsibilities and specifies them in order to complete them by a specific date, obtaining the improvement and growth metrics that are present.

Identify Potential Areas

Only by identifying the areas for improvement can a company become more successful and increase the likelihood that it will remain open and draw in clients. To know how well your service is performing, how well your goods are made, or even what they require, you should ideally solicit feedback from your clients on a regular basis.

You must determine which areas of the company need to be enhanced, such as the manufacturing, administrative, or even maintenance operations, and consider how to do it.

Find the Differentiation

Differentiation is one of the key characteristics that keeps a company from failing. It is feasible to draw an unlimited stream of customers and consumers who want to satiate any demand by providing something completely novel that distinguishes the firm.

Businesses that are disruptive stand out from their rivals and even succeed to alter the direction of their industry's development. In Latin America, a variety of enterprises have been established, from SMEs to major breakthroughs.

Attract clients consistently

Clients, in addition to money, are what keep a firm operating because they are the source from which money is raised to keep things going. They can be attracted in a variety of ways, including through digital presence, various sales channels, social media advertising, and other marketing tactics that you can customise to your company's goals.

At this point, we advise that you be highly familiar with the characteristics of your customers/clients and that your efforts actually serve and result in sales.

Startup Expenses for a New Business

The costs of starting the business must be considered in addition to those related to infrastructure and staff. The Board of Trade fees and, if necessary, the issuance of a permit are the main startup costs, along with other costs that vary by state.

The whole cost when using conventional methods might range from R$700 to R$2,000. The advantages of the internet, however, already affect these procedures, and it might be less expensive to launch an online firm.

Working through the Fear of Business Startup Risks

Making mistakes and therefore losing the money and time invested is one of the major anxieties that entrepreneurs have. This risk stands out among those associated with launching a business. This anxiety typically results from uncertainty while making significant decisions that carry dangers. Take chances even though you will inevitably make blunders, is the advice. It's normal for you to make a lot of blunders and make bad decisions.

All about Bank Loan for New Company

One of the most difficult problems an entrepreneur encounters when launching a new business is raising capital. With so many funding options available, it's critical for the entrepreneur to understand the benefits and drawbacks of each funding methodology, calculate the amount of money needed, determine how it will be used, project the business's future financial health, including returns, and develop a strategy for approaching and obtaining the needed capital.

Many entrepreneurs are not aware that financial institutions and banks can also be a source of funding for startups, despite the fact that venture capital firms and angel investors are frequently mentioned as excellent sources of funding for startups.

In reality, banks are one of the major sources of funding for startups in India, giving money to thousands of them annually. In this post, we discuss the many loan programmes offered by banks as well as a variety of additional concerns regarding bank loans for new enterprises in India.

Do banks offer loans to new businesses?

Yes, banks and other financial organisations offer financing to businesses at all stages of their development. Depending on their needs, startup businesses can access a variety of term loans, working capital, or asset-backed loans. Banks will lend even to start-ups if they are happy with the company plan, anticipated profits, ability to repay the loan (either through increased sales or other means), management experience and skill, and other security offered.

Will banks lend money to new business ventures?

Banks often demand greater collateral security coverage for new businesses whose business models have not yet been proven, typically with additional streams of income or backup sources of funding. Banks will also lend to a firm with innovative business ideas if the same can be delivered.

Can I acquire a bank loan as a startup for technological research and development?

The answer is that banks do indeed offer loans for the study and development of any technology. Asset-backed loans can be used for marketing, research and development, and other business expansion initiatives. Based on the market value of a residential, commercial, or industrial property, the bank offers asset-backed loans.

With a loan term of 7 to 15 years, banks will lend up to 70% of the property's estimated market value. The promoters must demonstrate to the banker, in addition to the collateral security given, the financial returns expected from the firm and the source of cash for timely payment of the loan's interest and principal obligations.

Are there any specific loans or schemes for startups?

Yes, a lot of banks and financial institutions have programmes specifically for entrepreneurs. For SMEs who need finance for growth, SIDBI, for instance, provides Growth Capital & Equity Assistance. The "Growth Capital & Equity Assistance funds from SIDBI can be utilised for marketing, brand development, distribution network construction, technical know-how, R&D, and software acquisition.

The SIDBI Revolving Fund for Technology Innovation (SRIJAN Scheme), another product offered by SIDBI, offers financial support to MSMEs for the creation, expansion, testing, and commercialization of cutting-edge technology-based initiatives.

For the development, demonstration, and commercialization of new innovations in developing technological fields, unproven technologies, new products, processes, etc. that have not yet been successfully commercialised, the bank offers assistance in the form of early-stage "debt" funding on softer terms. The maximum amount of aid is typically limited to Rs. 1 crore per project.

How should a business seek money from a bank?

The promoters of the business must first develop a pitch that details the business model, promoters' backgrounds, revenue model, anticipated sales, anticipated profit, anticipated growth rate, and returns before approaching a banker or investor with the request for money. For banks and stock investors alike, return on investment is a crucial consideration.

In light of this, it is crucial that the promoters first gather, familiarise, and compile the data in a presentable way (could be a Detailed Project Report). The promoters must identify possible banks with plans or the capability of supplying the desired cash once the investment pitch is ready.

It is crucial that the promoters shape their request to fit within the parameters of the lending policies of the RBI and Bank, which means they shouldn't ask for money for marketing from a company that only offers term loans. When the aforementioned two phases are finished, they can approach financiers, make their pitch, and ask for finance.

What benefits may a new company expect from obtaining a bank loan?

If a firm can obtain a bank loan rather than venture money during the startup phase, there are many advantages. The cost of venture capital funds is high, and VC investors often expect a 5–10 times return on their investment. Bank loans, on the other hand, do not call for equity dilution, and the bank is already receiving a nominal rate of return of between 13 and 17 percent.

It is simpler to approach banks. Since there are banks everywhere in India, it is simpler to ask your local banker for money than it would be to meet a venture capitalist or angel investor. created a system for judging financing. The system that banks use to process funding requests is very organised. Therefore, compared to a venture capitalist or angel investor, your request for money will receive a response more rapidly. Only you own the business's gains or losses.

How to apply for an SBA loan?

You must first find an SBA-approved intermediary in your area before you can submit an application for an SBA Microloan Program. On its website, the SBA Microloan Program maintains a list of lenders. You will submit a direct application through the intermediate lender, who will want information on the loan's objective.

An SBA Microloan Program is a $50,000 loan made to the owner of a small business or startup by a nonprofit intermediary. The SBA is the source of the funding, and it initially offers the intermediary a lower rate on a loan.

The most easily available SBA Microloan Program

options are SBA Microloan Program, which are a terrific choice for prospective business owners with a strategy. These loans, which are open to any for-profit small business, are frequently SBA Microloan Program for women, minorities, veterans, low-income families, or members of other groups that are represented (non-profit child care centres are also eligible for Microloans). SBA startup loans and SBA Microloan Program are frequently used interchangeably.

The SBA Microloan Program normally takes a backseat on these SBA loans aside from setting some guidelines for interest rates and permitted loan uses (in contrast to some other SBA Microloan Program, where the agency plays a more active role). The organisation gives intermediary SBA Microloan Program lenders a lot of latitude to choose the conditions and applicants for Microloans. Even yet, the SBA Microloan Program does not assess the loan applicants' creditworthiness.

Find a local intermediary in your area as the first step in applying for an SBA Microloan Program. All around the nation, there are several Microloan intermediaries. The SBA Microloan Program maintains an intermediary search engine that identifies lenders in each state to make your search simpler.

To choose which SBA Microloan Program lender to approach, consult the SBA's ranking of the top 25 Microloan intermediaries.The subsequent steps will be explained to you by your micro intermediate lender, who will also let you know what documents you must provide with your loan application. At least two to three weeks should be allowed for the process. Consider additional rapid business loan options if you require financing more quickly.

How Will a Small Business Loan Help My Company?

At different stages, such as when beginning a new project, growing operations, or recovering from losses, businesses need money. Funding, however, appears to be scarcest when a business is first launched. Entrepreneurs must figure out how to utilise their resources as efficiently as possible. However, it might not be enough. A small business loan is one of the most viable options for financing your company.

Although getting a loan from your own bank may seem simple, traditionally, only a select few people have been able to take advantage of small business loans. This situation is altering in India, nevertheless, as a result of the numerous government policies and programmes that support SMEs.

Increasingly, banks are recognising the distinctive potential of small and microbusinesses, SBA Microloan Program. Small business loans benefit your company in a variety of ways, including by funding the purchase of new machinery, expanding your inventory, and financing growth plans.

Flexibility

To meet certain business needs, you can choose from a variety of loan types. Business loans are made available by several government programmes like CGTMSE and other programmes of a same nature for MSEs to launch, grow, or improve the facility. A government programme like the CGTMSE is exempt from the need for a guarantee or security. The trust itself offers the financial institution the guarantee cover.

Comfortable Repayment

The repayment alternatives for company loans also demonstrate their adaptability. Banks are able to give such flexibility since their programmes are created taking into account the difficulties firms face, SBA Microloan Program. To avoid problems with financial management, they might provide a payback schedule that takes cash flow into account. Borrowers may also change their EMI depending on the company's financial situation. As a method of recurring repayment, they can also select bullet payments.

Low Interest Rates

Banks vary from private lending firms in that they charge lower interest rates. Due to the fact that government-sponsored programmes are created for the benefit of the general public rather than a financial institution, this is where it most frequently occurs.

Additionally, interest rates are not only based on the size of the loan. The length of the loan, the sustainability of the business plan, the company's financial standing, and the borrower's credentials are just a few of the considerations. Other charges, like the processing fee, are minor and one-time.

Simple accessibility

Small business loans are available from many banks, including some private lending organisations, without the need for security. Small business owners can now easily obtain these loans and maintain their ventures as a result, SBA Microloan Program. Additionally, the process is now a lot simpler than it was in the past thanks to EMI calculators and online tools made available by the majority of banks on their websites.

Expand Your Company

The three most important requirements for any organisation are money, people, and technology. Among all of them, finance is a crucial component that enables a firm to guarantee that all other needs are satisfied. As a result, the required cash flow can be quite important for growing a corporation because it can be used for a variety of purposes.

You might set up a different location or buy the necessary tools to speed up your operation. Additionally, owners are allowed to allocate the funds however they see fit. It permits them to use the money in accordance with the demands of the company.

Advantages and disadvantages of SBA microloans

The fundamental benefit of SBA Microloan Program is that they offer financing to companies that often wouldn't be eligible for a regular small-business loan, such as startups, people with poor credit, and people operating in disadvantaged areas.

Low fees, competitive interest rates, and lengthy repayment terms are further benefits of the SBA Microloan Program. The drawback of the SBA Microloan Program is that they are small-dollar business loans by definition. You might need to search elsewhere if your business requires more than $50,000 to expand.

Other nonprofit lenders, invoice financing, standard term loans from banks, and online lenders are all alternatives to an SBA Microloan Program. Online lenders and microlenders, in general, are more inclined than banks to lend to start-up companies or persons with less-than-perfect credit.

Average credit

Excellent credit is not typically required by microlenders. Actually, the majority of intermediaries require borrowers to have a minimum credit score of 575. Microlenders are accustomed to working with borrowers who are rebuilding their credit, have a spotty credit history, or have subpar credit scores.

Your credit history may make qualifying more difficult if you have recent bankruptcies or foreclosures, for example. You'll need to demonstrate strength in other aspects of your application if your credit score is poor.

Repayment capacity for a loan

In the end, microlenders, like all other lenders, just care about one thing: Will you be able to repay the loan on time? You have two options for demonstrating your ability to repay the loan: either using the company's current cash flow or, if the business isn't currently making money, using financial estimates.

All firms must submit a business plan to be eligible for an SBA Microloan Program, but new enterprises that aren't currently making money should put more emphasis on this step. This is your chance to persuade the lender that they can rely on your company to make the loan repayments on schedule.

Consider your business plan as a chance to introduce your company to the lender. A thorough knowledge of the goods and services offered by your company, as well as your financial situation, will help greatly in this regard.

Good character

You must also exhibit excellent character in order to qualify for an SBA Microloan Program. This often indicates that you shouldn't have any dishonesty-related offences on your record, such as fraud, theft, or burglary. Although having a record makes the process more challenging, it does not automatically rule you out of consideration.

Okay, now that we've discussed how the SBA Microloan Program functions generally, let's look at how they can benefit your company. The particular terms of your SBA Microloan will depend on your intermediary lender, however the SBA Microloan Program establishes ranges and criteria for terms that every intermediate lender for microloans must follow.

Terms and Costs of SBA Microloans

The SBA Microloan Program, which lends money to middlemen, is where the initial funding for SBA Microloans comes from. The cost and terms to the final end borrower are reasonable because the SBA lends the money at a significant discount.

Amounts of SBA Microloans

The SBA Microloan programme allows you to borrow up to $50,000, but the typical loan size in 2017 was $13,884. The smallest loan size offered by some SBA Microloan Program intermediaries is $500.

You can directly bargain your loan amount with the intermediate lender within this range, just like you would with any other loan. The size of the loan ultimately relies on how you plan to spend it and how creditworthy you are.

SBA Microloan Term Lengths

There is only one term length restriction set forth by the SBA for the SBA Microloan Program: the maximum repayment term is six years. Other than that, you and your intermediary can agree on a repayment schedule for your SBA Microloan Program.

Interest rates for SBA Microloans

Based on the cost for the intermediary to borrow from the SBA Microloan Program, the SBA Microloan Program sets limits on the highest rates that can be charged. Under similar conditions, SBA Microloan Program loan rates for microloans typically range from 8% to 13%. The average interest rate in 2019 was 7.5 percent, although there is little doubt that prices fluctuate from intermediary lender to intermediary lender.

Finance for invoices

Unpaid invoices are a common source of cash flow problems for B2B companies. The invoices can be used as leverage to obtain funds that you can employ for a range of business needs. Businesses with at least three months of operating history can access invoice funding, SBA Microloan Program.

Commercial Credit Cards

Business credit cards are frequently an excellent option if you only require a little quantity of money. Credit cards come with a variety of benefits, including large credit limits, rewards points, and sign-up incentives. Even some credit cards offer introductory interest rates of 0%. After that, the typical interest rate for business credit cards is between 14 and 19 percent.

To manage your costs and expenses you can use many available online accounting software.

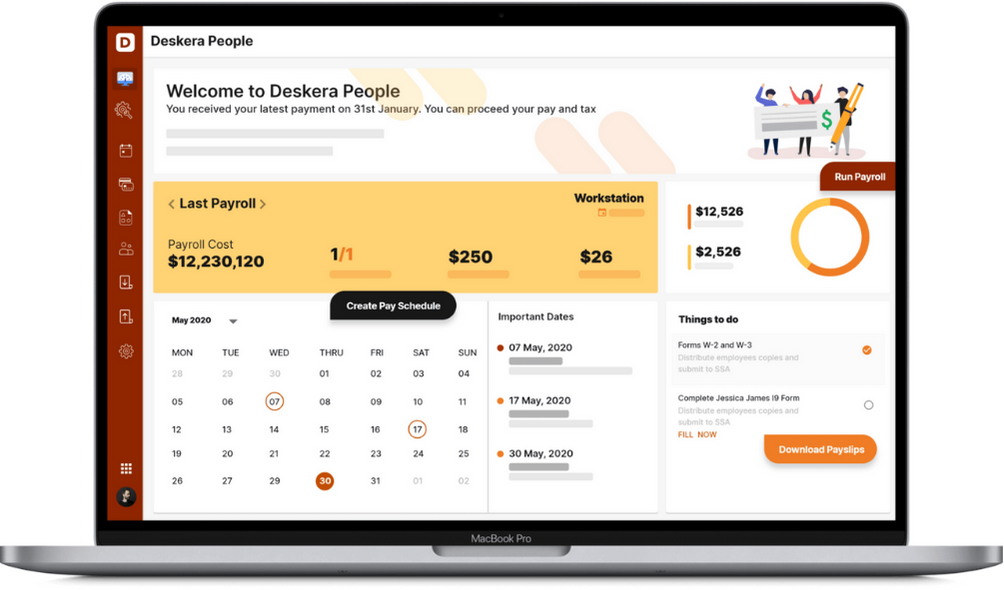

How can Deskera Help You?

Deskera People has the tools to help you manage your payroll, leaves, employee onboarding process, and managing employee expenses, all in a single system. With features like a flexible payment schedule, custom payroll components, detailed reports, customizable pay slips, scanning, and uploading expenses, and creating new leave types, it makes your work simple.

Key Takeaways

The Small Business Administration provides funding for SBA microloans, which are smaller-scale loans. Although loans can be up to $50,000 for qualified small-business owners, they are usually significantly smaller. The average SBA microloan in fiscal year 2020 was $14,434 and had a 6.5 percent interest rate.

While the SBA Microloan Program funds the microloans, an intermediate lender, typically a nonprofit community development corporation, handles the bulk of the work. The lender maintains the loan, distributes loan funds, and processes applications. With direction from the SBA Microloan Program, each intermediary lender is free to determine its own interest rates and eligibility standards, resulting in a range of rates, fees, and minimum loan amounts.

The SBA Microloan Program is open to all for-profit small businesses as well as some nonprofit child care facilities. It is targeted at startups and early-stage businesses, with 30% of microloans issued in fiscal year 2020 going to startups.

SBA microloans, in contrast to many standard loans, are accessible to small-business owners with poor credit histories and low incomes. The programme is also targeted at businesses that aren't often handled by traditional banks, such as those owned by women, minorities, and low-income communities.

Starting your own business is never an easy task. It's difficult to achieve your goal of creating the best workplace in the world. You must fortify your internet reputation and safeguard against libel. To ensure that you can finance expansions and take your business to the next level, you must additionally continuously improve the value of your sales.

To be able to fund the entire organisation and keep it from failing, financial resource management is crucial. The regulations that must be adhered to include regular evaluation of the financial statements, measurement of expenses and income, and consideration of the eventual need for funding.

In other words, if a company wishes to speed its expansion, it must acquire the necessary financial resources. Only 40% of entrepreneurs devote their resources to tactics that can generate long-term value, according to one of the research on credit and growth.

Banks vary from private lending firms in that they charge lower interest rates. Due to the fact that government-sponsored programmes are created for the benefit of the general public rather than a financial institution, this is where it most frequently occurs.

Additionally, interest rates are not only based on the size of the loan. The length of the loan, the sustainability of the business plan, the company's financial standing, and the borrower's credentials are just a few of the considerations. Other charges, like the processing fee, are minor and one-time.

Based on the cost for the intermediary to borrow from the SBA, the SBA sets limits on the highest rates that can be charged. Under similar conditions, SBA loan rates for microloans typically range from 8% to 13%. The average interest rate in 2019 was 7.5 percent, although there is little doubt that prices fluctuate from intermediary lender to intermediary lender.

Related Articles