In an ideal world, we would all work hard and save enough money to enjoy a comfortable retirement. Unfortunately, the reality is far from ideal. According to a survey, nearly half of all American households have no retirement savings. This is where pension plans come in.

A pension plan is a retirement savings plan that employers offer to their employees. The plan aims to provide a steady income stream to employees after they retire.

Pension plans are becoming increasingly rare in today's workforce, as many employers are switching to 401(k) plans. However, understanding how pension plans work is still important, especially for those who have one.

In this article, we will explore what a pension plan is, how it works, and what benefits it can provide. We will also discuss the different types of pension plans available and their advantages and disadvantages. By the end of this article, you will have a better understanding of pension plans and how they can help you prepare for retirement.

- What is a Pension Plan?

- How Pension Plan Works

- Pension Plan and ERISA

- Types of Pensions

- Advantages of Pensions

- Disadvantages of Pensions

- Pension Plan Vs. Pension Funds

- Pension Plans Vs. 401(k)

- Pension Reform

- Pension Plan FAQs

- How can Deskera Help You?

- Key Takeaways

- Related Articles

What is a Pension Plan?

A pension plan is a retirement savings plan typically offered by an employer to their employees as a benefit. It is designed to provide retired employees with a source of income by contributing a portion of their salary to the plan during their working years.

The employer may also contribute to the plan on behalf of the employee, and these contributions are invested to generate returns over time. Upon retirement, the employee receives regular payments from the plan, either as a lump sum or in installments, which serve as a source of income during their retirement years.

Pension plans can be defined benefit plans, which promise a fixed amount of retirement income based on factors such as salary and years of service, or defined contribution plans, which specify the contributions made to the plan but not the retirement benefit. The specific details of a pension plan vary depending on the employer and the plan's design.

How Pension Plan Works

A pension plan is a retirement savings plan that an employer provides to its employees. The goal of a pension plan is to provide a guaranteed income stream to employees during retirement.

The way a pension plan works is relatively simple. The employer sets up a pension plan and contributes a percentage of the employee's salary into it each year. Over time, the money in the plan grows through investment returns, and the employee accrues a pension benefit.

The amount of the pension benefit depends on various factors, such as the employee's salary, years of service, and the terms of the pension plan. For example, some pension plans calculate the benefit based on a percentage of the employee's salary multiplied by the number of years worked. Others use a formula that takes into account the employee's age and years of service.

Once the employee retires, the pension plan begins paying out the benefit. The payments typically continue for the rest of the employee's life, providing a reliable income stream during retirement.

It's worth noting that pension plans are becoming less common in the modern workforce, with many employers switching to 401(k) plans. However, for those who do have a pension plan, it can be an excellent source of retirement income, providing a guaranteed benefit that is not subject to market fluctuations.

Pension Plan and ERISA

Pension plans are governed by the Employee Retirement Income Security Act (ERISA) of 1974, a federal law that sets minimum standards for most private sector pension plans. ERISA is designed to protect employees and their retirement benefits by establishing rules for plan administration, funding, and vesting.

One of the most important provisions of ERISA is the requirement that employers fully fund their pension plans. ERISA mandates that employers make regular contributions to the pension plan and maintain adequate funding levels to ensure that the plan can pay out benefits to retirees.

ERISA also requires that pension plans provide certain information to participants, such as plan documents, annual reports, and summary plan descriptions. This information helps employees understand their rights and benefits under the plan and allows them to make informed decisions about their retirement savings.

ERISA also establishes standards for fiduciary responsibility, requiring plan sponsors to act in the best interests of the plan participants and to manage plan assets prudently. This ensures that plan sponsors and administrators act responsibly and ethically when managing pension plan assets and making investment decisions.

Overall, ERISA plays a critical role in protecting the retirement security of millions of American workers who participate in private sector pension plans. By establishing clear rules and standards for pension plan administration, funding, and disclosure, ERISA helps ensure that employees can count on their pension benefits to provide a reliable source of income during their retirement years.

Types of Pensions

There are several types of pensions, including:

- Defined Benefit Pension: A defined benefit pension plan is a retirement plan in which an employer promises to pay a specific benefit to employees upon retirement, based on factors such as salary, years of service, and age.

- Defined Contribution Pension: A defined contribution pension plan is a retirement plan in which the employer and/or employee contribute to a retirement savings account, and the benefits paid out upon retirement are based on the account balance at retirement.

- Cash Balance Pension: A cash balance pension plan is a type of defined benefit plan in which the employer contributes a specified amount to each employee’s account, and the account earns interest based on a predetermined rate.

- Hybrid Pension: A hybrid pension plan is a combination of a defined benefit and defined contribution plan, where the employer promises a specific benefit, but the plan may also include a separate defined contribution component.

- State and Local Government Pension: State and local government pensions are retirement plans provided to employees of state and local governments, which are often defined benefit plans.

- Military Pension: Military pensions are retirement plans provided to members of the military, which are defined benefit plans.

- Individual Retirement Accounts (IRAs): An IRA is a retirement savings account that individuals can contribute to on their own. There are two types of IRAs - traditional IRAs and Roth IRAs.

- Simplified Employee Pension (SEP) Plan: A SEP plan is a type of retirement plan for self-employed individuals and small businesses, where employers contribute to their own and their employees’ retirement accounts.

- Savings Incentive Match Plan for Employees (SIMPLE) IRA: A SIMPLE IRA is a retirement plan for small businesses, in which employers and employees can contribute to individual retirement accounts.

Overall, the type of pension plan that an individual has will depend on their employer and their own financial situation.

Advantages of Pensions

There are several advantages of having a pension:

- Guaranteed Income: Pensions provide a guaranteed income stream in retirement, which can help to provide financial security and peace of mind.

- Employer Contributions: Many pensions are funded by employer contributions, which can help to increase retirement savings without requiring additional contributions from the employee.

- Tax Benefits: Contributions to certain types of pension plans may be tax-deductible, and earnings on contributions are tax-deferred until withdrawal.

- Professional Management: Pension funds are typically managed by professional investment managers, which can help to optimize investment returns and reduce risk.

- Long-term Savings: Pensions are designed to provide income in retirement, which encourages long-term savings and can help individuals to build a nest egg for their later years.

- Portability: Some pensions may be portable, meaning that the employee can take their pension with them if they change jobs.

- Retirement Security: Pensions provide retirement security, which can help to reduce stress and improve overall well-being in retirement.

Overall, pensions offer several advantages for individuals who are looking to save for retirement and provide for their future financial security.

Disadvantages of Pensions

There are several potential disadvantages of pension plans, including:

- Limited flexibility: Pension plans typically have strict rules governing how and when you can access your funds. For example, you may not be able to withdraw your money until you reach a certain age or retire. This lack of flexibility can be a disadvantage if you need access to your money for other purposes.

- Lack of portability: If you change jobs frequently, you may not be able to take your pension plan with you. This can result in lost benefits and a lower retirement income.

- Risk of underfunding: Pension plans are typically funded by the employer, and there is always a risk that the employer will not contribute enough money to fully fund the plan. This can result in reduced benefits or even the possibility that the plan will be terminated altogether.

- Limited investment options: Pension plans often have limited investment options, which can result in lower returns than you might achieve with other investment vehicles.

- Inflation risk: Pension plans may not keep up with inflation, meaning that your retirement income may not be sufficient to maintain your standard of living over time.

- Tax implications: Pension plans are subject to complex tax rules, and the tax implications of participating in a plan can be significant.

Overall, while pension plans can be a valuable retirement savings tool, they may not be the best option for everyone. It is important to carefully consider the potential advantages and disadvantages of any retirement savings plan before making a decision.

Pension Plan Vs. Pension Funds

Pension plans and pension funds are two different concepts, but they are related to each other as pension funds are often used to finance pension plans. Here are the differences between the two:

- Definition: A pension plan is an employer-sponsored retirement plan that provides retirement income to employees, while a pension fund is a pool of assets set aside to finance the future pension obligations of the plan.

- Purpose: The purpose of a pension plan is to provide retirement benefits to employees, while the purpose of a pension fund is to invest the assets to generate returns that will be used to pay the retirement benefits.

- Funding: Pension plans are funded by the employer, while pension funds are funded by contributions from the employer, employee, and investment returns.

- Management: Pension plans are managed by the employer or a third-party administrator, while pension funds are managed by professional investment managers.

- Risk: Pension plans carry the risk that the employer may not be able to fund the plan, while pension funds carry investment risk, as the returns on the assets may not be sufficient to meet the pension obligations.

A pension plan is the retirement plan offered by an employer to its employees, while a pension fund is a vehicle used to invest the assets of the pension plan to generate returns to fund the retirement benefits.

Pension Plans Vs. 401(k)

Pension plans and 401(k) plans are both retirement savings plans, but they differ in several key ways. Here are some of the main differences between pension plans and 401(k) plans:

- Funding: Pension plans are funded by the employer, while 401(k) plans are primarily funded by employee contributions, although some employers may also contribute.

- Investment risk: With a pension plan, the employer bears the investment risk, while with a 401(k) plan, the employee bears the investment risk.

- Contributions: With a pension plan, the amount of the retirement benefit is usually based on a formula that takes into account factors such as years of service and salary. With a 401(k) plan, the retirement benefit is determined by the amount of money in the account, which is based on employee and employer contributions, investment returns, and fees.

- Portability: Pension plans are typically not portable, meaning that if you leave your employer, you may not be able to take your pension benefit with you. 401(k) plans are generally more portable, as you can roll over the funds into an IRA or another employer's 401(k) plan.

- Tax treatment: Contributions to pension plans and 401(k) plans are generally tax-deductible, but the tax treatment of the retirement benefits differs. With a pension plan, the benefits are generally taxed as income when you receive them, while with a 401(k) plan, you pay taxes on the funds when you withdraw them in retirement.

While both pension plans and 401(k) plans can be effective retirement savings vehicles, they differ in terms of funding, investment risk, contributions, portability, and tax treatment. It is important to carefully consider the pros and cons of each plan before making a decision.

Pension Reform

Pension reform refers to changes made to the retirement savings and income systems in order to make them more sustainable, equitable, and effective. Pension reform is typically driven by a combination of economic, demographic, and social factors that place pressure on the existing pension systems.

Here are some examples of pension reform measures:

- Raising the retirement age: Many pension systems have been designed based on the assumption that people will retire at a certain age, but as people live longer and work longer, some countries have raised the retirement age to ensure that the pension system remains sustainable.

- Increasing employee contributions: In order to increase funding for pensions, some countries have increased the amount that employees are required to contribute to their retirement savings.

- Switching from defined benefit to defined contribution plans: Some pension systems have shifted from defined benefit plans, which promise a specific level of retirement income, to defined contribution plans, which provide a retirement benefit based on the performance of the investments in the plan.

- Pension consolidation: In some cases, governments have consolidated multiple pension plans into a single plan in order to reduce administrative costs and increase efficiency.

- Reforming public pension systems: Many countries have implemented reforms to public pension systems in order to make them more sustainable, including reducing benefits, increasing retirement ages, and increasing contributions.

- Encouraging private retirement savings: Some countries have implemented policies to encourage private retirement savings, such as tax incentives for contributions to retirement accounts.

Pension Plan FAQs

Here are some frequently asked questions about pension plans along with their answers:

Q: What is a pension plan?

A pension plan is a retirement savings plan sponsored by an employer that provides a retirement income to employees. The employer contributes to the plan, and the retirement benefit is typically based on factors such as years of service and salary.

Q: What types of pension plans are there?

There are two main types of pension plans: defined benefit plans and defined contribution plans. In a defined benefit plan, the retirement benefit is based on a formula that takes into account factors such as years of service and salary. In a defined contribution plan, the retirement benefit is determined by the amount of money in the account, which is based on employee and employer contributions, investment returns, and fees.

Q: How much should I contribute to my pension plan?

The amount you should contribute to your pension plan depends on your individual financial situation and retirement goals. As a general rule, financial experts recommend saving at least 10-15% of your income for retirement.

Q: Can I withdraw money from my pension plan before I retire?

In most cases, you cannot withdraw money from your pension plan before you retire without incurring penalties. However, some plans may allow for hardship withdrawals in certain circumstances.

Q: What happens to my pension plan if I change jobs?

If you change jobs, you may be able to take your pension plan with you, depending on the type of plan and the rules of your employer. Alternatively, you may be able to roll over the funds into an IRA or another retirement plan.

Q: What happens to my pension plan if my employer goes out of business?

If your employer goes out of business, your pension plan may be at risk. However, most pension plans are insured by the Pension Benefit Guaranty Corporation (PBGC), which provides some protection for your retirement benefits in the event of your employer's bankruptcy.

Q: How is my pension income taxed?

Your pension income is generally taxed as ordinary income, meaning it is subject to federal and state income taxes. Some states may offer tax breaks for retirement income.

These are just a few frequently asked questions about pension plans, but there may be others that are specific to your situation. It is important to consult with a financial advisor or your plan administrator for more personalized information.

How can Deskera Help You?

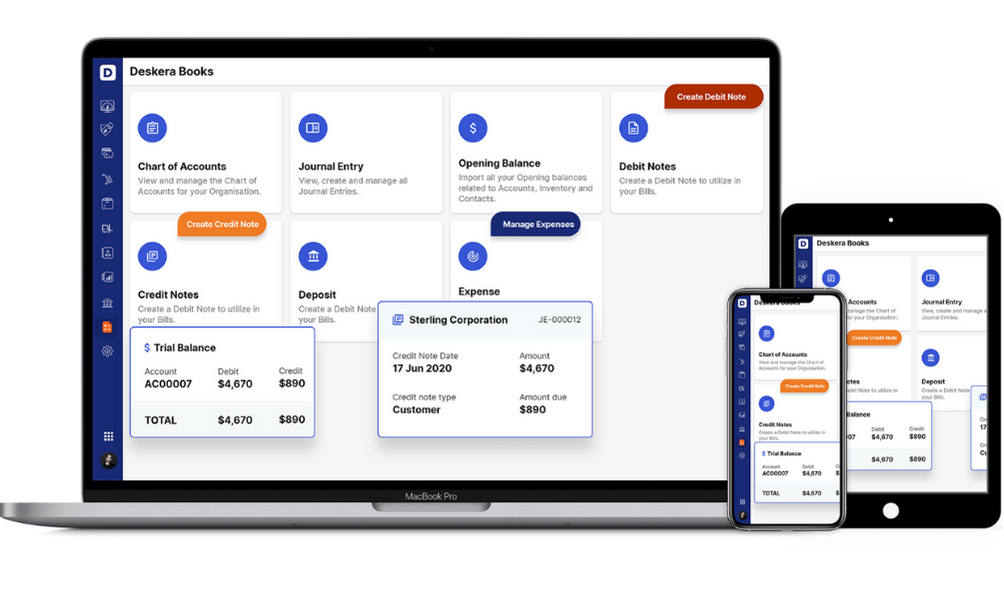

Deskera is an all-in-one cloud-based business software that can help businesses in handling financial risks by providing a range of features and tools that enable effective financial management. Here are some ways that Deskera can help in handling financial risks:

- Financial reporting

- Cash flow management

- Budgeting and forecasting

- Inventory management

For example, Deskera Books can be used to track income and expenses related to the trust, while its reporting tools can generate financial statements for the trust.

Additionally, Deskera's CRM module can be used to manage communication with beneficiaries and other stakeholders, while its inventory management module can help track physical assets held in the trust.

Deskera People helps you with all the administrative taks pertaining to the human resource unit of your business.

Deskera ERP is a cloud-based enterprise resource planning software that integrates multiple business functions and processes, such as finance, human resources, inventory management, and customer relationship management, into a single platform.

Key Takeaways

- Pension plans are retirement savings plans that provide a guaranteed income stream to retirees.

- Pension plans are either defined benefit plans or defined contribution plans.

- Defined benefit plans promise a specific retirement benefit based on factors such as years of service and salary, while defined contribution plans provide a retirement benefit based on the performance of the investments in the plan.

- Pension plans can be sponsored by employers, unions, or governments.

- Pension plans are typically subject to government regulations and oversight.

- Pension contributions and earnings are generally tax-deferred, meaning they are not subject to income tax until the funds are withdrawn in retirement.

- Taxation of pension income varies depending on the type of plan and the country's tax laws.

- Some countries offer tax incentives for pension contributions to encourage retirement savings.

- In addition to pension plans, there are other types of retirement savings plans, including 401(k) plans, individual retirement accounts (IRAs), and annuities.

- Each type of retirement savings plan has its own unique features and benefits, and it's important to carefully consider your options before choosing a plan.

Related Articles