How quickly does your business pay its suppliers? If you’re unsure, the accounts payable turnover ratio holds the answer. This essential financial metric shows how often your company pays off its accounts payable during a specific period. A higher ratio indicates timely payments and strong vendor relationships, while a lower ratio may suggest cash flow issues or delayed payments that could hurt your reputation.

Understanding and managing your accounts payable turnover ratio is crucial for maintaining healthy cash flow and optimizing your working capital. Whether you're a small business owner or a finance executive, knowing how to calculate and interpret this ratio can provide valuable insights into your company’s financial efficiency. It also helps in benchmarking your performance against industry standards and setting strategic goals for payment cycles.

In this blog, we’ll break down the formula for the accounts payable turnover ratio, walk you through the calculation process step by step, and share actionable strategies to improve it. We’ll also explore common pitfalls to avoid and explain how this ratio reflects your business’s overall financial health.

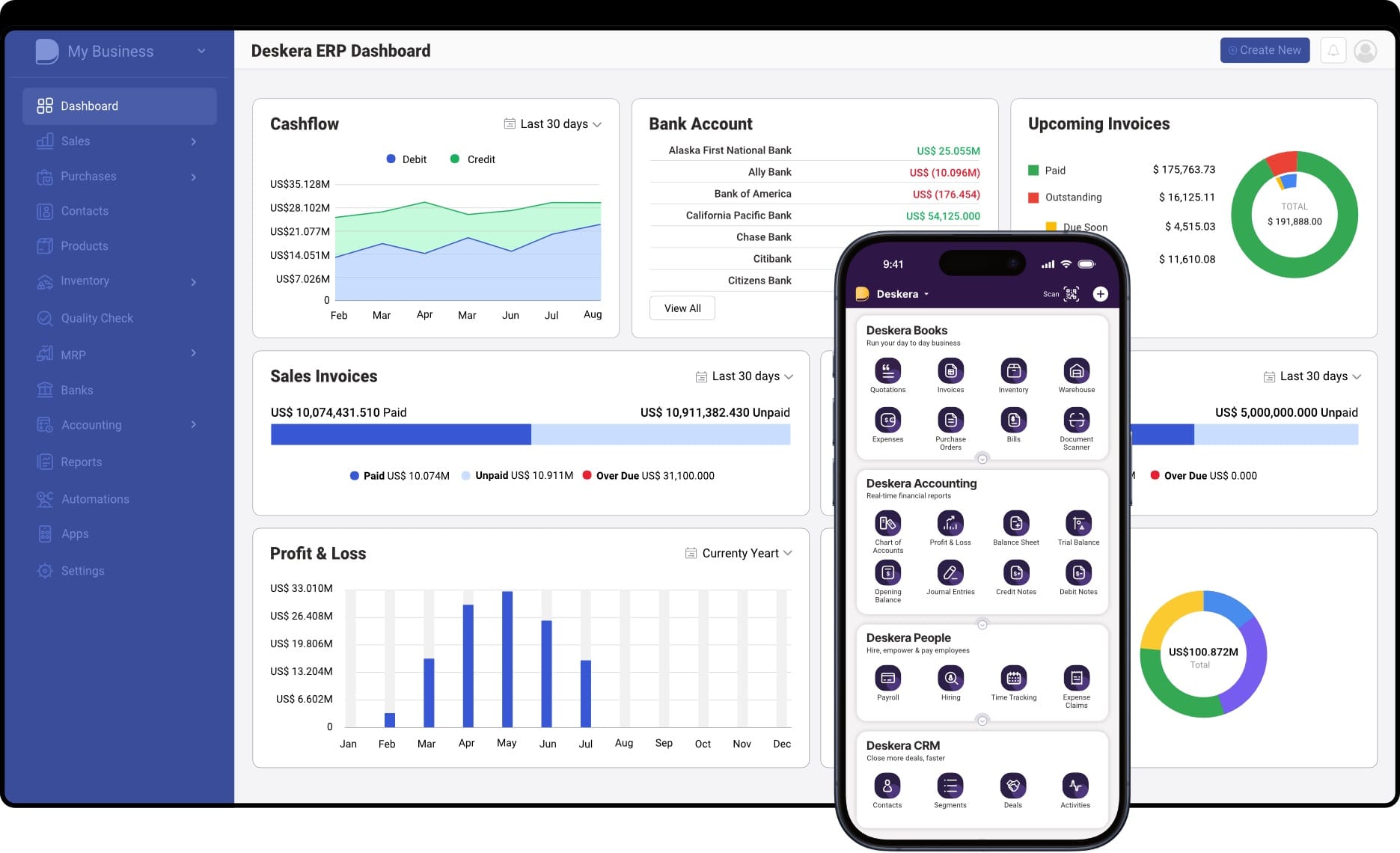

To make things even easier, tools like Deskera ERP can help automate and streamline your accounting processes. With features such as real-time accounts payable tracking, smart financial reporting, and built-in dashboards, Deskera ERP empowers businesses to monitor key metrics like the accounts payable turnover ratio efficiently. Whether you're aiming for tighter control or better forecasting, Deskera ensures you're always a step ahead.

What Is the Accounts Payable Turnover Ratio?

The accounts payable turnover ratio is a key short-term liquidity metric that measures how efficiently a company pays off its suppliers and creditors. It indicates how many times a business settles its outstanding accounts payable within a given accounting period—typically a fiscal year. In simpler terms, this ratio tells us how often a company “turns over” or clears its supplier-related debts.

Accounts payable refers to the money a business owes to its vendors for goods or services purchased on credit. The turnover ratio reflects how well a company manages these obligations. A higher ratio suggests timely payments and strong liquidity, while a lower ratio may signal delayed payments or potential cash flow concerns.

Formula and Calculation

The standard formula for calculating the accounts payable turnover ratio is:

Accounts Payable Turnover Ratio = Net Credit Purchases / Average Accounts Payable

Where:

- Net credit purchases refer to the total purchases made on credit, often derived from the cost of goods sold (COGS) adjusted for any direct purchases.

- Average accounts payable is calculated as:

(Beginning Accounts Payable + Ending Accounts Payable) / 2

For example, if a company had net credit purchases of ₹190 million and an average account payable of ₹70 million during a fiscal year, its accounts payable turnover ratio would be 2.71. This means the company paid off its payables approximately 2.7 times that year.

The accounts payable turnover ratio is a vital indicator for both internal decision-makers and external stakeholders. Investors and lenders analyze this ratio to assess a company's ability to meet its short-term liabilities and manage cash flow effectively.

A rising ratio could reflect improved financial strength, while a declining ratio might raise red flags—unless offset by favorable payment terms negotiated with suppliers.

It’s also helpful to convert the turnover ratio into accounts payable days to determine how many days, on average, it takes the company to pay its suppliers. This is done using the formula:

Accounts Payable Days = 365 / Accounts Payable Turnover Ratio

This additional insight helps businesses evaluate their payment cycles in a more tangible format.

Accounts Payable Turnover Ratio vs. Accounts Receivable Turnover Ratio

Both accounts payable turnover ratio and accounts receivable turnover ratio are important financial metrics that reflect how efficiently a company manages its short-term liabilities and assets. While they may sound similar, they measure opposite sides of a company’s operations—paying suppliers vs. collecting from customers.

1. Definition and Purpose

- Accounts Payable Turnover Ratio (APTR): This ratio measures how often a company pays off its suppliers and creditors within a given accounting period. It helps assess the company’s ability to manage its outgoing payments and maintain healthy relationships with vendors.

- Accounts Receivable Turnover Ratio (ARTR): This ratio calculates how frequently a business collects its accounts receivable from customers during a specific time frame. It evaluates the company’s efficiency in managing incoming cash flow and credit policies.

2. Formula Comparison

AP Turnover Ratio = Net Credit Purchases / Average Accounts Payable

AR Turnover Ratio = Net Credit Sales / Average Accounts Receivable

Both formulas rely on the average of beginning and ending balances and only consider credit transactions to reflect realistic operating performance.

3. What Each Ratio Indicates

4. Strategic Impact on Business

- AP Turnover: Directly impacts cash outflows and working capital. Higher ratios may suggest strong financial discipline, but excessively high values can harm supplier relationships.

- AR Turnover: Affects cash inflows and liquidity. A higher AR turnover indicates efficient collections, which is crucial for sustaining operations and funding growth.

5. Use in Financial Analysis

- AP Turnover is often used to assess a company’s liquidity and how effectively it manages its short-term obligations.

- AR Turnover helps investors and analysts gauge how efficiently a business converts sales into cash.

Comparing the two can provide insights into the cash conversion cycle (CCC)—the time it takes to convert inventory purchases into cash received from customers. Ideally, a company should collect receivables faster than it pays its payables, maintaining a healthy liquidity buffer.

Optimize Both with Deskera ERP

Tracking both these metrics can be complex without the right tools. With Deskera ERP, businesses can automate the calculation and analysis of both AP and AR turnover ratios, monitor trends over time, and generate real-time financial reports. This enables better decision-making, improves cash flow management, and strengthens vendor and customer relationships.

How to Calculate the Accounts Payable Turnover Ratio

Calculating the accounts payable turnover ratio is a straightforward process that involves two main components: net credit purchases and average accounts payable.

Follow these steps to accurately determine the ratio:

Step 1: Determine Net Credit Purchases

Net credit purchases refer to the total value of goods or services a company bought on credit during the accounting period. If net credit purchases aren't directly available, you can estimate them using:

Net Credit Purchases = Cost of Goods Sold (COGS) + Ending Inventory – Beginning Inventory

Alternatively, subtract purchase returns or discounts from total purchases if detailed data is available.

Step 2: Calculate Average Accounts Payable

To find the average accounts payable over the period, use this formula:

Average Accounts Payable = (Beginning Accounts Payable + Ending Accounts Payable) / 2

This smooths out fluctuations and provides a more accurate reflection of your liabilities over time.

Step 3: Apply the Accounts Payable Turnover Ratio Formula

Once you have both values, plug them into the formula:

Accounts Payable Turnover Ratio = Net Credit Purchases / Average Accounts Payable

Example Calculation

Let’s assume the following figures for Company XYZ:

- Net credit purchases during the year: ₹190 million

- Beginning accounts payable: ₹50 million

- Ending accounts payable: ₹90 million

Now calculate:

Average Accounts Payable = (₹50M + ₹90M) / 2 = ₹70M

Accounts Payable Turnover Ratio = ₹190M / ₹70M = 2.71

This means Company XYZ paid off its accounts payable approximately 2.71 times during the year.

This ratio alone doesn't tell the whole story, but it does serve as a strong indicator of how efficiently your business handles its short-term obligations. In the next section, we’ll explore how to interpret these results effectively.

Interpreting the Accounts Payable Turnover Ratio: What It Tells You

The accounts payable turnover ratio reveals how efficiently a company pays off its short-term obligations to suppliers. While the formula itself is simple, interpreting the ratio requires understanding its implications in the context of your company’s cash flow, industry norms, and historical performance.

1. High Turnover Ratio

A high accounts payable turnover ratio means your company is paying its suppliers quickly and frequently. This typically reflects:

- Strong liquidity and cash flow management

- Healthy relationships with vendors

- Lower risk of late fees or supply chain disruptions

In context: If your business has high reserves of cash or aims to build strong supplier trust, a higher ratio is beneficial. However, if you're paying suppliers too quickly—before invoices are due—you may be missing opportunities to optimize cash flow or invest in business growth.

2. Low Turnover Ratio

A low accounts payable turnover ratio indicates slower payments or less frequent settlements. This could suggest:

- Tight cash flow or potential financial strain

- Deliberate extension of payment cycles to preserve cash

- Supplier negotiations allowing for longer credit terms

In context: A lower ratio may be strategic if you've negotiated extended payment terms with suppliers, helping to improve working capital. But if the low ratio stems from financial instability, it could harm supplier trust and lead to stricter credit terms in the future.

3. Use Industry and Historical Comparisons

To interpret the ratio accurately, it’s important to:

- Compare against industry averages – For example, retail and manufacturing businesses often have very different turnover benchmarks.

- Evaluate trends over time – Is your ratio improving or declining? A rising trend might indicate better financial discipline, while a consistent decline could signal growing liabilities or cash flow constraints.

In context: If your ratio has declined compared to previous periods, ask whether it’s due to poor liquidity or a conscious decision to negotiate longer payment terms. On the other hand, a rising ratio might indicate stronger performance—but be sure it’s not at the cost of missed reinvestment opportunities.

In summary, the accounts payable turnover ratio isn’t just about speed—it’s about balance. Businesses should aim for a ratio that reflects both financial responsibility and strategic cash flow management. The ideal number will depend on your payment terms, supplier relationships, and overall financial goals.

How to Calculate Days Payable Outstanding (DPO) Using the Accounts Payable Turnover Ratio

Once you’ve calculated your accounts payable turnover ratio, the next step in understanding your payables performance is to convert it into Days Payable Outstanding (DPO). This metric tells you the average number of days your business takes to pay its suppliers and creditors.

What is Days Payable Outstanding (DPO)?

Days Payable Outstanding is a key efficiency metric that reflects how long a company holds onto its cash before paying its bills. While the AP turnover ratio tells you how many times you pay off your payables in a period, DPO tells you how many days it takes, on average, to pay those bills.

DPO Formula:

DPO = 365 / Accounts Payable Turnover Ratio

This formula assumes a 365-day year and uses the AP turnover ratio you've previously calculated.

Example Calculation

Let’s say your business has an accounts payable turnover ratio of 5.2.

Using the formula:

DPO = 365 / 5.2 ≈ 70.2 days

This means your company takes about 70 days on average to pay its suppliers. This time frame gives you insight into your cash flow strategy and helps assess whether you're using supplier credit efficiently.

How to Interpret DPO

- Higher DPO (More Days to Pay): A higher DPO suggests that your business is holding onto cash longer before paying vendors. This can be good for cash flow, but only if it doesn’t harm vendor relationships or lead to late-payment penalties.

- Lower DPO (Fewer Days to Pay): A lower DPO indicates you’re paying suppliers more quickly. This may reflect strong liquidity and could strengthen supplier trust, but it might also mean you’re missing out on credit terms or early payment discounts.

Why DPO Matters

DPO is widely used by CFOs, procurement leaders, and financial analysts to:

- Evaluate working capital efficiency

- Identify opportunities to negotiate better payment terms

- Benchmark against industry norms

- Balance cash flow management with supplier satisfaction

Simplify with Deskera ERP

If you want to calculate DPO and other financial metrics in real time without juggling spreadsheets, Deskera ERP offers integrated accounting and reporting tools. It automatically tracks your accounts payable activity and converts it into actionable insights like DPO, enabling smarter, faster financial decisions.

Why the Accounts Payable Turnover Ratio Matters

The accounts payable (AP) turnover ratio is more than a metric—it's a vital financial signal that speaks volumes about your company’s cash flow health, vendor relationships, and operational efficiency.

Here’s why this ratio is essential for business leaders, finance professionals, and decision-makers alike:

1. Enhances Cash Flow Visibility

The AP turnover ratio provides a clear view of your company’s cash outflow behavior. A high ratio indicates prompt payments but may put a strain on cash reserves.

Conversely, a low ratio suggests your business is holding on to cash longer, improving liquidity—though an extremely low figure could point to underlying cash flow issues. Understanding this balance helps in planning and maintaining healthy cash reserves.

2. Acts as a Liquidity Indicator

As a short-term liquidity ratio, AP turnover gives insight into how well your business can meet its immediate financial obligations. A higher ratio may reflect strong liquidity but could mean your company isn’t fully leveraging supplier credit.

A lower ratio, while potentially signaling weaker liquidity, might also indicate strategic use of extended payment terms to preserve working capital.

3. Strengthens Vendor Relationships

Vendors and suppliers closely observe your payment behavior. A consistently high AP turnover ratio builds trust, showing that your company is reliable and financially disciplined.

This can lead to more favorable credit terms, early payment discounts, or priority service. In contrast, a low ratio may raise red flags with vendors, leading to stricter terms or disruptions in supply.

4. Reveals Financial Stability and Risk

Both investors and creditors view the AP turnover ratio as a proxy for financial health. A very high or very low ratio may signal instability—such as overpaying too quickly or struggling to meet obligations. Regularly monitoring this metric allows finance leaders to address inefficiencies before they become serious risks, ensuring long-term business resilience.

5. Supports Strategic Payment Decisions

Not every low ratio is a cause for concern—it might reflect a deliberate payment strategy to improve cash flow or align with broader operational goals. What matters most is intentionality. Businesses that actively manage their payment cycles can use the AP turnover ratio to strike the right balance between optimizing working capital and maintaining supplier trust.

In essence, the accounts payable turnover ratio is a strategic tool that informs financial planning, builds credibility with stakeholders, and helps maintain operational continuity. When used effectively, it enables better decision-making that supports both short-term performance and long-term growth.

How to Improve Your Accounts Payable Turnover Ratio

Improving your accounts payable (AP) turnover ratio isn’t just about speeding up payments—it’s about refining your payment strategy, enhancing operational efficiency, and maintaining a healthy balance between liquidity and vendor relationships. A well-optimized AP turnover ratio reflects sound financial management and can significantly enhance business credibility.

Here’s how you can improve yours:

1. Streamline and Automate the Accounts Payable Workflow

Manual AP processes are not only time-consuming but also prone to errors, delays, and missed payment deadlines. To improve your AP turnover ratio, start by automating your accounts payable system.

Solutions like Deskera ERP offer end-to-end automation—from invoice capture and approvals to scheduled payments and reconciliation. With Deskera, finance teams can centralize vendor data, automate recurring payables, and track due dates with ease. Automation reduces processing time, eliminates late payments, and ensures financial accuracy—critical factors in maintaining a healthy AP turnover ratio.

Tip: Use automation to flag early payment opportunities, duplicate invoices, and overdue payables in real-time.

2. Leverage Early Payment Discounts Without Compromising Cash Flow

Many suppliers offer early payment discounts, such as 2/10 net 30 (2% discount if paid within 10 days), which not only help save money but also improve your turnover ratio by reducing outstanding payables faster.

To leverage these discounts effectively:

- Identify vendors offering early payment incentives.

- Prioritize these invoices in your payment schedule.

- Use ERP tools like Deskera to automatically capture discount terms and send reminders ahead of due dates.

However, early payments should be strategically timed so that they don’t disrupt your cash reserves. A calculated approach ensures that you’re improving your AP turnover ratio without risking liquidity.

3. Renegotiate Favorable Payment Terms with Vendors

Not all improvement comes from faster payments. Sometimes, it’s smarter to renegotiate supplier contracts for terms that align with your cash flow cycles. For example, extending payment terms from 30 to 45 or 60 days can help retain cash longer while keeping suppliers happy.

Good negotiation starts with transparency. Share your payment history, demonstrate reliability, and propose mutually beneficial terms. Suppliers are more likely to be flexible when they see a trusted and consistent payer.

Example: If your AP turnover ratio is too high, it may suggest you’re paying too quickly. Extending payment terms (without harming vendor relationships) can normalize the ratio and free up working capital.

4. Improve Cash Flow Forecasting and Liquidity Planning

A company can only pay on time if it knows how much cash is available and when. Poor forecasting leads to delayed payments or missed early-payment opportunities. Use forecasting tools within your ERP, such as Deskera’s real-time dashboards and reporting features, to:

- Monitor current liabilities.

- Predict upcoming payables.

- Allocate funds for priority vendor payments.

By anticipating shortfalls and planning disbursements, businesses can ensure timely payments and maintain an optimal turnover ratio.

5. Foster Strong Supplier Relationships

Healthy vendor relationships play a major role in payment flexibility. Vendors are more likely to accommodate extended terms, waive penalties, or offer discounts to clients who are transparent, consistent, and communicative. Building this trust takes time but pays off in better credit terms and smoother operations.

Make sure to:

- Maintain open lines of communication.

- Notify vendors about expected payment dates.

- Resolve disputes or billing errors swiftly.

Over time, these actions can result in more favorable arrangements that indirectly support improvements in your AP turnover ratio.

6. Monitor, Benchmark, and Act on Ratio Trends

Improving your AP turnover ratio is an ongoing process. It’s essential to regularly monitor the metric and compare it:

- Across different accounting periods to identify internal trends.

- Against industry benchmarks to evaluate competitive performance.

Use ERP systems like Deskera to generate real-time AP turnover reports and spot inconsistencies. If your ratio is too high, consider adjusting payment timing. If it’s too low, investigate cash flow issues or delayed invoice processing.

Insight: An ideal AP turnover ratio balances timely supplier payments with the optimal use of available credit. Regular analysis ensures your approach remains aligned with changing business needs.

Improving your accounts payable turnover ratio isn’t just a matter of better bookkeeping—it’s about aligning finance operations with strategic goals. From automating invoice workflows to negotiating better terms and forecasting accurately, each improvement has a direct impact on your company's cash flow and financial stability.

With tools like Deskera ERP, businesses can gain real-time control over their payables, automate routine tasks, and derive insights that drive smarter financial decisions. Ultimately, a well-optimized AP turnover ratio reflects a business that is efficient, trustworthy, and financially sound.

Common Mistakes to Avoid When Managing Your Accounts Payable Turnover Ratio

While tracking and improving your accounts payable turnover ratio can greatly enhance your business’s financial health, several common mistakes can distort the metric or lead to poor decision-making. Avoiding these pitfalls is key to maintaining accurate reporting, optimizing cash flow, and fostering strong vendor relationships.

1. Ignoring the Impact of One-Off or Seasonal Transactions

Many companies make the mistake of calculating the AP turnover ratio without adjusting for one-time purchases or seasonal spikes in procurement. These outliers can skew the ratio and lead to misinterpretation.

What to do instead: Segment your data by period or category to understand how recurring vs. one-off transactions affect your AP turnover. Use rolling averages or exclude anomalies for a clearer picture of your operational payables efficiency.

2. Using Total Purchases Instead of Net Credit Purchases

A common error is using total purchases (including cash purchases) in the numerator of the formula rather than net credit purchases. This overstates the ratio and gives a false impression of quick payment cycles.

Best practice: Always use only credit-based purchases, subtracting returns or discounts, to accurately calculate your AP turnover ratio. This ensures you’re measuring the speed of settling credit-based obligations—not total expenditures.

3. Failing to Track Average Accounts Payable Accurately

Another frequent mistake is using either the beginning or ending accounts payable figure instead of calculating the average. This skews the ratio and can either exaggerate or understate your payables turnover.

Fix it:

Use the formula:

Average Accounts Payable = (Beginning AP + Ending AP) / 2

For even more accuracy, use monthly or quarterly averages if your payables fluctuate significantly.

4. Overlooking the Strategic Context Behind Ratio Changes

A declining AP turnover ratio might seem negative at first glance, but if it's due to negotiated longer payment terms, it might actually be a smart working capital move. Conversely, a high ratio isn’t always good if it’s straining cash reserves.

Avoid tunnel vision: Always interpret the ratio in context. Consider cash flow strategy, supplier terms, and working capital goals before labeling a trend as good or bad.

5. Not Reconciling Discrepancies with Supplier Records

Late payments, duplicate invoices, or disputes with vendors can lead to inflated outstanding payables. If these aren't resolved or reconciled properly, your AP turnover ratio may appear artificially low.

Solution: Conduct regular vendor account reconciliations, resolve outstanding issues promptly, and ensure your AP ledger is up to date to reflect only valid, due payables.

6. Neglecting Ratio Trends and Benchmarking

Looking at the ratio in isolation or for a single period doesn’t tell the full story. Many businesses fail to track AP turnover trends over time or benchmark them against industry standards, which limits the usefulness of the metric.

What to do: Establish a cadence to monitor this ratio—monthly, quarterly, and annually—and compare it with similar-sized businesses in your industry. This gives you actionable insight into how your payables management stacks up.

Avoiding these mistakes ensures your accounts payable turnover ratio remains a reliable tool for evaluating liquidity, cash flow, and vendor relations. By keeping your calculations accurate and your interpretation strategic, you’ll gain meaningful insights that support smarter financial decision-making.

How Deskera ERP Helps You Improve Your Accounts Payable Turnover Ratio

Effectively managing your accounts payable is crucial for maintaining healthy cash flow and strong vendor relationships. This is where Deskera ERP proves to be an invaluable asset.

It offers a comprehensive suite of tools that help automate, monitor, and optimize your payables process—allowing you to improve your accounts payable turnover ratio with ease.

1. Automated Accounts Payable Tracking

Deskera ERP enables you to seamlessly record and track all your vendor bills, credit purchases, and payments in real-time. This automation ensures accuracy and reduces the risk of late payments, which helps maintain a healthy AP turnover ratio.

2. Real-Time Financial Reporting

With Deskera’s real-time dashboards and customizable financial reports, you can continuously monitor your average accounts payable, identify trends, and make informed decisions. These insights help you proactively manage due dates and payment cycles to optimize working capital.

3. Streamlined Payment Scheduling

Deskera lets you set automated reminders and payment schedules for upcoming vendor payments. This minimizes delays and improves payment consistency, which can positively influence your turnover ratio while keeping vendors satisfied.

4. Better Vendor Relationship Management

By staying on top of your payables, you can consistently pay suppliers on time or even early—building trust and potentially unlocking better credit terms, early payment discounts, or priority support from vendors.

5. Cash Flow Forecasting

Deskera ERP offers predictive insights into your cash flow, helping you balance timely payments with cash reserves. This ensures you’re not paying too quickly and compromising liquidity or too slowly and damaging vendor trust.

6. Integrated Inventory and Procurement Modules

The software integrates AP with inventory and procurement, allowing you to track purchase orders, receive goods, and match invoices automatically. This speeds up processing, reduces errors, and ensures you only pay for what you’ve received.

In summary, Deskera ERP empowers finance teams and business owners with full control over their payables process. Whether you're aiming to shorten payment cycles, improve supplier relations, or make smarter cash flow decisions, Deskera helps you manage it all from a single, user-friendly platform.

Key Takeaways

- The accounts payable turnover ratio measures how frequently a company pays off its suppliers within a specific period, indicating the efficiency of its short-term financial obligations management.

- While AP turnover focuses on how fast you pay suppliers, AR turnover measures how quickly you collect payments from customers. Both are essential for managing your company’s liquidity and operational efficiency.

- Use the formula: AP Turnover Ratio = Net Credit Purchases / Average Accounts Payable. This helps you understand how often your business pays suppliers and can guide decisions about payment terms and cash flow.

- A higher ratio suggests timely payments and strong liquidity, while a lower ratio may indicate cash flow issues or strategic delays. Always interpret the ratio in context—compare it with past performance or industry benchmarks.

- DPO is calculated using 365 ÷ AP Turnover Ratio and reflects the average number of days you take to pay your suppliers—offering additional clarity on payment timelines and working capital use.

- This ratio provides insights into your company’s cash management, liquidity position, supplier relationships, and financial credibility—crucial for maintaining operational stability and investor confidence.

- Improve the ratio by automating invoice processing, negotiating better terms with vendors, managing cash flow efficiently, and avoiding unnecessary payment delays.

- Avoid recording errors, overlooking credit terms, inconsistent payment schedules, and ignoring the ratio’s context. These mistakes can distort your financial analysis and strain vendor relationships.

- Deskera ERP simplifies accounts payable management through automation, real-time tracking, cash flow forecasting, and integration with procurement and inventory—helping you enhance financial efficiency and improve your AP turnover ratio.

Related Articles