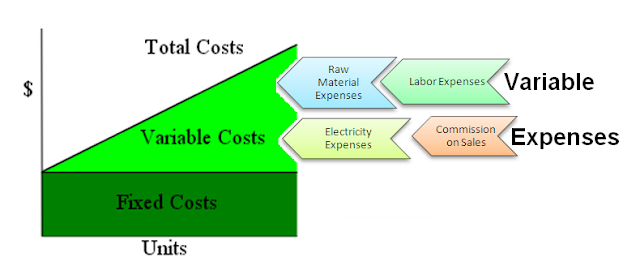

Variable costs are expenses that change according to the volume of goods or services that a business produces. The variable costs increase as the volume of activities increases and decrease as the volume of activities decreases. Hence, variable costs are costs that change depending on the volume of activity.

The Common Variable Costs

- Direct labor

- Direct materials

- Transaction fees

- Commissions

- Utility costs

- Billable labor

If a cost changes based on the volume of activity, it's a variable cost. Variable costs vary with industry types. In the case of production setting, these are a number of examples of variable costs :

- Piece rate labor: The amount paid to workers for every unit completed

- Billable staff wages: If a company bills out the time and the employees are only paid if they work billable hours, then this is a variable cost

- Production supplies: goods that are consumed based on the amount of machinery usage and production volume

- Direct materials: These are the raw materials that go into a product

- Freight out: A business gets shipping costs only when it sells and ships out a product

- Commissions: Sales people are paid a commission per sale made

- Credit card fees: Fees are only charged to a business if it accepts credit card purchases from its customers

A Deep-Dive into Variable Costs

Variable costs are generally different between industries. It is not useful to compare the variable costs of a car manufacturer with an appliance manufacturer. It is better to compare the variable costs between two businesses that operate in the same industry, such as two furniture manufacturers.

As explained previously, variable costs are a business's costs that are associated with the total of services or goods it produces.

A business's variable costs decrease and increase with its production volume. When production volume goes up, then the variable costs will increase. On the other hand, if the production goes down, so will the variable costs.

Let's say a company, XYZ, produces ceramic mugs for a cost of $4 a mug. If it produces 500 units, the variable cost would be $2,000. If the company produces 1000 units, then the variable cost will increase to $4,000.

Hence, the formula for Variable cost is :

Variable Cost Per Unit of Output X Total Quantity of Output= Total Variable Cost

Examples of variable costs include commissions, labor, raw materials, and packaging for production.

Fixed Costs

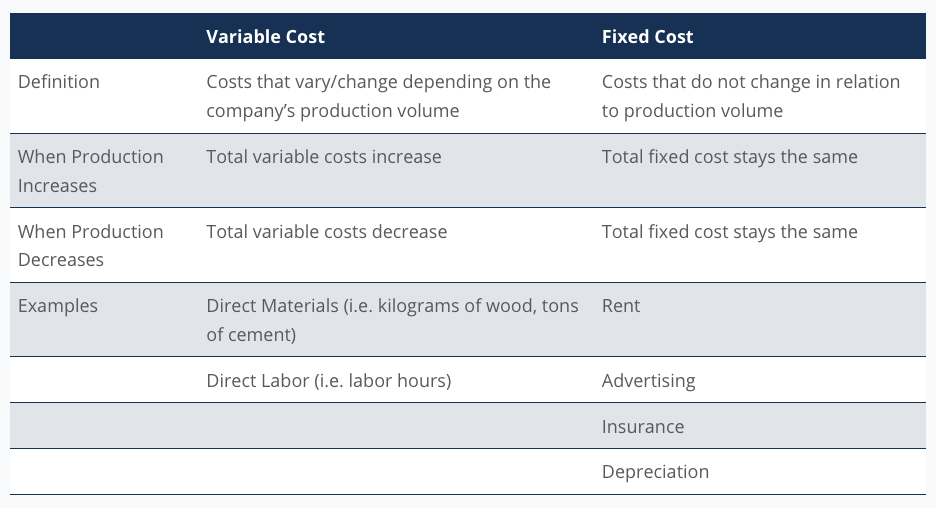

A business's fixed costs do not vary with the volume of production. A company cannot avoid fixed costs. Fixed costs remain the same irrespective of whether goods or services are produced or not.

Let's say suppose company XYZ has a fixed cost of $20,000 per month to rent the machine it uses to produce mugs. If the company does not produce mugs for a month, it still has to pay $20,000 for the cost of renting the equipment. On the other hand, if it produces a million mugs, its fixed cost remains the same. The variable costs change from zero to $4 million.

The common examples of fixed costs include rent, lease, payments, utilities, insurance, certain salaries, and interest payments.

Variable vs. Fixed Costs in Decision-Making

Understanding costs that are variable and the costs that are fixed is important for decision-making in business.

As mentioned, variable expenses are not constant when production levels keep changing.

Meanwhile, fixed costs are costs that remain steady and the same and independent of production levels like office rent.

Let's look at an example here. Jean is concerned about her bakery as the revenue generated from sales is below the total costs of running the bakery. Let's say Jean asks for your opinion if she should consider closing down the business. Plus, she is already committed to paying for a year of electricity, rent, and staff salaries.

Hence, even if the business were to shut down, Jean would still have to pay for the costs until the end of the year.

In January, the business reported revenues of $3,000 but incurred total costs of $4,000, for a net loss of $1,000. Jean estimates that February should experience revenues similar to that of January.

Jean's list of costs for the bakery is as follows:

A. January fixed costs:

- Rent: $1,000

- Electricity: $300

- Employee salaries: $600

Total January fixed costs: $1,900

B. January variable expenses:

- Cost of butter, flour, sugar, and milk: $1,500

- The total cost of labor: $600

Total January variable costs: $2,100

If Jean didn't know which costs were variable or fixed, it would be harder to make the correct decision. In such a case, we can see that total fixed costs are $1,900 and total variable expenses are $2,100.

If Jean were to shut down the business, Jean must still pay monthly fixed costs of $1,900. If Jean were to continue operating despite losing money, she would only lose $1,000 per month.

That is $3,000 in revenue and $4,000 in total costs. Therefore, Jean would actually lose more money ($1,900 per month) if she were to not continue with the business.

This shows the role that costs play in business decision-making. In this case, the best decision would be for Jean to continue in business while looking for ways to reduce the variable expenses.

Variable Cost Examples

The formula for the variable cost is simple because all of the organization's different types of variable expenses must be added together.

For instance, a juice company makes 20 bottles of juice, which costs Rs. 500 for raw materials, Rs. 900 for direct labor, and Rs. 300 for packaging. In this instance, the variable cost will be determined as the sum of the expenditures for raw materials, labor, and packaging, or Rs. 1700.

That represents the variable cost of producing a specific product type. Additionally, if the expenses of labor, raw materials, and packaging are listed for a single unit, the total should be multiplied by the quantity of goods produced by the company.

Now, there are two ways to describe this variable cost.

- Total variable cost

- Average variable cost

Total Variable Cost

You must take into account all of the items that the business develops or manufactures in order to get the overall variable cost. To start, figure out the variable cost per unit and multiply it by the number of units being produced. Apply the same procedure to all goods, and then add the determined individual variable costs.

Total Variable Cost Formula = cost of manufacture * number of units of the product

For instance, a business makes various flavors of cakes. Three of their goods come in strawberry, chocolate, and vanilla flavors. Vanilla now has a variable cost per unit of Rs. 10. Chocolate has a variable cost per unit of Rs. 30, whereas strawberry have a variable cost per unit of Rs. 10. The company makes chocolate, vanilla, and strawberry cakes in quantities of 40, 30, and 30 respectively.

Then as per TVC formula, it will be = (10∗40)+(30∗30)+(10∗30)

Therefore, the total variable cost will be Rs.1600.

Average Variable Cost

The average variable cost is an estimation of how much it takes to create one unit of items.

Average variable cost = (TVC of 1st product + TVC of 2nd product + …TVC of nth product) / Number of units produced

Special Considerations

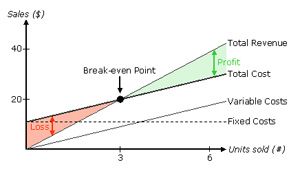

The more fixed cost a company has, the more revenue a company needs in order to break even. This means it needs to work harder to produce and sell its products. That is because these costs occur regularly and hardly change.

While variable costs tend to remain the same, the impact of fixed costs on a business's bottom line can change per the number of products that are produced.

The fixed costs drop when production increases. The price for a greater amount of goods can be spread over the same amount of a fixed cost. In this way, a company can scale by increasing production and lowering costs.

Let's say XYZ company has a lease of $10,000 per month on its production, and it produces 1,000 mugs per month. It can spread the fixed cost of the lease at $10 per mug. If the company produces 10,000 mugs a month, the fixed cost of the lease decreases to $1 per mug.

Why Is It Important to Differentiate Fixed Costs and Variable Costs?

For small business owners, it is crucial to keep track and understand how these various costs change with changes in the volume and output levels.

The breakdown of these costs determines the price level of the services and assists in many other aspects of the overall business strategy. These costs are also the primary ingredients to various costing methods employed by businesses.

Break-Even Analysis

Understanding the fixed and variable expenses is essential for calculating a profitable price level for its services. Most businesses do this by performing a break-even analysis. Let's say that V is the volume needed to break-even

V = Fixed costs / (Price – Variable costs)

The break-even equation provides valuable information about pricing but can also be modified to answer other important questions such as the expansion of business etc.

It can give insights to people who are considering investing in small business information about their projected profits. This equation can help them calculate the number of units and the dollar volume that is needed to make a profit and decide if the numbers seem credible to invest or buy.

Business Scaling Decisions

Fixed costs and variable costs always contribute to providing a clear picture of the overall cost structure of the business. Understanding of the fixed and variable costs can be used to understand and identify the economies for scale. The cost advantage is established by the fact that as output increases, fixed costs are spread over a larger number of output items.

Knowing the difference between variable costs and fixed costs is crucial for making rational decisions about the business costs, which have a direct impact on profitability.

Impact on Profitability

Variable cost is key in a business for profitability. A company with higher variable costs compared to the fixed costs will have more consistent profitability.

This is because, with higher variable costs, the break-even point is lower. This is due to lower fixed costs and higher variable costs which yields lower profits per unit sold.

As production volume increases, it is often possible to renegotiate purchasing agreements to reduce your per-unit cost. This is especially true with raw materials and shipping.

A company with lower variable costs and higher fixed costs will only have higher profits once the fixed costs are covered. This is cause once break-even is attained, profits are higher per unit due to lower variable costs.

The one variable cost which is quite difficult to control is direct labor costs. A way to reduce labor costs is to switch to a payment per piece produced instead of hourly wage.

Key Takeaways

- Companies have two types of costs; fixed cost and variable costs

- The fixed costs remain the same regardless of production output.

- Companies variable costs vary based on the amount of output produced

- Fixed costs examples include lease and rental payments, insurance, and interest payments

- Variable costs include commissions, labor, and goods and raw materials