Deskera Books

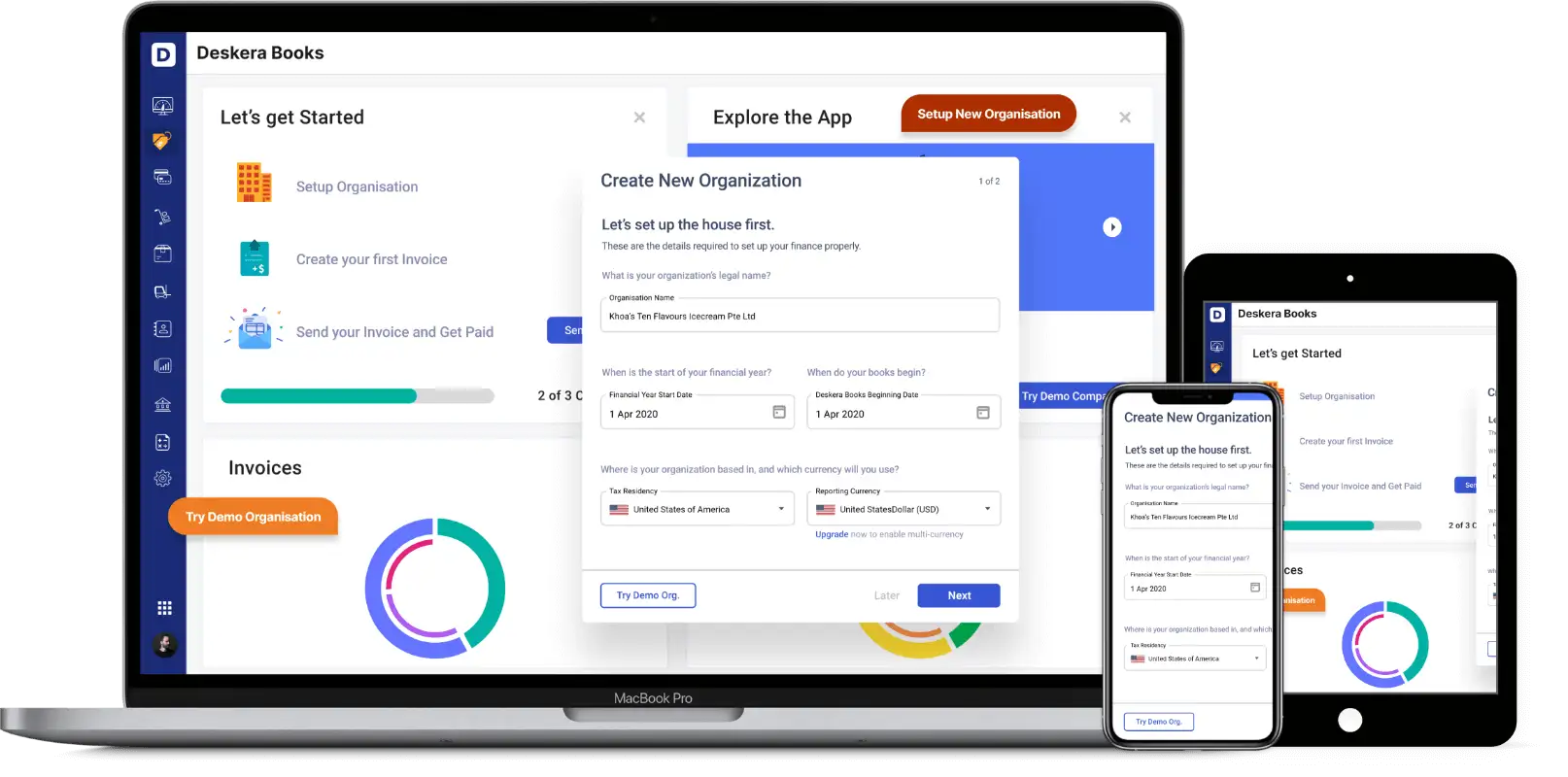

Setting up an account with Deskera Books during the onboarding process is trouble-free, by just filling in your organization name, book beginning and financial year start date, tax residency, and reporting currency.If you wish for a test run, to try out all the features in the system you can always use the Demo Organization.

Talk to Our Experts

Easily Import Your Data from Quickbooks and Xero

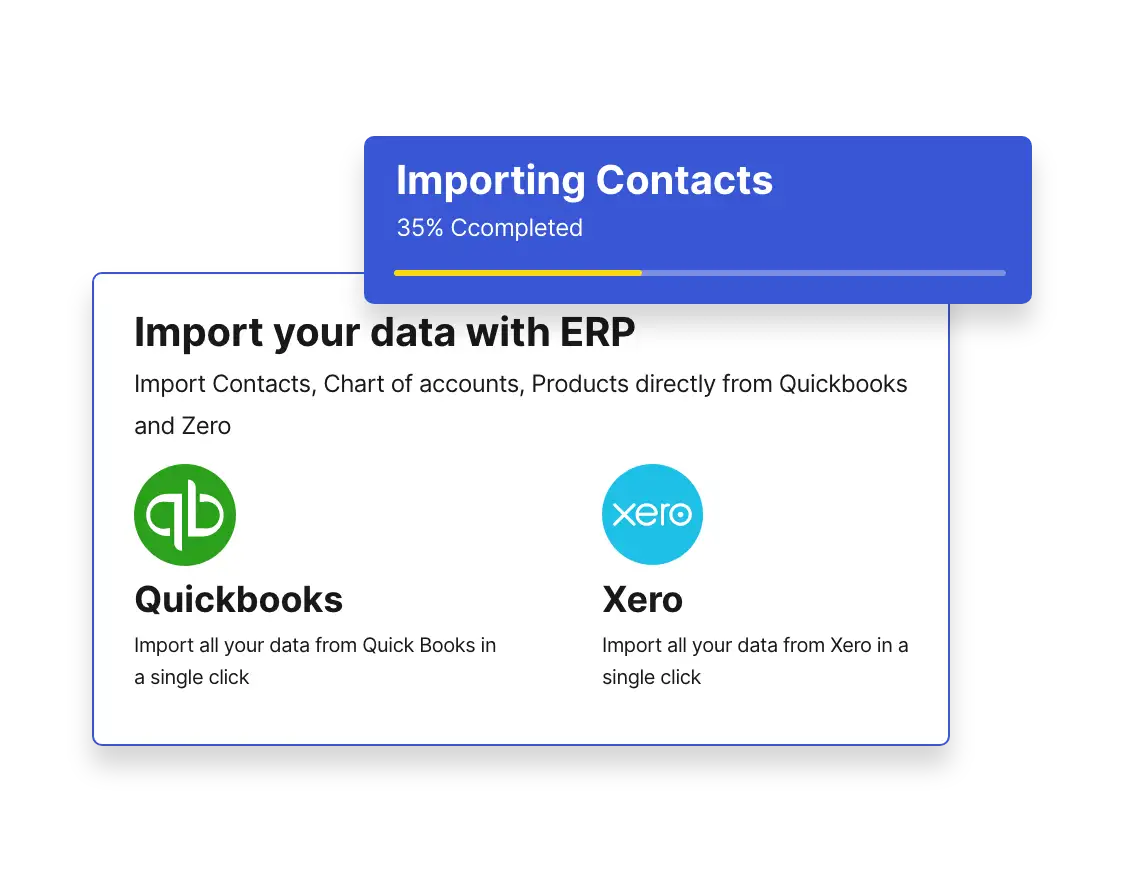

Switching from Quickbooks and Xero software to Deskera Books during the onboarding process isn't as hard as you might suspect it seems to be.

You can choose to connect your Xero and Quickbooks account to migrate your Charts of Accounts, Products, and even Contacts data to Deskera Books conveniently.

Talk to Our Experts

Add Your Existing Contacts and Products

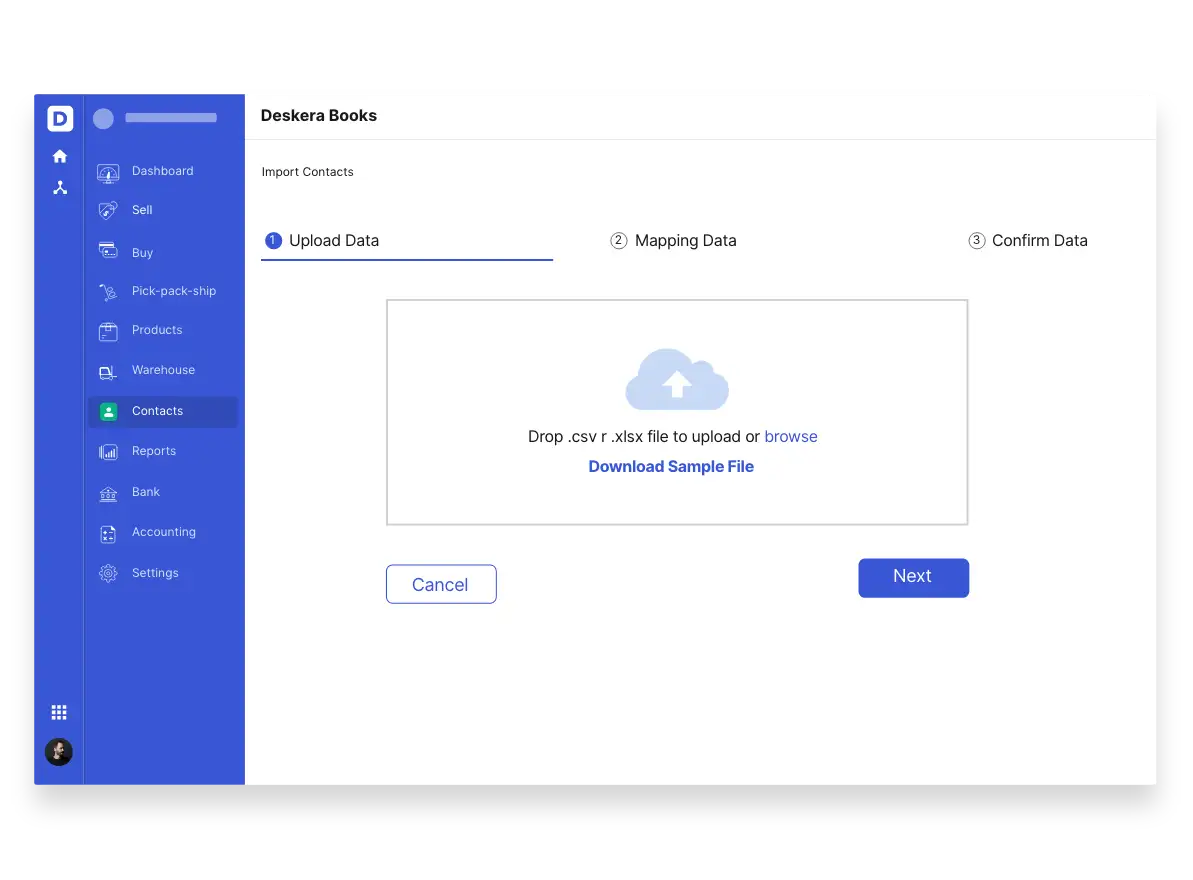

Do you have multiple contacts and products that you want to add in one go?

Deskera Books allows you to import your existing contacts and products using a sample excel file and bulk import them as mapped in the spreadsheet. It is especially useful for new users who are migrating from a previous system.

Talk to Our Experts

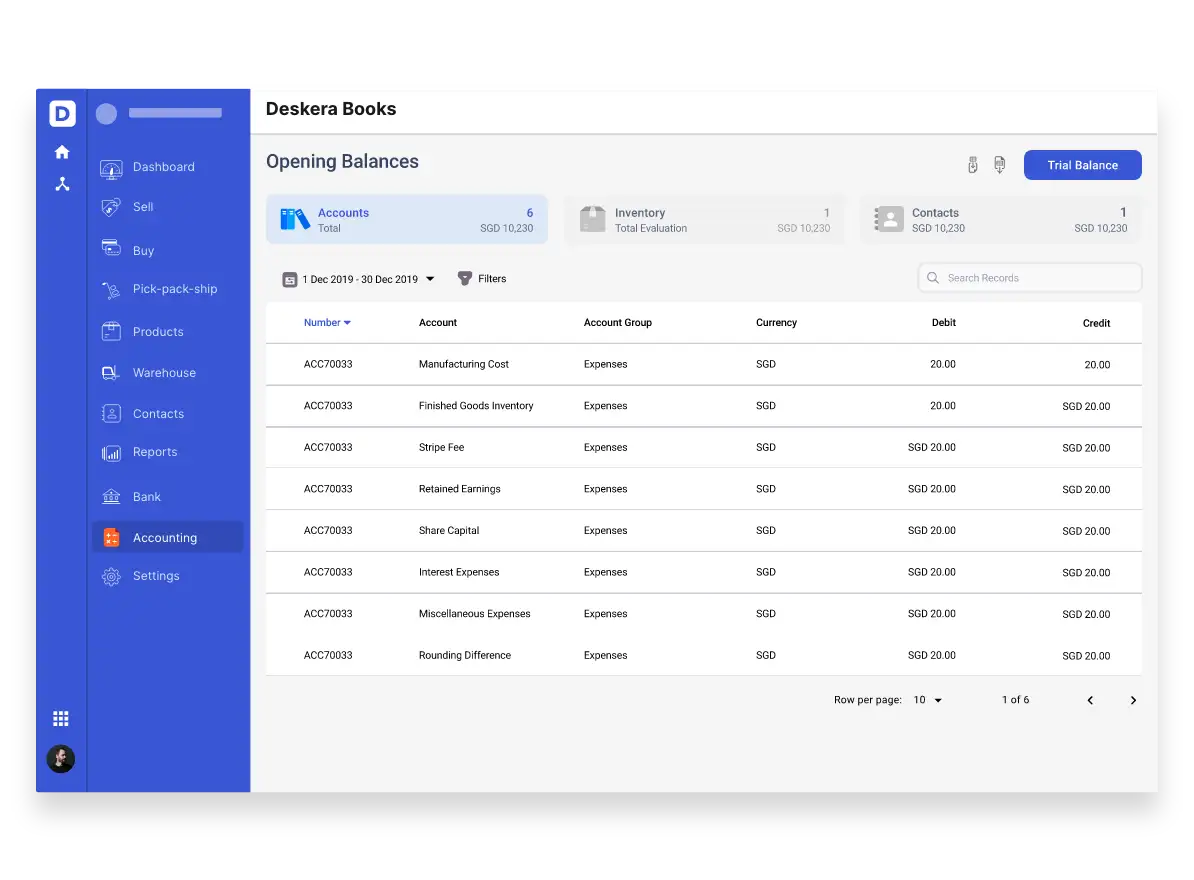

Set-up Your Opening Balances

Do you want a smoother data transition from your existing software to Deskera Books?

Deskera Books will automatically capture the opening balance from the sample file and bulk import your financial accounts, inventory, contacts, sales invoice, and bills instantaneously as mapped from the spreadsheet.

Talk to Our Experts

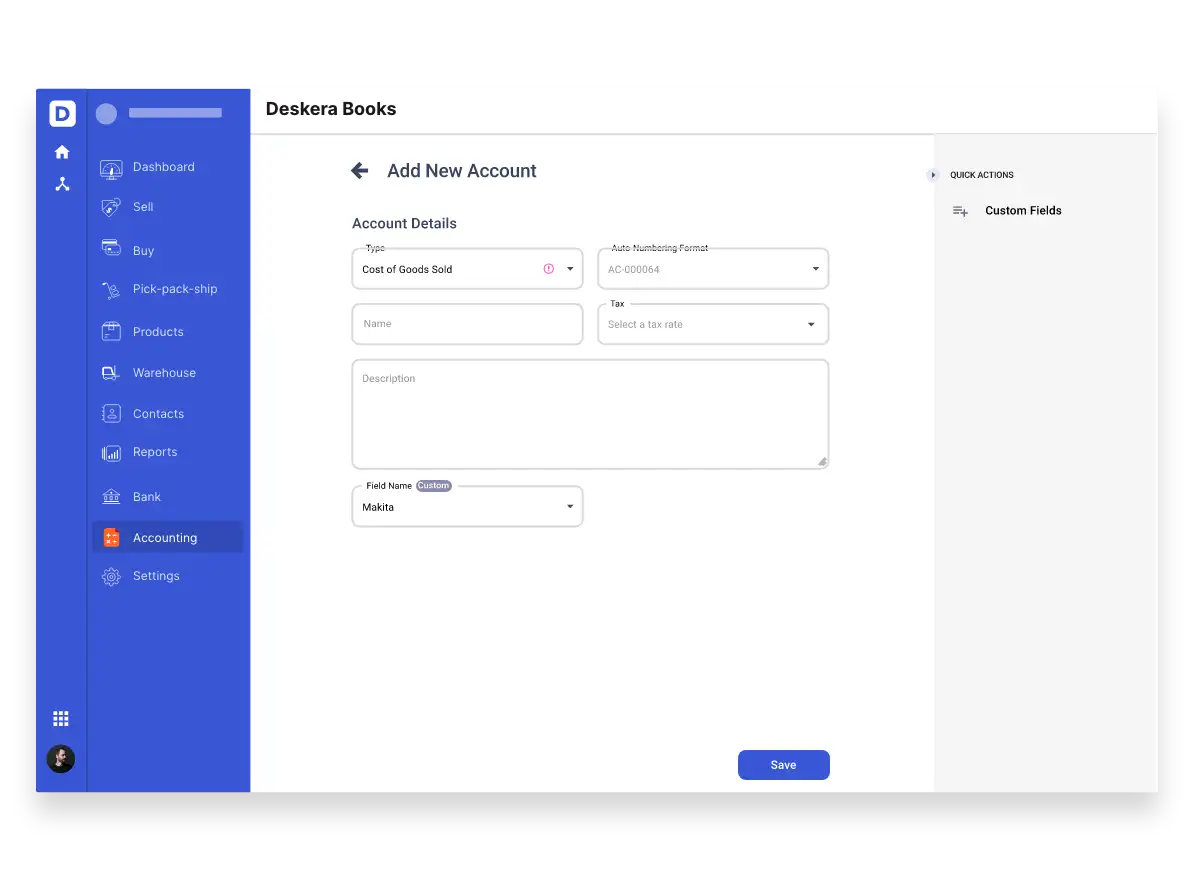

Configurable Chart of Accounts

Deskera Books has a set of predefined Chart of Accounts classified into different types such as Income, Expense, Equity, Liability & Assets.

While adding a contact or a product, the default account values are mapped automatically, so your accounting is always correct.

Deskera Books allows you to easily import your chart of accounts from your previous system to our system via excel or CSV file.

Talk to Our Experts

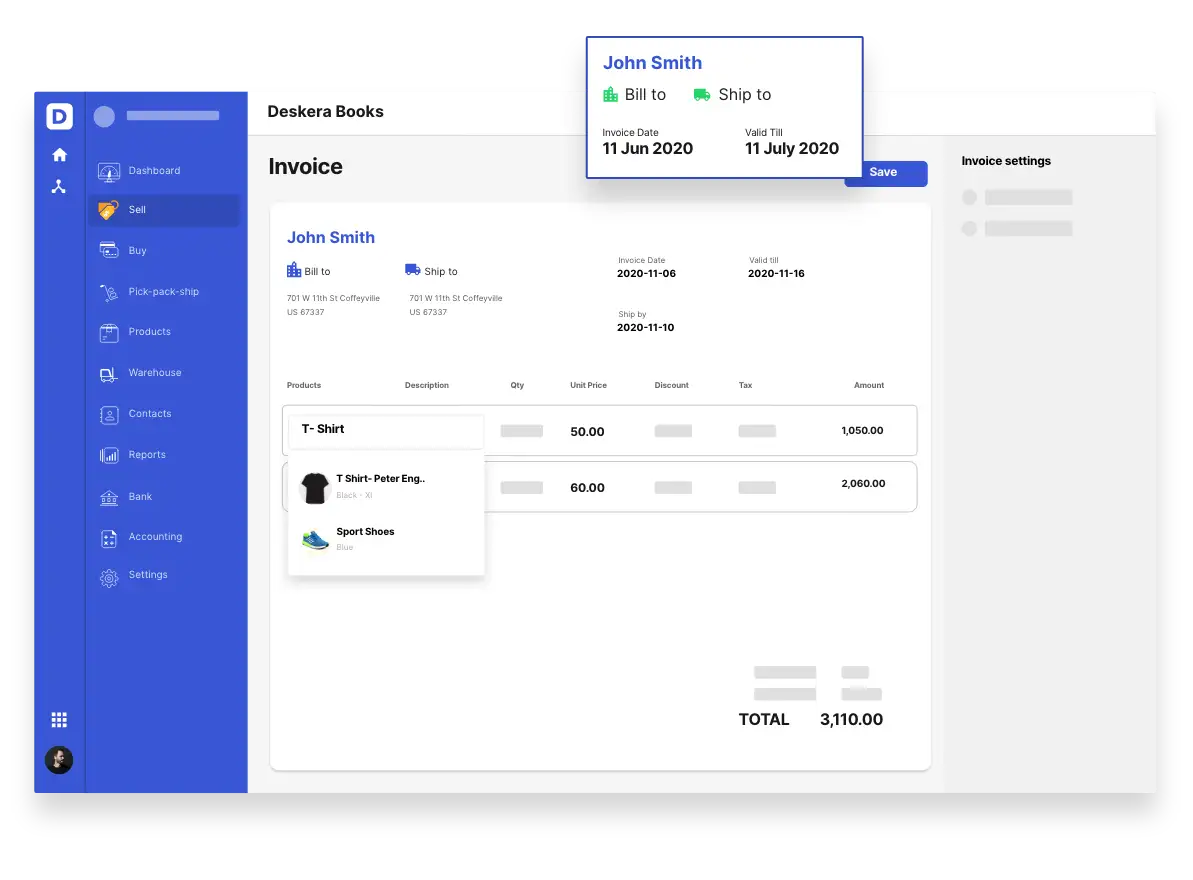

Go ahead and Create Your First Invoice with Ease

With the Deskera On-boarding process, you can get an overview of the invoice creation process. It will help you to understand and create your first invoice in the system smoothly with no mistakes.

Talk to Our Experts

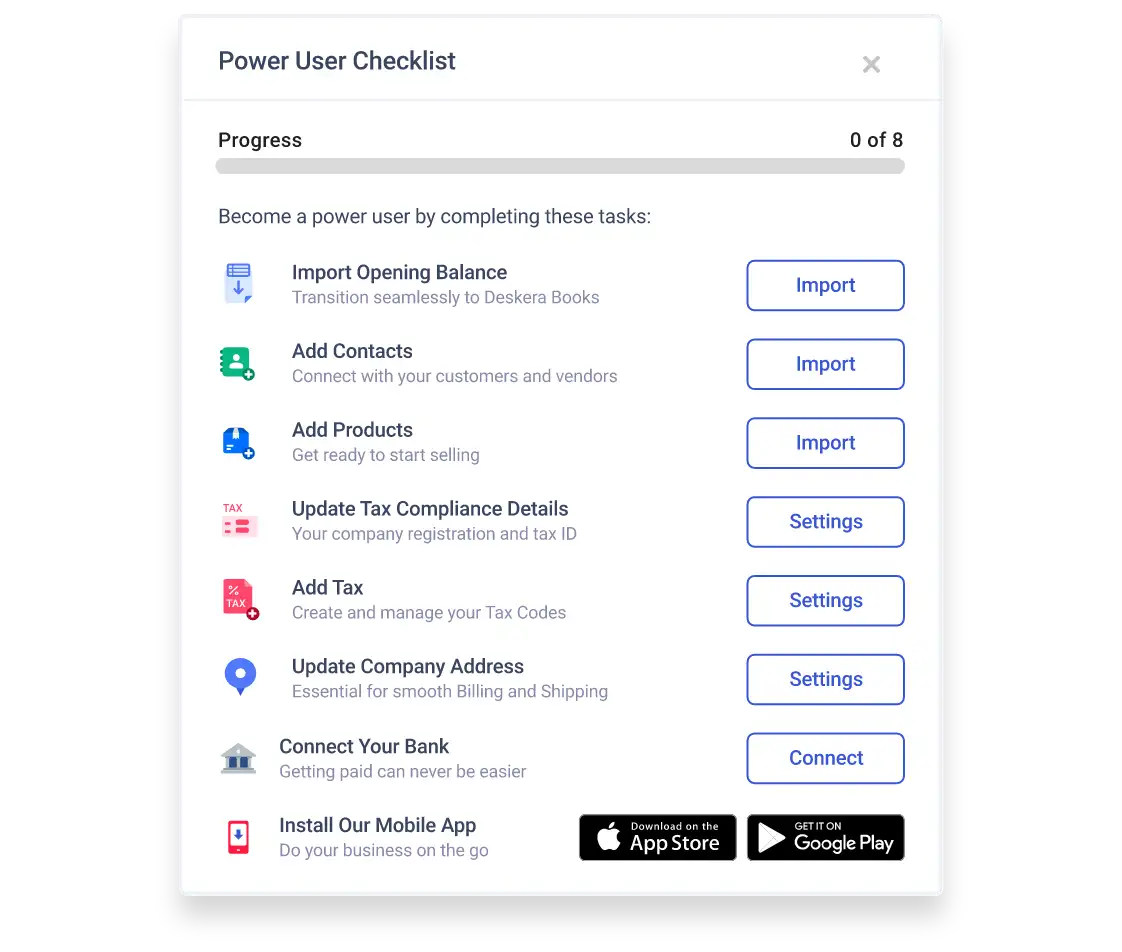

Get Guided Help

Deskera Accounting software provides you a proper checklist that assists you with the progress you have made at every step of the process.

It will help you to create your first contact, product, tax, update your tax compliance details and company address, import opening balances, connect your bank and install our mobile app on your iOS and Android devices.

Congratulations! You are now ready to use Deskera Books, and you can start creating and sending invoices and bills instantaneously.

Talk to Our Experts

What our Customers Say About Us

Whatever your business

size, Deskera enables you to

simplify operations across

business functions. Here's

what our customers say

about us.

Enterprise

Frequently Asked Questions

When can I start with my On-boarding Process in Deskera Books?

After sign in for how long is the trial period?

Can I explore an app using a demo company?

Can I set up my organization during on-boarding process?

Can I edit the book beginning date and financial year start dates?

Can I migrate the data from Quick Books and Xero in Deskera System?

For which modules can I migrate the data manually?

How can I create the first invoice in the system?

What is the usage of power checklist?

If I skip the on-boarding process can I continue again?

a) On at the bottom of the sidebar menu, click on your name.

b) This will open a box.

c) Click on the get started checklist to complete the on-boarding process.

Follow the onboarding process from a - h, as mentioned earlier to complete this process. Click on the sign-out button whenever you wish to log-out from your account.

Run Your Business With Deskera

Talk to Our Experts